Bio-Based Polyethylene Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

Bio-Based Polyethylene Market Size and Share:

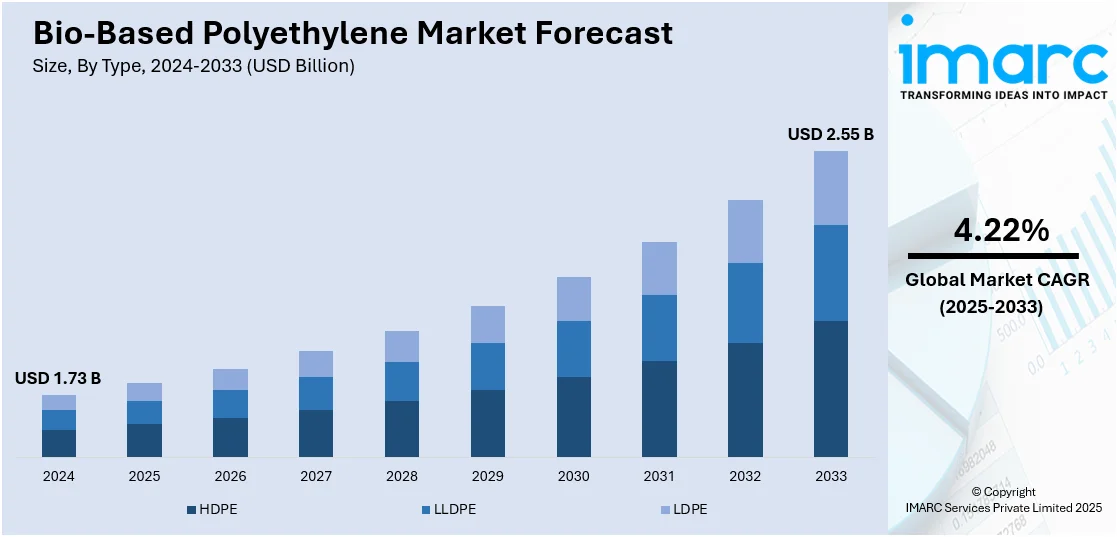

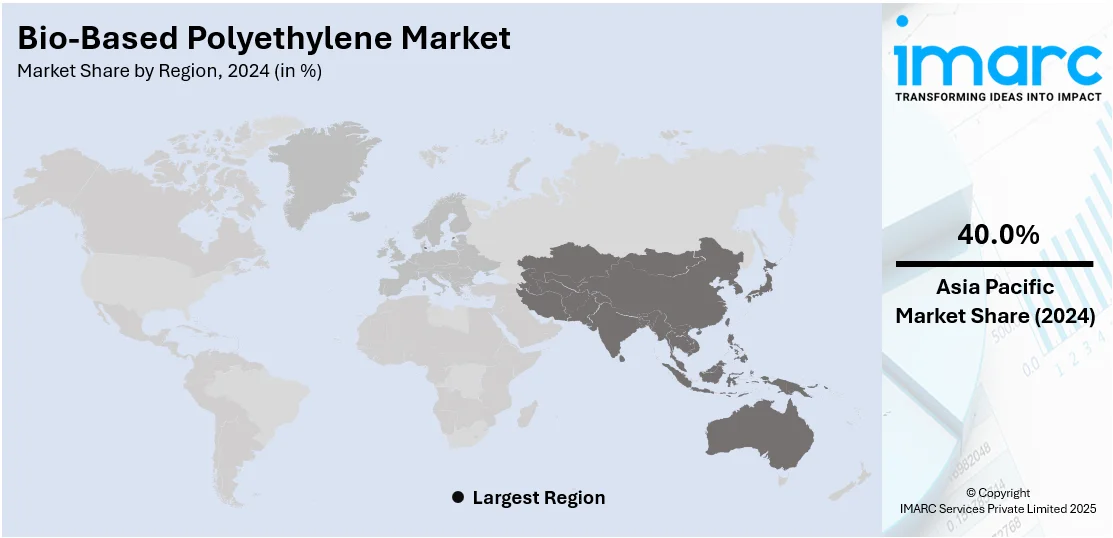

The global bio-based polyethylene market size was valued at USD 1.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.55 Billion by 2033, exhibiting a CAGR of 4.22% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.0% in 2024. The market is driven by increasing environmental concerns and stringent regulations aimed at reducing plastic waste and carbon emissions. Growing consumer demand for sustainable and eco-friendly packaging solutions further propels bio-based polyethylene market share. Additionally, corporate sustainability initiatives, government incentives, and the expanding e-commerce sector are significant factors accelerating the adoption of bio-based polyethylene across various industries, including packaging, personal care, and automotive.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.73 Billion |

|

Market Forecast in 2033

|

USD 2.55 Billion |

| Market Growth Rate 2025-2033 | 4.22% |

The global bio-based polyethylene market is primarily driven by increasing environmental concerns and stringent regulations aimed at reducing carbon emissions and plastic waste. On 5th December 2024, LG Chem notably partnered with Acies Bio to develop sustainable biomanufacturing solutions based on the OneCarbonBioTM platform of Acies Bio, converting renewable or recycled one-carbon feedstocks such as CO₂, plastic waste, and biogas into chemical intermediates. The partnership marries the biotechnology know-how of Acies Bio with LG Chem's capabilities in industrial-scale manufacturing to scale up production, making it greener for in-demand chemicals. Along with this, the growing consumer preference for sustainable and eco-friendly products further propels bio-based polyethylene market demand. Advancements in biotechnology and production processes have enhanced the cost-effectiveness and scalability of bio-based polyethylene, making it a viable alternative to conventional petroleum-based polyethylene. Additionally, corporate sustainability initiatives and government incentives for bio-based materials are significant market drivers. The packaging industry, in particular, is a major end-user, driven by the need for biodegradable and renewable materials to meet changing regulatory and consumer expectations.

The United States stands out as a key regional market, primarily driven by the increasing consumer awareness regarding environmental sustainability and the demand for eco-friendly alternatives to conventional plastics. Supportive government policies and incentives promoting renewable materials further stimulate bio-based polyethylene market growth. The robust packaging industry, particularly in food and beverage sectors, is adopting bio-based polyethylene to meet regulatory standards and consumer preferences for green products. On 25th November 2024, Delhi-based Ukhi successfully secured USD 1.2 Million in pre-seed funding to enhance its production of biodegradable packaging derived from agricultural waste. The initiative seeks to substitute plastic and address pollution concerns. This financial backing will facilitate the expansion of production capabilities and promote the global distribution of environmentally sustainable materials. Technological advancements in bio-refining processes have also enhanced production efficiency, making bio-based polyethylene more commercially viable. Additionally, corporate commitments to reducing carbon footprints and achieving sustainability goals are creating a positive bio-based polyethylene market outlook in the U.S.

Bio-Based Polyethylene Market Trends:

Growing Demand for Sustainable Packaging Solutions

Rising environmental concerns and increasing consumer awareness about the harmful effects of conventional plastics have led governments worldwide to promote sustainable packaging solutions with higher recyclability. This shift is driving the widespread adoption of bio-based polyethylene (PE) across various industries, including packaging for carry bags, bottles, plastic films, and containers. The need for carbon-free products to address fossil fuel depletion and reduce greenhouse gas (GHG) emissions is further propelling market growth. Notably, global CO2 emissions from fuel combustion increased by 1.3% in 2022, surpassing pre-pandemic levels, underscoring the urgency for sustainable alternatives including bio-based PE.

Technological Advancements and Shale Gas Utilization

Significant technological advancements in hydraulic fracturing have enhanced the extraction of shale gas, which serves as a key feedstock for polymer production. This development is supporting the growth of the market by ensuring a stable supply of raw materials. Additionally, the rise in e-commerce activities, accelerated by global lockdowns, has increased the demand for sustainable packaging materials. For instance, approximately 2.77 billion individuals worldwide are now purchasing products through e-commerce platforms or social media stores, further fueling the need for eco-friendly packaging solutions such as bio-based PE.

Strategic Collaborations and R&D Investments

The market is also benefiting from strategic collaborations among key players and substantial investments in research and development (R&D) activities. These efforts are focused on developing high-performance, recyclable, and non-toxic polymers to meet changing consumer and regulatory demands. Such initiatives are acting as one of the significant bio-based polyethylene market trends, as companies strive to innovate and align with global sustainability goals. These trends collectively highlight the market's potential for continued growth and its critical role in addressing environmental challenges.

Bio-Based Polyethylene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bio-based polyethylene market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, and application.

Analysis by Type:

- HDPE

- LLDPE

- LDPE

LDPE stands as the largest component in 2024, holding around 44.0% of the market, driven by its versatile applications and growing demand across multiple industries. LDPE is widely used in packaging, particularly for films, bags, and flexible containers, due to its excellent durability, flexibility, and moisture resistance. The shift toward sustainable packaging solutions, fueled by environmental regulations and consumer preference for eco-friendly materials, has significantly enhanced the adoption of bio-based LDPE. Additionally, its compatibility with existing recycling infrastructure enhances its appeal. The packaging industry, especially in food and beverages, remains a key driver, as bio-based LDPE aligns with global sustainability goals, reducing reliance on fossil fuels and lowering carbon footprints. This positions LDPE as a critical component in the market's growth trajectory.

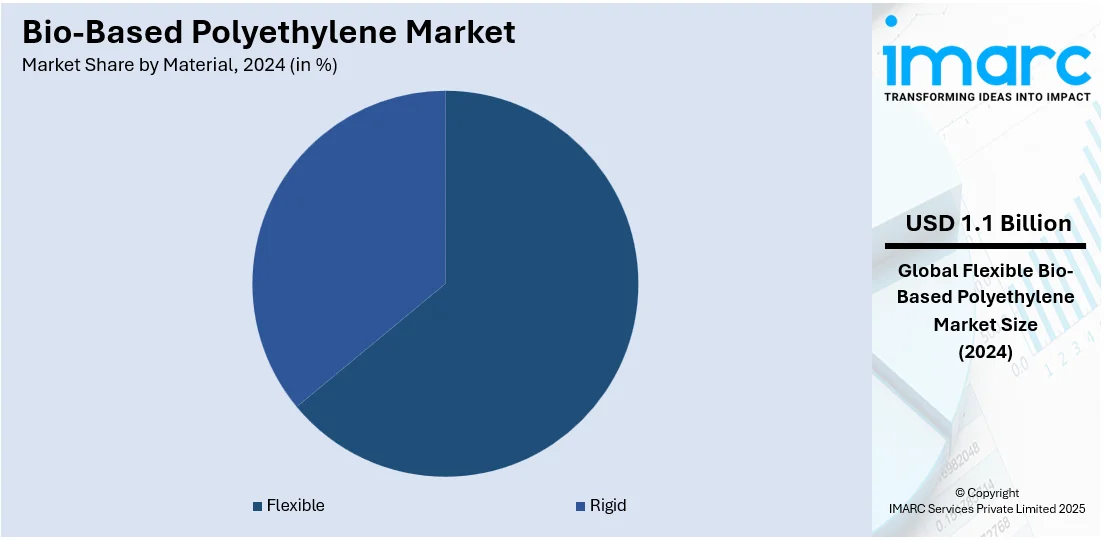

Analysis by Material:

- Rigid

- Flexible

Flexible leads the market with around 63.5% of market share in 2024, driven by their extensive use in packaging applications such as films, bags, and wraps. This thriving demand for lightweight, durable, and sustainable packaging solutions across various sectors, especially in food and beverage industry is contributing to flexible bio-based polyethylene innovatively emerging as a key solution. Due to its high barrier properties, versatility, simple processing way, this material has turned out a popular choice for manufacturers. Moreover, increasing consumer awareness regarding environmental sustainability and stringent regulations against single-use plastics are also contributing to the market demand for flexible bio-based polyethylene. With industries racing toward eco-friend-friendly alternatives, the flexible materials segment is projected to continue leading, supported by the developments and innovations of bio-based polymer technologies.

Analysis by Application:

- Agriculture

- Food and Beverages

- Cosmetics and Household Care

- Personal Care

- Textiles

- Pharmaceuticals

- Others

Personal care leads the market in 2024, driven by the increasing demand for sustainable and eco-friendly packaging solutions. Bio-based polyethylene is heavily used in the packaging of products such as shampoos, lotions, creams, and cosmetics owing to its enduring, flexible quality, and recyclability, which coincide with the industry's sustainability goals. Growing consumer awareness about environmental issues and the rising demand for sustainable products are pushing personal care brands to use bio-based materials to reduce their carbon footprints. In addition, stringent regulations related to plastic waste and pledges by associations to be sustainable reinforce the consumption of bio-based polyethylene in this domain, hence representing the dominant application segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%, driven by rapid industrialization, urbanization, and increasing consumer awareness about sustainable products. The region’s robust packaging industry, particularly in countries including China, India, and Japan, is a key contributor to the growing demand for bio-based polyethylene. Government initiatives promoting eco-friendly materials and stringent regulations to reduce plastic waste further accelerate market growth. Additionally, the expanding e-commerce sector and rising disposable incomes have fueled the need for sustainable packaging solutions. With significant investments in research and development and the presence of major manufacturing hubs, Asia-Pacific is poised to maintain its leading position in the market, supported by a strong focus on environmental sustainability and innovation.

Key Regional Takeaways:

United States Bio-Based Polyethylene Market Analysis

In 2024, the US accounted for around 84.80% of the total North America bio-based polyethylene market. The bio-based polyethylene adoption in the United States is increasing due to the growing pharmaceuticals sector, where sustainable packaging solutions are gaining traction. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. The shift toward bio-based polyethylene aligns with the demand for environmentally friendly alternatives in drug packaging, reducing reliance on conventional petroleum-based plastics. This growth is greatly influenced by increasing support from regulatory bodies and incentives for biodegradable materials. Moreover, investments in bio-based polyethylene formulations that enhance the shelf-life and packaging durability of products are expected to grow considerably, driven by the expanding pharmaceuticals market. Bio-based polyethylene is broadly used in medical-grade containers, blister packs, and drug delivery systems as manufacturers look to meet stringent sustainability goals. While the need for packaging evolution is driven by plastic sustainability, packaging made from bio-based polyethylene for both prescription and over-the-counter medication is becoming more common. The processing of bio-based polyethylene has been improved in order to be compatible with existing pharmaceutical packaging systems, allowing its easy integration. The growing need for green pharmaceutical packaging is reinforcing the place of bio-based polyethylene in the market. The pharmaceuticals sector is growing, so the use of bio-based polyethylene is expected to be both bulk and, thanks to its sustainable development ATL, it is solidifying its place as a responsible package solution.

Asia Pacific Bio-Based Polyethylene Market Analysis

The bio-based polyethylene adoption in Asia-Pacific is expanding due to the growing expansion and investments in agriculture, where sustainable plastic films and containers are gaining importance. For instance, in 2020, the Indian government invested approximately USD 4.32 Million in 346 agritech startups, aiming to enhance the growth of the agricultural sector. The growing demand for biodegradable and renewable materials is driving the transformation of traditional plastics to bio-based polyethylene in a number of applications, such as mulch films, seed coatings, and greenhouse coverings. This trend positively impacts the adoption and utilization of bio-based polyethylene in controlled environment agriculture and modern packaging alternatives for fertilizers and irrigation, being driven by the increasing investments in the modernization of agricultural practices. Efforts at reducing agricultural plastic waste are accelerating the shift to bio-based polyethylene options. As such agricultural expansion and investments continue to rise, companies are developing bio-based polyethylene products that are resistant to challenging farming conditions while remaining biodegradable. This is achieving dozens of layers of fruit and vegetable fibers combined with traditional plastics in order to improve their mechanical properties and align with the kind of durability that traditional plastics have, says the researcher ─yes, it is not easy, but it can be done. Moreover, government initiatives to encourage the adoption of bio-based polyethylene through sustainable farming practices are also playing an important role. As the demand for food security and efficient use of resources continues to increase, bio-based polyethylene plays an ever-increasing role in the development of innovative agricultural applications.

Europe Bio-Based Polyethylene Market Analysis

Bio-based polyethylene adoption in Europe is advancing due to the growing food and beverages sector, where eco-friendly packaging solutions are becoming a priority. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. The shift toward bio-based polyethylene is influenced by the need to reduce single-use plastic waste and enhance recyclability in food packaging. The growing food and beverage industry is a major driver for the increasing use of bio-based polyethylene within applications, including beverage cartons, food containers, and flexible packaging. This rapid transformation in consumer preferences is expected to augment the demand for bio-based polyethylene in the packaging of processed foods and ready-to-eat meals based on all facets of sustainability. Also, regulatory measures to limit petroleum-based plastics are increasing the adoption of bio-based polyethylene. These improvements in barrier properties are making bio-based polyethylene competitive alternatives for food packaging and extending the safety, quality, and shelf-life of packaged products. Investments in bioplastic production facilities are expanding the supply chain setups, enabling easier access to bio-based polyethylene for manufacturers. The growing food and beverage market fuels sustainability efforts and led companies to shift from conventional plastics to bio-based polyethylene. With the increasing demand for innovative food packaging solutions, the bio-based polyethylene industry is primed to revolutionize the sector.

Latin America Bio-Based Polyethylene Market Analysis

The Latin American market is expected to grow due to the accelerating cosmetics, household care, and personal care industries, where sustainable packaging alternatives are becoming more and more important. Also, the growth in numerous e-commerce platforms is further enhancing the demand for the packaging of personal care products using bio-based polyethylene, which is reducing the use of conventional plastics. The Latin American market has over 300 million digital consumers, according to reports. Moreover, the rising disposable income, in turn, creates a demand for products offering eco-friendly packaging, driving consumers to adopt bio-based polyethylene in packaging materials for shampoos, lotions, and skincare products. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. The use of biodegradable packaging is in line with biosustainability in cosmetics geometry, household care, and personal care. Firms are introducing new bio-based polyethylene innovations to improve packaging's aesthetic appeal and durability without losing its biodegradability. With the e-commerce market burgeoning, the market for sustainable packaging will continue to grow, driving the adoption of bio-based polyethylene. Demand for bio-based polyethylene will be fueled by a trend of lowering plastic waste from cosmetics, household care, and personal care products.

Middle East and Africa Bio-Based Polyethylene Market Analysis

Bio-based polyethylene adoption in the Middle East and Africa is expanding due to the growing textiles industry, where sustainable material applications are gaining momentum. According to reports, in 2022, the UAE textile market was valued at more than USD10 Billion and is now expected to expand by more than 5% a year over the medium term. One of the leading textile packages comes in this bio-based polyethylene, which is increasingly used for things such as fiberfill storage and packaging in view of the rising demand for green wrap. The expanding textile operating segment is incorporating bio-based polyethylene in garment bags, protective covers, and synthetic fabric packaging to lessen environmental impact. Increasing sustainability commitments are driving the use of bio-based polyethylene in fiber production and non-woven textiles. Studies on bio-based polyethylene-derived coatings provide an opportunity to push the durability of fabrics while remaining biodegradable. The bio-based polyethylene uptake in the textile industry will accelerate as the textile industry yet increasingly can also innovate sustainably with new materials.

Competitive Landscape:

The market is concentrated, with a few key players implementing agreements, collaborations, mergers, and acquisition strategies to expand their production capabilities and product portfolio. Leading players in the industry are making significant investments in R&D to develop bio-based polyethylene products that are innovative, high-performance, recyclable, and commercially viable. A major emphasis is being placed on sustainability goals in accordance with global environmental regulations, owing to the rising demand for eco-friendly packaging solutions. Additionally, companies are also pursuing partnerships with end-users and raw material suppliers to ensure supply chain security and enhanced access to the market. Data extensibility and agnostic nature result in a significant factor in reducing manufacturing inefficiency, contributing to lower costs, which enable lower price points in the market and penetration across industry verticals such as packaging, personal care, and automotive, among others.

The report provides a comprehensive analysis of the competitive landscape in the bio-based polyethylene market with detailed profiles of all major companies, including:

- Arkema S.A.

- Avery Dennison Corporation

- Braskem

- Dow Inc.

- Exxon Mobil Corporation

- LyondellBasell Industries N.V.

- Plantic Technologies Ltd (Kuraray Co. Ltd)

- PTT Global Chemical Public Company Limited

- Saudi Basic Industries Corporation (Saudi Aramco)

- Sealed Air Corporation

- Solvay S.A.

- TotalEnergies SE

- Tricorbraun Inc.

Latest News and Developments:

- November 2024: Indorama Ventures, in collaboration with Eneos, Mitsubishi, Iwatani, and Neste, has introduced the world’s first bio-PET bottle using ISCC+ certified bio-paraxylene from used cooking oil. Suntory Group began using these bottles in Japan from November, with plans for 45 Million units. The initiative highlights industry collaboration in promoting sustainable packaging solutions.

- October 2024: Indorama Ventures, in collaboration with Suntory and other partners, has launched the world’s first commercial bio-PET bottles using ISCC+ certified bio-paraxylene from used cooking oil. Starting November, Suntory will introduce 45 Million of these bottles in Japan, reducing CO2 emissions. This milestone highlights industry-wide efforts toward sustainable packaging solutions.

- October 2024: Suntory Group will launch the world’s first commercialized PET bottles using bio-paraxylene from used cooking oil in Japan this November. This innovation significantly reduces CO2 emissions compared to petroleum-based bottles. The company plans to introduce it in 45 Million bottles, with potential expansion across its portfolio.

- October 2024: Accredo Packaging will unveil the first 100% bio-based resin pouch at PACK EXPO International 2024, featuring a sugarcane-derived film and zipper closure. Developed in collaboration with Fresh-Lock® closures, the pouch offers a fully renewable packaging solution for food and consumer products. This innovation supports brands' sustainability goals by reducing environmental impact.

- July 2024: 2M Group has launched Sustainable Packaging Technologies, a new unit focused on bio-based packaging solutions. Supported by Innovate UK and SSPP funding, the business leverages Banner Chemicals' expertise to integrate biomaterials into existing packaging processes. Headquartered in Milton Keynes, it aims to provide sustainable plastic alternatives without compromising performance.

Bio-Based Polyethylene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | HDPE, LLDPE, LDPE |

| Materials Covered | Rigid, Flexible |

| Applications Covered | Agriculture, Food and Beverages, Cosmetics and Household Care, Personal Care, Textiles, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A., Avery Dennison Corporation, Braskem, Dow Inc., Exxon Mobil Corporation, LyondellBasell Industries N.V., Plantic Technologies Ltd (Kuraray Co. Ltd), PTT Global Chemical Public Company Limited, Saudi Basic Industries Corporation (Saudi Aramco), Sealed Air Corporation, Solvay S.A., TotalEnergies SE, Tricorbraun Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bio-based polyethylene market from 2019-2033.

- The bio-based polyethylene market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bio-based polyethylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bio-based polyethylene market was valued at USD 1.73 Billion in 2024.

IMARC estimates the bio-based polyethylene market to exhibit a CAGR of 4.22% during 2025-2033, reaching a value of USD 2.55 Billion by 2033.

The market is driven by increasing environmental concerns, stringent regulations to reduce plastic waste and carbon emissions, growing consumer demand for sustainable packaging, corporate sustainability initiatives, government incentives, and advancements in biotechnology and production processes.

Asia-Pacific currently dominates the bio-based polyethylene market, accounting for a share exceeding 40.0%. This dominance is fueled by rapid industrialization, urbanization, a robust packaging industry, government initiatives promoting eco-friendly materials, and the expanding e-commerce sector.

Some of the major players in the bio-based polyethylene market include Arkema S.A., Avery Dennison Corporation, Braskem, Dow Inc., Exxon Mobil Corporation, LyondellBasell Industries N.V., Plantic Technologies Ltd (Kuraray Co. Ltd), PTT Global Chemical Public Company Limited, Saudi Basic Industries Corporation (Saudi Aramco), Sealed Air Corporation, Solvay S.A., TotalEnergies SE, and Tricorbraun Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)