Base Oil Market Report by Type (Mineral, Synthetic, Bio-Based), Group (Group I, Group II, Group III, Group IV, Group V), Application (Automotive Oil, Industrial Oil, Metalworking Fluids, Hydraulic Oil, Greases, and Others), and Region 2026-2034

Base Oil Market Overview:

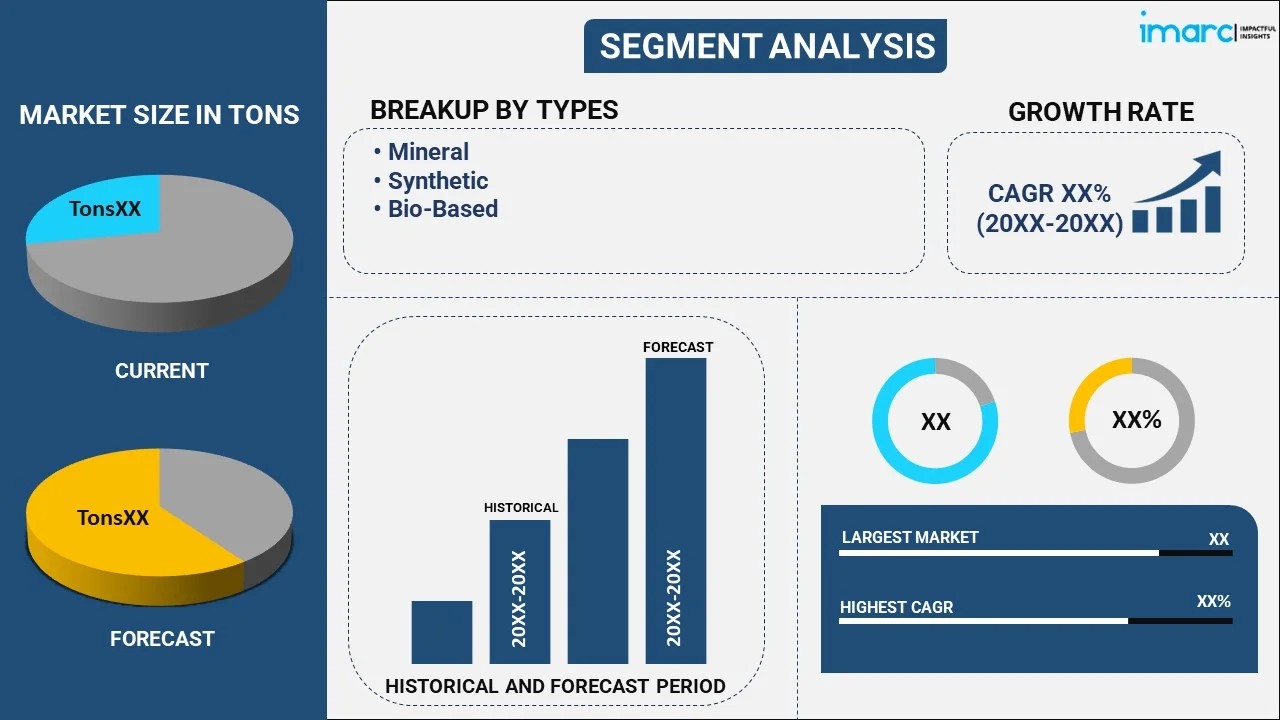

The global base oil market size reached 34.5 Million Tons in 2025. Looking forward, IMARC Group expects the market to reach 40.7 Million Tons by 2034, exhibiting a growth rate (CAGR) of 1.82% during 2026-2034. The growing implementation of stringent emission regulations, rising adoption of reprocessed items to lessen ecological footprint without compromising on product effectiveness, and the increasing demand for synthetic lubricants on account of their superior performance are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

34.5 Million Tons |

|

Market Forecast in 2034

|

40.7 Million Tons |

| Market Growth Rate 2026-2034 | 1.82% |

Base Oil Market Analysis:

- Major Market Drivers: The market is experiencing steady growth due to the rising automotive production. Besides this, the growing focus on energy efficiency and the shift toward high-performance lubricants is positively influencing the market.

- Key Market Trends: There is a demand for synthetic base oils because of their superior performance in extreme temperatures and improved fuel efficiency. Additionally, environment-friendly bio-based oils are gaining traction, driven by regulatory pressure and sustainability goals.

- Geographical Trends: Asia Pacific leads the market owing to the growing need for lubricants across various industries, increasing infrastructure development, and rising vehicle production.

- Competitive Landscape: Some of the major market players in the industry include Abu Dhabi National Oil Company, Bharat Petroleum Corporation Limited, BP plc, Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Evonik Industries AG, Exxon Mobil Corporation, Petroliam Nasional Berhad (PETRONAS), Phillips 66 Company, PT Pertamina (Persero), Repsol S.A., Saudi Arabian Oil Co., Shell plc, and TotalEnergies SE.

- Challenges and Opportunities: The fluctuating crude oil prices and the environmental impact of base oil production are influencing the base oil market revenue. However, opportunities in the rising demand for eco-friendly lubricants, technological advancements in refining, and expanding applications in various sectors are propelling the market growth.

To get more information on this market Request Sample

Base Oil Market Trends:

Increasing Demand for Synthetic Lubricants

The increasing demand for synthetic lubricants, which often utilize group III and group IV base oils, represents one of the key factors impelling the market growth. Synthetic lubricants offer superior performance, particularly in extreme temperatures and high-pressure environments, making them ideal for automotive, industrial, and aviation applications. Industries are seeking more durable and efficient lubricants to enhance machinery performance and reduce maintenance costs, which is facilitating the adoption of synthetic lubricants. The growing awareness about the benefits of synthetic oils, including better fuel efficiency and lower emissions, is driving the higher-quality base oil demand in their formulation. In 2024, AMSOIL launched its Synthetic-Blend Motor Oil series for mechanics, offered in 0W-20, 5W-20, and 5W-30 viscosities. This latest product includes more than 50% synthetic base oils, providing improved protection and performance in comparison to traditional oils. It is made to fulfill the needs of contemporary engines, including direct injection and turbocharged models.

Advancements in Base Oil Recycling Technologies

Recycling used lubricants is becoming an increasingly viable option as recycling technologies are improving. This is driving the need for premium base oils, as they are crucial for producing re-refined oils that comply with contemporary performance requirements. Reprocessed base oils provide a sustainable option for businesses seeking to lessen their ecological footprint without compromising on product effectiveness. Besides this, advancements in technology during re-refining, like vacuum distillation and hydrotreating, enable the creation of base oils that match the quality of virgin oils. This trend is offering a favorable base oil market outlook by meeting the growing needs of environmentally aware industries and individuals. In 2024, TotalEnergies acquired Tecoil, a Finnish company specializing in re-refined base oils, to enhance the production of environment-friendly, high-quality lubricants. Tecoil's facility in Finland processes 50,000 tons of re-refined base oils annually, aiding TotalEnergies in satisfying the growing demand for eco-friendly base oils. This purchase will enable TotalEnergies to speed up the utilization of re-refined base oils in its high-quality lubricant manufacturing, matching the increasing need for eco-friendly products in the automotive and industrial fields.

Environmental Regulations and Sustainability

The implementation of stringent regulations on emissions is leading to the creation of higher-quality, eco-friendly base oils. Companies are investing in base oils that offer enhanced performance while reducing environmental impact. These oils are less polluting and provide improved fuel efficiency, aligning with the efforts to reduce greenhouse gas emissions. Businesses are focusing on using renewable and biodegradable base oils to adhere to regulations and meet user demands for sustainability. In 2024, Stellantis launched Quartz EV3R 10W-40, the first sustainable engine lubricant produced entirely from regenerated oils in its SUSTAINera RECYCLE collection. Created in partnership with TotalEnergies Lubrifiants, this environment-friendly lubricant offers the same performance as those made from virgin oils and notably reduces carbon emissions. The project is in line with Stellantis' circular economy plan to advance sustainability in the automotive sector.

Base Oil Market Segmentation:

IMARC Group provides an analysis of the key base oil market trends in each segment, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, group, and application.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Mineral

- Synthetic

- Bio-Based

Mineral accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes mineral, synthetic, and bio-based. According to the report, mineral represented the largest segment.

Mineral account for the majority of the market share because of its widespread availability and reduced production expenses. It is obtained from crude oil through refining processes and is used in various lubricant formulations across industries. Mineral base oil provides sufficient performance for a broad range of applications like automotive oils, industrial lubricants, and hydraulic fluids, making it the preferred choice for manufacturers in cost-sensitive markets. According to base oil market insights, this segment continues to dominate due to its established infrastructure and high demand in developing regions.

Breakup by Group:

- Group I

- Group II

- Group III

- Group IV

- Group V

Group I hold the largest share of the industry

A detailed breakup and analysis of the market based on the group have also been provided in the report. This includes group I, group II, group III, group IV, and group V. According to the report, group I accounted for the largest market share.

Group I dominate the market because of their widespread use in various applications and cost-effectiveness. These oils are produced using solvent refining processes and offer good performance in a range of general-purpose lubricants like engine oils, industrial oils, and greases. The large-scale production of group I oils, especially in regions with established refining infrastructure, contributes to their dominant market share. According to the base oil market forecast, group I oils are retaining a notable market share, particularly in cost-sensitive applications and regions with lower regulatory pressures.

Breakup by Application:

- Automotive Oil

- Industrial Oil

- Metalworking Fluids

- Hydraulic Oil

- Greases

- Others

Automotive oil represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive oil, industrial oil, metalworking fluids, hydraulic oil, greases, and others. According to the report, automotive oil represented the largest segment.

Automotive oil holds the biggest market share, driven by the extensive use of lubricants in the maintenance and functioning of vehicles. The rising vehicle ownership is driving the demand for automotive oils, including engine oils, transmission fluids, and gear oils. The base oil industry outlook remains positive, as the increasing adoption of fuel-efficient and low-emission vehicles is driving the need for high-performance oils. Automotive oils rely on base oils as a key component to ensure efficient engine performance, reduce friction, and enhance fuel efficiency. The growing emphasis on fuel-efficient vehicles and the increasing use of synthetic and semi-synthetic oils, which provide superior performance, are catalyzing the demand for higher-quality base oils in this segment. In 2024, Energizer Holding, Inc. and Assurance Intl Limited announced the launch of STP lubricants and oil solutions in India, including engine oil, transmission oil, and diesel exhaust fluid. The collaboration focuses on high-performance products featuring proprietary synthetic base oil technology and advanced additives for superior engine protection.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest base oil market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for base oil.

Asia Pacific leads the market due to its strong industrial growth, increasing urbanization, and robust automotive and manufacturing sectors. The rising demand for base oils is driven by the growing need for lubricants across various industries, alongside infrastructure development and increased vehicle production. This high demand, coupled with ongoing investments in refining capacities, is bolstering the base oil market growth. The dominance is further supported by the presence of major refineries and base oil production facilities, ensuring a steady supply of products to meet the growing demand across various industries. In 2023, Bharat Petroleum Corp. Ltd. (BPCL) approved a $6 billion investment to add petrochemical production capacity, including an ethylene cracker, at its Bina refinery in Madhya Pradesh. Additionally, BPCL planned to invest in storage installations and pipelines for petroleum oil lubricants (POL) and lube base oil stocks (LOBS) at Rasayani, Maharashtra. These projects were aimed at expanding petrochemical capacity and integrating green energy solutions like wind power at their refineries.

Competitive Landscape:

- The base oil market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include Abu Dhabi National Oil Company, Bharat Petroleum Corporation Limited, BP plc, Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Evonik Industries AG, Exxon Mobil Corporation, Petroliam Nasional Berhad (PETRONAS), Phillips 66 Company, PT Pertamina (Persero), Repsol S.A., Saudi Arabian Oil Co., Shell plc, TotalEnergies SE, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are focusing on expanding their production capacities and investing in advanced refining technologies to enhance product quality and meet the growing demand for high-performance oils. They are also prioritizing the development of eco-friendly and synthetic base oils to align with increasing environmental regulations and sustainability goals. Strategic collaborations and mergers are being pursued to strengthen market presence and expand geographically. As base oil market dynamics shift toward sustainability and performance innovation, companies are leveraging new technologies to stay competitive and meet evolving industry standards. In 2024, Cerilon entered into technology licensing agreements with Chevron to use Chevron's Hydroprocessing technologies at its gas-to-liquids (GTL) facility in North Dakota. This facility will produce ultra-low sulfur diesel and Group III+ base oils, high-quality lubricants with superior performance. The project marks a key development in converting natural gas into premium synthetic products.

Base Oil Market News:

- March 2024: The Prime Minister of India inaugurated Bharat Petroleum Corporation Limited's (BPCL) projects worth Rs 9,800 crore. This includes an enhancement at the Mumbai Refinery to increase the production of Group III base oils, which are high-quality lubricants.

- February 2024: Chevron Lummus Global (CLG) commissioned the world's largest white oil hydroprocessing unit for Hongrun Petrochemical in China, with a capacity to produce 500,000 metric tons of API Group III base oils annually. This unit also includes facilities for producing industrial and food-grade white oil.

- September 2023: Petronas Lubricants International and PT Kilang Pertamina signed a Joint Study Agreement to explore the development of a greenfield lube base oil plant in Central Java. The plant is expected to produce up to 800 tons per day of high-grade base oils to meet the growing demand in Indonesia, China, and Southeast Asia.

Base Oil Industry Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral, Synthetic, Bio-Based |

| Groups Covered | Group I, Group II, Group III, Group IV, Group V |

| Applications Covered | Automotive Oil, Industrial Oil, Metalworking Fluids, Hydraulic Oil, Greases, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abu Dhabi National Oil Company, Bharat Petroleum Corporation Limited, BP plc, Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Evonik Industries AG, Exxon Mobil Corporation, Petroliam Nasional Berhad (PETRONAS), Phillips 66 Company, PT Pertamina(Persero), Repsol S.A., Saudi Arabian Oil Co., Shell plc, TotalEnergies SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the base oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the base oil industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global base oil market reached a volume of 34.5 Million Tons in 2025.

We expect the global base oil market to exhibit a CAGR of 1.82% during 2026-2034.

The rising utilization of base oil, as it aids in creating a thin film for enhancing heat transfer and reducing tension between moving parts, is primarily driving the global base oil market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for base oil.

Based on the type, the global base oil market can be segmented into mineral, synthetic, and bio-based. Currently, mineral holds the majority of the total market share.

Based on the group, the global base oil market has been divided into group I, group II, group III, group IV, and group V. Among these, group I currently exhibits a clear dominance in the market.

Based on the application, the global base oil market can be categorized into automotive oil, industrial oil, metalworking fluids, hydraulic oil, greases, and others. Currently, automotive oil accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global base oil market include Abu Dhabi National Oil Company, Bharat Petroleum Corporation Limited, BP plc, Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Evonik Industries AG, Exxon Mobil Corporation, Petroliam Nasional Berhad (PETRONAS), Phillips 66 Company, PT Pertamina(Persero), Repsol S.A., Saudi Arabian Oil Co., Shell plc, and TotalEnergies SE.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)