Battery Analyzer Market Size, Share, Trends and Forecast by Type, Battery Type, End User, and Region, 2025-2033

Battery Analyzer Market Size and Share:

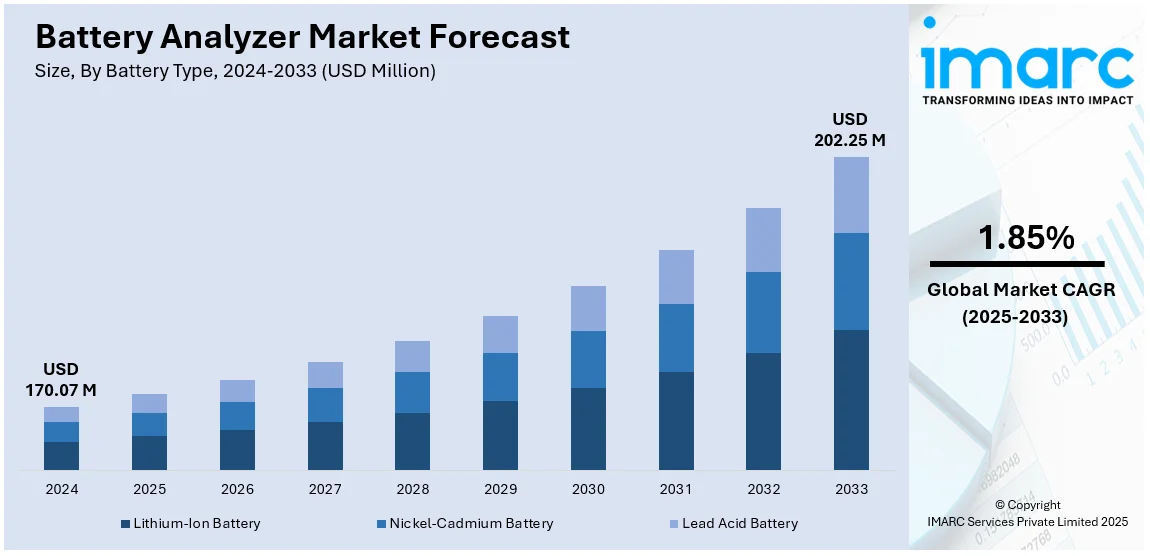

The global battery analyzer market size reached USD 170.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 202.25 Million by 2033, exhibiting a growth rate CAGR of 1.85% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 42.0% in 2024. The rising product demand across various industries, increasing sales of electric vehicles (EVs), and the increasing demand for smart electronic devices represent some of the key factors driving the market growth across the globe.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 170.07 Million |

| Market Forecast in 2033 | USD 202.25 Million |

| Market Growth Rate (2025-2033) | 1.85% |

The battery analyzer market is influenced by various key factors. The widespread adoption of electric vehicles (EVs) is a major catalyst, as these vehicles require frequent battery testing and performance monitoring. The growing shift toward renewable energy sources such as wind and solar also boosts the demand for energy storage systems, driving the need for efficient battery diagnostics. Additionally, industries such as telecommunications, automotive, and aerospace increasingly rely on predictive maintenance, further facilitating the demand for battery analyzers. Technological advancements in smart and portable analyzers, which provide real-time data and remote monitoring capabilities, have made testing more efficient. Government incentives for clean energy adoption and investments in R&D by major manufacturers contribute to battery analyzer market growth, creating a sustainable demand for reliable battery performance solutions.

In the United States, the battery analyzer market is propelled by several factors. The rapid growth of the electric vehicle (EV) market is a primary influence, as EVs require efficient battery testing and monitoring for optimal performance. Additionally, the widespread adoption of renewable energy systems, like wind and solar power, fuels the need for energy storage solutions, which drives the need for battery analyzers. The rise of predictive maintenance across industries like telecommunications, data centers, and automotive further accelerates market demand. Technological advancements in smart, portable, and IoT-enabled analyzers enhance ease of use and real-time diagnostics, making them more attractive for various applications. For instance, in October 2024, AVL announced the launch of the AVL Cell Tester ECO, a small, multi-channel battery cell cycler, at Detroit's The Battery Show. The AVL Cell Tester ECO comes with cabinet configurations of 8, 12, 16, 24, 32, 48, and 72 channels and is available in power classes of 12A, 50A, 100A, 300A, or 600A. Since it enables the user to suitably size the equipment to fit their project, this is considered crucial for battery labs.

Battery Analyzer Market Trends:

Growing Adoption of Electric Vehicles (EVs)

One of the primary drivers of the market is the fast-paced global rollout of electric vehicles. Over 14 million EVs were sold worldwide in 2023, a 35% increase from the last year, according to data from the International Energy Agency. As a result of this sharp growth, there is increased focus on battery safety, durability, and performance-all of which require advanced battery analysers. The need for close monitoring of EV batteries, usually made from lithium-ion, has increased testing frequency due to strict government rules on safety and pollution. The demand for battery analysers is mainly triggered by countries like China, which, in 2023, captured 60% of global EV sales according to reports, and Europe where EV sales accounted for 20% of all vehicle sales, according to the data by International Energy Agency. Moreover, the integration of fast-charging technologies into EVs, which generally operate on the basis of battery health data, underlines how crucial battery analysers are for sustainable performance in the long run.

Increased Deployment of Renewable Energy Storage Systems

The growth in the utilization of renewable energy sources such as wind and solar represent one of the major battery analyzer market trends. Renewable energy sources have increased demand for energy storage systems, with the International Energy Agency reporting that the capacity added to electricity systems worldwide increased by 50% in 2023, reaching about 510 gigawatts (GW), with solar PV accounting for three-quarters of additions globally. The intermittency of renewable sources of energy creates a need for energy storage technologies like large-scale battery systems, which require sophisticated analysers to confirm the validity of their operation. Analyzers are, therefore, highly essential in ensuring the monitoring and maintenance of system dependability, especially with growing grid-scale storage installations, as lithium-ion battery systems now constitute a significant portion of the market.

Rising Demand for Consumer Electronics and Portable Devices

The market for battery analysers is growing with the rising need for consumer electronics like wearables, laptops, and smartphones. A sizable percentage of over 1.2 billion smartphones shipped worldwide in 2023 have fast-charging lithium-ion batteries, according to reports. Battery analysers are critical in ensuring the reliability and safety of these devices, particularly when manufacturers are trying to maximize battery life to meet customer requirements. Furthermore, 240 million laptops were sold worldwide as per reports, many of which have high-capacity batteries designed for hybrid work models. The healthcare sector is depending more and more on battery-powered solutions, which increases demand for portable medical devices like glucose monitors and oxygen concentrators.

Battery Analyzer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global battery analyzer market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, battery type, and end user.

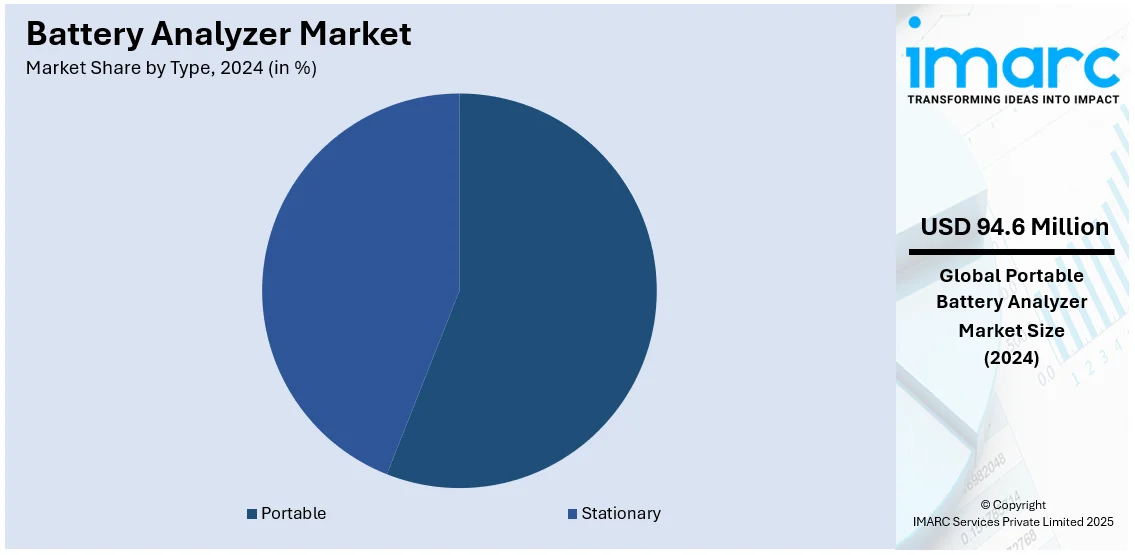

Analysis by Type:

- Stationary

- Portable

Portable leads the market with around 55.6% of market share in 2024. Portable battery analyzers hold the largest share in the market because of their versatility, ease of use, and growing demand across diverse applications. Their compact design and lightweight nature make them ideal for on-site testing, maintenance, and troubleshooting in industries like automotive, telecommunications, and renewable energy. With advancements in technology, portable analyzers now offer high accuracy, real-time diagnostics, and connectivity features, enhancing efficiency. The increasing adoption of electric vehicles and decentralized energy systems has further amplified the need for portable solutions that provide flexibility and mobility. These factors make portable battery analyzers the preferred choice over stationary alternatives.

Analysis by Battery Type:

- Lithium-Ion Battery

- Nickel-Cadmium Battery

- Lead Acid Battery

Lithium-ion batteries hold the largest share in the battery analyzer market due to their widespread use across key industries, including consumer electronics, renewable energy storage, and electric vehicles (EVs). These batteries are preferred for their long lifespan, lightweight properties, and high energy density, driving significant demand. The widespread adoption of EVs and the move toward clean energy have amplified the need for efficient lithium-ion battery performance testing and monitoring. Additionally, advancements in battery technologies and the increasing use of lithium-ion batteries in critical applications, such as medical devices and aerospace, require precise diagnostics, further solidifying their dominance in the battery analyzer market.

Analysis by End User:

- Automotive

- IT and Telecom

- Healthcare

- Aviation and Defense

- Others

The automotive sector holds the largest battery analyzer market share due to the rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which rely heavily on battery performance. As EV adoption accelerates, the need for efficient battery monitoring and diagnostics increases to ensure safety, reliability, and optimal performance. Automotive manufacturers and service providers require advanced battery analyzers to support production, quality assurance, and maintenance processes. Additionally, the growth of connected and autonomous vehicles has heightened the demand for robust battery systems, further driving the market growth. The sector's focus on innovation and sustainability reinforces its dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42.0%. The region has emerged as a leader in the battery analyser market because of its successful consumer electronics, automotive, and energy storage sectors. China is the world's largest EV market, with over 60% of the total global EV sales in 2023, as per International Energy Agency, thereby increasing demand for testing and diagnostics in the battery analysers. India is quickly increasing its capacity for renewable energy with a target of 450 GW by 2030, according to data by Ministry of Power, which includes massive battery storage systems. Leading battery producers like Panasonic, CATL, and BYD are based in the area and depend on sophisticated analysers to ensure their products are of high quality. With over 1.5 billion smartphone users according to reports, there is still much demand for consumer electronics battery testing devices. Market drivers in Asia-Pacific also arise from government-backed initiatives promoting renewable energy and battery production within the region, which is augmented by increasing numbers of smart cities and industrial automation.

Key Regional Takeaways:

North America Battery Analyzer Market Analysis

The battery analyzer market in North America is experiencing significant growth, driven by multiple factors. The widespread adoption of electric vehicles (EVs) is a primary driver, as the need for reliable battery performance monitoring grows with the expansion of EV infrastructure. The region's strong focus on renewable energy, such as solar and wind power, has amplified the demand for energy storage systems, requiring battery analyzers to ensure efficiency and durability. Industries like telecommunications, data centers, and aerospace are also adopting predictive maintenance practices, boosting the need for advanced battery testing solutions. Technological advancements, such as smart and portable battery analyzers with IoT capabilities, further support market growth, enabling real-time data monitoring and diagnostics. The region benefits from robust government initiatives promoting clean energy adoption, alongside investments in R&D by major battery and testing equipment manufacturers.

United States Battery Analyzer Market Analysis

In 2024, the United States accounted for the largest market share of over 76.80% in North America. Rapid developments in consumer electronics, automobiles, and renewable energy are driving the battery analyser industry in the US. The demand for advanced analyzers is upped by increased usage of EVs, as over 1.2 million units were sold in 2023, reports say. Periodic health check-ups and servicing of batteries thus become essential. With more than 21% of electricity coming from renewable sources in 2023 as per the data by U.S. Energy Information Administration, the United States also holds the number one position globally in renewable energy that has sparked interest in energy storage technologies. To maintain the dependability and efficiency of these storage systems, battery analyzers play an essential role. Additionally, the consumer electronics segment, where reports indicate smartphone penetration is above 90%, has a great demand for portable battery testing solutions. The sector also gets additional stimuli from the governments through tax credits for installing solar batteries as part of renewable energy and energy storage infrastructure. Mission-critical application demands of the aerospace and defence segments, requiring precise battery testing, also contribute to the increase.

Europe Battery Analyzer Market Analysis

The market for battery analysers in Europe is driven by the continent's dedication to electrification and sustainability. As per the data by The European Automobile Manufacturers' Association (ACEA), more than 2.7 million EVs have been delivered so far in 2023, which has hastened the adoption of EVs due to the stringent carbon emission objectives of the European Union and subsequently increased demand for battery health monitoring devices. Battery analysers also have growth potential in the health maintenance and diagnostics field given that energy storage technology is the foundation of the renewable energy sector, which accounts for a significant 37% of electricity consumption in Europe according to the data from the European Commission. More than 500 million smartphone users are reported in Europe, and there is an ever-growing demand for portable battery management solutions in the consumer electronics sector as well. The importance of efficient testing and analysis has increased due to government regulations for the circular economy and proper battery recycling. The battery analyzer market demand is also increasing with growth in energy storage systems in industrial applications and the installation of smart grids in countries such as Germany, France, and the UK.

Latin America Battery Analyzer Market Analysis

With the increasing demand for electric vehicles and renewable energy supply, the market of Latin American battery analyser is growing. Mexico and Brazil are among the major players; in 2023, the solar energy capacity of Brazil was more than 17.5 GW, which necessitates an effective energy storage system combined with efficient battery management technologies, as per reports. Electric vehicle models are in high demand, and the automobile market is going to be fully electrified. The consumer electronics sector also drives the demand for handheld battery testing equipment, as the region is experiencing a smartphone penetration rate of more than 60%, as per an industry report. Expansion in the market is also driven by initiatives from governments to modernize grid infrastructure and progressive policies in favour of renewable energy and energy-efficient technologies.

Middle East and Africa Battery Analyzer Market Analysis

Investments in renewable energy and increased usage of energy storage systems are driving the battery analyser market in the Middle East and Africa. Saudi Arabia's NEOM city project, which focuses on sustainable energy storage technologies, and the United Arab Emirates' 1.17 GW Noor Abu Dhabi Solar Plant are some of the projects that are leading the two countries towards renewable energy. The growing use of battery-powered equipment in the telecom and industrial sectors further increases the demand for battery analysers. The market expansion is further assisted by the increased number of EVs in cities and improved mobile connectivity—Africa has more than 500 million mobile users as per reports. The need for sophisticated battery testing solutions is further fuelled by government subsidies for the use of renewable energy and infrastructure improvements.

Competitive Landscape:

The battery analyzer market is highly competitive, driven by the growing demand for reliable battery performance testing across industries like automotive, aerospace, and consumer electronics. Key players include Fluke Corporation, Hioki E.E. Corporation, and Megger, offering advanced portable and stationary analyzers. Emerging companies focus on cost-effective solutions with smart connectivity. The market is fueled by increasing adoption of renewable energy systems and electric vehicles, necessitating efficient battery diagnostics. Regional competitors in Asia-Pacific, particularly China and Japan, dominate due to their robust manufacturing base and innovation capabilities. Differentiation hinges on accuracy, ease of use, and integration with predictive maintenance technologies.

The global battery analyzer market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ACT Meters (UK) Ltd

- AMETEK Inc.

- B&K Precision Corporation

- Cadex Electronics Inc.

- Eagle Eye Power Solutions LLC

- Energy Storage Instruments Inc.

- Fluke Corporation (Fortive Corporation)

- Hioki E.E. Corporation

- Kussmaul Electronics Co. Inc.

- Meco Instruments Pvt. Ltd.

- PulseTech Products Corporation

- Xiamen Tmax Battery Equipments Limited

Recent Developments:

- December 2024: At the 2024 CTI Symposium in Berlin, Marelli introduced their most recent battery management system (BMS) technology, which optimizes battery lifespan, safety, and efficiency to improve electric vehicle (EV) performance. It further supports scalability for several EV systems by integrating AI-based predictive analytics and sophisticated thermal management.

- December 2024: A new generation vanadium flow battery from Invinity Energy Systems is intended to improve energy storage options. The increasing need for long-duration energy storage in renewable energy applications is met by this novel system, which delivers increased efficiency, dependability, and scalability. Because the battery's architecture allows for integration with several energy sources, it can be deployed in a variety of ways for commercial and utility-scale projects. This invention is a testament to Invinity's dedication to developing sustainable energy technology.

Battery Analyzer Market Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stationary, Portable |

| Battery Types Covered | Lithium-Ion Battery, Nickel-Cadmium Battery, Lead Acid Battery |

| End Users Covered | Automotive, IT and Telecom, Healthcare, Aviation and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACT Meters (UK) Ltd, AMETEK Inc., B&K Precision Corporation, Cadex Electronics Inc., Eagle Eye Power Solutions LLC, Energy Storage Instruments Inc., Fluke Corporation (Fortive Corporation), Hioki E.E. Corporation, Kussmaul Electronics Co. Inc., Meco Instruments Pvt. Ltd., PulseTech Products Corporation, Xiamen Tmax Battery Equipments Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, battery analyzer market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global battery analyzer market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the battery analyzer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The battery analyzer market was valued at USD 170.07 Million in 2024.

The battery analyzer market is projected to exhibit a CAGR of 1.85% during 2025-2033, reaching a value of USD 202.25 Million by 2033.

Key factors driving the battery analyzer market include the rapid growth of electric vehicles, increasing demand for renewable energy storage, advancements in battery technology, and the need for predictive maintenance in various industries. Additionally, the rise of smart, portable battery analyzers and government incentives for clean energy projects fuel market expansion. The factors collectively are creating a positive battery analyzer market outlook across the globe.

Asia Pacific currently dominates the battery analyzer market, accounting for a share of 42.0%. In Asia-Pacific, factors driving the battery analyzer market include rapid EV adoption, renewable energy expansion, and manufacturing advancements.

Some of the major players in the global battery analyzer market include ACT Meters (UK) Ltd, AMETEK Inc., B&K Precision Corporation, Cadex Electronics Inc., Eagle Eye Power Solutions LLC, Energy Storage Instruments Inc., Fluke Corporation (Fortive Corporation), Hioki E.E. Corporation, Kussmaul Electronics Co. Inc., Meco Instruments Pvt. Ltd., PulseTech Products Corporation, Xiamen Tmax Battery Equipments Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)