Biodegradable Food Service Disposables Market Size, Share, Trends and Forecast by Raw Material Type, Product Type, Distribution Channel, and Region, 2025-2033

Biodegradable Food Service Disposables Market Size and Share:

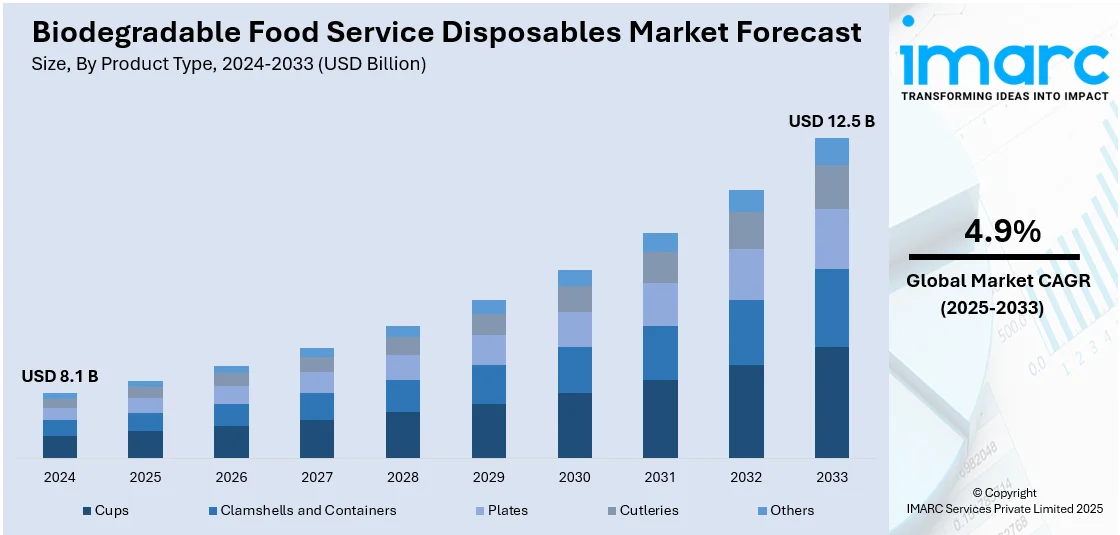

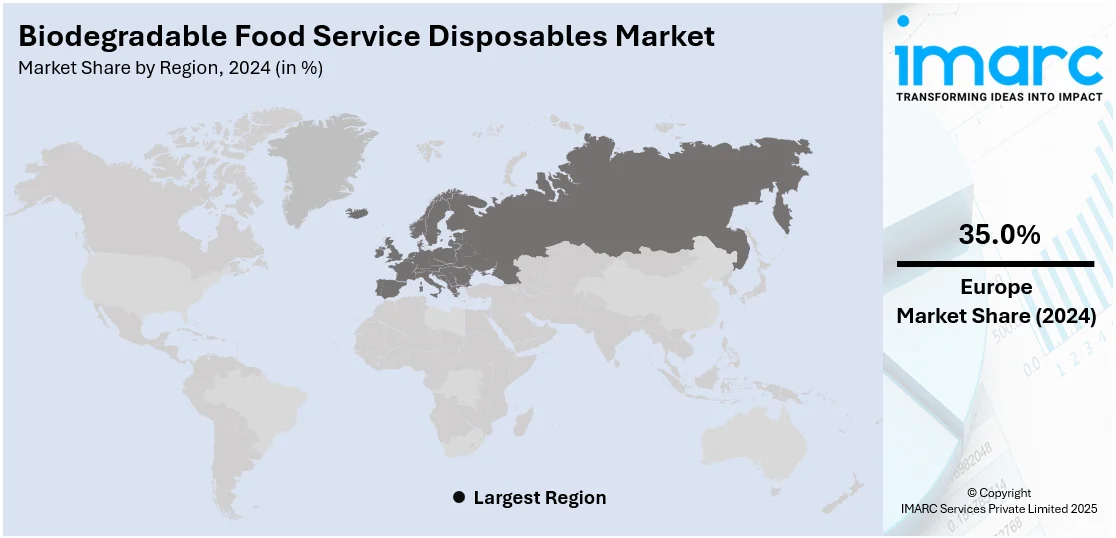

The global biodegradable food service disposables market size was valued at USD 8.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.5 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033. Europe currently dominates the market, holding a market share of around 35.0% in 2024. At present, the growing disposable issues of plastic are positively influencing the market. Besides this, government agencies around the world are introducing bans or restrictions on single-use plastics, which is leading businesses to shift towards eco-friendly alternatives, thereby contributing to the expansion of the biodegradable food service disposables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.1 Billion |

|

Market Forecast in 2033

|

USD 12.5 Billion |

| Market Growth Rate 2025-2033 | 4.9% |

At present, the market is growing steadily due to increasing awareness among the masses about environmental protection and plastic waste reduction. People prefer eco-friendly alternatives as they are becoming more conscious about sustainability. Government regulations banning single-use plastics are encouraging businesses to adopt biodegradable options. Besides this, food delivery and takeaway services are expanding rapidly, driving the demand for disposable and eco-conscious packaging. Restaurants, cafés, and catering services are employing biodegradable plates, cups, and cutlery to meet customer expectations and minimize their environmental impact. Rising health concerns are also driving interest in natural and chemical-free packaging materials. Businesses are utilizing green practices to enhance brand image and meet corporate social responsibility goals.

The United States has emerged as a major region in the biodegradable food service disposables market owing to many factors. Increasing environmental concerns and stringent government regulations on single-use plastics are fueling the biodegradable food service disposables market growth. People are demanding sustainable alternatives as awareness about plastic pollution is rising. The burgeoning food service industry, inculcating restaurants and catering services, is employing biodegradable disposables to align with eco-friendly practices and customer preferences. According to the IMARC Group, the US food service market size reached USD 1,515.5 Billion in 2024. The broadening of food delivery and takeaway services is creating the need for environmentally safe packaging. Businesses are also aiming to enhance their brand image by using green products. Technological advancements further aid in improving the quality and affordability of biodegradable materials, making them a practical choice.

Biodegradable Food Service Disposables Market Trends:

Growing disposal issues of plastic

Increasing disposal issues of plastic are stimulating the market growth. As of May 2024, the globe generated about 400 Million Tons of plastic, with 60% of it being discarded in landfills or polluting the environment. Plastic waste accumulates in landfills and oceans, causing serious environmental harm and leading to stringent regulations on single-use plastics. As awareness about these issues is rising, food service providers are shifting towards biodegradable options to reduce their ecological footprint. Biodegradable disposables break down more quickly and safely, offering a practical solution to mounting plastic waste concerns. This shift is further supported by rising preferences for eco-friendly products, which are encouraging restaurants and catering services to adopt sustainable packaging. Public campaigns and environmental policies also play a significant role by discouraging plastic use and promoting greener substitutes. Consequently, the demand for biodegradable food service disposables continues to increase, addressing both environmental concerns and customer expectations for responsible choices.

Increasing implementation of government initiatives

Rising execution of government initiatives is offering a favorable biodegradable food service disposables market outlook. Governments are introducing bans or restrictions on single-use plastics, which is encouraging businesses to shift towards eco-friendly alternatives like biodegradable disposables. For example, to curb the increasing plastic packaging waste, the European Parliament enacted a new regulation in April 2024 that banned certain single-use plastic packaging items, including delicate plastic grocery bags. Additionally, starting in 2029, nations in Europe are required to guarantee that deposit return programs gather 90% of single-use plastic bottles and cans annually. Beginning in 2030, beverage distributors will need to guarantee that 10% of their offerings are stored in reusable containers. Government agencies are also offering incentives, tax benefits, and subsidies to manufacturers and suppliers producing environment friendly products. Governments are also running awareness campaigns to enhance awareness among the masses about the harmful effects of plastic and the benefits of employing sustainable alternatives.

Rising applications in food and beverage (F&B) industry

The growing applications of biodegradable food service disposables in the F&B industry are positively influencing the market. As more restaurants, cafes, and food delivery services are prioritizing sustainability, they are using eco-friendly packaging to serve customers. These businesses aim to reduce their environmental impact and align with user preferences for greener choices. With rising demand for takeaway and online food orders, the need for disposable containers, cups, and cutlery is increasing. By switching to biodegradable options, F&B companies meet both functional and environmental needs. This shift is not only helping brands improve their public image but also ensuring compliance with government regulations against single-use plastics. Apart from this, the high requirement for ready-to-eat (RTE) food items is propelling the market growth. According to a report published by the IMARC Group, the global RTE food market reached USD 189.1 Billion in 2024 and is set to grow at a CAGR of 4.01% during 2025-2033.

Biodegradable Food Service Disposables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biodegradable food service disposables market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on raw material type, product type, and distribution channel.

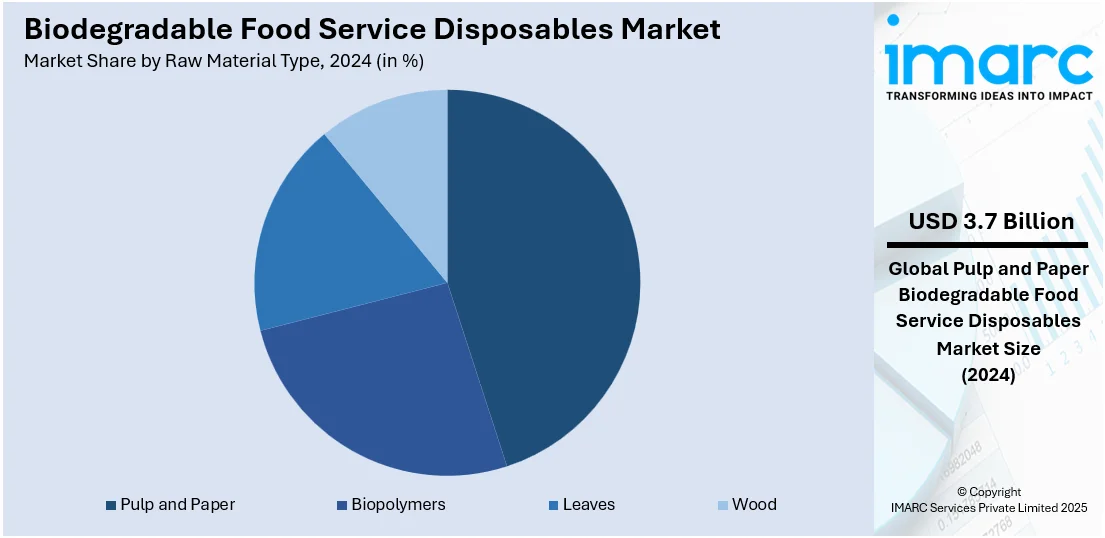

Analysis by Raw Material Type:

- Pulp and Paper

- Biopolymers

- Leaves

- Wood

Pulp and paper held 45.3% of the market share in 2024. They offer a cost-effective, widely available, and environment friendly alternative to plastic. Manufacturers prefer paper and pulp due to their ease of processing, lightweight nature, and ability to decompose quickly without leaving harmful residues. These materials come from renewable resources, making them highly sustainable and appealing to eco-conscious users and businesses. Paper-based disposables, such as plates, cups, trays, and containers, are suitable for both hot and cold food items, enhancing their versatility in food service applications. The growing demand for eco-friendly packaging and increasing bans on single-use plastics are encouraging food service providers to adopt paper and pulp-based products. Additionally, innovations in coating technologies improve the durability and leak resistance of paper disposables, making them more practical for everyday use. According to the biodegradable food service disposables market forecast, with rising awareness about environmental impact, paper and pulp will continue to be the top choice in the market.

Analysis by Product Type:

- Cups

- Clamshells and Containers

- Plates

- Cutleries

- Others

Cups account for 35.4% of the market share. They are widely used across various sectors, such as cafés, restaurants, offices, and events. The high consumption of beverages like coffee, tea, and soft drinks is driving the demand for disposable cups, especially in takeaway and on-the-go formats. Biodegradable cups made from materials like paper and cornstarch serve as sustainable alternatives to plastic, aligning with the growing environmental concerns. Businesses prefer these eco-friendly options to comply with regulations on single-use plastics and to appeal to environmentally conscious users. Cups are easy to manufacture, customize, and brand, which further boosts their popularity among food service providers. Their versatility in serving both hot and cold drinks makes them a convenient and practical choice. As more people are seeking sustainable lifestyles, the shift towards biodegradable cups continues to strengthen the market. This consistent demand and wide application across industries are making cups the leading product type in the market.

Analysis by Distribution Channel:

- Business to Business (B2B)

- Business to Customer (B2C)

- Supermarkets and Hypermarkets

- Online Stores

- Others

Business to business (B2B) holds 60.2% of the market share. B2B distribution allows manufacturers to reach bulk buyers, such as restaurants, hotels, catering companies, and institutional food providers, directly. These businesses consistently require large quantities of disposable items like plates, bowls, cutlery, and packaging materials to support their daily operations. Since B2B dealings frequently entail prolonged agreements and repeated purchases, they provide stability and higher volume sales for producers. Businesses in the food service industry are shifting towards sustainable alternatives to comply with regulations and meet the expectations of environmentally conscious customers. Because B2B clients prioritize cost-efficiency, reliability, and sustainability, they prefer sourcing eco-friendly disposables in bulk from trusted suppliers. Moreover, B2B distribution enables streamlined logistics, personalized product offerings, and better customer support. This makes it an ideal channel for manufacturers to grow their presence and build lasting relationships.

Regional Analysis:

- Europe

- North America

- Asia-Pacific

- Middle East and Africa

- Latin America

Europe, accounting for a share of 35.0%, enjoys the leading position in the market. The region is noted for its strong commitment to environmental sustainability and stringent regulatory frameworks. Governments across the region are introducing bans and restrictions on single-use plastics, leading businesses to adopt eco-friendly alternatives. The population in Europe is highly environmentally conscious, which is driving the demand for biodegradable options in restaurants, cafes, and food delivery services. Companies are responding to this demand by innovating and expanding their range of compostable and plant-based products. The European Union is supporting sustainable practices through funding, policies, and research, which is further accelerating the employment of green alternatives. Moreover, Europe has a well-developed recycling and waste management infrastructure that complements the use of biodegradable materials. Moreover, the increasing demand from the thriving hospitality industry is offering a favorable market outlook. As per industry reports, the hospitality industry in Europe was projected to expand by about 8% in 2024.

Key Regional Takeaways:

North America Biodegradable Food Service Disposables Market Analysis

The North America biodegradable food service disposables market is experiencing rapid expansion, fueled by increasing consumer demand for environmentally friendly and sustainable products. For instance, as per a 2024 survey conducted in the United States, 80% of respondents were significantly concerned about the environmental impact of their purchases, highlighting a major increase in comparison to 2023 at 68% and 2022 at 66%. As more consumers embrace eco-conscious lifestyles, there is a growing expectation for brands in the food service industry to adopt environmentally friendly practices, including the use of biodegradable disposables. This demand is also being propelled by an increasing number of eco-friendly certifications and labels that help guide consumers in making sustainable purchasing decisions. Additionally, the growing presence of online food delivery services and takeout dining has further heightened the need for sustainable, single-use packaging solutions. According to a report by the IMARC Group, the online food delivery service market in North America reached USD 38.0 Billion in 2024 and is expected to grow at a CAGR of 11.57% during 2025-2033. Besides this, government regulations and policies aimed at reducing single-use plastic waste, such as plastic bans and extended producer responsibility laws, are also supporting market growth.

United States Biodegradable Food Service Disposables Market Analysis

The United States market, holding a share of 83.20%, is primarily driven by increasing environmental awareness and the growing concern about plastic pollution. According to a 2021 industry report, the United States generated around 42 Million Metric Tons of plastic waste each year, rendering it the biggest contributor to plastic pollution worldwide. As people and businesses are becoming more conscious about sustainability, there is a shift towards eco-friendly alternatives in packaging. Government regulations, such as plastic bans and restrictions on single-use plastics, have also heightened the demand for biodegradable food service items, providing a clear incentive for the industry to adopt sustainable solutions. In addition, the rising need for eco-conscious brands is encouraging food service providers to invest in biodegradable options. The availability of innovative biodegradable materials like plant-based plastics, sugarcane, and cornstarch is further fueling the market growth, offering functional and cost-effective alternatives to traditional plastic disposables. Apart from this, the burgeoning fast-casual dining sector, where sustainability is a key selling point, is contributing substantially to an increase in biodegradable packaging usage.

Europe Biodegradable Food Service Disposables Market Analysis

The market in Europe is experiencing robust growth, fueled by stringent environmental regulations across European countries, which have played a pivotal role in propelling the industry towards sustainable alternatives. These regulatory measures are encouraging foodservice businesses to adopt biodegradable products that align with new environmental standards. Moreover, the rising demand for eco-friendly products is contributing substantially to industry expansion, as people are prioritizing sustainability while choosing foodservice providers. For instance, according to a survey by the European Commission, in 2023, 83% of participants indicated that a product's environmental effect was an important factor when they made a purchase. Additionally, 77% of those surveyed expressed a willingness to spend more on environment friendly items. The growing awareness about the environmental effects of plastic waste, particularly in landfills and oceans, is also motivating individuals and businesses to shift towards biodegradable alternatives. Moreover, heightened corporate social responsibility (CSR) efforts within the foodservice industry, combined with the increasing trend of eco-conscious branding, are leading foodservice operators to choose eco-friendly disposables.

Asia-Pacific Biodegradable Food Service Disposables Market Analysis

In the Asia-Pacific region, the market is expanding due to a shift towards sustainable business practices and increased investments in green innovation. As user demand for environmentally conscious products is rising, foodservice companies are adopting biodegradable disposables to meet the growing expectation for eco-friendly packaging. Additionally, the region’s rapid urbanization activities and the expansion of quick-service restaurants (QSRs) and food delivery services are creating the need for disposable packaging that aligns with modern user values. For instance, the online food delivery market in India reached USD 45.15 Billion in 2024 and is set to grow at a CAGR of 23.10% from 2025-2033, as per a report by the IMARC Group. Furthermore, technological advancements in biodegradable materials have led to a wider range of cost-effective options that perform similarly to traditional plastics, making them more attractive to businesses.

Latin America Biodegradable Food Service Disposables Market Analysis

In Latin America, the market is significantly propelled by increased environmental activism and the growing influence of sustainability-focused businesses. As people are becoming more eco-conscious, there is a rising demand for foodservice operators to adopt biodegradable alternatives that align with responsible consumption trends. The region's thriving tourism industry is also contributing substantially to the demand for eco-friendly packaging, as both international visitors and local users prefer businesses that prioritize sustainability. For instance, from January to June 2024, Brazil witnessed 3.6 Million international tourists, who spent nearly USD 3.7 Billion in the country, as per industry reports. Besides this, the availability of locally sourced biodegradable materials and innovations in product design are making biodegradable disposables more accessible and practical for a wide assortment of foodservice applications.

Middle East and Africa Biodegradable Food Service Disposables Market Analysis

In the Middle East and Africa region, the market is influenced by increasing government incentives and collaborations aimed at reducing plastic waste. Numerous countries are offering subsidies and tax benefits for businesses adopting sustainable packaging, encouraging the transition to biodegradable materials. The emergence of date palm leaf cutlery for reducing the reliance on plastic waste is also propelling the market growth. The rise of eco-conscious startups and foodservice brands that prioritize environmental sustainability is also contributing substantially to industry expansion. Furthermore, as disposable incomes are increasing and awareness about global environmental impacts is growing, people are seeking eco-conscious brands. The availability of affordable and innovative biodegradable materials is further encouraging employment across foodservice industries in the region.

Competitive Landscape:

Key players are investing in research and development (R&D) activities to create high-quality, durable, and cost-effective products. They are introducing innovative materials like plant-based plastics, bagasse, and cornstarch to replace traditional plastics. These companies actively promote sustainability through marketing campaigns and collaborations with food service providers. They are expanding their product portfolios to meet the varying needs of restaurants, cafes, and delivery services. By improving supply chains and scaling up production, key players are making biodegradable options more accessible and affordable. They are also working with governments and environmental organizations to support regulations that encourage eco-friendly alternatives. Their consistent efforts to educate individuals and businesses about environmental impacts are further driving the demand. For instance, in June 2024, Bioelements Group made its debut in the US market by opening its headquarters in Houston and announcing plans for a BIOLab research plant. The firm created and supplied a line of food service packaging that used different biobased, biodegradable, and compostable materials.

The report provides a comprehensive analysis of the competitive landscape in the biodegradable food service disposables market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Santan, the F&B branch of Capital A, declared its transition from single-use plastics to biodegradable alternatives. All of its disposable in-flight food service items, including cutlery, lids, and cups, would be made from Polylactic Acid (PLA), a material derived from renewable sources like corn and cassava, and fully biodegradable.

- March 2025: Fiberdom revealed that it formed a strategic alliance with S Group, a retailer based in Finland. Through this partnership, shoppers would have the opportunity to purchase Fiberdom’s full range of 100% plastic-free, compostable at home, and recyclable single-use cutlery in S Group outlets nationwide. The product range, which combined sustainability with functionality, included knives, forks, soup spoons, and the newly launched small spoon.

- February 2025: Ecopax introduced BioBrew, an eco-friendly disposable coffee cup designed to significantly reduce the company's environmental footprint. BioBrew provided a sustainable alternative to conventional paper cups, being 90% recyclable and completely free of polyethylene.

- December 2024: Biocup, a prominent Mexican company known for its biodegradable disposable food service containers, expanded into the US with assistance from the MileOne Incubator Program. Biocup was a biodegradable packaging startup focused on plant-based materials, providing catering and food service packaging that aligned with circular economy objectives.

Biodegradable Food Service Disposables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Material Types Covered | Pulp and Paper, Biopolymers, Leaves, Wood |

| Product Types Covered | Cups, Clamshells and Containers, Plates, Cutleries, Others |

| Distribution Channels Covered |

|

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biodegradable food service disposables market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global biodegradable food service disposables market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biodegradable food service disposables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biodegradable food service disposables market was valued at USD 8.1 Billion in 2024.

The biodegradable food service disposables market is projected to exhibit a CAGR of 4.9% during 2025-2033, reaching a value of USD 12.5 Billion by 2033.

Government regulations and bans on single-use plastics are driving the demand for eco-friendly disposables in the food service industry. QSRs prefer biodegradable options to align with sustainability goals and appeal to environmentally aware customers. Moreover, technological advancements are making biodegradable materials, such as bagasse, PLA, and bamboo, more accessible and cost-effective, enhancing product variety and performance.

Europe currently dominates the biodegradable food service disposables market, accounting for a share of 35.0% in 2024, due to stringent environmental regulations, high user awareness, and strong government support. Businesses are adopting sustainable products to meet eco-friendly standards, while advanced waste management systems are encouraging widespread use of biodegradable alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)