Barium Carbonate Market Report by End-Use (Glass, Brick and Clay, Barium Ferrites, Photographic Paper Coatings, and Others), and Region 2026-2034

Barium Carbonate Market Size and Share:

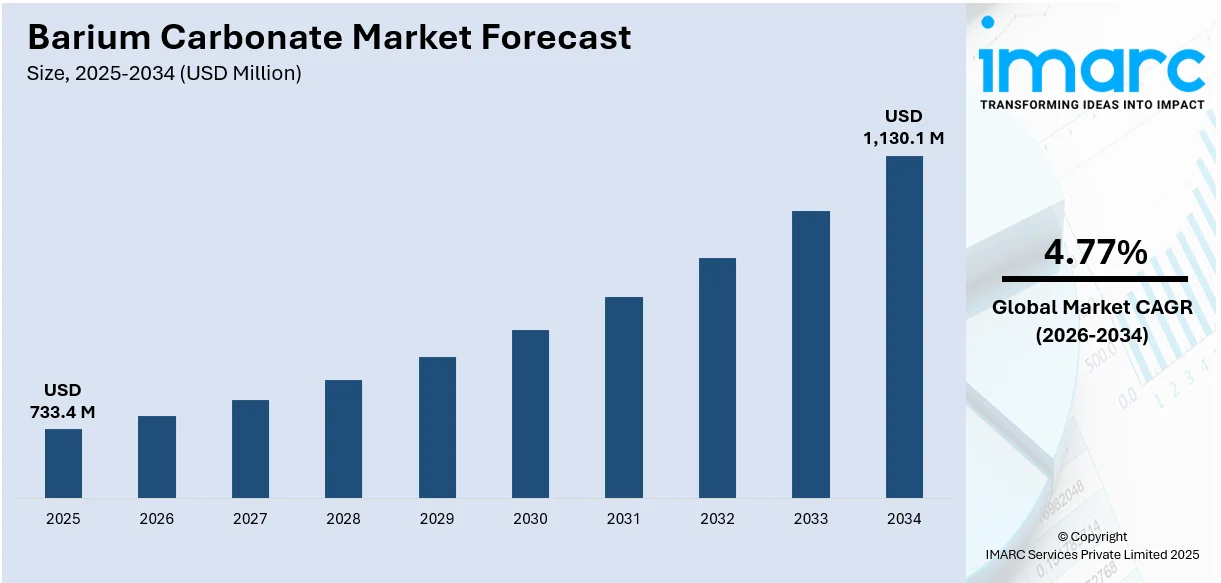

The global barium carbonate market size reached USD 733.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,130.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.77% during 2026-2034. The rising demand from the chemical industry, the continuous research and development activities in various sectors, and the presence of a stable and well-established supply chain are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 733.4 Million |

|

Market Forecast in 2034

|

USD 1,130.1 Million |

| Market Growth Rate 2026-2034 | 4.77% |

Barium carbonate, often represented by the chemical formula BaCO₃, is a white solid compound that is naturally occurring and commonly found in the mineral witherite. It is used in a variety of applications. In the ceramic industry, barium carbonate is utilized to enhance the brightness and smoothness of glazes. It's also a key ingredient in producing special types of glass, including those used for television tubes. Furthermore, it is employed to purify specific chemical solutions by removing sulfates. Another significant application is its role in the manufacturing of bricks, where it counteracts the detrimental effects of natural soluble salts, preventing the formation of salt marks. Handling barium carbonate requires caution since ingestion can be harmful. Its use and disposal are governed by environmental and safety regulations to ensure the well-being of both individuals and the environment.

To get more information on this market Request Sample

The escalating demand from the chemical industry is majorly driving the global market. Along with this, continual advancements in the formulation of numerous pharmaceutical products and the development of new materials is providing an impetus to the market. As more complex processes and products emerge, the need for highly purified chemical solutions is escalating. In addition to this, continuous research and development activities in various sectors are positively influencing the market. Any innovative use or efficiency improvements are acting as a growth-inducing factor. As industries diversify and expand their product offerings, they may find new uses for barium carbonate. For instance, while it's already used in ceramics and glass, there might be specialized products within these sectors that come to rely more heavily on barium carbonate as they grow in popularity. Moreover, the presence of a stable and well-established supply chain creates a positive market outlook.

Barium Carbonate Market Trends/Drivers:

Expansion of the electronics and television industry

The electronics and television industry is expanding at a rapid pace, and this has significantly driven the demand. It is a crucial component in the production of cathode-ray tubes (CRTs) for televisions and other display devices. These tubes require special types of glass to function efficiently, and it plays a pivotal role in achieving the required properties for this glass. As developing countries continue to industrialize, there is a rise in the demand for electronics, especially in regions where the market penetration for these products is still low. In addition, the emergence of newer technologies might have shifted some of the demand away from CRTs in favor of technologies including LCD, LED, and OLED. Moreover, the expansion and diversification of the electronics industry, coupled with the rise in the number of households purchasing televisions, especially in emerging economies, are fueling the demand.

Growing ceramic and glass industries

Barium carbonate is an essential component in the ceramic industry, especially in glazing. Additionally, it enhances the brightness and smoothness of ceramic glazes. With urbanization and increased infrastructure development worldwide, the demand for ceramic products, including tiles and sanitary ware, has skyrocketed. In addition, the glass industry heavily relies on barium carbonate for producing various specialized types of glass. Furthermore, the construction growth in many developing nations is leading to a rise in the demand for glass products. From architectural applications to household decor, the versatility of glass products is undeniable. As these industries grow, the ripple effect on the demand for barium carbonate becomes more pronounced, marking it as a significant market driver.

Requirement in brick manufacturing

The brick manufacturing industry is another sector where barium carbonate holds importance. In this industry, the product is used to combat the harmful effects of natural soluble salts. These salts further lead to the formation of efflorescence or salt marks on bricks, compromising their aesthetic appeal and structural integrity. With rapid urbanization and infrastructural developments, the demand for construction materials, including bricks, has accelerated. In confluence with this, quality bricks are a staple in construction, and the need for bricks free from efflorescence is high. As the construction industry grows, especially in growing urban centers, the demand for barium carbonate in brick manufacturing also sees a corresponding growth.

Barium Carbonate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels from 2026-2034. Our report has categorized the market based on end use.

Breakup by End Use:

Access the comprehensive market breakdown Request Sample

- Glass

- Brick and Clay

- Barium Ferrites

- Photographic Paper Coatings

- Others

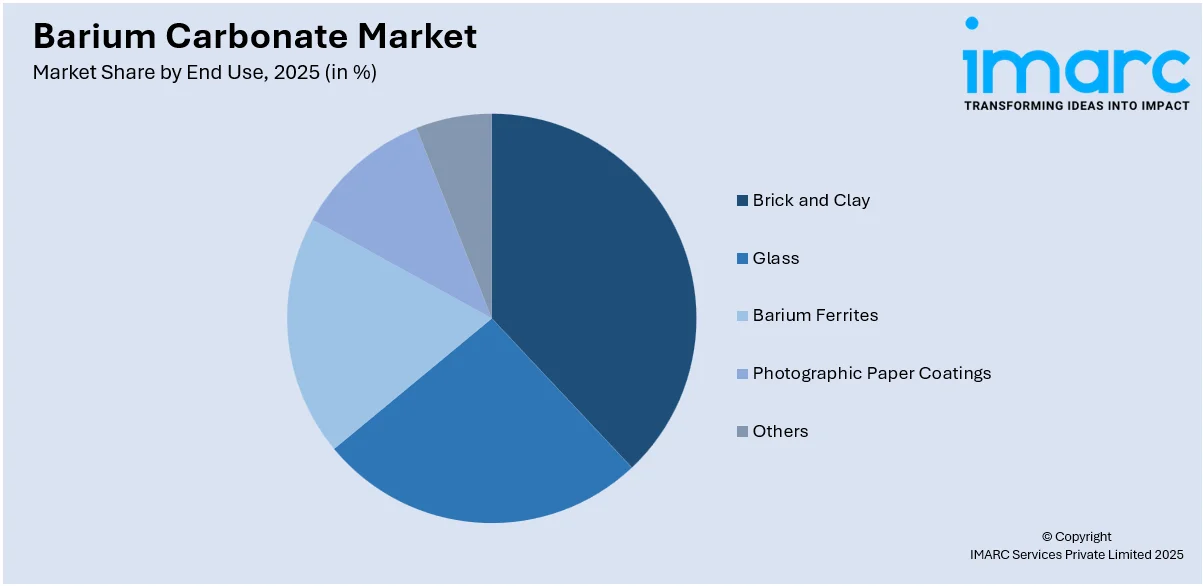

Brick and clay hold the largest market share

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes glass, brick and clay, barium ferrites, photographic paper coatings, and others. According to the report, brick and clay accounted for the largest market share.

Market drivers for the brick and clay end use segment in the industry include the sustained growth in the construction and infrastructure sectors. As urbanization continues, there is a growing demand for high-quality bricks, tiles, and sanitary ware. Additionally, the product plays a critical role in this domain by countering the adverse effects of natural soluble salts, preventing the formation of unsightly efflorescence on bricks, and ensuring their structural integrity and aesthetic appeal. Along with this, stringent quality standards and regulations in the construction industry further underscore the need for barium carbonate in brick manufacturing. Moreover, the growing emphasis on sustainable building materials is leading to increased research and development efforts, potentially uncovering novel applications for construction materials. As a result, the brick and clay segment in the industry is poised for continued growth, fueled by the ever-expanding construction sector and its enduring need for high-performance building materials.

Breakup by Region:

- China

- Japan

- Latin America

- Middle East and Africa

- Europe

- Others

China leads the market, accounting for the largest barium carbonate market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, Latin America, Middle East and Africa, Europe, and others. According to the report, China accounted for the largest market share.

The barium carbonate industry in China is experiencing robust growth, primarily driven by the region’s growing electronics manufacturing sector, one of the largest in the world, which relies heavily on barium carbonate for the production of cathode-ray tubes (CRTs), a fundamental component in older television and display technologies. As the country continues to advance technologically and urbanize, the demand for electronic devices remains high, influencing the need for barium carbonate. In addition, China's construction industry is expanding rapidly, driven by urbanization and infrastructure development. In addition, the government's commitment to quality and sustainability in construction projects further cements the demand.

Apart from this, China's chemical industry, another significant consumer of barium carbonate, is also experiencing growth as it diversifies and modernizes. The compound's use in purifying chemical solutions makes it indispensable in various industrial processes. Furthermore, the Chinese government's push for environmental regulations and cleaner production processes is resulting in a focus on the use of barium carbonate for sulfate removal in certain industries, thereby contributing to the market growth.

Competitive Landscape:

The key players are focusing on efficient and cost-effective production processes to ensure a stable supply of high-quality barium carbonate to their customers. They are investing in modernization and capacity expansion to meet growing demand. Along with this, the accelerating investments in research and development to explore new applications for barium carbonate and improve existing ones are positively influencing the market. In addition, companies must adhere to environmental and safety regulations, especially in the handling and disposal of barium compounds. Compliance is crucial to maintaining their social and environmental responsibilities, which is acting as another growth-inducing factor. Apart from this, manufacturers are implementing sustainable practices, such as recycling or reducing emissions, to minimize their environmental footprint and align with global sustainability goals. Furthermore, key players are diversifying their product portfolio by offering related chemicals or services to cater to a broader range of industries.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- American Elements

- Chemical Products Corporation (CPC)

- Hebei Xinji Chemical Group Co., Ltd.

- Honeywell International Inc

- Hubei Jingshan Chutian Barium Salt Corp. Ltd.

- Nippon Chemical Industrial CO., LTD.

- Sakai Chemical Industry Co. Ltd.

- Shaanxi Ankang Jianghua Group Co. Ltd.

- Solvay

- Thermo Fisher Scientific Inc.

- Vishnu Chemicals

- Zaozhuang Yongli Chemical Co., Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- In March 2022, Solvay S.A. developed a new Renewable Materials and Biotechnology platform with the goal of creating creative and sustainable solutions for various sectors utilizing biotechnology and renewable feedstocks.

- In December 2020, Guizhou Hongxing Development Co., Ltd. announced mandatory cleaner production audits in compliance with Guizhou Provincial regulations, detailing its use of toxic materials, emissions, and environmental risk measures. The company has also implemented risk prevention protocols including an emergency plan and safety installations.

- In August 2023, Sakai Chemical Industry Co., Ltd. announced the initiation of a new business creation project following its acquisition of Sakai Trading Co., Ltd. as a wholly-owned subsidiary. The project aims to leverage the agility of Sakai Trading to create innovative businesses, with a focus on unifying management resources across the Sakai Chemical Group.

Barium Carbonate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD, ‘000 Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Uses Covered | Glass, Brick and Clay, Barium Ferrites, Photographic Paper Coatings, Others |

| Regions Covered | China, Japan, Latin America, Middle East and Africa, Europe, Others |

| Companies Covered | American Elements, Chemical Products Corporation (CPC), Hebei Xinji Chemical Group Co., Ltd., Honeywell International Inc, Hubei Jingshan Chutian Barium Salt Corp. Ltd., Nippon Chemical Industrial CO., LTD., Sakai Chemical Industry Co. Ltd., Shaanxi Ankang Jianghua Group Co. Ltd., Solvay, Thermo Fisher Scientific Inc., Vishnu Chemicals, Zaozhuang Yongli Chemical Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the barium carbonate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global barium carbonate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the barium carbonate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global barium carbonate market was valued at USD 733.4 Million in 2025.

We expect the global barium carbonate market to exhibit a CAGR of 4.77% during 2026-2034.

The extensive utilization of barium carbonate in production of various commercial items, such as bricks, clay, glass, photographic paper coatings, hard ferrite magnets, etc., is currently driving the global barium carbonate market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries for barium carbonate.

Based on the end-use, the global barium carbonate market can be divided into glass, barium ferrites,brick and clay, photographic paper coatings, and others. Currently, brick and clay represents the majority of the total market share.

On a regional level, the market has been classified into China, Japan, Europe, Latin America, Middle East and Africa, and others, where China currently dominates the global market.

Some of the major players in the global barium carbonate market include American Elements, Chemical Products Corporation (CPC), Hebei Xinji Chemical Group Co., Ltd., Honeywell International Inc, Hubei Jingshan Chutian Barium Salt Corp. Ltd., Nippon Chemical Industrial CO., LTD., Sakai Chemical Industry Co. Ltd., Shaanxi Ankang Jianghua Group Co. Ltd., Solvay, Thermo Fisher Scientific Inc., Vishnu Chemicals, Zaozhuang Yongli Chemical Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)