Barrier Films Market Report by Type (Metalized Barrier Films, Transparent Barrier Films, White Barrier Film), Material (Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), and Others), End Use (Food and Beverage Packaging, Pharmaceutical Packaging, Agriculture, and Others), and Region 2026-2034

Market Overview:

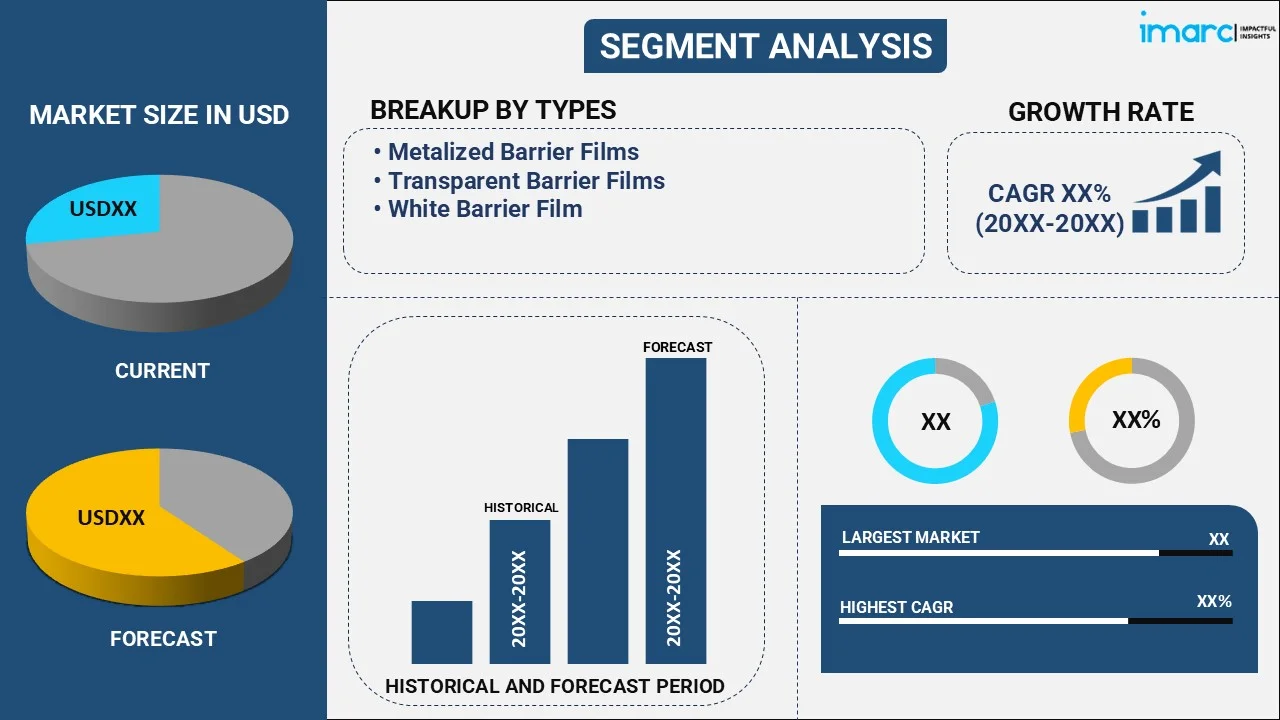

The global barrier films market size reached USD 38.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 54.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.03% during 2026-2034. Asia-Pacific dominates the market, driven by the broadening of e-commerce platforms and escalating need for portable and lightweight packaging solutions. Increasing demand for packaged food items, recent advancements in pharmaceutical packaging, and the globalization of supply chain are propelling the market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 38.0 Billion |

| Market Forecast in 2034 | USD 54.2 Billion |

| Market Growth Rate 2026-2034 | 4.03% |

Barrier films refer to specialized packaging materials designed to control the permeation of gases, moisture, or light, thereby extending the shelf-life and maintaining the quality of the packaged contents. It includes polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and ethylene vinyl alcohol (EVOH), each offering unique barrier properties. Barrier films are widely used in food packaging, pharmaceuticals, electronics, agriculture, cosmetics, vacuum insulation panels, solar cells, flexible displays, and gas separation. They are cost-effective, durable, and versatile products that aid in prolonging shelf-life, maintaining freshness, and preventing spoilage.

To get more information on this market, Request Sample

The widespread product adoption due to the escalating demand for portable and lightweight packaging solutions in various industries, such as consumer goods and automotive, is propelling the market growth. Additionally, the recent technological innovations resulting in new types of barrier films with specialized functionalities, such as antimicrobial or flame-retardant properties, are contributing to the market growth. Furthermore, the globalization of supply chains, which require more robust packaging solutions to ensure product safety and quality during longer transit times, is acting as another growth-inducing factor. Furthermore, the widespread product utilization in automotive industry for battery packaging, where moisture and oxygen control are essential. Besides this, the increasing product utilization in the cosmetics industry for protective and aesthetically pleasing packaging is strengthening the market growth.

Barrier Films Market Trends:

Expansion of pharmaceutical and healthcare sectors

Barrier films are widely used in the thriving pharmaceutical and healthcare industries to ensure product safety, stability, and shelf life. Medicines, vaccines, and medical devices require packaging that prevents contamination, moisture ingress, and chemical degradation. The expansion of the pharmaceutical sector, driven by rising healthcare awareness, aging populations, and increasing chronic diseases, has heightened the demand for high-performance barrier films. As per the IMARC Group, the India pharmaceutical market size was valued at USD 61.36 Billion in 2024. Moreover, innovations in drug delivery systems, cold-chain logistics, and sterile packaging are creating opportunities for advanced film solutions. As government agencies and healthcare organizations are focusing on maintaining quality standards and regulatory compliance, barrier films are playing an essential role.

Broadening of e-commerce portals

The rise of e-commerce platforms is driving the demand for protective packaging solutions, including barrier films. As per industry reports, the US e-commerce revenue reached USD 352.93 Billion during Q4 2024. Products shipped across long distances require packaging that maintains quality, prevents leakage, and protects against environmental factors like humidity, oxygen, and contamination. The increasing volume of online orders, particularly for food, pharmaceuticals, and electronics, has led to higher adoption of barrier films in shipping and transit packaging. Additionally, advancements in cold-chain logistics demand high-performance films for temperature-sensitive goods. Companies prioritize films that are lightweight, durable, and flexible to reduce shipping costs while maintaining product integrity. This surge in online retail and global trade is directly driving the adoption of barrier films across multiple industries worldwide.

Rising consumer preferences for convenience food items

Consumer demand for ready-to-eat (RTE) meals, pre-packaged snacks, and frozen food products is growing rapidly due to urbanization, busy lifestyles, and disposable income increase. In 2024, Italy's frozen food consumption at home increased by 1.3%, totaling 652,643 Tons, as reported by the Italian Frozen Food Institute (IIAS). Barrier films are critical in maintaining the freshness, taste, and nutritional value of these convenience food items. They prevent spoilage caused by moisture, oxygen, or microbial contamination, extending product shelf life and reducing food waste. Manufacturers are increasingly incorporating barrier films into flexible pouches, vacuum packs, and multi-layer food packaging to meet these consumer expectations. With the trend of healthier and fresh-tasting packaged food items, the demand for high-performance barrier films continues to grow.

Key Growth Drivers of Barrier Films Market:

Surging need for sustainable and eco-friendly packaging

Environmental concerns and stringent regulations are encouraging companies to adopt sustainable packaging solutions, including biodegradable and recyclable barrier films. Consumers and governments increasingly favor materials that reduce plastic waste, lower carbon footprints, and are compliant with environmental standards. Barrier films can be engineered using bio-based polymers and multi-layer structures that maintain performance while being eco-friendly. This trend is particularly significant in Europe and North America, where packaging sustainability is a critical market growth driver. Companies investing in research to develop compostable or recyclable barrier films are gaining a competitive advantage. As sustainability continues to shape consumer preferences and regulatory frameworks are tightening, the demand for innovative barrier films designed to protect products while minimizing environmental impact will remain a major driver for the market expansion.

Increasing demand from electronics and electrical industries

Barrier films are essential in the electronics and electrical sector for protecting sensitive components from moisture, oxygen, and dust. As consumer electronics, including smartphones, tablets, and wearable devices, are becoming more prevalent, the need for reliable packaging materials is rising. Advanced barrier films ensure the integrity and longevity of electronic components during storage and transportation. The growth of e-mobility, renewable energy devices, and electronic components for industrial automation is also contributing to the market expansion. Manufacturers are seeking high-performance films that offer thin profiles without compromising protection, making barrier films an ideal solution. With rapid technological advancements and the growing electronics market, the adoption of barrier films is expected to increase.

Technological advancements in barrier film production

Innovations in film production technologies are driving the market expansion by enhancing performance, versatility, and application scope. Multi-layer extrusion, co-extrusion, and coating techniques allow the production of films with superior barrier properties against moisture, oxygen, and light. Advanced films can also combine functionality with flexibility, transparency, and printability, meeting diverse industry requirements. Improved production methods reduce material waste, lower energy consumption, and increase cost-effectiveness, which attracts manufacturers. Companies continuously spending on research and development (R&D) activities are launching films that cater to specific applications, such as high-barrier food packaging, pharmaceutical blister packs, or industrial protective layers. Technological progress is ensuring continuous improvement in product quality and expanding the market by meeting evolving consumer and industrial demands.

Barrier Films Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global barrier films market report, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, material, and end use.

Breakup by Type:

- Metalized Barrier Films

- Transparent Barrier Films

- White Barrier Film

The report has provided a detailed breakup and analysis of the market based on type. This includes metalized barrier films, transparent barrier films, and white barrier film.

Metalized barrier films are highly effective in blocking moisture, oxygen, and light. This superior barrier function is especially critical in the food and pharmaceutical sectors, where maintaining the integrity and shelf-life of products is a primary concern. Furthermore, they offer a cost-effective alternative to foil-based laminates while still providing comparable barrier properties. Additionally, the aesthetic appeal of metalized films, with their glossy and premium finish, attracts consumer attention, making them a preferred choice for packaging luxury goods and high-quality products.

Transparent barrier films allow for easy product visibility, which is a significant advantage in retail settings. Consumers often prefer to see the actual product before purchase, making transparent barrier films a favored choice in food and consumer goods packaging. Additionally, the advancements in material science have enabled transparent films to achieve excellent barrier properties without the need for opaque materials. Besides this, transparent barrier films are highly adaptable and can be used in conjunction with other materials in multi-layer packaging solutions.

Breakup by Material:

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyamides (PA)

- Ethylene Vinyl Alcohol (EVOH)

- Linear Low-Density Polyethylene (LLDPE)

- Others

Polyethylene (PE) hold the largest share in the market

A detailed breakup and analysis of the market based on material has also been provided in the report. This includes polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), polyamides (PA), ethylene vinyl alcohol (EVOH), linear low-density polyethylene (LLDPE), and others. According to the report, polyethylene (PE) represented the largest segment.

Polyethylene is known for its excellent moisture barrier properties, which are crucial for packaging perishable goods like food and pharmaceuticals, where moisture ingress can adversely affect product quality and shelf life. Additionally, it is cost-effective to produce, making it an attractive option for companies aiming to control manufacturing costs without compromising on quality. Furthermore, polyethylene exhibits high chemical resistance, which makes it suitable for applications involving contact with various substances, including acids, alkalis, and solvents. Besides this, polyethylene films offer a good degree of mechanical strength and durability, providing the required toughness for packaging that withstands transportation, handling, and other stresses. Along with this, it is highly flexible and can be easily adapted into various forms and sizes, offering versatility in packaging design.

Breakup by End Use:

- Food and Beverage Packaging

- Pharmaceutical Packaging

- Agriculture

- Others

Food and beverage packaging holds the largest share in the market

A detailed breakup and analysis of the market based on end use has also been provided in the report. This includes food and beverages packaging, pharmaceutical packaging, agriculture, and others. According to the report, food and beverage packaging accounted for the largest market share.

Barrier films are widely used in food and beverage (F&B) packaging as they offer excellent resistance against moisture, oxygen, and light, all of which contribute to the degradation of food items. Furthermore, barrier films offer aesthetic advantages to F&B products, such as clarity and a premium look, which are valuable for brand positioning in a competitive market. Additionally, they meet the stringent regulations imposed by food safety authorities, ensuring that the packaged contents are free from contamination. Besides this, the growing international trade of food and beverages (F&B) necessitates packaging that can withstand long shipping times and varying environmental conditions. Barrier films offer the required mechanical strength and protective attributes, ensuring that products reach global markets in optimal condition.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

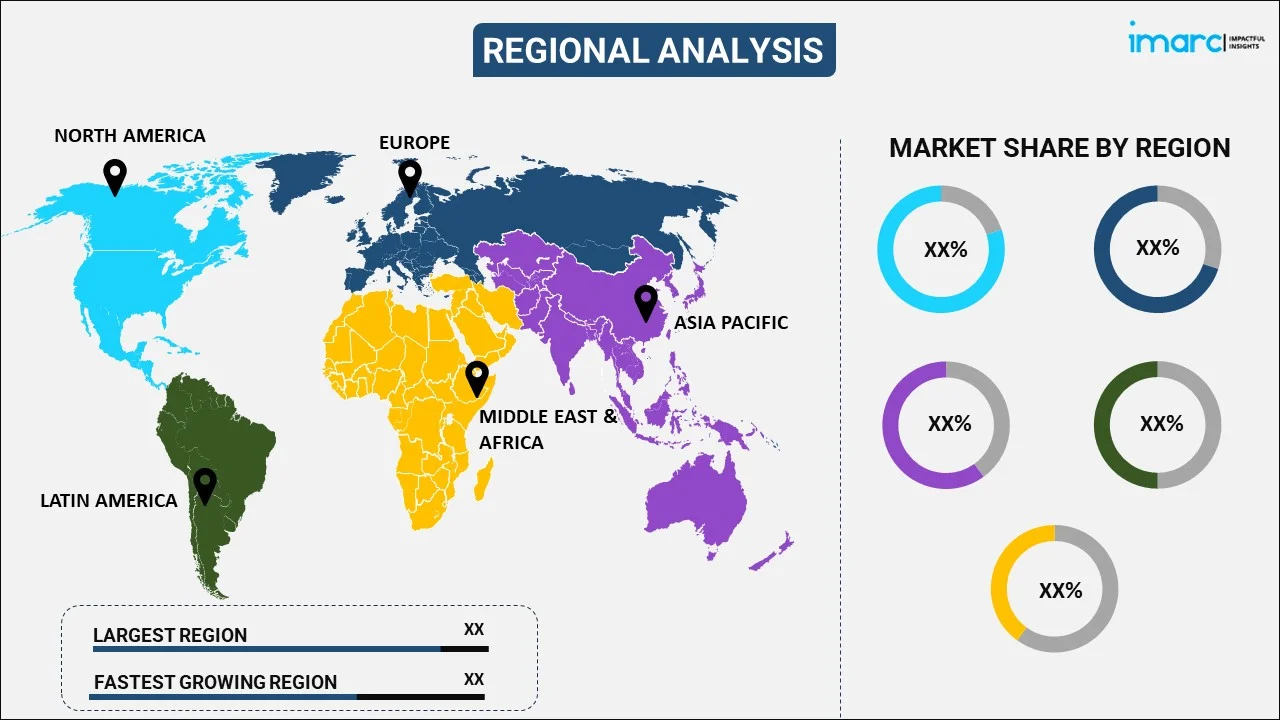

Asia Pacific exhibits a clear dominance, accounting for the largest barrier films market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific has witnessed a rise in industrial activities, creating a high demand for packaging solutions, including barrier films. Furthermore, the region has a burgeoning food and beverage (F&B) industry, which requires effective packaging solutions to extend shelf life and preserve quality. Along with this, the growing demand for packaged goods due to the increasing middle-class population and disposable incomes is acting as another growth-inducing factor. Additionally, local manufacturers are investing in research and innovation to produce high-quality barrier films, making the region self-sufficient and even an exporter. Besides this, the manufacturing costs in Asia Pacific are relatively low, which makes the production of barrier films more cost-effective compared to other regions. Moreover, the imposition of supportive policies by regional governments encouraging manufacturing activities is supporting the market growth.

Competitive Landscape:

Several companies are investing in research and innovation to create more efficient and sustainable barrier film solutions. Furthermore, they are looking at improving characteristics such as barrier properties, biodegradability, and recyclability. Additionally, leading players are engaging in merger and acquisition (M&A) activities to expand their product portfolio and reach. Along with this, they are increasingly focusing on meeting specific customer needs, offering customized solutions for various applications like food packaging, pharmaceuticals, and electronics. Besides this, leading companies are developing eco-friendly barrier films that are either recyclable or biodegradable to attract eco-conscious consumers. Moreover, companies are forming alliances and partnerships with material suppliers, technology providers, and even competitors to collectively advance the technology and lower costs. Apart from this, they are improving their quality control and assurance mechanisms to gain customer trust and regulatory approval.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amcor Plc

- Berry Global Inc.

- Cosmo Films Ltd.

- Dupont Teijin Films

- Flair Flexible Packaging Corporation

- HPM Global Inc

- Jindal Poly Films Ltd.

- Mondi plc

- Sealed Air Corporation

- Toppan Inc.

Recent Developments:

- September 2025: TIPA Compostable Packaging revealed an extension of its portfolio with the addition of four new high-barrier film and laminate offerings. The laminates furthered TIPA’s goal of providing compostable options without sacrificing performance, barrier, or compatibility with machines.

- July 2025: RDM Group, a top manufacturer of recycled cartonboard, collaborated with Ecopol, an expert in biodegradable and water-soluble film technologies, to create a groundbreaking recyclable barrier board. Combining Ecopol’s functional barrier film with RDM Group's board would result in packaging that was both functional and entirely recyclable.

- June 2025: Coveris unveiled a new board-based MAP tray solution for the meat, fish, and poultry industries, asserting a 90% reduction in plastic usage while maintaining recyclability and product durability. The groundbreaking BarrierFresh MAP trays combined sustainably sourced cardboard with a uniquely engineered EVOH barrier film to produce a completely printable, airtight, single-SKU package capable of maintaining product quality and recyclability for the chilled meat, fish, and poultry industries. The trays had a durability of 21 days.

Barrier Films Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Metalized Barrier Films, Transparent Barrier Films, White Barrier Film |

| Materials Covered | Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), Others |

| End Uses Covered | Food and Beverage Packaging, Pharmaceutical Packaging, Agriculture, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, Berry Global Inc., Cosmo Films Ltd., Dupont Teijin Films, Flair Flexible Packaging Corporation, HPM Global Inc, Jindal Poly Films Ltd., Mondi plc, Sealed Air Corporation, Toppan Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the barrier films market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global barrier films market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the barrier films industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global barrier films market was valued at USD 38.0 Billion in 2025.

The barrier films market is projected to exhibit a CAGR of 4.03% during 2026-2034, reaching a value of USD 54.2 Billion by 2034.

The shift towards lightweight, flexible packaging over rigid formats is encouraging manufacturers to use barrier films for improved sustainability and cost efficiency. Technological advancements, such as nano-coatings, bio-based films, and high-barrier laminates, enhance performance and support regulatory compliance. Rising pharmaceutical production and stringent protection requirements for medical supplies are also strengthening the demand, making barrier films essential across multiple industrial applications.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous production activities for barrier films.

Based on the material, the global barrier films market has been segregated into Polyethylene Teraphthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), and others. Among these, Polyethylene (PE) currently exhibits a clear dominance in the market.

Based on the end use, the global barrier films market can be bifurcated into food and beverage packaging, pharmaceutical packaging, agriculture, and others. Currently, the food and beverage packaging industry holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global barrier films market include Amcor plc, Berry Global Inc., Cosmo Films Ltd., Dupont Teijin Films, Flair Flexible Packaging Corporation, HPM Global Inc, Jindal Poly Films Ltd., Mondi plc, Sealed Air Corporation, and Toppan Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)