Biometric Driver Identification System Market Size, Share, Trends and Forecast by Identification Method, Vehicle Type and Region, 2025-2033

Biometric Driver Identification System Market Size and Share:

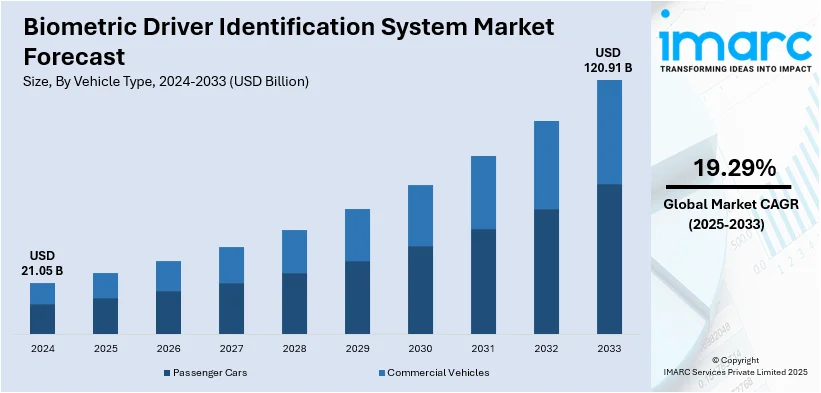

The global biometric driver identification system market size was valued at USD 21.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 120.91 Billion by 2033, exhibiting a CAGR of 19.29% from 2025-2033. North America currently dominates the market, holding a significant biometric driver identification system market share of over 36.7% in 2024. The surging emphasis on road safety and prevention of unauthorized vehicle use, government regulations mandating biometric integration, technological advancements, increased adoption in connected vehicles, rising awareness of vehicle theft, convenience of biometric authentication, and collaborations for innovative solutions are factors augmenting the market growth.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.05 Billion |

| Market Forecast in 2033 | USD 120.91 Billion |

| Market Growth Rate (2025-2033) | 19.29% |

One major driver in the global biometric driver identification system market is the increasing demand for enhanced vehicle security and anti-theft measures. Growing concerns about vehicle theft and unauthorized access have prompted automotive manufacturers to adopt biometric systems, including fingerprint recognition, facial recognition, and iris scanning, for driver authentication. These systems enhance security by preventing unauthorized individuals from starting or accessing vehicles. Moreover, strict government regulations requiring advanced safety features are accelerating adoption. Automakers are leveraging biometrics to personalize user experiences, enabling seat adjustments, infotainment settings, and driving preferences based on the identified driver, boosting biometric driver identification system market growth across various vehicle segments.

The U.S. biometric driver identification system market is expanding due to the growing adoption of advanced driver assistance systems and autonomous vehicle technologies. Automotive innovation is accelerating with five ADAS features, including forward collision warning and automatic emergency braking, reaching over 90% market penetration by model year 2023. Biometric identification is increasingly integrated to enhance driver authentication, safety, and user personalization. Automobile and tech industries are investing in facial recognition, fingerprint scanning, and iris detection to assure proper access and unauthorized vehicle use. Furthermore, up-tight regulations towards safe production force manufacturers to opt for biometric solutions; connected vehicle demand and seamless human-machine interaction stimulate biometric authentication implementations within the U.S. market.

Biometric Driver Identification System Market Trends:

Emphasis on road safety and unauthorized vehicle use

The global biometric driver identification system market is significantly propelled by an increasing emphasis on road safety and the imperative to prevent unauthorized vehicle use. As road safety concerns escalate globally, governments and regulatory bodies are increasingly recognizing the role of biometric technologies in enhancing driver accountability and reducing accidents. According to the World Health Organization (WHO), approximately 1.19 Million people die globally each year due to road traffic accidents. Biometric driver identification systems offer a reliable means to ensure that only authorized individuals operate vehicles, reducing the likelihood of accidents caused by unauthorized drivers. This heightened focus on road safety has led to a surge in the demand for biometric identification solutions that can accurately verify the driver's identity before granting access to the vehicle. Moreover, as stolen vehicles and fraudulent usage remain persistent challenges, biometric driver identification systems provide an effective deterrent against such activities, reinforcing the biometric driver identification system market demand.

Government regulations and integration mandates

Government regulations on the implementation of biometric technologies in automotive systems can be termed as a strong mover in the biometric driver identification system. Different governments and transport departments have realized the potential of such biometric identification systems in improving security and accountability in the transportation sector. The regulatory requirements are there to ensure that vehicles are made highly secure with advanced authentication methods that would reduce the risk of unauthorized usage and vehicle theft. In this regard, by formulating and enforcing such regulatory requirements, governments are nudging car manufacturers and technology solution providers to integrate the biometric driver identification solution within vehicles as a standard feature. This regulation is therefore contributing to increasing the demand for these biometric identification technologies as well as giving impetus for further innovation and even cooperation within these industries.

Advancements in biometric technologies

Advances in biometric technologies, including facial recognition and fingerprint scanning, are some of the prominent factors driving the growth of the market for biometric driver identification systems. For example, the average funding round value into the biometrics industry is about USD 15.5 Million. To date, more than 1.2K investors have been attracted to the industry, with more than 4550 rounds closed for 1340 companies. These technologies have significantly enhanced accuracy, reliability, and user experience to bridge the gaps associated with conventional methods of authentication. Facial recognition, for example, can be used to analyze distinct facial features for identifying drivers with high accuracy in a wide range of lighting conditions. Fingerprint scanning, in turn, is a tactile method that provides for security in the identification process. These advancements will further strengthen the security aspects of driver identification but, at the same time, offer convenience to the users in eliminating the use of physical keys or cards. Further, the growing biometric technologies are going to be increasingly and effectively integrated into driver identification systems, driving growth in the market.

Biometric Driver Identification System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biometric driver identification system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on identification method and vehicle type.

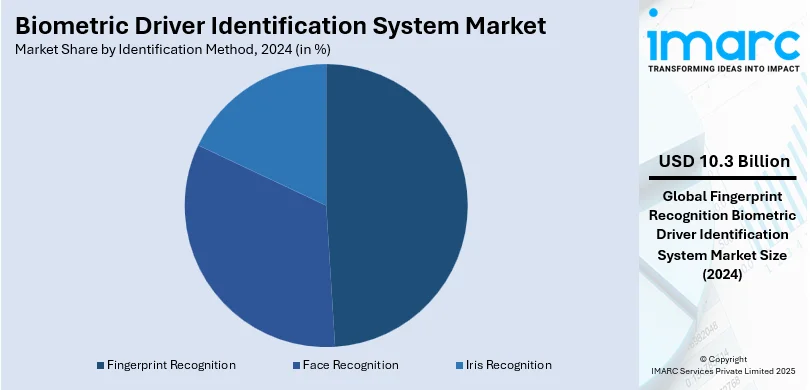

Analysis by Identification Method:

- Fingerprint Recognition

- Face Recognition

- Iris Recognition

Fingerprint recognition dominates the market, accounting for 48.7% biometric driver identification system market share due to its reliability, ease of incorporation, and cost-effectiveness into existing vehicle systems. Unlike facial or iris recognition, fingerprint scanners require minimal hardware modifications, making them a preferred choice for automakers. Their high accuracy in driver authentication enhances vehicle security, preventing unauthorized access and theft. Additionally, fingerprint sensors offer quick response times, ensuring seamless user experiences without delays. With advancements in sensor technology, modern fingerprint recognition systems now provide enhanced anti-spoofing capabilities, improving security standards. The growing adoption of connected vehicles and regulatory emphasis on safety further drive its widespread implementation, solidifying its market dominance over other biometric authentication methods.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

The commercial vehicles segment leads the biometric driver identification system market due to the growing emphasis on fleet security, driver monitoring, and regulatory compliance. Logistics and transportation companies are increasingly adopting biometric authentication to prevent unauthorized vehicle access, enhance operational safety, and track driver behavior. Fleet managers benefit from improved accountability and reduced risk of theft or misuse. Additionally, stringent regulations regarding driver fatigue monitoring and safety compliance drive the adoption of biometric solutions, such as fingerprint and facial recognition. The integration of biometric systems in commercial trucks and buses enhances efficiency by enabling personalized settings for drivers. As fleet digitization expands, the demand for secure, data-driven authentication solutions further strengthens the dominance of commercial vehicles in this biometric driver identification system market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the biometric driver identification system market forecast, North America holds the largest share of the biometric driver identification system market at 36.7% due to the region’s strong emphasis on vehicle security, advanced automotive technology, and stringent regulatory standards. Automakers and technology firms in the U.S. and Canada are actively integrating biometric solutions, such as fingerprint and facial recognition, to enhance driver authentication and prevent vehicle theft. The growing adoption of connected and autonomous vehicles (AVs) further accelerates demand for biometric security features. Additionally, government regulations promoting road safety and driver monitoring, particularly in commercial fleets, drive market growth. The increasing preference for personalized in-car experiences and the rising penetration of electric and high-end vehicles with advanced security systems further solidify North America’s dominance in this market.

Key Regional Takeaways:

United States Biometric Driver Identification System Market Analysis

The growing biometric driver identification system adoption in the United States is driven by increasing investments in the automotive sector, enabling advanced security features and personalized vehicle access. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. Automakers and technology firms are integrating biometric driver identification systems to enhance authentication, preventing unauthorized vehicle use and ensuring seamless user experiences. The automotive sector's commitment to innovation is fostering the deployment of facial recognition, fingerprint scanning, and iris recognition in vehicles, aligning with consumer demand for enhanced security. Expanding research and development efforts within the automotive sector further accelerate the integration of biometric driver identification systems, particularly in connected and AVs. Growing collaborations between industry players and financial backing for next-generation vehicle technologies are reinforcing adoption. With the automotive sector continuously evolving, manufacturers are embedding biometric driver identification systems to comply with stringent safety regulations, ensuring secure vehicle access and reducing identity fraud.

Asia Pacific Biometric Driver Identification System Market Analysis

Rapid growing of biometric driver identification in Asia-Pacific to prevent rising incidents of vehicle thefts and improve the adoption rates of advanced security solutions. For example, in 2023, India had an alarming increase of 2.5x in the number of cars stolen, as compared to 2022. This tremendous increase in vehicle theft has increased the demand for stronger driver authentication techniques that encourage auto players to integrate biometric driver identification systems in next-generation vehicles. There has also been promotion from governments and regulatory bodies about the implementation of biometric driver identification systems. This is intended to prevent more thefts because only authorized drivers can drive such vehicles. Connected cars and most premium vehicle models are now going to be built with fingerprint recognition, facial recognition, and other behavioral biometrics because of escalating vehicle theft fears. Automakers are further investing in next-generation security frameworks that leverage biometric driver identification systems to deter unauthorized access, aligning with consumer preferences for enhanced vehicle protection against vehicle theft.

Europe Biometric Driver Identification System Market Analysis

The expansion of biometric driver identification system adoption in Europe is strongly linked to the increase in vehicle ownership, necessitating secure and efficient authentication mechanisms. The International Council on Clean Transportation reports that 10.6 million new cars were registered across the 27 EU member states in 2023, marking a 14% increase from 2022. The rising number of personal and commercial vehicles on the road underscores the need for biometric driver identification systems to enhance safety, reduce identity fraud, and prevent unauthorized access. With vehicle ownership reaching new heights, manufacturers are focusing on integrating fingerprint recognition, facial recognition, and voice-based authentication into modern vehicles to ensure seamless driver verification. The growing vehicle ownership trend is also prompting regulatory bodies to encourage the adoption of biometric driver identification systems, particularly in fleet management and high-end vehicles. As vehicle ownership continues to surge, automakers are prioritizing the deployment of biometric driver identification systems to cater to security-conscious consumers seeking robust authentication solutions.

Latin America Biometric Driver Identification System Market Analysis

The increasing biometric driver identification system adoption in Latin America is primarily attributed to the rise in passenger cars, fuelled by growing disposable income. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. As economic conditions improve, the demand for passenger cars is accelerating, creating a need for enhanced security solutions that ensure safe and personalized vehicle access. Automakers are embedding biometric driver identification systems into passenger cars, leveraging fingerprint recognition and facial authentication to cater to evolving consumer expectations. With growing disposable income leading to higher vehicle acquisition rates, the necessity for biometric driver identification systems is expanding, offering added protection against theft and unauthorized usage. This adoption aligns with consumer preferences for innovative security technologies, reinforcing biometric driver identification systems as an integral component of modern passenger cars in the region.

Middle East and Africa Biometric Driver Identification System Market Analysis

The biometric driver identification system adoption is rising as road safety concerns escalate globally, prompting regulatory bodies to mandate biometric solutions for enhanced driver accountability. For instance, total reported car accidents in UAE: approximately 3,945 in the year 2022. Governments recognize the potential of biometrics in preventing unauthorized vehicle use and reducing traffic violations. Growing accidents are increasing the demand for driver monitoring systems incorporating biometric authentication to ensure responsible driving behaviour. Fleet operators are integrating biometrics to enhance security and compliance with safety regulations. The growing need for intelligent vehicle access solutions is accelerating the adoption of biometric driver identification system in commercial and private vehicles.

Competitive Landscape:

The competitive landscape of the global biometric driver identification system market is marked by intense innovation and strategic collaborations among technology providers and automotive manufacturers. Companies are prioritizing the integration of advanced biometric technologies, including facial recognition, fingerprint scanning, and iris detection, to enhance vehicle security and driver authentication systems. The market is witnessing significant investments in research and development to enhance accuracy, response time, and user experience. Partnership with automobile OEMs and software houses is becoming a norm to ensure easy deployment on modern vehicles. In addition, regulatory issues and data security are causing companies to enrich encryption and cyber-security mechanisms in their market strategies. The above factors are giving competition to the development of connected and AVs.

The report provides a comprehensive analysis of the competitive landscape in the biometric driver identification system market with detailed profiles of all major companies, including:

- Bayometric

- Fingerprint Cards AB

- Fulcrum Biometrics Inc. (Fujitsu Limited)

- Gentex Corporation

- Iritech Inc.

- NEC Corporation

Latest News and Developments:

- October 2024: Infineon Technologies launched automotive-qualified fingerprint sensor ICs, CYFP10020A00 and CYFP10020S00, designed for secure in-vehicle authentication. These sensors, compliant with AEC-Q100 standards, enhance personalization and payment authentication for automotive applications. Partnering with Precise Biometrics, Infineon integrates advanced fingerprint identification with encrypted data transmission.

- May 2024: Ford has patented a facial recognition system for vehicle entry, aiming to enhance security and convenience. The system uses a camera to scan and verify the driver’s face before unlocking the vehicle. In case of failure, a backup code entry method ensures access. This innovation is part of Ford's ongoing exploration of advanced vehicle access technologies.

- February 2024: trinamiX, in collaboration with Continental, is showcasing its secure Face Authentication for vehicles at MWC 2024. The technology enables contactless unlocking and ignition via biometric authentication with liveness detection. Seamlessly integrated into the B-pillar and driver display, it enhances security and design. Visitors can experience it at Hall 6, Stand E68.

- January 2024: Continental unveiled an invisible face authentication camera behind the driver display at CES 2024, enabling secure starts and digital payments. Additional biometric sensors in the B-pillar unlock the vehicle upon detecting an authorized user. The seamless display integrates into the vehicle's exterior, appearing only when needed. This innovation enhances security and interaction in modern vehicles.

- January 2024: BYD unveiled the world's first palm key at the 2024 Dream Day event, using palm vein recognition for secure vehicle access. With an 8-20cm recognition range and 360° rotation support, it enables driving without a phone or key. Officials highlight its forgery-resistant nature, as palm vein patterns remain unique for life. The launch underscores the growing role of biometric authentication in identity verification.

Biometric Driver Identification System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Identification Methods Covered | Fingerprint Recognition, Face Recognition, Iris Recognition |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bayometric, Fingerprint Cards AB, Fulcrum Biometrics Inc. (Fujitsu Limited), Gentex Corporation, Iritech Inc., NEC Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biometric driver identification system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global biometric driver identification system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biometric driver identification system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biometric driver identification system market was valued at USD 21.05 Billion in 2024.

The biometric driver identification system market was valued at USD 120.91 Billion in 2033 exhibiting a CAGR of 19.29% during 2025-2033.

Key factors driving the biometric driver identification system market include rising vehicle theft concerns, increasing demand for advanced security, and regulatory mandates for driver authentication. The growth of connected and AVs, fleet management needs, and user personalization trends further boost adoption, enhancing safety, convenience, and operational efficiency across the automotive sector.

North America dominates the market due to advanced automotive security adoption, regulatory mandates, and rising demand for biometric authentication in vehicles.

Some of the major players in the biometric driver identification system market include Bayometric, Fingerprint Cards AB, Fulcrum Biometrics Inc. (Fujitsu Limited), Gentex Corporation, Iritech Inc., NEC Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)