Bakery Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Bakery Products Market 2024, Size and Trends:

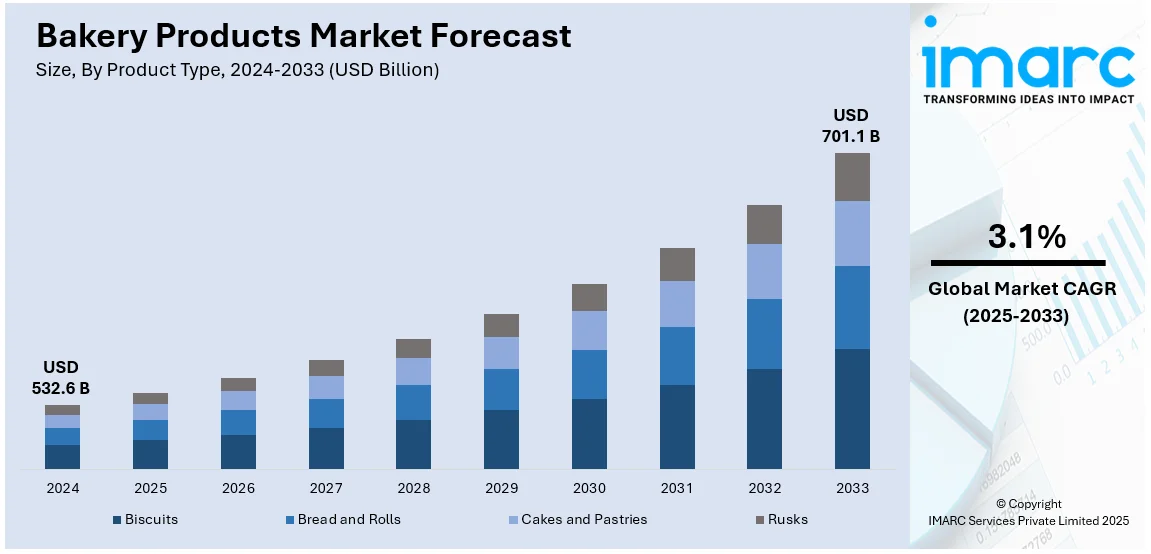

The global bakery products market size reached USD 532.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 701.1 Billion by 2033, exhibiting a growth rate CAGR of 3.1% during 2025-2033. Europe currently dominates the market, holding a market share of 36.3% in 2024. The shifting consumer preferences towards ready to consume (RTC) baked goods due to busy lifestyles and significant innovation and product diversification are key factors propelling the market growth. Besides this, bakery products market share is driven by premiumization of baked products and increasing number of e-commerce platforms, which ease access to baked food items.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 532.6 Billion |

|

Market Forecast in 2033

|

USD 701.1 Billion |

| Market Growth Rate (2025-2033) | 3.1% |

The transition to online shopping is increasing consumer access to a variety of bakery items. Internet platforms offer a convenient method for consumers to explore and buy fresh baked products. E-commerce enables shoppers to find high-quality and specialized bakery items that might not be obtainable in their local area. Bakeries are embracing direct-to-consumer online sales methods, minimizing the reliance on traditional retail outlets. The capability to provide subscription services for consistent delivery of baked goods is becoming increasingly popular. E-commerce platforms enable bakeries to connect with a broader audience beyond their local areas. By providing online ordering and contact-free delivery, bakeries fulfill consumer needs for convenience and safety. Social media and influencer marketing are crucial in advertising online bakery goods to larger audiences. The expansion of mobile applications is further simplifying the process for individuals to purchase bakery items.

To get more information on this market, Request Sample

Convenience and ready-to-eat (RTE) products are significantly driving the United States bakery products market demand. Busy lifestyles are prompting consumers to seek quick and convenient meal solutions. Ready-to-consume (RTC) bakery items like pre-packaged snacks and sandwiches, offer immediate consumption options, making them highly attractive. The demand for time-saving options is encouraging bakeries to innovate with easy to consume products. Consumer preferences are shifting towards grab-and-go bakery items that fit into on-the-go (OTG) routines. To cater this demand, in October 2024, Astoria based Chip City Cookies launched a limited-edition Strawberry Poppable Pop-Tarts Cookie in collaboration with Kellanova. The cookie features a vanilla sugar base with strawberry jam, vanilla icing, and Pop-Tarts Crunchy Poppers. Available for two weekends in October and November, it can be purchased at Chip City's locations across New York, Long Island, and beyond. Moreover, the growth of busy urban centers is increasing demand for convenient and fast-food solutions. Online platforms are facilitating the purchase of RTE bakery products, adding convenience, which is bolstering the market growth.

Bakery Products Market Trends:

Shifting consumer preferences

Health-aware shoppers frequently look for baked goods that match their eating habits and nutritional needs. Individuals utilize social media to monitor various trends. Research indicates that 42% of Americans report having experimented with a new brand or product, while 51% state they have tried a new dish due to social media engagement. The demand for products composed of whole grains, seeds, and other healthier components is increasing, as they provide superior nutritional benefits. Moreover, there is a rise in demand for baked goods that contains less amount of sugar as well as those that accommodate particular dietary requirements, such as gluten-free and dairy-free. The rise of plant-based diets is prompting bakeries to introduce vegan-friendly products, catering to specific dietary needs. Consumers are also gravitating toward organic ingredients, encouraging bakeries to adopt cleaner production methods.

Rapid urbanization and busy lifestyles

There is a rising demand for convenient and easily accessible bakery items due to the busy lifestyle of people, especially in urban centers. According to the data from World Bank, 4.4 billion people, or 56% of the world's population, currently live in cities. By 2050, the urban population is expected to double from its current level, with seven out of ten people living in cities. The rising number of consumers embracing packaged snacks, grab-and-go products, and single-portion servings for better integration with urban lifestyles supports this trend. Similarly, rapid increases in the penetration of quick-service restaurants and cafes in the cities tend to escalate consumption of bakery products, and such consumption habits would vary differently among different cities.

Innovation and product diversification

As urban populations increase and people encounter time limitations, the demand for convenient and readily available bakery products is on the rise. According to data from the World Bank, nearly 4.4 billion individuals, representing 56% of the global population, live in urban areas. By 2050, it is anticipated that the urban population will double from its present size, with about seven out of ten individuals residing in urban areas. Packaged snacks, on-the-go items, and single-serving packs are becoming more popular as they align perfectly with the hectic lifestyles of city residents. Furthermore, the growth of fast-food restaurants and cafes in city regions is increasing the intake of baked goods, leading to varied consumption trends across different urban centers.

Bakery Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bakery products market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product type and distribution channel.

Analysis by Product Type:

- Biscuits

- Cookies

- Cream Biscuits

- Glucose Biscuits

- Marie Biscuits

- Non-Salt Cracker Biscuits

- Salt Cracker Biscuits

- Milk Biscuits

- Others

- Bread and Rolls

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

- Cakes and Pastries

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

- Rusks

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

In 2024, bread and rolls dominate the market with 33.9% market share. The report indicates that bread and rolls are essential food items eaten across the globe, serving as a crucial component of diets across multiple cultures. The extensive appeal of these items guarantees a steady and considerable demand, enhancing their leading market status. They provide adaptability, making them ideal for different dining situations. They can be eaten during breakfast, lunch, dinner, or as snacks, offering a flexible option for consumers with various dietary habits and preferences. They are recognized for their practicality and extended shelf life. Their long-lasting freshness and convenient storage options make them a favored selection for consumers looking for products with prolonged usability. Furthermore, the emphasis on product innovation within the bakery sector and the launch of healthier options are significantly contributing to maintaining the appeal of bread and rolls. The presence of whole-grain, multigrain, and artisanal choices is drawing in health-aware consumers, thus influencing the market’s expansion. In accordance with this, the comparatively low-price range of bread and rolls in relation to other bakery items allows for wider consumer access, which aids in their market leadership.

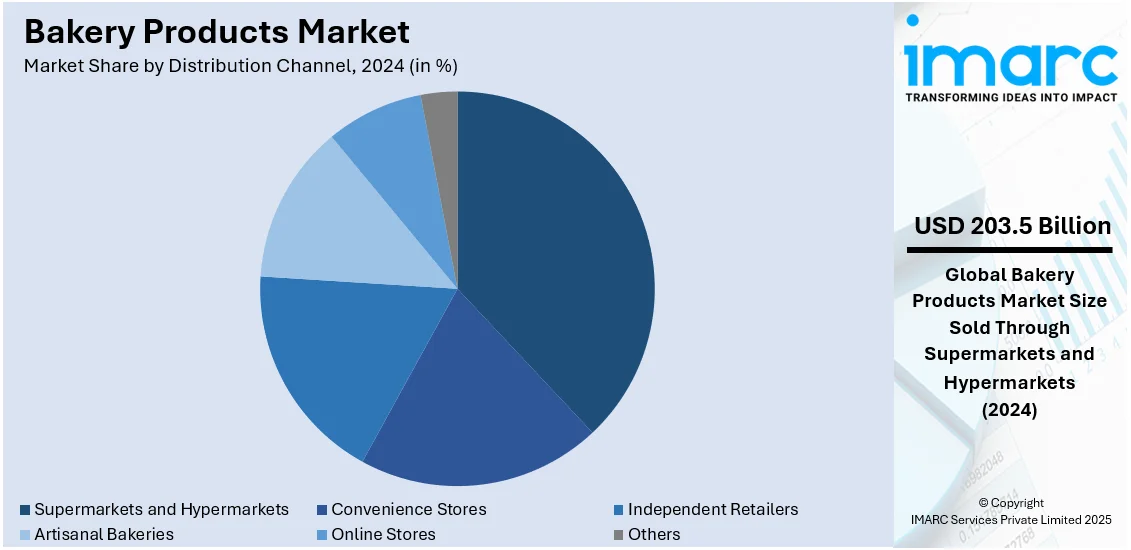

Analysis by Distribution Channel:

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with 38.2% of market share in 2024. The report indicates that supermarkets and hypermarkets create a convenient shopping experience for customers by presenting a diverse range of products, such as bakery goods, all in one location. This convenience draws a large number of customers looking to meet their grocery and bakery requirements in one trip. They possess comprehensive and established distribution networks, frequently operating numerous outlets that span urban and suburban regions, guaranteeing broad accessibility for consumers. Their extensive operations and streamlined supply chains allow them to access a wider audience, aiding in their leading market status. They usually provide appealing prices and deals, making them appealing to budget-minded shoppers. Their capacity to provide discounts and package offers increases customer loyalty and encourages repeat purchases. Moreover, these retail formats focus on strategic marketing and merchandising to improve product visibility and foster a positive shopping experience. They utilize attractive displays and marketing efforts to affect the sales of bakery goods and additional products.

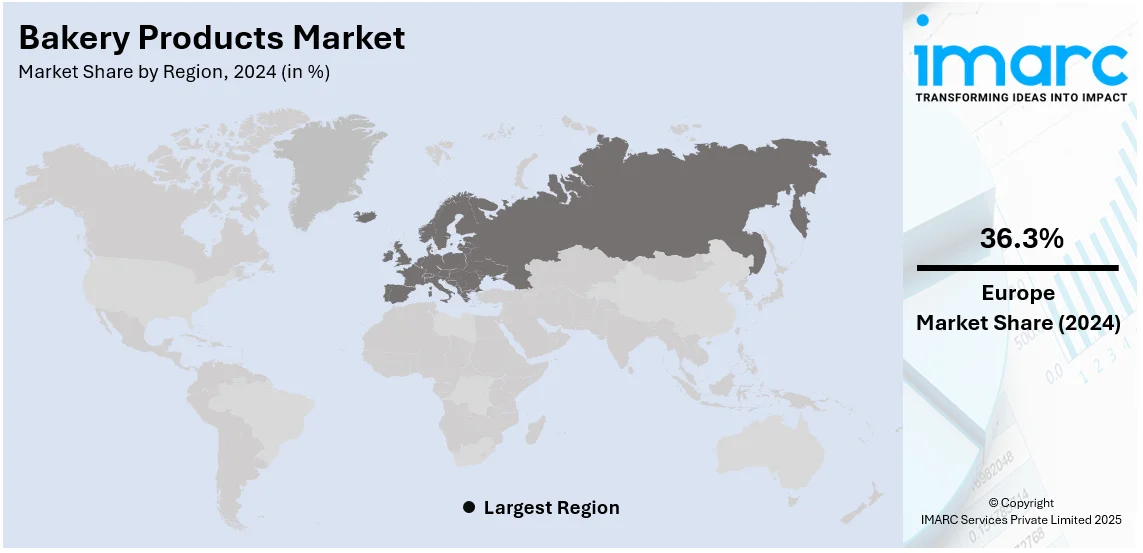

Regional Analysis:

- Asia-Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Europe accounted for the largest market share of over 36.3%. According to the report, bread is a staple food in European diets for centuries, deeply ingrained in the culinary traditions of various European countries. This cultural preference for bread consumption is leading to a consistent and substantial demand for bakery products across the region. Additionally, Europe boasts a diverse range of traditional bakery specialties, such as croissants from France, pastries from Austria, and pretzels from Germany. These unique and iconic bakery offerings are gaining popularity not only within Europe but also internationally, further contributing to the region's dominant market position. Other than this, Europe's strong emphasis on quality and craftsmanship in bakery production has earned it a reputation for producing high-quality bakery products. The use of premium ingredients and artisanal techniques has attracted discerning consumers seeking authentic and delicious bakery experiences. In line with this, Europe's well-developed bakery industry is characterized by a competitive landscape with numerous established players and bakeries of all sizes, catering to various consumer segments. This vibrant and competitive market environment fosters continuous innovation and product diversification, keeping the bakery products market dynamic and responsive to evolving consumer preferences. For instance, in April 2024, St. Michel, a leading French brand, launched its Choco Cakes range in the UK. The collection includes Choco Muffin, Choco Waffle, Choco Donut, and Choco Burger, all made with French wheat, cage-free eggs, and no palm oil.

Key Regional Takeaways:

United States Bakery Products Market Analysis

The United States hold 87.80% of the market share in North America. Growing on-the-go (OTG) lifestyles, changing customer preferences, and rising demand for healthier baked items are driving the United States market for bakery products. According to a survey report, almost one-third of Americans eat bread more than four times a week, and 72% of customers purchased bread and bread-related products in 2023. As 63% of consumers eat bread at lunch and more than 40% at breakfast or dinner, bread is commonly consumed as part of a meal. Bread is a staple and accounts for almost half of bakery sales, with the majority of American households (82%) visit grocery store bakeries on average 12 times a year, as per the research. As health-conscious consumers look for alternatives to traditional products, innovations in artisanal and organic bread variations are propelling market growth. Trends like gluten-free, low-carb, sugar-free and keto-friendly diet are strengthening the baked goods market growth. Cakes, pastries, and cookies are in high demand during the holiday season, increasing cyclical surges. E-commerce sites are also made bakery products much more accessible than ever before, in 2023, e-commerce sales made up more than 22% of total retail sales.

Asia Pacific Bakery Products Market Analysis

Markets in the Asia-Pacific region for baked products are experiencing rapid growth based on Westernized diets and an increased disposable income. Due to these factors, it is gradually replacing traditional staple breakfast foods as bread is cheaper and easily available compared to other substitutes, especially within China and India. Bread and cakes are popular in China among young demographics living in cities. According to statistics, every citizen of China consumes around 5.83 kilograms of baked items per year, whereas around 22 kg is consumed in Japan. Premium baked goods are trending in Japan, which is known for its intricate and somewhat exotic pastries. The growth in quick-service restaurants is increasing the demand for bread, which has been a massive change in India's bakery industry. Customers are becoming more accustomed to western-style baked goods due to the growth of international brands in the region. E-commerce sites and local bakeries are increasing the availability of bakery goods, which is positively impacting the bakery products market outlook.

Latin America Bakery Products Market Analysis

Latin American culture places immense importance on the presence of bread and pastry as staples in most daily diets, thereby driving the demand for bakery goods in this region. In Brazil, Mexico, Argentina every person consumes white bread and sweet rolls amounting to about 30 kilograms a year. Occasions like Día de los Muertos increases the demand for pan dulce a type of sweet bread. Moreover, a growing number of supermarkets and convenience stores has brought packaged baked goods within easy reach of time-crunched shoppers. Rising consumer spending by an expanding middle class is leading more consumers to purchase healthier and higher quality bakery products like whole-grain bread and sugar-free cookies. According to reports, about 75% of customers prefer freshly baked products over industrially processed products, which goes to show the continued role of small-scale bakeries in the market.

Middle East and Africa Bakery Products Market Analysis

Bread is the staple food for the Middle East and Africa (MEA), and the bakery products become an integral part of daily diets. Pita, flatbreads, and other traditional forms of consumption are still dominant, especially in countries such as Egypt, where over 65% of households receive bread subsidies, according to reports. A young, multicultural population and the growth of the travel and tourism sector are increasing demand for Western-style baked goods in the United Arab Emirates and Saudi Arabia. Whole-wheat and gluten-free options are also gaining traction because of the health-conscious consumer. Urbanization and the expansion of retail infrastructure in Africa have made packaged bakery products more accessible, and South Africa and other countries have set the pace for product innovation and diversification.

Competitive Landscape:

Top bakery firms allocate substantial resources to research and development (R&D) in order to launch new and inventive bakery offerings. They concentrate on addressing changing consumer demands, including healthier choices, gluten-free items, and organic components. Product diversification enables them to draw a wider range of consumers and maintain an advantage over rivals. Moreover, main participants recognize the significance of impactful branding and marketing to establish a robust market presence. They allocate resources to ad campaigns, digital marketing, and social media promotions to increase brand visibility and engage consumers. Successful branding also fosters trust and commitment among customers. In addition, international bakery leaders frequently broaden their market presence by entering new territories or purchasing local bakery companies. This approach allows them to utilize existing distribution networks and secure a presence in developing markets. Aside from this, numerous major players are progressively embracing sustainable practices in their operations. They concentrate on minimizing their carbon footprint, using sustainable packaging, and obtaining ingredients ethically. Additionally, the increasing awareness among consumers regarding environmental concerns has positioned sustainability as a crucial differentiator in the bakery sector. Forming strategic partnerships with suppliers, retailers, and foodservice providers enables key players to expand their product distribution and engage with a larger audience. Collaborations with other food and drink brands can create chances for cross-promotion and product combination.

The report provides a comprehensive analysis of the competitive landscape in the bakery products market with detailed profiles of all major companies, including:

- ARYZTA AG

- Associated British Foods (ABF) Plc

- Dr. August Oetker KG

- Flowers Foods, Inc.

- General Mills, Inc.

- Gruma, S.A.B. de C.V.

- Grupo Bimbo S.A.B de C.V.

- JAB Holding Company

- Mondelēz International, Inc.

- Rich Products Corporation

- Yamazaki Baking Co., Ltd.

Latest News and Developments:

- December 2024: Bikaji Foods entered the frozen foods market by establishing a subsidiary that specializes in frozen bread goods. This calculated action supports the company's growth initiatives to broaden its product line and adapt to shifting consumer tastes. The new subsidiary intends to investigate growth prospects in the frozen baking industry by utilizing Bikaji's current market position.

- April 2024: Flowers Foods introduced eleven new items with a focus on baked goods innovation. Fresh bread alternatives, snacks, and specialty baked goods are among the new products introduced to satisfy changing consumer demands for convenience, quality, and variety of flavor. In the bakery business, the company is stepping up its efforts to provide a wide range of creative options.

- March 2024: McDonald's and Krispy Kreme have announced an extended national relationship, with Krispy Kreme serving fresh doughnuts every day at McDonald's locations nationwide. The staggered implementation will begin in second half 2024, with countrywide availability projected by the end of 2026. Three of Krispy Kreme's most popular doughnuts will be delivered fresh to McDonald's locations every day, beginning with breakfast and continuing throughout the day. These delights will be sold singly or in boxes of six, beginning with breakfast and continuing throughout the day.

- February 2024: Gruma's subsidiary, Mission Foods México, announced a $792 million investment over the next five years to build a new snack manufacturing center and expand its Mission facility in Puebla. The facility will have an installed capacity of 200 tons per year, while the Huejotzingo tortilla, toast, and fried food plant will be expanded to produce 70 thousand tons per year.

Bakery Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Independent Retailers, Artisanal Bakeries, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ARYZTA AG, Associated British Foods (ABF) Plc, Dr. August Oetker KG, Flowers Foods, Inc., General Mills, Inc., Gruma, S.A.B. de C.V., Grupo Bimbo S.A.B de C.V., JAB Holding Company, Mondelēz International, Inc., Rich Products Corporation, Yamazaki Baking Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, bakery products market outlook, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global bakery products market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bakery products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bakery products market was valued at USD 532.6 Billion in 2024.

The bakery products market is projected to exhibit a CAGR of 3.1% during 2025-2033, reaching a value of USD 701.1 Billion by 2033.

The bakery products market growth is driven by rising health-consciousness, with demand for healthier, low-sugar, and gluten-free options. Convenience is another major factor, as consumers prefer to ready-to-eat (RTE), on-the-go (OTG)bakery products. Customization trends, such as personalized cakes or breads, are gaining popularity. Innovation in flavors, ingredients, and formats also plays a significant role, with exotic and novel offerings attracting consumers. Additionally, the rise of e-commerce is providing fresh avenues for product distribution and accessibility.

Bread and rolls dominate the bakery market due to their staple status in daily diets, affordability, and versatility. Rising health-conscious consumption has driven demand for whole grain and fortified options, while convenience and widespread availability further bolster their market dominance.

Europe currently dominates the market, accounting for a share of 36.3% in 2024, due to its strong baking tradition. The region's diverse consumer base drives demand for artisanal, premium, and traditional bakery items. High disposable incomes and a well-established bakery industry contribute to market dominance. Growing health-consciousness is increasing the popularity of organic, gluten-free, and low-sugar products in Europe.

Some of the major players in the bakery products market include ARYZTA AG, Associated British Foods (ABF) Plc, Dr. August Oetker KG, Flowers Foods, Inc., General Mills, Inc., Gruma, S.A.B. de C.V., Grupo Bimbo S.A.B de C.V., JAB Holding Company, Mondelez International, Inc., Rich Products Corporation, Yamazaki Baking Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)