Bio-Implants Market Size, Share, Trends and Forecast by Type of Bio-Implants, Material, Origin, Mode of Administration, End User, and Region, 2025-2033

Bio-Implants Market Size and Share:

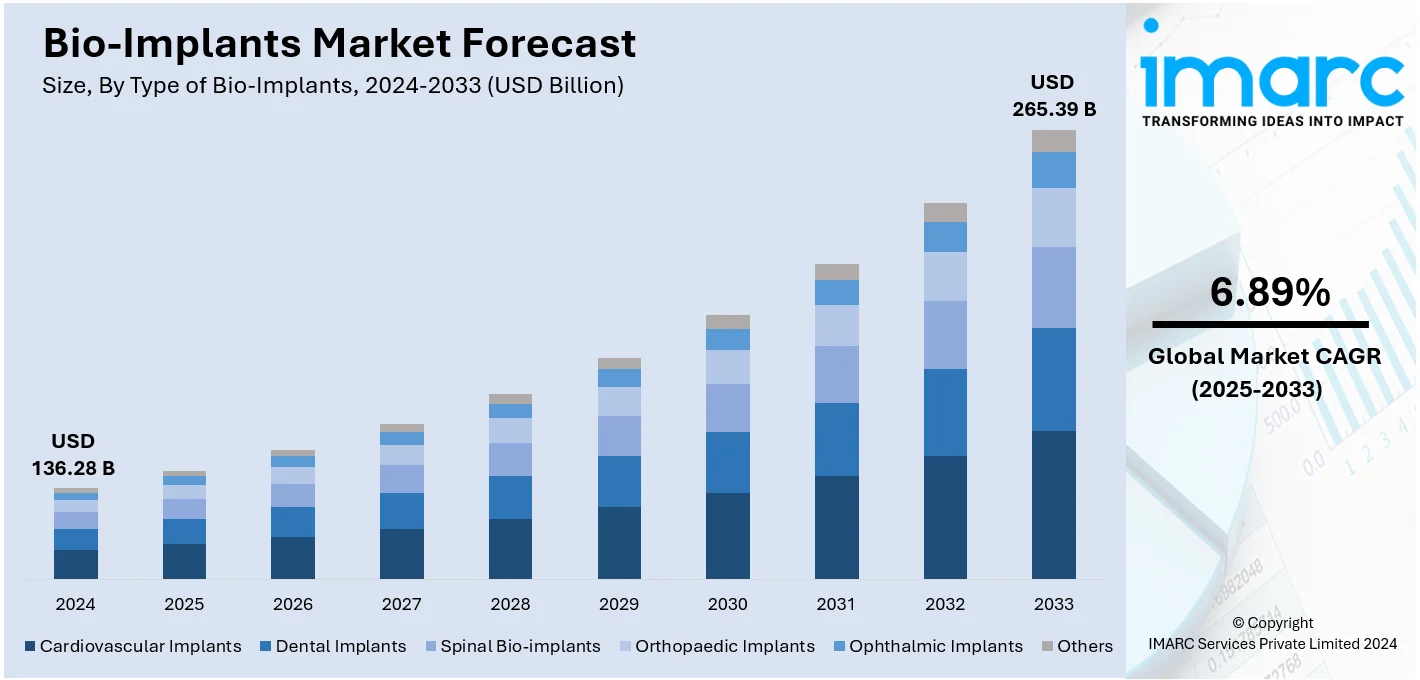

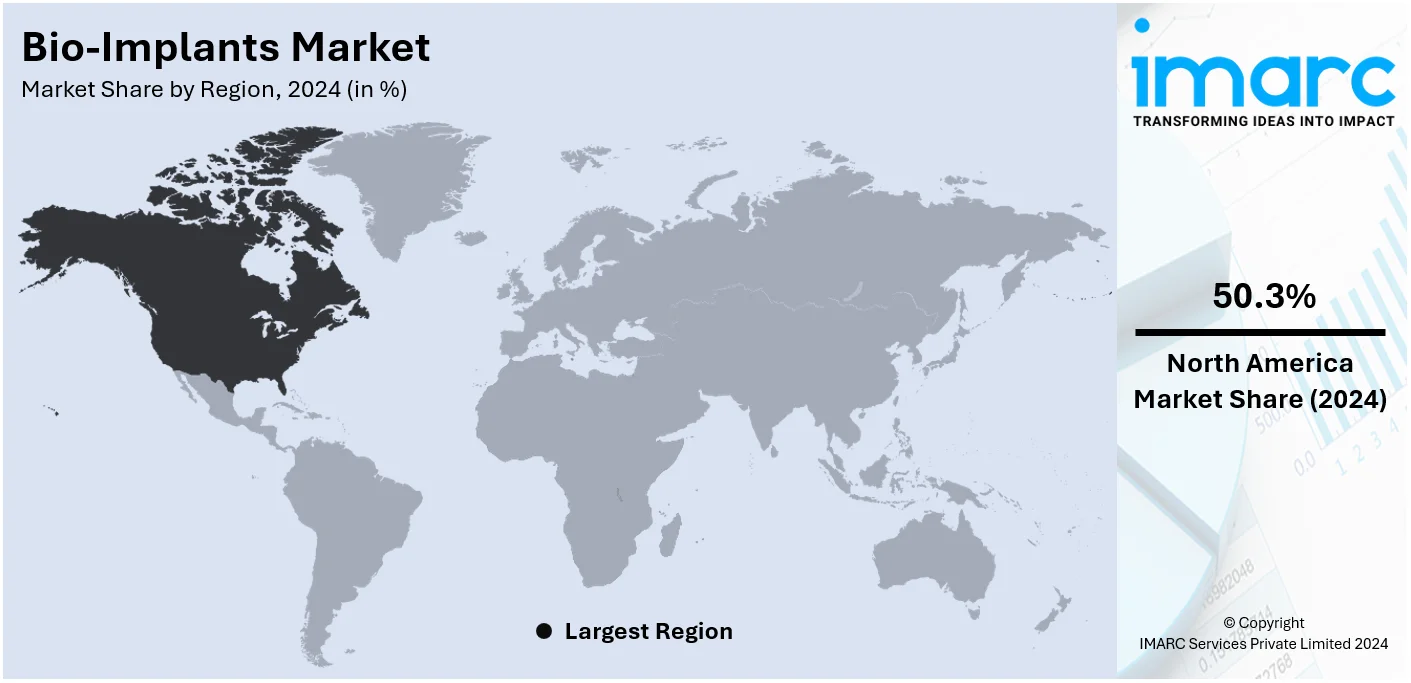

The global bio-implants market size was valued at USD 136.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 265.39 Billion by 2033, exhibiting a CAGR of 6.89% from 2025-2033. North America currently dominates the market, holding a market share of over 50.3% in 2024. The rising geriatric population, constant advancements in medical technology, including biomaterials, 3D printing, and tissue engineering, and the growing awareness among patients about the benefits of bio-implants are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 136.28 Billion |

| Market Forecast in 2033 | USD 265.39 Billion |

| Market Growth Rate (2025-2033) | 6.89% |

The global bio-implants market is growing rapidly due to progress in the field of biotechnology together with increasing rate of chronic diseases and growing population of geriatric people. Advancements in technology like 3D printing, coupled with biomaterials are helping to improve the accuracy and biocompatibility of implants cementing growth across healthcare segments. Moreover, rising awareness of people about minimally invasive procedures and advancements in the healthcare industry in the emerging nations add to market growth. In addition, regulatory approvals and strategic partnerships among manufacturers act as another significant factor, fostering innovation and accessibility, making bio-implants a critical component of modern medicine.

The United States is a key contributor to the global bio-implants market, fueled by high healthcare spending and advanced medical technologies. Factors driving demand for bio-implants include an aging population and rising orthopedic, cardiovascular, and dental disorders. Expanding the focus on research and development and favorable reimbursement policies accelerate their adoption across hospitals and clinics. In addition to these factors, U.S.-based manufacturers are utilizing new technology to develop implants that are strong, durable, and better performing while being tailored to specific medical needs. For instance, in early 2024, UC San Diego Health implanted the new dual chamber leadless pacemaker system, for the first time in the state. This treatment aims at treating irregular heart rhythms, commonly known as arrhythmias. The FDA approved this technology in July 2023, offering a less-invasive treatment alternative to traditional pacemakers with leads and a generator. Furthermore, as patient awareness and preference for minimally invasive treatments grow, the U.S. continues to lead in market adoption, shaping global trends in bio-implant innovation and healthcare outcomes.

Bio-Implants Market Trends:

Increasing Demand from Geriatric Population

The global surge in the geriatric population is a significant driver fueling the bio-implants market growth. With the growth in the elderly population, the prevalence of age-related medical conditions such as joint degeneration, cardiovascular diseases, and dental issues also increases. According to the WHO, the global population of people aged 60 and older was 1 Billion in 2019, and is expected to reach 1.4 Billion by 2030 and 2.1 Billion by 2050. Bio-implants play a vital role in addressing these conditions by providing solutions including joint replacements, cardiac implants, and dental prosthetics. As a result, the need to enhance the quality of life and restore functional independence among seniors drives the demand for bio-implants, contributing to market expansion. The elderly population is more inclined to opt for bio-implants to enhance their physical and functional capabilities. Moreover, with advancements in medical technology, these implants are becoming increasingly sophisticated, durable, and tailored to individual patient needs.

Advancements in Medical Technology

The continuous progress in medical technology, encompassing biomaterials, 3D printing, and tissue engineering, is a pivotal factor driving the growth of the bio-implants market. Innovations in biomaterials have led to the development of implants with enhanced biocompatibility and durability, reducing the risk of adverse reactions. 3D printing enables precise customization of implants, improving patient-specific outcomes and reducing surgical complications. The global 3D printing market size reached USD 28.5 Billion in 2024. Moreover, tissue engineering techniques have opened growth avenues for creating biologically functional implants that can integrate seamlessly with the body's tissues. These technological advancements have expanded the applications and effectiveness of bio-implants, attracting both healthcare professionals and patients seeking advanced and tailored medical solutions.

Increasing Patient Awareness and Demand for Long-term Treatment Options

Increasing patient awareness about the benefits of bio-implants is a key driver propelling market growth. Patients are becoming more informed about the potential of bio-implants to restore normal bodily functions, alleviate pain, and enhance overall quality of life. With access to information through the internet and healthcare campaigns, patients are actively seeking alternatives that offer long-term solutions to their medical conditions. This heightened awareness has not only boosted patient acceptance but also encouraged healthcare providers to recommend bio-implants as viable treatment options, thereby contributing to the expansion of the market. According to the WHO, more than 300 Million surgical procedures are conducted globally each year. Furthermore, the growing awareness among patients has prompted healthcare professionals to include bio-implants as part of their treatment recommendations. Medical practitioners are increasingly considering bio-implants as effective therapeutic options across various specialties. This alignment between patient interest and medical endorsement is driving greater adoption of bio-implants and contributing to market growth.

Bio-Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bio-implants market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type of bio-implants, material, origin, mode of administration, and end user.

Analysis by Type of Bio-Implants:

- Cardiovascular Implants

- Dental Implants

- Spinal Bio-implants

- Orthopaedic Implants

- Ophthalmic Implants

- Others

Orthopedic implants are widely used to address a range of musculoskeletal disorders, including joint degeneration, fractures, and bone deformities. The prevalence of conditions such as osteoarthritis and fractures, especially among the aging population, drives the demand for orthopedic implants. Moreover, they offer patients the ability to regain mobility, reduce pain, and improve overall functionality. This positive impact on patients' quality of life encourages greater acceptance of orthopedic implant procedures. In addition, there are frequent developments in orthopedic implant technology, including biomaterial improvements, orthopedic implant design modifications, and enhanced approaches to surgery such as minimally invasive surgery. These improvements lead to an increase in the uptake and effectiveness of orthopedic implants.

Analysis by Material:

- Metallic

- Ceramic

- Polymer

- Biological

Metallic implants are extensively used in number of medical applications because of their higher tensile strength, durability, and biocompatibility. It is used for joint replacement, orthopedic implants, and dental applications such as titanium and stainless steel. Currently, metallic implants are good loading system since they are applied to regions of the human body that bear loads.

Ceramic implants are biocompatible, resistant to wear, and capable of replicating natural tissue structures in terms of performance. Some of the materials widely used in various surgical procedures include alumina and zirconia which can be used to make dental implants and joint replacement. They are considered to be ornamental because of the likeness to natural teeth and bones to improve patient satisfaction.

Polymer implants are more reliable than metal parts and can be designed to meet certain specifications. They are often applied in non-weight-bearing applications as they are ideal for tissue, cardiovascular and cosmetic products. Flexible and chemically resistant polymers such as polyethylene and polyurethane are preferred, as they exert minimal pressure on the local tissues.

Biological implants are made from tissues or cells harvested from human or animal donors. Implants herein include allografts which are tissue from a different donor human, xenografts, which is animal tissue, and autografts, tissues from the patient. These implants are used in grafts, transplants, as well as regenerative treatments. Their greatest advantage is that they can easily and readily be incorporated into the structure of the patient's body.

Analysis by Origin:

- Allograft

- Autograft

- Xenograft

- Synthetic

Xenograft leads the market with around 35.8% of market share in 2024. Xenografts benefit from a readily available and sustainable supply of biological tissues, primarily sourced from animals such as pigs and cows. This abundant supply helps meet the demand for bio-implants without significant limitations, which can be particularly advantageous when addressing large patient populations. Moreover, they are processed to reduce the risk of immune rejection and adverse reactions when implanted in humans. While some immune response mitigation might still be necessary, advancements in processing techniques have significantly improved xenograft biocompatibility, making them suitable for a wide range of applications. Besides, xenografts often offer cost-effective solutions compared to other types of bio-implants, making them an attractive option for both patients and healthcare systems seeking high-quality medical interventions without exorbitant costs.

Analysis by Mode of Administration:

- Non-Surgical

- Surgical

Non-surgical leads the market with around 56.7% of market share in 2024. Non-surgical bio-implants involve methods of implantation that do not require invasive surgical procedures. Instead, they often rely on minimally invasive techniques or external applications. Some examples of non-surgical bio-implants are devices that can be worn, like insulin pump for managing diabetes, or hearing aid for impaired hearing. These devices are non-invasive and are intended to be located on or affixed to the surface of the skin or other external body part; they may be used for monitoring, delivery of medicines or to augment some body functions on a continuous basis without having to perform surgery. Bioimplants market growth is also driven by developments in biomaterials and biotechnology, including the use of xenografts in selected applications. Overall, this segment is seeing a lot of innovation that is indicative of a broader movement towards patient centric healthcare.

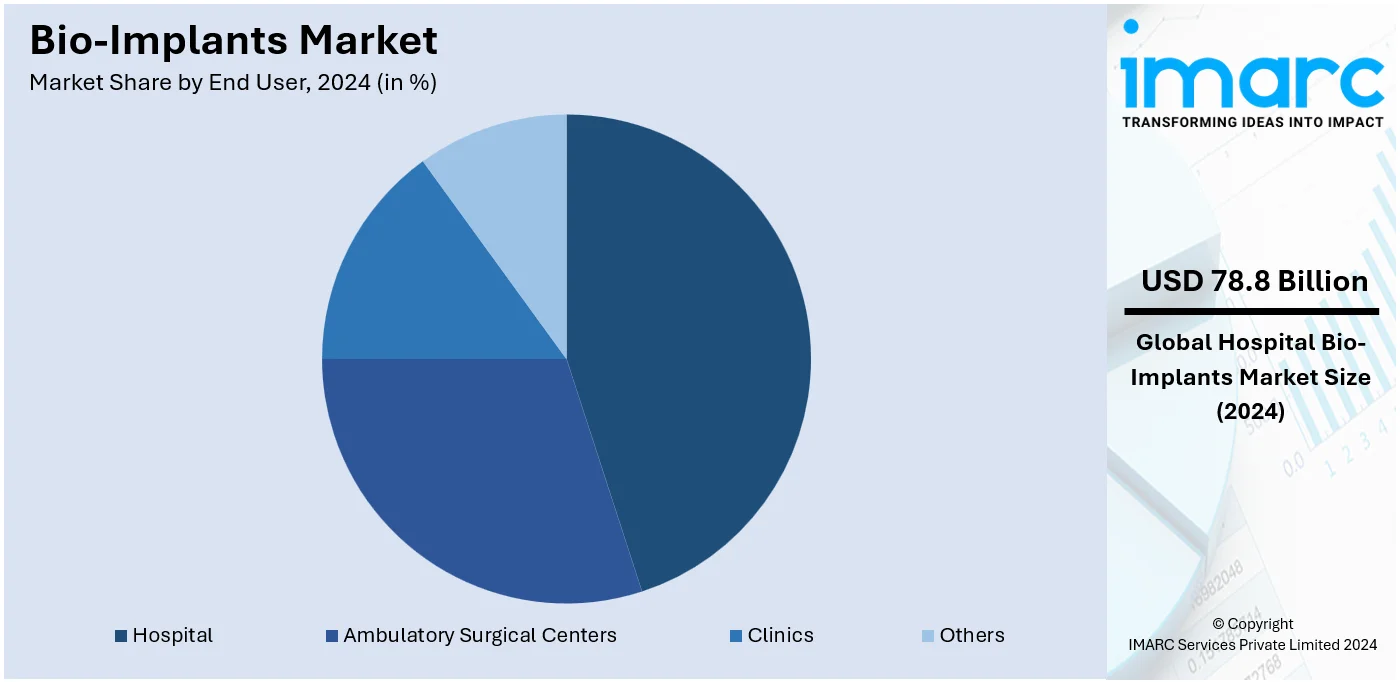

Analysis by End User:

- Ambulatory Surgical Centers

- Clinics

- Hospital

- Others

Hospitals lead the market with around 57.8% of market share in 2024. Hospitals house a diverse range of medical specialists, including surgeons, orthopedists, cardiologists, and dentists. These experts are trained to diagnose, recommend, and perform surgical procedures that involve the use of bio-implants. In addition, the presence of skilled healthcare professionals ensures that implants are correctly selected, implanted, and monitored for optimal patient outcomes. Moreover, hospitals are equipped with state-of-the-art surgical facilities, including operating rooms, advanced imaging technologies, and post-operative care units. Furthermore, these facilities are essential for performing complex implant surgeries safely and efficiently, ensuring the best possible results for patients.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 50.3%. North America boasts a well-developed and advanced healthcare infrastructure, including modern hospitals, research institutions, and medical universities. This infrastructure supports the adoption of innovative medical technologies, including bio-implants, and facilitates their integration into clinical practice. Moreover, the region's substantial healthcare expenditure allows for significant investments in medical research, technology, and patient care. This financial commitment enables healthcare providers to offer a wide range of advanced medical interventions, including bio-implants, to patients. Besides, stringent regulatory standards and thorough approval processes ensure the safety and efficacy of medical devices, including bio-implants, in North America. This regulatory framework instills confidence among healthcare professionals and patients, promoting the adoption of bio-implant technologies.

Key Regional Takeaways:

United States Bio-Implants Market Analysis

In 2024, United States accounted for 88.00% of the market share in North America. The U.S. bio-implants market is driven by the increasing prevalence of chronic conditions, such as heart disease, cancer, diabetes, obesity, and hypertension, which affect an estimated 129 Million people in the country, as defined by the U.S. Department of Health and Human Services. These conditions often require surgical interventions and the use of implants. Additionally, advancements in medical technology, particularly in bio-integrative materials, have enhanced the adoption of bio-implants, offering improved healing outcomes and reduced complications compared to traditional implants. The aging population further fuels demand, as older adults are more susceptible to degenerative conditions requiring joint replacements. Minimally invasive procedures, supported by innovations in surgical techniques, also drive market growth. Reimbursement policies and regulatory support from the U.S. Food and Drug Administration (FDA) foster market expansion. Moreover, leading healthcare institutions and research organizations in the U.S. are developing novel bio-implant technologies, increasing market competition and innovation. Growing patient awareness about the benefits of bio-implants and the preference for biocompatible options are key factors contributing to market growth. The strong healthcare infrastructure provides an ideal environment for the widespread adoption of advanced bio-implant treatments in various specialties, including orthopedics, dental, and cardiovascular fields.

Europe Bio-Implants Market Analysis

The bio-implants market in Europe is primarily driven by the increasing demand for advanced medical solutions across various surgical specialties, including orthopedics, dental care, and cardiovascular surgeries. An aging population is a key factor, with various reports reporting more than one-fifth (21.3%) of the EU population, estimated at 448.8 Million people on January 1, 2023, being aged 65 years and older. This demographic is more susceptible to degenerative diseases and joint disorders, driving the need for bio-implants. Additionally, the rise in chronic diseases, such as osteoporosis and cardiovascular conditions, further boosts demand. Europe benefits from stringent regulatory standards set by the European Medicines Agency (EMA), ensuring the safety and efficacy of bio-implants and enhancing consumer confidence. The region also sees high demand for minimally invasive procedures, which are made possible by bio-implant technologies that promote faster recovery and reduced surgical complications. Innovations in bio-implant materials, including bio-resorbable and bio-integrative options, have increased their appeal among patients and healthcare providers. Favorable reimbursement policies and well-established healthcare systems, particularly in countries like the UK, Germany, and France, further support market growth, while collaboration between research organizations and manufacturers drives continued innovation in bio-implant technology.

Asia Pacific Bio-Implants Market Analysis

The bio-implants market in the Asia-Pacific (APAC) region is driven by the increasing incidence of chronic diseases and the growing demand for advanced medical solutions. Rising healthcare awareness and improvements in healthcare infrastructure across countries such as China, India, and Japan contribute to market growth. Additionally, the aging population, particularly in Japan and China, fuels demand for bio-implants in orthopedic and dental surgeries. The Asia Pacific Orthopaedic Association (APOA), with 24 member chapters and over 65,000 members from more than 40 countries, plays a significant role in promoting advanced surgical techniques and implant adoption in the region. The growing medical tourism industry in countries like India and Thailand further boosts demand for high-quality, bio-integrative implants. Cost-effective bio-implant solutions, coupled with rising healthcare access, make these products more affordable in emerging APAC markets. Regulatory improvements and government initiatives to support healthcare innovation also contribute to the region's bio-implants market expansion.

Latin America Bio-Implants Market Analysis

The bio-implants market in Latin America is growing due to rising healthcare awareness, an aging population, and the increasing prevalence of chronic diseases. In Brazil, for example, an estimated 928,000 deaths occur annually due to chronic diseases, according to PubMed Central, driving the demand for surgical interventions and bio-implants. The demand for advanced, minimally invasive surgical solutions is also on the rise, further boosting bio-implant adoption. Cost-effective implant options have made these technologies more accessible in emerging markets, supporting broader use. Additionally, governments and healthcare organizations in the region are improving healthcare infrastructure and regulatory frameworks, which facilitates the growth of the bio-implants market.

Middle East and Africa Bio-Implants Market Analysis

The bio-implants market in the Middle East and Africa is driven by increasing healthcare standards and rising chronic disease prevalence. In the UAE, for example, the prevalence of self-reported chronic diseases was 23.0%, with obesity, diabetes, and asthma/allergies being the most common conditions, according to PubMed Central. These conditions contribute to the growing demand for bio-implants in surgical treatments. Furthermore, improving healthcare infrastructure and increased medical tourism, especially in the UAE and Saudi Arabia, support market growth. Government initiatives and investments in healthcare innovation also enhance the adoption of advanced bio-implants across the region.

Competitive Landscape:

The bio-implants market is highly competitive, with major players targeting growth, improved biomaterials in their product offerings, and collaboration to expand their share of the bio-implants market. Firms are exploring new opportunities in 3D printing, tissue engineering, and minimally invasive devices to produce enhanced implants for orthopedic, cardiovascular, and dental surgeries. Moreover, mergers, acquisitions, and collaboration are industry standards to diversify the product offering and geographical network. For instance, in April 2024, Osstem Implant acquired Brazil’s Implacil de Bortoli for USD 89.8 million, strengthening its position in the dental implant market and expanding its presence in Brazil and South America through product synergy and advanced R&D. Increasing investment in research and development promotes product innovations, while adherence to higher regulatory requirements guarantees product quality and effectiveness. In addition, emerging players in the global market are increasing by providing affordable services, which increases competition and promotes the market for bio-implants.

The report provides a comprehensive analysis of the competitive landscape in the bio-implants market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Boston Scientific Corporation

- Stryker Corporation

- St. Jude Medical Inc

- Medtronic Inc.

- Smith and Nephew

- Wright Medical Group

- Zimmer Biomet

- Dentsply Sirona

- Invibio Limited

- Straumann

- Danaher Corporation

- Cardinal Health

- Johnson & Johnson

- B. Braun Melsungen

- LifeNet Health, Inc

- Endo International plc

Latest News and Developments:

- December 2024: Zimmer Biomet received FDA clearance for the OsseoFit™ Stemless Shoulder System. It is an innovative implant that contains anatomically shaped, asymmetric stemless design that saves healthy bone by optimizing fit. It is integrable with Identity® Humeral Heads and Alliance® Glenoid for adaptable glenoid options. Available in Q1 2025, the system supports stable fixation with OsseoTi® Porous Metal Technology, enhancing biological fixation.

- September 2024: Establishment Labs Holdings Inc., a global medical technology company specializing in women’s health, has received U.S. FDA approval for its Motiva® SmoothSilk® Ergonomix® and Motiva® SmoothSilk® Round breast implants for primary and revision breast augmentation.

- June 2024: CollPlant Biotechnologies, a regenerative medicine company specializing in non-animal-derived recombinant human collagen (rhCollagen), has successfully 3D-printed 200 cc commercial-sized breast implants using its proprietary rhCollagen bioinks. The company announced positive interim results from preclinical large-animal studies evaluating its regenerative breast implants.

- June 2024: BioHorizons has introduced the Tapered Pro Conical dental implant, featuring a deep conical connection and the patented CONELOG® system. This implant offers a predictable solution for immediate treatments, with Laser-Lok microchannels for tissue attachment and bone retention. Its tapered design ensures stability, while self-tapping flutes aid placement. A new surgical kit supports efficient freehand and guided approaches, enhancing both surgical and restorative workflows.

- July 2023: Smith+Nephew has launched its REGENETEN Bioinductive Implant in India. Used in over 100,000 procedures globally, the collagen-based implant promotes tendon-like tissue growth for rotator cuff healing. Delivered arthroscopically, it is absorbed within six months, leaving functional tissue behind.

- August 2022: OSSIO, Inc. has launched its OSSIOfiber® Suture Anchors in the U.S., expanding its bio-integrative implant portfolio for foot/ankle, shoulder, knee, hand/wrist, and elbow surgeries. The anchors provide strength and safety, allowing surgeons to maintain preferred soft tissue fixation techniques while improving outcomes. This launch signifies a major advancement for OSSIOfiber in setting a new standard for orthopedic fixation.

Bio-Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Bio-Implants Covered | Cardiovascular Implants, Dental Implants, Spinal Bio-Implants, Orthopaedic Implants, Ophthalmic Implants, Others |

| Materials Covered | Metallic, Ceramic, Polymer, Biological |

| Origins Covered | Allograft, Autograft, Xenograft, Synthetic |

| Mode of Administrations Covered | Non-surgical, Surgical |

| End Users Covered | Ambulatory Surgical Centers, Clinics, Hospital, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, St. Jude Medical Inc, Medtronic Inc., Smith and Nephew, Wright Medical Group, Zimmer Biomet, Dentsply Sirona, Invibio Limited, Straumann, Danaher Corporation, Cardinal Health, Johnson & Johnson, B. Braun Melsungen, LifeNet Health, Inc, Endo International plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bio-implants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bio-implants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bio-implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Bio-implants are medical devices or tissues designed to replace, support, or enhance biological structures and functions within the body. Made from biocompatible materials, they are used in applications like orthopedic implants, cardiovascular devices, and dental solutions. Bio-implants improve patient outcomes by restoring functionality, supporting healing, and addressing chronic medical conditions effectively.

The bio-implants market was valued at USD 136.28 Billion in 2024.

IMARC estimates the global bio-implants market to exhibit a CAGR of 6.89% during 2025-2033.

The market is driven by advancements in biotechnology, an aging population, and the rising prevalence of chronic conditions. Innovations in materials, minimally invasive procedures, and increasing demand for orthopedic, cardiovascular, and dental implants further fuel growth. Enhanced healthcare infrastructure and patient awareness also contribute to market expansion.

In 2024, orthopedic implants represented the largest segment by type of bio-implants, driven by advancements in materials and technology, addressing conditions like fractures, joint replacements, and spinal disorders with high precision and durability.

Xenograft leads the market by origin, offering widely used solutions derived from animal tissues, particularly in cardiac and orthopedic applications, due to their availability and compatibility.

The non-surgical is the leading segment by mode of administration, driven by their minimally invasive application, reduced recovery time, and increasing preference in dental and cosmetic procedures.

Hospitals lead the market by end user, attributed to advanced infrastructure, skilled professionals, and high procedural volumes in orthopedic, cardiac, and reconstructive surgeries.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global bio-implants market include Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, St. Jude Medical Inc, Medtronic Inc., Smith and Nephew, Wright Medical Group, Zimmer Biomet, Dentsply Sirona, Invibio Limited, Straumann, Danaher Corporation, Cardinal Health, Johnson & Johnson, B. Braun Melsungen, LifeNet Health, Inc, Endo International plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)