Biological Safety Testing Market Size, Share, Trends, and Forecast by Product and Services, Test Type, Application, and Region, 2025-2033

Biological Safety Testing Market Size and Share:

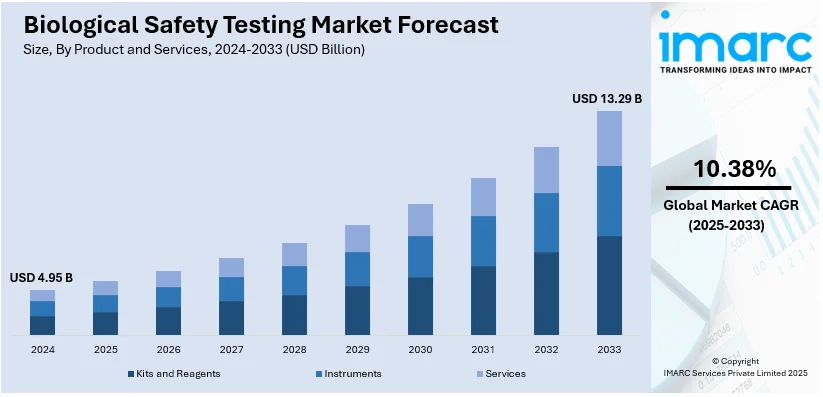

The global biological safety testing market size was valued at USD 4.95 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.29 Billion by 2033, exhibiting a CAGR of 10.38% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.8% in 2024. The expansion of the pharmaceutical and biotechnology sectors, the impact of the COVID-19 pandemic, and the rising emphasis on regulatory compliance and safety standards are some of the major factors increasing the biological safety testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.95 Billion |

|

Market Forecast in 2033

|

USD 13.29 Billion |

| Market Growth Rate 2025-2033 | 10.38% |

The increasing demand for biopharmaceuticals, vaccines, and biosimilars drives the biological safety testing market due to rising healthcare needs and chronic disease prevalence. Stringent regulatory guidelines for product safety and efficacy, and the growing investment in biotechnology research and development, further fuel market growth. Advancements in cell and gene therapies and the expansion of contract research organizations (CROs) have also boosted the demand for reliable safety testing. The rise in infectious diseases and pandemic preparedness has accelerated vaccine production, necessitating rigorous safety testing. Innovations in testing technologies, such as automated systems and high-throughput screening, enhance testing efficiency, contributing to the market's expansion. The increasing awareness about product quality further drives the biological safety testing market growth across the globe.

The biological safety testing market in the United States is driven by the growing demand for biopharmaceuticals, vaccines, and advanced therapies due to the rising prevalence of chronic and infectious diseases. Stringent regulatory standards from the FDA and other authorities necessitate comprehensive safety testing to ensure product quality and compliance. The U.S. is also a leader in adopting innovative testing technologies, including automation and high-throughput systems, enhancing testing accuracy and efficiency. Additionally, the presence of well-established pharmaceutical companies, a strong focus on pandemic preparedness, and the growth of contract research organizations (CROs) represent some of the key biological safety testing market trends. For instance, in October 2024, in Rockville, Maryland, USA, MilliporeSigma, the Life Science division of Merck KGaA, Darmstadt, Germany, unveiled a new biosafety testing facility worth €290 million. For conventional and innovative modalities, biosafety testing and analytical development are essential elements of medication development and commercialization. The demand for these services is increasing at a double-digit rate on a global scale. The company will be able to drive automation and technological development in a single integrated hub due to this expansion, which represents the largest investment in contract testing in its history.

Biological Safety Testing Market Trends:

Expanding Pharmaceutical and Biotechnology Sectors

The pharmaceutical and biotechnology industries are expanding due to increased investments in research and development. According to an industrial report, in 2023, global R&D spending in the pharmaceutical sector exceeded approximately USD 300 billion. The development of medications, biologics, and vaccines for a range of medical conditions, including complicated illnesses, is dominated by these sectors. As a result, there is a greater need for thorough safety evaluations, and biological safety testing is essential to guaranteeing patient safety. It entails comprehensive assessments for pollutants including bacteria, viruses, and endotoxins, ensuring adherence to safety and legal requirements. Concurrently, the evolving nature of diseases and the continuous innovation in products maintain a high demand for safety testing, including specialized assessments for emerging therapies including gene and cell therapies, contributing significantly to the biological safety testing market demand.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic has significantly impacted the industry by accelerating the development and deployment of vaccines and treatments. For instance, according to the World Health Organization (WHO), more than 13 billion COVID-19 vaccine doses were administered globally by 2021. This has emphasized the crucial role of rigorous safety testing. In addition to this, governments and regulatory authorities globally have intensified their scrutiny of these products, leading to a surge in demand for various testing services, including vaccine safety assessments, virus detection assays, and quality control measures for COVID-19 diagnostics and treatments. In addition, the pandemic has changed the industry's emphasis by emphasizing the necessity of readiness for upcoming health emergencies, which has maintained market expansion.

Rising Emphasis on Regulatory Compliance

Global regulatory bodies are tightening oversight of biopharmaceutical products, emphasizing patient safety and product quality. These regulations mandate comprehensive safety evaluations, making biological safety testing integral to drug approvals. Advanced therapy medicinal products, such as gene and cell therapies, have been receiving more approvals over the past few years. For example, the Committee for Advanced Therapies of the European Medicines Agency adopted a positive draft opinion for Durveqtix (fidanacogene elaparvovec) during its plenary meeting in May 2024 for the treatment of severe and moderately severe haemophilia B. This is part of a general trend where the number of approved ATMPs is constantly on the rise. The need for testing services is increased and the significance of biological safety testing in compliance is emphasized by the strict adherence to changing standards that pharmaceutical and biotech businesses must follow to obtain product approval and market access. Additionally, the necessity for specialist testing is highlighted by the growing complexity of regulatory regulations, particularly for sophisticated therapeutics like gene and cell therapies. As specialist evaluations adjust to the distinct features of these treatments, guaranteeing their efficacy and safety while satisfying changing regulatory requirements, this maintains market growth.

Biological Safety Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product and services, test type, and application.

Analysis by Product and Services:

- Kits and Reagents

- Instruments

- Services

Kits and reagents leads the market with around 41.3% of market share in 2024. The increasing trend towards decentralized testing and point-of-care (POC) diagnostics driving the need for user-friendly and portable testing kits represents one of the prime factors fueling the demand for biological safety testing. These kits enable healthcare professionals to perform safety assessments quickly and efficiently, especially in resource-limited settings. In confluence with this, the expansion of research and development activities in the life sciences, including genomics, proteomics, and cell culture, necessitates a continuous supply of high-quality testing reagents and kits for various applications, spurring market growth. Furthermore, the growing focus on ensuring product quality and safety in the food and beverage (F&B) industry, where biological contaminants can pose significant risks, is boosting demand for testing kits and reagents for microbiological analysis, aiding market expansion.

Analysis by Test Type:

- Endotoxin Tests

- Sterility Tests

- Cell Line Authentication and Characterization Tests

- Bioburden Tests

- Residual Host Contaminant Detection Tests

- Adventitious Agent Detection Tests

- Others

Endotoxin tests leads the market with around 24.9% of market share in 2024. The rising demand for endotoxin tests primarily propelled by the critical need to ensure the safety and efficacy of medical devices and pharmaceutical products is strengthening the global biological safety testing market. Endotoxins, toxic substances present in the cell walls of Gram-negative bacteria, can lead to severe health complications when introduced into the human body. The increasing complexity and diversity of medical devices, including implants and drug delivery systems, necessitate stringent testing for endotoxins to mitigate potential patient risk. Furthermore, the rising focus on personalized medicine and biopharmaceuticals, such as gene therapies and monoclonal antibodies, requires meticulous endotoxin testing to guarantee the purity and safety of these advanced therapies, strengthening the market. Besides this, regulatory agencies worldwide mandate compliance with strict endotoxin limits, reinforcing the demand for accurate and reliable endotoxin tests in pharmaceutical manufacturing and healthcare settings, thereby bolstering the market growth.

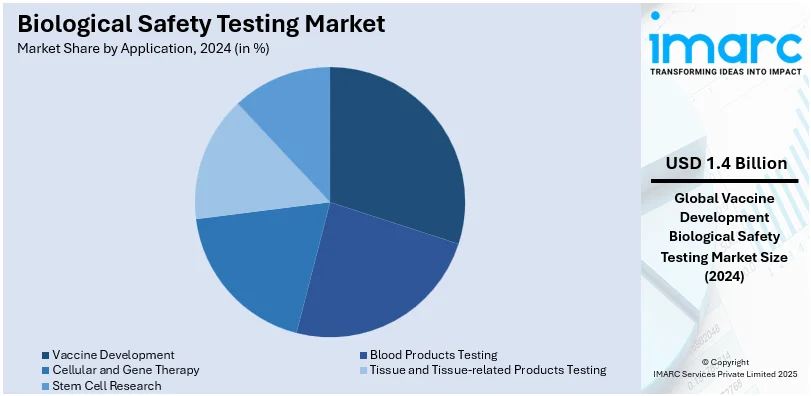

Analysis by Application:

- Vaccine Development

- Blood Products Testing

- Cellular and Gene Therapy

- Tissue and Tissue-related Products Testing

- Stem Cell Research

Vaccine development leads the market with around 28.7% of market share in 2024. The demand for biological safety testing in vaccine development is primarily propelled by the urgent global need for safe and effective vaccines. As the world faces various infectious diseases and viral outbreaks, including the COVID-19 pandemic, there is an unprecedented focus on vaccine development. Regulatory authorities require comprehensive safety assessments to ensure that vaccines are not only effective but also free from harmful contaminants. Biological safety testing plays a critical role in this process, involving the evaluation of vaccine candidates for potential viral and microbial contaminants, ensuring the absence of endotoxins, and assessing their overall safety for human use. Moreover, the emergence of novel vaccine technologies, such as mRNA-based vaccines, necessitates specialized safety evaluations, contributing to the growing demand for biological safety testing services. This heightened emphasis on vaccine safety underscores the crucial role played by such testing in safeguarding public health on a global scale.

Regional Analysis

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.8%. North America boasts a robust pharmaceutical and biotechnology industry, with a strong emphasis on research and development. The constant innovation and introduction of new drugs, biologics, and medical devices necessitate rigorous safety evaluations, driving the demand for biological safety testing services. In addition to this, the region's proactive regulatory environment, governed by stringent standards set by the FDA and other regulatory bodies, mandates comprehensive safety assessments, further propelling market growth. Moreover, the ongoing efforts to combat public health threats, such as the COVID-19 pandemic, have heightened the demand for vaccine development and testing, particularly in North America, where numerous pharmaceutical companies and research institutions are actively involved in vaccine research and production. These factors, combined with the region's advanced healthcare infrastructure and the increasing awareness of product quality and safety, continue to fuel the expansion of the North America biological safety testing market.

Key Regional Takeaways:

United States Biological Safety Testing Market Analysis

In 2024, the United States accounted for the largest market share of over 88.60% in North America. There are increased growth aspects related to U.S. biological safety testing with an increase in the development of pharmaceuticals, the rise of treatments based on biologics. In 2023 alone, the FDA approved 25 biologics under 55 newly approved drugs; 12 monoclonal antibodies (mAbs) and 5 of those were either an enzyme or protein. According to an industrial report, as of January 2024, there were 20,465 clinical trials accepting patients in the United States that clinically signified the growing need for biologics safety testing. There are major vendors of companies such as Charles River Laboratories and WuXi AppTec, which are interested in bringing testing technologies forward. The high urge for advanced safety testing of gene therapies and vaccines further amplified the market growth. The increasing focus on in-vitro testing and automation is also augmenting enhanced market efficiency. Improvements in technology are enhancing testing accuracy and reducing the turnaround time, while higher standards of safety regulatory requirements continue to drive innovation that positions the United States as the key player globally in the field of biological safety testing.

Europe Biological Safety Testing Market Analysis

The biological safety testing market is also growing in Europe due to strong regulatory framework and increased demands for safe pharmaceutical and biologic products. A recent industrial report suggests that revenue in the European pharmaceutical industry already surpassed EUR 300 billion (USD 309 billion) in 2022, which creates high demand for solutions in terms of safety testing. Germany and Switzerland happen to be strong market contributors while the pharmaceutical leaders Roche and Bayer are always concerned about their biologic safety. In more detail, especially, regulatory institutions such as EMA have upgraded testing standards due to which more quality biologic testing services flourished. Growth in the demand for clinical research, gene therapy, and also the increasing significance of biosimilars fuels the market demand. Additionally, the emerging concept of personalized medicine, coupled with precision testing, is further changing the playing field for regional safety testing service providers. Efficiency in testing has been improved with the increasing utilization of automation and AI technology.

Asia Pacific Biological Safety Testing Market Analysis

Asia Pacific's market for biological safety testing is fast growing due to increased investments in biotechnology as well as increasing pharmaceutical manufacturing. According to industrial reports, China's pharmaceutical market reached a value of USD 160 billion in 2023, which also led to greater demand for biologics. Rising population with above the age bracket population makes investment by the nation, in region attractive to multinationals for example Labcorp and Bio-merieux extending the presence based on rising spending in R and D. Advanced technologies like high-throughput testing and next-generation sequencing have been adopted by the biotech sector in the region, leading to a more sophisticated safety testing environment. In addition, strong manufacturing capabilities in the region along with cost-effective testing solutions have made it an important player in the global biological safety testing arena.

Latin America Biological Safety Testing Market Analysis

The biological safety testing market in Latin America is also on the rise, that is driven by growing pharmaceutical production and a deepening focus on compliance with international standards for safety. Brazil leads this boom, and the growing demand for biologic safety testing services can be tracked in response to the country's further increasing biologics production capability. Argentina and Mexico are also contributing to the growth through investments in upgrading their pharmaceutical manufacturing capabilities. According to an industry report, as of April 2024, Brazil boasts the highest number of clinical trials in the region with approximately 10,000 studies. Mexico ranks next with about 5,000 studies. Thus, this signifies a heavy reliance on clinical research and biologic safety. Testing requirements have become even more rigorous on the part of Brazil's regulatory body, ANVISA. This is leading to increased demands for high-tech safety testing to meet the new international standards set. Moreover, the investment by local manufacturers in testing services and infrastructure enhancement to meet the increasing demands is directly contributing to the expanding market and makes the region increasingly significant in the global biological safety testing market.

Middle East and Africa Biological Safety Testing Market Analysis

In the Middle East and Africa, the biological safety testing market is burgeoning, driven by increased healthcare investment and pharmaceutical production in many countries. Saudi Arabia's defense spending, which includes allocations for medical and pharmaceutical safety, fuels the growth of the market. The pharmaceutical market in the UAE remains in growth mode, and biological safety testing is fast becoming a key area of focus. South Africa is emerging as one of the key biomanufacturing hubs. There is a huge growth in domestic biologic production. There are 4,593 clinical trials in the Middle East and 861 in Africa as of 2022 according to the WHO International Clinical Trial Registry Platform, where there is increased demand for clinical research and biologic safety. Demand for biological safety testing services will be raised due to increases in healthcare facilities and clinical trials in the region. Testing service will grow annually at 10% over the next five years. This trend is further supported by the efforts of local governments to improve healthcare standards and infrastructure.

Competitive Landscape:

The fierce competition among major companies in the global biological safety testing market is a result of the sector's vital role in guaranteeing the quality and safety of pharmaceuticals, biologics, and medical devices. Prominent companies in this landscape engage in various strategies to maintain their market positions, such as mergers, acquisitions, and collaborations to expand their service portfolios and geographic reach. Furthermore, companies can also remain ahead of industry trends by investing in research and development to adopt cutting-edge testing technologies and procedures. The increasing focus on personalized medicine and advanced therapies, such as gene and cell therapies, presents growth opportunities for firms specializing in specialized safety testing services. Overall, the competitive landscape of the global biological safety testing market is marked by a dynamic interplay of established players.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Avance Biosciences

- Charles River Laboratories

- Creative Biogene

- Eurofins Scientific

- Lonza Group AG

- Maravai LifeSciences

- Pace Analytical Services Inc.

- Pacific BioLabs

- Sartorius AG

- SGS SA

- ViruSure GmbH (Asahi Kasei Corporation)

- WuXi Biologics

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- November 2024: Maravai LifeSciences announced that it intends to buy DNA and RNA from Officinae Bio. This will strengthen the mRNA manufacturing capability within TriLink BioTechnologies of Maravai, accelerating the research in nucleic acids. Officinae Bio's AI-based technologies will be helpful for innovative nucleic acid-based therapies and biologics safety testing.

- September 2024: Eurofins reported its acquisition of Modern Testing Services. This acquisition will help increase its biological safety testing capabilities in the consumer products industry. The strategic expansion will therefore strengthen Eurofins S&L-T&H's global network with its testing, inspection, and certification services spread over more than 35 locations across 20 countries, taking leverage of MTS's expertise.

- July 2024: SGS North America extended its biologics testing services at its Lincolnshire Center of Excellence. The new development includes instrumentation, scientific expertise, and the capacity to support the characterization of novel biologics and biosimilars. All these are set to make the testing process smoother for biopharmaceutical companies and ensure that they meet all regulatory requirements for their products' safety.

- June 2024: Charles River Laboratories, in collaboration with MatTek Corporation, received a USD 1.3 million grant to develop an in vitro inhalation toxicology test. The project was designed to minimize the reliance on animal research while utilizing the model EpiAirway™ developed by MatTek and other partners to push the New Approach Methodology (NAM) in aerosol substance testing.

- February 2024: Creative Biogene reported it developed a microbial platform for enumerating validation in microbial tests, custom-tailored for reliable detection of undesirable organisms in biological products, which further improves safety and efficiency. Its flexibility offers bespoke solutions to diverse client needs.

Biological Safety Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products and Services Covered | Kits and Reagents, Instruments, Services |

| Test Types Covered | Endotoxin Tests, Sterility Tests, Cell Line Authentication and Characterization Tests, Bioburden Tests, Residual Host Contaminant Detection Tests, Adventitious Agent Detection Tests, Others |

| Applications Covered | Vaccine Development, Blood Products Testing, Cellular and Gene Therapy, Tissue and Tissue-related Products Testing, Stem Cell Research |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Avance Biosciences, Charles River Laboratories, Creative Biogene, Eurofins Scientific, Lonza Group AG, Maravai LifeSciences, Pace Analytical Services Inc., Pacific BioLabs, Sartorius AG, SGS SA, ViruSure GmbH (Asahi Kasei Corporation), WuXi Biologics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biological safety testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biological safety testing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the biological safety testing industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biological safety testing market was valued at USD 4.95 Billion in 2024.

The biological safety testing market is projected to exhibit a CAGR of 10.38% during 2025-2033, reaching a value of USD 13.29 Billion by 2033.

The global biological safety testing market is driven by an increasing demand for biopharmaceuticals, vaccines, and biosimilars, rising chronic and infectious diseases, stringent regulatory requirements, and advancements in biotechnology. Growth in cell and gene therapies, pandemic preparedness, expanding contract research organizations (CROs), and innovations in testing technologies further fuel market expansion.

North America currently dominates the biological safety testing market, accounting for a share of 38.8%. The continual innovations and advent of new drugs, biologics, and medical devices mandates rigorous safety evaluations, thereby facilitating the demand for biological safety testing services in the region. Other factors, such as the prevalence of advanced healthcare infrastructure and the rising awareness regarding product quality and safety, are creating a positive biological safety testing market outlook across the region.

Some of the major players in the biological safety testing market include Avance Biosciences, Charles River Laboratories, Creative Biogene, Eurofins Scientific, Lonza Group AG, Maravai LifeSciences, Pace Analytical Services Inc., Pacific BioLabs, Sartorius AG, SGS SA, ViruSure GmbH (Asahi Kasei Corporation), WuXi Biologics, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)