Biofuel Additives Market Size, Share, Trends and Forecast by Type, Biofuel Type, Application, and Region, 2025-2033

Biofuel Additives Market Size and Share:

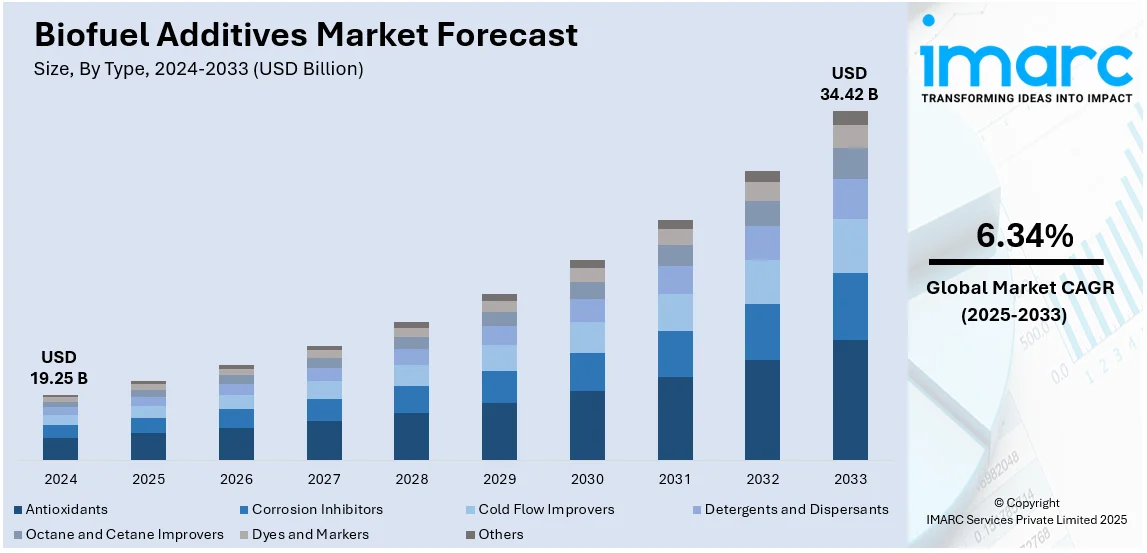

The global biofuel additives market size was valued at USD 19.25 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.42 Billion by 2033, exhibiting a CAGR of 6.34% from 2025-2033. North America currently dominates the biofuel additives market share by holding over 44.0% in 2024. The market in the region is driven by stringent environmental regulations, increasing adoption of biofuels to reduce carbon emissions, and government incentives promoting renewable fuel integration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.25 Billion |

|

Market Forecast in 2033

|

USD 34.42 Billion |

| Market Growth Rate (2025-2033) | 6.34% |

The global biofuel additives market growth is driven by the stringent environmental regulations that are increasing the demand for additives that enhance fuel efficiency and reduce emissions. In addition, government policies, including tax incentives and blending mandates, are aiding the market growth. Moreover, the rising energy security concerns are driving the shift toward renewable fuels, boosting additive consumption for fuel stability and performance, which is providing an impetus to the market. For example, United Airlines Ventures launched the Sustainable Flight Fund in 2023, amassing over $200 million from 22 corporate backers by February, aiming to scale sustainable aviation fuel as a viable alternative. Besides this, the growing vehicle fleets and industrial applications are increasing biofuel usage, necessitating additives for improved combustion and storage, fostering the market demand. Also, ongoing advancements in additive formulations are enhancing fuel properties which is encouraging adoption and impelling the market growth.

The United States biofuel additives market demand is expanding due to the increasing Renewable Fuel Standard (RFS) mandates, driving higher biofuel blending and the need for stabilizers and anti-corrosion agents. In line with this, the rising aviation biofuel adoption is significantly contributing to the market expansion for additives, enhancing the fuel efficiency and thermal stability. For instance, The U.S. Energy Information Administration projects a fourteen-fold increase in domestic SAF production capacity by 2024, with significant contributions from facilities like Phillips 66's Rodeo and Valero’s Diamond Green. This rapid expansion is further accelerating the demand for specialized additives to optimize fuel performance. Additionally, continuous advancements in refining technologies are enabling higher biofuel integration, requiring specialized additives for compatibility and strengthening the biofuel additives market share. Furthermore, the expanding agricultural feedstock availability is supporting biodiesel and ethanol production, increasing the use of lubricity and deposit control additives, which is impelling the market growth. Apart from this, the growing investment in next-generation biofuels is driving demand for multifunctional additives, thereby propelling the market forward.

Biofuel Additives Market Trends:

Stringent environmental regulations to reduce carbon footprint

Multiple countries have established strict environmental regulations for greenhouse gas (GHG) emission reduction purposes, through their governing agencies, which drives the market expansion. A reported data shows that total greenhouse gas (GHG) emissions worldwide increased by 51% from the year 1990 to 2021. The governing agencies continue to enforce stricter emission standards across both industries and transportation sectors. Biofuel additives serve as essential tools for biofuels to satisfy strict governmental regulations. The market outlook remains positive as biofuel additives improve fuel combustion efficiency, leading to a reduction in harmful emissions such as carbon monoxide, nitrogen oxides, and particulate matter. Besides this, the requirements of clean energy initiatives and sustainability targets are met by biofuels through this approach.

Increasing demand for renewable energy

The rising demand for renewable energy (RE) sources due to increasing concerns about fossil fuel depletion and environmental sustainability is bolstering the growth of the market. International Energy Association predicts renewable electricity generation will reach 17,000 TWh (60 EJ) in 2030 which represents an almost 90% increase from current levels in 2023. The market has observed a fast-growing interest in biofuels as substitute fossil fuels because these fuels are produced from renewable resources like biomass and agricultural feedstocks. The market is also growing because biofuel additives boost biofuel viability through better combustion properties, emission reduction, and engine protection mechanisms. In addition, multiple industries are currently searching for eco-friendly sustainable energy solutions. The rising consumer preferences for eco-friendly products to promote a greener environment are propelling the market growth.

Rising focus on energy efficiency

The rising focus on energy efficiency is influencing the biofuel additives market trends. Energy efficiency has emerged as an essential factor for all sectors including transportation and agriculture as well as industrial processes. The worldwide production of primary crops in agriculture increased by 54 percent from 2000 to 2021 to achieve 9.5 Billion Tons in 2021 according to available reports. Biofuels experience increased energy efficiency due to the addition of these performance-enhancing substances. The additives achieve maximum combustion optimization which leads to higher conversion rates of fuel energy into useful work outputs. Moreover, the market growth receives support from additives because they improve system efficiency which reduces both fuel usage and operational expenses for industries and transportation fleets. Furthermore, the advancement of energy efficiency finds alignment with sustainability targets while simultaneously minimizing the carbon output during energy creation and utilization processes.

Biofuel Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biofuel additives market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, biofuel type, and application.

Analysis by Type:

- Antioxidants

- Corrosion Inhibitors

- Cold Flow Improvers

- Detergents and Dispersants

- Octane and Cetane Improvers

- Dyes and Markers

- Others

Antioxidants dominate the market with 36.6% shares. Growing concerns over biofuel oxidation and degradation are driving the demand for antioxidants that prevent gum formation, enhance fuel stability, and extend storage life. The increasing biofuel blending mandates and higher biodiesel content are further boosting the need for oxidation inhibitors. The expanding biofuel industry, coupled with advancements in fuel additive technologies, is further propelling market growth. Manufacturers are focusing on developing high-performance antioxidants to meet evolving fuel standards. Moreover, the shift toward renewable energy sources and sustainable fuel solutions is amplifying demand. As governments worldwide enforce stricter fuel regulations, the role of antioxidants in ensuring fuel efficiency and longevity is becoming increasingly crucial.

Analysis by Fuel Type:

- Bioethanol

- Biodiesel

Bioethanol leads the market with a significant market share in 2024. Bioethanol originates from renewable biological resources which primarily include corn and sugarcane and cellulosic plant materials. The fuel assists both environmental goals by lowering carbon pollution and fossil fuel requirements. Moreover, bioethanol functions as an octane booster in fuel mixtures to maintain quality criteria while boosting engine efficiency. The substance easily draws water vapor out of the environment which creates problems with fuel composition and separation between phases. The additives also control both moisture content and protect against water-related issues. Furthermore, bioethanol shows its strength by reducing carbon dioxide emissions in addition to other properties. Apart from this, using additives enhances environmental benefits through their capability to optimize combustion processes while decreasing dangerous pollutant emissions, thus enhancing the biofuel additives market outlook.

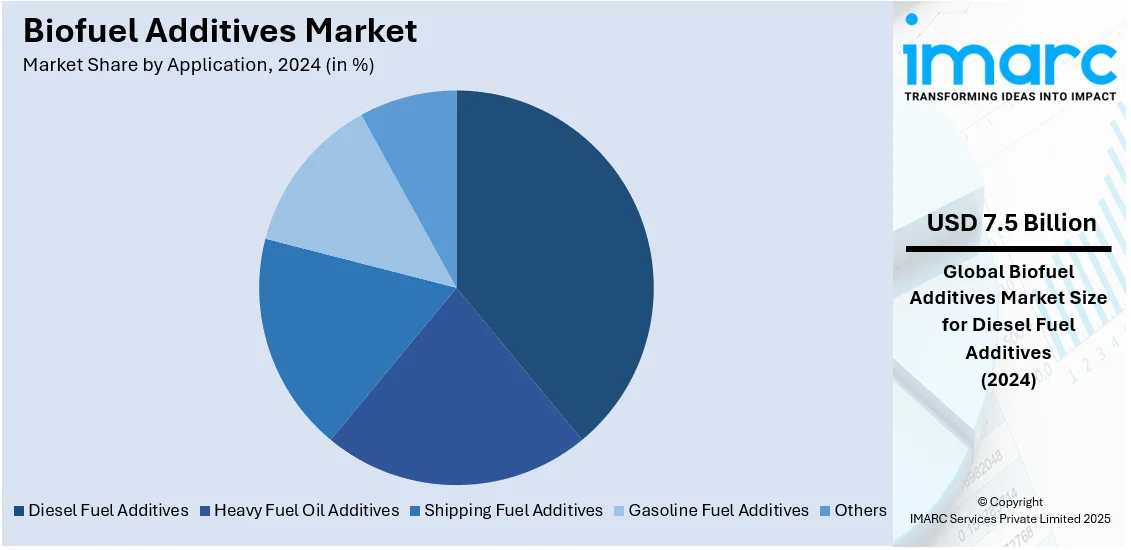

Analysis by Application:

- Diesel Fuel Additives

- Heavy Fuel Oil Additives

- Shipping Fuel Additives

- Gasoline Fuel Additives

- Others

Diesel fuel additives account for 38.8% shares. They are designed to enhance the performance and quality of diesel fuels. These substances work to fulfill different goals which involve boosting combustion efficiency while decreasing emissions and protecting engines against damage. The growth of the market advances because diesel fuels are extensively utilized throughout transportation, agricultural, construction, and industrial operations. Besides this, the market demands diesel fuel additives because they resolve environmental challenges while simultaneously providing better fuel efficiency and longer-lasting performance of diesel engines. Additionally, stringent emission regulations and the rising adoption of ultra-low sulfur diesel (ULSD) are further propelling demand for advanced fuel additives.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America held the biggest market share at 44.0% due to the increasing adoption of renewable energy sources. The market growth in this region receives additional support from both efforts to lower greenhouse gas emissions and initiatives to promote cleaner energy sources. The market demonstrates a positive outlook because industries are increasing their demand for biofuels. The market growth in the North American region is also supported by mature biofuel production and distribution systems that already exist. Moreover, the expansion of industry depends on government policies that combine both federal and state-level biofuel blending requirements and tax benefits. For instance, Pennsylvania Governor Josh Shapiro has announced plans to accelerate the development of new power plants and introduce substantial tax incentives for hydrogen-based projects, reinforcing the state’s leadership in renewable energy and enhancing overall market competitiveness. Besides this, the market demand for performance-enhancing additives increases because of growing investments in sustainable aviation fuel (SAF) and next-generation biofuels. The region's leading research and development (R&D) integrity fosters new developments in biofuel additive composition.

Key Regional Takeaways:

United States Biofuel Additives Market Analysis

The expanding chemical industry in the United States significantly influences the adoption of biofuel additives. According to the American Chemistry Council (ACC), global chemical production is expected to grow by 3.4% in 2024 and 3.5% in 2025, following a modest 0.3% increase in 2023. This sector's rapid expansion is fueled by the demand for sustainable alternatives to conventional fossil fuels, driving innovation in chemical manufacturing. Increased investments in research and development by chemical companies are leading to advancements in biofuel additive formulations, enhancing their efficiency and compatibility with existing fuel infrastructure. Additionally, there is a concerted effort to meet environmental regulations that encourage cleaner and more sustainable fuel solutions. As industries in the U.S. prioritize reducing their carbon footprint, biofuel additives are increasingly recognized for their role in achieving environmental sustainability goals. Furthermore, the growing regulatory push for cleaner fuel standards further boosts the adoption of biofuel additives, aligning with broader goals of energy efficiency and pollution reduction. As such, the chemical industry is helping create a robust market for biofuel additives, making them a vital part of the energy landscape.

Europe Biofuel Additives Market Analysis

In Europe, the increasing adoption of biofuel additives is largely driven by the emphasis on reducing greenhouse gas (GHG) emissions. For example, the EU has established a 2030 target to achieve a 55% net reduction in greenhouse gas emissions. European nations are intensifying efforts to meet climate change targets outlined in international agreements, and biofuels are a key component of their strategy to decarbonize the energy sector. Biofuel additives improve the efficiency of biofuels, helping them generate lower emissions than conventional fossil fuels. The European Union's ambitious renewable energy and emission reduction targets are driving industries across the region to transition toward cleaner energy solutions. As a result, the demand for biofuel additives is expected to rise as they help optimize the combustion of biofuels, reducing their environmental impact. Governments, through regulatory frameworks, are incentivizing the use of biofuels and additives, creating a conducive environment for the market to flourish. With an increased focus on environmental sustainability, biofuel additives are becoming an integral part of Europe's strategy to address climate change.

Asia Pacific Biofuel Additives Market Analysis

The growth of agricultural production in the Asia-Pacific area drives the increasing use of biofuel additives throughout the region. For example, the Indian government plans to invest USD 4.32 Million through 346 agritech startups in 2020 to advance agricultural sector growth. Growing agricultural production requires sustainable methods to make use of excess crops and agricultural waste while maintaining environmental stability. Biofuel additives enhance the operational capabilities of biofuels obtained from bio-based materials to meet rising environmental-friendly fuel demands. Raw materials obtained from regional agricultural production activities of corn sugarcane and palm oil contribute to biofuel production requirements thus driving the demand for additives. This market receives government backing through policies that encourage biofuel usage alongside additives because these measures boost the expansion of the industry. Biofuel production in the region relies on agriculture as its foundation since biofuel additives play a vital role in boosting biofuel performance and enabling sustainable agricultural methods.

Latin America Biofuel Additives Market Analysis

In Latin America, the growing renewable energy sector is driving the adoption of biofuel additives. For example, the renewable energy capacity across Latin America will grow by 165 GW between 2023 and 2028 with a 100% increase compared to the previous five-year period. The region's extensive agricultural resources provide the basis for biofuel production thus creating an active market need for additives that boost their operational capabilities. The growth of renewable energy technologies to minimize fossil fuel consumption resulted in biofuels becoming widely accepted throughout the world. Biofuel additives have gained significant importance because Latin American countries need them to enhance both biofuel efficiency and reduce their environmental impact while their energy needs increase. Governments across Latin American countries back renewable energy adoption by implementing policies that boost the utilization of biofuels thus driving the acceptance of biofuel additives. Biofuel additives will be vital for sustainable energy development in Latin America as renewable energy markets prepare to expand.

Middle East and Africa Biofuel Additives Market Analysis

The adoption of biofuel additives has expanded because the Middle East and Africa region experiences rapid growth in its logistics sector along with its expanding transportation industry. The logistics sector in the Middle East is experiencing rapid growth, driven by the strategic location of GCC countries. With approximately 30% of global trade passing through the Red Sea and the Gulf of Aden, this advantage fosters further development and diversification within the industry. The regional trade and supply chain developments have created an increasingly strong market demand for sustainable fuel solutions which decrease operational expenses and minimize environmental impact. Biofuels that incorporate additives serve as a sustainable transportation fuel alternative which reduces pollution and increases efficiency in engine performance. The growth of the logistics industry depends heavily on biofuel additive usage because it follows infrastructure development alongside rising trade volumes. Biofuel performance benefits from these additives while the region advances its environmental targets. The transportation sector in the region adopts biofuel additives as fundamental elements because of rising initiatives to decrease air pollution while maximizing fuel efficiency.

Competitive Landscape:

Key market players in the biofuel additives sector are focusing on product innovation, and launching advanced multifunctional additives to enhance fuel efficiency, stability, and emissions control. Companies are investing in R&D to develop eco-friendly, non-toxic additives that comply with stringent environmental regulations. Strategic partnerships and collaborations with biofuel producers are expanding market reach and ensuring additive compatibility with evolving fuel formulations. Mergers and acquisitions are increasing as firms seek to strengthen market positions and broaden product portfolios. Manufacturers are also optimizing supply chains to address fluctuating raw material costs. Additionally, increasing investments in SAF and next-generation biofuels are driving demand for specialized additives, pushing market players to develop tailored solutions for emerging fuel technologies.

The report provides a comprehensive analysis of the competitive landscape in the biofuel additives market with detailed profiles of all major companies, including:

- Afton Chemical Corporation (NewMarket Corporation)

- BASF SE

- Biofuel Systems Group Ltd.

- Chemiphase International Ltd.

- Chevron Corporation

- Clariant AG

- Eastman Chemical Company

- Evonik Industries AG

- E-ZOIL

- Fuel Quality Services Inc.

- Infineum International Limited

- The Lubrizol Corporation

Latest News and Developments:

- August 2024: ExxonMobil Hong Kong has launched Esso Renewable Diesel R20, the first renewable diesel for public road use in Hong Kong, at the Esso Tsing Yi South service station. This biofuel additive-rich diesel, with a 20% renewable content, offers 15.4% lower lifecycle GHG emissions than conventional diesel. The product also features Esso Synergy™ additives, ensuring excellent protection and cleaning power for all diesel engines.

- March 2024: Bunge and Chevron's partnership, Bunge Chevron Ag Renewables LLC, has been granted final approval to construct a new oilseed processing plant in Destrehan, Louisiana, located on the Gulf Coast. The facility will enhance its existing operations and focus on producing biofuel additives. This expansion marks a significant step toward advancing renewable energy solutions. The plant's construction is set to bolster the companies' contributions to the biofuels market.

- May 2024: Braskem the largest polyolefins producer in the Americas, has expanded its fuels portfolio with the launch of Octane Plus. This innovative additive, blended into gasoline, enhances octane ratings, improving performance for high-performance engines. Octane Plus provides greater fuel quality and efficiency, aligning with Braskem's commitment to value-added products and new business opportunities in the automotive fuels market.

- January 2024: The Industrial Development Bureau of Abu Dhabi (IDB) established a first enzyme-based fuel additives processing plant in the Middle East and Africa region together with the XMILE Group. The joint initiative seeks to drive sustainable development of low-carbon fuels across the entire fuel supply system. This initiative supports the local drive for sustainable industrial development in Abu Dhabi. XMILE Group's enzyme-based additives will play a key role in advancing these efforts.

- January 2024: BASF has launched an improved version of its Keropur® gasoline additive in Taiwan, specifically designed for modern direct injection spark ignition (DISI) engines, while also being effective for traditional port fuel injection (PFI) engines. This advanced formulation significantly improves engine cleanliness, leading to reduced emissions and better fuel efficiency. By cleaning deposits in the engine, Keropur® not only prolongs engine lifespan but also contributes to more sustainable mobility.

Biofuel Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Antioxidants, Corrosion Inhibitors, Cold Flow Improvers, Detergents and Dispersants, Octane and Cetane Improvers, Dyes and Markers, Others |

| Biofuel Types Covered | Bioethanol, Biodiesel |

| Applications Covered | Diesel Fuel Additives, Heavy Fuel Oil Additives, Shipping Fuel Additives, Gasoline Fuel Additives, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Afton Chemical Corporation (NewMarket Corporation), BASF SE, Biofuel Systems Group Ltd., Chemiphase International Ltd., Chevron Corporation, Clariant AG, Eastman Chemical Company, Evonik Industries AG, E-ZOIL, Fuel Quality Services Inc., Infineum International Limited, The Lubrizol Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biofuel additives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global biofuel additives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biofuel additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biofuel additives market was valued at USD 19.25 Billion in 2024.

The biofuel additives market is projected to exhibit a CAGR of 6.34% during 2025-2033.

The biofuel additives market is driven by the growing demand for sustainable and eco-friendly energy sources. Increasing government regulations promoting renewable energy, along with the rise in biofuel production, fuels market growth. Additionally, the need to improve fuel efficiency, reduce emissions, and enhance engine performance boosts the adoption of biofuel additives.

North America currently dominates the market driven by the increasing adoption of renewable energy sources, the rising focus on reducing greenhouse gas emissions, and promoting cleaner energy sources.

Some of the major players in the biofuel additives market include Afton Chemical Corporation (NewMarket Corporation), BASF SE, Biofuel Systems Group Ltd., Chemiphase International Ltd., Chevron Corporation, Clariant AG, Eastman Chemical Company, Evonik Industries AG, E-ZOIL, Fuel Quality Services Inc., Infineum International Limited, The Lubrizol Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)