Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing, and Region, 2025-2033

Biologics Market Size and Share:

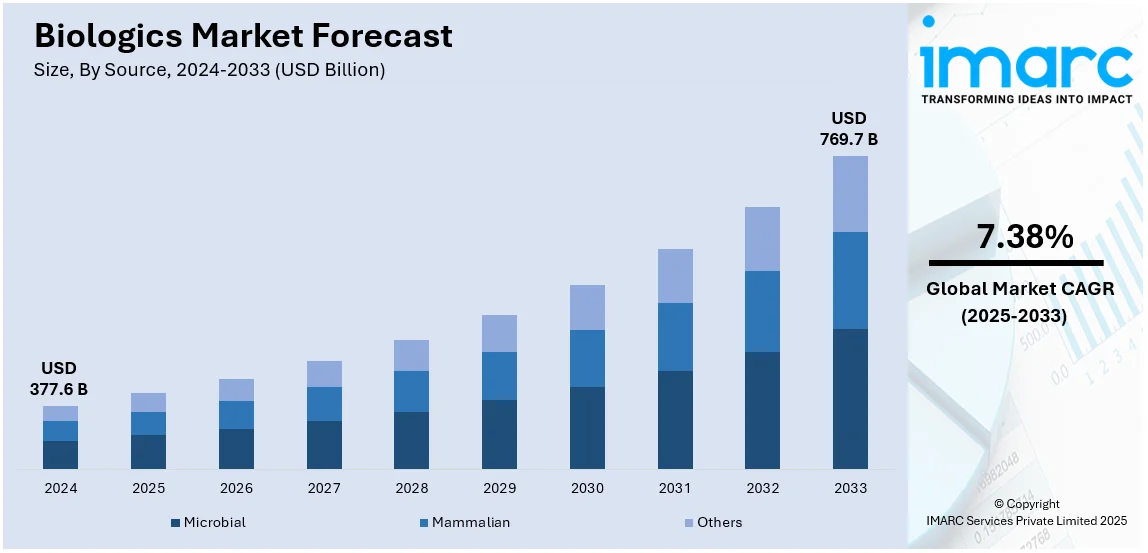

The global biologics market size was valued at USD 377.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 769.7 Billion by 2033, exhibiting a CAGR of 7.38% from 2025-2033. North America currently dominates the market, holding a market share of over 44.8% in 2024. The rising prevalence of chronic diseases, which necessitate more effective treatment options, continuous technological advancements facilitating the development of increasingly targeted therapies, and the emergence of advanced drug delivery systems are some of the factors catalyzing the biologics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 377.6 Billion |

| Market Forecast in 2033 | USD 769.7 Billion |

| Market Growth Rate (2025-2033) | 7.38% |

The global biologics market is expanding at a very fast pace due to the increasing demand for innovative therapies and biotechnology advancement. Biologics are products that derive from living organisms, and such products include monoclonal antibodies, vaccines, cell and gene therapies, and recombinant proteins. All of these therapies are altering health care since they bring focused, effective treatments for chronic diseases such as diabetes, cancer and autoimmune diseases. The increasing incidence of chronic diseases, along with the geriatric population, is highly driving the uptake of biologics. Furthermore, investments in research and development are fast-tracking the launch of next-generation biologics, including biosimilars, which provide cost-effective alternatives. Support from regulations and approvals has also paved the way for the biologics market growth.

The United States has emerged as a key regional market for biologics. The market is fueled by growing demand for innovative therapies, advancements in biotechnology, and increasingly interested in personalized medicine. The high incidence of chronic conditions, such as cancer, autoimmunity disorders, and diabetes, is driving the demand for biological treatments. The further expansion of biosimilars and the trend toward more use of biologic medicines over traditional pharmaceuticals is fueling further market growth. As per the biologics market analysis report, steadily growing investment research and development by pharmaceutical companies in support of favorable government policies promote growth in the market. Moreover, improvement in infrastructure for healthcare and reimbursement policy further enhances the availability of biological drugs. Further, a focus on precision medicine and the future of biologics is going to help the U.S. market grow steadily.

Biologics Market Trends:

Continuous innovations in targeted therapies

One of the significant biologics market trends for complex molecules is the continuous innovation in targeted therapies. These are therapies designed to specifically act on certain cells or molecules responsible for disease, thus increasing treatment effectiveness while minimizing side effects. Given the critical nature of diseases like cancer and autoimmune disorders, targeted therapies offer a novel and effective avenue for treatment. According to the European Society for Medical Oncology, between 2006 and 2020, there were 72 approvals for 51 drugs targeting 36 genomic indications across 18 types of cancer, which increased eligibility for genome-targeted therapies from 5. 13% to 13. 60% and increased response rates from 2. 73% to 7. 04%. Meanwhile, genome-informed therapies increased eligibility from 10. 70% to 27. 30% and response rates improved from 3. 33% to 11. 10%. For example, in March 2024, Caltech researchers created an ultrasound-activated drug-delivery system that focused on cancer treatment with minimum side effects. This technique combines gas vesicles and mechanophores to activate drugs, thereby reducing harm to healthy tissues precisely. Similarly, Nature Medicine released its report in March 2024 on the results of patients with recurrent glioblastoma (rGBM) treated intrathecally with bivalent chimeric antigen receptor T-cells, being autologous, with dual targeting of two proteins: epidermal growth factor receptor (EGFR), interleukin-13 receptor alpha 2 (IL13Rα2). These targeted T-cells against aggressive brain tumor growth end. Science research in large scales has been able to reveal mechanisms of diseases at the molecular level, and thus a treatment approach has been provided with specialized therapies that are much more effective and less toxic than traditional approaches. This trend is likely to see increased investments in research and development, along with a heightened focus on personalized medicine. Their introduction and subsequent success can significantly increase the demand for complex molecules, thereby acting as a critical catalyst for the market. The rising preference for precision treatments that offer higher efficacy and lower toxicity is accelerating market demand for targeted biologics.

Emergence of advanced drug delivery systems

Drug delivery systems have become increasingly important in healthcare, often determining the efficacy and patient compliance for complex molecular treatments. Innovation in this field takes many forms, from controlled-release mechanisms to nanotechnology-based delivery systems. According to reports, nanotechnology is expected to cross USD 125 Billion worldwide by 2024, which transforms biologics by facilitating targeted drug delivery, boosting cancer therapies, and increasing the stability and effectiveness of biomolecules. An example includes scientists from the University of North Carolina, who, in January 2024, launched the Spatiotemporal On-Demand Patch SOP, a wireless drug delivery system that resembles a band-aid. The wireless patch can receive commands from the computer or smartphone, where its delivery can be scheduled and controlled on the microneedle. This will allow a patient to follow the plan for their treatment much easier, leading to better outcomes in clinical practice. New delivery systems might eventually replace daily injections with a weekly or even a monthly dose, significantly increasing patient convenience and willingness to stay on treatment. Major investments are pouring into their research and development with the intention of maximizing the therapeutic efficiency of complex molecules. Such research in drug delivery systems advances significantly contribute to the biologics market value and opportunities for growth in satisfying a huge demand for more efficient, patient-friendly therapeutic alternatives. This innovation-driven environment reflects growing demand for delivery methods that align with patient-centric care models.

Regulatory changes and harmonization

Companies in the healthcare industry have had to grapple with a very difficult, labyrinthine regulatory environment. However, regulatory harmonization is making the scenario increasingly straightforward. The draft guidance of July 2023 from the US Food and Drug Administration, titled "Good Clinical Practice (GCP) E6(R3)", in cooperation with the International Council for Harmonisation (ICH), says it has been put in place "to provide a unified standard to facilitate mutual acceptance of clinical data between ICH member countries and regions in order to enhance more innovative and efficient design of clinical trials.". Reduced substantially, market entry barriers through unified or mutually recognized approval processes across different countries mean new and existing products can now easily reach a much wider patient base much sooner than they previously could. The rapid rollout of innovative therapies to patients and their significant geographic expansion has significant implications. This favorable alignment of regulatory practices, which expedites approval and expands market access, is driving ongoing growth in the global market for complex biologics molecules, thereby creating a positive biologics market outlook. These regulatory streamlining efforts are also encouraging global manufacturers to invest more aggressively in cross-border biologics development.

Biologics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biologics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on source, product, disease, and manufacturing.

Analysis by Source:

- Microbial

- Mammalian

- Others

The microbial sources account for a majority share of 58.5% driven mainly by their cost-effectiveness, scalability, and high productivity in biologics manufacture. Microorganisms such as E. coli and yeast are very widespread to produce recombinant proteins, enzymes, and vaccines because they produce at very fast growth rates and because of simpler genetic manipulation. The manufacture of biologics involving minimal post-translational modification is very good with the system, and therefore, they dominate insulin, growth hormones, and certain therapeutic enzymes. Advances in the technological aspects of fermentation systems and bioprocessing techniques have further increased yield and efficiency, thus making microbial platforms even more attractive. Increasing demand for biosimilars and the trend of precision medicine continue to fuel investment in microbial technologies. Pharmaceutical companies also prefer microbial systems as they help them meet regulatory compliance while lowering production costs. These factors will ensure the continued dominance of microbial platforms in biologics manufacturing.

Analysis by Product:

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense, RNAi, and Molecular Therapy

- Others

Monoclonal antibodies represent the largest segment with a share of 66.7% due to their crucial role in cancer, autoimmune diseases, and infectious disorders. The accuracy in the specificity of targeting antigens has placed them in a position as indispensable in personalized medicine. New areas of improvement in antibody engineering include bispecific antibodies and antibody-drug conjugates, which improve the efficacy of the therapeutic products. More investments in R&D have accelerated the regulatory approvals of these products, and they are increasingly being applied in clinical practice. The growing adoption of biosimilar monoclonal antibodies offers cost-effective solutions, widening their accessibility and further fueling market expansion. With ongoing innovation and the rising prevalence of chronic diseases, monoclonal antibodies remain a cornerstone of biologics development and commercialization, ensuring sustained growth.

Analysis by Disease:

- Oncology

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

The oncology segment holds the largest share of 28.7%, supported by a global rise in cancer prevalence and the increasing adoption of targeted therapies. Advances in biologic products such as monoclonal antibodies, checkpoint inhibitors, and cell-based therapies offer improved survival advantages and quality of life as a part of cancer care. Investment in precision medicines and innovative developments in immuno-therapies also augment growth in this space. Further regulatory approval of new biologic products for varied types of cancers drives demand and supports growth in this market. As biologics demonstrate efficacy in managing and perhaps even curing cancers, their application within oncology remains on track, making it the most profitable segment in the market for biologics.

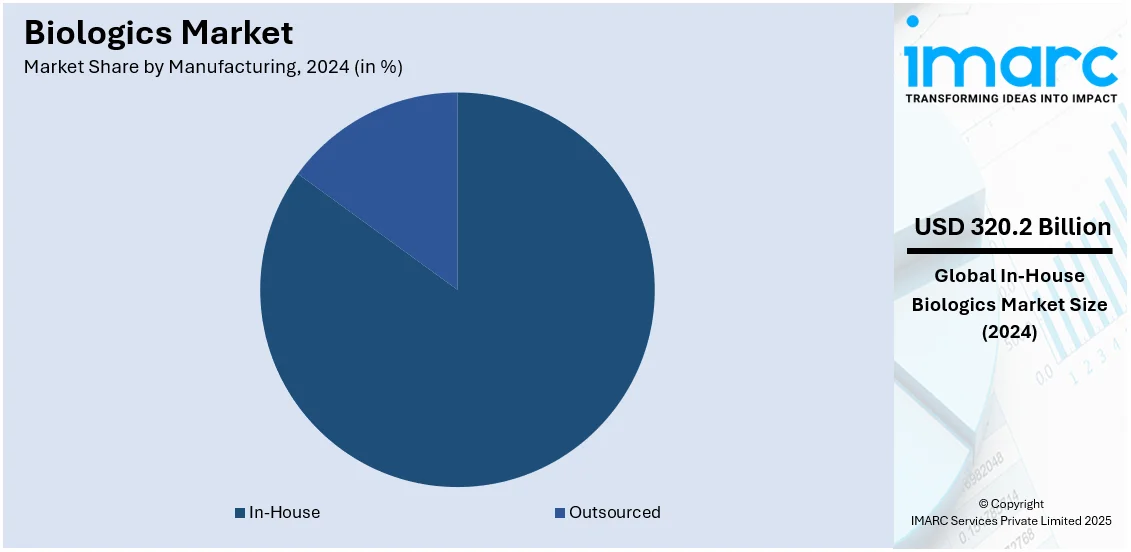

Analysis by Manufacturing:

- Outsourced

- In-House

In-house manufacturing leads the market with an 84.8% share, driven by the need to have greater control over production processes, intellectual property protection, and regulatory standards that are quite stringent. Companies using the in-house capacity can directly control quality assurance, respond quicker to production problems, and maintain integration with internal R&D teams. This also contributes to cost optimization in the long run by eliminating dependency on other partners. Such capability to streamline operations with proprietary knowledge, especially about high-value biologics, gives the advantage to in-house manufacturing. More importantly, modular and continuous manufacturing technologies have advanced with which companies have developed means to enhance scalability as well as efficiency, where different production demands can be met accordingly, but they do not have any external dependence on partners.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America held the highest share in 2024, with over 44.8%. North America dominates the market due to its developed healthcare infrastructure and increased investments in biopharmaceutical research. It contains numerous top biopharmaceutical companies and research organizations. Such innovation by various entities in the region creates an optimistic outlook for the market. Favorable regulatory support in the form of fast-track approvals for biologics and various financial incentives for extensive research and development activities are also contributing to the market growth. Furthermore, increasing patient awareness and willingness to adopt new therapies are further fueling the demand for biologics in North America. The U.S. also constitutes the biggest market in the region, primarily due to high healthcare spending, broad insurance coverage, and increasing chronic and lifestyle-related diseases.

Advanced demand for biologic therapies, accelerating healthcare, and improving infrastructure for healthcare drive the Asia Pacific biologics market. The increasing prevalence of chronic diseases coupled with an increased awareness about, and affordability of, biologics is promoting growth in the market. Government incentives to develop biosimilars are also driving market growth and have surged healthcare expenditure in the nations of China and India. A huge patient population and increasing research and development are two of the primary drivers of this market growth in the region.

In Europe, a well-developed healthcare system with higher accessibility toward advanced biologic treatment enhances the market growth for biologics. A high rate of incidence of autoimmune diseases, cancer, and other chronic conditions stimulates the need for biologics. Governments' support with positive regulation sets an impetus to accept biosimilars. The region's focus on research and innovation with a strong healthcare infrastructure provides the right environment to grow in biologics. In addition, increased expenditure on healthcare, as well as collaborative efforts between the public and private sectors, contribute to the momentum of this market.

In Latin America, better access to healthcare is fueling the growth of biologics. The region is also witnessing increased investments in the healthcare sector and a greater prevalence of chronic diseases. Affordability and access to biologics are improving through the efforts of governments, thereby increasing demand. Biosimilar adoption is also increasing along with regional initiatives that help cut drug costs. Brazil, Mexico, and Argentina are some of the major contributors to this growth due to increasing awareness about biologics and the expansion of healthcare markets, which attracts investments from multinational pharmaceutical companies.

The biologics market of the Middle East and Africa is expanding due to increasing health investments in the region, development in healthcare facilities, and greater demand for advanced therapies. More chronic diseases are being noticed in the region, including diabetic conditions, cardiovascular disease, and cancer, which is making the demand for these biologic drugs rise. The government is also investing in healthcare reforms to make access to biologics better, especially in countries like the UAE, Saudi Arabia, and South Africa. The use of biosimilars and health awareness among patients is also increasing market growth.

Key Regional Takeaways:

United States Biologics Market Analysis

In 2024, the United Sates accounts for 88.70% of the biologics market in North America. The adoption of advanced treatments is transforming medicine by offering more personalized treatment options in the US. Advanced therapies are now tailored to specific disease mechanisms and have resulted in outcomes that traditional methods often cannot achieve. According to HIPAA Journal, the average private healthcare spending in the U. S. is USD 11,197 per person annually (CMS, 2024), which reflects this growing trend toward personalized medicine. This movement opens high-technology avenues for biologics to satisfy a diversity of medical needs. Shifting focus toward personalized medicine has significantly improved the condition of people with chronic diseases. Innovation in R&D is bringing safer and more efficient next-generation therapies. The tie-up between service providers, who are the healthcare operators, and the biotech organizations is accelerating non-stop new technology interventions into treatment modules while ensuring an effective governance architecture that will ensure and continue to drive safety coupled with innovation. Furthermore, better support for patients is bridging the access gaps to advanced therapies and leads to better management of disease. These collaborations are sowing a rich healthcare future that continually pushes the limits of medical advancement.

Asia Pacific Biologics Market Analysis

Fast innovations in advanced medical technologies are altering the treatment paradigms and providing tailored strategies that are meeting unmet clinical needs. Initiatives in the expansion of capacity for production are making access more widespread, thus facilitating the reduction of barriers to healthcare services. Collaboration between local research institutes and international companies promotes knowledge sharing and, thus, the pace of innovation. Sensitization and training programs are significantly increasing the patient's understanding and embracing of new therapeutic interventions. Investment in the healthcare structure is opening opportunities for many, especially those in the urban areas, to have access to complex treatment modalities. According to the Ministry of Health and Family Welfare, the healthcare structure of India is aided by an increase in government health spending, reaching about USD 51 Billion in 2021-22, and an aim for public investment to increase to 2.5% of GDP by 2025, builds support for the biologics ecosystem by enhancing the ease of access to superior health facilities through initiatives like National Health Mission and Ayushman Bharat Health Infrastructure Mission. The introduction of low-cost biosimilars plays a vital role in ensuring the extension of innovative medicines, thereby ensuring diverse population groups benefit from medical innovation.

Europe Biologics Market Analysis

European countries are emerging as leaders in healthcare innovation, focusing on cutting-edge research and novel medical breakthroughs. With more financial investment in biotechnology and clinical trials, the way is now becoming smooth for effective treatment options for complex health problems. Accelerations in the pace of disease management research and development resulting from collaborations between academic institutes and pharmaceutical companies have paved the way for better services to patients. Huge coverage of insurance systems and reimbursement structures make specialist care accessible as well as affordable for most of the population. This is seen in Germany; according to Germany Visa, Germany has allocated approximately $521.5 Billion toward healthcare in 2021, with over 90% of its population falling under statutory health insurance. This extensive coverage leads to a higher life expectancy and allows for significant investments in biologics focused on conditions like cancer and cardiovascular diseases. Moreover, sustainability is also becoming a priority, with green manufacturing approaches on the rise. The cross-border sharing of clinical data also supports the adoption of more advanced medical practices, leading to better healthcare delivery throughout the region.

Latin America Biologics Market Analysis

Advances in therapy in the field have been based on meeting local needs with specific tailored solutions, ensuring wider suitability. A greater emphasis on research and development in specific therapeutic areas helps to bring about cost-effective breakthroughs without compromising efficacy. According to the International Trade Administration, U. S. Department of Commerce, Brazil is the largest healthcare market in Latin America, with 9.47% of its GDP allocated to healthcare (USD161 Billion), which strengthens strong research and development programs that improve biologics innovation. With 427,097 hospital beds and public-private partnerships, its focus on innovation, including vaccine manufacturing and therapeutic developments, provides extensive opportunities for biologics to address chronic illnesses and prepare for pandemics. Using the latest emerging technologies, the region is able to show excellent local production capabilities, which is necessary to increase availability. Moreover, cross-industry efforts directed toward increasing knowledge-sharing and skill development create an environment that fosters transformational improvements.

Middle East and Africa Biologics Market Analysis

Biologics are transforming the treatment landscapes as they have precision in targeting the disease mechanisms. These therapies allow for more effective and tailored interventions, particularly with complex conditions, as they focus on root causes rather than merely addressing symptoms. Their capacity to provide individualized treatments promotes better results and lower probabilities of adverse side effects, thus instilling trust among patients and health professionals. At the same time, the growing prevalence of cancer has created a demand for innovative therapies. According to the WHO, the surging cancer rates in the Arab World, with an anticipated 1.8-fold increase in incidence by 2030, underscore the escalating burden of disease. This surge presents a significant opportunity for biologics, offering advanced therapeutic solutions to confront the rising public health challenge. This shift is driven by increased awareness about early diagnosis and improved access to advanced medical treatments. With the emphasis on improving outcomes, the uptake of innovative therapies is gaining pace steadily, making it a very lively environment for enhancements in treatment protocols and patient care.

Competitive Landscape:

Increasing focus is on strategic collaborations, acquisitions, and research for improving their market positioning by players in the biologics market. They are also focusing on advancement in monoclonal antibodies, gene therapies, and cell-based therapies that have potential applications in dealing with the complexity of disease states, including cancer, autoimmune diseases, and many genetic conditions. Next-generation biologics, including bispecific antibodies and CAR-T therapies, are investments by companies to fill in unmet medical needs. Biosimilars, too, are aggressively being developed by various market players, which take advantage of patent expiries for blockbuster biologic drugs, making them cost-efficient alternatives for originators. Biologic manufacturing processes have also become optimized through advanced technologies like automation, AI, and machine learning to enhance efficiency and scalability. These strategies are expected to fuel market growth and innovation over the coming years.

The report provides a comprehensive analysis of the competitive landscape in the biologics market with detailed profiles of all major companies, including:

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Sanofi

Latest News and Developments:

- April 2025: Samsung Biologics highlighted its adoption of a Quality-by-Design (QbD) framework to enhance biopharmaceutical product lifecycle management, spanning from process characterization to commercial manufacturing. The strategy aims to improve consistency, compliance, and scalability in contract development and manufacturing operations (CDMO), a critical factor in the biologics market's ongoing growth.

- June 2025: WuXi Biologics announced a commercial manufacturing partnership with Virogen Biotechnology to support production of VG712, a first-in-class anti-CD3 immunotoxin targeting immune system reset for cancer and autoimmune diseases. WuXi Biologics will provide technology transfer, process validation, and full-scale manufacturing of drug substance and drug product, enabling VG712’s progression from Phase II trials toward a planned Biologics License Application between 2027 and 2028.

- May 2025: Forge Biologics announced a manufacturing partnership with Fractyl Health to support the development of Rejuva, an AAV-based pancreatic gene therapy platform targeting obesity and type 2 diabetes. Under the agreement, Forge will provide process development, cGMP manufacturing, and analytical services using its FUEL™ platform at its 200,000 square foot facility in Columbus, Ohio.

- May 2025: Biocon Biologics announced it secured market access for YESINTEK™ (ustekinumab-kfce) across major U.S. formularies, reaching coverage for over 100 million lives—equivalent to approximately 70–80% of the commercial market. The biosimilar to Stelara® has been approved for chronic autoimmune conditions such as Crohn’s disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis, and received U.S. FDA approval in December 2024.

- March 2024: Lonza, the Swiss CDMO, has acquired Roche's California biologic drug manufacturing site for USD 1.2 Billion. The acquisition strengthens Lonza's capacity in biologic drug manufacturing and expands its global presence. The facility is one of the largest in its class and fits into Lonza's growth strategy in the pharmaceutical industry. The growing demand for biologic drugs across the globe also features in this deal.

- March 2024: Pearl Bio entered into a strategic collaboration with Merck to develop biologic therapies incorporating non-standard amino acids. The collaboration focuses on Pearl Bio's strength in synthetic biology and the pharmaceutical capabilities of Merck. The deal is structured under licensing, collaboration, and an option structure that will be used to forward innovative treatment modalities. The partnership reflects growing interest in novel biologic platforms to address complex diseases.

- March 2024: Eris Lifesciences acquired Biocon Biologics' branded formulation business and secured a 10-year supply agreement. Eris's portfolio is upgraded, especially in biosimilars and biologics, within India's fast-growing healthcare market with the long-term supply deal giving consistent access to high-quality products. This move confirms Eris's commitment to increasing its footprint in the biologics sector.

Biologics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Microbial, Mammalian, Others |

| Products Covered | Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense, RNAi and Molecular Therapy, Others |

| Diseases Covered | Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others |

| Manufacturing Covered | Outsourced, In-House |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AbbVie Inc., Amgen Inc., AstraZeneca plc, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, Johnson & Johnson, Merck KGaA, Novartis AG, Pfizer Inc., Sanofi, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biologics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biologics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biologics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biologics market was valued at USD 377.6 Billion in 2024.

The biologics market is projected to exhibit a CAGR of 7.38% during 2025-2033, reaching a value of USD 769.7 Billion by 2033.

The biologics market is majorly driven by the rising prevalence of chronic diseases, which necessitate more effective treatment options, continuous technological advancements facilitating the development of increasingly targeted therapies, and the emergence of advanced drug delivery systems.

North America currently dominates the market, accounting for a share of around 44.8%. The dominance is driven by advanced healthcare infrastructure, rising chronic disease prevalence, robust R&D investments, favorable regulatory frameworks, growing biopharmaceutical demand, and increasing adoption of personalized medicine solutions.

Some of the major players in the biologics market include AbbVie Inc., Amgen Inc., AstraZeneca plc, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, Johnson & Johnson, Merck KGaA, Novartis AG, Pfizer Inc., and Sanofi, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)