Barley Market Size, Share, Trends and Forecast by Type, Grade, Distribution Channel, Industry Vertical, and Region, 2026-2034

Barley Market 2025, Size and Overview:

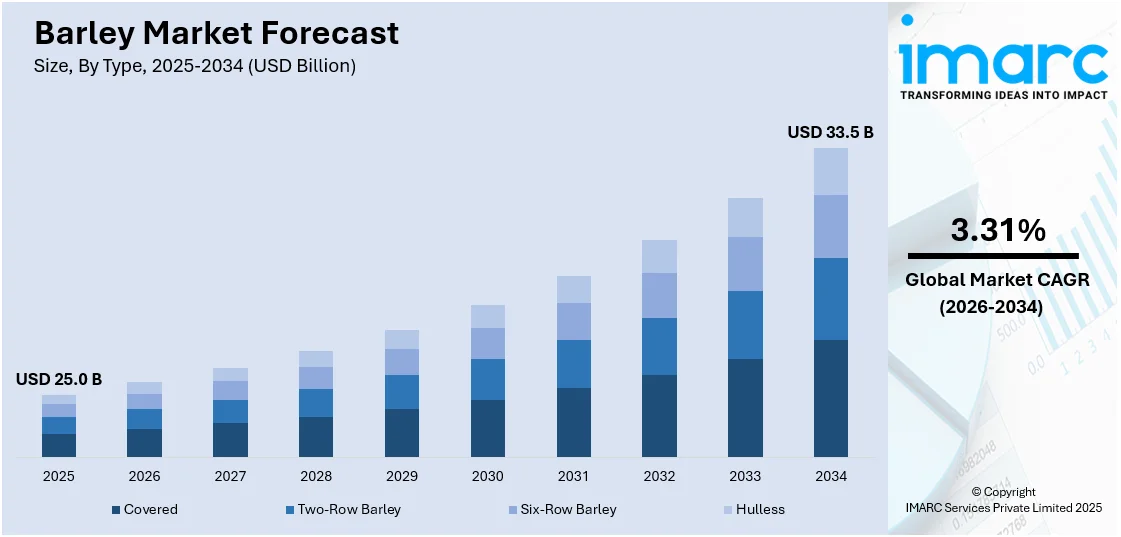

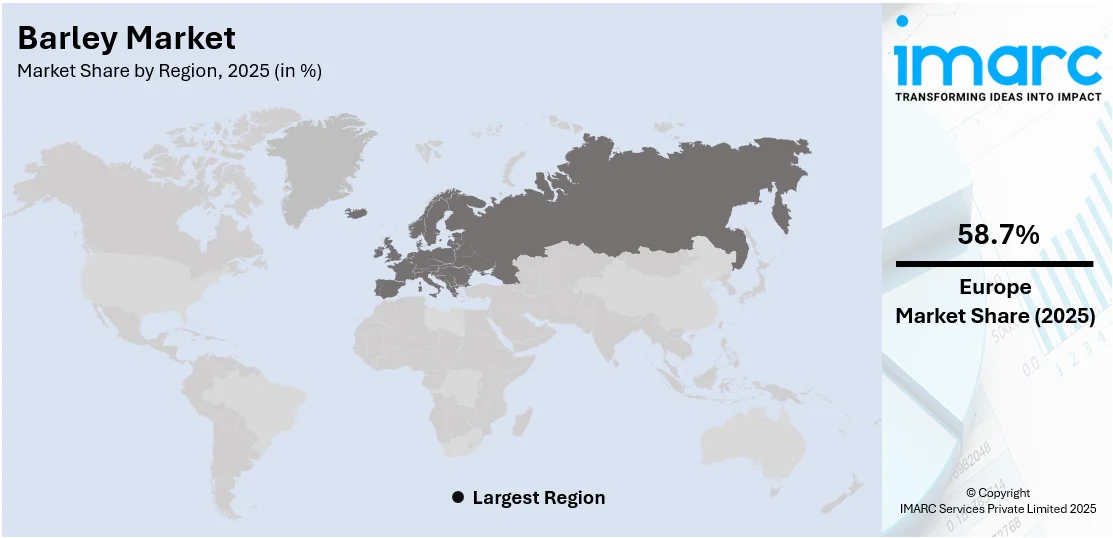

The global barley market size was valued at USD 25.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 33.5 Billion by 2034, exhibiting a CAGR of 3.31% from 2026-2034. Europe currently dominates the market, holding a market share of over 58.7% in 2025. The global market is largely influenced by its significant demand in the brewing and food industries, influenced by climate conditions, technological advancements in agriculture, international trade policies, and changing economic factors and supply and consumer trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 25.0 Billion |

|

Market Forecast in 2034

|

USD 33.5 Billion |

| Market Growth Rate 2026-2034 | 3.31% |

The extensive use of barley across industries, especially in brewing, animal feed, and food production, serves as the primary driver of the global barley market. The increasing demand for malt-based beverages, such as beer and whiskey, has significantly boosted the need for barley as a key ingredient. This trend is supported by the growing consumer preference for high-quality and innovative beverage offerings. Furthermore, barley is a vital component in livestock feed, offering essential nutrients that promote animal health and productivity. This application continues to grow as the demand for meat and dairy products rises, making barley indispensable in the agricultural supply chain.

To get more information on this market Request Sample

The United States barley market thrives on its versatile applications in brewing and animal feed. As a key ingredient in malt, barley plays a crucial role in meeting the brewing industry’s demand for beer and spirits. Its high nutritional value also makes it an essential component of livestock feed, supporting the growing meat and dairy sectors. Advancements in agricultural techniques have enhanced yields and quality, ensuring a steady and reliable supply. Moreover, with a shift toward sustainable farming and increased investments in barley cultivation, the crop continues to strengthen its importance in U.S. agriculture. For instance, according to industry reports, Idaho farmers contributed 39% of the nation’s barley production in 2024, up from 33% in 2023, reflecting the crop's expanding role in key agricultural states.

Barley Market Trends:

Climate and Environmental Conditions

The cultivation and yield are heavily dependent on climatic and environmental factors. Ideal growing regions feature temperate climates, providing the cool and dry conditions necessary for optimal growth. For instance, yields in the European Union that have favorable conditions can be 4 to 6 metric tons per hectare. Too much heat or moisture can also be detrimental, reducing the yield by up to 30%. Sensitivity to the composition of the soil and pH levels also plays a significant role, as the ideal pH range for the growth of barley is 6 to 7. Generally, areas with better climatic conditions tend to produce higher yields, such as, Canada and Russia. The country of Canada produced 8.4 million metric tons of barley in 2023. However, due to climate change and weather variability, availability and prices can change greatly. The U.S. and Europe had a drought condition in 2022, which resulted in a 10% decline in barley production, thereby contributing to a 15% increase in global barley prices. These fluctuations have an effect on the global supply chain and dynamics, making the barley market very sensitive to environmental aspects.

Rising Demand in Brewing and Food Industries

Its role as a crucial ingredient in the brewing industry, especially for malt production in beer manufacturing, underlines its market significance. According to a report by the Brewers Association, global beer consumption in 2023 reached approximately 198 billion liters, directly boosting the demand for barley, particularly for malt production. The global increase in beer consumption directly provides a boost to the demand. Concurrently, the growing trend towards health-conscious eating has amplified the use in food products. Its nutritional value, marked by high fiber content and essential vitamins, adds to its appeal. Its versatility, evident in its use in a variety of food products, including soups, bread, and cereals, further augments its demand. As consumer preferences continue to change and products gain popularity, the demand from both the brewing and food industries considerably propels the market forward.

Technological Advancements in Agriculture

The role of technology in agriculture has been transformative for the market. Advances in farming practices, enhanced seed varieties, and more effective irrigation systems have collectively contributed to higher yields and improved crop quality. For example, the use of precision agriculture, which utilizes data analysis and GPS technology, has been shown to increase crop yields by up to 20% while reducing water usage by approximately 30%. The adoption of precision agriculture, leveraging data analysis and GPS technology, enables farmers to refine their planting, watering, and harvesting strategies. These technological advancements bolster production efficiency and mitigate the effects of environmental challenges. As a result, these innovations lead to a more stable and predictable supply, significantly influencing global market dynamics. This aspect underscores the intersection of technology and agriculture in shaping the future trajectory of the market.

Barley Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global barley market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, grade, distribution channel, and industry vertical.

Analysis by Type:

- Covered

- Two-Row Barley

- Six-Row Barley

- Hulless

Covered, distinguished by its husk that remains attached during harvesting and processing, represents the largest segment of the barley market. This feature makes it particularly suitable for animal feed and certain brewing processes. The husk provides a protective layer, making the cereal more resilient to environmental factors and pests during cultivation. Its wide application in the animal feed industry, driven by the growing demand for livestock products, significantly contributes to its dominant market position. Furthermore, certain traditional beer brewing methods favor covered cereal, adding to its demand in the brewing industry.

Analysis by Grade:

- Food Grade

- Feed Grade

- Malt Grade

Malt grade leads the market with around 41.5% of market share in 2025. Malt grade, the largest segment in the market, is primarily utilized in the brewing and distilling industries. This grade is preferred for its high enzyme content, optimal starch levels, and the ability to efficiently convert starches into sugars during the malting process. These sugars are crucial for fermentation in beer and whiskey production. Malt grade is carefully cultivated to meet specific quality criteria, including uniformity in kernel size, color, and moisture content, which are essential for consistent brewing and distilling outcomes. The fact that it delivers better results in the fermentation process indicates its importance in the production of quality alcoholic end products establishing its dominance in the global barley market.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

Supermarkets and hypermarkets lead the market with around 59.8% of market share in 2025. Supermarkets and hypermarkets form the largest segment of the market distribution channel. These large retail establishments offer a wide range of products, including whole variant, flakes, and pearled, catering to a broad consumer base. The convenience of finding a variety of products under one roof, along with competitive pricing and the availability of both national and private label brands, makes supermarkets and hypermarkets a preferred shopping destination for customers. Furthermore, the large number of outlets and strong supply chain of these retailers also guarantee timely supply of goods in both the urban and distant retail outlets. Promotional campaigns for a definite period, special offers on purchases of bulk amounts, and loyalty programs also contribute to increased consumer reach, making supermarkets and hypermarkets as vital for barley sale.

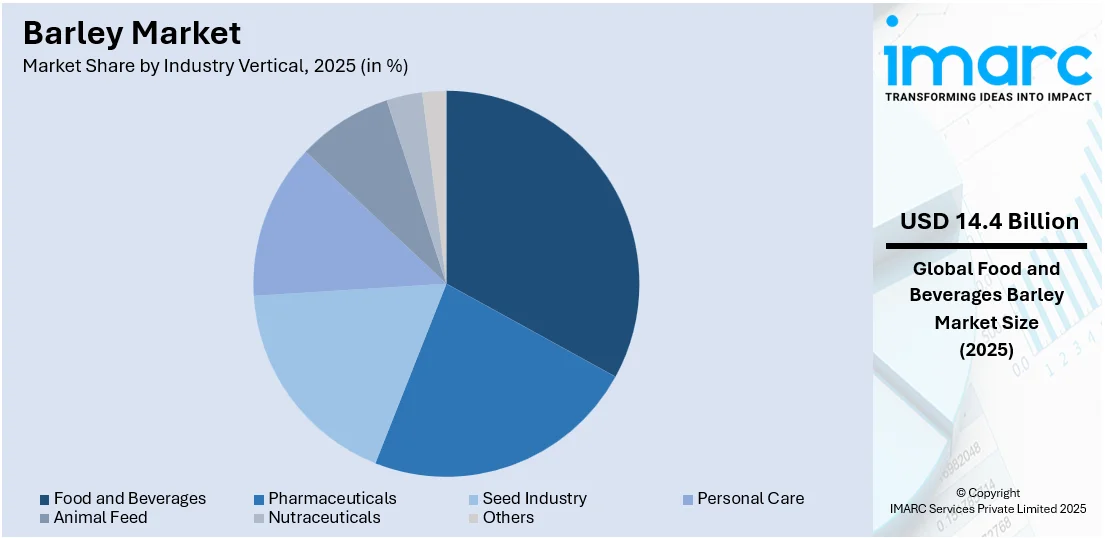

Analysis by Industry Vertical:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Pharmaceuticals

- Seed Industry

- Personal Care

- Animal Feed

- Nutraceuticals

- Others

Food and beverages lead the market with around 59.7% of market share in 2025. The food and beverages sector are the largest segment in the market. It is extensively used in this industry, primarily for brewing beer and producing malt beverages. It's also incorporated in various food products, including bread, cereals, and health bars, owing to its nutritional advantages, such as high fiber content and essential vitamins. The versatility in culinary applications, ranging from traditional dishes to innovative food products, drives its demand in this segment. The rising trend of health-conscious eating and the growing popularity of craft beers further enhance its prominence in the food and beverages industry, making it a key driver of the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe accounted for the largest market share of over 58.7%. Europe is the largest segment in the regional barley market, benefiting from its rich agricultural tradition and significant beer production heritage. Nations such as Germany, France, and the UK are at the forefront of barley production, leveraging advanced farming techniques and favorable climates that ensure consistent, high-quality yields. Barley serves as a vital ingredient in beer production, supporting both industrial-scale breweries and the thriving craft beer sector. The region’s established beer culture, coupled with a growing preference for artisanal beverages, continues to fuel demand. Furthermore, robust infrastructure for storage and distribution, along with government support for sustainable farming, enhances Europe’s position as a key player in the global barley market.

Key Regional Takeaways:

United States Barley Market Analysis

In 2025, United States accounted for 70% of the market shares in North America. Demand for the U.S. barley market remains stable by both brewing and feed sectors with some slight variations in the recent years production data. The U.S. Department of Agriculture reports that for 2023/2024, there was a production of around 4.05 million tons on an area of 1.04 million hectares with a yield of 3.9 tons per hectare. Over the years, production varied greatly, with a recent record of 4.75 million tons in 2015/2016 but within recent times, an overall decrease has been registered from the area under cultivation while the five-year average recorded would see 2024/2025 experience 18% decline in the area. Despite the above variations, the market's resiliency is largely maintained due to consistent demand from the brewing industry that uses more than 80% of the barley and is on an increase for use in animal feed and biofuels. Among key producers, there is the Anheuser-Busch InBev and Molson Coors that hold the strongest market positions in the United States to continue its presence in the world's barley market.

Europe Barley Market Analysis

The European barley market is witnessing moderate growth, mainly on the back of strong demand from the brewing and animal feed industries. As per the European Commission, in 2023, Europe's barley production was about 47.4 million metric tons. Major producers like France, Germany, and Russia have been experiencing consistent output. The focus of the EU on sustainability is driving innovation in barley cultivation, improving yield and quality. Furthermore, Europe is a malt-exporting leader, with countries such as France and Germany being the primary suppliers to the global market. Barley is also increasingly used in alternative products, such as bioethanol, which contributes to diversifying market demand.

Asia Pacific Barley Market Analysis

The Asia Pacific barley market is growing mainly on account of the increased demand for beer in countries such as China, India, and Japan. China barley imports increased to 6.4 million metric tons during 2023 according to a report issued by International Grain Council. Australia tops the region in barley production, which reached an amount of around 14.37 million tons during 2022. According to the Food and Agriculture Organization, India is increasing its barley production with emphasis on yield improvement. Increasing demand for craft beer and developments in brewing technology are likely to be additional factors that will continue to propel demand for barley throughout the region. Growth of biofuels in countries such as Australia is another factor contributing to market expansion.

Latin America Barley Market Analysis

Latin America's market for barley is growing strongly, with a rise in production and demand from the brewing industry, mainly in Argentina. According to the USDA Foreign Agricultural Service, Argentina was the leading producer in Latin America in 2022, with production of 4.5 million metric tons of barley and an estimated consumption of 1.75 million metric tons of barley. Mexico and Uruguay were the second and third biggest producers with 950 thousand metric tons and 790 thousand metric tons respectively. Brazil is the region's largest importer of barley, importing USD 267 million worth in 2022 and is building out its malting capacity to reduce malt imports. Latin America has kept its barley area at a steady 1,000,000 hectares for the last two decades since 1991. Although this is likely to stabilize going forward, the region would experience growth in malt barley supply as its beer industry continues expanding.

Middle East and Africa Barley Market Analysis

The market of barley in the Middle East and Africa is booming, with Saudi Arabia seeing significant developments in production and imports. According to the USDA, barley production in Saudi Arabia will likely hit above 800,000 metric tons in 2026 at 3.1% average yearly growth rate from the level 673,160 in the year 2021. For 2022/23, the import of 2.7 million metric tons of barley into the Saudi market represented an increase by 11% on yearly comparison basis. Nevertheless, imports will be lower in the demand for barley since torrential rains helped improve domestic livestock pastures. Barley produced for consumption by humans comes in at 25,000 metric tons in Saudi, while feed barley is imported. Genetic fingerprinting is one of the techniques that is being used for various crops that include barley to improve quality and efficiency. Egypt continues to be the largest barley producer in the region, followed closely by Algeria and Morocco, given growing demand from increasing sectors for beverages and animal feed.

Competitive Landscape:

Key players in the market are actively engaging in a range of strategic initiatives to strengthen their market positions. These include investments in research and development to enhance its varieties for higher yield and better disease resistance, aligning with the changing demands of both the brewing and agricultural sectors. For instance, in January 2024, the National Barley Improvement Committee (NBIC) introduced the Resilient Barley Initiative (RBI) as a key priority for 2024. The RBI focuses on improving barley resilience through advanced genetics and management to address abiotic stressors that affect yield and quality. It aims to reduce supply disruptions, support winter barley development, and enhance profitability for U.S. farmers. This multi-state project seeks USD 8 million annually to support ARS and university-led research efforts. Many are also expanding their geographical reach through partnerships, mergers, and acquisitions, especially in rapidly growing markets. Additionally, they are increasingly focusing on sustainable and environmentally friendly farming practices to satisfy the growing consumer interest in sustainable and environmentally-friendly products. Marketing efforts are being tailored to highlight the health benefits, tapping into the growing health-conscious consumer base. Companies are also leveraging advanced technologies to improve supply chain efficiency and to respond effectively to market trends and consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the barley market with detailed profiles of all major companies, including:

- Briess Malt & Ingredients Co.

- Cargill Incorporated

- Crisp Malting Group

- EverGrain LLC (Anheuser-Busch InBev)

- Grain Millers Inc.

- GrainCorp Limited

- IREKS GmbH

- Malt Products Corporation

- Malteurop Groupe S.A. (VIVESCIA)

- Maltexco S.A

- Muntons PLC

- The Soufflet Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- November 2024: GrainCorp’s announced sustainability initiative, GrainCorp Next, initially focusing on canola but plans to expand to barley and wheat, promoting low-carbon farming practices, renewable energy, and emissions reduction across Australia's grain supply chain.

- October 2024: According to Grain Central, GrainCorp's 2024-25 harvest update highlights barley deliveries underway in Queensland and northern New South Wales, including Burren Junction, Moree, and Dubbo, with quality reported as excellent.

- November 2023: Cargill Incorporated announced Commitment to Eliminate Deforestation and Land Conversion in Brazil, Argentina, and Uruguay by 2025. Cargill’s commitment will help protect native vegetation and support sustainable agriculture in these countries.

- June 2022: Anheuser-Busch announced that EverGrain LLC (Anheuser-Busch InBev) a sustainable ingredient company backed by AB InBev, is officially operational with its barley protein, EverPro. The new full-scale plant protein production facility will enable EverGrain to deliver on its promise of transforming sustainable ingredients.

- September 2021: InVivo Group completes the acquisition of Soufflet Group. The establishment of this Group helps in the promotion of food sovereignty for the farmers and subsequently increases added value for other players in the food production chain.

Barley Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Covered, Two-Row Barley, Six-Row Barley, Hulless |

| Grades Covered | Food Grade, Feed Grade, Malt Grade |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores |

| Industry Verticals Covered | Food and Beverages, Pharmaceuticals, Seed Industry, Personal Care, Animal Feed, Nutraceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Briess Malt & Ingredients Co, Cargill Incorporated, Crisp Malting Group, EverGrain LLC (Anheuser-Busch InBev), Grain Millers Inc., GrainCorp Limited, IREKS GmbH, Malt Products Corporation, Malteurop Groupe S.A. (VIVESCIA), Maltexco S.A, Muntons PLC, The Soufflet Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the barley market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global barley market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the barley industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Barley is a cereal grain valued for its versatility and widespread applications. It is a key ingredient in brewing, a staple in animal feed, and a nutritious component in various food products. Known for its adaptability and sustainability, barley plays a significant role in agriculture and multiple industrial sectors globally.

The barley market was valued at USD 25.0 Billion in 2025.

IMARC estimates the global barley market to exhibit a CAGR of 3.31% during 2026-2034.

The global barley market is driven by its extensive use in brewing, animal feed, and health-conscious food products. Rising demand for craft beverages, growing livestock industries, and barley’s nutritional appeal fuel its growth. Moreover, advancements in farming practices and increasing focus on sustainability further strengthen its position in global agricultural markets.

According to the report, covered represented the largest segment by type, primarily due to its protective husk, which enhances resilience against environmental stressors and pests. Widely utilized in animal feed and traditional brewing methods, its durability and versatility cater to high-demand sectors. This robust application solidifies its position as a key driver of market growth.

Malt grade leads the market by grade owing to its critical role in brewing and distilling industries. Known for high enzyme content and optimal starch levels, it ensures efficient fermentation for beer and whiskey production. Its strict quality standards, including kernel uniformity and moisture control, make it indispensable for consistent, high-quality alcoholic beverages.

The supermarkets and hypermarkets are the leading segment by distribution channel, offering a wide range of products such as whole barley, flakes, and pearled variants. Their extensive reach, competitive pricing, and convenience of a one-stop shopping experience drive consumer preference. Robust supply chains and regular promotional activities further enhance their role in boosting barley sales globally.

Food and beverages are the leading segment by industry vertical, driven by its extensive use in brewing, distilling, and health-focused food products. Barley’s nutritional value and functional properties make it essential for beer production, cereals, and snacks. Its versatility and growing consumer demand for natural ingredients bolster its dominance in this segment.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global barley market include Briess Malt & Ingredients Co, Cargill Incorporated, Crisp Malting Group, EverGrain LLC (Anheuser-Busch InBev), Grain Millers Inc., GrainCorp Limited, IREKS GmbH, Malt Products Corporation, Malteurop Groupe S.A. (VIVESCIA), Maltexco S.A, Muntons PLC, The Soufflet Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)