Bioplastics Packaging Market Size, Share, Trends and Forecast by Product Type, Packaging Type, End User, and Region, 2025-2033

Bioplastics Packaging Market Size and Share:

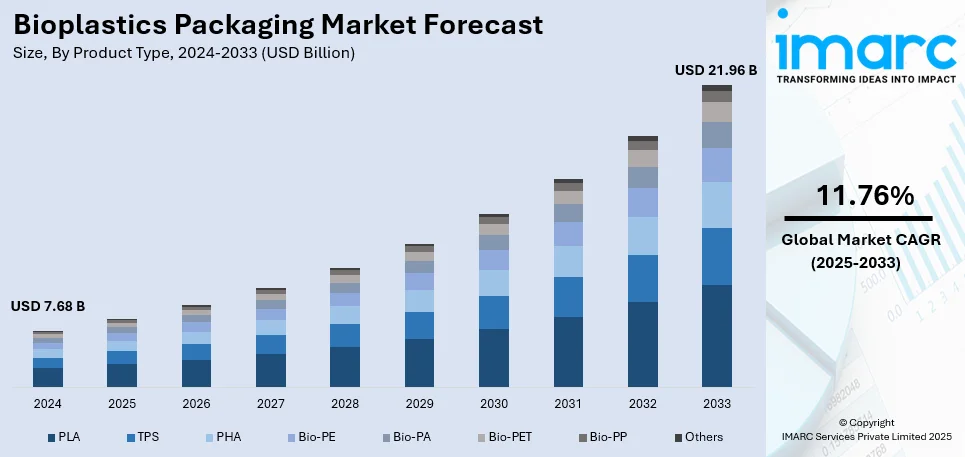

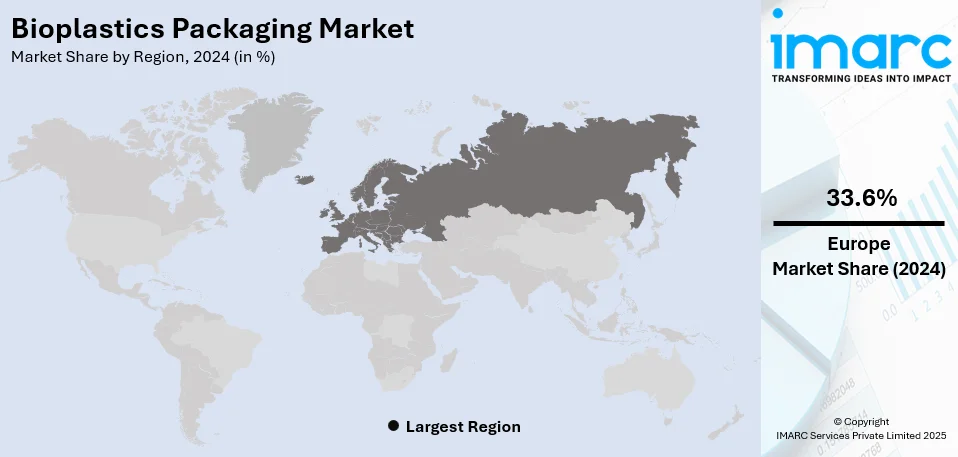

The global bioplastics packaging market size was valued at USD 7.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.96 Billion by 2033, exhibiting a CAGR of 11.76% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 33.6% in 2024. The increasing demand for eco-friendly and sustainable packaging solutions, the implementation of favorable government initiatives, and the development of new and advanced bioplastics that offer improved properties represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.68 Billion |

|

Market Forecast in 2033

|

USD 21.96 Billion |

| Market Growth Rate (2025-2033) | 11.76% |

Governments worldwide are enforcing plastic bans and sustainability mandates, driving the demand for biodegradable and compostable packaging. The rising awareness of plastic pollution and demand for eco-friendly alternatives are pushing brands toward bioplastics in food, beverage, and retail packaging. Innovations in PLA, PHA, and starch-based bioplastics improve durability, barrier properties, and compostability, expanding market applications. Major brands and retailers are committing to reducing carbon footprints by integrating bioplastics into packaging to meet ESG goals. Tax benefits and subsidies for bio-based material production are encouraging bioplastics adoption in flexible and rigid packaging applications. The factors, collectively, are creating the bioplastics packaging market outlook across the globe.

Federal and state laws, such as California’s Single-Use Plastics Ban, drive demand for biodegradable and compostable packaging alternatives. The growing awareness of plastic waste and preference for eco-friendly packaging encourage brands to adopt PLA, PHA, and starch-based bioplastics. Major companies like Coca-Cola, Nestlé, and Amazon are integrating bioplastics into packaging to meet ESG and carbon neutrality goals. For instance, in April 2024, The Coca-Cola Company is implementing new, lighter PET bottles for its sparkling beverage line in the United States and Canada. It is undertaken as a part of a bigger effort to make packaging more circular. Consequently, Minute Maid Refreshments, Minute Maid Aguas Frescas, and 12-, 16.9-, and 20-ounce bottles of Trademark Coca-Cola, Sprite, and Fanta are now available in novel forms that use lesser raw materials to make. Improved durability, flexibility, and barrier properties make bioplastics competitive with traditional plastics in food, beverage, and e-commerce packaging. Federal subsidies, tax incentives, and investments in bio-based materials support bioplastics production and innovation, accelerating market growth.

Bioplastics Packaging Market Trends:

Increasing Demand for Eco-friendly and Sustainable Packaging Solutions

The integration of artificial intelligence (AI) and automation into bioplastics packaging systems is revolutionizing the way visual data is analyzed and utilized. AI-powered algorithms can swiftly process vast amounts of high-speed visual data, extracting meaningful insights and patterns that were once labor-intensive and time-consuming to obtain. This integration enables real-time decision-making based on actionable information, minimizing the need for manual intervention and reducing operational costs. Businesses can identify anomalies, predict potential issues, and optimize processes with greater efficiency, enhancing overall productivity, which, in turn, is contributing to the bioplastics packaging market growth. According to a 2023 industrial report, 72% of organizations plan to invest in AI to improve supply chain sustainability. Additionally, AI-driven automation extends the utility of bioplastics packaging beyond mere data capture, transforming them into proactive tools that contribute to streamlined operations and improved product quality. As industries across sectors seek to embrace the benefits of AI and automation, the demand for bioplastics packaging equipped with these capabilities is expected to rise significantly.

Implementation of Favorable Government Initiatives

Governments worldwide are enacting regulations that target single-use plastics, which constitute a significant portion of plastic waste. Bans or restrictions on items like plastic bags, straws, and utensils have spurred the exploration of bioplastics as a viable replacement, which represents one of the key bioplastics packaging market trends. In 2023, the California Department of Resources Recycling and Recovery (CalRecycle) outlined new regulations as part of the Plastic Pollution Prevention and Packaging Producer Responsibility Act (SB 54), which mandates a 25% reduction in single-use plastic packaging and foodware by 2032. These rules also require that such products be made recyclable or compostable and that the recycling rate increases to 65%. Additionally, in 2024, California passed a law to eliminate plastic shopping bags at grocery stores by 2026, further accelerating the transition to sustainable packaging. Moreover, government initiatives often provide incentives for the use of biodegradable and compostable materials in packaging. These materials align with circular economy principles and waste reduction strategies. Besides, these agencies allocate funding for research and development of sustainable materials, including bioplastics. This support accelerates technological advancements, leading to the creation of more efficient, cost-effective, and versatile bioplastics suitable for various packaging applications.

Development of New and Advanced Bioplastics

Newly developed bioplastics are designed to offer enhanced functionality and performance compared to their predecessors. Innovations in material science have led to bioplastics with improved mechanical strength, durability, and heat resistance. These advancements make them suitable for a wider range of packaging applications, including items that require protection from external factors, such as moisture and oxygen. As bioplastics become more versatile, businesses are increasingly incorporating them into packaging solutions for various industries. Besides, the development of advanced bioplastics allows manufacturers to tailor materials to specific packaging needs. Whether it's flexible films, rigid containers, or specialized shapes, bioplastics can now be customized to meet the requirements of diverse products. In 2021, The Coca-Cola Company unveiled a prototype beverage bottle made from 100% plant-based plastic, excluding the cap and label. This innovation utilized plant-based paraxylene (bPX) and plant-based monoethylene glycol (bMEG) to create a fully recyclable PET plastic bottle. The development of such advanced bioplastics is expected to continue fueling market growth, as businesses seek to enhance their sustainability efforts while maintaining product functionality.

Bioplastics Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bioplastics packaging market report, along with forecasts at the global, regional and country levels for 2025-2033. Our report has categorized the market based on product type, packaging type, and end user.

Analysis by Product Type:

- PLA

- TPS

- PHA

- Bio-PE

- Bio-PA

- Bio-PET

- Bio-PP

- Others

PLA dominates the market share as the renewable origin of PLA uses cornstarch or sugarcane as its raw materials which makes this material highly appealing for environmentally focused customers and businesses. PLA originates from renewable sources which supports fossil fuel reduction efforts while meeting sustainability criteria for carbon emission reduction. The development of PLA technology has resulted in better material characteristics where strength, heat resistance and barrier properties have been improved. The improved properties of PLA address former shortcomings while expanding its suitability for different packaging needs. The transparent nature of PLA keeps it visually like standard plastic materials, thus making it appealing for both market consumers and business users. PLA packaging serves brands as an effective material to display product contents which provides consumers superior visibility and helps them identify packaged items more easily.

Analysis by Packaging Type:

- Flexible Plastic Packaging

- Rigid Plastic Packaging

Flexible bioplastics leads the market with around 59.7% of the total bioplastics packaging market share in 2024. Flexible bioplastics offer unparalleled versatility in terms of design, shape, and size. Bioplastics show excellent molding abilities, folding capabilities and flexible adaptation to packaging needs which makes them suitable for packaging various types of food items and personal and household goods. This adaptability aligns with the diverse needs of industries, driving their extensive market presence. Moreover, they offer consumer convenience through features such as resealable zippers, tear notches, and spouts. These attributes enhance the usability of products and contribute to a positive consumer experience. The ease of carrying, opening, and resealing flexible packages aligns with modern consumer preferences for on-the-go convenience.

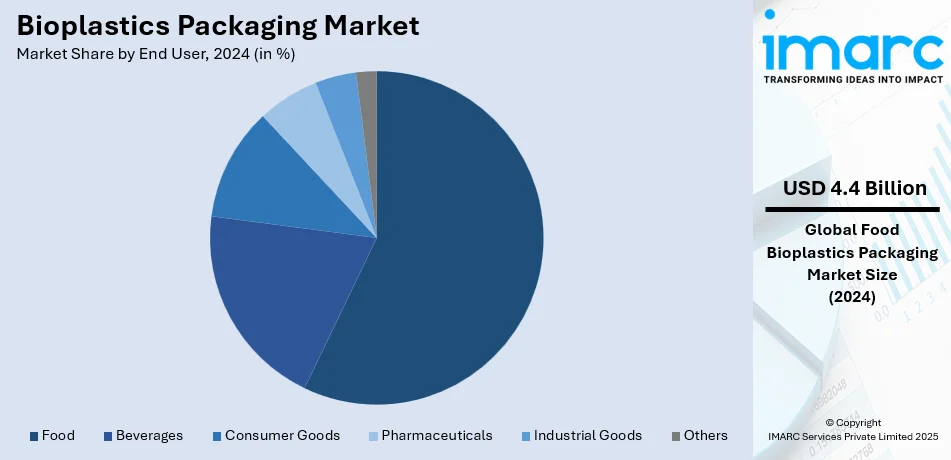

Analysis by End User:

- Food

- Beverages

- Consumer Goods

- Pharmaceuticals

- Industrial Goods

- Others

Food leads the market with around 57.3% of market share in 2024. Packaging plays a critical role in preserving the freshness, quality, and safety of food products. The use of bioplastics packaging provides dependable solutions that pass all necessary food contact material evaluations. The consumer market demands food items that come in safe and non-toxic packaging without dangerous chemicals. The sustainability of renewable-source-derived bioplastics makes them an ideal replacement for consumers who prioritize health-oriented choices. Food products typically maintain their freshness only for a specific period because oxidation along with moisture and microbial growth shorten their shelf life. The engineering of bioplastic materials enables the delivery of protective barriers that shield food items against environmental factors thus increasing their storage duration. The food industry requires minimum food waste reduction since it represents an essential business goal.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 33.6%. The bioplastics packaging market in Europe is experiencing significant growth because of increased emphasis on sustainability and environmental regulations. The European Bioplastics Association has reported that Europe accounted for around 40% of global bioplastics production in 2023, thanks to robust EU policies that encourage recycling and waste reduction. Germany and France have been major frontrunners in terms of bioplastic adoption and a lot of research and development funds have gone into plant-based polymers. High demand from food and beverages can be noted to reduce the carbon footprint as far as the industry is concerned, and even with the toughened regulations set in place for the EU for banning single-use plastics, there's been considerable innovation in terms of compostable and biodegradable bioplastics packaging solutions. The key players in Europe are BASF, Arkema, and Total Corbion PLA.

Key Regional Takeaways:

North America Bioplastics Packaging Market Analysis

The bioplastics packaging market in North America is driven by increasing environmental concerns, regulatory policies, and shifting consumer preferences. Governments are enforcing stricter regulations on single-use plastics, including bans and extended producer responsibility (EPR) programs, pushing businesses to adopt sustainable alternatives. Consumers are also demanding eco-friendly packaging, prompting brands to invest in biodegradable and compostable materials to enhance their sustainability commitments. Technological advancements in bioplastics have improved their durability, performance, and cost efficiency, making them more competitive with traditional plastics. Additionally, major corporations are implementing sustainability initiatives and circular economy strategies, further driving demand for bioplastics. The availability of renewable raw materials, such as cornstarch, sugarcane, and polylactic acid (PLA), supports production expansion.

United States Bioplastics Packaging Market Analysis

In 2024, the United States accounted for the largest market share of over 88.20% in North America. The U.S. bioplastics packaging market is rapidly expanding with increasing environmental concerns and sustainability efforts across industries. According to the report, in 2023, the estimated volume of bioplastic production in the United States was approximately USD 3.07 billion, of which a major portion comprised bioplastic packaging. Sectors like food and beverages require the most eco-friendly packaging because consumers and businesses look for an alternative to the conventional plastic used. Retailers and food companies are embracing bioplastic packaging options, and the production of plant-based polymers like PLA is seeing increased focus. Key players in the market involved in the innovation of biodegradable and recyclable packaging solutions are NatureWorks, BASF, and Novamont. Favorable government policies and a shift toward circular economies place the U.S. bioplastics packaging market towards sustained growth.

Asia Pacific Bioplastics Packaging Market Analysis

Asian Pacific is exponentially growing bioplastics packaging due to the dominant production capacity in this region and enhanced regulatory support. As of 2023, industry reports indicate that Asia held more than 50% of the global bioplastics production capacity. China, Japan, and India are some of the leading countries embracing sustainable packaging solutions; in particular, the growth in plant-based polymers such as PLA is strong. This is seen particularly in food and beverage packaging, which continues to shift with the rise of consumer demand for eco-friendly packaging. The favorable government policies are promoting sustainability and waste reduction; hence, there is innovation that is significant for biodegradable and recyclable bioplastic solutions in this region. The key players of the market include Mitsubishi Chemical, Kaneka Corporation, and Green Dot Bioplastics, with Asia Pacific becoming a major driving force in the global bioplastics packaging market.

Latin America Bioplastics Packaging Market Analysis

Latin America bioplastics packaging is growing; these countries adapt and change policies as they search to overcome different kinds of challenges about the environment. In the 2023 survey, a good volume was realized in bioplastic from Brazil, for the most significant contributions, coming from Braskem's bioplastic range named "I'm green"; much of which takes the format of bioPEs. By then, capacities were planned on how to double at 260,000 tons yearly. Demand for environmentally friendly packaging is quite high in Brazil, mainly in food and beverage-based packaging. The other countries taking up such trends are Mexico and Argentina, as demand for plant-based packaging solutions increases. Growth in the market can be seen to be driven by government policies and increased environmental awareness among consumers. Braskem is followed by others, such as Plastipak, where these companies can help Latin America be the share in the packaging bioplastics global market that continues to be increasingly developed throughout the region.

Middle East and Africa Bioplastics Packaging Market Analysis

The Middle East and Africa market for bioplastics packaging is at the growth initiation stage, with prospects appearing optimistic. From available statistics, in 2023, Saudi Arabia accounted for approximately 16.2 thousand tonnes of bioplastics production. Thus, Saudi Arabia represents a major chunk of the bioplastics market share in the Middle East and Africa region. Increasing demand for eco-friendly packaging products has started rising across the Middle East and Africa regions, with special interest within the food and beverages segment. Other countries such as South Africa and the UAE are also moving towards reducing plastic waste through encouraging bioplastics innovation. The market is still developing to the scale of other regions, and more awareness and investment by international players are taking place. Local manufacturers are posturing themselves in line with providing eco-friendly packaging as the demand evolves. Such a company is Biodegradable Plastics located in South Africa. Further technological advancements and government regulations will further expand the market for sustainable packaging solutions.

Competitive Landscape:

The competitive landscape of the market is characterized by a dynamic interplay of established players and innovative startups. Nowadays, leading companies are investing in research and development to create innovative bioplastics materials that offer improved properties, such as enhanced durability, barrier capabilities, and heat resistance. These innovations enable them to provide packaging solutions that meet the specific needs of different industries while remaining environmentally friendly. Moreover, key players are forming strategic collaborations and partnerships with other stakeholders across the value chain. This includes partnerships with material suppliers, packaging manufacturers, retailers, and consumer brands. Besides, companies are focusing on sourcing bioplastics materials sustainably and ensuring transparency in their supply chains.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ALPAGRO Packaging

- Amcor plc

- Arkema S.A.

- BASF SE

- Biome Bioplastics Limited (Biome Technologies plc)

- Braskem S.A.

- Eastman Chemical Company

- Koninklijke DSM N.V.

- Mondi PLC

- NatureWorks LLC (Cargill Incorporated)

- Novamont S.p.A

- Tetra Laval International SA

- TIPA Corp Ltd.

- WestRock Company

Recent Developments:

- January 2025: IIT-M established the Centre of Biodegradable Packaging to develop zero-waste bioplastics. The center aims to create cost-effective and scalable alternatives to traditional plastics, addressing microplastics' impact on human health. The initiative focuses on sustainable solutions to tackle environmental concerns.

- November 2024: Amcor announced its plan to acquire Berry Global in an USD 8.4 billion all-stock deal, aiming to strengthen its position in consumer and healthcare packaging. The merger, expected to close by mid-2025, will create a global packaging leader with combined revenues of $24 billion, generating $650 million in synergies by year three.

- September 2024: CSIRO and Murdoch University have launched the Bioplastics Innovation Hub aimed at eliminating plastic waste. The facility will focus on developing biologically derived plastics that can decompose in compost, land, or water without leaving any trace.

Bioplastics Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | PLA, TPS, PHA, Bio-PE, Bio-PA, Bio-PET, Bio-PP, Others |

| Packaging Types Covered | Flexible Plastic Packaging, Rigid Plastic Packaging |

| End Users Covered | Food, Beverages, Consumer Goods, Pharmaceuticals, Industrial Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ALPAGRO Packaging, Amcor plc, Arkema S.A., BASF SE, Biome Bioplastics Limited (Biome Technologies plc), Braskem S.A., Eastman Chemical Company, Koninklijke DSM N.V., Mondi PLC, NatureWorks LLC (Cargill Incorporated), Novamont S.p.A, Tetra Laval International SA, TIPA Corp Ltd., WestRock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bioplastics packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global bioplastics packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the bioplastics packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioplastics packaging market was valued at USD 7.68 Billion in 2024.

The bioplastics packaging market is projected to exhibit a CAGR of 11.76% during 2025-2033, reaching a value of USD 21.96 Billion by 2033.

The bioplastics packaging market is driven by environmental concerns, government regulations on single-use plastics, and rising consumer demand for sustainable products. Technological advancements, corporate sustainability initiatives, and the availability of renewable raw materials like cornstarch and sugarcane also contribute to growth. High costs and limited recycling infrastructure remain challenges.

Europe currently dominates the bioplastics packaging market, accounting for a share of 33.6%. In Europe, environmental regulations, consumer demand, corporate sustainability goals, and innovation in renewable materials drive the bioplastics packaging market.

Some of the major players in the bioplastics packaging market include ALPAGRO Packaging, Amcor plc, Arkema S.A., BASF SE, Biome Bioplastics Limited (Biome Technologies plc), Braskem S.A., Eastman Chemical Company, Koninklijke DSM N.V., Mondi PLC, NatureWorks LLC (Cargill Incorporated), Novamont S.p.A, Tetra Laval International SA, TIPA Corp Ltd., WestRock Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)