Battery Additives Market by Type (Conductive Additive, Porous Additive, Nucleating Additive, and Others), Application (Lead-Acid Battery, Lithium-Ion Battery, and Others), End User (Electronics, Automotive, and Others), and Region 2026-2034

Battery Additives Market Size:

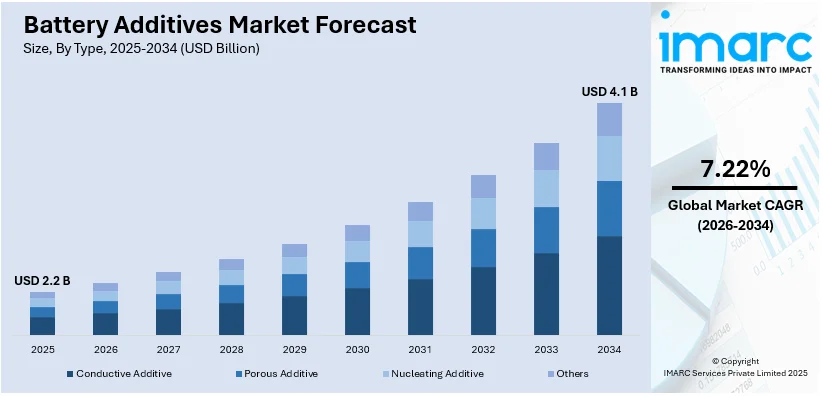

The global battery additives market size reached USD 2.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.22% during 2026-2034. Continual technological advancements in the production of solid-state batteries, numerous innovations in additive formulations, the rising e-mobility trends, the growing demand for sustainable energy solutions, and the escalating battery recycling initiatives are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.2 Billion |

| Market Forecast in 2034 | USD 4.1 Billion |

| Market Growth Rate (2026-2034) | 7.22% |

Battery Additives Market Analysis:

- Major Market Drivers: Some of the key drivers propelling the battery additives market growth include the growing demand for electric vehicles (EVs), energy storage systems, and advancements in renewable energy integration. Furthermore, the global push toward sustainable energy solutions is also bolstering demand for high-performance batteries, which require advanced additives for improved efficiency, longevity, and energy density.

- Key Market Trends: Several prominent trends are shaping the market, including the increasing focus on research and development (R&D) to create more effective, cost-efficient battery additives that enhance performance and reduce environmental impact.

- Geographical Trends: Asia Pacific is leading the market due to the region's dominance in EV production and the presence of major battery manufacturers in countries like China, Japan, and South Korea. Moreover, the region's growing investments in renewable energy projects and grid infrastructure upgrades are further accelerating demand for battery storage solutions, consequently driving the need for additives.

- Competitive Landscape: Some of the key market players include 3M Company, Borregaard AS, Cabot Corporation, Imerys S.A., Orion Engineered Carbons, Penox Group GmbH, SGL Carbon SE, Taiwan Hopax Chemicals Mfg. Co. Ltd., US Research Nanomaterials Inc., etc.

- Challenges and Opportunities: Some of the challenges in the market include the high cost of advanced battery additives, environmental concerns related to material extraction, and the complexity of recycling used batteries containing additives. However, there are significant opportunities in the form of ongoing technological advancements, growing investment in R&D for next-generation batteries, and the increasing adoption of clean energy systems globally.

To get more information on this market Request Sample

Battery Additives Market Trends:

Increasing sales of hybrid and electric vehicles

There is a significant shift in the automotive industry towards greener and more efficient modes of transportation, which is resulting in the augmented demand for superior performance batteries, such as lithium-ion batteries. Battery additives are one of the most essential components for EV and hybrid vehicle batteries as they enhance the performance, life span, and safety of batteries. These additives become highly instrumental in optimizing battery technology by conquering critical challenges: thermal management, cycle life, and energy density. The new battery additives improve energy storage, extend driving ranges, and ensure the safety of these vehicles. The changing automotive landscape toward electrification, along with the mutual relation between electric vehicles and battery additives, are therefore driving the market growth.

Significant improvements in the automotive infrastructure

New advancements in automotive infrastructure, including the provision of adequate charging facilities for electric vehicles (EVs) as well as pro-EV policies and standards are impelling the market. As electric vehicles (EVs) become more prevalent, the need for enhanced battery efficiency, lifespan, and safety grows. Modern infrastructure developments, such as advanced charging networks, encourage EV adoption, which in turn stimulates the demand for battery additives that improve charging cycles, capacity retention, and thermal management. With better infrastructure, faster charging stations are becoming widespread, necessitating additives that enable quicker charging cycles without compromising battery integrity or safety. The expanding infrastructure for EVs is also pushing the need for longer-lasting batteries, thereby driving demand for additives that minimize degradation and enhance the durability of batteries under frequent use.

Rising sales of consumer electronics

The increasing sales of consumer electronics are bolstering the market. Consumers continue to use various electronics, such as smartphones, laptops, wearable gadgets, as well as wireless accessories, hence the need to develop high-performance batteries in these electronics arises. Electronics are prone to overheating, especially during prolonged use, and since additives improve thermal management, ensuring safer battery operation in high-performance gadgets, their demand is on a rise. Additionally, rising sales of smartphones, laptops, and wearables that require more advanced batteries with longer lifespans are pushing manufacturers to use additives that enhance battery capacity and performance. As consumers expect faster charging and longer usage times, battery additives help improve energy storage efficiency, meeting the growing power needs of modern devices. Furthermore, with the trend toward smaller, thinner electronics, additives help increase battery energy density without increasing size, enabling compact and efficient battery designs, which is creating a positive outlook for the market.

Battery Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Breakup by Type:

- Conductive Additive

- Porous Additive

- Nucleating Additive

- Others

Conductive additive dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes conductive additive, porous additive, nucleating additive, and others. According to the report, conductive additive represented the largest segment.

Conductive additives help to increase the electrical conductivity of batteries, resulting in more efficient charge and discharge processes. These additives are especially important in lithium-ion batteries, which power a variety of devices, including electric vehicles and portable electronics. As the demand for high-performance batteries grows, particularly in the thriving electric car market, the role of conductive additives becomes more important. They help to improve battery longevity, stability, and charging speed, meeting consumer expectations for longer-lasting gadgets and cleaner energy solutions. Furthermore, the conductive additive industry is experiencing ongoing innovation, with companies producing improved materials to address the changing needs of modern energy storage. These factors are resulting in the dominance of the segment.

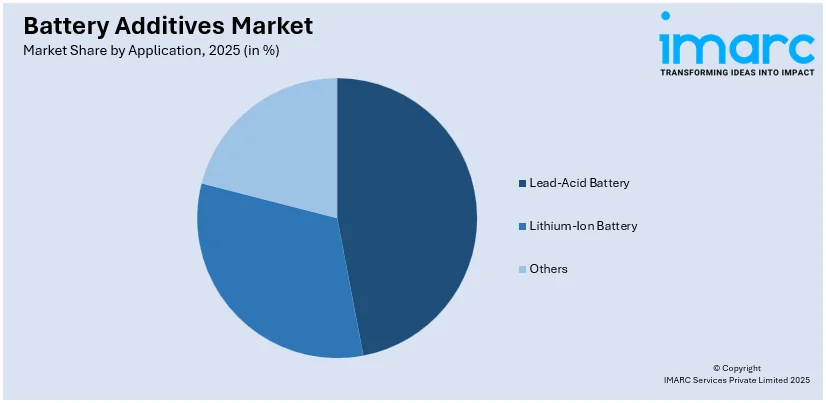

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Lead-Acid Battery

- Lithium-Ion Battery

- Others

Lead-acid battery hold the largest share in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes lead-acid battery, lithium-ion battery, and others. According to the report, lead-acid battery accounted for the largest market share.

Lead-acid batteries are commonly employed in different application areas, which include automotive, industrial, and standby power systems. It must be noted that these additives are very essential in the enhancement of the performance as well as the durability of the lead-acid batteries. They assist in overcoming widespread problems, for instance, sulfation that affects battery performance and shortens their use time. These drawbacks can however be addressed in the lead-acid batteries through the addition of the additive which promotes better reliability, long cycle life, and charge acceptance among others. This is especially so in applications, which require often uninterrupted power supply like emergency lights backup and various operating equipment in industries. In addition, in line with the growing search for environmental efficiency in industries, these additives in lead-acid batteries ensure efficiency in battery performance, longer intervals between replacements, and hence eco-friendly measures.

Breakup by End User:

- Electronics

- Automotive

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes electronics, automotive, and others.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest battery additives market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for battery additives.

Asia Pacific is a global manufacturing hub, with countries like China, Japan, and South Korea hosting major electronics and automotive industries. The region's extensive consumer electronics and electric vehicle production spurs the demand for these additives, which are crucial for improving energy storage solutions. It accelerates electric vehicle adoption, driven by government incentives, environmental concerns, and urbanization. These additives play a pivotal role in enhancing the performance and longevity of electric vehicle batteries, contributing to the growth of this market segment. With a growing middle class and increasing disposable incomes, the region experiences robust sales of consumer electronics. These additives are essential for meeting the demand for longer lasting and more efficient smartphone batteries, laptops, and other devices. It is home to several battery technology research and development centers, fostering innovation in battery additives. Collaborations between research institutions and manufacturers drive advancements in battery performance. Asia Pacific countries are increasingly focused on sustainability and reducing environmental impact. These additives support these efforts by improving the efficiency and longevity of batteries, reducing waste, and promoting cleaner energy storage solutions.

Competitive Landscape:

- The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include 3M Company, Borregaard AS, Cabot Corporation, Imerys S.A., Orion Engineered Carbons, Penox Group GmbH, SGL Carbon SE, Taiwan Hopax Chemicals Mfg. Co. Ltd., US Research Nanomaterials Inc., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Top companies are strengthening the market through multifaceted strategies. These industry leaders prioritize research and development, investing in innovative formulations and technologies that enhance battery performance, safety, and sustainability. Their collaborations with battery manufacturers and technology providers foster innovation and the integration of advanced additives into battery production processes, ensuring the continual improvement of energy storage solutions. Top companies also leverage their global presence to meet the rising demand for battery additives, especially in the expanding electric vehicle and renewable energy sectors. Furthermore, they actively comply with environmental regulations and sustainability initiatives, promoting eco-friendly battery solutions.

Battery Additives Market News:

- January 26, 2023: Cabot Corporation announced its plans to expand its conductive carbon additives (CCA) production in the United States, aimed at bolstering its market leadership and supporting the shift toward electric vehicles (EVs). The company will increase its CCA capacity at its Pampa, Texas facility, as part of a broader $200 million investment initiative over the next five years..

- November 6, 2023: Imerys announced a €43 million investment in a new state-of-the-art specialty mineral polymer additive plant in Wuhu, China. This facility will utilize Imerys’ expertise in minerals to provide the Chinese market with high-quality specialty talc solutions. The new plant aims to meet the rising demand for mineral reinforcement additives used in lightweight automotive plastics.

- September 4, 2024: Orion, a global specialty chemicals company, has officially broken ground on a new plant in La Porte, Texas. This facility will be the sole U.S. site producing acetylene-based conductive additives for lithium-ion batteries and other key applications crucial to the shift toward electrification. The additives manufactured at this new site will be notably eco-friendly, boasting only one-tenth of the carbon footprint compared to other commonly used materials.

Battery Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Conductive Additive, Porous Additive, Nucleating Additive, Others |

| Applications Covered | Lead-Acid Battery, Lithium-Ion Battery, Others |

| End Users Covered | Electronics, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Borregaard AS, Cabot Corporation, Imerys S.A., Orion Engineered Carbons, Penox Group GmbH, SGL Carbon SE, Taiwan Hopax Chemicals Mfg. Co. Ltd., US Research Nanomaterials Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global battery additives market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global battery additives market?

- What is the impact of each driver, restraint, and opportunity on the global battery additives market?

- What are the key regional markets?

- Which countries represent the most attractive battery additives market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the battery additives market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the battery additives market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the battery additives market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global battery additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the battery additives market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global battery additives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the battery additives industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)