Big Data Software Market Size, Share, Trends and Forecast by Software Type, Deployment Type, Industry, End-Use, and Region, 2025-2033

Big Data Software Market Size and Share:

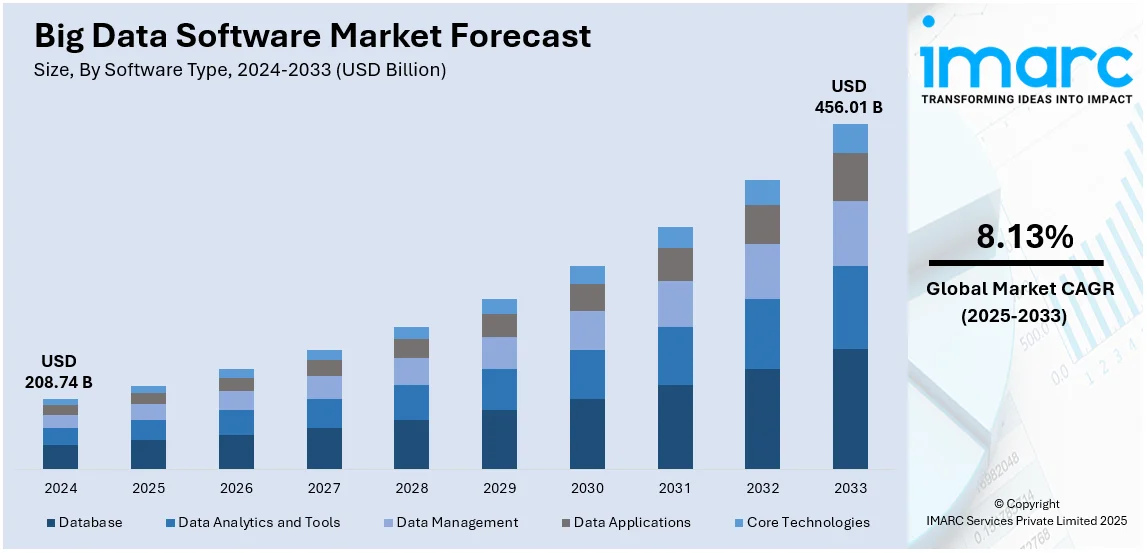

The global big data software market size was valued at USD 208.74 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 456.01 Billion by 2033, exhibiting a CAGR of 8.13% from 2025-2033. North America currently dominates the market, with a share of 45.4% in 2024. The market is driven by increased data from Internet of Things (IoT) devices and advancements in artificial intelligence/machine learning (AI/ML), digitalization in emerging markets and the crucial role of data in strategic enterprise decisions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 208.74 Billion |

|

Market Forecast in 2033

|

USD 456.01 Billion |

| Market Growth Rate (2025-2033) | 8.13% |

Big data software is an efficient software that collects, hosts, and strategically processes data. With the increased implementation of digital transformation strategies by various businesses, the current daily produced data volume has hit unprecedented levels. The developments in Internet of Things devices, mobile applications, social media, and cloud platforms have been the primary reasons for this growth. Big data software solutions have been designed for both structured as well as unstructured data. This gives the organization the means to unlock value hidden in such massive datasets. The growing variety of data types from text and video to sensor data and geospatial information demands sophisticated solutions capable of integrating, processing, and analyzing diverse streams of data. With such a complex landscape, organizations try to derive insights from it by relying more on big data software to handle the intricacies.

Exponential growth in data generation has led the United States to become a significant regional market for big data software. More and more devices, applications, and digital platforms connect to the internet, resulting in the massive generation of data at an incredibly high rate day by day. Increasing usage of IoT devices, social media applications, e-commerce, and mobile applications is a key contributor to volume increase. Furthermore, data generated through connected devices, sensors, and smart cities increases the complexity involved in the storage and management of this information. In the United States, there is a requirement for big data software solutions mainly due to processing, storing, and analyzing huge datasets. Healthcare, finance, retail, and manufacturing companies across various industries are looking for enterprise data management software solutions that process high volumes of data. According to the predictions made by the IMARC Group, the US enterprise data management market is anticipated to reach USD 37.4 billion by 2033.

Big Data Software Market Trends:

Growing Demand for Data-driven Decision-making

Data-driven decision-making has become an essential requirement for businesses that focus on expansion in the current competitive market landscape. For example, 73.5% of managers and executives at data-leading companies worldwide reported that their decision-making processes are always data-driven. Businesses are increasingly unlocking the potential of data-driven decision-making to drive the development of informed and precise strategic decisions. Organizations with the infrastructure and tools that could be used to tap this goldmine are much better placed to make decisions which are firmly based on actual performance and real-time information. Nowadays, instead of focusing on aged reports or impressions, businesses can use real-time data regarding market conditions, customer behavior, and internal performance to evaluate these. This has become one of the major driving forces behind the adoption of data-driven strategies. Organizations are turning to big data solutions for mitigating risks, unlocking opportunities, and optimizing performance. The tremendous potential of such solutions to analyze, process, and derive actionable insights from huge datasets is enabling businesses to respond to big data software market trends quickly.

Increasing Implementation of Edge Computing

Growing deployment of connected IoT devices is one factor that is increasing the edge computing implementation. For example, as reported by a survey, 83% feel that, to remain competitive in the near future, it will be impossible without edge computing. These generate enormous amounts of data at the network's edge. Edge computing brings more scalability and efficiency in processing the growing amount and speed of data. As the number of connected IoT devices continues to grow, the demand for big data software tools designed for edge computing is likely to surge. These tools are expected to play a crucial role in unlocking the complete potential of IoT-driven data, enabling advanced applications and propelling business value.

Integration With Artificial Intelligence (AI) and Machine Learning (ML)

It is making organizations empowered to derive further insights into their data for making informed decisions using big data with AI and ML. For example, as of 2018, only 40% of organizations are reported to be actively using AI. The process involving data preparation, cleaning, and analysis can also be automated using AI-driven tools because they save both time and the effort of data scientists. With growing AI and ML technology advancements, convergence with big data analytics tools is expected to be even more rampant. The trend is anticipated to drive advanced solutions to assist businesses extract the highest value from their data assets. AI mimics human thinking in speech recognition, language processing, and decision-making through cognitive computing. When AI is combined with the virtue of ML regarding learning from data, businesses can use it in developing more intelligent autonomous systems which would, in turn, be helpful in terms of decision making but require minimal human input.

Big Data Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global big data software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on software type, deployment type, industry, and end-use.

Analysis by Software Type:

- Database

- Data Analytics and Tools

- Data Management

- Data Applications

- Core Technologies

Database is the largest segment in the market, with a share of 53.2%. These software solutions are intended to store, manage, and retrieve large amounts of structured, semi-structured, and unstructured data. These databases are highly critical in an organization that contains a huge amount of data to be accessed for analytics and reporting purposes. Some of the reasons behind this increasing demand for advanced database solutions are the explosive growth of data coming from multiple sources, such as IoT devices, social media, and enterprise applications. Relational databases, NoSQL databases, and distributed databases are major database types currently found in the market and offer support for the scalable and flexible storage needs of modern enterprises. As the reliance of organizations on data for decision-making keeps growing, the need for effective database systems also increases.

Analysis by Deployment Type:

- On-Premise

- Cloud

The on-premise segment is the largest in the market, holding a share of 65.5%, primarily because many businesses still prefer to host and manage their data infrastructure in-house due to concerns about data security, compliance, and control. On-premise solutions allow organizations to maintain full control over their data storage, processing, and analytics capabilities within their own data centers. This is especially important for industries that handle sensitive information, such as healthcare, finance, and government, where strict regulatory and security requirements dictate the need for in-house management of data. Additionally, on-premise deployment offers businesses the ability to customize their infrastructure and integrate it with legacy systems more effectively. Despite the growing trend towards cloud computing, on-premise deployments remain the preferred choice for many enterprises, especially those with significant IT resources and the need for higher levels of control over their Big Data environments.

Analysis by Industry:

- Banking

- Discrete Manufacturing

- Professional Services

- Process Manufacturing

- Federal/Central Government

- Others

The banking segment is the largest in the market, accounting for a share of 13.7%, due to the extensive use of data in the financial sector for a variety of applications, such as risk management, fraud detection, customer segmentation, and personalized services. Banks and financial institutions handle vast amounts of structured and unstructured data, including transaction records, customer behavior, market data, and regulatory information. Big data analytics help financial institutions make data-driven decisions, optimize their operations, and enhance customer experiences. Apart from this, banks use big data to identify patterns in spending, assess credit risk, detect fraudulent activities, and tailor financial products to individual customers. The high demand for data security, compliance with regulations like general data protection regulation (GDPR), and the need for real-time decision-making continue to drive the growth of big data in the banking sector.

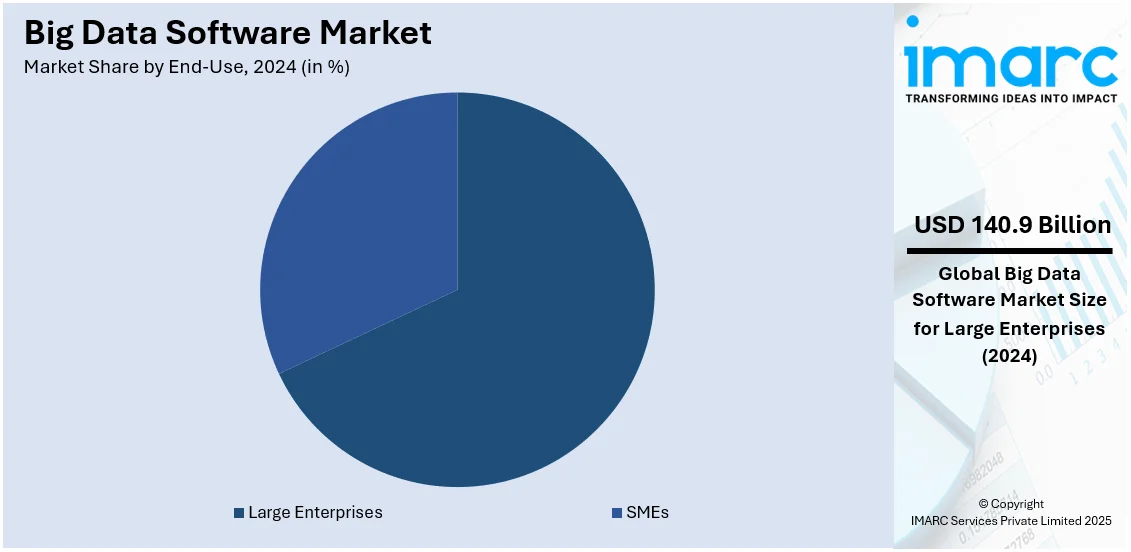

Analysis by End-Use:

- Large Enterprises

- SMEs

The large enterprises segment dominates the market with a share of 67.5%, due to the significant resources and data requirements of these organizations. Large enterprises typically operate in multiple industries, handle vast amounts of data, and require complex, scalable data solutions to support their global operations. They use big data software to gain insights from structured and unstructured data, optimize processes, enhance customer experiences, and drive strategic decision-making. In addition, large organizations often have dedicated IT departments capable of implementing and managing advanced big data infrastructure, including on-premise and hybrid cloud solutions. The need for real-time analytics, predictive modeling, data governance, and compliance with various regulations has propelled the demand for big data software in this segment. Industries such as finance, retail, healthcare, and manufacturing are major adopters, using big data to improve operational efficiency, mitigate risks, and innovate new products and services.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- Vietnam

- Australia

- South Korea

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Others

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Others

North America represents the largest regional market, with a share of 45.4% in 2024. The growing adoption of cloud-based solutions is one of the most significant trends driving the expansion of the market in North America. Cloud computing provides innumerable benefits like flexibility, cost-efficiency, and scalability, which make it a useful alternative for companies of all sizes. In particular, cloud-based big data software enables organizations to manage, store, and analyze vast amounts of data without the need for significant upfront investment in on-premise infrastructure. The integration of artificial intelligence (AI) and machine learning (ML) with big data software is another prominent trend that is driving the market in North America. AI and ML algorithms allow businesses to extract more value from their data by enabling predictive analytics, automation, and the identification of complex patterns that would otherwise go unnoticed. These technologies can help organizations enhance their decision-making processes, improve customer experiences, and streamline operations. According to the IMARC Group’s predictions the US ML market size reached USD 98.9 billion by 2033.

Key Regional Takeaways:

United States Big Data Software Market Analysis

In 2024, the United States accounted for a share of 86.50% in the North America big data software market. In the United States, the widespread use of big data software is driven by the increasing reliance on cloud computing services. According to survey, over 51% of businesses now leverage cloud services (IaaS, PaaS, SaaS), driving efficiency and scalability in big data software applications. The scalability and flexibility of cloud services have led to a surge in the adoption of big data software, allowing organizations to process, store, and manage data with ease. This trend is particularly beneficial for businesses that need to analyze large datasets in real time. The integration of advanced analytics tools in the cloud further enhances the ability to extract valuable insights from data, making it easier for organizations to make data-driven decisions. As cloud adoption continues to rise across industries, big data software plays a crucial role in enabling organizations to tap into the full potential of their data.

Europe Big Data Software Market Analysis

In Europe, the growing banking sector is a major driver of big data software adoption. According to reports, there were 784 foreign bank branches in the EU in 2021, of which 619 were from other EU Member States and 165 from third countries. As financial institutions expand their digital services and customer bases, the volume of data they generate continues to rise. To manage and analyze this data effectively, banks are turning to big data software solutions. These tools allow banks to enhance customer experiences, streamline operations, and mitigate risks by analyzing customer behavior, transaction data, and market trends. The integration of big data software enables banks to better understand customer needs, personalize offerings, and prevent fraud instances. In the process of digitization in the banking industry, demand for big data software would continue to grow in order to help financial institutions maintain profitability and compliance with regulatory standards.

Asia Pacific Big Data Software Market Analysis

In the Asia-Pacific region, the rise of small and medium-sized businesses (SMEs) is fueling the adoption of big data software. According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%, driving increased demand for big data software solutions to support their scaling operations. As more SMEs enter the market, the need for efficient data management and analysis solutions becomes critical. With the increasing availability of affordable big data software solutions, SMEs are able to leverage data analytics to improve operational efficiency, understand customer behavior, and drive growth. These businesses are leveraging big data software to make good decisions, realize market trends, and optimize business processes. It is also contributing to the vast adoption of the region's software, which leads to digital transformation, allowing the SMEs in the region to scale and maintain competitiveness.

Latin America Big Data Software Market Analysis

In Latin America, the IT sector’s expansion is a key factor driving the adoption of big data software. For instance, São Paulo's thriving tech sector, growing 10-15% annually, fosters a booming IT landscape that significantly benefits big data software development and innovation. With increasing investments in technology infrastructure and digital transformation initiatives, companies in the region are increasingly relying on big data solutions to manage and analyze vast amounts of information. The rise of cloud computing and the growing number of tech startups have accelerated the demand for advanced data analytics tools. Businesses across various industries are using big data software to optimize operations, enhance customer engagement, and improve decision-making. As the IT sector continues to grow, the need for powerful big data solutions to support these innovations becomes even more apparent, driving further adoption across the region.

Middle East and Africa Big Data Software Market Analysis

In the Middle East and Africa, the growth of large enterprises is driving the adoption of big data software. According to PwC, Middle East businesses saw a 6.2% revenue growth in 2023, driving expansion in large enterprises and creating new opportunities for big data software to optimize operations and decision-making. These enterprises are recognizing the importance of leveraging data to enhance operational efficiency, improve customer satisfaction, and stay competitive in the global market. As organizations in these regions expand their digital capabilities, they require advanced software solutions to handle vast datasets and extract valuable insights. Big data software enables large enterprises to streamline decision-making processes, improve supply chain management, and develop more personalized products and services. As these businesses continue to scale and invest in digital technologies, the demand for big data solutions is expected to grow, enhancing their ability to thrive in a data-driven world.

Competitive Landscape:

One of the most important ways that key market players are working to improve their business is through continuous product innovation. The big data software landscape is characterized by rapid advancements in technology, and leading companies are heavily investing in research and development (R&D) to create new, more efficient, and scalable solutions. Innovations such as cloud-based big data platforms, AI and ML integration, and real-time data analytics are high on the agenda for these companies. For instance, in 2024, Qlik has enhanced its AI-ready data integration capabilities with SAP SE, Databricks, and Snowflake, enabling enterprises to streamline data workflows and accelerate AI deployment. These advancements ensure businesses can leverage high-quality, real-time data on Amazon Web Services (AWS). Drew Clarke of Qlik emphasized that these improvements make it easier for companies to prepare their data for AI use, fostering innovation with reliable insights. Moreover, mergers and acquisitions (M&As) and strategic partnerships are common tactics used by leading players in the big data software market to strengthen their position and expand their capabilities. Through acquisitions, companies can quickly add new technologies, increase their market share, and broaden their customer base. By acquiring smaller, innovative companies, larger organizations can integrate new solutions and capabilities into their existing product offerings, thereby enhancing their competitive advantage.

The report provides a comprehensive analysis of the competitive landscape in the big data software market with detailed profiles of all major companies, including:

- Amazon Web Services, Inc.

- Cloudera, Inc.

- Dell Inc.

- Informatica Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Mu Sigma

- Oracle Corporation

- SAP SE

- SAS Institute

- Splunk Inc. (Cisco Systems, Inc.)

- Teradata Corporation

Latest News and Developments:

- December 2024: Tiger Analytics declared its partnership with Google Cloud for driving Gen AI innovation, improving enterprise solutions with context-aware, natural language interfaces. This collaboration aims to provide businesses with intuitive ways to interact with big data, improving decision-making across industries. The strategic partnership positions both companies to unlock new possibilities in AI-driven analytics.

- December 2024: AWS has introduced the latest version of Amazon SageMaker at AWS re:Invent, integrating data, analytics, and AI into a cohesive platform for rapid SQL analytics, large-scale big data handling, and model creation. The SageMaker Unified Studio simplifies access to organizational data, integrating AWS analytics and AI tools. Additionally, the new SageMaker Lakehouse unifies data across multiple sources, enabling easy integration and analysis without complex data pipelines.

- December 2024: Acceldata has launched expanded AI-powered data reconciliation capabilities to enhance data integrity across industries. This new technology ensures accurate, consistent, and audit-ready data across on-premises, cloud, and hybrid environments. By addressing the complexities of modern data ecosystems, Acceldata eliminates the need for traditional, manual reconciliation methods.

- June 2024: Narrative BI has unveiled its AI Data Analyst, a groundbreaking tool that simplifies data analysis by allowing businesses to connect data sources and ask questions in natural language. Powered by the proprietary NBI.AI-1 Generative BI model, it delivers actionable insights with ease. This innovation aims to streamline big data analysis and enhance decision-making.

Big Data Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Types Covered | Database, Data Analytics and Tools, Data Management, Data Applications, Core Technologies |

| Deployment Types Covered | On-Premise, Cloud |

| Industries Covered | Banking, Discrete Manufacturing, Professional Services, Process Manufacturing, Federal/Central Government, Others |

| End-Uses Covered | Large Enterprises, SMEs |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Vietnam, Brazil, Mexico, Argentina, Colombia, Chile, Saudi Arabia, United Arab Emirates, South Africa |

| Companies Covered | Amazon Web Services, Inc., Cloudera, Inc., Dell Inc., Informatica Inc., International Business Machines Corporation, Microsoft Corporation, Mu Sigma, Oracle Corporation, SAP SE, SAS Institute, Splunk Inc. (Cisco Systems, Inc.), Teradata Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the big data software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global big data software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the big data software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global big data software market was valued at USD 208.74 Billion in 2024.

The market is estimated to reach USD 456.01 Billion by 2033, exhibiting a CAGR of 8.13% from 2025-2033.

The key drivers for the market include the exponential growth of data from IoT devices, advancements in AI/ML technologies, increasing digitalization, and the growing importance of data-driven decision-making in organizations. These factors fuel the demand for robust software solutions that handle large-scale data processing and analysis.

North America currently dominates the market, with a share of 45.4% in 2024. The region’s dominance is driven by increased data from Internet of Things (IoT) devices and advancements in artificial intelligence/machine learning (AI/ML), digitalization in emerging markets, and the crucial role of data in strategic enterprise decisions.

Some of the major players in the global big data software market include Amazon Web Services, Inc., Cloudera, Inc., Dell Inc., Informatica Inc., International Business Machines Corporation, Microsoft Corporation, Mu Sigma, Oracle Corporation, SAP SE, SAS Institute, Splunk Inc. (Cisco Systems, Inc.), Teradata Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)