Barite Market Size, Share, Trends and Forecast by Grade, Application, and Region, 2025-2033

Barite Market Size and Share:

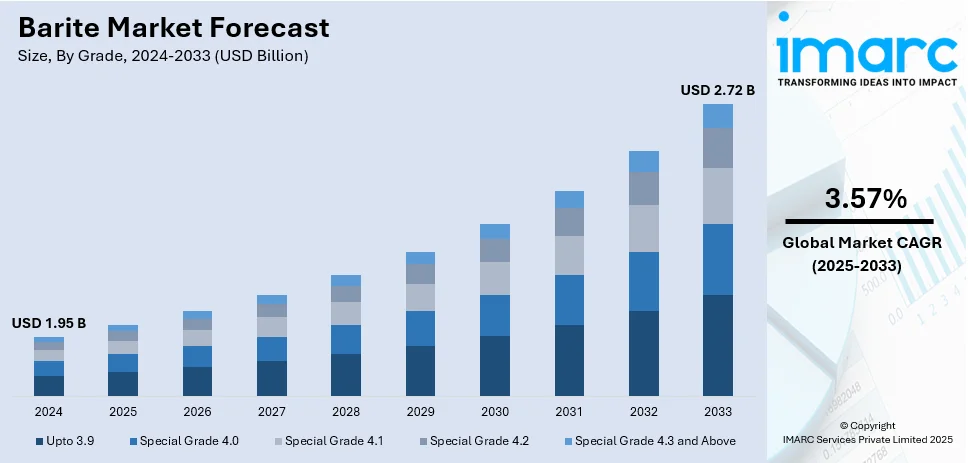

The global barite market size was valued at USD 1.95 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.72 Billion by 2033, exhibiting a CAGR of 3.57% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024. The market is growing due to an increasing demand in oil and gas drilling, paints, plastics and pharmaceuticals. Rising exploration activities, regulatory impacts and supply chain disruptions are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.95 Billion |

|

Market Forecast in 2033

|

USD 2.72 Billion |

| Market Growth Rate (2025-2033) | 3.57% |

The barite market is driven by the rising demand in the oil and gas industry where it serves as a weighting agent in drilling fluids to prevent blowouts and enhance well stability. According to the report published by International Energy Agency (IEA), the demand for oil across the globe is expected to increase from 840 kb/d in 2024 to 1.1 mb/d in 2025 reaching 103.9 mb/d. Global supply increased by 130 kb/d to 103.4 mb/d in November. Refinery throughputs will peak at 84.3 mb/d, while Brent crude averaged $73/bbl in November. Increasing number of exploration activities especially in offshore and shale gas fields are fueling consumption. Growth in the paints, plastics and rubber industries is also facilitating the demand due to barite’s use as a filler and pigment extender. The widespread adoption in pharmaceuticals and radiation shielding applications is further supporting barite market growth.

The demand for barite in the United States is mainly driven by the oil and gas industry where it is used as a weighting agent in drilling fluids particularly in shale and offshore drilling. Growth in domestic energy production and increasing drilling activities in regions like Texas and North Dakota are boosting consumption. According to data published by US Energy Information Administration, in August 2024, U.S. crude oil production reached a record 13.4 million barrels per day surpassing the previous high of 13.3 million b/d set in December 2023. The forecast for 2024 anticipates an average of 13.2 million b/d with 2025 expected to increase to 13.5 million b/d. Increasing use in industrial applications including paints, plastics, and automotive coatings is acting as other contributing factors. Regulatory emphasis on radiation shielding in medical and nuclear applications is supporting barite demand.

Barite Market Trends:

Rising Oil and Gas Exploration

Rising oil and gas exploration is fueling demand for barite a critical weighting agent in drilling fluids. Shale gas extraction is increasing consumption as hydraulic fracturing requires large quantities of high-density barite to control well pressure. Offshore drilling projects in deepwater regions further boost demand due to the need for stable drilling mud formulations. Expanding energy production supported by technological advancements in drilling techniques is strengthening barite's role in maintaining wellbore stability and preventing blowouts. Increasing offshore drilling activities are contributing to higher barite consumption driven by the need for stable drilling fluids in deepwater operations. The U.S. Energy Information Administration forecasts Gulf of Mexico production at 1.8 million b/d of crude oil and 1.8 Bcf/d of natural gas in 2024, increasing to 1.9 million b/d and 1.8 Bcf/d in 2025. Twelve new fields are expected to start their production in 2024-2025.

Rising Use in Industrial Applications

Barite is widely used in industrial applications as a high-density filler and pigment extender enhancing durability, brightness and chemical resistance, which represents one of the key global barite market trends. In the paints and coatings industry barite is added to improve gloss, weather resistance and corrosion protection. In plastics and rubber industries, its usage enhances strength, reduces shrinkage, and improves soundproofing properties. According to the report published by the Rubber Board in India, the country’s natural rubber production for 2023-24 reached 857000 tonnes, which is an increase of 2.1% from 839000 tonnes in 2022-23. The domestic consumption rose 4.9% to 1416000 tonnes. Projected figures for 2024-25 are 875000 tonnes and 1425000 tonnes respectively. Cumulative NR imports and exports stood at 492682 tonnes and 4199 tonnes. Its ability to enhance scratch resistance and UV stability is beneficial for automotive coatings. As demand for high-performance materials continues to grow so does the application of barite in industrial uses across numerous manufacturing industries.

Increased Adoption in Radiation Shielding

Barite is gaining traction in radiation shielding applications due to its high density and ability to absorb gamma and X-rays. The medical industry uses barite-infused concrete and panels in hospitals, diagnostic centers and radiation therapy rooms to protect against harmful exposure. The nuclear sector incorporates barite in reactor shielding and protective barriers for workers and equipment. With the increase in healthcare infrastructure and more stringent regulations regarding radiation safety the demand for barite-based shielding materials is likely to increase within medical and nuclear industries. Ongoing research is advancing barite-based radiation shielding solutions enhancing their effectiveness and sustainability. For instance, in February 2024, researchers developed radiation-shielding concrete by combining hazardous chrysotile mine waste with barite. By incorporating 25% and 50% barite the new mixes demonstrated enhanced mechanical properties and improved radiation attenuation. These factors are creating a positive barite market outlook further across the world.

Barite Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global barite market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on grade and application.

Analysis by Grade:

- Upto 3.9

- Special Grade 4.0

- Special Grade 4.1

- Special Grade 4.2

- Special Grade 4.3 and Above

Special grade 4.2 stand as the largest grade in 2024, holding around 26.7% of the market. Special grade 4.2 barite holds the largest market share due to its high specific gravity 4.2 g/cm³ and is the preferred choice for drilling fluids in the oil and gas industry. This grade ensures optimal wellbore stability and pressure control in high-density drilling applications. Its superior purity and consistent performance also make it valuable in industrial sectors like paints, plastics and radiation shielding. Substantial demand from energy and manufacturing sectors has resulted in strict quality requirements for special grade 4.2 barite thereby driving the barite market demand.

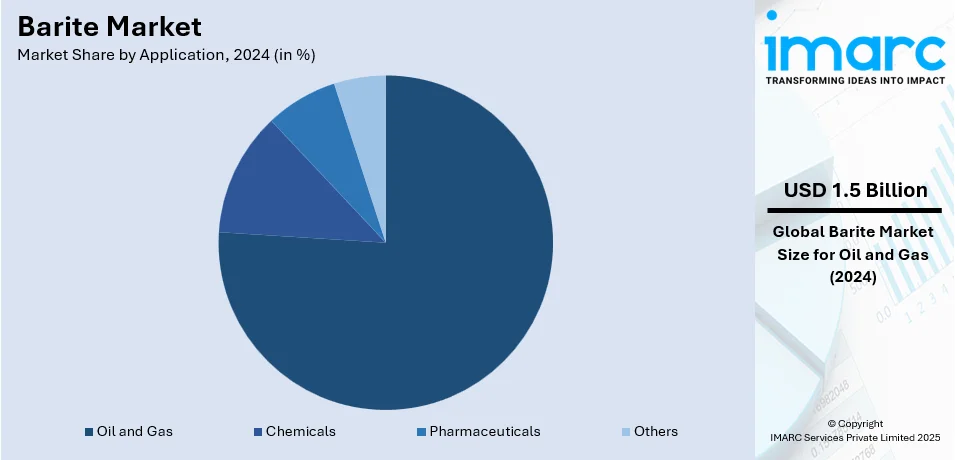

Analysis by Application:

- Oil and Gas

- Chemicals

- Pharmaceuticals

- Others

Oil and gas leads the market with around 76.5% of market share in 2024. The oil and gas industry remains the largest consumer of barite mainly due to its application as a weighting agent in drilling fluids. Barite enhances wellbore stability, prevents blowouts and optimizes pressure control in deepwater and shale drilling operations. The increase in exploration activities particularly in the Gulf of Mexico and shale-rich regions will boost demand. The regulatory requirement for high-performance drilling muds further reinforces the dominance of barite in this sector. The energy production increase keeps oil and gas at the forefront of the drivers for barite consumption.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest barite market share of over 40.0%. North America holds the largest share in the barite market driven by extensive oil and gas exploration particularly in the U.S. shale reserves and offshore fields. The region's strong drilling activity supported by advanced hydraulic fracturing techniques fuels high barite consumption. The presence of key producers, stable supply chains and strict regulatory standards further strengthen market dominance. Growing demand in industrial applications, including paints, plastics and radiation shielding also contributes to North America's leadership in the global barite market.

Key Regional Takeaways:

United States Barite Market Analysis

In 2024, the United States captured 85.60% of revenue in the North American market. The United States barite market is driven by the significant demand from the oil and gas sector, where barite serves as a weighting agent in drilling muds. The resurgence of shale gas exploration and the increased number of drilling activities in states like Texas and North Dakota have created a robust market for barite. Environmental regulations emphasizing the use of non-toxic and eco-friendly drilling fluids is further bolstering the demand for high-grade barite. This shift is particularly prominent in offshore drilling operations, where compliance with stringent environmental standards is mandatory. Additionally, advancements in drilling technologies are increasing the efficiency of barite usage, driving its adoption across diverse geographies in the U.S. Another critical driver is the expanding pharmaceutical and chemical industries, which utilize barite in barium compounds. The rising production and sales of pharmaceutical items in the country is bolstering the market growth. According to reports, the U.S. pharmaceutical sector was valued at around USD 574.37 billion in 2023. This substantial amount establishes the U.S. as a frontrunner in the global pharmaceutical market, representing roughly 45% of total pharmaceutical sales worldwide. The healthcare sector's growth, coupled with increased investments in medical infrastructure, has indirectly supported the barite market. Moreover, the rising use of barite in radiation shielding materials for diagnostic equipment also contributes to its market demand.

Asia Pacific Barite Market Analysis

The Asia Pacific barite market is experiencing robust growth because of the region’s thriving oil and gas exploration activities. Major energy-consuming economies like China, India, and Indonesia are heavily investing in energy security, increasing the demand for barite as a critical additive in drilling fluids. In addition, rapid industrialization and urbanization in the region is expanding the use of barite in various industries, including paints, coatings, and plastics. The demand for high-performance coatings in automotive and construction sectors has been a significant contributor, as barite enhances the durability and density of such products. The rising production and sales of vehicles in the region is catalyzing the demand for barite. As per reports, Indian sales of passenger vehicles reached 300,459 units in November 2024, showing a year-on-year increase of 4.4%. Additionally, barite’s use in producing rubber and plastics for diverse industrial applications is gaining momentum, further driving market growth. Environmental regulations and the push for cleaner drilling operations is compelling industries to adopt higher-grade barite products. China, as the world’s major producer and consumer of barite, plays a pivotal role in setting the market trend. Indian market dynamics are also evolving, with increased government focus on oil and gas production and support for domestic barite mining projects.

Europe Barite Market Analysis

The region’s expanding energy and healthcare sectors is bolstering the market growth. Although the reliance on fossil fuels is gradually reducing, oil and gas exploration activities in the North Sea remain a significant consumer of barite, especially as countries strive for domestic energy independence. The European Union’s stringent environmental regulations also drive the demand for high-grade, non-toxic barite in drilling operations, ensuring safe and sustainable practices. Another important factor is the increasing use of barite in the automotive and construction industries. As Europe advances its infrastructure projects, the use of high-density barite in concrete and coatings has grown steadily. According to the report published by the Eurostat, in June 2024, construction production rose by 1.7% in the euro area and 1.4% in the EU compared to May. Year-over-year production increased by 1.0% in the euro area but decreased by 0.1% in the EU. Similarly, the automotive sector leverages barite for manufacturing durable paints and coatings, as well as in brake linings and other applications requiring high-density materials. Germany, France, and the UK are prominent markets for such applications. Besides this, Europe’s focus on green energy and sustainability is opening new opportunities for barite in emerging applications like wind turbine components and renewable energy infrastructure. As the region continues to invest in clean energy and infrastructure upgrades, the demand for barite is expected to grow.

Latin America Barite Market Analysis

The thriving construction sector is creating a demand for barite in high-density concrete and coatings. Government investments in urbanization projects and transportation infrastructure, such as smart city initiatives, further amplify this trend. By the end of 2023, global spending on smart city initiatives is projected to exceed USD 190 Billion. Latin America accounts for less than 10% of global smart city spending but is experiencing increasing engagement in smart city projects, as per reports. Apart from this, domestic mining activities is contributing to the market stability. Latin America’s growing healthcare sector also supports the barite market, with increasing demand for barium-based diagnostic products. Barite’s utility in radiation shielding for nuclear medicine and diagnostic facilities underpins its importance in the healthcare domain.

Middle East and Africa Barite Market Analysis

The Middle East and Africa (MEA) barite market is primarily driven by the region’s dominant oil and gas sector. Countries such as Saudi Arabia, UAE, and Nigeria heavily depend on barite as a critical component in drilling fluids for exploration and production activities. With ongoing investments in upstream oil and gas projects, the demand for barite in the MEA region remains robust. Saudi Aramco has allocated between USD 40 to 50 billion for upstream initiatives, with a target to reach a sustainable production capacity of 13 million barrels per day by 2027. Additionally, the rising demand for advanced medical diagnostic equipment in Africa and the Gulf Cooperation Council (GCC) countries is increasing the use of barium-based diagnostic agents. As these sectors continue to grow, the MEA barite market is expected to exhibit steady demand.

Competitive Landscape:

The barite market is highly competitive with numerous players operating across mining, processing and distribution. Competition is driven by factors such as product quality supply chain reliability and pricing strategies. Companies focus on securing high-grade barite reserves to ensure consistent supply particularly for the oil and gas sector. Advancements in beneficiation and processing techniques are improving product purity and performance strengthening market positioning. Geopolitical factors, trade regulations and environmental policies influence production costs and regional competitiveness. Market participants are investing in capacity expansion, sustainability initiatives and vertical integration to gain an edge. The rise of synthetic barite alternatives and fluctuating raw material availability further shape competition compelling companies to innovate and optimize production efficiency to maintain market share.

The report provides a comprehensive analysis of the competitive landscape in the barite market with detailed profiles of all major companies, including:

- Anglo Pacific Minerals Ltd.

- Baribright Co. Ltd

- Demeter O&G Supplies Sdn Bhd

- Sachtleben Minerals GmbH & Co. KG

- Shenzhen Rocky Mountains Industry Development Co., Ltd

- Sibelco

- Sinobarite Industrials Ltd

- SLB

- The Kish Company, LLC

Latest News and Developments:

- July 2023: Vishnu Chemicals a specialty chemical manufacturer based in Hyderabad fully acquired Ramadas Minerals Pvt Ltd a company located in Chennai through its wholly-owned subsidiary Vishnu Barium Pvt Ltd. Ramadas Minerals specializes in the beneficiation of Baryte ores and is recognized for its advanced beneficiation plant that utilizes US-patented technology to eliminate impurities and produce a higher-grade Barium.

- May 2023: The Nigerian Federal Government announced its plans to foster the development of downstream barite mining industries by setting up a processing plant in Ugaga located in the Yala local government area of Cross River State an area noted for its substantial barite reserves.

- October 2022: Newpark Resources, Inc. completed a transaction to transfer nearly all assets, inventory and operations of its Excalibar mineral grinding division to Cimbar Resources, Inc., a company based in Chatsworth, GA, that focuses on mineral-based additives. As of September 30, 2022, Excalibar reported approximately $65 million in net capital employed. This agreement is anticipated to generate around $66 million in net cash for Newpark, sourced from a combination of cash received at closing and net collections from specific retained assets and liabilities. Additionally, Cimbar and Newpark have established a long-term supply contract for barite to support Newpark's U.S. drilling fluids division.

- May 2022: The Andhra Pradesh Mineral Development Corporation (APMDC) has shifted its focus to the U.S. market after signing Memoranda of Understanding (MoUs) valued at USD 90 million to supply 1.6 million metric tons of baryte to three American companies.

Barite Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Upto 3.9, Special Grade 4.0, Special Grade 4.1, Special Grade 4.2, Special Grade 4.3 and Above |

| Applications Covered | Oil and Gas, Chemicals, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anglo Pacific Minerals Ltd., Baribright Co. Ltd, Demeter O&G Supplies Sdn Bhd, Sachtleben Minerals GmbH & Co. KG, Shenzhen Rocky Mountains Industry Development Co., Ltd, Sibelco, Sinobarite Industrials Ltd, SLB, The Kish Company, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the barite market from 2019-2033.

- The barite market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the barite industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The barite market was valued at USD 1.95 Billion in 2024.

IMARC estimates the barite market to reach USD 2.72 Billion by 2033, exhibiting a CAGR of 3.57% during 2025-2033.

Growth is fueled by rising oil and gas drilling activities, increasing use in paints, plastics, and rubber, expanding radiation shielding applications, and regulatory emphasis on non-toxic drilling fluids. Offshore and shale gas exploration further boost demand.

North America holds the largest market share, accounting for over 40.0% in 2024, driven by strong oil and gas exploration in the U.S. In addition to this, extensive research and development (R&D) activities and significant technological advancements are further increasing the market growth of barite across the globe.

Some of the major players in the barite market include Anglo Pacific Minerals Ltd., Baribright Co. Ltd, Demeter O&G Supplies Sdn Bhd, Sachtleben Minerals GmbH & Co. KG, Shenzhen Rocky Mountains Industry Development Co., Ltd, Sibelco, Sinobarite Industrials Ltd, SLB, The Kish Company, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)