Battery Management System Market Report by Battery Type (Lithium-Ion Based, Lead-Acid Based, Nickel Based, and Others), Type (Motive Battery, Stationary Battery), Topology (Centralized, Distributed, Modular), Application (Automotive, Military and Defense, Healthcare, Consumer Electronics, Telecommunications, Renewable Energy Systems, and Others), and Region 2026-2034

Battery Management System Market Size:

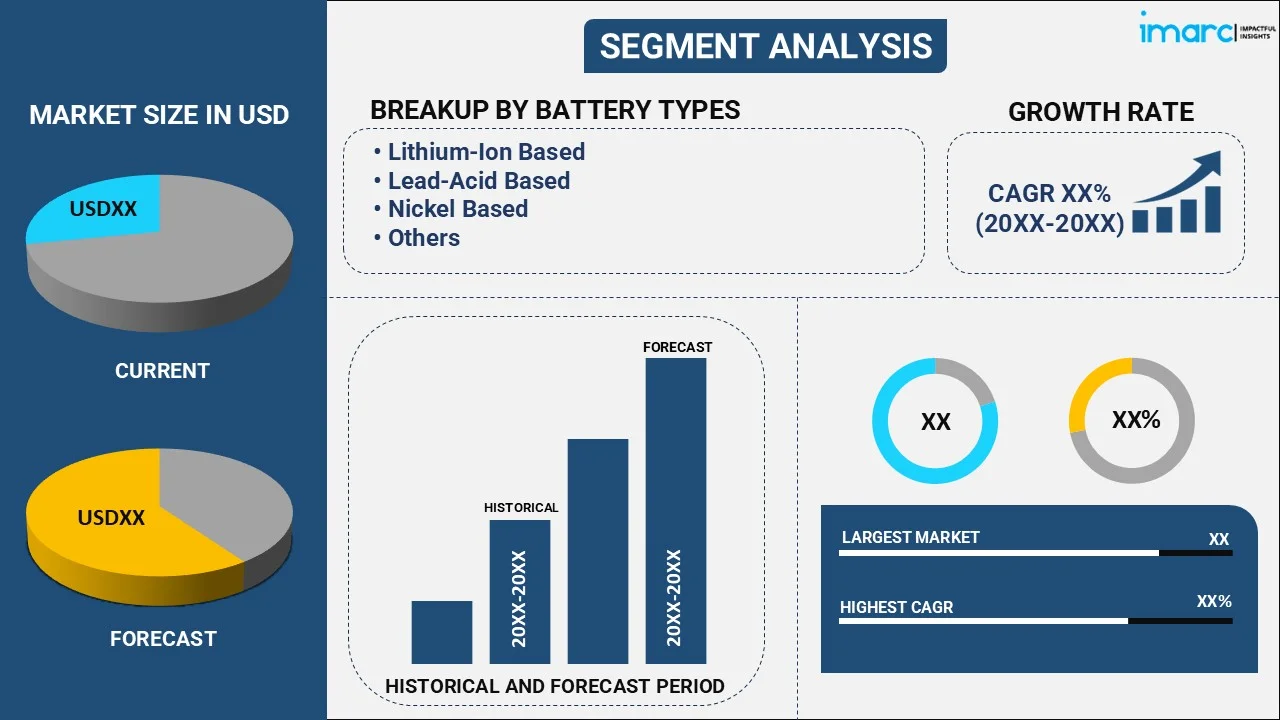

The global battery management system market size reached USD 9.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 39.0 Billion by 2034, exhibiting a growth rate (CAGR) of 15.96% during 2026-2034. The increasing demand for electric vehicles (EVs), advancements in renewable energy storage, the need for efficient battery performance and safety, significant technological advancements in battery management, and the widespread adoption of portable electronics and grid storage solutions are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 9.9 Billion |

|

Market Forecast in 2034

|

USD 39.0 Billion |

| Market Growth Rate 2026-2034 | 15.96% |

Battery Management System Market Analysis:

- Major Market Drivers: The escalating demand for electric vehicles (EVs) represents the major driver of the market. As consumers and governments prioritize sustainable transportation, automakers are increasingly integrating BMS to optimize battery performance, extend lifespan, and ensure safety.

- Key Market Trends: Significant advancements in wireless BMS technology and the increasing integration of artificial intelligence (AI) represent the key trends in the market. Wireless BMS eliminates complex wiring, reducing vehicle weight and manufacturing costs while enhancing reliability. In line with this, AI integration in BMS enables predictive analytics and real-time monitoring, improving battery health management and operational efficiency.

- Geographical Trends: According to the battery management system market overview, Asia Pacific accounts for the largest region in the market. The rapid adoption of electric vehicles, substantial investments in renewable energy projects, and the growing demand for consumer electronics are driving the growth of the market. Government incentives and regulations promoting green technologies, coupled with advancements in battery technology and increasing industrialization, further propel the market growth in the region.

- Competitive Landscape: Some of the major market players in the battery management system industry include Eberspaecher Vecture, Elithion Inc., Johnson Matthey, Leclanche, Lithium Balance, Navitas Systems LLC (East Penn Manufacturing Company), Nuvation Engineering, NXP Semiconductor N.V., Storage Battery Systems LLC, Valence Technology Inc. (Lithium Werks B.V.), among many others.

- Challenges and Opportunities: Some of the key battery management system market recent opportunities include the widespread adoption of electric vehicles, renewable energy storage systems, and portable electronics. In line with this, innovations in wireless BMS and AI integration offer the potential for improved efficiency and cost reduction. The increasing government incentives for green technologies and the expanding focus on energy efficiency and sustainability further bolster opportunities for market growth and development. However, the market also faces several challenges including high initial costs, complex integration processes, and the need for advanced technological expertise. In addition to this, ensuring compatibility with diverse battery chemistries and managing safety concerns are significant hurdles.

To get more information on this market Request Sample

Battery Management System Market Trends:

Widespread Adoption of Electric Vehicles (EVs)

As governments and consumers prioritize sustainability, the demand for EVs is increasing. According to IBEF, the Indian EV market is forecasted to expand from US$ 3.21 billion in 2022 to US$ 113.99 billion by 2029, with a 66.52% CAGR. A subsidy of Rs. 5,790 crore (US$ 693 million) has been granted to electric vehicle manufacturers for the sale of 1,341,459 electric vehicles under phase II of the FAME India Scheme. A dedicated policy FAME II with a budgetary outlay of Rs. 10,000 crore (US$ 1.43 billion), to incentivize electric vehicle consumption and support manufacturing. Moreover, BMS is crucial in optimizing battery performance, enhancing safety, and extending battery lifespan, which makes it integral to the EV market, thereby increasing the overall battery management system market revenue.

Significant Advancements in Battery Technologies

Innovations in battery technology, including higher energy densities and improved safety features, necessitate advanced BMS for optimal performance. For instance, in July 2024, Eberspaecher announced the launch of a battery management system (BMS) for the low-voltage range with a connection to the vehicle power grid. This makes the company one of the first in Europe to take such a product into series production. It is used in the 12 V lithium iron phosphate starter battery from an international manufacturer. From lane departure warning systems and automatic parking to traffic jam pilots—vehicles boasting a plethora of new functions are already on the road, up to highly automated driving level 3. At the same time, continuous efficiency and weight optimizations are required, and high safety criteria must be met. Switching from lead-acid to lithium-ion batteries in the low-voltage range saves up to five kilograms in weight. The 12 V battery management system (BMS) from Eberspaecher provides the necessary safety for automated driving functions up to safety integrity level ASIL C. According to the battery management system market forecast, these advancements will be pivotal in driving the need for more sophisticated BMS solutions, which is projected to boost the market growth.

Rising Renewable Energy Storage

The shift towards renewable energy sources such as solar and wind requires efficient energy storage solutions. BMS plays a vital role in managing these storage systems, ensuring efficient energy use and stability, thus driving the demand. For instance, in March 2023, Nuvation Energy, a leading provider of battery management systems (BMS) to energy storage companies, announced that their most recent product release, the G5 BMS, is now shipping in volume with UL 1973 Recognition. Nuvation Energy battery management systems scale to the power and energy requirements of large-scale battery energy storage systems and are designed to support the UL 1973 and UL 9540 certification process.

Battery Management System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on battery type, type, topology, and application.

Breakup by Battery Type:

To get detailed segment analysis of this market Request Sample

- Lithium-Ion Based

- Lead-Acid Based

- Nickel Based

- Others

Lithium-ion based accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion based, lead-acid based, Nickel based, and others. According to the report, lithium-ion based represented the largest segment.

The demand for lithium-ion-based batteries in the market is driven by their high energy density, long lifespan, and efficiency. These batteries are preferred in electric vehicles (EVs) and portable electronics due to their lightweight and compact nature. The widespread adoption of renewable energy storage solutions also boosts demand, as lithium-ion batteries offer reliable and scalable energy storage. Technological advancements reducing costs and improving safety further enhance their appeal. Additionally, government incentives and regulations promoting clean energy and electric mobility contribute to the rising demand for lithium-ion-based battery systems in the market.

Breakup by Type:

- Motive Battery

- Stationary Battery

Stationary battery holds the largest share of the industry

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes motive battery and stationary battery. According to the battery management system market report, stationary battery accounted for the largest market share.

The demand for stationary battery management systems (BMS) is driven by the increasing need for reliable and efficient energy storage solutions in renewable energy projects such as solar and wind farms. These systems ensure optimal battery performance and longevity, crucial for grid stability and energy management. In addition to this, the growing trend of microgrids and smart grids, along with rising energy consumption, necessitates advanced stationary BMS for seamless integration and management. In line with this, significant technological advancements improving battery efficiency and safety, combined with supportive government policies and incentives for renewable energy infrastructure, further propel the demand for stationary BMS in the market.

Breakup by Topology:

- Centralized

- Distributed

- Modular

Modular represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the topology. This includes centralized, distributed, and modular. According to the report, modular represented the largest segment.

The demand for modular topology in the market is driven by its scalability and flexibility, allowing easy customization and expansion of battery systems. This topology supports the efficient management of large and complex battery arrays, making it ideal for applications in electric vehicles, renewable energy storage, and industrial systems which is further driving the battery management system demand. Improved fault tolerance and enhanced reliability are additional benefits, ensuring optimal performance and safety. Technological advancements and the increasing adoption of electric mobility and renewable energy solutions further drive the demand for modular BMS, as they offer superior adaptability and ease of maintenance compared to centralized systems.

Breakup by Application:

- Automotive

- Electric Vehicles

- E-Bikes

- Golf Carts

- Military and Defense

- Healthcare

- Consumer Electronics

- Telecommunications

- Renewable Energy Systems

- Others

Automotive exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive (electric vehicles, e-bikes, and golf carts), military and defense, healthcare, consumer electronics, telecommunications, renewable energy systems, and others. According to the report, automotive accounted for the largest battery management system market share.

The demand for battery management systems (BMS) in the automotive sector is driven by the rapid adoption of electric vehicles (EVs) and the need for efficient battery performance and safety. BMS optimizes battery usage, extending lifespan and ensuring reliability, which is crucial for the growing EV market. Government regulations and incentives promoting electric mobility further boost demand. Additionally, advancements in battery technologies, such as higher energy densities and faster charging capabilities, require sophisticated BMS for effective management. The increasing integration of smart features and connectivity in modern vehicles also enhances the need for advanced BMS solutions in the automotive industry which is further boosting the battery management system market growth.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for battery management systems.

The market in Asia Pacific is driven by the rapid adoption of electric vehicles (EVs) due to supportive government policies and incentives. Significant investments in renewable energy projects enhance the need for efficient energy storage solutions. The region's booming consumer electronics market demands advanced BMS for better battery performance and longevity. Additionally, increasing industrialization and urbanization contribute to the rising demand for reliable power sources, further propelling the market growth. For instance, in February 2024, Nissan Motor Co., Ltd. announced to launch of Nissan Energy Share in Japan on March 1 to further unlock the value of electric vehicles. The new service features Nissan-unique energy management technology that controls the charging and discharging of EV batteries. Significant technological advancements and local manufacturing capabilities are supporting the growth and innovation which is creating a positive battery management system market outlook across the region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the battery management system industry include Eberspaecher Vecture, Elithion Inc., Johnson Matthey, Leclanche, Lithium Balance, Navitas Systems LLC (East Penn Manufacturing Company), Nuvation Engineering, NXP Semiconductor N.V., Storage Battery Systems LLC, and Valence Technology Inc. (Lithium Werks B.V.).

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The market for battery management systems is highly competitive, featuring key players such as Texas Instruments, NXP Semiconductors, and Renesas Electronics. These battery management system companies focus on innovations in battery monitoring, safety, and efficiency. Strategic partnerships, technological advancements, and extensive R&D efforts are common strategies to maintain competitive advantage and cater to the growing demand from electric vehicles, renewable energy, and consumer electronics sectors. For instance, in November 2023, NXP introduced a battery cell controller IC designed for lifetime performance and battery pack safety in EVs and energy storage systems. NXP’s next-generation battery cell controller with down to 0.8 mV cell measurement accuracy and lifetime design robustness enhances the performance of the battery management system to maximize the usable capacity and safety for e-mobility Li-ion batteries and energy storage systems. Some of the key battery management system market recent developments further include entry of the emerging firms like Elithion and Navitas Systems which also contribute to market dynamics with specialized solutions.

Battery Management System Market News:

- In May 2024, Italian electric motorcycle manufacturer Energica Motor Company entered a research and development(R&D) partnership with Electra Vehicles Inc., a company that specializes in AI-powered battery management software solutions. The collaboration aims to improve battery performance and related features on Energica's high-performance electric motorcycles by integrating Electra's cutting-edge technology.

- In January 2024, Viritech, the leading hydrogen powertrain solutions provider, launched its Battery Management Ecosystem, focused on delivering high-performance, volume-optimized solutions for OEM and Tier-1 manufacturers seeking to integrate high-performance battery systems.

Battery Management System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Based, Lead-Acid Based, Nickel Based, Others |

| Types Covered | Motive Battery, Stationary Battery |

| Topologies Covered | Centralized, Distributed, Modular |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Eberspaecher Vecture, Elithion Inc., Johnson Matthey, Leclanche, Lithium Balance, Navitas Systems LLC (East Penn Manufacturing Company), Nuvation Engineering, NXP Semiconductor N.V., Storage Battery Systems LLC, Valence Technology Inc. (Lithium Werks B.V.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the battery management system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global battery management system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the battery management system industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The battery management system market was valued at USD 9.9 Billion in 2025.

The battery management system market is projected to exhibit a CAGR of 15.96% during 2026-2034, reaching a value of USD 39.0 Billion by 2034.

The battery management system market is driven by the growing demand for renewable energy storage, electric vehicles along with consumer electronics. Advances in battery technology, along with the need for efficient energy management, safety, and longer battery life, are also key factors fueling market growth.

In 2025, Asia Pacific dominated the battery management system market driven by the rapid growth of electric vehicle production, large-scale adoption of renewable energy solutions, and significant investments in battery technologies. The region's strong manufacturing capabilities and supportive government policies also contributed to its market leadership.

Some of the major players in the global battery management system market include Eberspaecher Vecture, Elithion Inc., Johnson Matthey, Leclanche, Lithium Balance, Navitas Systems LLC (East Penn Manufacturing Company), Nuvation Engineering, NXP Semiconductor N.V., Storage Battery Systems LLC, Valence Technology Inc. (Lithium Werks B.V.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)