BFSI BPO Services Market Size, Share, Trends and Forecast by Service Type, Enterprise Size, End User, and Region, 2025-2033

BFSI BPO Services Market Size and Share:

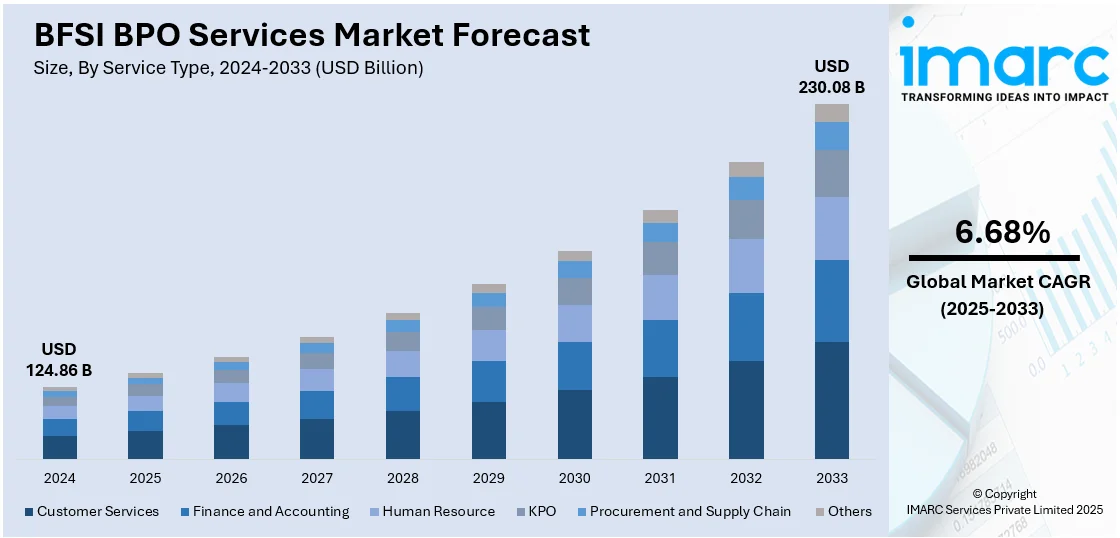

The global BFSI BPO services market size was valued at USD 124.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 230.08 Billion by 2033, exhibiting a CAGR of 6.68% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.0% in 2024. Stringent regulatory requirements, rapid advancements in technology and rising demand for enhanced customer experience are propelling the market growth. Besides this, BFSI BPO services market share is driven by specialized risk management services and globalization of financial services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 124.86 Billion |

|

Market Forecast in 2033

|

USD 230.08 Billion |

| Market Growth Rate 2025-2033 | 6.68% |

By promoting digital transformation, the expanding fintech industry is increasing demand for BFSI BPO services. Traditional banking methods are being disrupted by fintech companies, which need outsourced solutions for operational efficiency and scalability. BPO companies help fintech companies streamline fraud detection, customer service, and payment processing. Fintech-driven financial services benefit from increased transaction speed and accuracy thanks to advanced automation and AI-driven solutions. Solutions for risk management and regulatory compliance are made possible by fintech alliances with BPO companies. Fintech businesses may securely and effectively handle massive amounts of financial data with the help of cloud-based BPO services. For quicker loan approvals, digital lending platforms contract out the consumer verification and credit risk assessment procedures. Fintech companies may improve client engagement and personalized financial services with the aid of BPO-driven analytics solutions. Outsourcing cybersecurity services strengthens fintech platforms against cyber threats, fraud, and data breaches.

Rising cybersecurity threats are driving the United States market demand for BFSI BPO services. Financial institutions face increasing risks from cyberattacks, data breaches, and identity theft incidents. Strict regulatory frameworks mandate strong cybersecurity measures, leading banks to outsource risk management services. According to the report published by the IMARC Group the United States cyber security market is expected to reach US$ 172.65 Billion by 2032, exhibiting a growth rate (CAGR) of 8.20% during 2024-2032. BPO providers offer advanced fraud detection and cybersecurity solutions to protect financial data and transactions. Artificial intelligence (AI) and machine learning (ML) enhance real-time threat detection in outsourced security operations. Cloud-based security solutions in BPO services help banks manage encrypted data and prevent cyber risks. Financial firms require 24/7 security monitoring, which specialized BPO providers efficiently deliver. Increased adoption of digital banking and online payments has heightened the risk of cyber fraud. Third-party cybersecurity experts in BPO firms assist BFSI clients in mitigating risks effectively. BPO services ensure compliance with financial cybersecurity regulations like GLBA, FFIEC, and PCI DSS. Identity verification and biometric authentication outsourcing help prevent unauthorized access to financial systems.

BFSI BPO Services Market Trends:

Cost efficiency

Cost efficiency is a key factor driving the BFSI BPO services market, with financial institutions striving to cut expenses while ensuring high service standards. The growing competition, fueled by around 30,000 fintech startups, intensifies the need for cost-effective solutions. These organizations can realize significant cost savings by outsourcing non-core functions like data entry, customer support, and claims processing to specialized BPO providers. These providers offer scalable solutions, allowing BFSI companies to adjust costs based on service demand. Outsourcing eliminates expenses associated with hiring, training, and managing an in-house customer support team. Advanced automation and AI-driven solutions further enhance cost savings by minimizing manual processes and errors. Financial institutions leverage BPO expertise to streamline back-office operations, such as loan processing and claims management. Lower labor costs in offshore outsourcing destinations contribute to significant savings for BFSI firms. Reduced infrastructure expenses allow financial institutions to allocate resources toward innovation and digital transformation initiatives. Outsourcing compliance-related services helps BFSI firms navigate regulatory requirements without incurring high legal costs. Cost-effective fraud detection and risk management solutions strengthen financial security without excessive investment in internal teams.

Regulatory compliance

Financial institutions face increasing regulatory complexities, requiring expert solutions to manage compliance efficiently. BPO providers offer specialized services to help BFSI firms comply with evolving global and regional regulations. Outsourcing regulatory compliance reduces financial institutions' burden of maintaining in-house legal and compliance teams. BPO firms assist in implementing risk management frameworks that align with industry-specific regulatory standards. Automated compliance solutions help BFSI companies streamline reporting, audits, and data governance. Outsourcing guarantees compliance to know-your-customer (KYC) and anti-money laundering (AML) regulations with minimal operational disruptions. Financial institutions leverage BPO expertise to monitor transactions, detect fraud, and prevent regulatory violations. Regulatory changes demand constant updates, which BPO providers efficiently manage through dedicated compliance teams. Cost-effective compliance outsourcing minimizes penalties and legal risks for banks, insurance firms, and financial institutions. BPO firms offer real-time regulatory monitoring, reducing exposure to financial crimes and fraudulent activities.

Technological advancements

Financial institutions increasingly adopt AI, ML, and robotic process automation to streamline operations. BPO providers leverage automation to reduce manual errors and accelerate transaction processing for BFSI firms. A 2023 banking report states that generative AI could enhance productivity by 5% and cut global costs by $300 billion. Blockchain technology enhances security, transparency, and fraud prevention in financial transactions and compliance processes. Cybersecurity advancements enable BPO firms to protect sensitive banking data against evolving cyber threats. Fintech integration in BPO services supports digital banking, payment processing, and financial advisory solutions. Voice recognition and biometric authentication enhance security and fraud detection in outsourced BFSI operations. Predictive analytics optimize loan approvals, credit risk assessment, and investment decision-making for financial institutions. BPO firms implement API-based solutions to facilitate seamless integration with core banking and insurance systems. Cloud-based BPO platforms enable real-time data sharing and collaboration for BFSI clients. Continuous innovation in financial technology strengthens outsourcing capabilities and accelerates BFSI digital transformation.

BFSI BPO Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global BFSI BPO services market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on service type, enterprise size, and end user.

Analysis by Service Type:

- Customer Services

- Finance and Accounting

- Human Resource

- KPO

- Procurement and Supply Chain

- Others

Customer services stand as the largest component in 2024, holding 23.8% of the market. The surging needs to outsource customer services in the financial sector represents one of the key factor propelling the market growth. Customer service is critical for BFSI companies as it directly impacts customer satisfaction, loyalty, and overall brand perception. In an increasingly competitive BFSI landscape, providing exceptional customer experiences is a strategic imperative. BPO services specialized in customer support can offer round-the-clock assistance, multichannel support, and personalized interactions, contributing to higher customer satisfaction. Additionally, the proliferation of digital channels and fintech innovations has intensified customer expectations for real-time responses and personalized interactions, making it crucial for banks to leverage BPO expertise in leveraging emerging technologies and analytics for enhanced customer engagement.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead the market with 59.98% of market share in 2024. They typically possess extensive financial resources, allowing them to invest in comprehensive and sophisticated outsourcing solutions, providing an impetus to the market growth. Besides this, they can afford to engage multiple BPO providers for various specialized services, creating a diverse and resilient outsourcing ecosystem. Moreover, large enterprises often operate on a global scale, with complex operations spanning multiple regions and customer bases. This global footprint necessitates a higher volume of outsourcing services to manage diverse customer needs and regulatory environments effectively, thereby bolstering the market growth. Additionally, the heightened focus on risk management and cybersecurity compels large financial enterprises to leverage the specialized expertise and resources of BPO partners to fortify their defenses and ensure compliance with evolving regulations.

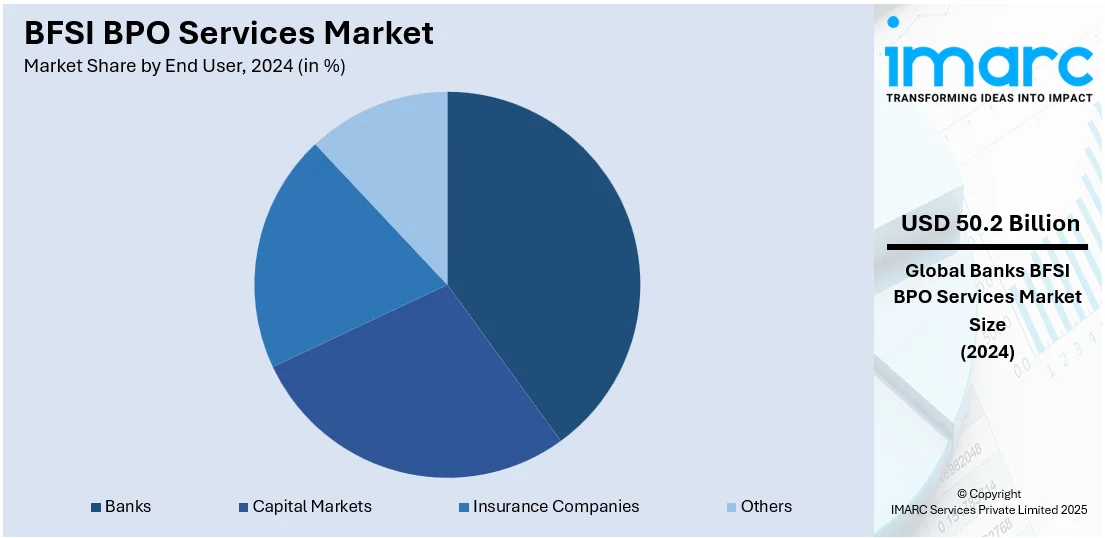

Analysis by End User:

- Banks

- Commercial Banking

- Retail Banking

- Cards

- Lending

- Capital Markets

- Investment Banking

- Brokerage

- Asset Management

- Others

- Insurance Companies

- Others

Banks dominate the market with 40.2% of market share in 2024. The surging demand for BFSI BPO services, particularly from banks encompassing commercial, retail, cards, and lending sectors, is primarily propelled by the ever-evolving regulatory landscape in the financial industry. Stringent regulations necessitate strict compliance and reporting standards, driving banks to seek specialized BPO providers with expertise in managing complex compliance processes. Moreover, the rapid technological advancements in fintech and digital banking are creating a need for banks to enhance their customer experience and operational efficiency, prompting them to outsource non-core functions such as customer support and data management to BPO partners. Furthermore, the need for scalability and flexibility in response to fluctuating market demands further influence the demand for BFSI BPO services as banks seek adaptable outsourcing partners to support their dynamic requirements in a rapidly changing financial landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.0%. The region boasts a robust and mature financial services industry, home to numerous banking and insurance giants with a substantial demand for outsourcing non-core functions to specialized BPO providers, which is presenting lucrative opportunities for market expansion. Besides this, stringent regulatory requirements in the region are compelling financial institutions to seek specialized BPO partners with in-depth knowledge of compliance and risk management. Moreover, the region's time zone proximity to major financial hubs in Europe and its English-speaking population offers a strategic advantage for global BFSI firms looking to outsource functions like customer support and data processing while ensuring seamless communication and service continuity, bolstering the market growth. Apart from this, the increasing adoption of digital banking and fintech innovations is spurring a demand for BPO services to assist in digital transformation initiatives, including the development of mobile apps, AI-powered chatbots, and data analytics, thereby strengthening the market growth.

Key Regional Takeaways:

United States BFSI BPO Services Market Analysis

The United States holds 87.50% of the market share in the North American market. Adoption is increasing because more investments are being made and the number of fintech companies is on the rise. More than 13,100 fintech startups in the United States are fueling the demand for outsourced financial services. The necessity for cost-effective financial operations is prompting companies to implement scalable outsourcing solutions. Financial services BPO enhancements and payment processing technology are propelling BFSI BPO adoption for smooth transactions. AI-based solutions are revolutionizing customer engagement, risk management, and back-office processes at financial institutions. Sophisticated regulatory needs are leading companies to outsource fraud detection and compliance management services. Customized customer interactions are creating demand for sophisticated analytics and automation in BFSI BPO. Cloud computing solutions facilitate better secure data management, fostering trust in outsourcing relationships. Venture capital and private equity investments in fintech startups are increasing outsourcing opportunities for scalability. Greater partnerships between fintech companies and legacy banks are underpinning the demand for BFSI BPO services. Financial institutions depend on outsourcing partners to handle expanding service portfolios effectively. The changing digital landscape continues to fuel the growth of BFSI BPO services in the US market.

Asia Pacific BFSI BPO Services Market Analysis

Asia Pacific BFSI BPO services uptake is increasing due to small and medium-sized businesses (SMEs) needing affordable financial assistance solutions. India Brand Equity Foundation estimates MSMEs in India to increase from 6.3 crore to 7.5 crore with a 2.5% CAGR. Digitalization across the region compels companies to outsource finance services for scale and efficiency. The demand for simplified payment processing, compliance management, and risk analysis is driving outsourcing alliances. Easy access to cloud-based services strengthens data security, which enhances BFSI BPO trust. Mobile banking and electronic payments growth are driving outsourced financial support services demand. The integration of AI and automation with customer service and fraud detection is enhancing BFSI BPO operating efficiency. Enlarging regulatory environments force financial institutions to outsource compliance management to mitigate risks. Increasing demand for customized financial products is fueling BFSI BPO adoption for analytics-based customer insights. SME growth in emerging economies is boosting the demand for outsourced financial operations. Outsourcing solutions allow financial companies to attain sustainable growth and operational flexibility in competitive markets. Asia Pacific's dynamic financial environment continues to yield new chances for BFSI BPO providers. The increase in the region's fintech sector further cements the country's need for scalable outsourcing service solutions.

Europe BFSI BPO Services Market Analysis

BFSI BPO services adoption in the Europe is rising as financial institutions seek efficiency and regulatory compliance. In 2021, the European Union had 784 foreign bank branches including 619 from member states and 165 from third countries. Digital transformation is driving financial firms to outsource key operations for enhanced scalability. Cost-effective risk management and fraud detection solutions are increasing demand for BFSI BPO services. Digital banking expansion and fintech partnerships are fueling the need for outsourced customer support and back-office functions. AI-driven automation is optimizing financial processes, improving efficiency, and enhancing customer experiences. Cross-border transactions and trade finance growth compel institutions to rely on outsourcing for seamless operations. Cloud-based solutions strengthen data security and management, encouraging BFSI BPO adoption. Wealth management and investment advisory firms seek outsourcing for scalable financial solutions. Increasing regulatory complexity is driving financial institutions to leverage BPO services for compliance and risk assessment. The growing focus on customer-centric services is reinforcing BFSI BPO adoption for personalized banking experiences.

Latin America BFSI BPO Services Market Analysis

BFSI BPO services adoption in Latin America is growing as rising disposable income increases financial product demand. Latin America’s total disposable income is projected to rise nearly 60% from 2021 to 2040. A growing banking customer base is driving financial firms to outsource customer support and transaction processing. Cost-effective financial services are encouraging institutions to adopt BFSI BPO solutions for operational efficiency. Expanding digital payment systems are fueling demand for outsourced financial operations. Increased banking infrastructure investments are strengthening the BFSI BPO market. Mobile banking adoption is accelerating outsourced support needs. Expanding regulatory frameworks are prompting financial institutions to seek compliance-driven outsourcing solutions.

Middle East and Africa BFSI BPO Services Market Analysis

The increasing number of banks in the Middle East and Africa is driving BFSI BPO services adoption. UAE Banks Federation (UBF) members include 20 national banks, 28 foreign banks, and 7 special status banks licensed by the UAE Central Bank. Expanding banking institutions require outsourced customer support, risk management, and compliance solutions. BFSI BPO providers streamline operations, reduce costs, and ensure regulatory compliance for financial firms. Rising demand for digital banking and financial automation is accelerating outsourcing adoption. Financial inclusion initiatives further contribute to BFSI BPO market growth across the region. Outsourcing enhances efficiency, scalability, and customer engagement for the expanding financial sector.

Competitive Landscape:

Key players are making investments in artificial intelligence (AI), blockchain, and cloud technologies to streamline service delivery and data security. Top companies offer end-to-end process automation, enhancing operational efficiency and lowering the cost for financial institutions. They offer niche services in risk management, fraud detection, and compliance to enable banks to comply with regulatory requirements. Global players expand their service offerings by incorporating advanced analytics and ML-based insights. Customer-focused solutions, such as multilingual support and omnichannel communication, enhance interaction and the customer experience. BPO providers create strong cybersecurity models to safeguard sensitive financial information from cyber-attacks and breaches. Outsourcing companies help digital transformation efforts, enabling BFSI firms to update operations and enhance agility. They set up offshore delivery centers to offer cost-effective services for global banking and insurance customers. For instance, in January 2025, Accenture PLC purchased a digital twin technology platform from Percipient, a Singapore fintech firm that specializes in banking technology innovation. The purchase expands Accenture's banking transformation abilities, allowing its financial services clients in Asia Pacific to accelerate the transformation of their core systems, innovate, and grow. Moreover, strategic alliances with fintech firms allow BPO companies to provide innovative payment processing and digital banking assistance.

The report provides a comprehensive analysis of the competitive landscape in the BFSI BPO services market with detailed profiles of all major companies, including:

- Accenture PLC

- Cognizant

- Concentrix Corporation

- Genpact

- IBM Corporation

- Infosys Limited

- Mphasis Limited

- NTT Data Corporation

- Tata Consultancy Services Limited

- Wipro Limited

Latest News and Developments:

- January 2025: Fusion CX acquired S4 Communications to strengthen its BPO services in the telecom and utilities sectors. The acquisition adds 900 employees across Texas and the Philippines, enhancing customer service operations. S4 Communications reported USD 23.5 million in revenue for CY 2024, highlighting its strong market position. This deal strengthens Fusion CX’s technology-driven service offerings, improving operational efficiency and client solutions.

- February 2024: Acquire BPO introduced Acquire.AI, a consulting division specializing in AI-driven business solutions. The division supports companies in adopting AI for improved efficiency and growth. Headquartered in Irving, Texas, Acquire.AI focuses on transforming industries with customized AI strategies. This launch reinforces Acquire BPO’s leadership in customer experience and business process outsourcing.

- February 2024: Bandhan Bank upgraded its core banking system and expanded digital services with Oracle FLEXCUBE and Oracle Banking Digital Experience. This transformation enhances retail and wholesale banking, covering payments, loan originations, and mobile banking for 32 million customers. The transition from legacy systems to Oracle’s technology improves efficiency and strengthens financial services for underserved segments across India.

- February 2024: Fusion CX opened a 500-seat BPO facility in Navi Mumbai, set to expand its India workforce beyond 10,000 next quarter. Spanning 20,000 square feet, the center provides multilingual, omnichannel customer experience management, technical support, and back-office operations. Serving sectors such as technology, healthcare, banking, utilities, and retail, the facility enhances Fusion CX’s global service capabilities.

BFSI BPO Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Customer Services, Finance and Accounting, Human Resource, KPO, Procurement and Supply Chain, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Users Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Accenture PLC, Cognizant, Concentrix Corporation, Genpact, IBM Corporation, Infosys Limited, Mphasis Limited, NTT Data Corporation, Tata Consultancy Services Limited, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, BFSI BPO services market outlook, and dynamics of the market from 2019-2033.

- The BFSI BPO services market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the BFSI BPO services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The BFSI BPO services market was valued at USD 124.86 Billion in 2024.

The BFSI BPO services market is projected to exhibit a CAGR of 6.68% during 2025-2033, reaching a value of USD 230.08 Billion by 2033

The BFSI BPO services market growth is driven by cost efficiency, regulatory compliance, and digital transformation. Financial institutions outsource services to reduce operational costs while maintaining high service quality. Strict regulations compel firms to leverage BPO solutions for compliance management and risk assessment. The rise of AI, automation, and cloud-based solutions enhances efficiency in financial operations. Growing fintech collaborations and digital banking expansion catalyzes outsourcing demand.

North America currently dominates the BFSI BPO services market, accounting for a share of 36.0% in 2024. Leading banks, insurance firms, and fintech companies in the region drive demand for cost-efficient and technology-driven BPO solutions. Strict regulatory requirements compel financial institutions to outsource compliance management and risk assessment. Widespread adoption of AI, automation, and cloud-based solutions enhances operational efficiency in outsourced services. The growing need for advanced cybersecurity solutions further influences BPO demand.

Some of the major players in the BFSI BPO services market include Accenture PLC, Cognizant, Concentrix Corporation, Genpact, IBM Corporation, Infosys Limited, Mphasis Limited, NTT Data Corporation, Tata Consultancy Services Limited, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)