Bakery Processing Equipment Market Report by Equipment (Mixer and Blenders, Dividers and Rounders, Molders and Sheeters, Ovens and Proofers, and Others), Application (Bread, Cakes and Pastries, Cookies and Biscuits, Pizza Crusts, and Others), and Region 2026-2034

Bakery Processing Equipment Market Size:

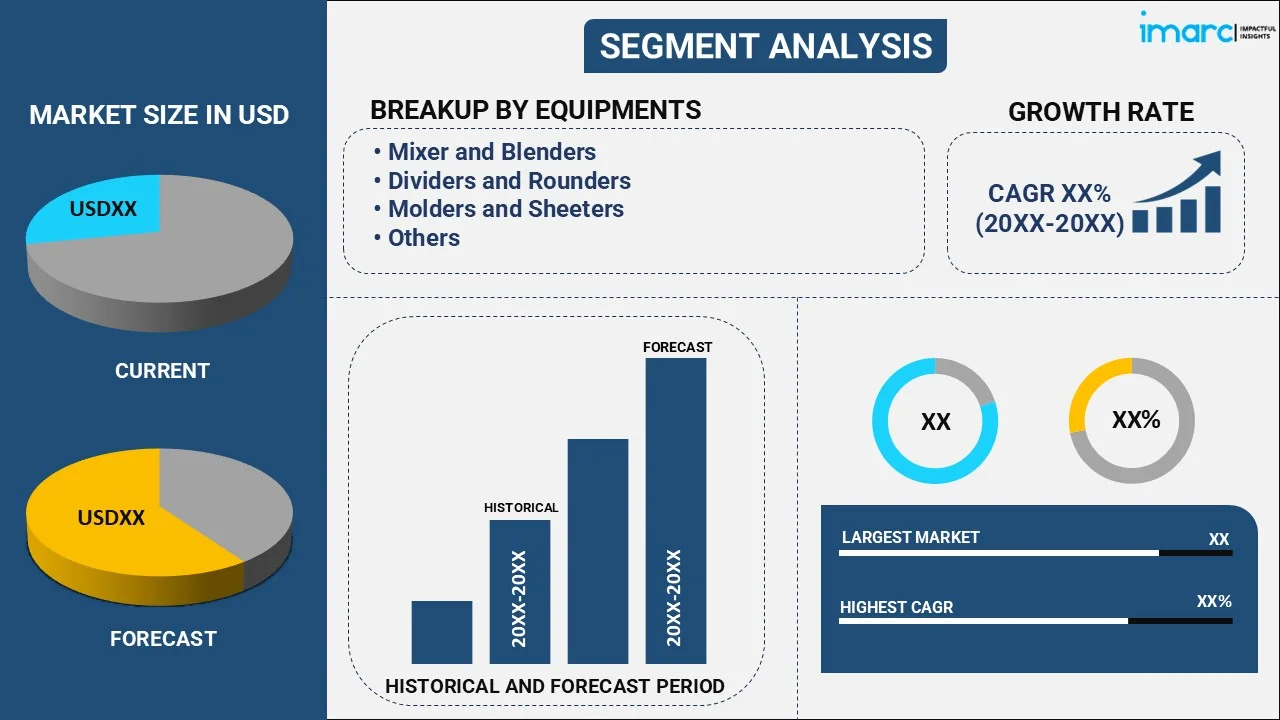

The global bakery processing equipment market size reached USD 14.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 21.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.54% during 2026-2034. The market is experiencing steady growth driven by the increasing consumption of convenient food products, which eliminate the hassle of cooking, the escalating demand for energy-efficient equipment, and the rising focus of manufacturers to diversify their product portfolio.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 14.1 Billion |

|

Market Forecast in 2034

|

USD 21.3 Billion |

| Market Growth Rate 2026-2034 | 4.54% |

Bakery Processing Equipment Market Analysis:

- Market Growth and Size: The bakery processing equipment market is witnessing moderate growth on account of the rising demand for convenience foods, technological advancements, and health-conscious consumer trends.

- Major Market Drivers: Key factors include the diversification of bakery products, rising focus on maintaining compliance with food safety and quality regulations and increasing number of ecommerce platforms and direct to customer (D2C) sale channels.

- Technological Advancements: Ongoing innovations in bakery equipment are resulting in digital controls, energy-efficient designs, and automation, improving product quality and cost-effectiveness. Equipment durability and ease of maintenance have extended equipment lifespans.

- Industry Applications: Bakery processing equipment is used in bread, cakes and pastries, cookies and biscuits, and pizza crusts, catering to diverse consumer preferences.

- Key Market Trends: The rising demand for artisanal and specialty bakery products, clean-label and transparent ingredient labeling, and sustainability initiatives are major trends in the industry.

- Geographical Trends: Asia Pacific dominates the market due to rapid urbanization and evolving consumer lifestyles. However, North America is emerging as a fast-growing market on account of the rising focus on clean-label products.

- Competitive Landscape: The bakery equipment market is highly competitive, with key players investing in research and development (R&D), expanding globally through mergers and acquisitions (M&A), and focusing on sustainability. They aim to meet the evolving demands of the bakery industry.

- Challenges and Opportunities: Challenges include regulatory compliance and rising energy costs. Nonetheless, opportunities for catering to niche markets, such as gluten-free and allergen-friendly products, and aligning with consumer trends for healthier and sustainable bakery options are projected to overcome these challenges.

To get more information on this market Request Sample

Bakery Processing Equipment Market Trends:

Rising demand for convenience foods

The increasing consumer demand for convenience foods represents one of the primary factors impelling the growth of the market. In the fast-paced world, consumers are seeking quick and ready-to-eat options to fit their busy lifestyles. Bakeries are recognizing this shift in consumer behavior and adapting by offering a wide array of convenience bakery products, including pre-packaged sandwiches, pastries, and snacks. Bakery processing equipment is instrumental in meeting this soaring demand efficiently and effectively. The automation capabilities of bakery processing equipment are pivotal in streamlining various stages of the production process. From precise ingredient mixing and dough preparation to efficient baking and packaging, these machines ensure consistency in product quality while significantly reducing labor costs. This automation allows bakeries to keep pace with the high demand for convenience bakery products. Furthermore, bakery processing equipment enhances production speed, ensuring that consumers can access fresh and delicious bakery items when they need them. With the convenience trend showing no signs of slowing down, bakeries worldwide are making substantial investments in advanced processing equipment to remain competitive and cater to evolving consumer preferences.

Technological advancements

The ongoing technological advancements are propelling the market growth. These innovations are playing a pivotal part in enhancing production efficiency, product quality, and cost-effectiveness. One significant advancement is the integration of cutting-edge digital controls and monitoring systems into bakery machinery. These technologies enable precise regulation of crucial factors, such as temperature, humidity, and mixing speeds. The result is consistent product quality and higher efficiency in the production process. Moreover, modern bakery equipment designs prioritize energy efficiency, which not only reduces operational costs but also aligns with sustainability goals. Automation is another key area of improvement in bakery processing equipment. Advanced machines offer increased levels of automation, reducing the need for manual labor and the potential for human errors. This leads to higher production rates and greater product consistency, which are essential for meeting market demands efficiently. Equipment durability and ease of maintenance are also becoming improved, extending the lifespan of bakery machines and minimizing production downtime. These advancements are especially crucial as bakeries seek to optimize their operations and minimize waste.

Health and wellness trends

The growing consumer consciousness of health and wellness is reshaping the bakery industry and, consequently, driving the demand for bakery processing equipment. Consumers are increasingly concerned about the components or ingredients and nutritional content of the food products they consume, leading to a shift in preferences toward healthier bakery products with reduced fat, sugar, and additives. Bakery processing equipment plays a pivotal role in achieving these health-conscious goals. These machines allow for precise portion control and ingredient mixing, ensuring that healthier alternatives meet the desired taste and texture expectations. Additionally, advanced ovens and baking equipment are designed to optimize the baking process for low-fat and low-sugar recipes, further aligning with consumer preferences.

By embracing health and wellness trends, bakeries can cater to an extensive consumer base, including those with dietary restrictions or preferences. Bakery processing equipment is instrumental in enabling bakeries to adapt their production processes efficiently to create these healthier alternatives. Furthermore, as regulatory authorities and health organizations emphasize the importance of reduced sugar and fat intake, bakeries are under pressure to reformulate their products. Bakery processing equipment assists in achieving these reformulation goals without compromising on taste or quality.

Bakery Processing Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on equipment and application.

Breakup by Equipment:

To get detailed segment analysis of this market Request Sample

- Mixer and Blenders

- Dividers and Rounders

- Molders and Sheeters

- Ovens and Proofers

- Others

Ovens and proofers account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes mixer and blenders, dividers and rounders, molders and sheeters, ovens and proofers, and others. According to the report, ovens and proofers represented the largest segment.

The ovens and proofers segment is the largest within the bakery equipment market. These machines are the heart of the baking process, responsible for baking and proofing a wide range of bakery products, including bread, cakes, pastries, and more. Ovens are designed to bake products to perfection, providing the desired texture and flavor. Proofers, on the other hand, are used for fermentation and the rising of dough before baking, which is crucial for achieving the ideal crumb structure and taste. The dominance of this segment reflects the central role of ovens and proofers in the bakery industry, where precision and efficiency are paramount for delivering high-quality baked goods to meet consumer demands.

The mixer and blender segment within the bakery equipment market includes a wide range of equipment used for the preparation of dough and batter. These machines play a fundamental role in ensuring consistent quality and texture in bakery products. They are essential for mixing ingredients, incorporating air, and achieving the desired consistency for various baked goods. Bakeries of all sizes, from small artisanal operations to large-scale industrial facilities, rely on mixers and blenders to streamline their production processes and maintain product consistency.

Dividers and rounders are critical in the bakery industry for portion control and shaping of dough. This segment includes machinery that divides dough into uniform portions and rounds them into balls or other desired shapes. These machines are especially crucial in the production of products like bread rolls, buns, and pizza dough. The dividers and rounders segment enables bakeries to achieve consistent product sizes and shapes, contributing to the overall quality and presentation of their baked goods.

The molders and sheeters encompass equipment designed to shape and flatten the dough into specific forms and sizes. Molders are used for shaping dough into intricate shapes, such as croissants or pastries. Sheeters, on the other hand, are utilized to roll out dough uniformly for products like pie crusts and laminated doughs. This segment is vital for bakeries producing a wide variety of baked goods, including pastries, pies, and specialty bread, where precise shaping and thickness are essential for the final product's quality and consistency.

Breakup by Application:

- Bread

- Cakes and Pastries

- Cookies and Biscuits

- Pizza Crusts

- Others

Bread holds the largest share in the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bread, cakes and pastries, cookies and biscuits, pizza crusts, and others. According to the report, bread accounted for the largest market share.

Bread encompasses equipment used for the production of various types of bread, including traditional loaves, baguettes, rolls, and specialty bread. The demand for bread remains consistently high globally, making it a staple in most households. Bakery equipment, such as mixers, dividers, rounders, and ovens, plays a vital role in the efficient and large-scale production of bread. Bread production relies on precise equipment to achieve consistent quality, texture, and volume.

The cakes and pastries segment focuses on the equipment used in the production of cakes, cupcakes, pies, tarts, and a wide array of pastries. This category encompasses mixers for batter preparation, ovens for baking delicate pastries, and sheeters for rolling out dough for pastry shells. The demand for cakes and pastries is driven by celebrations, special occasions, and the growing cafe culture.

The cookies and biscuits segment includes equipment designed for the production of various types of cookies, biscuits, and crackers. This category covers machines for mixing dough, forming cookies, and baking them to perfection. Cookies and biscuits are popular snacks enjoyed by people of all ages, making this segment a significant part of the bakery industry.

The pizza crusts segment focuses on equipment used in the production of pizza dough, including mixers, dough sheeters, and ovens specifically designed for pizza crusts. With the global popularity of pizza, both in restaurants and as a convenient at-home meal option, this segment is gaining prominence. Pizza crusts come in various styles, from thin and crispy to thick and doughy, and bakery equipment plays a crucial part in achieving the desired characteristics.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest bakery processing equipment market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific bakery processing equipment market is driven by evolving consumer lifestyles, leading to increased demand for convenience foods and bakery products. This shift in consumer behavior is catalyzing the need for bakery equipment as bakeries strive to meet the need for a wide range of baked goods.

North America maintains a strong presence driven by the demand for transparency in ingredient labeling and clean-label bakery products. This is leading to the adoption of bakery equipment that can efficiently produce clean-label products with natural and recognizable ingredients.

Europe stands as another key region in the market, driven by the increasing development of bakery equipment that can produce healthier alternatives while maintaining taste and texture.

Latin America exhibits growing potential in the bakery processing equipment market, fueled by the increasing need for bakery equipment that can scale production while maintaining product quality.

The Middle East and Africa region show a developing market for bakery processing equipment, driven by the increasing investment in bakery equipment to meet the needs of the expanding consumer base.

Leading Key Players in the Bakery Processing Equipment Industry:

The key players in the bakery equipment market are actively engaged in several strategic initiatives to maintain their market leadership. These initiatives include continuous research and development (R&D) efforts to introduce innovative and technologically advanced bakery equipment that enhances efficiency, reduces energy consumption, and meets evolving consumer demands for healthier and customized bakery products. Additionally, many players are expanding their global footprint through mergers, acquisitions, and partnerships to tap into emerging markets and strengthen their distribution networks. Moreover, sustainability has become a significant focus, with key players working on eco-friendly equipment designs and manufacturing processes to align with environmental regulations and consumer preferences. Overall, key players are committed to staying at the forefront of the bakery equipment industry by combining innovation, expansion, and sustainability efforts.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ali Group S.r.l.

- Baker Perkins Limited (Schenck Process Holding GmbH)

- Bühler AG

- GEA Group Aktiengesellschaft

- The Middleby Corporation

- JBT Corporation

- Anko Food Machine Co. Ltd.

- Markel Ventures Inc.

- Koenig Maschinen GmbH

- Heat & Control Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- April 2023: Heat & Control Inc. announced the opening of a new facility in Mexico, which will benefit its operations and provide additional support to customers, and further reinforce its commitment to serving the industry.

- December 2023: JBT Corporation announced the launch of a new updated version of Stein TwinDrum PRoYIELD™ 600 Spiral Oven, which is an innovative spiral oven engineering designed to redefine processing standards worldwide.

Bakery Processing Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Mixer and Blenders, Dividers and Rounders, Molders and Sheeters, Ovens and Proofers, Others |

| Applications Covered | Bread, Cakes and Pastries, Cookies and Biscuits, Pizza Crusts, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ali Group S.r.l., Baker Perkins Limited (Schenck Process Holding GmbH), Bühler AG, GEA Group Aktiengesellschaft, The Middleby Corporation, JBT Corporation, Anko Food Machine Co. Ltd., Markel Ventures Inc., Koenig Maschinen GmbH, Heat & Control Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bakery processing equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global bakery processing equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bakery processing equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bakery processing equipment market was valued at USD 14.1 Billion in 2025.

The bakery processing equipment market is projected to exhibit a CAGR of 4.54% during 2026-2034, reaching a value of USD 21.3 Billion by 2034.

Key factors driving the bakery processing equipment market include rising demand for convenience and packaged bakery goods, technological advancements (automation, energy-efficiency, digital controls), growing preference for healthy/specialty products (gluten-free, low-sugar), stringent food safety regulations, and expansion of large-scale and artisanal bakery operations.

Asia Pacific currently dominates the bakery processing equipment market rapid urbanization, rising disposable incomes, growing demand for convenience and ready-to-eat bakery products, and expanding food processing industries. Additionally, increasing Western dietary influences, technological advancements, and supportive government initiatives in countries like China, India, and Japan boost market growth.

Some of the major players in the bakery processing equipment market include Ali Group S.r.l., Baker Perkins Limited (Schenck Process Holding GmbH), Bühler AG, GEA Group Aktiengesellschaft, The Middleby Corporation, JBT Corporation, Anko Food Machine Co. Ltd., Markel Ventures Inc., Koenig Maschinen GmbH, Heat & Control Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)