Ballistic Composites Market Size, Share, Trends and Forecast by Fiber Type, Matrix Type, Application, and Region, 2025-2033

Ballistic Composites Market Size and Share:

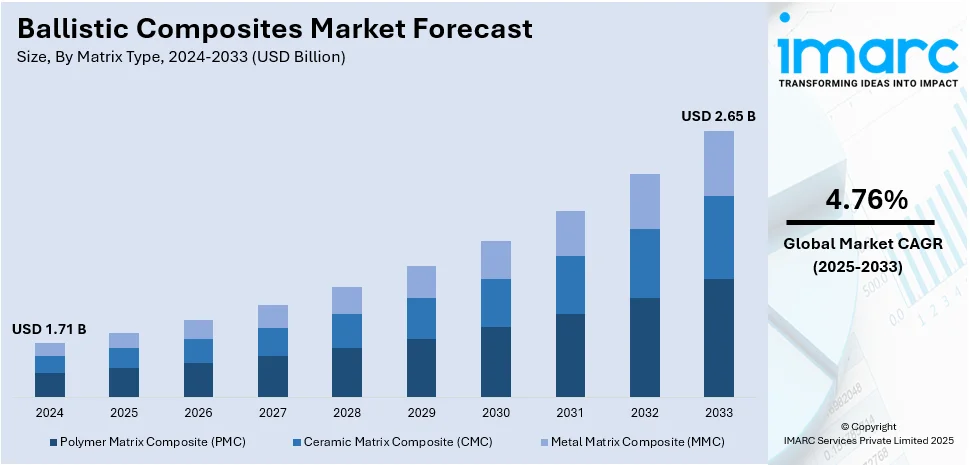

The global ballistic composites market size was valued at USD 1.71 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.65 Billion by 2033, exhibiting a CAGR of 4.76% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.3% in 2024. The market is driven by rising defense spending, increasing demand for lightweight and high-strength materials in military applications, advancements in composite material technology, and growing adoption in law enforcement and civilian protection gear. Additionally, stringent safety regulations and investments in next-generation armor solutions fuel ballistic composites market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.71 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Market Growth Rate (2025-2033) | 4.76% |

The market is expanding due to increasing defense budgets, rising geopolitical tensions, and the demand for lightweight, high-strength protective materials. Advancements in composite technologies, including aramid fibers, UHMWPE, and ceramic-reinforced composites, are enhancing ballistic resistance while reducing soldier fatigue. The growing adoption of body armor, vehicle armor, and aerospace applications further propels market growth. Law enforcement and homeland security investments in protective gear contribute to demand. Additionally, the shift toward multi-threat protection against bullets, fragmentation, and explosive blasts supports innovation. The rising use of nanotechnology and advanced manufacturing processes, such as 3D printing, is improving material performance. Government regulations mandating enhanced protection standards also drive adoption across military and civilian applications which is creating a positive ballistic composites market outlook.

The U.S. ballistic composites market is driven by high defense spending, increasing military modernization programs, and rising homeland security concerns. The Department of Defense (DoD) prioritizes lightweight, high-strength materials for body armor, helmets, and vehicle protection, boosting demand for aramid fibers, UHMWPE, and ceramic composites. Law enforcement agencies invest in advanced protective gear due to growing security threats. The presence of key defense contractors and R&D investments in next-generation materials, including nanotechnology and 3D printing, accelerate innovation. Stricter government regulations on soldier and law enforcement safety enhance adoption. Additionally, the expansion of aerospace and civilian applications, including armored vehicles and infrastructure protection, further supports market growth. Collaborations between private firms and defense agencies drive technological advancements. For instance, in October 2023, Integris Composites USA stated that the US Air Force 582nd Helicopter Group had placed the first substantial order for the company's Cratus Wave ballistic armor, which was launched a year ago.

Ballistic Composites Market Trends:

Increased Defense Spending

The demand for high-tech protection solutions has risen steadily due to global increases in defense spending, especially ballistic composites. The Stockholm International Peace Research Institute (SIPRI) suggests military expenditure across the world reached an estimated USD 2.24 trillion in 2022, which is a 3.7% rise compared to the previous year. The increased defense budget is largely a function of geopolitical tensions, increased technology application in warfare, and more focus on national security. Ballistic composites are a key ingredient for armor vehicles, body armor, and military infrastructure against ballistic threats, being light and durable. Consequently, with increasing defense budgets, ballistic composites will see added growth through government contracts and investments in defense technologies. This ongoing demand for enhanced protection for soldiers, military assets, and critical infrastructure will support market demand for these materials.

Technological Advancements in Materials

Technological innovations in the manufacturing of lighter, stronger, and tougher ballistic composites are revolutionizing their use in military and non-military applications. Carbon fiber, aramid fibers, and ultra-high molecular weight polyethylene (UHMWPE) are gaining popularity in composite armor systems because they offer greater performance. For instance, House Report 116-120 on National Defense Authorization Act for Fiscal Year 2020 proposed USD 53.1 million for the Manufacturing Technology Program, in particular for revolutionizing aerospace composites manufacturing. This investment is meant to help facilitate cost savings, low-cost tooling, and rapid response rapid requirements for new unmanned aerial systems and other future vehicles. The emphasis of the program on lowering the cost of composite materials and enhancing manufacturing methods will lead to more effective and less expensive ballistic composites. As these developments in material science and production processes proceed, the market for ballistic composites will grow, meeting military and commercial needs for greater protection and performance.

Growth in Commercial and Law Enforcement Applications

Ballistic composites are increasingly used in commercial and law enforcement industries because of rising safety issues and the increasing demand for greater personal protection. The trend is largely seen in police and security forces use of bulletproof vests, armored cars, and protective screens. The use of ballistic composites is reportedly on the increase in the United States. Bureau of Justice Statistics (BJS), over 350,000 law enforcement agents worked in the U.S. during 2021, where several of these rely on ballistics-resistant body armor for safeguarding. As an added bonus, the unprecedented spike in crimes, especially at locations with elevated threat levels, has fueled needs for increased safety solutions. There is also commercial automotive interest and a growing request for passenger auto light armor protection solutions. Governments are now more involved in law enforcement protection, further stimulating the ballistic composites market demand. As safety for both officers and civilians continues to rise in importance, use of ballistic composites within these fields will be much greater.

Ballistic Composites Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global ballistic composites market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on fiber type, matrix type, and application.

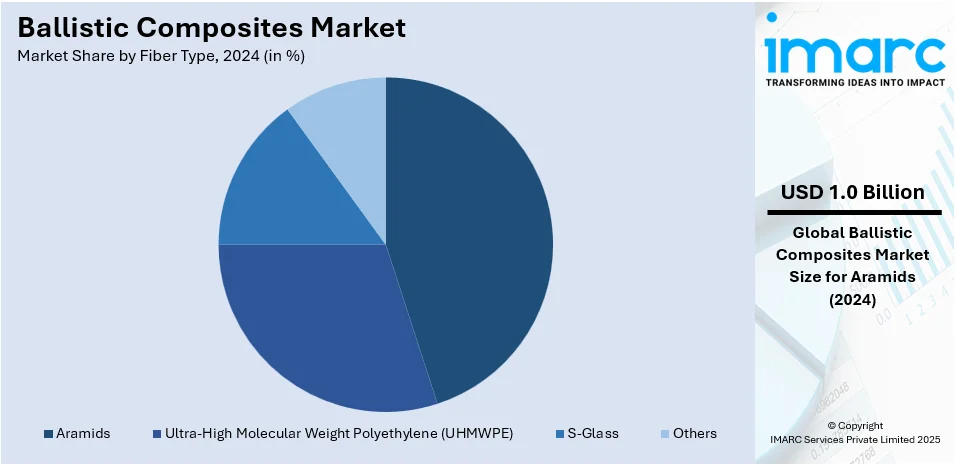

Analysis by Fiber Type:

- Aramids

- Ultra-High Molecular Weight Polyethylene (UHMWPE)

- S-Glass

- Others

Aramids leads the market with around 44.4% of market share in 2024. Aramids hold the major share in the ballistic composites market due to their high strength-to-weight ratio, excellent impact resistance, and thermal stability. Materials like Kevlar® and Twaron® provide superior ballistic protection while remaining lightweight, reducing fatigue for military and law enforcement personnel. Their high-energy absorption capability makes them ideal for body armor, helmets, and vehicle protection. Aramids also offer durability and flexibility, enhancing mobility in combat situations. Widespread adoption in defense, aerospace, and law enforcement sectors, along with continuous advancements in fiber technology, further strengthens their dominance. Additionally, regulatory requirements for lightweight protective gear drive aramid demand globally.

Analysis by Matrix Type:

- Polymer Matrix Composite (PMC)

- Ceramic Matrix Composite (CMC)

- Metal Matrix Composite (MMC)

Polymer Matrix Composite (PMC) leads the market with around 48.7% of market share in 2024. Polymer Matrix Composites (PMCs) hold the largest share in the ballistic composites market due to their exceptional strength-to-weight ratio, high impact resistance, and flexibility in design. These composites, typically reinforced with aramid fibers (e.g., Kevlar) or ultra-high-molecular-weight polyethylene (UHMWPE), provide superior ballistic protection while maintaining lightweight properties essential for body armor, helmets, and vehicle armor. PMCs also offer cost-effective manufacturing, corrosion resistance, and ease of customization, making them ideal for military and law enforcement applications. Their ability to absorb and dissipate impact energy efficiently further enhances their dominance in the ballistic composites market, ensuring maximum protection and durability.

Analysis by Application:

- Armor

- Helmets and Face Protection

- Others

Armor holds the largest share in the ballistic composites market due to the growing demand for lightweight, high-performance protection in military, defense, and law enforcement applications. Ballistic composite armor, used in body armor, vehicle armor, and protective shields, provides superior impact resistance while reducing weight, enhancing mobility, and improving soldier endurance. Advanced materials such as aramid fibers and ultra-high-molecular-weight polyethylene (UHMWPE) provide increased durability and multi-hit protection. Rising geopolitical tensions, increased defense budgets, and technological breakthroughs all contribute to the adoption of ballistic composite armor, which has become the leading segment in the market for protecting persons and assets.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.3%. The ballistic composites market in North America is driven by increasing defense spending, rising security concerns, and technological advancements in protective materials. The U.S. Department of Defense (DoD) and law enforcement agencies are investing heavily in advanced armor solutions for military personnel, vehicles, and aircraft. Additionally, the increased demand for high-strength, lightweight materials, such as ultra-high-molecular-weight polyethylene (UHMWPE) and aramid fibers, improves mobility and protection. Rising geopolitical tensions and cross-border conflicts further boost market growth. The presence of key industry players, continuous R&D efforts, and stringent government regulations on soldier safety also contribute to market expansion. Moreover, the adoption of ballistic composites in civilian applications, such as personal protection and armored vehicles, strengthens North America's market dominance.

Key Regional Takeaways:

United States Ballistic Composites Market Analysis

In 2024, the United States accounted for over 90.60% of the ballistic composites market in North America. The U.S. market for ballistics composites is growing with rising defense expenditure and rising demand from military and law enforcement agencies. The U.S. Department of Defense states that in 2023, the U.S. defense budget was USD 820.3 billion, with large amounts being spent on improving ballistic protection and advanced materials. The demand for products resistant to ballistic attacks, including body armor and vehicle armor, is still growing. Civilian demand, as well as police and security forces, is fuelling the market. Industry leaders Honeywell and DuPont are taking the lead in innovation in ballistic composite materials. Innovative materials, including ultra-lightweight aramids and ceramics, are propelling technology, while government programs in public safety and military modernization are still influencing the industry. The industry is also expanding with export possibilities because U.S. producers are going international.

Europe Ballistic Composites Market Analysis

In Europe, the ballistics composites market is increasing due to increased defense spending and rising security concerns. According to an industry report, Germany in 2023 has budgeted USD 107.2 billion towards defense, with military modernization efforts involving extensive investment in ballistic protection technologies. The drive of the European Union towards the upgrading of law enforcement equipment is also adding momentum to the growth of the market. Nations such as France, the UK, and Italy are heavily investing in ballistic composites for military applications, body armor, and defense infrastructure. Rheinmetall and Thales are at the forefront in terms of advancing advanced materials and products. Furthermore, government-supported initiatives to enhance safety standards and regulation for composite materials are spurring innovation. Increased worries regarding terrorism and civil disturbance in the area also heighten the need for advanced ballistic composites to guard both military and civilian properties.

Asia Pacific Ballistic Composites Market Analysis

Asia Pacific market for ballistics composites is growing rapidly based on expanding defense budgets, rising geopolitical tensions, and higher security equipment demand. The Indian Ministry of Defense noted that India's defense budget climbed to USD 72.6 billion in the 2023-2024 budget with special emphasis on upgradation of defense systems such as ballistic protection systems. Other countries such as China, Japan, and South Korea are also going all out on advanced composites for defense systems. The civilian market is experiencing a surge in demand for personal protective equipment (PPE), particularly in nations such as India and Australia. Top players such as Toray Industries and China National Chemical Corporation are at the forefront of spearheading innovations in composite materials, particularly in the creation of lighter, stronger, and more resilient composites. The increased focus on law enforcement and military expenditure is also contributing to the growth in the region.

Latin America Ballistic Composites Market Analysis

Latin America's market for ballistics composites is growing as defense spending rises and security issues increase. According to an industry report, Brazil, with its USD 21.8 billion defense budget in 2022, is at the forefront of spending on ballistic protection materials for law enforcement and military use. More than 1.6 million firearm licenses issued in Brazil have also driven demand for protective equipment higher. Businesses such as CBC play a pivotal role in driving the evolution of composite materials within the region. In addition, the region is reaping rewards from global alliances that are stimulating local manufacturing and technological prowess. Government investment in public security and military modernization in nations such as Mexico and Colombia is increasing the demand for ballistic composites among law enforcement and military organizations. With ongoing infrastructure growth and urbanization in the area, demand for sophisticated security materials is likely to increase.

Middle East and Africa Ballistic Composites Market Analysis

The Middle East and African regions also experience increasing demands for ballistics composites attributable to military developments and increased threats to security. According to an industry report, the defense expenditure of Saudi Arabia was estimated to reach USD 75.01 billion in 2022, which was inclusive of huge allocations toward ballistic protection material for its forces and military forces. South Africa, being at the center stage in the continent, has several players such as Denel investing in high-grade ballistic protection services both for its local and external markets. The rising geopolitical tensions and security concerns in the region are also accelerating the need for lightweight, robust composite materials. Law enforcement institutions in the Middle East are more and more incorporating ballistic-resistant materials to maintain public safety. Alliances with international manufacturers are solidifying the region's capability to produce advanced ballistic composites to keep the region competitive in the international market.

Competitive Landscape:

The market is highly competitive, with key players focusing on lightweight, high-strength materials for defense, aerospace, and law enforcement applications. Major companies include DuPont, Honeywell International, DSM, Teijin, and BAE Systems, competing through technological advancements in aramid fibers, UHMWPE, and ceramic composites. Increasing defense budgets and demand for body armor, helmets, and vehicle protection drive market expansion. Companies are investing in research and development (R&D) for advanced ballistic solutions, integrating nanotechnology and hybrid composites to enhance protection. Strategic partnerships, government contracts, and acquisitions shape competition. Emerging players are introducing cost-effective, sustainable alternatives, while established firms leverage proprietary materials and global supply chains to maintain market dominance. Regulatory compliance and military procurement trends significantly influence competitive positioning

The report provides a comprehensive analysis of the competitive landscape in the ballistic composites market with detailed profiles of all major companies, including:

- BAE Systems plc

- Barrday Inc.

- Gaffco Ballistics Inc.

- Gurit Holding AG

- Honeywell International Inc.

- II-VI Incorporated

- Koninklijke DSM N.V.

- Koninklijke Ten Cate B.V.

- MKU Limited

- Morgan Advanced Materials

- PRF Composite Materials

- Southern States LLC

- Teijin Limited

Latest News and Developments:

- January 2025: Dyneema® launched its advanced ballistic products, Dyneema® HB330 and HB332, offering a 45% weight reduction in protective armor systems. These third-generation materials provide enhanced protection in hard armor applications like inserts and helmets. The innovations deliver improved comfort, agility, and survivability, supporting law enforcement and military personnel in high-pressure environments.

- September 2024: Teijin Group companies, including Teijin Carbon America and Teijin Aramid, showcased innovative composite solutions at CAMX 2024 in San Diego. Emphasizing sustainability, Teijin focuses on eco-friendly materials such as carbon and aramid fibers, aiming to reduce environmental impact in aerospace, defense, and commercial aircraft sectors through advanced, sustainable technologies.

Ballistic Composites Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Aramids, Ultra-High Molecular Weight Polyethylene (UHMWPE), S-Glass, Others |

| Matrix Types Covered | Polymer Matrix Composite (PMC), Ceramic Matrix Composite (CMC), Metal Matrix Composite (MMC) |

| Applications Covered | Armor, Helmets and Face Protection, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAE Systems plc, Barrday Inc., Gaffco Ballistics Inc., Gurit Holding AG, Honeywell International Inc., II-VI Incorporated, Koninklijke DSM N.V., Koninklijke Ten Cate B.V., MKU Limited, Morgan Advanced Materials, PRF Composite Materials, Southern States LLC, Teijin Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ballistic composites market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global ballistic composites market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the ballistic composites industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ballistic composites market was valued at USD 1.71 Billion in 2024.

The ballistic composites market is projected to exhibit a CAGR of 4.76% during 2025-2033, reaching a value of USD 2.65 Billion by 2033.

The market is driven by rising defense budgets, increasing security concerns, and advancements in lightweight, high-strength materials like aramid and UHMWPE. Growing demand for protective gear, vehicle armor, and aerospace applications, along with technological innovations and stringent safety regulations, further fuel market growth across military, law enforcement, and civilian sectors.

North America currently dominates the ballistic composites market, accounting for a share of 39.3%. Rising defense spending, security concerns, technological advancements, lightweight materials, military modernization, law enforcement demand, geopolitical tensions, and stringent safety regulations

Some of the major players in the ballistic composites market include BAE Systems plc, Barrday Inc., Gaffco Ballistics Inc., Gurit Holding AG, Honeywell International Inc., II-VI Incorporated, Koninklijke DSM N.V., Koninklijke Ten Cate B.V., MKU Limited, Morgan Advanced Materials, PRF Composite Materials, Southern States LLC and Teijin Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)