Ball Bearing Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Ball Bearing Market Size and Share:

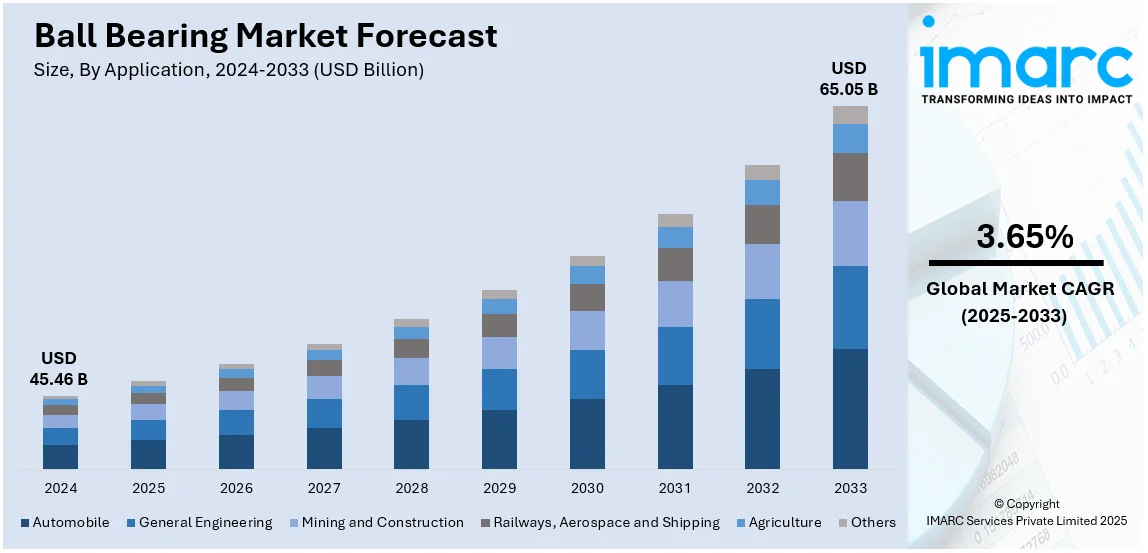

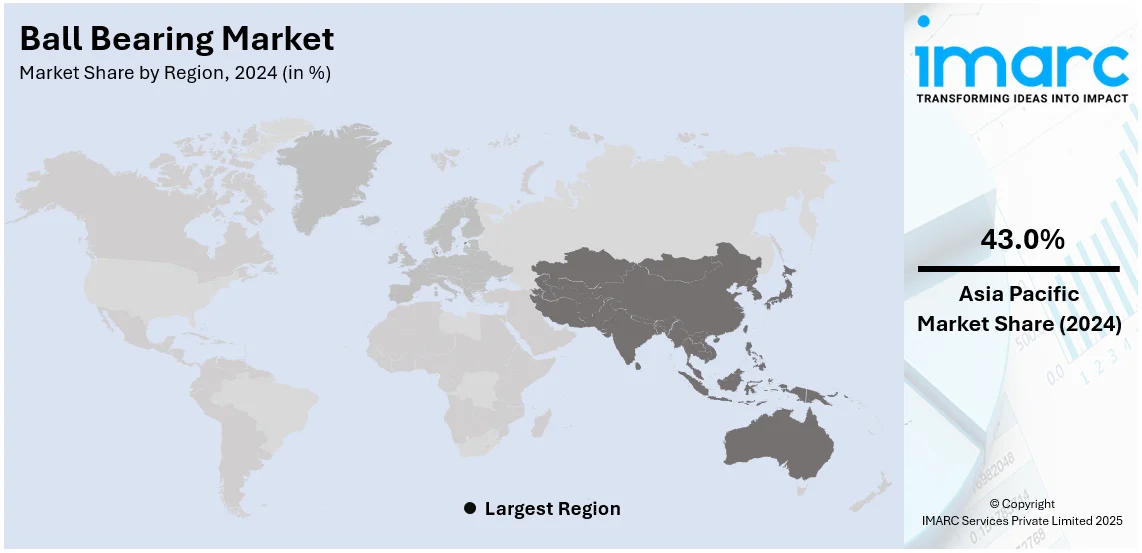

The global ball bearing market size was valued at USD 45.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 65.05 Billion by 2033, exhibiting a CAGR of 3.65% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 43.0% in 2024. The growing demand for machinery and equipment, rising demand for automation and robotics in various industries to optimize processes and improve productivity, and technological innovations to enhance durability are some of the major factors propelling the ball bearing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 45.46 Billion |

|

Market Forecast in 2033

|

USD 65.05 Billion |

| Market Growth Rate (2025-2033) | 3.65% |

The automotive industry remains a significant driver of the global ball bearing market growth, particularly with the rising demand for electric vehicles (EVs). As global vehicle production increases, the need for high-performance bearings in various automotive applications—such as in wheels, engines, transmissions, and steering systems—intensifies. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached around 93 million units in 2023, reflecting a steady growth and a shift towards cleaner technologies. Electric vehicle production is also surging, with the European Automobile Manufacturers' Association (ACEA) reporting that battery-electric vehicle registrations in the EU accounted for 14.6% of total share in 2023. The demand for specialized ball bearings, including those designed for electric drivetrains and battery systems, is anticipated to grow in tandem.

In the United States, several factors are contributing to the robust growth of the ball bearing market share. A key driver is the resurgence of manufacturing and industrial production, spurred by the U.S. government's push for reshoring and revitalizing domestic supply chains. According to the U.S. Bureau of Economic Analysis (BEA), the manufacturing sector is expanding continuously, with heavy machinery, automotive, and aerospace industries leading the charge. As these sectors expand, the demand for ball bearings used in machinery, engines, and other critical components rises correspondingly. The automotive industry is another major contributor. The shift towards EVs is intensifying the demand for high-performance bearings tailored to electric drivetrains and battery systems. Furthermore, the U.S. government’s investment in renewable energy projects, particularly wind turbines, is another factor boosting ball bearing market demand.

Ball Bearing Market Trends:

Rising Demand for Machinery and Equipment in Various Industries

The rising demand for machinery and equipment in various industries around the world is contributing to the growth of the market. Countries are developing and modernizing their machinery and equipment that provide smooth and efficient movement. Various industries, such as automotive, aerospace, construction, and manufacturing, heavily depend on ball bearings to reduce friction and enhance operational efficiency. The U.S. Census Bureau's 2021 Annual Survey of Manufactures reported that the total value of shipments for the Machinery Manufacturing subsector (NAICS 333), which includes agricultural, construction, and mining machinery, was USD 200.7 billion in 2021. The Transportation Equipment Manufacturing subsector (NAICS 336) reached USD 878.7 billion, while the Chemical Manufacturing subsector (NAICS 325) generated USD 832.3 billion. Industries are modernizing their machinery to boost operational efficiency and reduce downtime. The automotive and aerospace sectors, which rely heavily on precision components like ball bearings to reduce friction, are also seeing increased demand. In addition, there is a rise in the demand for advanced machinery to meet production requirements and reduce operational costs. Apart from this, the increasing demand for heavy machinery and construction equipment on account of the rising number of infrastructure development projects is bolstering the growth of the market.

Increasing Demand for Automation and Robotics to Perform Numerous Tasks

Automation involves the usage of technology to perform various tasks that were previously executed by humans, whereas robotics comprise the deployment of intelligent machines to perform complex actions with precision. As a result, the rising trend of automation and the introduction of robotics in various industries are supporting the growth of the market. According to the International Federation of Robotics (IFR), the global market value of industrial robot installations reached an all-time high of USD 16.5 billion in 2022. There is also an increase in the preference for automation and robotics to enhance efficiency, reduce costs, and improve quality in manufacturing, logistics, and service sectors. In addition, robots are becoming more adaptable and intelligent, which enables them to streamline the workflows and performing accurate and repetitive tasks in industries. Industries are adopting automated systems that rely on precision components and optimize processes and improve productivity.

Technological Innovations to Create High-performance Ball Bearings

As per the latest ball bearing market outlook, manufacturers are constantly investing in research and development (R&D) activities to create high-performance ball bearings that offer enhanced durability, increased load capacities, and reduced friction. In line with this, these innovations allow ball bearings to operate more efficiently and withstand higher stress conditions, which makes them suitable for a wide range of applications in various industries. For instance, in 2024, NTN Corporation developed a large diameter deep groove ball bearing for coaxial e-Axles in EVs, offering a dmn value of 1.5 million and reducing torque by over 50%. This innovation enhances e-Axle efficiency, reduces size and weight, and extends EV cruising distance. Apart from this, the development of specialized coatings and materials for these bearings benefits in expanding their usage in extreme environments and challenging operating conditions, such as high temperatures or corrosive environments. Moreover, the continuous improvement in technology encourages industries to adopt these bearings across diverse sectors for increased productivity.

Ball Bearing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ball bearing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Automobile

- General Engineering

- Mining and Construction

- Railways, Aerospace and Shipping

- Agriculture

- Others

In the global ball bearing market, the automobile sector dominates, holding a substantial 53.0% market share. This dominance is primarily driven by the critical role bearings play in various automotive systems, including engines, transmissions, suspension, and wheel assemblies. The demand for ball bearings in automobiles has been growing consistently, supported by the continuous rise in global vehicle production and the increasing complexity of modern vehicles. As vehicles become more fuel-efficient and technologically advanced, there is an escalating need for high-performance, durable, and lightweight bearings that can enhance overall vehicle efficiency, reduce friction, and improve energy consumption. Additionally, the shift towards electric vehicles (EVs) has further bolstered the automotive segment’s dominance in the ball bearing market.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

According to the latest ball bearing market forecast, Asia-Pacific dominates the market, holding 43.0% of the share. This is primarily driven by the strong automotive manufacturing sectors in countries like China, Japan, and India, which act as key production hubs. The region's rapid industrialization, large-scale infrastructure projects, and increasing consumer electronics demand also drive ball bearing consumption. As the region continues to lead in manufacturing and technological advancements, particularly in electric vehicle production, Asia-Pacific is expected to maintain its dominance in the market. The expanding automotive and industrial sectors in countries like China, Japan, and South Korea remain key drivers of growth in the Asia-Pacific region.

Key Regional Takeaways:

North America Ball Bearing Market Analysis

The North American ball bearing market is being driven by industrialization, robust manufacturing sectors and a large investment being made in massive infrastructure in the region. Demand from automotive, aerospace, energy, and heavy machinery industries has fueled the need for high-performance ball bearings, which improve operational efficiency and reduce friction. Technological advancements in this respect have allowed for more durable and precision-engineered bearings, which drives expansion in this market. Manufacturers are doing more research and development in adding some innovative designs and sustainable solutions, and the competitive dynamics between global firms and locals are intensifying. However, risks that will need consideration include changing raw material costs, uncertainty in trade, and others, which could challenge profit margins. Strategic collaborations, mergers, and investments in modern factories will probably help to reduce such risks. In conclusion, the North America ball bearing market continues to have promising growth prospects due to constant industrial innovation and incorporation of energy-efficient technologies in various industries. The above elements ensure combined strong market performance in the following years.

United States Ball Bearing Market Analysis

The U.S. ball bearing market is steadily growing, supported by demand in automotive, aerospace, industrial machinery, and defense. According to Baker Bearing Company, one of the largest ball bearing suppliers in the U.S., it holds over 6 million parts in stock and offers 140,000 unique product SKUs, a testament to the robust domestic supply chain. The major driver for the automotive sector is growing electric vehicle (EV) adoption, demanding high-performance bearings in drivetrains, motors, and wheel assemblies. In aerospace, the precision bearings required for aircraft engines and control systems also reflect growth momentum. Industrial automation/robotics constitute another area of expansion, where specific bearings are required due to various pressures. Leading manufacturers, including The Timken Company and SKF, are investing in advanced materials and engineering to improve durability and efficiency. Government infrastructure projects and rising defense spending also expand the market, making the U.S. a critical player in the global ball bearing industry.

Europe Ball bearing Ball Bearing Analysis

Europe ball bearing market is growing steadily as automotive, industrial machinery, and aerospace segments are experiencing high demand in the region. As per IMARC report, the market size of ball bearing recorded USD 14.9 billion in 2024 and is expected to increase at a CAGR of 3.6%, thereby reaching USD 20.5 billion by 2033. Germany, France, and Italy are leading the market, wherein Germany forms an integral part of the market as it dominates the manufacturing sector and holds the highest share in the automotive sector. SKF of Sweden and Schaeffler Group of Germany continue to innovate in high-performance and precision bearings for sectors like renewable energy, aerospace, and automotive. With the increasing adoption of electric vehicles in the continent, demand for special bearings in electric drivetrains and motors is also rising. This is because the focus on industrial automation and energy-efficient machinery drives further demand, positioning Europe as a leader in technological advancement within the ball bearing market.

Asia Pacific Ball Bearing Market Analysis

Asia Pacific is a significant market driver in the global sphere, as markets in automobile, aerospace, and industrial sectors are on the rise. Technological superiority is witnessed in companies such as NSK, leading the innovations. NSK, which is one of the key players in Japan has designed a ball bearing with a high rigidity resin cage, reportedly operating at over dmN 1.8 million, ideally suited for electric vehicle (EV) motors which are seeing increased traction of late. NSK also introduced a low-friction hub unit bearing offering 40% lower friction than conventional products, allowing for an extension of driving ranges for automobiles. Miniature ball bearings provided by Seiko Instruments Inc. (SII) were used for the LEV-1 actuator in the Smart Landing Investigating Moon (SLIM) probe launched from Tanegashima Space Center in September 2023, which touched down on the moon in early 2024. These trends point to increased need for high-precision, high-performance bearings in the automotive, space, and EV segments and are propelling the market forward.

Latin America Ball Bearing Market Analysis

The ball bearing market in Latin America is growing steadily with the key industries being automotive, aerospace, mining, and oil and gas. Industrial reports reveal that Brazil, the largest economy in the region, imports ball bearings valued at USD 510 million and exports bearings worth USD 102 million, with local production totaling USD 250 million. The country hosts about 30 local manufacturers and the automotive is the largest manufacturing sector driving the demand. Others include electronics, aerospace, oil and gas, and mining sectors. Moreover, the region has seen an increased construction, food and beverage, and pharmaceutical industries which boost market growth. Other growth factors supporting the ball bearing market include a rising demand for renewable energy as well as machinery and equipment. Latin America is strengthening its position in the global ball bearing supply chain, as the number of local producers increases. Brazil is leading the way in imports and exports, and the market will continue to grow steadily.

Middle East and Africa Ball Bearing Market Analysis

The Middle East and Africa are also witnessing the growth of ball bearing markets with growing demand across automotive, aerospace, and industrial machinery industries. As per an industrial report, between March 2023 to February 2024, UAE imported 3,498 shipments of ball bearings, which demonstrates that the region is increasingly becoming dependent on the availability of good-quality bearings for its industrial purposes. Besides automotive and aerospace, the oil and gas, construction, and manufacturing sectors are also major users of ball bearings. South Africa is one of the prominent countries in the region, manufacturing bearings locally for local consumption and exports. A significant player in the country is Denel. The rising need for energy-efficient machinery, as well as ongoing infrastructure development and industrialization in the Middle East and Africa, makes it an emerging market for ball bearings, with high growth potential in the next few years.

Competitive Landscape:

Various companies are investing in research and development (R&D) activities to create innovative products that offer improved performance, durability, and efficiency. They are also focusing on developing specialized bearings for specific applications and exploring new materials and manufacturing processes. Apart from this, major manufacturers are diversifying their product portfolio to cater to a wide range of industries and applications. They may offer different types of bearings, such as deep groove, angular contact, and thrust ball bearings, to address specific customer needs. In line with this, many companies are offering customized solutions to meet the unique requirements of their clients. They are closely working with customers to design and manufacture products that cater to specific applications or industries.

The report provides a comprehensive analysis of the competitive landscape in the ball bearing market with detailed profiles of all major companies, including:

- NTN Corporation

- Timken

- JTEKT

- SKF

- Schaeffler Group

Latest News and Developments:

- December 2024: SKF introduced its new SKF Infinium bearings, designed for circular performance. These bearings can be recoated and reused multiple times, aligning with SKF’s Clean and Intelligent strategy to minimize bearing waste, according to Thomas Fröst, President, Independent and Emerging Business.

- September 2024: Schaeffler joined Alstom Alliance as a strategic partner for rolling bearing technology at InnoTrans 2024. The cooperation seeks to deepen collaboration, grow business, and contribute toward sustainability steps, such as bearing remanufacturing. Schaeffler further solidifies its status as Alstom's preferred supplier of rolling bearings while underlining its commitment to innovation and long-term growth in rail transport.

- May 2024: NTN Corporation developed a large diameter deep groove ball bearing for coaxial e-Axles in electric vehicles (EVs), achieving a dmn value of 1.5 million and reducing torque by over 50%. This innovation enhances e-Axle efficiency, reduces size and weight, and extends EV cruising distance.

- February 2024: NTN supplied all bearings for turbo pumps in the H3TF2 launch vehicle, ensuring ultra-high-speed rotation under cryogenic conditions. The bearings use proprietary solid lubricant and reinforced fiberglass retainers, with ceramic balls enhancing speed and rigidity, marking Japan's first use of ceramic balls in commercial rockets.

- May 2023: SKF is restructuring its spherical roller bearing production to strengthen its market position in Europe. The company is also making significant investments to enhance machinery and improve manufacturing processes.

Ball Bearing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automobile, General Engineering, Mining and Construction, Railways, Aerospace and Shipping, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | NTN Corporation, Timken, JTEKT, SKF, Schaeffler Group etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ball bearing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ball bearing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ball bearing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ball bearing market was valued at USD 45.46 Billion in 2024.

IMARC estimates the ball bearing market to exhibit a CAGR of 3.65% during 2025-2033, reaching USD 65.05 Billion by 2033.

The growing demand for machinery and equipment, rising demand for automation and robotics in various industries to optimize processes and improve productivity, and technological innovations to enhance durability are some of the major factors propelling the market.

Asia Pacific currently dominates the market, driven by the robust automotive manufacturing sectors in countries like China, Japan, and India, which serve as major production hubs.

Some of the major players in the ball bearing market include NTN Corporation, Timken, JTEKT, SKF, Schaeffler Group etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)