Bakery Ingredients Market Report by Product Type (Emulsifiers, Leavening Agents, Enzymes, Baking Powder & Mixes, Oils, Fats and Shortenings, Colors & Flavors, Starch, and Others), Application (Breads, Cookies & Biscuits, Rolls & Pies, Cakes & Pastries, and Others), End Use Sector (Industrial, Foodservice, Retail), and Region 2025-2033

Global Bakery Ingredients Market:

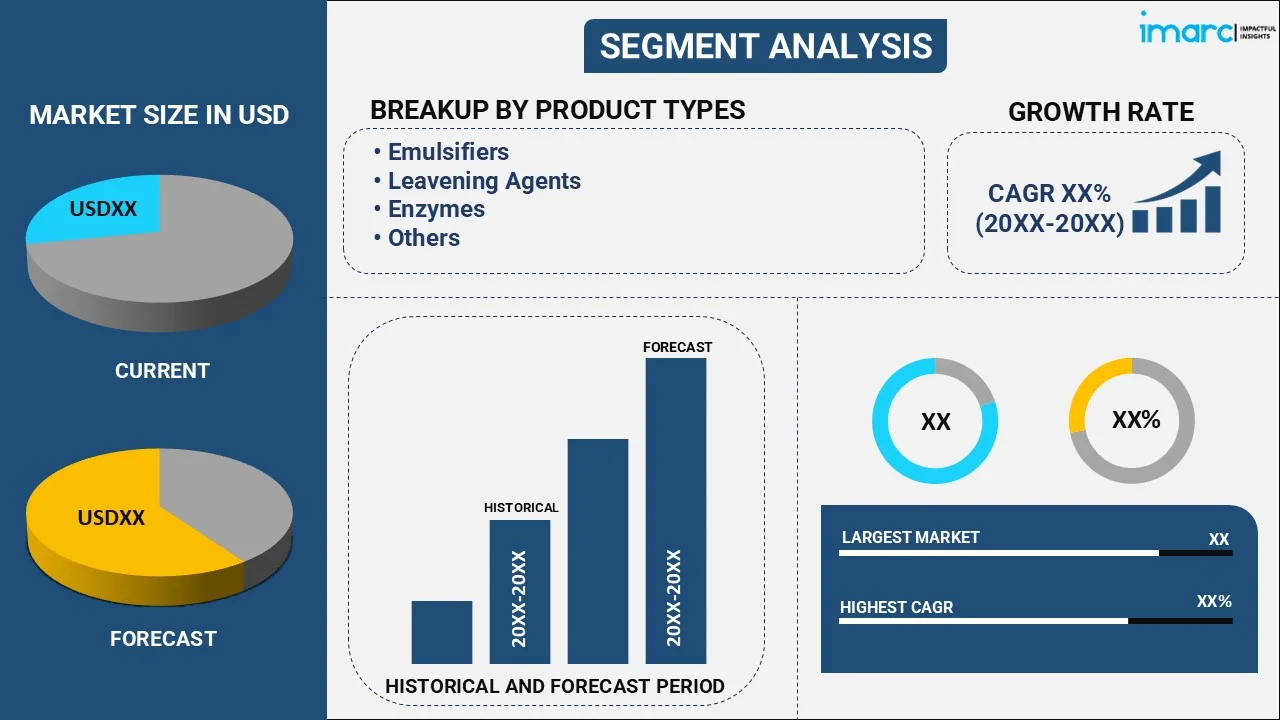

The global bakery ingredients market size reached USD 17.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The shifting preferences towards premium and artisanal bakery products are among the key factors bolstering the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.3 Billion |

| Market Forecast in 2033 | USD 26.0 Billion |

| Market Growth Rate (2025-2033) | 4.4% |

Bakery Ingredients Market Analysis:

- Major Market Drivers: The busy lifestyles of individuals are escalating the demand for convenient bakery products, which is acting as a significant growth-inducing factor. Moreover, the increasing interest of people in home baking is also propelling the market.

- Key Market Trends: Key players are introducing packaging solutions that extend shelf life, preserve freshness, and enhance convenience for both consumers and commercial bakers, which is fueling the overall market.

- Competitive Landscape: Some of the prominent companies in the global market include Cargill, Incorporated, Koninklijke DSM N.V., Kerry Group, Südzucker AB, AAK AB, Associated British Foods, Lesaffre ET Compagnie, Tate & Lyle, PLC Archer Daniels Midland Company, Ingredion Incorporated, Corbion N.V., IFFCO Ingredients Solution, Taura Natural Ingredients Limited, Dawn Foods Products, Inc., Muntons Plc, British Bakels Ltd., Lallemand Inc., Novozymes A/S, and Puratos Group, among many others.

- Geographical Trends: The deep-rooted baking traditions and culinary legacies of Europe are augmenting the market across the region. Besides this, the rising number of centers and skilled bakers is further catalyzing the market.

- Challenges and Opportunities: One of the primary challenges hindering the market is the inflating costs of raw materials. However, the development of cost-effective ingredient alternatives will continue to fuel the market over the forecasted period.

To get more information on this market, Request Sample

Bakery Ingredients Market Trends:

Rising Popularity of Natural Ingredients

The growing consumer health-consciousness is bolstering the demand for organic bakery components. This trend is also driven by the shifting preference for clean labels and minimally processed foods. For instance, in February 2024, GoodMills Innovation launched a new range of clean-label ingredients called Slow Milling, designed to help industrial and retail bakeries make artisan-style baked goods. By enabling the production of traditional goods on an industrial scale, the range aims to enhance cost efficiency while providing fresh, visually appealing bakery products.

Increasing Innovations in Vegan Baking

The inflating popularity of plant-based alternatives is stimulating the bakery ingredients market insights. Companies like Just Egg have launched plant-based egg substitutes, while Follow Your Heart offers vegan butter suitable for baking. Furthermore, in March 2024, one of the food tech companies, Incredo, Inc. (U.S.), announced the introduction of Incredo Sugar G2, a concentrated version of its globally recognized sugar-based sugar reduction solution, Incredo Sugar. The solution is the latest addition to its portfolio of innovative offerings for food manufacturers and CPGs. Incredo Sugar G2 is a clean-label, patent-pending concentrated sugar-carrier complex and is now available to companies in Europe and North America for use in chocolates, spreads, baked goods, gummies, etc.

Growing Demand for Convenience

The introduction of ready-to-use baking mixes, which offer easy and quick solutions for home baking, is bolstering the market. Furthermore, Pillsbury's launch of pre-mixed batters and doughs exemplifies this trend, thereby providing consumers with hassle-free options for making bread, cookies, and cakes. Similarly, Duncan Hines offers a variety of ready-to-bake mixes that simplify the baking process. These product launches cater to the busy lifestyles of modern consumers, emphasizing convenience without compromising on quality and driving the growth of the ready-to-use segment in the market.

Global Bakery Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the bakery ingredients market forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on the product type, application, and end use sector.

Breakup by Product Type:

- Emulsifiers

- Leavening Agents

- Enzymes

- Baking Powder and Mixes

- Oils, Fats and Shortenings

- Colors and Flavors

- Starch

- Others

Baking powder and mixes currently exhibit a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes emulsifiers, leavening agents, enzymes, baking powder and mixes, oils, fats and shortenings, colors and flavors, starch, and others. According to the report, baking powder and mixes represented the largest market segmentation.

Baking powder and mixes have seen innovative product launches aimed at catering to diverse consumer preferences and dietary needs. For instance, Bob's Red Mill introduced a gluten-free baking powder, appealing to those with gluten sensitivities or celiac disease. Similarly, Pillsbury has expanded its product line with convenient, ready-to-use baking mixes that simplify home baking. This, in turn, is expanding the bakery ingredients industry size across the segmentation.

Breakup by Application:

- Breads

- Cookies and Biscuits

- Rolls and Pies

- Cakes and Pastries

- Others

Currently, breads hold the largest bakery ingredients market demand

The report has provided a detailed breakup and analysis of the market based on the application. This includes breads, cookies and biscuits, rolls and pies, cakes and pastries, and others. According to the report, breads represented the largest market segmentation.

Breads represent the largest segmentation in the market due to their fundamental role in diets worldwide and the variety of bread types that cater to different tastes and preferences. The high consumption of staples like sandwich loaves, artisanal breads, and specialty breads such as gluten-free or whole grain options fuels this segment's dominance. For example, the popularity of sourdough has surged, driving demand for specific ingredients like sourdough starters and high-quality flours. Companies like King Arthur Baking Company offer a wide range of flours and bread mixes to meet this demand. Additionally, Bob's Red Mill provides diverse bread-baking ingredients, including whole wheat and organic flour, catering to health-conscious consumers. This, in turn, is bakery ingredients market revenue.

Breakup by End Use Sector:

- Industrial

- Foodservice

- Retail

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes industrial, foodservice, and retail.

Allylamines, such as terbinafine, are prominently featured due to their high efficacy and relatively short treatment duration, making them a preferred choice for both patients and healthcare providers. Azoles, including itraconazole and fluconazole, are also thoroughly examined, highlighting their broad-spectrum antifungal activity and flexibility in dosing regimens, which cater to patients requiring alternative treatment options. Griseofulvin, an older antifungal, is analyzed for its continued use in cases where other treatments are contraindicated. The report further explores other emerging drug classes and novel antifungal agents that are being developed to address the limitations of existing therapies, which is propelling the bakery ingredients market share. This analysis not only informs about the market dynamics but also aids in understanding the evolving preferences and trends in antifungal treatments.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Europe currently dominates the market

The bakery ingredients market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Europe accounted for the largest market share.

The market is robust, driven by the region's rich baking traditions and growing consumer demand for high-quality and innovative products. Countries like France, Germany, and Italy, renowned for their artisanal breads and pastries, significantly influence market trends. For instance, French baguettes and croissants require specialized flour and butter, while Italian panettone demands unique yeast and candied fruit. Companies like Lesaffre and Puratos are pivotal in supplying these essential ingredients, ensuring authenticity and quality. This, in turn, is bolstering the bakery ingredients market outlook across Europe.

Competitive Landscape:

Companies are investing in research and development (R&D) activities to create innovative ingredient formulations that align with changing consumer preferences. They are focusing on clean-label ingredients, natural alternatives to artificial additives, and functional ingredients that enhance the nutritional profile of baked goods. Additionally, many bakery ingredients manufacturers are prioritizing sustainability by adopting eco-friendly practices throughout their supply chains. They are sourcing raw materials responsibly, using sustainable packaging materials, and implementing energy-efficient manufacturing processes to reduce their environmental footprint. Apart from this, various leading manufacturers are forming strategic partnerships with bakeries and food service chains to provide customized solutions and support their product development efforts.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Cargill Incorporated

- Koninklijke DSM N.V.

- Kerry Group

- Südzucker AB

- AAK AB

- Associated British Foods

- Lesaffre ET Compagnie

- Tate & Lyle

- PLC Archer Daniels Midland Company

- Ingredion Incorporated

- Corbion N.V.

- IFFCO Ingredients Solution

- Taura Natural Ingredients Limited

- Dawn Foods Products Inc.

- Muntons Plc

- British Bakels Ltd.

- Lallemand Inc.

- Novozymes A/S

- Puratos Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Bakery Ingredients Market Recent Developments:

- March 2024: One of the food tech companies, Incredo, Inc. (U.S.), announced the introduction of Incredo Sugar G2, a concentrated version of its globally recognized sugar-based sugar reduction solution, Incredo Sugar.

- February 2024: Ann Clark, a leading manufacturer of cookie cutters and baking supplies, expanded its product line with a new gourmet cake mix and frosting kits.

- February 2024: GoodMills Innovation launched a new range of clean-label bakery ingredients called Slow Milling, designed to help industrial and retail bakeries make artisan-style baked goods.

Bakery Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Emulsifiers, Leavening Agents, Enzymes, Baking Powder and Mixes, Oils, Fats and Shortenings, Colors and Flavors, Starch, Others |

| Applications Covered | Breads, Cookies and Biscuits, Rolls and Pies, Cakes and Pastries, Others |

| End Use Sectors Covered | Industrial, Foodservice, Retail |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cargill, Incorporated, Koninklijke DSM N.V., Kerry Group, Südzucker AB, AAK AB, Associated British Foods, Lesaffre ET Compagnie, Tate & Lyle, PLC Archer Daniels Midland Company, Ingredion Incorporated, Corbion N.V., IFFCO Ingredients Solution, Taura Natural Ingredients Limited, Dawn Foods Products, Inc., Muntons Plc, British Bakels Ltd., Lallemand Inc., Novozymes A/S, Puratos Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bakery ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global bakery ingredients market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bakery ingredients industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global bakery ingredients market was valued at USD 17.3 Billion in 2024.

We expect the global bakery ingredients market to grow at a CAGR of 4.4% during 2025-2033.

The rising demand for ready-to-cook and convenience food products represents one of the key factors driving the global bakery ingredients market growth.

The sudden outbreak of the COVID-19 pandemic has led to growing online sales of bakery ingredients, owing to the adoption of the Bake-at-Home trend for preparing cakes, pastries, cookies, etc., during the lockdown scenario.

Based on the product type, the global bakery ingredients market has been bifurcated into emulsifiers, leavening agents, enzymes, baking powder & mixes, oils, fats and shortenings, colors & flavors, starch, and others. Currently, baking powder & mixes hold the majority of the total market share.

Based on the application, the global bakery ingredients market can be divided into breads, cookies & biscuits, rolls & pies, cakes & pastries, and others. Among these, breads represent the largest segment.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Europe currently dominates the global market.

Some of the major players in the global bakery ingredients market include Cargill, Incorporated, Koninklijke DSM N.V., Kerry Group, Südzucker AB, AAK AB, Associated British Foods, Lesaffre ET Compagnie, Tate & Lyle, PLC Archer Daniels Midland Company, Ingredion Incorporated, Corbion N.V., IFFCO Ingredients Solution, Taura Natural Ingredients Limited, Dawn Foods Products, Inc., Muntons Plc, British Bakels Ltd., Lallemand Inc., Novozymes A/S, and Puratos Group.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)