Biobanking Market Size, Share, Trends and Forecast by Specimen Type, Biobank Type, Application, End-User, and Region, 2025-2033

Biobanking Market Size and Share:

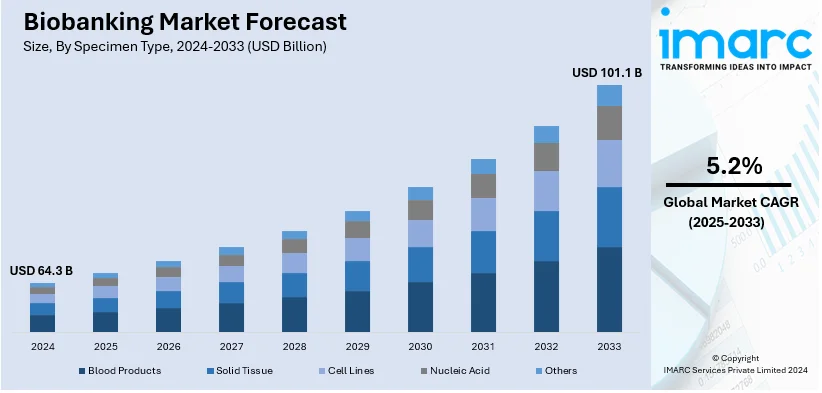

The global biobanking market size was valued at USD 64.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 101.1 Billion by 2033, exhibiting a CAGR of 5.2% from 2025-2033. North America currently dominates the market, holding a market share of over 34% in 2024. The rising number of genomic research activities, increasing prevalence of chronic diseases, and rising focus on virtual biobank represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 64.3 Billion |

|

Market Forecast in 2033

|

USD 101.1 Billion |

| Market Growth Rate (2025-2033) | 5.2% |

The global biobanking market is expanding due to increased demand for high-quality biological samples in medical research and personalized medicine. Advances in genomics and proteomics are driving the need for well-maintained biospecimens to support drug discovery, disease diagnosis, and biomarker development. For instance, in August 2024, Mayo Clinic's Center for Individualized Medicine launched an omics strategy, integrating genomics, proteomics, metabolomics, and microbiomics to explore gene-environment interactions. This initiative focuses on advancing disease prediction, diagnosis, and management, including cancer and chronic conditions. By utilizing polygenic risk scores and advanced sequencing, the center aims to deliver personalized healthcare and innovative treatment solutions. Government and private investments in biobanking infrastructure and the growing focus on regenerative medicine further boost the market. Additionally, the integration of advanced storage technologies, such as automated sample management systems, enhances efficiency and reliability, fueling market growth.

Rising awareness of the importance of biobanks in combating global health challenges, including cancer and rare diseases, is significantly influencing the market, especially in Europe. The adoption of digital platforms for data management and remote sample tracking ensures better accessibility and transparency. Moreover, collaborations between research institutions, pharmaceutical companies, and biobanks are accelerating innovations, reinforcing the market's role in supporting advancements in clinical research and therapeutics. For instance, in April 2024, EIT Health Scandinavia, part of the European Institute of Innovation and Technology (EIT), introduced the EIT Health Biobanks and Health Data Registries platform. This hub connects researchers, clinicians, and industry professionals with European biobanks and data registries. Developed with BBMRI-ERIC, it simplifies access, boosts sample utilisation, and fosters collaboration to drive medical research and innovation.

Biobanking Market Trends:

Expanding Role of Biobanking in Genomic Research and Personalized Medicine

At present, the rising demand for biobanking due to the increasing number of genomic research activities represents one of the key factors supporting the growth of the market. Besides this, the growing number of biobanks across the globe, due to its potential to enhance the reproductivity and meaning of data generated by biomedical research, is offering a positive market outlook. Additionally, there is a rise in the prevalence of chronic diseases, such as diabetes, hypertension, cancer, heart attack, and respiratory disorders, among the masses around the world. The World Health Organization (WHO) reports that chronic diseases account for 41 Million deaths annually, representing 74% of all global fatalities. This, coupled with the increasing demand for biobanking to develop diagnostics that can effectively identify pathogens, is propelling the growth of the market. Apart from this, the rising expenditure in advanced therapies, such as regenerative medicine, personalized medicine, and cancer genomic studies, is offering lucrative growth opportunities to industry investors. For instance, the UK Biobank has collected genetic data from 500,000 participants, including whole genome sequencing (WGS) for all, whole exome sequencing (WES) for 470,000, and genotyping of 800,000 variants, with imputation extending this to 90 Million variants. Moreover, the increasing demand for biospecimens from clinical labs to develop assays for genetic testing is positively influencing the market. In addition, the growing focus on virtual biobank that minimizes time constraints, generates high revenue, and allows researchers to conduct the research smoothly is contributing to the growth of the market. Furthermore, key players are introducing a biobank software solution that assists in gaining visibility and improving the quality of the service provided to customers, which is strengthening the market growth.

Increasing Adoption of Digital Biobanking Solutions

The adoption of digital technologies is transforming the global biobanking market, improving efficiency, and ensuring better data management. Virtual biobanks are gaining traction for their ability to eliminate geographical and logistical barriers, providing researchers seamless access to biospecimens and associated data. Digital platforms enhance transparency, enable real-time tracking, and streamline operations, contributing to better sample integrity. For instance, in August 2024, Verisense Health, Inc. launched the Verisense Digital Biobank, with health data from over one million people, expected to reach two million by the end of 2024. It includes data from 570 studies and uses an AI-powered Dataset Cataloger to manage and update datasets. This helps researchers access, validate, and use digital health data more efficiently. Additionally, advancements in biobank management software are enabling stakeholders to optimize storage conditions, improve compliance, and increase operational scalability, ensuring high-quality biospecimens for research and diagnostics.

Expanding Demand for Biospecimens in Chronic Disease Research

The rising prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular conditions, is fueling demand for biospecimens to support diagnostics and therapeutic advancements. Biobanks play a vital role in developing innovative solutions for early detection and treatment by providing access to diverse biological samples. For instance, in November 2024, Oxford Nanopore Technologies partnered with UK Biobank to develop the first large-scale epigenetic dataset, sequencing 50,000 samples using advanced DNA/RNA technology. This initiative aims to uncover disease mechanisms, enhance diagnostics, and advance personalised treatments. By providing nearly complete epigenome insights, the project supports breakthroughs in healthcare, including early detection, tailored interventions, and improved understanding of disease progression. Moreover, with chronic diseases accounting for the majority of global fatalities, research institutions and pharmaceutical companies are leveraging biobanking to accelerate clinical trials and develop targeted therapies. Collectively, this trend underscores biobanking's importance in addressing global healthcare challenges and enhancing patient outcomes.

Biobanking Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biobanking market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on specimen type, biobank type, application, and end-user.

Analysis by Specimen Type:

- Blood Products

- Solid Tissue

- Cell Lines

- Nucleic Acid

- Others

According to the report, blood products are the leading specimen type in the global biobanking market, owing to their pivotal role in advancing medical research, diagnostics, and therapeutic innovations. Comprising plasma, serum, and whole blood, these samples are integral to studying biomarkers, genetic disorders, and disease mechanisms. Their widespread application in research on chronic conditions such as cancer, cardiovascular diseases, and diabetes highlights their significance. Blood products are also essential for infectious disease studies, aiding in vaccine development and diagnostics. The integration of advanced storage and preservation technologies ensures the integrity and reliability of these specimens, supporting their use in longitudinal and cross-sectional studies. Furthermore, the growing emphasis on precision medicine and genomics has amplified the demand for blood samples, as they enable the development of personalized therapeutic solutions. The expanding global biobanking infrastructure, coupled with collaborations among research institutions and pharmaceutical companies, enhances the accessibility and quality of blood specimens. This strong demand solidifies blood products' position as the dominant specimen type in the global biobanking market, driving innovation and contributing to improved healthcare outcomes.

Analysis by Biobank Type:

- Population-based Biobanks

- Disease-oriented Biobanks

According to the report, disease-oriented biobanks dominate the global biobanking market as they provide critical resources for advancing research and treatments focused on specific diseases. These biobanks collect, store, and manage biological samples, such as tissues, blood, and DNA, specifically related to conditions like cancer, cardiovascular diseases, and neurological disorders. Their targeted approach supports precision medicine initiatives by enabling the identification of disease biomarkers, understanding disease mechanisms, and developing tailored therapies. The increasing prevalence of chronic and rare diseases worldwide has amplified the demand for disease-oriented biobanks, driving investments from governments, research institutions, and pharmaceutical companies. Advanced data integration and sample management technologies further enhance their value, enabling seamless sharing of high-quality biospecimens and associated data. These biobanks also play a pivotal role in supporting clinical trials and accelerating the development of innovative diagnostics and treatments. With their focused contribution to global healthcare challenges, disease-oriented biobanks are the cornerstone of modern biobanking, ensuring meaningful progress in disease management and therapeutic advancements.

Analysis by Application:

- Therapeutics

- Research

According to the report, research is the leading therapeutics segment in the global biobanking market, driven by the increasing need for high-quality biospecimens to support advancements in medical science and therapeutic innovation. Biobanks are uniquely positioned as the main infrastructures sourcing samples and data for research on diseases and drug discovery and as nuanced repositories of biomarkers to help advance treatment outcomes. Nevertheless, the biobanks with a research orientation have emerged with the growth in precision medicine and genomics because of the maximum importance of developing biomolecules for treatment from the patient’s genetic profile. Also, biobanks have the function of responding to the worldwide health problems by contributing to research on the chronic, infectious, and rare genetic diseases. Advancements in sample preservation and handling enhance the application of stored tissues a s useful tools of effective clinical trials and other applications. The relationship between biobanks, research institutions, and pharmaceutical companies enhance the ecosystem and overlays efficiency in discovery of treatments. This firm association with research activities places it as the largest therapeutics segment in the biobanking market, which is facilitating advancements in global healthcare.

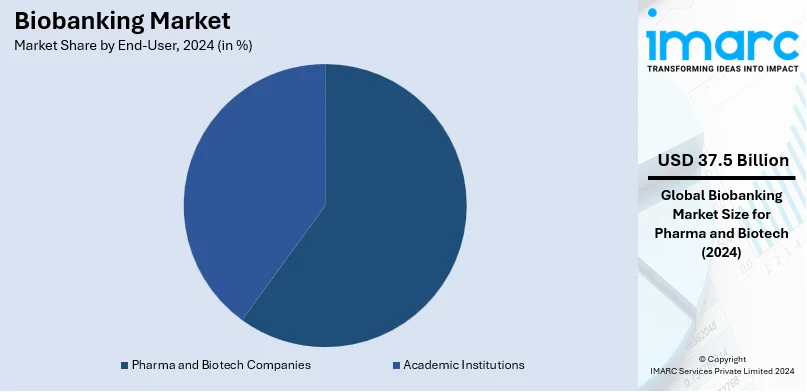

Analysis by End-User:

- Academic Institutions

- Pharma and Biotech Companies

Pharma and biotech companies lead the market with around 58.3% of market share in 2024. Companies involved in pharma and biotech industries are highly motivated by the utilization of biospecimens in therapeutic products, trials, and precision medicine. These companies rely on biobanks to obtain high quality phenotype samples for biomarker identification, target validation as well as therapeutic validation. The inclusion of biobanking resources into the R&D value chains advances in the timeframe of the preclinical stage and increases productivity in drug development. Due to the trend towards the development of more and more chronic diseases and few occurrences of single diseases, there has been a growing need for various types of biological products, which can improve the methods of treatment for individuals and the technologies for tissue engineering and regeneration. Pharma and biotech firms also benefit from advanced biobank technologies, including automated storage systems and AI-driven data analytics, which enhance sample integrity and optimize utilization. Collaborations with biobanks provide these companies with access to ethically sourced specimens, ensuring compliance with regulatory standards and bolstering their research capabilities. By driving innovation and enabling groundbreaking therapies, pharma and biotech companies play a pivotal role in shaping the global biobanking market and advancing global healthcare solutions.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34%. The North America region is driven by advanced healthcare infrastructure, significant investments in research and development, and a strong focus on precision medicine. The region benefits from robust biobank networks, supporting large-scale genomic and disease-specific research. Private sector initiatives in association with government funding are further improving the accessibility and quality of biospecimens, thereby forming strong stewardship. Moreover, North America is paying more attention to cutting-edge technologies adoption, including automated biobank management systems and AI-driven analytics. These technologies also improve sample preservation and data integration facilities that validates reliability for research applications. Increase in the incidences of chronic diseases such as cancer, and cardiovascular diseases put more emphasis on the procurement of good quality biospecimens for diagnostics and other therapeutic developments. This creates synergy among various institutions, research centers, and pharmaceutical industries with the result of promoting higher research outcomes of personalized medicine and regenerative options. North America, which continually exhibits a high level of commitment to legal requirements as well as ethics in biobanking, continues to lead in the growth of the worldwide business and its contributions to medical innovation.

Key Regional Takeaways:

United States Biobanking Market Analysis

The US accounted for 84.5% market share in North America. This can be attributed to the rising demand for personalized medicine, advancements in genomics, and increasing government investments in healthcare infrastructure. According to the U.S. Department of Health and Human Services, an estimated 129 Million Americans are affected by at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension. This growing prevalence of chronic conditions has heightened the need for biobanks to support research in targeted therapies and precision medicine. Robust funding from institutions such as the National Institutes of Health (NIH) further accelerates biobank development, fostering advancements in genomics and biomedical research. Additionally, the integration of advanced technologies like artificial intelligence (AI) and machine learning enhances the analysis of complex datasets, significantly improving biobank capabilities. Collaboration among private biotech companies, academic institutions, and healthcare organizations strengthens the biobanking ecosystem. Regulatory frameworks, such as the Health Insurance Portability and Accountability Act (HIPAA), ensure secure management and sharing of biological data, instilling trust and encouraging participation. Together, these factors propel the growth of the U.S. biobanking market.

Asia Pacific Biobanking Market Analysis

The biobanking market in the Asia-Pacific (APAC) region is driven by advancements in healthcare infrastructure, increased government investment in research, and growing awareness of personalized medicine. According to the United Nations, China and India account for 18% of the world’s population, providing a diverse genetic pool for biobank development. Also, according to the NIH, the 3 major NCDs in the Asia Pacific region are CVDs, cancer and diabetes due to the increasing loss of disability adjusted life years (DALYs). These nations, alongside Japan, play a significant role in advancing genomics research, particularly in cancer and genetic disorders. Expanding healthcare initiatives in countries like India and South Korea, coupled with supportive government policies, further stimulate market growth. International collaborations with global biopharmaceutical companies strengthen biobank capabilities, fostering innovation and research across the region. The combination of population diversity and research focus positions APAC as a key player in the global biobanking landscape.

Europe Biobanking Market Analysis

The European biobanking market is witnessing significant growth, driven by government funding, advancements in biotechnology, and the increasing emphasis on personalized medicine. According to the European Commission, over 35% of the EU population reported a chronic health condition in 2023, including cardiovascular diseases, diabetes, and cancer. This prevalence highlights the need for biobanks to support research and develop targeted therapies for these widespread conditions. Europe’s strong healthcare infrastructure, coupled with its collaborative ecosystem of universities, research organizations, and private enterprises, provides a solid foundation for biobank development. Key initiatives, such as the EU’s Horizon 2020 programme, have been instrumental in funding large-scale biobank projects focusing on genomics and disease-specific research. The adoption of advanced technologies and analytics further enhances the capabilities of European biobanks in managing and analyzing biological samples. Additionally, the region’s stringent regulatory frameworks, including the General Data Protection Regulation (GDPR), ensure the ethical collection, storage, and use of biological data, fostering trust among stakeholders and encouraging public participation. These factors collectively position Europe as a global leader in biobanking, playing a crucial role in advancing medical research, supporting precision medicine, and addressing the growing healthcare challenges associated with chronic diseases.

Latin America Biobanking Market Analysis

The biobanking market in Latin America is driven by rising research investments and a growing focus on chronic disease management. According to the NIH, Brazil alone reported an estimated 928,000 deaths from chronic diseases, highlighting the need for enhanced medical research and biobank support. Governments in countries like Brazil and Mexico are strengthening healthcare infrastructure, creating opportunities for biobank development. Additionally, collaborations with international research institutions and private companies are improving biobank capabilities. While challenges like data management and regulatory frameworks persist, ongoing advancements in these areas are expected to drive further market growth in the region.

Middle East and Africa Biobanking Market Analysis

The Middle East and Africa biobanking market is gaining traction, driven by advancements in healthcare infrastructure and investments in cutting-edge technologies. In the UAE, the Al Jalila Foundation, part of the Mohammed Bin Rashid Al Maktoum Global Initiatives, invested USD 4.6 Million (AED 17 Million) to establish a state-of-the-art robotic biobank in 2022. Developed in collaboration with the Mohammed Bin Rashid University of Medicine and Health Sciences (MBRU) and the Dubai Health Authority (DHA), the biobank will use advanced robotics and artificial intelligence to securely store over seven Million biological samples in cryogenic conditions below -80°C for genetic research. Such initiatives underscore the region's focus on leveraging technology to enhance research capabilities. Additionally, increasing government support and international collaborations further bolster the biobanking landscape in the region, paving the way for significant advancements in medical research and personalized medicine.

Competitive Landscape:

The global biobanking market is competitive, driven by advancements in technology, strategic collaborations, and the growing demand for high-quality biospecimens. Companies are focusing on developing innovative biobank management systems, automated storage solutions, and digital tools to enhance operational efficiency and meet research needs. Collaborative initiatives between biobanks, research organizations, and pharmaceutical firms are fostering innovation in genomic and personalized medicine. For instance, in August 2024, Owkin and Finnish Biobank Cooperative (FINBB) collaborated to advance medical research by applying AI to multimodal patient data. This partnership leverages 11 million biobank samples, biodata, and participant recruitment from Finland’s public biobanks. By combining expertise and resources, the initiative aims to accelerate innovative treatments for diseases like inflammatory bowel disease through impactful public-private partnerships. The rise of virtual biobanking and digital platforms is intensifying competition by improving accessibility and scalability. Market players are also emphasizing regulatory compliance, expanding biobank networks, and investing in R&D to address evolving healthcare challenges, further shaping the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Brooks Automation Inc.

- Bay Biosciences LLC

- Boca Biolistics

- Ctibiotech

- Cureline Inc.

- Firalis

- Greiner Bio-One International GmbH

- Hamilton Company

- Merck KGaA

- ProteoGenex Inc.

- Thermo Fisher Scientific Inc.

- VWR Corporation (Avantor Inc.)

Latest News and Developments:

- October 2024: NABL has launched a new Accreditation Programme for Biobanking, aligned with ISO 20387:2018, "Biotechnology — Biobanking — General Requirements." The programme was unveiled in Delhi. The accreditation ensures quality, traceability, and consistency in biobanking, crucial for preserving biological materials used in research and drug development. ISO 20387:2018 sets requirements for biobank competence and impartiality, ensuring the integrity of biological resources.

- July 2024: Amazon Web Services (AWS) will provide USD 8.7 Million in cloud computing credits to UK Biobank, announced by Science and Technology Secretary Peter Kyle. This will support data storage and processing, including AI and machine learning services. The contribution is matched by USD 8.7 Million in government funding, part of a broader USD 54.3 Million effort to secure UK Biobank's long-term future in medical research.

- May 2024: CHA Bio Group and CIC have signed an MoU to establish an open innovation centre focused on the CGB (Cell Gene Biobank) in Pangyo 2nd Techno Valley. The collaboration aims to attract biotech ventures and create a biotech innovation ecosystem. CHA Bio Group will draw biotech ventures from domestic and international R&D centres, while CIC will support investment, development, and customized programmes for resident companies.

Biobanking Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Specimen Types Covered | Blood Products, Solid Tissue, Cell Lines, Nucleic Acid, Others |

| Biobank Types Covered | Population-based biobanks, Disease-oriented biobanks |

| Applications Covered | Therapeutics, Research |

| End-Users Covered | Academic institutions, Pharma and biotech companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brooks Automation Inc., Bay Biosciences LLC, Boca Biolistics, Ctibiotech, Cureline Inc., Firalis, Greiner Bio-One International GmbH, Hamilton Company, Merck KGaA, ProteoGenex Inc., Thermo Fisher Scientific Inc. and VWR Corporation (Avantor Inc.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biobanking market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global biobanking market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biobanking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Biobanking refers to the collection, storage, and management of biological samples, such as tissues, blood, and DNA, for use in medical research, diagnostics, and therapeutic development. These samples, preserved with advanced technologies, support studies on disease mechanisms, biomarker discovery, and personalized medicine, playing a vital role in advancing healthcare and scientific innovation globally.

The biobanking market was valued at USD 64.3 Billion in 2024.

IMARC estimates the global biobanking market to exhibit a CAGR of 5.2% during 2025-2033.

The global biobanking market is driven by growing demand for high-quality biospecimens in medical research, advancements in genomics, and increasing focus on personalized medicine. Rising prevalence of chronic diseases, government funding, and technological innovations in storage and data management further fuel growth, highlighting biobanking’s critical role in advancing healthcare and therapeutic development.

According to the report, blood products represented the largest segment by specimen type, due to their versatility in medical research, diagnostics, and therapeutic development. Including plasma, serum, and whole blood, these samples are crucial for studying biomarkers, disease mechanisms, and drug discovery. Their wide applicability in chronic disease research and personalized medicine reinforces their significance in the biobanking industry.

Disease-oriented biobanks lead the market by biobank type, driven by their focus on collecting and storing biospecimens specific to diseases like cancer, cardiovascular disorders, and rare conditions. These biobanks support precision medicine by enabling biomarker discovery and tailored therapies. Their critical role in advancing targeted research and addressing global health challenges solidifies their position as a key segment.

Research leads the market by application due to the rising demand for high-quality biospecimens to support studies in genomics, disease mechanisms, and biomarker discovery. Biobanks play a crucial role in advancing drug development and personalized medicine, providing reliable resources for clinical trials and translational research, thereby accelerating innovation in healthcare and therapeutics.

According to the report, academic institutions represented the largest segment by end-user leveraging biospecimens for cutting-edge research in genomics, personalized medicine, and translational studies. Their role in advancing biomarker discovery and therapeutic development underscores their significance. Collaborative projects and access to high-quality samples enhance research outcomes, solidifying their position as key stakeholders in the biobanking ecosystem.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global biobanking market include Brooks Automation Inc., Bay Biosciences LLC, Boca Biolistics, Ctibiotech, Cureline Inc., Firalis, Greiner Bio-One International GmbH, Hamilton Company, Merck KGaA, ProteoGenex Inc., Thermo Fisher Scientific Inc. and VWR Corporation (Avantor Inc.).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)