Battery Electrolyte Market Size, Share, Trends and Forecast by Battery Type, Electrolyte Type, End User, and Region, 2026-2034

Battery Electrolyte Market Size and Share:

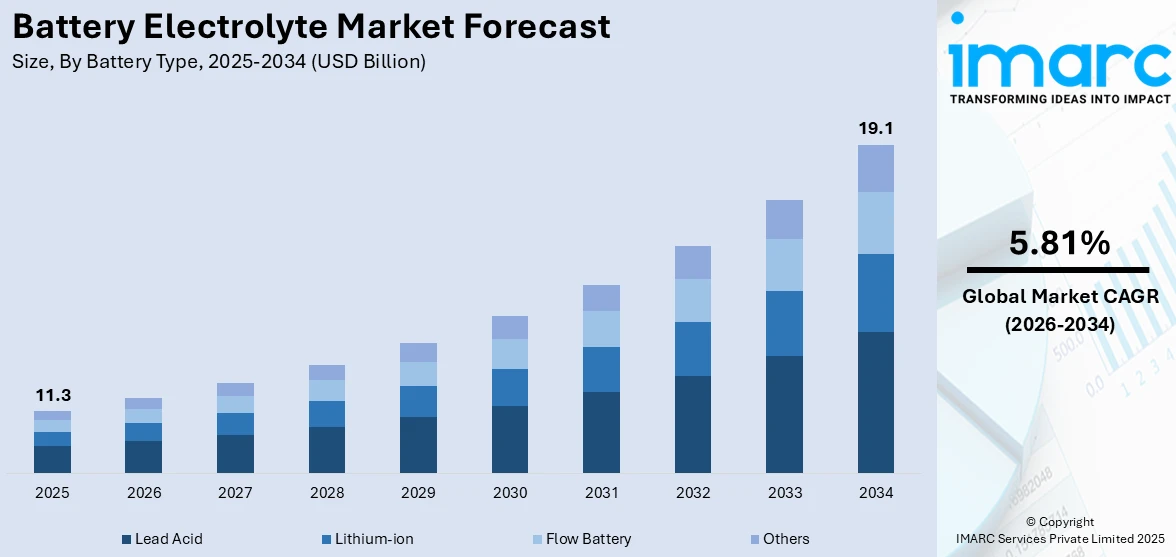

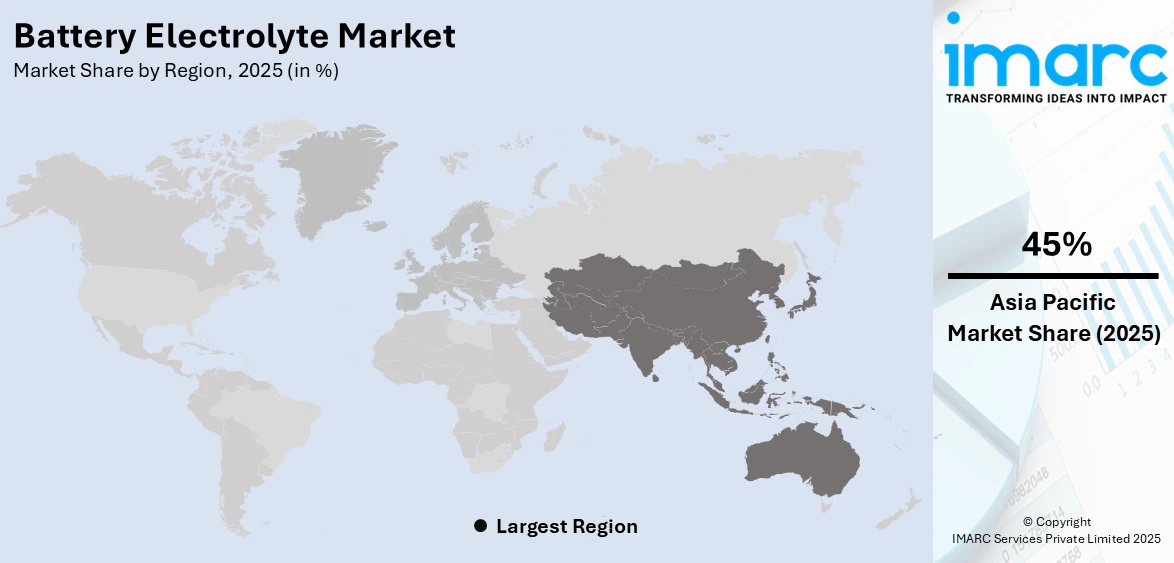

The global battery electrolyte market size was valued at USD 11.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 19.1 Billion by 2034, exhibiting a CAGR of 5.81% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of 45% in 2025. The market is experiencing massive growth with increased demand for electric vehicles, consumer electronics, and energy storage products. Advances in electrolyte efficiency, including faster charging and enhanced safety, are driving this growth. Additionally, battery electrolyte market share is set to rise as advances in battery technology, especially solid-state and lithium-ion technologies, drive improved performance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 11.3 Billion |

|

Market Forecast in 2034

|

USD 19.1 Billion |

| Market Growth Rate 2026-2034 | 5.81% |

The world battery electrolyte market is experiencing rapid growth propelled by increasing consumer electronics demand. These include smartphones, laptops, digital cameras, gaming consoles, and wearable devices, which are all dependent on lithium-ion batteries, which are powered by electrolyte innovation. As of 2024, global smartphone users numbered 4.88 billion, accounting for 60.42% of the population, indicating how large the market for lithium-ion batteries is. The ongoing quest for greater battery life, quicker charging, and better energy storage has spurred electrolyte makers to create better solutions. Solid-state batteries, for example, that take advantage of sophisticated electrolyte formulations, are gaining popularity based on their improved safety credentials and greater energy densities.

To get more information on this market Request Sample

The battery electrolyte market in the United States is growing rapidly, driven by the expansion of investments in electric vehicles and smart home technology adoption. The United States is a leader globally in EV adoption, with electric vehicle sales exceeding 1.3 Million units in 2023, and this trend is likely to increase further amid rising environmental concerns and government incentives. To date, as of 2024, US regulators are providing incentives like tax credits and subsidies to incentivize the purchase of EVs. This is propelling the demand for high-energy battery electrolytes to support the capabilities of long-range, fast-charging electric vehicles. The successful validation of FEST solid-state battery cells in 2025, which has improved energy densities and faster charging, has further stimulated interest in electrolytes to enable such breakthroughs.

Battery Electrolyte Market Trends

Advancing Performance and Efficiency in Battery Electrolyte

The global market is increasingly focused on enhancing the performance and efficiency of battery systems to meet the rising demand for sustainable and reliable energy storage solutions. As the adoption of electric vehicles (EVs) grows, battery technology plays a pivotal role in determining driving range, charging time, and overall vehicle performance. Key developments in this trend include Stellantis and Factorial Energy’s successful validation of FEST solid-state battery cells in April 2025. These cells offer a breakthrough in battery electrolyte technology, with 375Wh/kg energy density and rapid charging capabilities. This development promises a significant leap in the energy storage potential of EVs by improving both range and charging speed, which addresses two critical consumer concerns: range anxiety and long charging times. The shift to solid-state technology, which eliminates many of the limitations of traditional lithium-ion batteries, has sparked interest across the industry, with a clear impact on the battery electrolyte industry. As manufacturers prioritize efficiency, safety, and performance, the market is expected to see more innovations in solid-state batteries, with an emphasis on better electrolytes and improved battery integration. These advancements contribute to an overall reduction in costs, making electric vehicles more affordable and accessible, while also promoting faster adoption and supporting the transition to greener transportation solutions.

Focus on Enhancing Lithium-Ion Battery Lifespan

The focus on improving the lifespan and performance of existing lithium-ion batteries is impelling the battery electrolyte market growth. While solid-state batteries are gaining attention, lithium-ion technology continues to dominate the EV market and energy storage sectors. As battery longevity, performance, and efficiency become more crucial, addressing the challenges of degradation and reducing capacity loss over time is essential for sustaining battery systems. In April 2025, researchers at the University of Colorado Boulder made a notable breakthrough in this area. Their discovery highlighted how hydrogen interference in the electrolyte contributes to the degradation of lithium-ion batteries, which directly impacts their lifespan and efficiency. By addressing this issue and applying a special coating to the cathode, the research demonstrated the potential to enhance battery performance and extend the driving range of electric vehicles by up to 60%. This discovery presents a valuable opportunity for battery manufacturers to refine their current technologies and improve the overall efficiency of lithium-ion batteries. The impact of such advancements on the market is significant, as it enables the development of longer-lasting. These more efficient battery solutions can meet the increasing demands for EV range and reduce the need for frequent battery replacements, lowering overall costs for consumers and driving industry growth.

Rising Demand for Battery Electrolytes

The growing trend of high-end consumer electronics, such as smartphones, laptops, digital cameras, gaming consoles, and flashlights, is significantly fueling the demand for electrolyte-based lithium-ion batteries worldwide. For example, as of 2024, there were around 4.88 Billion smartphone users globally, making up approximately 60.42% of the global population. Additionally, the increasing adoption of electric vehicles (EVs), driven by a shift towards sustainable development and heightened awareness of the environmental impact of petroleum-based vehicles, is propelling market growth. According to the International Energy Agency, electric vehicle sales approached 14 Million units in 2023, marking strong market expansion. Governments in various countries are also offering subsidies and incentives to encourage EV adoption, further contributing to this growth. Moreover, the rising sales of vacuum cleaners, driven by busy lifestyles, higher incomes, and urbanization, are increasing the demand for battery electrolytes. This trend is also linked to the growing popularity of smart homes and the increasing demand for time-saving automated products. Additionally, the use of battery electrolytes in the production of alkaline zinc-manganese oxide batteries is expanding, with rising demand for these batteries in devices like digital cameras, portable TVs, shavers, office equipment, and gaming consoles.

Battery Electrolyte Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global battery electrolyte market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on battery type, electrolyte type, and end user.

Analysis by Battery Type:

- Lead Acid

- Lithium-ion

- Flow Battery

- Others

As per the battery electrolyte market outlook, in 2025, the lithium-ion segment led the market accounting for 63.2% of the total market share, driven by the growing demand for high-energy density batteries across various industries. Lithium-ion batteries are widely used in electric vehicles (EVs), consumer electronics, and energy storage systems due to their superior performance, longer lifespan, and lightweight nature. The rapid expansion of electric vehicles, coupled with the increasing adoption of renewable energy storage solutions, has significantly boosted the demand for lithium-ion batteries. This, in turn, drives the need for advanced lithium-ion electrolytes, contributing to their market dominance.

Analysis by Electrolyte Type:

- Liquid Electrolyte

- Solid Electrolyte

- Gel Electrolyte

- Sodium Chloride

- Nitric Acid

- Sulphuric Acid

- Others

Liquid electrolytes are widely used in lithium-ion and other types of rechargeable batteries due to their high ionic conductivity, which allows efficient energy transfer. Typically composed of lithium salts dissolved in organic solvents, liquid electrolytes play a crucial role in ensuring stable charge and discharge cycles in batteries. The flexibility in formulation and ease of production contribute to their dominance in the market, especially for applications in electric vehicles, portable electronics, and energy storage systems. However, safety concerns regarding flammability and leakage are prompting research into safer and more stable alternatives.

Solid electrolytes are gaining popularity in the battery electrolyte market due to their enhanced safety features compared to liquid electrolytes. These materials offer better thermal stability and reduce risks like leakage or combustion. They are primarily used in solid-state batteries, which are considered the next step in battery technology due to their potential for higher energy densities and longer life cycles. Solid electrolytes are being researched for use in applications ranging from electric vehicles to grid storage, as they can provide a more stable and efficient energy solution without the limitations of traditional liquid electrolytes.

Gel electrolytes, a hybrid between liquid and solid electrolytes, are used in batteries that require a balance between high ionic conductivity and safety. They consist of a polymer matrix that holds the electrolyte solution in a gel-like form. This structure helps reduce leakage risks and improves the mechanical strength of the battery. Gel electrolytes are commonly found in applications such as flexible batteries, wearable devices, and advanced energy storage systems. Their ability to maintain a solid-state while ensuring efficient ion transport makes them an attractive choice for next-generation battery technologies.

Sodium chloride, or common salt, is used in certain types of batteries, particularly in sodium-ion batteries, as an electrolyte component. It offers a cost-effective and abundant alternative to lithium-based electrolytes. Sodium-ion batteries are increasingly being explored for large-scale energy storage applications due to their lower cost and less dependence on rare materials. Sodium chloride-based electrolytes enhance the sustainability of energy storage systems, as sodium is more widely available and environmentally friendly compared to lithium. While sodium-ion batteries are still in development, they hold potential for high-capacity storage solutions in the future.

Nitric acid is occasionally used in some battery chemistries, especially in the production of certain types of lead-acid batteries. It serves as an electrolyte in these batteries by providing the necessary ionic medium for energy flow. Nitric acid-based electrolytes are particularly beneficial in certain industrial applications where high charge/discharge cycles and robustness are essential. However, their use is limited due to environmental concerns associated with acid-based solutions and the complexity of managing corrosive substances. Advances in recycling technologies and efforts to reduce harmful emissions are gradually mitigating these challenges for broader use.

Sulphuric acid is widely used as an electrolyte in lead-acid batteries, the oldest and most common type of rechargeable battery. In these batteries, sulphuric acid serves as the medium for ion exchange during charging and discharging cycles, enabling energy storage and release. Lead-acid batteries, which are commonly found in automotive and backup power applications, rely on this electrolyte for their functionality. While the lead-acid battery market faces competition from newer technologies like lithium-ion, sulphuric acid remains integral to cost-effective energy storage solutions, especially in regions with large fleets of traditional vehicles and backup power systems.

The "Others" category includes a wide range of alternative electrolyte materials used in specialized battery chemistries. These may include ionic liquids, polymer electrolytes, and various combinations of salts and solvents tailored to meet the specific needs of advanced battery technologies such as flow batteries, magnesium-ion batteries, and more. These alternative electrolytes offer potential advantages in terms of efficiency, energy density, and safety. Research is ongoing to explore the use of these materials in next-generation batteries, aiming for higher performance, lower cost, and greater environmental sustainability. As innovation continues, "Others" will play a crucial role in shaping the future of battery technology.

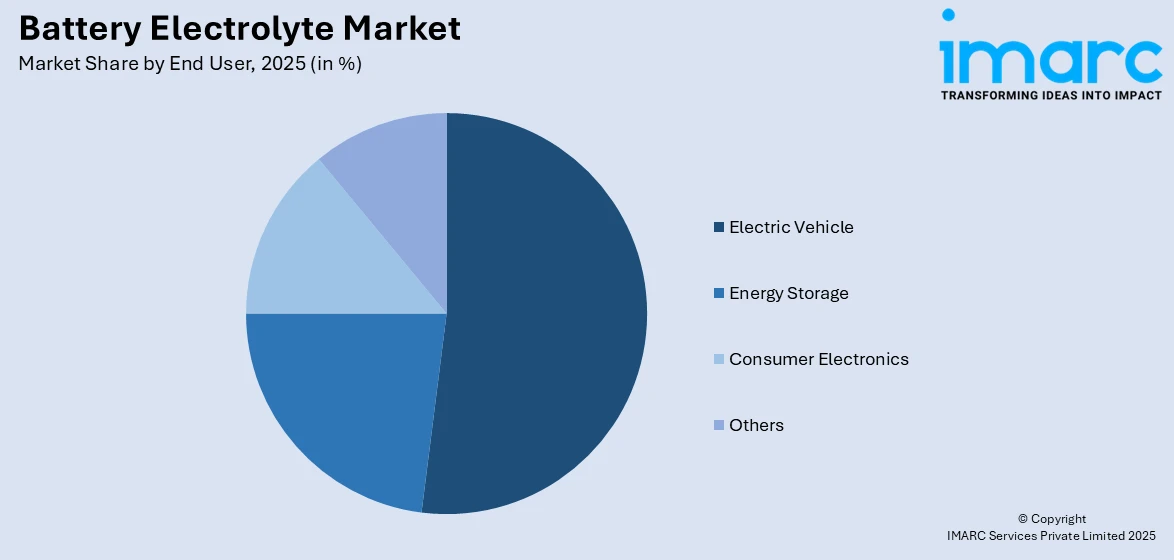

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Electric Vehicle

- Energy Storage

- Consumer Electronics

- Others

In 2025, the electric vehicle segment led the battery electrolyte market accounting for 52.8% of the total market share, driven by the global shift toward sustainable transportation and government policies promoting the adoption of electric vehicles. With the increasing number of EVs on the road, the demand for high-performance battery electrolytes has surged. These electrolytes are essential for maximizing the efficiency, range, and lifespan of EV batteries. As automakers continue to invest in EV technology and infrastructure, the demand for advanced electrolytes tailored for electric vehicle applications remains a key growth driver in the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific led the battery electrolyte market accounting for 45% of the total market share, driven by the region’s dominance in manufacturing, rapid adoption of electric vehicles, and significant investments in renewable energy. China, Japan, and South Korea are key players in the global battery production market, which has fueled the demand for advanced battery electrolytes. Furthermore, Asia-Pacific’s robust infrastructure for electric vehicle manufacturing and energy storage solutions has boosted electrolyte demand in the region. Government incentives, coupled with a rising focus on sustainable energy, are further accelerating the growth of the battery electrolyte market in this region.

Key Regional Takeaways:

North America Battery Electrolyte Market Analysis

The North American battery electrolyte market is experiencing rapid growth, driven by the increasing adoption of electric vehicles (EVs) and advancements in energy storage technologies. As the demand for EVs continues to rise, with over 1.3 Million EVs sold in the U.S. alone in 2023, the need for high-performance batteries is escalating. The adoption of battery electrolytes is critical to meet the evolving demands for longer driving ranges, faster charging times, and enhanced safety features. In January 2025, ProLogium unveiled its fourth-generation lithium-ceramic battery with a fully inorganic electrolyte, marking a major step in battery technology. This development enhanced energy density, fast charging, and safety, impacting the market by promoting more efficient, safer, and sustainable EV battery solutions. As the U.S. government continues to implement policies such as tax rebates and incentives for EVs, the market is set to expand further. Additionally, ongoing research and development efforts in battery technology are expected to strengthen North America's position as a leader in the global battery electrolyte market.

United States Battery Electrolyte Market Analysis

The United States is witnessing increased battery electrolyte adoption driven by the surge in consumer electronics demand. For instance, the total consumer electronics production volume is expected to grow from 7,749.2 Million pieces in 2018, reaching a projected 9,014.2 Million pieces in 2028. Rising usage of smartphones, tablets, laptops, and wearables is boosting the need for efficient and compact energy storage solutions. The expanding digital lifestyle and remote work culture have significantly contributed to the proliferation of portable electronic devices, creating consistent demand for lithium-ion batteries and, consequently, battery electrolyte. Continuous technological innovations in consumer electronics are further pushing manufacturers to enhance battery performance, thereby propelling the need for advanced electrolyte formulations. The robust electronics manufacturing sector and growing consumer preference for high-performance devices are key contributors to this trend. In addition, domestic research efforts focusing on battery material improvements are expected to strengthen the battery electrolyte supply chain and support the expanding consumer electronics market.

Asia Pacific Battery Electrolyte Market Analysis

Asia-Pacific is experiencing a notable rise in battery electrolyte adoption supported by governing agencies of numerous countries offering subsidies and implementing favorable initiatives to promote electric vehicles. For instance, the GST on EVs was reduced from 12% to 5%, while the GST on chargers/ charging stations for EVs was reduced from 18% to 5%, under the FAME India Scheme Phase-II, keeping in mind the increasing penetration of the EV market. These policy measures are aimed at reducing carbon emissions, enhancing energy efficiency, and supporting green mobility goals. With increasing investment in EV infrastructure and supportive tax schemes, the region is fostering a competitive environment for electric mobility adoption. The push from the public and private sectors to transition from internal combustion engines to electrified transport is significantly boosting battery demand. As batteries form the core of EVs, the requirement for high-performance battery electrolyte has risen sharply.

Europe Battery Electrolyte Market Analysis

Europe is seeing heightened battery electrolyte adoption attributed to the increasing presence of smart homes and the rising demand for automated products that can perform household activities. For instance, the number of smart homes in the region is forecasted to reach about 101.2 Million at the end of 2028, representing a market penetration of close to 42%. Integration of connected devices such as robotic vacuum cleaners, smart refrigerators, and automated lighting systems has created a strong market for energy-efficient battery technologies. These household systems rely heavily on rechargeable battery systems that require stable and long-lasting electrolyte compositions. The demand for user convenience, energy optimization, and home automation is accelerating the development and deployment of smart devices powered by advanced batteries. Manufacturers in Europe are focusing on battery innovation to match the requirements of compactness and durability suitable for smart homes. The convergence of automation, connectivity, and sustainability continues to boost battery electrolyte application in the residential sector.

Latin America Battery Electrolyte Market Analysis

Latin America is witnessing a rise in the adoption of battery electrolytes, driven by the growing demand for electric vehicles (EVs). For instance, by the end of 2024, the number of light electric vehicles in Latin America and the Caribbean reached 444,071 units—nearly tripling compared to the end of 2023. As more consumers and businesses shift toward sustainable mobility solutions, the need for efficient and reliable battery technologies becomes more critical. The increased use of lithium-ion batteries in EVs, coupled with government incentives and investments in clean energy, is propelling the demand for advanced battery electrolytes in the region. This trend is expected to continue, positioning Latin America as a key player in the global transition toward electric transportation.

Middle East and Africa Battery Electrolyte Market Analysis

The Middle East and Africa are witnessing rising battery electrolyte adoption driven by the growing electric vehicles segment. For instance, the UAE had more than 147,000 electric and hybrid vehicles on its roads in 2024, with EV registrations alone rising by more than 25% year on year. Total new vehicle sales in the UAE were 316,000 units during the same year. As regional interest in clean transportation grows, the demand for efficient batteries incorporating high-quality electrolyte formulations is increasing.

Competitive Landscape:

Advancements in battery electrolyte production, application technologies, and integration strategies are fueling the growth of the battery electrolyte market. Companies are concentrating on improving material properties, scalability, and efficiency for applications in energy storage, electronics, and electric vehicles. Competition in the sector is driven by the development of high-performance, versatile solutions with broader uses in renewable energy, healthcare, and environmental protection. Strategic partnerships, global market expansion, and continuous innovation are accelerating the adoption of these materials. The battery electrolyte market forecast predicts increased demand as industries prioritize energy-efficient solutions, sustainable technologies, and the development of high-quality applications, prompting greater investment in advanced electrolyte materials.

The report provides a comprehensive analysis of the competitive landscape in the battery electrolyte market with detailed profiles of all major companies, including:

- 3M Company

- American Elements

- BASF SE

- GS Yuasa International Ltd.

- Guangzhou Tinci Materials Technology Co. Ltd.

- Johnson Controls

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Shenzhen Capchem Technology Co. Ltd.

- Targray

- Ube Industries Ltd.

Latest News and Developments:

- May 2025: FEV and Mahindra co-developed a new LFP battery system featuring advanced battery electrolytes, tailored for Mahindra’s Electric Origin SUV line-up. The system reportedly demonstrates a rapid 20%-80% charging in 20 minutes.

- April 2025: Toshiba launched a new SCiB lithium-ion battery module with an aluminum baseplate that doubled heat dissipation compared to previous models. The battery electrolyte and lithium titanate electrode enable stable high-power input and output while preserving battery life in EV buses, electric ships, and stationary systems.

- March 2025: Lohum launched India’s first battery-grade lithium refinery with an annual production capacity of 1,000 metric tons. The facility refines battery electrolyte components with over 90% lithium recovery and 99.8% purity, positioning Lohum as a key domestic supplier. It also expanded into Cathode Active Materials to support lithium-ion battery production.

- February 2025: Duracell Inc. partnered with Satya International to manufacture and distribute Duracell-branded batteries (including automotive, tubular, inverter, and UPS types) across Asia and Africa. The collaboration focuses on enhancing battery performance, including advancements in battery electrolyte formulations, to improve power efficiency and longevity.

- February 2025: Luminous Power Technologies opened a new unit for lead-acid batteries in Haridwar, Uttarakhand, which incorporated battery electrolyte systems, a wet paste filling process, and acid circulation technology. The plant features a smart interface, green positive plate manufacturing, and sustainable practices including solar rooftop installation.

Battery Electrolyte Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Battery Types Covered | Lead Acid, Lithium-ion, Flow Battery, Others |

| Electrolyte Types Covered | Liquid Electrolyte, Solid Electrolyte, Gel Electrolyte, Sodium Chloride, Nitric Acid, Sulphuric Acid, Others |

| End Users Covered | Electric Vehicle, Energy Storage, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, American Elements, BASF SE, GS Yuasa International Ltd., Guangzhou Tinci Materials Technology Co. Ltd., Johnson Controls, LG Chem Ltd., Mitsubishi Chemical Corporation, Mitsui Chemicals Inc., Shenzhen Capchem Technology Co. Ltd., Targray, Ube Industries Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the battery electrolyte market from 2020-2034.

- The battery electrolyte market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the battery electrolyte industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The battery electrolyte market was valued at USD 11.3 Billion in 2025.

The battery electrolyte market is projected to exhibit a CAGR of 5.81% during 2026-2034, reaching a value of USD 19.1 Billion by 2034.

Key factors driving the battery electrolyte market include increasing demand for energy storage solutions, growth in electric vehicles, advancements in battery technologies, rising adoption of renewable energy, and the need for high-performance materials in electronics. Strategic collaborations and innovations also contribute to market growth.

In 2025, Asia Pacific dominated the battery electrolyte market accounting for 45% of the total market share, driven by the rapid expansion of electric vehicle production, increased demand for energy storage systems, and the region's strong manufacturing capabilities in battery technologies.

Some of the major players in the global battery electrolyte market include 3M Company, American Elements, BASF SE, GS Yuasa International Ltd., Guangzhou Tinci Materials Technology Co. Ltd., Johnson Controls, LG Chem Ltd., Mitsubishi Chemical Corporation, Mitsui Chemicals Inc., Shenzhen Capchem Technology Co. Ltd., Targray, Ube Industries Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)