Bioprocess Validation Market Size, Share, Trends and Forecast by Test Type, Process Component, End User, and Region, 2025-2033

Bioprocess Validation Market Size and Share:

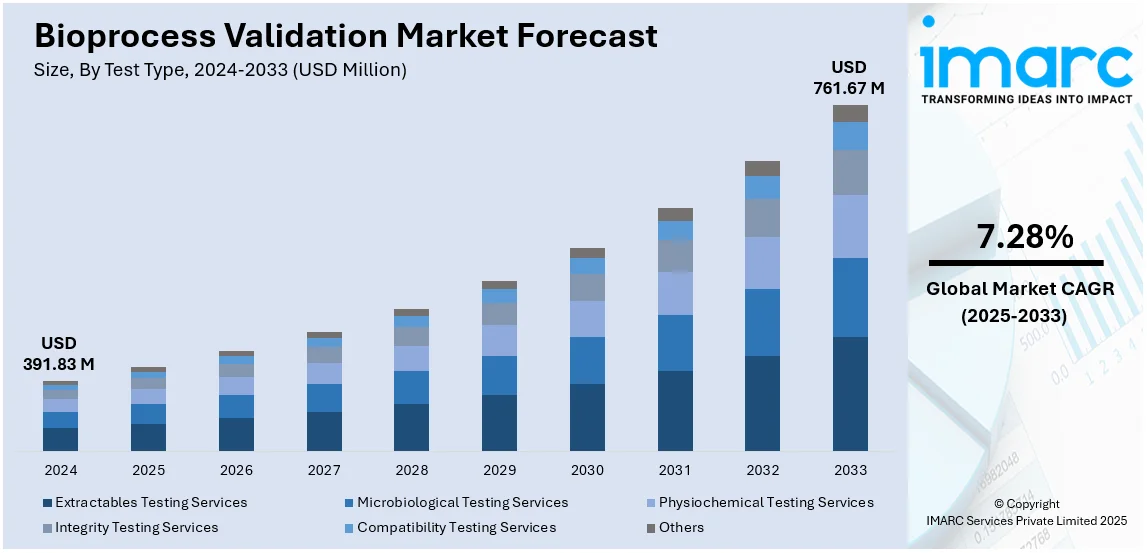

The global bioprocess validation market size was valued at USD 391.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 761.67 Million by 2033, exhibiting a CAGR of 7.28% from 2025-2033. North America currently dominates the market, holding a market share of over 38.9% in 2024. The growing production of biopharmaceuticals, implementation of strict regulatory requirements, rapid technological advancements, and significant growth in contract manufacturing organizations (CMOs), are some of the factors bolstering the bioprocess validation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 391.83 Million |

|

Market Forecast in 2033

|

USD 761.67 Million |

| Market Growth Rate (2025-2033) | 7.28% |

The global bioprocess validation market demand is experiencing significant growth, primarily driven by the increasing production of biopharmaceuticals. In 2023, the European Medicines Agency (EMA) approved 77 medicines for human use, with 39 containing a novel active substance, reflecting a strong biopharmaceutical development pipeline. This upward trend is expected to continue into 2024 and 2025, with numerous biologics and biosimilars anticipated to receive approval. The expansion of biopharmaceutical production further amplifies the demand for rigorous bioprocess validation, which ensures the quality, safety, and efficacy of these therapeutics. Process validation, analytical method validation, and cleaning validation are becoming essential components of compliance frameworks, particularly as manufacturing processes grow more sophisticated with the adoption of continuous bioprocessing, single-use technologies, and automation.

The bioprocess validation market share in the United States is recording clear growth from various aspects, holding 88.90% market share. In particular, the US FDA has issued stringent regulations for any manufacture of biopharmaceuticals, which demand for extensive validation to ascertain product safety, efficacy, and approval in the market. Later on, in January 2025, an updated guidance by the FDA was released, in which bioanalytical method validation for biomarkers has been recognized as a stringent need with established protocols during troubleshooting and development of drugs. Also, yet the FDA's Office of Biostatistics plays to the great role of developing an analysis to consider the safety and efficacy of any medications in biopharmaceutical pre-market reviews, ever the whole of verifying sound evidence of the validations undertaken extensively is encouraged. Such regulatory strides, combined with the growing complexity of the biopharmaceutical products, will increase the demand for advanced bioprocess validation services in the United States.

Bioprocess Validation Market Trends:

Stringent Regulatory Requirements

In recent years, regulatory agencies have intensified their focus on process validation to ensure the safety and efficacy of biopharmaceuticals. In January 2025, the U.S. Food and Drug Administration (FDA) released the "Bioanalytical Method Validation for Biomarkers" guidance, providing detailed recommendations for validating bioanalytical methods used in drug development. Similarly, the European Medicines Agency (EMA) has emphasized process validation in its guidelines, underscoring the necessity for comprehensive validation data in regulatory submissions. These stringent regulatory requirements compel biopharmaceutical companies to invest significantly in validation processes, thereby driving the global bioprocess validation market growth.

Technological Advancements

In 2024 and 2025, technological advancements have significantly bolstered the global bioprocess validation market. Governments worldwide have released several guidelines, which underscores the need for advanced validation techniques in bioprocessing. Additionally, the International Council for Harmonisation (ICH) introduced the M10 guideline on bioanalytical method validation, which has been adopted by regulatory bodies like the European Medicines Agency (EMA). This guideline provides a framework for validating bioanalytical assays, promoting the adoption of innovative technologies in bioprocess validation. Additionally, the FDA's adoption of the first edition of ISO 17665 in March 2024, which establishes guidelines for developing, validating, and controlling medical device sterilization processes, underscores its dedication to enhancing sterilization validation techniques in bioprocessing. These regulatory developments highlight the increasing reliance on cutting-edge technologies to ensure the efficacy and safety of biopharmaceutical products.

Growth in Contract Manufacturing Organizations (CMOs)

The expansion of Contract Development and Manufacturing Organizations (CDMOs) significantly influences the global bioprocess validation market. Over the past decade, CDMOs have been pivotal in the biopharmaceutical sector, contributing to the development of over 80% of New Molecular Entities (NMEs) approved by the FDA and EMA. Since 2017, they have produced more than 55% of NMEs, including critical vaccines and treatments. Currently, CDMOs manufacture approximately 40% of all drug doses, vaccines, and over-the-counter products distributed in Western markets. This substantial involvement underscores the growing reliance on CDMOs for efficient and compliant bioprocesses, thereby driving the demand for comprehensive validation services to ensure product quality and regulatory adherence.

Bioprocess Validation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bioprocess validation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on test type, process component, and end user.

Analysis by Test Type:

- Extractables Testing Services

- Microbiological Testing Services

- Physiochemical Testing Services

- Integrity Testing Services

- Compatibility Testing Services

- Others

Based on the recent bioprocess validation market forecast, extractables testing services have the lion's share of the market, accounting for the cause of heightened veterinary scrutiny towards ensuring that a product is proven safe and efficacious for bioprocess validation. Regulatory bodies recommend comprehensive extractables and leachables examinations to identify contaminants in manufacturing subcomponents, such as filters and tubing, which directly affect the purity of drugs. These intricate procedures ensure compliance with GMPs and lower the risk of possible side effects for patients. Thanks to the ever-complicated nature of biopharmaceuticals and the burgeoning popularity of single-use systems in manufacturing, demand for extractables testing services is on the rise, and this has consequently solidified their position at the forefront of the market.

Analysis by Process Component:

- Filter Elements

- Media Containers and Bags

- Freezing And Thawing Process Bags

- Mixing Systems

- Bioreactors

- Transfer Systems

- Others

Filter elements are critical elements in bioprocess validation, with high significance in assuring product purity, sterility, and compliance with guideline standards. Filtration is widely used in biopharmaceutical manufacturing for the removal of particulates, microbial contaminants, and endotoxins in the production of raw materials, intermediates, and final drug formulations. With the increasing production of biologics, vaccines, and gene therapies, there came a lot of demand for better filtration systems. Membrane filters, depth filters, and sterile filters are among the most commonly used filter elements in bioprocessing. Any removed contending into cell culture media, buffer, or a final drug product can guarantee its integrity. The emergence of single-use filtration systems is also in demand owing to their economy on the material used, reduced risk of cross-contamination, and convenience of use under GMP conditions.

Analysis by End User:

- Pharmaceutical and Biotechnology Companies

- Contract Development and Manufacturing Organizations

- Others

As per the latest bioprocess validation market outlook, pharmaceutical and biotechnology companies account for the largest share of the bioprocess validation market, due to rigid quality control measures, compliance with standards, and innovation. These companies devote large amounts of funding to research and development, with a view to bringing biologics, biosimilars, and gene therapies to market. Biologics and gene therapies require extensive validation to show that their use is safe and effective. Increased demand for mAbs, vaccines, cell and gene therapies, and recombinant proteins increases the demand for robust bioprocess validation services. Various regulatory agencies such as U.S. FDA, EMA, and ICH operate under very stringent regulations, requiring biopharmaceutical companies to validate processes-protocols-from upstream fermentation processes to downstream purification-in order to produce reliable products. Any change in the affiliated process parameters will affect the product's consistency, which in turn increases emphasis on validation during drug manufacturing. Advances in single-use bioprocessing systems, automation, and digital biomanufacturing are giving rise to the use of new analytical tools that enable process validation through real-time monitoring.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America represented the largest share, with about 38.9% of the overall global bioprocess validation market. Factors leading to this region's dominance are majorly attributed to the leading biopharmaceutical companies, stringent regulatory framework, and major investments in R&D. Agencies such as the FDA and Health Canada enforce strict guidelines over the manufacturing of biologics that require some level of validation in order to ensure compliance with GMP. The demands of these agencies directly relay into a demand for validation services, particularly in process development, quality assurance, and risk mitigation. Other factors benefiting North America include an established biopharmaceutical industry, where several big players are investing in new biologics, biosimilars, and gene therapies. The rising adoption of advanced bioprocessing technologies-such as single-use systems, automation, and AI-driven analytics-is giving the necessary boost to this market. Growth of CDMOs in North America has also led to a demand for third-party validation services in compliance with regulatory standards for services confirming operational excellence.

Key Regional Takeaways:

United States Bioprocess Validation Market Analysis

The U.S. bioprocess validation market is expanding due to the strict regulatory requirements by the U.S. Food and Drug Administration (FDA) for biopharmaceutical production. The comprehensive validation studies required in the Biologics License Application (BLA) process have propelled the demand for validation services. The existing robust biopharmaceutical industry, where a large portion of the companies are heavily investing in optimizing their production processes, is driving adoption. The biopharmaceutical industry in the U.S. is a major contributor to the economy, accounting for around 1.6% of the nation's GDP, as per reports. Furthermore, scaling up production around monoclonal antibodies (mAb) and cell and gene therapies will call for the implementation of advanced methodologies for bioprocess validation to guarantee product quality and efficacy. Besides that, investments in research and development (R&D), the provision of government funds, and public-private partnerships bolster innovations in bioprocess validation technologies. Furthermore, the trend towards single-use bioprocessing will offer any rigorous validation required to overcome these sources of contamination and ensure reproducibility an encouraging outlook. Moreover, as biomanufacturing becomes more complex, furthered by the introduction of continuous processes and increased automation, a larger obligation arises for extensive validation protocols. In addition, the validation has to cover all aspects from sourcing raw materials to licensing/batch release of the finished product for automated systems and continuous processes to work reliably. Key players in the country are striving to extend their service offerings to cater to the rising demand from the industry, thereby augmenting market growth.

Europe Bioprocess Validation Market Analysis

A very strong regulatory environment led by the European Medicines Agency (EMA) and the European Directorate for the Quality of Medicines & HealthCare (EDQM) creates a highly developed continuum of validation requirements for biologics and biosimilars. The long-established biopharmaceutical sector in the region, especially Germany, the UK, and France, fuels demand for process validation solutions. The growing demand for personalized medicine, cell and gene therapies, and next-generation biologics is leading to the establishment of stringent validation strategies for compliance. The gene therapy market in Europe is projected to grow at 12.8% CAGR during the forecast period of 2024-2032, according to the IMARC Group. Emerging investments and developments in biomanufacturing are pushing the expansion of the validation market. Quality-by-design (QbD) principles and real-time process monitoring initiatives in the European Union further drive trust in robust validation tools. Besides this, with the rising sustainability concerns globally, new validation innovations are founded on minimizing environmental impact, specifically in single-use technologies. Besides this, a supportive network of CDMOs and biopharma clusters in the region complements the validation market. CDMO is a third-party firm that offers specialized services in biomanufacturing like process development, scale-up, and production. As these organizations turn to advanced technologies, they seek to ensure consistency and quality in their processes by implementing robust validation protocols.

Asia Pacific Bioprocess Validation Market Analysis

The Asia Pacific bioprocess validation market is witnessing strong growth on account of the rapid expansion of biopharmaceutical manufacturing in countries like China, India, South Korea, and Japan. In addition, governing agencies in the region are promoting domestic biologics production through financial incentives and favorable regulations, increasing demand for validation services. Besides this, rising healthcare expenditure and a growing patient base drive the need for cost-effective biosimilars, leading manufacturers to focus on robust validation processes to meet international regulatory standards. As per the India Brand Equity Foundation (IBEF), India’s public healthcare expenditure reached 1.9% of GDP in the financial year 2024. Moreover, the region's lower operational costs attract global biopharma companies, creating a surge in contract development and manufacturing organization (CDMO) activities, which require stringent process validation. Apart from this, the increasing adoption of single-use bioprocessing systems necessitates validation studies to ensure process reliability. Expansion of research institutes and academic collaborations with industry players further strengthens the market. These partnerships facilitate the exchange of knowledge, bringing cutting-edge scientific discoveries and technological innovations into the biomanufacturing sector. By combining academic expertise with industry experience, these collaborations help develop more efficient, reliable, and cost-effective validation methods. Furthermore, evolving regulatory frameworks, particularly in China and India, are aligning with global standards, reinforcing the necessity of extensive bioprocess validation protocols.

Latin America Bioprocess Validation Market Analysis

The Latin American bioprocess validation market is growing due to increasing biopharmaceutical production in countries like Brazil, Mexico, and Argentina. Government initiatives supporting local biologics manufacturing and biosimilar development drive validation requirements. In line with this, rising investments in biotech startups and CDMOs is contributing to the market expansion. Reports indicate a substantial rise in venture capital investments in biotech across Brazil and Latin America, with Brazil accounting for over 60% of the region's share in 2023. Furthermore, the region is aligning its regulatory frameworks with international standards, prompting manufacturers to enhance validation procedures. Growing demand for vaccines and monoclonal antibodies is boosting process validation needs. Additionally, the rising adoption of single-use bioprocessing systems is increasing the need for validation services to ensure sterility and efficiency.

Middle East and Africa Bioprocess Validation Market Analysis

The growing pharmaceutical and biopharmaceutical manufacturing sectors in the UAE, Saudi Arabia, and South Africa are driving market expansion. In the Middle East and Africa's pharmaceutical industry, 16 M&A deals were announced in Q3 2024, totaling USD 1.8 billion, according to reports. In addition, government initiatives promoting local vaccine and biosimilar production are increasing validation requirements. The region’s improving regulatory landscape, with agencies striving to meet global quality standards, is encouraging rigorous validation processes. Furthermore, growing investments in biotechnology research and partnerships with global biopharma companies further support the market growth. Apart from this, the rise in chronic diseases and demand for biologics is pushing manufacturers to adopt validated bioprocessing solutions for quality assurance.

Competitive Landscape:

Key players in the bioprocess validation market are adopting strategic initiatives to reinforce their market presence and address the evolving needs of the biopharmaceutical sector. They are investing in advanced technologies to optimize validation processes while maintaining compliance with strict regulatory requirements. Collaborations and partnerships are being formed to expand service offerings and global reach. Additionally, companies are focusing on integrating digital solutions and automation to improve efficiency and data accuracy in validation procedures. These initiatives indicate a commitment to innovation, quality assurance, and the expansion of capabilities to support the growing complexity of biopharmaceutical products.

The report provides a comprehensive analysis of the competitive landscape in the bioprocess validation market with detailed profiles of all major companies, including:

- Almac Group, Biozeen

- Doc S.R.L.

- Eurofins Scientific

- Hangzhou Anow Microfiltration Co. Ltd.

- Hangzhou Cobetter Filtration Equipment Co. Ltd.

- Hangzhou Tianshan Precision Filter Material Co. Ltd.

- Meissner Filtration Products, Inc.

- Merck KGaA

- Sartorius AG

- SGS SA

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- November 2024: Sartorius Stedim Biotech has launched its new Center for Bioprocess Innovation in Marlborough, Massachusetts, where specialized teams will provide process development, optimization, and validation services.

- October 2024: Thermo Fisher Scientific signed a Memorandum of Understanding (MoU) with the Government of Telangana to set up a Bioprocess Design Centre (BDC) in Genome Valley, Hyderabad. The facility will feature advanced capabilities for upstream and downstream research, cell culture media development, single-use manufacturing, and product validation.

- June 2024: Syntegon introduced its modular bioprocessing platform (MBP) at Achema, alongside showcasing additional innovations from its extensive portfolio for processing and packaging liquid and solid pharmaceuticals.

- April 2024: Watson-Marlow Fluid Technology Solutions (WMFTS) introduced WMArchitect™ single-use solutions, providing a comprehensive range of biopharmaceutical fluid management innovations from a single, reliable supplier. WMArchitect™ is an end-to-end single-use fluid path management solution that includes validation testing, customized designs, single-use assemblies, fluid transfer assemblies, and fill/finish single-use assemblies.

Bioprocess Validation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Extractables Testing Services, Microbiological Testing Services, Physiochemical Testing Services, Integrity Testing Services, Compatibility Testing Services, Others |

| Process Components Covered | Filter Elements, Media Containers and Bags, Freezing And Thawing Process Bags, Mixing Systems, Bioreactors, Transfer Systems, Others |

| End Users Covered | Pharmaceutical and Biotechnology Companies, Contract Development and Manufacturing Organizations, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Almac Group, Biozeen, Doc S.R.L., Eurofins Scientific, Hangzhou Anow Microfiltration Co. Ltd., Hangzhou Cobetter Filtration Equipment Co. Ltd., Hangzhou Tianshan Precision Filter Material Co. Ltd., Meissner Filtration Products, Inc., Merck KGaA, Sartorius AG, SGS SA, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bioprocess validation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bioprocess validation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bioprocess validation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioprocess validation market was valued at USD 391.83 Million in 2024.

IMARC estimates the bioprocess validation market to exhibit a CAGR of 7.28% during 2025-2033, reaching USD 761.67 Million by 2033.

The growing production of biopharmaceuticals, implementation of strict regulatory requirements, rapid technological advancements, and significant growth in contract manufacturing organizations (CMOs), are some of the factors bolstering the bioprocess validation market share.

North America currently dominates the market, driven by the presence of major biopharmaceutical companies, advanced research infrastructure, and stringent regulatory frameworks that mandate thorough validation processes.

Some of the major players in the bioprocess validation market include Almac Group, Biozeen, Doc S.R.L., Eurofins Scientific, Hangzhou Anow Microfiltration Co. Ltd., Hangzhou Cobetter Filtration Equipment Co. Ltd., Hangzhou Tianshan Precision Filter Material Co. Ltd., Meissner Filtration Products, Inc., Merck KGaA, Sartorius AG, SGS SA, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)