Bio-Based Polymer Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Bio-Based Polymer Market Size and Share:

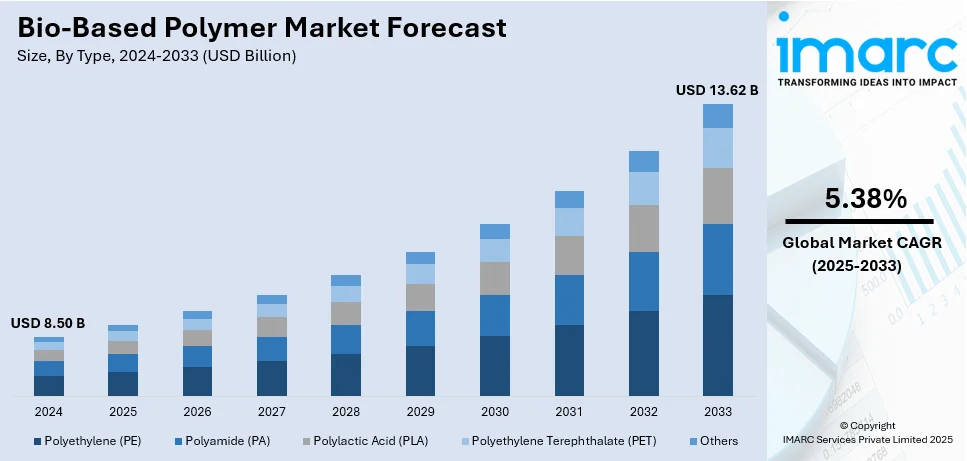

The global bio-based polymer market size was valued at USD 8.50 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.62 Billion by 2033, exhibiting a CAGR of 5.38% from 2025-2033. Asia Pacific currently dominates the market in 2024. The implementation of various government regulations and policies, growing demand for sustainable packaging, increasing investment in bioplastic production, and rapid advancements in bio-based polymer materials, are some of the factors propelling the market forward.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.50 Billion |

|

Market Forecast in 2033

|

USD 13.62 Billion |

| Market Growth Rate (2025-2033) | 5.38% |

Government laws and policies have a major role in driving the market for bio-based polymers worldwide. In November 2022, the European Commission initiated a comprehensive policy framework addressing the sourcing, labelling, and utilization of bio-based, biodegradable, and compostable plastics. This initiative aims to enhance environmental benefits and prevent market fragmentation by promoting a unified understanding across the EU. Furthermore, the Circular Bio-based Europe Joint Undertaking (CBE JU) has allocated significant funding to promote bio-based solutions. In 2023, CBE JU announced €215.5 million for 18 funding topics, including €10 million dedicated to developing novel, high-performance bio-based polymers and co-polymers. These regulatory measures and financial commitments underscore the EU's dedication to reducing reliance on fossil-based plastics, fostering innovation, and ensuring the sustainability of bio-based polymers.

To get more information on this market, Request Sample

The growth of the bio-based polymer market in the United States is driven by several key factors, supported by recent government data. A significant contributor is the economic impact of the biobased products industry, which, in 2021, added $489 billion to the U.S. economy and supported 3.94 million jobs. Government initiatives further bolster this growth. The U.S. Department of Agriculture (USDA) unveiled a strategy in March 2024 to improve the resilience of the biomass supply chain with the goal of increasing domestic production of biobased products and opening up new markets for farmers. Furthermore, according to the U.S. Department of Energy's 2023 Billion-Ton Report, the country could sustainably increase its annual biomass production to more than 1 billion tons, which would provide a plentiful supply of raw materials for bio-based polymers. These factors, combined with increasing consumer demand for sustainable products and advancements in biomanufacturing technologies, are propelling the expansion of the bio-based polymer market in the United States.

Bio-Based Polymer Market Trends:

Growing Demand for Sustainable Packaging

The bio-based polymer market is expanding fast because of the increased demand for sustainable packaging solutions. The U.S. Environmental Protection Agency estimated that plastic waste comprised 12.2% of the total municipal solid waste in 2021. Moreover, the growing interest in reducing plastic pollution leads to a wider adoption of bio-based alternatives. In a supportive gesture toward this direction, the USDA has already supported efforts such as initiatives through the BioPreferred program on the promotion of biobased products in packages. All these can only ensure a rise in bio-based polymers such as polylactic acid and PHA, for use in packages. The USDA 2021 report shows that bio-based products account for USD 200 Billion in sales in the U.S. Bio-based plastics are a rapidly growing segment. Regulatory measures like Extended Producer Responsibility (EPR) laws also help push companies to use sustainable materials in packaging.

Increased Investment in Bioplastics Production

Investment in the production of bio-based polymers is now increasing, with both private companies and government organizations understanding that there is a great need for sustainable materials. For instance, the U.S. Department of Energy has put bioplastics as an important area for growth and invests in research and development supporting the bio-based polymer industry. The DOE's 2022 Bioeconomy Report stresses the importance of bioplastics in the transition of the country to a sustainable economy as biobased chemicals and materials are increasingly featured in federal programs. Likewise, the European Commission's Green Deal calls for the uptake of renewable and bio-based materials and the investment in sustainable production modes. With governmental funds like the USDA USD 100 Million Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program set in place, large scale bioplastic manufacturing seems to be supported by governmental financing. The combination of increased consumers demand and these efforts increases growth for the bio-based polymer market.

Advancements in Bio-based Polymer Materials

Bio-based polymer materials are changing the automotive and textile industries. The U.S. Department of Energy (DOE) is investing in next-generation bio-based materials to replace petroleum-based alternatives, especially in high-performance applications. In 2021, the DOE launched the Advanced Manufacturing Office's Bioproducts Program to accelerate the development of renewable materials, including bio-based polymers. In the automotive sector, the U.S. EPA is actively promoting renewable material usage, and the NREL has demonstrated bio-based polyurethane for automobile application. The European Union Horizon 2020 program also financed various projects for the development of bio-based materials in the area of textiles and consumer goods and their potential in achieving the environmental impact of this bio-based material. These developments in biobased polymers should be adopted in various sectors, leading to faster diffusion toward more sustainable manufacturing techniques.

Bio-Based Polymer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bio-based polymer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Polyethylene (PE)

- Polyamide (PA)

- Polylactic Acid (PLA)

- Polyethylene Terephthalate (PET)

- Others

Polyethylene (PE) leads the bio-based polymer market due to its wide applicability and strong resemblance to traditional fossil-based polyethylene. Bio-based PE, typically derived from renewable feedstocks like sugarcane ethanol, is chemically identical to its petroleum-based counterpart, ensuring seamless integration into existing infrastructure and applications. This similarity makes bio-based PE a preferred choice for industries such as packaging, consumer goods, and automotive. According to a 2023 report by the European Bioplastics Association, bio-based PE accounted for over 25% of global bio-based polymer production, driven by increasing demand for sustainable materials. Additionally, major corporations have adopted bio-based PE for packaging, further boosting market share. Its recyclability and durability, combined with reduced carbon footprints, solidify its dominance in the market.

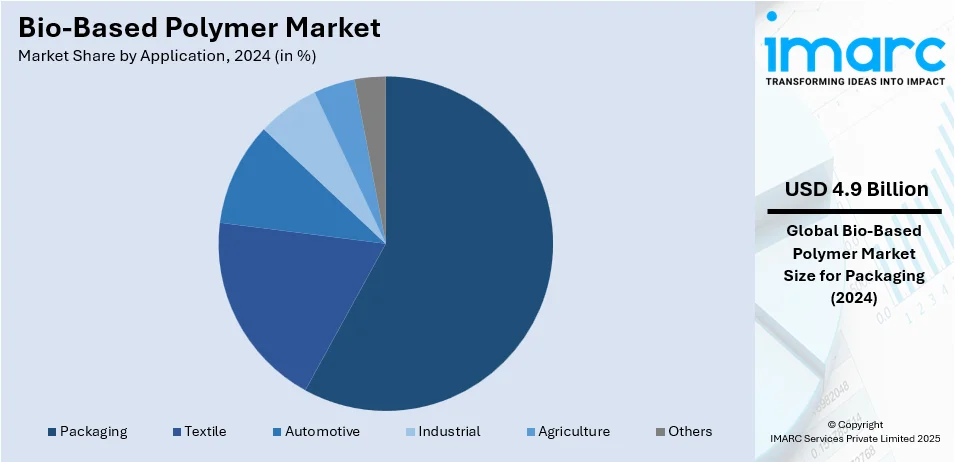

Analysis by Application:

- Packaging

- Textile

- Automotive

- Industrial

- Agriculture

- Others

Packaging is the largest segment in the bio-based polymer markets. Rising consumer consciousness towards environmental sustainability and regulatory bans against single-use plastics have given more drive to bio-based polymers usage in food containers, beverage bottles, and films. Big brands have been putting some bio-based solutions into their packaging systems so that they can be more aligned with the sustainability goals. Moreover, new improvements in the technology of bio-based polymers, as to the barrier properties and biodegradability, are well suited for applications in food and beverages. E-commerce is also stealing the thunder on increased requirements for green packaging materials, thereby boosting the penetration of biopolymers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

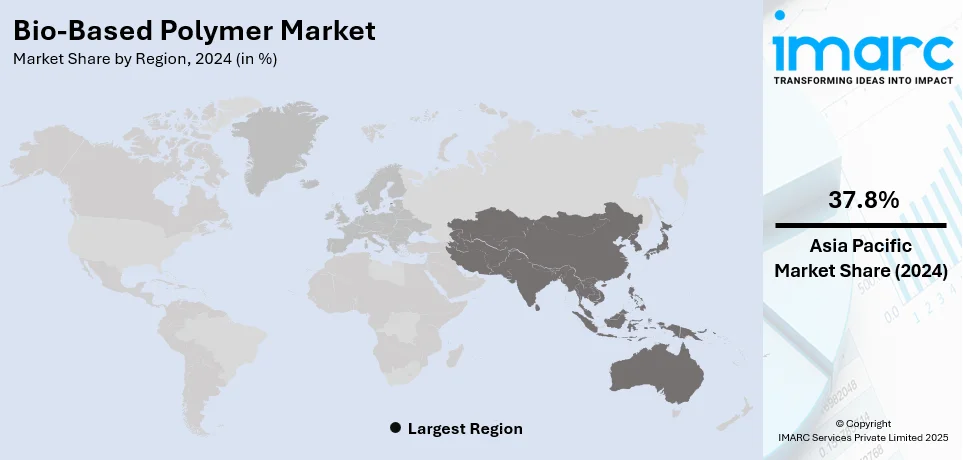

Asia-Pacific represents the largest regional market for bio-based polymers in 2024. This dominance is fueled by rapid industrialization, growing environmental regulations, and abundant agricultural resources in countries like China, India, and Thailand. The region's strong manufacturing base and expanding middle class drive the demand for bio-based materials, particularly in packaging, automotive, and textiles. Government programs that encourage the use of sustainable technology, such as bio-based polymers, include India's National Bio-Energy Mission and China's "Made in China 2025" strategy. Moreover, the Asia-Pacific region hosts several leading bio-based polymer producers and research institutions, fostering innovation and cost-effective production. This combination of regulatory support, market demand, and resource availability cements Asia-Pacific as a global leader in the bio-based polymer market.

Key Regional Takeaways:

North America Keyword Market Analysis

The market for bio-based polymers in North America is expanding significantly due to a confluence of economic, environmental, and regulatory considerations. Industries are being encouraged to switch to bio-based polymers by strict government laws and policies, such as prohibitions on single-use plastics and rewards for using sustainable materials. Additionally, the U.S. Department of Agriculture’s (USDA) BioPreferred Program provides certification and promotes the use of bio-based products, bolstering market adoption. Another important factor is the growing need for environmentally friendly packaging in sectors like consumer goods, e-commerce, and food and beverage. Major corporations headquartered in North America are integrating bio-based polymers into their packaging solutions to meet sustainability goals and align with consumer preferences for eco-friendly products. Additionally, research and development expenditures along with technological developments are making it possible to produce high-performance bio-based polymers that can rival conventional plastics.

United States Bio-Based Polymer Market Analysis

The U.S. Bio-based polymer market is recording tremendous growth supported by U.S. Government policies under the sustainability agenda for a sustainable and environmentally friendly life pattern. The 2023 USDA report on bio-based industries states that bio-based products valued at USD 489 Billion to the economy in 2021 year, with chemical components registering high values under the categories of bio-based chemicals. A 2023 White House document on U.S. Biotechnology and Biomanufacturing estimated that in 2017, the industry of bio-based products added directly USD 150 Billion to the economy of the U.S., with USD 6.2 Billion being accounted for by the bio-based chemicals and USD 21.7 Billion by the bio-based enzymes. This contribution brings out the increasingly significant aspect of bio-based polymers that is becoming more important in the larger bio-based product market through increasing consumer demand for sustainable alternatives and support by government initiatives. Owing to the investments of continuous research and development in this area, the market of bio-based polymers will keep growing in the near future.

Europe Bio-Based Polymer Market Analysis

Bio-based polymers are highly supported by the European government through regulations and environmental policies. As outlined by the European Commission, the European Union has set a goal to recycle 50% of plastic packaging by 2025, which drives demand for sustainable alternatives, such as bio-based polymers. Moreover, according to the European Bioplastics Association, EUR 100 Million (USD 104 Million) was provided by the European Union in Horizon Europe 2022 under sustainable material innovation, incorporating bio-based polymers, while EU Circular Economy Action Plan and specific targets established to limit single-use plastic use further open up regulations to favorable and greener bio-based polymer solutions through companies' competition. European governments are also investing in research for scaling up and improving the efficiency of the production of bio-based polymers.

Asia Pacific Bio-Based Polymer Market Analysis

Rapid growth in the Asia Pacific region is being observed in the bio-based polymer sector as part of government-driven initiatives toward sustainable development. According to China's Ministry of Industry and Information Technology, "China's 14th Five-Year Plan for Eco-Economic Development focuses on controlling plastic pollution with a target reduction in plastic consumption by 30% in 2025". "Make in India" has been the drive by the Indian government toward producing more bio-based polymers. The Ministry of Chemicals and Fertilizers says bio-plastics is one of its areas of priority in research and development. The Japanese Ministry of the Environment is actively promoting the consumption of bio-based polymers in consumer goods and packaging, furthering the cause with governmental incentives to accelerate the change towards sustainable materials. These efforts should boost the region's use of bio-based polymers.

Latin America Bio-Based Polymer Market Analysis

Brazil is very much engaged in activities that would reduce its impact on the environment through different sustainability initiatives, among which are great efforts in reducing plastic waste. According to an industrial report, Brazil aims to decrease its greenhouse gas emissions by 53% by 2030 from the levels recorded in 2005. This goal fits into the efforts the country is taking towards sustainability, such as decreasing plastic pollution. Reduction in emission rates and plastic waste will foster the use of bio-based polymers as a mode of Brazil's implementation agenda for a circular economy. With governmental regulations, such as local capital investment in bio-based production, the market scope opens up even more opportunities here. Brazilian initiatives support broader regional efforts in Latin America, where increased environmental awareness and regulations drive the transition toward more sustainable materials, such as bio-based polymers.

Middle East and Africa Bio-Based Polymer Market Analysis

The bio-based polymers market in the Middle East and Africa is picking up due to government efforts and awareness about environmental issues. The UAE Ministry of Climate Change and Environment states the country is promoting the production and application of biodegradable polymers and plans to stop single-use plastics by 2025. South Africa Department of Environmental Affairs has initiated plastic reduction strategy, and packaging development using bio-based material are increasing the demand for sustainable polymers. In addition, the African Development Bank is financing projects to be undertaken in countries, such as Kenya, toward the development of bio-based alternatives to plastic. Some governmental initiatives are expected to facilitate the step-by-step development of the bio-based polymer market in this region.

Competitive Landscape:

Prominent companies in the bio-based polymer industry are aggressively seeking methods to increase their market share, develop new products, and meet the increasing needs of sustainability. Companies are spending a lot of money on research and development to improve the cost-competitiveness, scalability, and performance of bio-based polymers. Many are focusing on diversifying their product portfolios to cater to a wide range of industries, including packaging, automotive, construction, and textiles. Strategic collaborations and partnerships are also prominent. Companies are teaming up with technology providers, raw material suppliers, and end-users to develop new applications and streamline supply chains. Sustainability certifications and lifecycle analyses are being prioritized to meet consumer demand for transparency and compliance with government regulations. In addition, a number of industry giants are strengthening their production capabilities to satisfy the growing demand worldwide.

The report provides a comprehensive analysis of the competitive landscape in the bio-based polymer market with detailed profiles of all major companies, including:

- Arkema S.A

- BASF SE

- BiologiQ, Inc.

- Biome Bioplastics

- Corbion

- Ecovia Bio

- FKuR

- Novamont S.p.A.

- Rodenburg Biopolymers

- thyssenkrupp Uhde GmbH

Latest News and Developments:

- October 2024: Arkema states that the company has started production of Ethyl Acrylate, fully derived from bioethanol, at its Carling site in France. This bio-based product contains 40% bio carbon content and reduces the product carbon footprint by 30%, using bioethanol sourced sustainably from biomass feedstock.

- August 2024: BASF stated the company will shift to a bio-based Ethyl Acrylate (EA) by Q4 2024, phasing out fossil-based EA. The same specs but with a bio content of 40 percent and a carbon footprint lowered by 30 percent can be expected. It is made of sustainable European bioethanol and supports customer sustainability goals.

- June 2024: Novara has played host to the first "TERRIFIC" project coordination, coordinated by Novamont. This project has financing exceeding Euro 16 Million (USD 16.70 Million). Its purpose is to create materials that are biobased, compostable, and recyclable for packaging purposes. The project focuses on agro-industrial sub-products and involves 19 partners from 9 European countries.

- February 2024: TotalEnergies Corbion and Bluepha successfully developed its first sustainable fibers, keeping in line with the strategic partnership established back in May 2023. Luminy PLA-based and Bluepha PHA, both produced from bio-based polymers derived from renewable raw materials, give rise to these sustainable fibers.

- January 2024: Braskem and FKuR stated that they have signed a distribution agreement for I’m Green bio-based EVA in the EU, Norway, Switzerland, UK, Israel, Turkey, and India. FKuR will distribute the bio-based polymer, which is produced using sustainably sourced sugarcane-based ethanol, reducing greenhouse emissions. This expands their long-standing partnership.

Bio-Based Polymer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyethylene (PE), Polyamide (PA), Polylactic Acid (PLA), Polyethylene Terephthalate (PET), Others |

| Applications Covered | Packaging, Textile, Automotive, Industrial, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A, BASF SE, BiologiQ, Inc., Biome Bioplastics, Corbion, Ecovia Bio, FKuR, Novamont S.p.A., Rodenburg Biopolymers, thyssenkrupp Uhde GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bio-based polymer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bio-based polymer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bio-based polymer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A bio-based polymer is one that is made entirely or in part from renewable biological resources, including microbes, plants, and animals. Unlike traditional polymers that are typically made from fossil fuels (petroleum-based), bio-based polymers are sourced from materials like starch, cellulose, proteins, lignin, and lipids. These polymers can be biodegradable or non-biodegradable, depending on their chemical structure and processing.

The global bio-based polymer market was valued at USD 8.50 Billion in 2024.

IMARC estimates the global bio-based polymer market to exhibit a CAGR of 5.38% during 2025-2033.

The implementation of various government regulations and policies, growing demand for sustainable packaging, increasing investment in bioplastic production, and rapid advancements in bio-based polymer materials, are some of the factors propelling the market forward.

In 2024, polyethylene represented the largest segment by type due to its wide applicability and strong resemblance to traditional fossil-based polyethylene.

Packaging leads the market by application owing to the growing consumer awareness of environmental sustainability and regulatory bans on single-use plastics.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global bio-based polymer market include Arkema S.A, BASF SE, BiologiQ, Inc., Biome Bioplastics, Corbion, Ecovia Bio, FKuR, Novamont S.p.A., Rodenburg Biopolymers and thyssenkrupp Uhde GmbH.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)