Biodiesel Market Size, Share, Trends and Forecast by Feedstock, Application, Type, Production Technology, and Region, 2025-2033

Biodiesel Market 2024, Size and Trends:

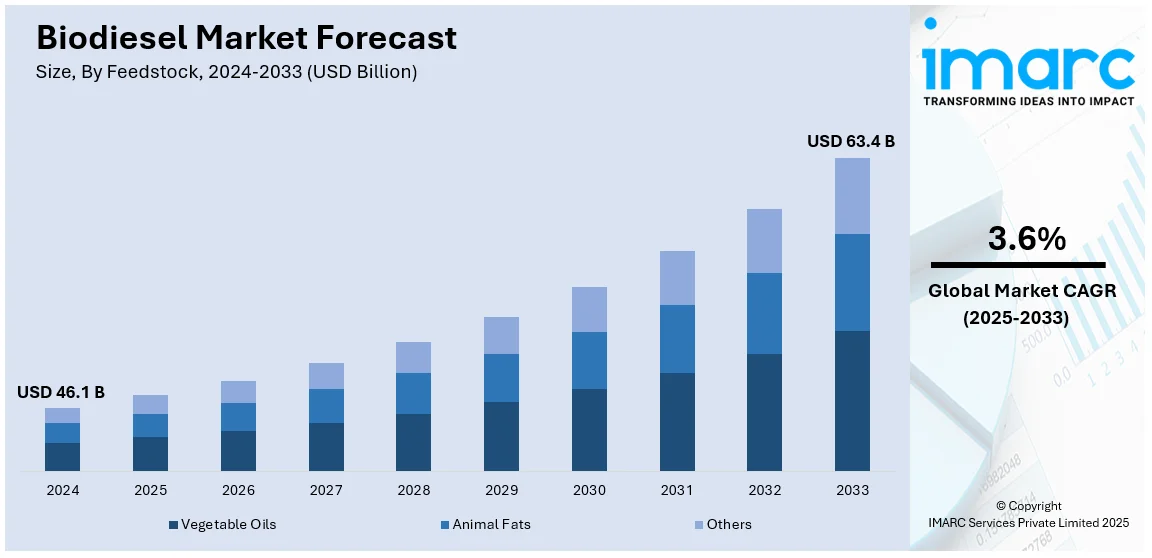

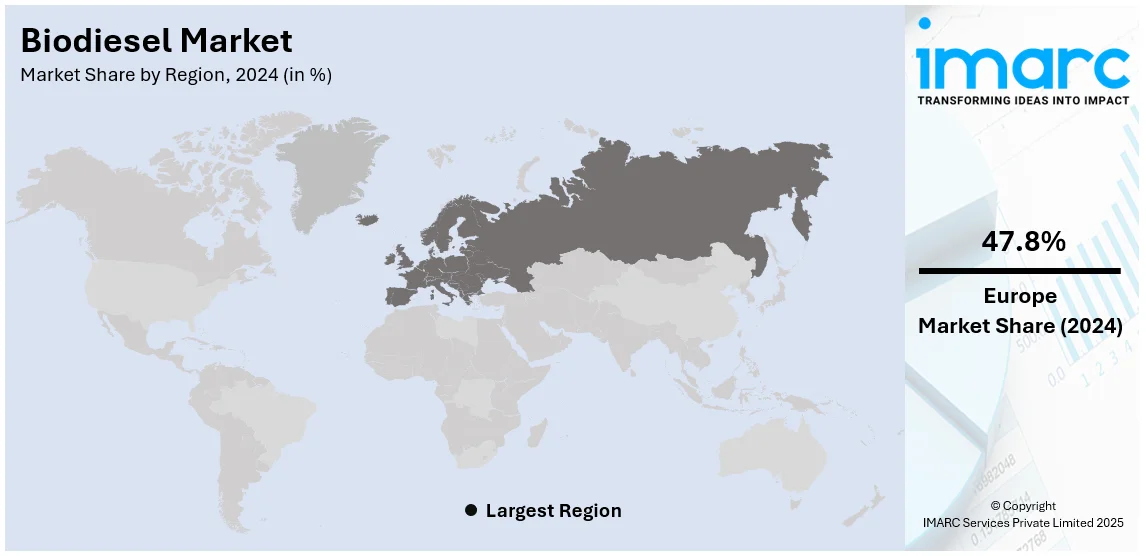

The global biodiesel market size was valued at USD 46.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 63.4 Billion by 2033, exhibiting a CAGR of 3.6% from 2025-2033. Europe currently dominates the biodiesel market share by holding over 47.8% in 2024. The market is being driven by government policies supporting renewable energy (RE), rising concerns about energy security and oil price instability, ongoing technological innovations in production methods, growing public awareness of environmental challenges, and intensifying actions to address climate change.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 46.1 Billion |

|

Market Forecast in 2033

|

USD 63.4 Billion |

| Market Growth Rate (2025-2033) | 3.6% |

Biodiesel Market Analysis:

- Major Market Drivers: Increasing environmental issues, government regulations such as the Renewable Fuel Standard (RFS), and rising demand for low-carbon fuels spur biodiesel market expansion. Rising energy security requirements and alternative fuel support further promote biodiesel use in transportation and industrial applications.

- Key Market Trends: Market trends are influenced by technological developments in transesterification, increased use of feedstocks beyond vegetable oils, and an expansion of biodiesel blending mandates. The movement toward second-generation biodiesel and circular economy models, such as UCO-based biodiesel, promotes sustainability and investment in new production technology.

- Competitive Landscape: The market is characterized by regional and worldwide producers concentrating on innovation in feedstocks, strategic acquisitions, and growth. The players compete on the basis of cost optimization, capacity increase, and alliances with energy players. Competitive positioning among biodiesel-producing countries depends on regional policies and feedstock availability.

- Challenges and Opportunities: Volatility in the cost of feedstock, food-versus-fuel controversy, and variable worldwide regulations present challenges. However, opportunities are presented by new non-food feedstocks such as algae, policy stimulus, and technology advancement. Potential lies in growth from marine, power generation, and agricultural industries embracing biodiesel to make cleaner energy transitions.

Tget more information on this market, Request Sample

Biodiesel has become a practical solution to reduce the environmental impact of transportation and industrial activities. It is produced from renewable materials like vegetable oils, animal fats, or used cooking oils. Through the process of transesterification, these raw materials are chemically converted into biodiesel, with glycerol as a byproduct. The benefits of biodiesel are significant, including a reduction in greenhouse gas emissions, which helps decrease air pollution and supports global efforts to address climate change. Its use also enhances energy security by enabling domestic production, reducing reliance on imported fossil fuels. Additionally, biodiesel offers improved lubricating qualities, contributing to longer engine life and better efficiency. Furthermore, it can be easily integrated into the existing diesel infrastructure without the need for engine modifications.

The biodiesel market in the United States is influenced by government regulations and policies promoting sustainable energy sources and reducing greenhouse gas emissions. This is further supported by the increasing concerns over energy security and volatility in oil prices. Moreover, advancements in biodiesel production technologies and the expansion of feedstock availability enhance the feasibility and efficiency of biodiesel production, which, in turn, is accelerating the biodiesel market growth. In line with this, rising public awareness about environmental issues and the escalating need for cleaner energy solutions are creating a favorable environment for the market growth. Additionally, collaborations between public and private sectors foster research and development (R&D) activities in biodiesel applications, which is augmenting the market growth. For instance, in January 2024, the University of Kentucky's CAER and Department of Chemistry received a USD 1 million DOE grant to develop a catalyst for converting waste biomass, like brown grease, into renewable diesel, enhancing sustainability and reducing greenhouse gas emissions. Furthermore, international efforts to combat climate change and achieve sustainable development goals are enhancing the biodiesel market outlook.

Biodiesel Market Trends:

Government Regulations and Policies

The global biodiesel market is strongly influenced by government regulations and policies aimed at promoting sustainable energy sources and mitigating climate change. In 2021, biodiesel’s fuel application led the market, driven by regulations promoting renewable energy, reducing VOC emissions, and encouraging its use in commercial vehicles. Umpteen countries have implemented mandates and incentives to encourage the use of biodiesel as a sustainable substitute for traditional fossil fuels. For instance, the Renewable Fuel Standard (RFS), which is enforced by the Environmental Protection Agency (EPA), requires that transportation fuel contain renewable fuels, such as biodiesel. Biodiesel made up almost 9% of the total amount of biofuels produced and used in the United States in 2022. The vegetable oil segment dominated the biodiesel market in 2021, accounting for over 97% of global revenue. However, feedstock selection varies by region due to availability and cost. Countries like Indonesia, Thailand, Germany, France, and Colombia have widely used palm oil for biodiesel production, driven by government policies promoting renewable energy (RE). These policies often include blending mandates, tax incentives, and subsidies for biodiesel production and consumption. For instance, the Renewable Fuel Standard (RFS) in the United States requires a certain volume of renewable fuels, including biodiesel, to be blended into transportation fuels. These regulations not only create a stable demand for biodiesel but also signal a commitment to reducing greenhouse gas emissions, driving investments in biodiesel production infrastructure and technology.

Energy Security and Oil Price Volatility

The global biodiesel market trends are influenced by concerns over energy security and the fluctuation of oil prices in the international market. Biodiesel offers a viable alternative to traditional petroleum-based fuels, reducing dependence on imported oil and enhancing energy self-sufficiency. Profits from the manufacture of biodiesel can fluctuate greatly depending on changes in oil prices. As per reports, the profits from biodiesel production, for example, had a wild ride during the renewable diesel boom years of 2021–2024. They averaged losses of -USD 0.59 per gallon in the early part of the boom, recovered to a historically high average of +$0.41 per gallon in the middle, and then returned to losses averaging -USD 0.19 per gallon since mid-2023. In times of geopolitical tensions or supply disruptions, the availability of domestically produced biodiesel can provide a buffer against price shocks and supply uncertainties. Additionally, the price volatility of crude oil makes biodiesel an attractive option for consumers seeking more stable and predictable fuel costs. As a result, increased awareness of the potential benefits of biodiesel in ensuring energy security and stability further drives the growth of the global biodiesel market. Biodiesel is gaining popularity in the automotive and marine sectors, helping reduce dependence on crude oil while also boosting demand in agriculture due to increased mechanization. Furthermore, Indonesia and Thailand, which produce over 80% of global palm oil, use a significant portion for biofuel production, while European nations rely on imports from these countries. The demand for alternative vegetable oils, such as UCO and rapeseed, has increased, particularly in China and India, to reduce dependence on conventional fossil fuels and stabilize energy security.

Technological Advancements and Feedstock Availability

The biodiesel industry's growth is closely linked to advancements in production technologies and the availability of suitable feedstock. Technological innovations, such as improved catalysts and more efficient conversion processes, have significantly enhanced biodiesel production yields and reduced costs. Furthermore, Research and development initiatives have concentrated on converting multiple feedstock materials including vegetable oils, animal fats, and waste oils into biodiesel products. According to data from the US Energy Information Administration, the production of biodiesel in the United States used over 1,176 million pounds of feedstocks in December 2020, with soybean oil accounting for the greatest part at 744 million pounds. Expanding feedstock options enhances the industry's ability to withstand agricultural market fluctuations and reduces the risks associated with food-versus-fuel debates. With the emergence of alternative feedstocks like algae and non-food biomass, the biodiesel market broadens its sustainability and economic prospects, driving increased investment and adoption. Moreover, ongoing technological progress is driving biodiesel’s growth in power generation, as governments focus on renewable energy to reduce GHG emissions, supported by better feedstock availability. Besides this, UCO-based biodiesel (UCOME) is gaining traction in the Asia-Pacific region, but concerns over product availability impact its growth. Innovations in feedstock processing and improved collection mechanisms are crucial to ensuring a stable supply and enhancing biodiesel production efficiency.

Biodiesel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biodiesel market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on feedstock, application, type, and production technology.

Analysis by Feedstock:

- Vegetable Oils

- Animal Fats

- Others

Vegetable oils lead the market with around 96.7% of market share in 2024. The segment experiences sustained growth due to an ample supply of vegetable oil sources available for feedstock production. Vegetable oils including soybean, rapeseed, palm and sunflower oil have become fundamental products for food purposes which makes them affordable and accessible feedstock for biodiesel manufacturing. In addition, the extensive use of vegetable oils as biofuel stems primarily from their compatibility with existing biodiesel production systems. Moreover, the production of biodiesel from vegetable oils benefits from government incentive programs which prioritize them because of their reduced carbon footprint and their demonstrated favorable effects on agricultural economies. Besides this, consumers and industries now require sustainable, environmentally friendly products, while also embracing renewable feedstocks such as vegetable oils. Biodiesel offers vast benefits which draw the market toward vegetable oil-based biodiesel as an enduring environmentally conscious substitute. Furthermore, the production efficiency of vegetable oil-based biodiesel receives continuous research attention to establish it as a technologically advanced option for achieving renewable energy objectives.

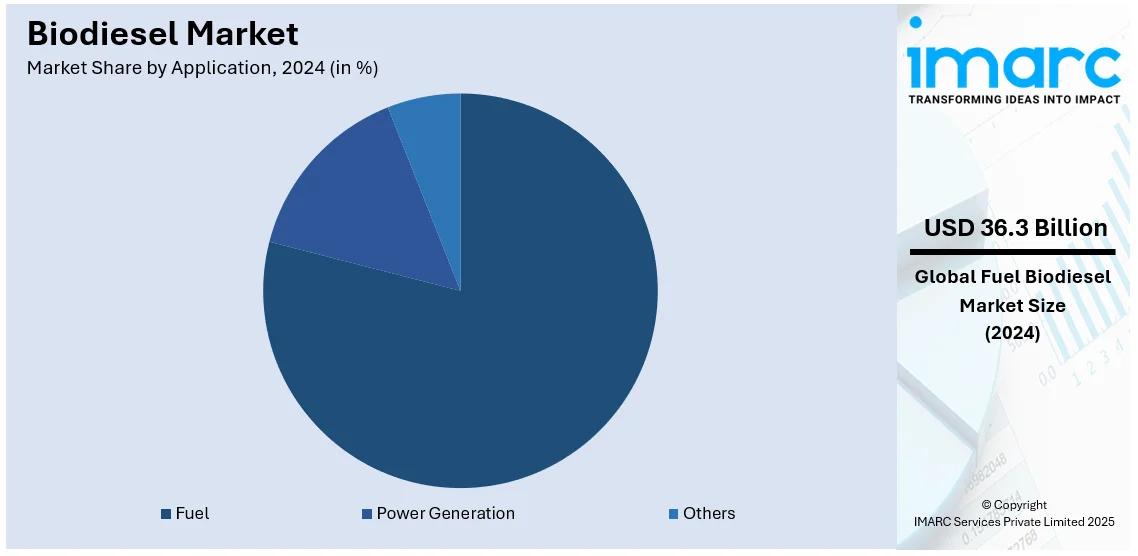

Analysis by Application:

- Fuel

- Power Generation

- Others

Fuel leads the market with around 78.7% of the biodiesel market share in 2024. The fuel segment holds the largest share of the biodiesel market because mandates from the government require biodiesel blending with traditional petroleum products. Many nations now enforce biodiesel blending requirements which push biodiesel consumption forward as a fuel component for both gasoline and diesel. Additionally, the increasing concerns over environmental sustainability and the need to reduce greenhouse gas emissions have motivated consumers and industries to seek cleaner fuel alternatives. Biodiesel, being a renewable and low-carbon fuel, appeals to environmentally conscious individuals and businesses, leading to a surge in its usage in the transportation sector. Furthermore, the widespread availability of feedstock sources, such as vegetable oils and animal fats, has made biodiesel a viable and cost-effective option for blending with conventional fuels. The ample availability of these feedstocks ensures a steady supply of biodiesel, further bolstering its dominance in the fuel segment. Moreover, advancements in biodiesel production technologies and the establishment of efficient distribution networks have facilitated the integration of biodiesel into the existing fuel infrastructure. This has made it convenient for consumers to access biodiesel blends, contributing to its dominance in the market.

Analysis by Type:

- B100

- B20

- B10

- B5

B100 leads the market in 2024. The B100 segment, referring to pure biodiesel, dominates the market due to several key drivers, including government policies and regulations favoring B100 usage as it represents a higher level of renewable content, aligning with sustainability goals and reducing greenhouse gas emissions. Many countries have implemented blending mandates or tax incentives specifically for B100, driving its demand in the transportation and industrial sectors. Additionally, B100's superior environmental credentials and reduced carbon footprint attract environmentally conscious consumers and businesses. As concerns over climate change intensify, the demand for cleaner fuels like B100 grows, bolstering its market share. In line with this, technological advancements and increased research and development (R&D) activities have resulted in improved engine compatibility and performance, addressing concerns about potential compatibility issues with existing engines. Besides this, the development of a well-established infrastructure to support the distribution and usage of B100 further solidifies its dominance in the market, ensuring accessibility and availability to consumers.

Analysis by Production Technology:

- Conventional Alcohol Trans-esterification

- Pyrolysis

- Hydro Heating

Pyrolysis leads the market in 2024. The dominance of this segment is due to several compelling market drivers which have solidified its position. The technology presents an unmatched benefit by transforming different types of raw materials including agricultural waste alongside wood resources and municipal solid waste to produce biodiesel. Multiple feedstock options available through the pyrolysis segment permit sustainable and flexible fuel supply systems that lower market dependence on agricultural product growth and eliminate conflicts with basic food services. Additionally, pyrolysis technology enables the production of biodiesel with lower production costs and higher yields compared to traditional transesterification processes. The efficient conversion of feedstock into biodiesel makes pyrolysis an economically viable option, attracting investors and fostering market growth. Moreover, through pyrolysis processing of organic waste materials, economic value emerges as energy products that serve both environmental protection needs and support circular economic methodologies. The growing awareness about waste-to-energy solutions within global environmental agencies, coupled with government support creates expanded biodiesel market demand from pyrolysis processes.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 47.8%. Europe's dominance in the biodiesel market can be attributed to the stringent environmental regulations and ambitious climate goals set by European governments. Biodiesel, being a low-carbon alternative to fossil fuels, aligns well with these objectives, leading to its widespread adoption. Additionally, the region has a well-established agricultural sector, providing ample feedstock for biodiesel production. Abundant sources of vegetable oils, such as rapeseed, soybean, and sunflower, contribute to the region's biodiesel production capacity. Moreover, government support through policies, incentives, and subsidies has incentivized the biodiesel industry's expansion. Initiatives like blending mandates and tax breaks for biofuels have created a stable market for biodiesel producers and encouraged investment in the sector. Furthermore, the European Union's commitment to reducing its carbon footprint has fostered research and development in advanced biodiesel technologies, ensuring the industry's competitiveness and sustainability. Besides this, the region's well-developed infrastructure, including distribution networks and fueling stations, has facilitated the widespread availability and use of biodiesel, further solidifying Europe's dominance in the global biodiesel market.

Key Regional Takeaways:

United States Biodiesel Market Analysis

In 2024, United States accounted for 90% of the market share in North America. Government policies promoting renewable energy and reducing emissions of greenhouse gases are fueling the biodiesel industry in the United States. A strong demand for the commodity is provided by the Renewable Fuel Standard, which requires biofuels, especially biodiesel, in transportation fuels. According to IEA Bioenergy data, the United States' capacity to produce biofuel increased to 23.8 billion gallons per year (BGPY) in 2023, an increase of more than 1.7 billion gallons over 2022. To meet strict carbon intensity reduction targets, state-specific initiatives like California's Low Carbon Fuel Standard (LCFS) further encourage the use of biodiesel. Demand for biodiesel is mainly driven by the transportation sector, which contributes to 29% of greenhouse gas emissions in the United States, according to data by US Environmental Protection Agency. For sustainability goals, fleets such as UPS and Walmart are also incorporating biodiesel blends. More than 40% of all feedstocks used in the production of biomass-based diesel come from soybean oil. In 2014–15, it was 5 billion pounds; in 2022–2023 it was 12.5 billion pounds. Corn and canola oils are also being used increasingly, albeit in smaller amounts, in biofuel manufacturing, based on data from the USDA Economic Research Service. Growth in investments in next-generation biodiesel technologies and feedstock innovations continues to underpin steady market growth.

North America Biodiesel Market Analysis

The North American biodiesel market relies on strong environmental regulations while renewable fuel standards and rising demand for sustainable solutions drive its growth. Multiple support mechanisms along with tax incentives drive biodiesel companies and user institutions across different market segments. For instance, in January 2024, USDA awarded USD 19 million in grants across 22 states to expand biofuel access. This supports energy independence, reduces fuel costs, creates rural jobs, and increases domestic biofuel availability at fueling stations. The combination of technology advancements with additional raw material choices based on vegetable oils and animal fats enhances manufacturing performance while enabling better market accessibility. Moreover, the market expands due to escalating environmental sustainability understanding and mounting requirements for greenhouse gas reductions. Furthermore, the transportation and industrial sectors are key contributors, leveraging biodiesel for cleaner energy alternatives.

Europe Biodiesel Market Analysis

The main reason why Europe leads the world market for biodiesel is the strict emissions restrictions under the Renewable Energy Directive (RED II) of the European Union, which requires at least 14% renewable energy in transportation by 2030 according to the data by European Union. In Europe, according to figures from the European Biodiesel Board, in 2022, production reached 13.7 million tonnes in the European Union excluding the United Kingdom, accounting for around 25% of global output; making it the country that produces the greatest biodiesel market share in the world. Given its local accessibility, rapeseed oil accounts for around 40% of feedstock and is considered a strong drive. A major driving force for the shift to renewable energy sources in the transportation sector is that countries such as Sweden have already attained 25% biodiesel utilization in their transportation fleets and aim to utilize 90% renewable fuels in transportation, as per reports. Additionally, the increasing use of second-generation biodiesel derived from animal fats and waste oils aligns with the principles of the circular economy. Further driving the demand for biodiesel are Europe's goals to reduce reliance on fossil fuels and enhance energy security. Although high-energy companies have been investing considerable amounts in construction of biodiesel production plants, consumer uptake of biodiesel-powered vehicles is bolstered by government publicity programs and subsidies.

Asia Pacific Biodiesel Market Analysis

Biodiesel Asia-Pacific market is experiencing fast growth owing to increasing energy consumption, government regulations, and environmental consciousness. Countries such as Indonesia and Malaysia produce a significant portion of the world's biodiesel, and they have a near monopoly on the market and primarily use palm oil as a feedstock. Domestic consumption is highly impacted by Indonesia's B35 regulation, which requires a 35% biodiesel blend in diesel, according to reports. India's biodiesel projects under the National Bio-Energy Mission will replace 5% of petroleum diesel with biodiesel, using locally accessible non-edible oils like jatropha. Increasing urbanisation and industrialisation also increase the need for greener energy options in industry and transportation. The region has a large population, and car sales exceed 35 million annually, making this a huge growth opportunity. In addition, international partnerships, for example, China's biofuel technology cooperation with ASEAN nations enhance the development and use of biodiesel.

Latin America Biodiesel Market Analysis

Biodiesel market in Latin America is growing due to favorable government policies and an available feedstock. Using mostly soybean oil, Brazil, the largest producer in the region, produces more than 70% of the biodiesel produced in the region and is the third largest biodiesel producer in the world as per the data by USDA. Local usage is influenced by the government's B12 mandate, which calls for a 12% biodiesel blend. A key exporter, Argentina has been using the huge capacity in soybean production to meet demands across the world, especially Europe. Biodiesel production also gives jobs directly and indirectly in Brazil. Investments in state-of-the-art feedstocks such as algae-based biodiesel, alliances with large biodiesel manufacturers across the world improve the sustainability and efficiency of the production process.

Middle East and Africa Biodiesel Market Analysis

Growing initiatives in energy diversification and agriculture are giving this biodiesel industry in MEA a boost. South Africa leads in the region with biodiesel projects using sunflower and canola oil as feedstocks. In initiatives such as Vision 2030, larger sustainability objectives are being targeted by governments in nations such as the United Arab Emirates and Saudi Arabia, to integrate biodiesel into their renewable energy plans. In cities, adoption is facilitated by biodiesel's contribution in waste management - used cooking oil conversion. A region where reportedly more than 40% is agriculture land area, Africa will be one more potential location that offers a means of production in feedstock, and it boosts production capacity aided by foreign funds and investments by these renewable energy advocating groups. Other sectors that support biodiesel include the mining and logistics industries through their demand for cleaner fuels.

Competitive Landscape:

The competitive landscape of the global biodiesel market features a diverse array of players, ranging from established multinational corporations to innovative startups. These companies combine biodiesel production activities with distribution services and research toward developing biodiesel technology. The market's competitive dynamics are influenced by factors such as technological advancements, feedstock availability, production capacity, and geographical presence. In addition, key players are continuously investing in research to enhance production efficiency and explore new feedstock sources. Market leaders are often characterized by a strong international presence, strategic partnerships, and a broad portfolio of sustainable energy solutions. For instance, in September 2024, Chevron, Restaurant Technologies, and Sheetz created a circular economy by recycling used cooking oil into biodiesel. This collaboration reduced waste, lowered life cycle carbon emissions, and supported sustainable energy without requiring changes in consumer behavior. Meanwhile, emerging players are making significant strides by leveraging niche markets and focusing on novel feedstock options. Additionally, collaborations with government bodies and industry associations play a pivotal role in shaping the competitive landscape, driving regulatory compliance and market expansion. Furthermore, intensifying biodiesel market competition will compel businesses to innovate and establish sustainable practices because renewable energy demand continues to increase.

The report provides a comprehensive analysis of the competitive landscape in the biodiesel market with detailed profiles of all major companies, including:

- Archer Daniels Midland Company (ADM)

- Wilmar International Limited

- Renewable Energy Group Inc.

- Bunge Limited

- Cargill, Incorporated

- Neste Oyj

- Louis Dreyfus Company B.V.

- Biox Corporation

- Diester Industrie

- Biomass Technology Group (BTG) BV

- DuPont

- POET

- Verbio Vereinigte BioEnergie AG

- China Clean Energy, Inc.

- CropEnergies AG

- INEOS AG

Latest News and Developments:

- August 2024: Gunvor Group has acquired a 50% share in VARO Energy's Rotterdam Sustainable Aviation Fuel (SAF) project, advancing the project. With the goal of producing low-carbon fuels to satisfy the growing demand for sustainable energy in aviation, this partnership expands the project's scope. The investment promotes the global transition to sustainable energy sources and places a strong emphasis on strategic alignment on transportation decarbonisation initiatives.

- June 2024: Bunge's 50% share in bp Bunge Bioenergia was agreed to be purchased by bp, making bp the sole proprietor of one of Brazil's top biofuels enterprises. The goal of this calculated action is to improve BP's integration and value generation in the biofuels industry.

- July 2023: Cargill partnered with TREES Consulting to create a methodology providing the beef industry with a framework to assess methane emissions.

- July 2023: Wilmar International divested its interest in the sugar business, Cosumar.

- June 2021: Bunge (BG.N) merged with Glencore-backed (GLEN.L) to create an agricultural trading giant worth about USD 34 billion.

Biodiesel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstocks Covered | Vegetable Oils, Animal Fats, Others |

| Applications Covered | Fuel, Power Generation, Others |

| Types Covered | B100, B20, B10, B5 |

| Production Technologies Covered | Conventional Alcohol Trans-esterification, Pyrolysis, Hydro Heating |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Archer Daniels Midland Company (ADM), Wilmar International Limited, Renewable Energy Group Inc., Bunge Limited, Cargill, Incorporated, Neste Oyj, Louis Dreyfus Company B.V., Biox Corporation, Diester Industrie, Biomass Technology Group (BTG) BV, DuPont, POET, Verbio Vereinigte BioEnergie AG, China Clean Energy, Inc., CropEnergies AG, INEOS AG. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biodiesel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global biodiesel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biodiesel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global biodiesel market was valued at USD 46.1 Billion in 2024.

IMARC estimates the biodiesel market to exhibit a CAGR of 3.6% during 2025-2033, expecting to reach USD 63.4 Billion by 2033.

The market is driven by rising environmental concerns, strict regulations on greenhouse gas emissions, and increasing demand for sustainable energy alternatives. Advancements in production technologies, diverse feedstock availability, and supportive government policies further enhance market growth, while public awareness and global efforts to combat climate change create favorable conditions for expansion.

Fuel leads the biodiesel market based on application. This demand is driven by its eco-friendly nature, lower emissions, government incentives, and its role in reducing dependence on fossil fuels while ensuring energy security.

Europe currently dominates the market, holding a significant share of 47.8% in 2024. The domination in the market is due to stringent environmental regulations, renewable energy targets, and government incentives promoting biofuels. High biodiesel adoption in transportation and significant investments in advanced production technologies further strengthen the region's leadership.

Some of the major players in the biodiesel market include Archer Daniels Midland Company (ADM), Wilmar International Limited, Renewable Energy Group Inc., Bunge Limited, Cargill, Incorporated, Neste Oyj, Louis Dreyfus Company B.V., Biox Corporation, Diester Industrie, Biomass Technology Group (BTG) BV, DuPont, POET, Verbio Vereinigte BioEnergie AG, China Clean Energy, Inc., CropEnergies AG, INEOS AG., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)