Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, and End-User, and Region, 2026-2034

Biometrics Market Size and Share:

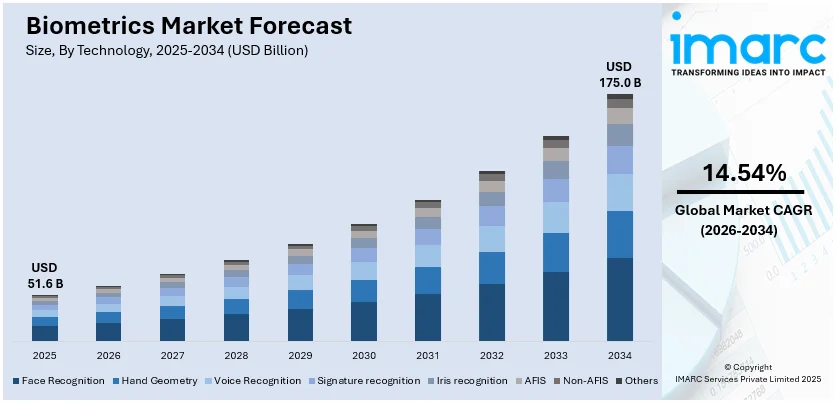

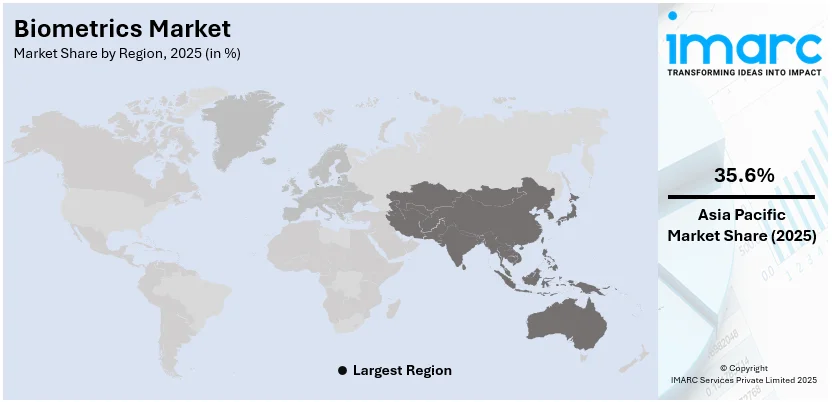

The global biometrics market size was valued at USD 51.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 175.0 Billion by 2034, exhibiting a CAGR of 14.54% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 35.6% in 2025. The growing advancements in technology and innovation, rising maintenance of border control and travel security, and increasing focus on maintaining workplace security to reduce the risk of unauthorized access are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 51.6 Billion |

| Market Forecast in 2034 | USD 175.0 Billion |

| Market Growth Rate 2026-2034 | 14.54% |

Governments and institutions globally are embracing biometrics to boost identification verification, security, and fraud prevention. Fingerprint, facial recognition, and iris scanning are being incorporated into official identification schemes by most countries, facilitating secure access to financial services, healthcare, and public assistance. Border control authorities are using biometric-based immigration checkpoints to streamline passenger verification and enhance security measures. Biometric authentication is being deployed in online payments and online banking by financial institutions to block identity theft and cyber fraud. For instance, in January 2024, Mastercard launched its Biometric Authentication Service, leveraging fingerprints, iris scans, and facial recognition to replace passwords, enhance security, and streamline authentication for online transactions and app logins. Moreover, mobile devices and smart home applications are adding biometric sensors for facilitating easy access control. Heightened data breach and digital fraud worries are making businesses implement workforce security with the use of biometric-based multi-factor authentication. Policymaking organizations are clarifying regulations for promoting biometric deployment and working towards solutions regarding privacy and ethical issues. With amplified dependence on secure digital identities, adoption of biometrics is increasing in various industries, strengthening digital trust.

To get more information on this market Request Sample

As per biometrics market research, the US currently holds a market share of 86.70% as it is growingly utilizing biometrics for public safety, law enforcement, and border control. Facial recognition and fingerprint matching are being employed by security agencies to identify criminals in investigations and surveillance activities. Airports and transportation terminals are introducing biometric identification for speedier and safer passenger checks. For example, in Aug 2024, U.S. Customs and Border Protection (CBP) issued an RFI for "on the move" biometric facial capture technology to enhance traveler verification at Ports of Entry while ensuring inspection integrity and privacy compliance. Additionally, government agencies are intensely extending biometric-based authentication to enhance access control in secure environments and curtail identity spoofing in public services. Police departments are adopting mobile biometric scanners to identify suspects in real time, enhance response rates, and increase accuracy. Prisons and jails are adopting biometric systems to track the movement of inmates and limit unauthorized entry. The adoption of AI-powered biometric technology is enhancing accuracy and minimizing errors in identification procedures. With the accelerating use of biometrics in public security, policymakers are still evaluating regulations to guarantee ethical use while upholding privacy safeguards.

Biometrics Market Trends:

Growing Advancements in Technology and Innovation

The growing advancements in technology and innovation are exerting a positive influence on the biometrics market share. Moreover, continuous upgradations in biometric algorithms, sensor technologies, and processing capabilities are leading to significant improvements in the accuracy, reliability, and performance of biometric systems. For instance, in 2022, the Transportation Security Administration introduced an identity management roadmap for biometrics, which is followed by Credential Authentication Technology (CAT). These units can scan a traveler's photo ID and match it with their flight details. These advancements enable more precise identification and authentication of individuals. Furthermore, the widespread adoption of smartphones equipped with biometric sensors, such as fingerprint scanners, facial recognition cameras, and iris scanners, has fueled the growth of mobile biometrics. Mobile biometric authentication enables secure and convenient access to devices, applications, and digital services, driving its integration into mobile banking, e-commerce, and identity verification solutions. For example, in October 2023, Google updated face verification in its latest smartphone that enables users to authenticate sign-in apps and authorize payments. Pixel 8 and Pixel 8 Pro selfie cameras blend AI and machine learning to provide secure Face Unlock that passes the highest Android biometric class standards. In line with this, the adoption of multimodal biometric systems, which combine two or more biometric modalities, such as fingerprint, facial, iris, voice, and behavioral biometrics, is increasing. Also, multimodal systems offer higher accuracy and reliability by leveraging multiple biometric traits for authentication, enhancing security and usability across various applications. For instance, in December 2023, Rank One Computing (ROC.ai) launched an iris solution, multimodal biometrics. These factors are further positively influencing the biometrics market growth.

Rising Focus on Security and Identity Management

With the rising risk of cyber threats, data breaches, and identity theft, organizations across industries are emphasizing security measures to safeguard sensitive data and prevent unauthorized access. For example, in 2023, there were over 2,300 cyberattacks that reached a total of approximately 343,338,964 victims. Data breaches grew by 72% in 2023, breaking the previous all-time high set in 2021. Consistent with this, in May of 2024, the giant health system, Ascencion, was the victim of a cyberattack as there are growing fears about cybersecurity within healthcare and an alarming spike in breaches. Biometric authentication offers a more secure and reliable method of verifying identities compared to traditional authentication methods like passwords or PINs, making it an essential component of modern security strategies. In addition, the proliferation of online transactions, digital payments, and e-commerce platforms has led to an escalation in fraudulent activities, including identity theft, account takeover, and financial fraud. Biometric solutions, such as fingerprint recognition, facial recognition, and behavioral biometrics, help mitigate fraud by accurately verifying users' identities and detecting suspicious behavior patterns. For instance, in 2023, 1.13 Million cases of financial cyber fraud were reported. Additionally, in many sectors like banking, finance, healthcare, and government, precise identity verification is required for regulatory compliance, fraud prevention, and risk management. Biometric technology allows companies to create a secure identity authentication procedure by authenticating individuals according to distinct physiological or behavioral features, thereby minimizing the potential for fraud and impersonation. For example, ID-PAL, a biometric document, and database checks provider, released a new document fraud detection solution. In support of this, in April 2024, Mastercard launched Scam Protect, a package of AI-based tools. The Scam Protect tool offers protection against scams by combining digital identity with biometrics, AI, and open banking capabilities to safeguard the consumers. These factors are proliferating the industry’s growth.

Increasing Government Investments

Governments worldwide are investing in biometric technologies to strengthen border security and improve immigration control. Biometric systems, such as facial recognition, iris scanning, and fingerprint identification, enable automated and accurate verification of travelers' identities, helping authorities identify potential threats, criminals, or individuals with fraudulent travel documents. As per the reports, in May 2024, the UK Government stated that it would be investing USD 295 Million in police biometrics. Consistent with this, in June 2023, the Canadian government made a public statement that submitting biometrics would be a compulsory part of the application process for every candidate seeking permanent residence. The motive behind this new rule is to enhance border security and speed up immigration checking. Apart from this, biometric authentication facilitates smooth passenger processing and minimizes waiting times at border crossings, airports, and other travel points. Biometric systems automate identity verification, making it fast and frictionless, and enabling travelers to pass through checkpoints more quickly while ensuring high security levels. For example, in January 2024, the Government of India stated that it is going to introduce a biometrics-based system for international passengers and speed up immigration checks. The biometrics-based system will use fingerprints or face recognition to verify passenger identities, as well as automatic immigration clearances that would eliminate the requirement for physical passport verification. In addition, the adoption of e-passports and smart border initiatives facilitates the integration of biometric technologies into travel documents and border control systems. E-passports store biometric data, such as facial images and fingerprints, enabling automated identity verification at border crossings. Smart border solutions leverage biometrics for seamless and secure border management, including visa processing, immigration control, and traveler tracking, which is augmenting the market growth. For instance, by the end of 2025, foreign visitors will be able to utilize India's Digi Yatra biometric airport ID system. The non-profit Digi Yatra Foundation (DYF), which is in charge of the facial recognition project, is awaiting certain extended use cases as well as the introduction of electronic passports in India to expedite access for visitors from abroad. This is further expected to proliferate the demand for biometrics.

Biometrics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biometrics market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on technology, functionality, component, authentication, and end-user.

Analysis by Technology:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature recognition

- Iris recognition

- AFIS

- Non-AFIS

- Others

Non-AFIS stand as the largest component in 2025, holding around 35.6% of the market. Voice recognition, also known as speaker recognition, is a biometric technology that involves the identification or verification of individuals dependent on their unique voice patterns. It can be used to provide secure authentication for devices, systems, or accounts. Users can gain access by simply speaking a passphrase or a specific phrase. It can also be used as part of a multi-factor authentication process, adding an extra layer of security alongside passwords or other biometric methods. Voice recognition can identify callers and provide personalized services based on their previous interactions and preferences. For instance, in May 2024, the Bank of Ireland declared that it is planning to invest USD 36 Million to develop its phone and CRM systems, including voice biometrics for verification to decrease customer wait times while enhancing fraud prevention. It is also adopted by doctors to transcribe their spoken notes into text, saving time, and improving accuracy in medical documentation.

Analysis by Functionality:

- Contact

- Non-contact

- Combined

Contact leads the market with around 54.2% of market share in 2025. The non-contact feature in biometrics refers to the ability to collect and analyze biometric data without physical contact between the sensing equipment and the individual being authenticated. In situations where physical contact can transmit diseases or infections, non-contact biometrics offer a safer alternative. Non-contact biometric methods are more convenient for users as individuals don't need to touch any surfaces or devices, making the authentication process faster and more user-friendly. Moreover, traditional contact-based biometric methods like fingerprint scanners might be uncomfortable or inconvenient for some individuals, especially if they have certain skin conditions or cultural preferences. Non-contact methods can provide a more inclusive and pleasant user experience. Furthermore, non-contact biometric systems can process a larger number of people quickly, making them suitable for high-traffic areas like airports, stadiums, and event venues. For instance, in December 2023, the Eastern Bank in Bangladesh launched a metal biometric payment card to authenticate contactless payment at the point of sale using the fingerprint.

Analysis by Component:

- Hardware

- Software

Hardware electronics leads the market with around 84% of market share in 2025. As per the biometrics market outlook, hardware plays a crucial role in the field of biometrics, providing the necessary tools for capturing, processing, and storing biometric data. It comprises sensors and scanners which are used to capture the unique physiological or behavioral characteristics of individuals. Biometric hardware ensures accurate data capture by minimizing noise and interference. It is commonly used for authentication and access control purposes as systems equipped with fingerprint scanners, iris recognition cameras, or facial recognition cameras can grant or deny access to secured areas, devices, or data based on the biometric traits of individuals. It is employed in workplace environments to track employee attendance and working hours accurately.

Analysis by Authentication:

- Single-Factor Authentication

- Multifactor Authentication

Single-factor authentication leads the market with around 67.4% of market share in 2025. Multifactor authentication (MFA) refers to a security process that requires users to provide two or more different authentication parameters to verify their identity before gaining access to a system, application, or data. When combined with biometrics, which involves the use of unique physical or behavioral traits for identification, MFA becomes an even more robust and secure authentication method. Besides this, combining biometrics with other authentication factors (a password or token) adds an extra layer of security. Biometric traits like fingerprints, facial features, iris patterns, and voice characteristics are unique to everyone, making it complicated for unauthorized users to gain access. Biometric authentication is user-friendly and convenient, as users don't need to remember complex passwords or carry additional hardware tokens. They can simply use their unique biometric traits to access their accounts or systems. For instance, in February 2024, MinkasuPay, a biometric authentication solutions provider, received a patent in India for its biometric 2-factor authentication technology.

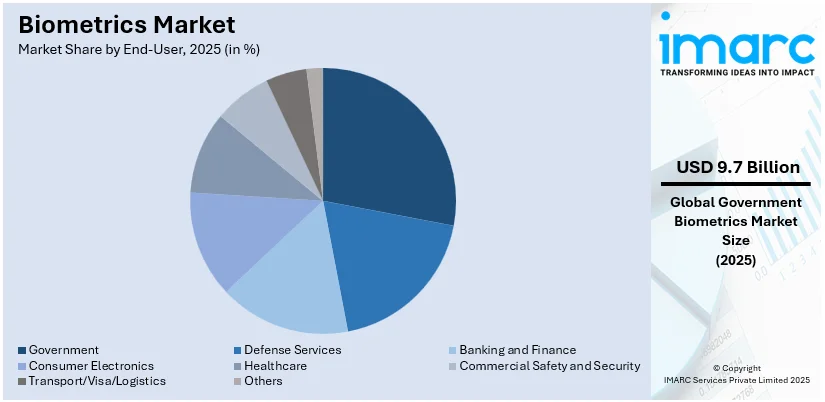

Analysis by End-User:

Access the comprehensive market breakdown Request Sample

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

Government leads the market with around 21.4% of market share in 2025. The banking and finance sector uses biometrics for a variety of reasons, primarily to enhance security, streamline processes, and refine the overall user experience. Biometric authentication offers better security compared to traditional authentication methods like passwords. It minimizes the risk of fraud, as biometric traits are difficult to forge or replicate. This helps in preventing unauthorized individuals from accessing accounts, conducting fraudulent transactions, or stealing sensitive information. Biometric technologies consisting of fingerprint recognition, facial recognition, and iris scanning offer a reliable way to verify the identity of a customer before granting access to accounts or conducting financial transactions. This helps ensure that the person performing the transaction is indeed the authorized account holder. For instance, in April 2024, Mutual Trust Bank (MTB), a Bangladesh-based bank, collaborated with IDEX Pay, the biometric solution from IDEX Biometrics and launched biometric payment cards.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 35.6%. According to the biometrics market overview, Asia Pacific held the biggest market share due to rising technological advancements in security maintenance processes. Besides this, the intensifying integration of biometrics in the financial sector to enhance security and streamline customer authentication processes is contributing to the growth of the market. Additionally, the rising utilization of online payment platforms to make cashless transactions and pay for online purchases is supporting the growth of the market. For instance, in January 2024, the Indian Government announced plans to deploy a biometrics-based system for foreign passengers to speed up immigration processes.

Key Regional Takeaways:

North America Biometrics Market Analysis

The North America biometrics industry is growing in response to higher demand for authenticated security in healthcare, financial services, and enterprise security. Fingerprint and face recognition biometric payment solutions are becoming more prevalent as banks and fintech institutions implement the modalities to reduce fraud and complete transactions efficiently. In the medical sector, patient identity confirmation by biometric verification is making fewer medical mistakes possible, along with protecting electronic patient records. Corporate settings are embracing biometric access control to thwart unauthorized access and enhance cybersecurity practices. Smart home technology growth is propelling demand for voice recognition and biometric-enabled locks. Development in AI and deep learning is enhancing biometric accuracy, widening applications in identity verification and workforce management. Privacy issues and regulatory compliance necessitate market players to amplify data protection practices. Growing investments in biometric R&D and government support for secure identification programs are also defining the development of the market across various industries.

United States Biometrics Market Analysis

Biometrics adoption in the United States is accelerating as defense services increasingly integrate advanced security measures for personnel identification, access control, and surveillance. As per reports, U.S. defense expenditures rose by USD 55 Billion between 2022 and 2023. Defense agencies and high-security centers are adopting biometric authentication to improve operational efficiency and protect sensitive information. Cutting-edge fingerprint identification, facial recognition, and iris scanning technologies are being used to strengthen border protection, military camps, and defense infrastructure. Secure authentication in defense operations is generating interest in multimodal biometrics. Biometric technologies are enhancing identity verification procedures for military personnel, preventing unauthorized access, and improving national security mechanisms. Artificial intelligence -enabled biometric systems are enabling real-time monitoring and verification, enhancing situational awareness during defense activities. The rise in defense budgets and strategic initiatives to modernize military security frameworks are amplifying biometrics integration across various defense applications. Secure identity management and rapid authentication solutions are becoming indispensable, reinforcing security protocols and mitigating potential threats. The synergy between biometrics and defense services is driving innovations, ensuring enhanced security measures across defense ecosystems.

Asia Pacific Biometrics Market Analysis

Biometrics adoption in Asia-Pacific is gaining traction as expansion and investments in transport, visa, and logistics intensify across the region. Indian logistics market to grow to USD 159.54 Billion (Rs. 13.4 Trillion) by FY28: India Brand Equity Foundation. Transportation facilities, such as airports, railway stations, and seaports are adopting biometric-based security solutions for smooth passenger authentication, improving travel experiences and avoiding risks from identity frauds. Visa processing agencies are incorporating biometric verification to make border control processes more efficient, fast-tracking document validation and immigration processing. Logistics firms are implementing biometric authentication for safe warehouse access, supply chain management, and employee verification. AI-based facial identification and fingerprint scanning technologies are enhancing identity authentication processes, providing quick and safe transactions. Government initiatives and regulatory mandates are fostering the adoption of biometrics across transport, visa, and logistics, addressing security concerns while improving operational efficiency. Advanced biometric-enabled e-gates, mobile identity solutions, and digital passports are enhancing travel security and logistics infrastructure. The integration of biometric authentication within automated systems is mitigating security risks, accelerating processing times, and enabling secure cross-border movements.

Europe Biometrics Market Analysis

Biometrics adoption in Europe is advancing as banking and finance facilities prioritize secure authentication and fraud prevention mechanisms. As per the reports, 784 foreign bank branches operated in the EU during 2021, of which 619 belonged to other Member States of the EU and 165 belonged to third countries. Financial institutions are using biometric technologies for identification of customers, secure transactions, and fraud protection. Advanced face recognition, fingerprint scanning, and voice recognition are supporting multi-factor authentication systems to ensure safe access to banking applications and ATMs. Mobile payment systems and digital banking platforms are using biometric authentication to increase user convenience while improving cybersecurity measures. AI-powered biometric analytics are facilitating real-time risk assessment, fraud detection, and identity validation, enhancing financial security. Stringent regulatory requirements for financial data protection and anti-money laundering compliance are accelerating biometrics implementation across banking ecosystems. The expansion of contactless banking solutions and biometric payment cards is streamlining financial transactions, reducing dependence on traditional authentication methods. Banks and financial institutions are integrating biometric encryption technologies to enhance data security, preventing identity theft and unauthorized transactions.

Latin America Biometrics Market Analysis

Biometrics adoption in Latin America is increasing as e-commerce and online transactions drive the need for enhanced identity authentication, fraud prevention, and secure digital payments. As per reports, the Latin America market now has more than 300 Million digital consumers. Digital platforms are adopting facial and fingerprint recognition for hassle-free user authentication, minimizing account takeovers and identity theft. Financial service providers are integrating biometric authentication into online banking and mobile payment services, making transactions secure. E-commerce sites are using voice and behavioral biometrics to build customer trust and prevent unauthorized purchases. AI-based biometric fraud detection is enhancing the security of transactions, reducing digital payment fraud risks. Mobile wallets and digital payment gateways are adopting biometric authentication, ensuring seamless and secure checkout experiences. The rising demand for secure identity verification in online transactions is prompting investments in advanced biometric solutions, improving digital trust and consumer confidence.

Middle East and Africa Biometrics Market Analysis

Biometrics adoption in the Middle East and Africa is advancing as the healthcare industry incorporates biometric authentication for patient identification, medical record security, and access control in hospitals and clinics. According on reports, the Latin America market currently it has more than 300 Million digital consumers. Digital channels are adopting facial and fingerprint identification for frictionless user authentication, preventing account takeovers and identity theft. Financial institutions are adding biometric authentication to online banking and mobile payments, making transactions secure. Online shopping platforms are using voice and behavioral biometrics to build customer confidence and prevent unauthorized transactions. Artificial intelligence-driven biometric fraud detection is enhancing payment security, reducing threats of electronic payment fraud. AI-powered biometric analytics are facilitating remote patient monitoring, improving healthcare accessibility. The Healthcare industry is leveraging biometric solutions for secure access to medical data, enhancing patient privacy and operational efficiency.

Competitive Landscape:

The world biometrics market is changing with the evolution of multimodal authentication, which combines fingerprint, facial, iris, and voice recognition for improved security. Technology developers and research centers are concentrating on enhancing accuracy through AI-driven recognition algorithms that adjust to different populations and conditions. Standardization is driving the development of interoperable biometric systems for global security, financial transactions, and employee authentication. Cloud-based biometric solutions are picking up steam, facilitating remote identity authentication in digital banking and e-governance. Developing markets are making investments in biometric infrastructure to upgrade public services, while global regulatory authorities are evolving data protection frameworks to achieve security and privacy balance. Growing use of biometrics in wearable technology and automotive security is opening up new areas of application outside traditional domains. International collaborations among research organizations, security agencies, and biometric technology pioneers are fueling ongoing innovations, defining a competitive market with a focus on technological efficiency, regulatory compliance, and responsiveness to changing security requirements.

The biometrics market report provides a comprehensive analysis of the competitive landscape with detailed profiles of all major companies, including:

- Accu-Time Systems, Inc.

- BIO-Key International, Inc.

- Cognitec Systems, GmbH

- Fujitsu Limited

- 3M Cogent, Inc.

- IDTECK

- NEC Corporation

- Siemens AG

- RCG Holdings, Ltd.

- Suprema, Inc.

- Lumidigm, Inc.

- IrisGuard, Inc.

- Daon, Inc.

- DigitalPersona, Inc.

- IDEMIA

Latest News and Developments:

- May 2025: Suprema launched BioStar Air, the first cloud-based access control platform with native biometric authentication, eliminating the need for on-premise servers. Designed for SMBs, multi-branch companies, and mixed-use buildings, BioStar Air features smart readers with built-in controllers that connect directly to networks, simplifying installation and reducing costs. It processes biometric data at the edge for fast, reliable authentication, supports multiple credential types, and offers intuitive web and mobile management interfaces. This platform centralizes access control, enhances scalability, and secures distributed workplaces efficiently.

- April 2025: IDEMIA Public Security and Saudi Arabia’s Technology Control Company (TCC) signed a Memorandum of Understanding to drive innovation in digital identity, biometrics, and smart city solutions, supporting Saudi Vision 2030. The partnership will deliver AI-driven biometric identification for enhanced security and efficiency at borders and airports, implement smart city initiatives, and provide localized training in advanced technologies.

- April 2025: HID Global launched the HID Integration Service, a platform-as-a-service designed to unify physical security, cybersecurity, and digital identity management. Debuted at ISC West 2025, this IPaaS enables developers and integrators to streamline and accelerate the integration of security solutions, reducing maintenance costs and operational complexity. Key features include scalable multi-party integrations, pre-built connectors, and enhanced security.

- April 2025: BIO-key International formed a strategic partnership with Arrow ECS Iberia, a leading IT and cybersecurity distributor in Spain and Portugal, to expand the availability of BIO-key’s advanced Identity and Access Management (IAM) solutions. This collaboration supports phoneless, tokenless, passwordless, and phishing-resistant authentication technologies, enhancing cybersecurity and regulatory compliance with NIS2 and GDPR. The partnership, includes pre-sales, technical training, and deployment support, targeting sectors like finance, healthcare, and public infrastructure.

- April 2025: Daon and CallMiner formed a strategic partnership to enhance conversation intelligence ROI for contact centers by integrating Daon’s advanced biometric identity verification and fraud prevention with CallMiner’s AI-powered conversation analytics. This collaboration enables seamless, secure customer authentication, real-time fraud detection-including deepfake prevention-and improved operational efficiency.

- March 2025: Cognitec Systems Pty Ltd began a contract with Australia's Department of Home Affairs to supply biometric cameras and related services. The project focuses on enhancing biometric photo capture and verification at international airport primary lines. Cognitec will provide biometric camera hardware, cabling, capture and verification software with licenses, traveller-side user interfaces, integration services, mounting rigs, and physical installation.

- February 2025: NEC Corporation developed a biometric digital signature technology enabling highly accurate face recognition without storing facial data, enhancing security and reducing leakage risks. The technology generates unique keys from fluctuating facial information by estimating differences between registration and authentication images, preventing false matches and enabling fast, large-scale processing. It uses encrypted computation to verify keys securely, eliminating key leakage risks. Applicable beyond facial biometrics, it supports standard digital signatures (ECDSA, EdDSA) for authenticating electronic documents and digital transactions.

Biometrics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others |

| Functionalities Covered | Contact, Non-Contact, Combined |

| Components Covered | Hardware, Software |

| Authentications Covered | Single-Factor Authentication, Multifactor Authentication |

| End-Users Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Accu-Time Systems, BIO-Key International, Inc., Cognitec Systems, GmbH, Fujitsu Limited, 3M Cogent, Inc., IDTECK, NEC Corporation, Siemens AG, RCG Holdings, Ltd., Suprema, Inc., Lumidigm, Inc., IrisGuard, Inc., Daon, Inc., DigitalPersona, Inc., IDEMIA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biometrics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biometrics market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biometrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biometrics market was valued at USD 51.6 Billion in 2025.

The biometrics market is projected to exhibit a CAGR of 14.54% during 2026-2034, reaching a value of USD 175.0 Billion by 2034.

Rising security concerns, digital identity adoption, and increasing fraud prevention efforts are driving the biometrics market. Growth in financial services, healthcare, and border control applications, along with AI-driven accuracy improvements and regulatory compliance requirements, are expanding adoption. Demand for contactless authentication and multimodal biometrics is further accelerating market expansion.

Asia Pacific currently dominates the biometrics market, accounting for a share of 35.6%. The market is driven by national ID programs, financial sector adoption, mobile biometrics growth, and expanding security applications in public and private sectors, fueling significant biometrics adoption across the region.

Some of the major players in the biometrics market include Accu-Time Systems, Inc., BIO-Key International, Inc., Cognitec Systems, GmbH, Fujitsu Limited, 3M Cogent, Inc., IDTECK, NEC Corporation, Siemens AG, RCG Holdings, Ltd., Suprema, Inc., Lumidigm, Inc., IrisGuard, Inc., Daon, Inc., DigitalPersona, Inc., IDEMIA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)