Bioprocess Technology Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Bioprocess Technology Market 2024, Size and Overview:

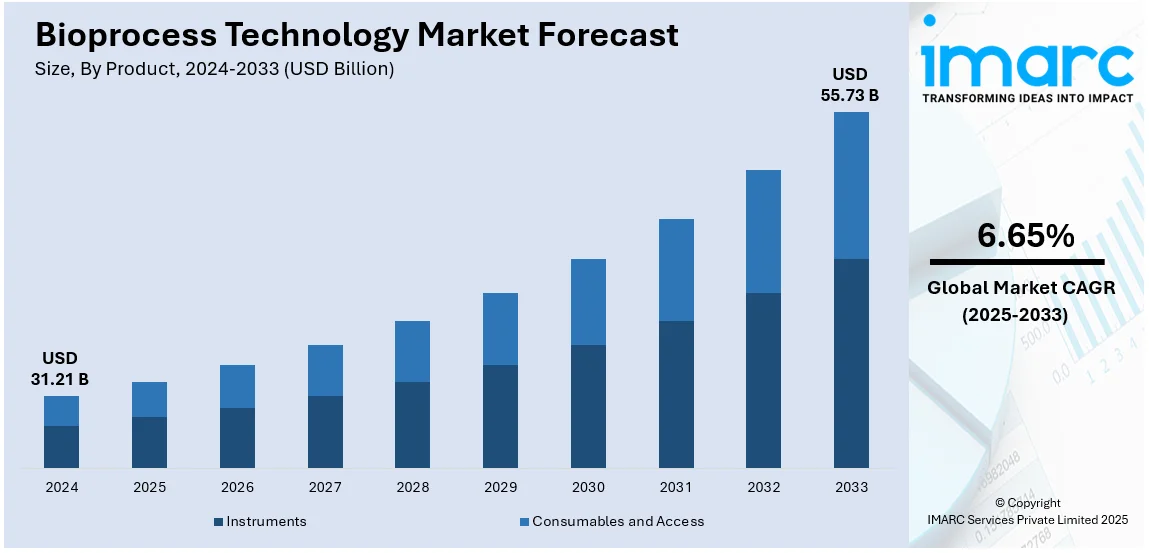

The global bioprocess technology market size was valued at USD 31.21 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 55.73 Billion by 2033, exhibiting a CAGR of 6.65% during 2025-2033. North America currently dominates the market, holding a significant market share of over 44.5% in 2024. The increasing demand for sustainable and eco-friendly production processes, the growing need for high-value biologically derived products, and advancements in biotechnology and genetic engineering represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 31.21 Billion |

| Market Forecast in 2033 | USD 55.73 Billion |

| Market Growth Rate (2025-2033) | 6.65% |

Key drivers in the bioprocess technology market growth are the rising demand for pharmaceuticals such as vaccines, monoclonal antibodies, and biosimilars due to growing healthcare requirements and chronic diseases. According to the report published by the Press Information Bureau, India’s pharmaceutical industry recognized as the "Pharmacy of the World" witnessing an export rise 8.36% from $2.13 Billion in July 2023 to $2.31 Billion in July 2024. The sector is expected to reach $100 billion by 2025 is boosted by a 10-12% growth rate and PLI schemes worth INR 15,000 Crore. Improved bioprocessing equipment and automation improve the production efficiency and scalability. Increasing single-use technologies are reducing the contamination risks and operating costs. Regenerative medicine, cell and gene therapies and bio-manufacturing applications are growing and strengthening the bioprocess technology market growth. Regulatory support and investments in R&D further propel the development of innovative bioprocess technologies.

Key drivers in the United States bioprocess technology market demand include increasing demand for biologics such as monoclonal antibodies, vaccines and biosimilars to combat chronic diseases and emerging health threats. Advances in bioprocessing technologies including single-use systems and automation, improve efficiency and scalability driving adoption. The increased focus on cell and gene therapies supported by increased R&D investments and regulatory approvals is accelerating market growth. For instance, in December 2024, Governor of New York announced the opening of New York's first cell and gene therapy hub at Roswell Park Comprehensive Cancer Center in Buffalo. The $98 million facility intends to enhance research, generate employment, and focus on treating solid tumors.

Bioprocess Technology Market Trends:

Single Use Technologies

Single-use technologies are revolutionizing the bioprocess technology market offering economical and flexible solutions for biopharmaceutical production. Single-use bioreactors, mixers and tubing for example reduce cleaning and sterilization costs and time significantly. For instance, in October 2023, Getinge announced the launch of the AppliFlex ST GMP, a single-use bioreactor system aimed at enhancing clinical cell and gene therapy production. This innovative solution bridges research and clinical applications ensuring GMP compliance. With customizable sizes and integrated software, it supports manufacturers in translating laboratory processes to clinical trials efficiently. These systems reduce contamination risks due to pre-sterilized disposable components thus ensuring the safety and quality of the product. They are ideal for small-scale production and clinical trials due to their scalability and ease of implementation. Single-use systems facilitate quick changeovers and increase productivity in multiproduct facilities. Advances in material science also have enhanced the durability and performance of these technologies leading to a greater adoption in bioprocessing.

Shift Towards Continuous Bioprocessing

Continuous bioprocessing is the transformative shift in biomanufacturing, enabling the seamless production of biologics through uninterrupted processes, which represents one of the key bioprocess technology market trends. For instance, in November 2023, WuXi Biologics successfully implemented a fully integrated continuous bioprocess achieving an average productivity of ~6 g/L/day at pilot scale. Utilizing its proprietary WuXiUPTM platform the process enhances biologics manufacturing efficiency allowing more than 60 kg of mAbs per batch with plans to scale up for GMP production globally. Continuous methods do not separate upstream and downstream operations thus shortening processing times and increasing efficiency. This allows for scalability as steady-state production can be maintained for increasing demands of biologics such as monoclonal antibodies and vaccines. Continuous bioprocessing also achieves this through lower resource consumption, reduction in costs and higher product quality due to continuous monitoring and control. The current drivers of adoption are automation, process intensification and real-time analytics therefore it is now a cornerstone for innovation in the bioprocess technology market and pharmaceutical manufacturing. These factors are collectively creating a positive bioprocess technology market outlook further across the world.

Cell and Gene Therapy Expansion

The demand for specialized bioprocessing solutions tailored to the production of these advanced therapies is being driven by the expansion of cell and gene therapy. The manufacturing process of such therapies must be highly controlled in order to ensure safety, efficacy and scalability. Innovations in bioprocessing including single-use technologies, closed systems and automated platforms are critical in meeting regulatory and quality standards while enabling cost-effective production. For instance, in October 2024, NewBiologix announced the launch of the Xcell™ Portfolio a suite of advanced technologies aimed at enhancing gene and cell therapy production. The portfolio addresses challenges like low yields and high costs offering innovative tools and insights for rAAV quality. This initiative aims to accelerate the development of effective gene therapies for patients. Companies are investing in flexible bioreactors, vector production systems and cryopreservation technologies to address the unique challenges of cell and gene therapy manufacturing. As these therapies gain traction in both the clinic and the marketplace bioprocess solutions play a vital role in their successful delivery.

Bioprocess Technology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bioprocess technology market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Instruments

- Bioprocess Analyzers

- Osmometers

- Bioreactors

- Incubators

- Others

- Consumables and Access

- Culture Media

- Reagents

- Others

Bioprocess technology instruments include bioprocess analyzers, osmometers, bioreactors and incubators. These instruments are crucial in the precise monitoring, control and optimization of biological processes. Bioreactors are central in scaling up production while the osmometer maintains media osmolality consistency. Bioprocess analyzers are used to acquire real-time data which aids in efficient process adjustment. Advanced incubators are used to provide an ideal environment for cell growth. These instruments improve the efficiency of operations, scalability and product quality thus showing their indispensable nature in research and commercial bioprocessing.

The consumables and access segment comprises of all the basic materials including culture media, reagents and other associated components that are used in bioprocess workflows. Culture media offer nutrients to support cell and microbial growth while reagents enable downstream processing such as purification and quality testing. Access is defined as the availability of high-quality pre-validated materials that simplify operations and ensure compliance with regulatory standards. Growing demands for tailored media formulations and innovative reagents in cell and gene therapies and personalized medicine are fueled by the continued advancements in those fields.

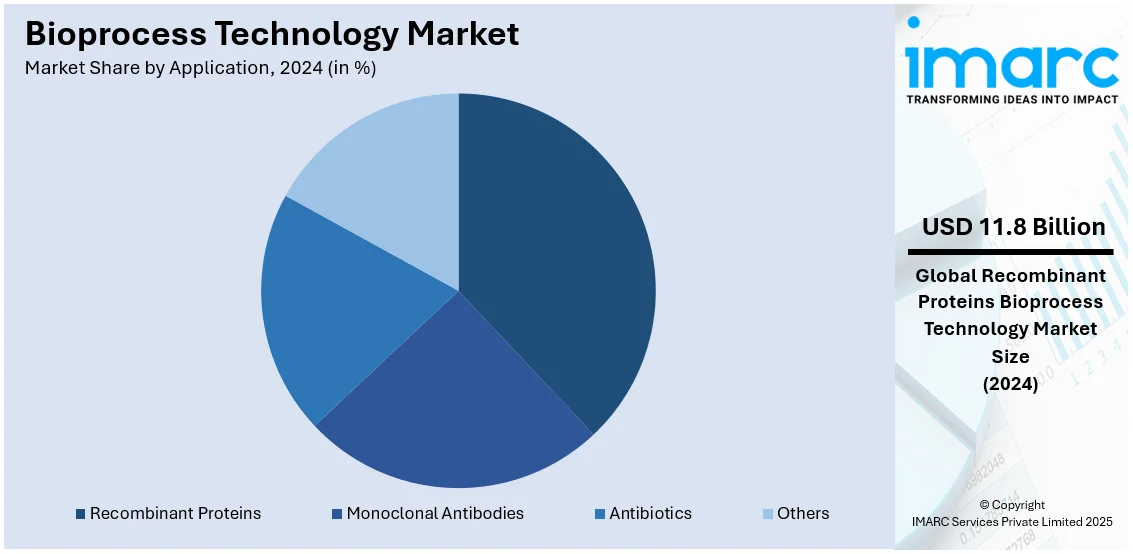

Analysis by Application:

- Recombinant Proteins

- Monoclonal Antibodies

- Antibiotics

- Others

Due to their use in therapeutic, diagnostic and industrial processes recombinant proteins are leading the market by application in bioprocess technology. They play a crucial role in the production of biopharmaceuticals such as monoclonal antibodies, hormones and vaccines in the treatment of critical healthcare issues like cancer and diabetes. Bioprocessing technologies like scalable bioreactors and optimized expression systems increase recombinant protein yield, purity and functionality. Demand for biologics mainly due to increasing chronic diseases and personalized medicine drives market growth. Moreover, recombinant proteins are extensively used in research, enzyme production and as tools in synthetic biology further reinforcing their leadership in bioprocessing applications.

Analysis by End User:

- Biotechnology and Biopharmaceutical Companies

- Research and Academic Institutes

- Others

Biotechnology and biopharmaceutical companies are the largest end users of bioprocess technology. Their focus on developing biologics, biosimilars and advanced therapies drives this market. They require bioprocessing technologies for efficient production of monoclonal antibodies, vaccines and cell and gene therapies. Their demand for scalable, high-quality manufacturing processes has spurred innovation in single-use systems, automation and process analytics. Expansion of R&D investment and a developing pipeline of biologics makes these companies contributors to the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest bioprocess technology market share of over 44.5%. North America has the largest share in the bioprocess technology market primarily due to its advanced healthcare infrastructure, strong presence of biopharmaceutical companies and significant investments in biotechnology R&D. The region's leadership in biologics production including monoclonal antibodies and vaccines drives demand for innovative bioprocessing solutions. Regulatory support, growing adoption of single-use technologies and advancements in automation further bolster market growth. The strong pipeline of cell and gene therapies and a high prevalence of chronic diseases ensure market dominance in North America.

Key Regional Takeaways:

United States Bioprocess Technology Market Analysis

In 2024, the United States captured 89.00% of revenue in the North American market. Bioprocess technology adoption is expanding rapidly, especially within the biotechnology and biopharmaceutical sectors, driven by substantial investments. According to industry reports, Seed and Series A funding into U.S. biopharma companies totalled USD 5.1 Billion across 105 rounds in the first half of 2024. There has been a surge in funding, fostering innovation and infrastructure advancements. These developments are accelerating the production of therapeutics, vaccines, and biologics, meeting increasing global healthcare demands. This rise in financial support facilitates the adoption of advanced techniques, such as genetic engineering, fermentation, and cell culture, optimizing production efficiency and cost-effectiveness. As research and development efforts grow in these industries, the need for robust, scalable bioprocess technologies becomes even more critical. Moreover, the regulatory environment is evolving to accommodate these advancements, encouraging stakeholders to leverage these technologies for more efficient and sustainable production. This transformation is poised to lead to groundbreaking therapies and medicines that were previously not feasible, marking a significant milestone in medical science and healthcare solutions.

Asia Pacific Bioprocess Technology Market Analysis

In the Asia-Pacific region, bioprocess technology adoption is being significantly influenced by the increasing focus on renewable biological resources. According to the Renewable Energy Statistics 2024 published by International Renewable Energy Agency (IRENA), India ranks 4th position globally in overall renewable energy installed capacity. Specifically, India holds 4th position in both wind power and Bio power installations. The growing availability of these resources offers opportunities for more sustainable production processes, reducing reliance on non-renewable raw materials. As agricultural and forest biomass become more prevalent, industries are harnessing these renewable inputs to drive processes like fermentation and enzyme production. Moreover, the shift towards bio-based feedstocks aligns with broader environmental goals, pushing companies in various sectors to adopt greener, more sustainable production practices. These innovations not only reduce carbon footprints but also improve the efficiency of the bioprocess, making it a compelling choice for industries striving to meet both economic and environmental targets. As industries like agriculture, chemicals, and energy intensify their focus on renewable resources, bioprocess technology is being recognized as a cornerstone of sustainable industrial practices.

Europe Bioprocess Technology Market Analysis

In Europe, the growing food and beverages industry is playing a pivotal role in boosting the adoption of bioprocess technologies. According to reports, there are approximately 445k businesses in the food & drink wholesaling industry in Europe. As consumer demand shifts towards natural, healthy, and sustainable food options, companies in the sector are seeking innovative ways to produce these products more efficiently. Bioprocess technologies, including fermentation and enzymatic processes, are increasingly being implemented to enhance production yields, reduce waste, and ensure the quality of ingredients. The move toward cleaner production processes and the demand for plant-based alternatives are also contributing to this trend. These technologies support the development of products that meet both consumer expectations and regulatory standards, positioning them as a critical element in the food and beverage sector's evolution. The integration of bioprocess solutions also aligns with sustainability goals, making it a key component of the industry's strategy to address growing environmental concerns and consumer preferences for eco-friendly products.

Latin America Bioprocess Technology Market Analysis

Investment in research and development (R&D) is significantly influencing the bioprocess technology market demand. Institutions are channelling resources toward exploring innovative bio-manufacturing techniques to enhance efficiency and scalability. According to National Library of Medicine, Brazilian investment in research and development (R&D) is approximately 1.3% of the GDP, according to UNESCO for biomedical research. These R&D efforts have led to breakthroughs in areas such as cell culture optimization, gene editing, and bioreactor design. The focus is on creating robust and adaptable systems capable of producing biologics and other complex bio-based products. Furthermore, partnerships between academia and industries are fostering an ecosystem that encourages experimentation and commercialization of novel technologies. This collaborative environment is also helping to streamline regulatory pathways, ensuring quicker time-to-market for advanced products.

Middle East and Africa Bioprocess Technology Market Analysis

In the Middle East and Africa, the rise in chronic health conditions has prompted the need for more advanced bioprocess technologies in drug production. According to reports, 114.9% increase in cirrhosis and other chronic liver disease incidence within the MENA region between 1990 and 2021. As healthcare systems work to meet the growing demand for treatments, the adoption of biotechnological processes is becoming essential for developing effective medicines. Bioprocess technologies enable the production of complex biologics and personalized treatments at scale, offering solutions to chronic disorders that require specialized, targeted therapies. The increased prevalence of conditions such as diabetes, cardiovascular diseases, and cancer is driving the urgency for innovation in drug production, and bioprocess technologies are proving to be a critical tool in addressing these challenges efficiently.

Competitive Landscape:

The bioprocess technology market is highly competitive characterized by the presence of established players and emerging innovators striving for market share through advanced solutions. Companies are focusing on developing cutting-edge technologies such as single-use systems, automated bioreactors and real-time monitoring tools to improve process efficiency and scalability. Strategic collaborations with research institutions, investments in R&D and expanding global footprints are key competitive strategies. The growing emphasis on personalized medicine, biologics and cell and gene therapies drives bioprocess technology market demand. Players are also leveraging partnerships to enhance their portfolios and cater to specialized applications. The market is witnessing increased activity in digital bioprocessing integrating AI and IoT for real-time process optimization and enhanced productivity.

The report provides a comprehensive analysis of the competitive landscape in the bioprocess technology market with detailed profiles of all major companies, including:

- Advanced Instruments LLC

- Biopharma Dynamics Ltd.

- Danaher Corporation

- Hoffmann-La Roche AG

- Lonza Group AG

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Univercells Technologies

Latest News and Developments:

- December 2024: Sartorius Stedim Biotech opened its new Center for Bioprocess Innovation in Marlborough, Massachusetts, aiming to foster collaboration and co-development with customers and innovation partners. The facility focuses on advancing bioprocess workflows, particularly for cell and gene therapies, to enhance efficiency and reduce costs in manufacturing novel treatments.

- November 2024: New Wave Biotech has launched Bioprocess Foresight, an AI-powered simulation platform aimed at helping biomanufacturing innovators in the alt protein industry design smarter, commercialize faster, and scale more sustainably. The platform provides tailored techno-economic, output, and environmental impact insights, allowing users to test various process scenarios and identify key R&D opportunities.

- October 2024: Croda Pharma has launched Super Refined™ Poloxamer 188, a bioprocessing solution designed to reduce shear stress in mammalian cell culture. Introduced at the Festival of Biologics in Basel, Switzerland, this product offers optimized impurity profiles and consistent batch-to-batch performance. It supports biopharmaceutical development and can be used in biologic formulations.

- July 2024: BioProcess360 Partners has launched a new investment fund to aid businesses advancing emerging tools and technologies in the bioprocessing of traditional mAbs and newer drug modalities. The fund combines capital, expert support, and connections to global biopharma companies to assist with R&D and commercialization challenges. Led by Chris Major, former head of Purolite's Bioprocessing division, and Bradford Beatty of Rabbit Run Partners, the initiative aims to drive growth in the bioprocess sector.

- July 2024: Nirrin Technologies has launched Atlas, a system for at-line analysis at the point of sampling, offering biopharma rapid, actionable data on buffer components and product titer within one minute. Powered by HPTLS technology, Atlas addresses blind spots and bottlenecks in biomanufacturing, giving scientists more control over their bioprocesses and accelerating drug development timelines by eliminating delays caused by traditional lab testing.

- June 2024: At Achema 2024, Syntegon's subsidiary Pharmatec unveils its Modular Bioprocessing Platform (MBP). This flexible, fully integrated solution is designed for biopharmaceutical production, supporting microbial and mammalian cell culture applications. The MBP offers shorter lead times and cost savings without compromising on quality, providing biopharmaceutical manufacturers with seamless production solutions.

Bioprocess Technology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Recombinant Proteins, Monoclonal Antibodies, Antibiotics, Others |

| End Users Covered | Biotechnology and Biopharmaceutical Companies, Research and Academic Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Instruments LLC, Biopharma Dynamics Ltd., Danaher Corporation, Hoffmann-La Roche AG, Lonza Group AG, Sartorius AG, Thermo Fisher Scientific Inc., Univercells Technologies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bioprocess technology market from 2019-2033.

- The bioprocess technology market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bioprocess technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioprocess technology market was valued at USD 31.21 Billion in 2024.

IMARC estimates the bioprocess technology market to exhibit a CAGR of 6.65% during 2025-2033, reaching USD 55.73 Billion by 2033.

The market is driven by rising demand for biologics like vaccines, monoclonal antibodies, and biosimilars, advances in bioprocessing technologies, growing adoption of single-use systems, and expanding cell and gene therapy applications.

North America leads the market with over 44.5% share in 2024, driven by advanced healthcare infrastructure, robust R&D investments, and leadership in biologics production. Favorable governmental support, the widespread adoption of single-use technologies and significant advancements in automation, along with a high prevalence of chronic diseases create a positive market outlook in North America.

Some of the major players in the bioprocess technology market include Advanced Instruments LLC, Biopharma Dynamics Ltd., Danaher Corporation, Hoffmann-La Roche AG, Lonza Group AG, Sartorius AG, Thermo Fisher Scientific Inc., Univercells Technologies, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)