Back to College Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Back To College Market Size and Share:

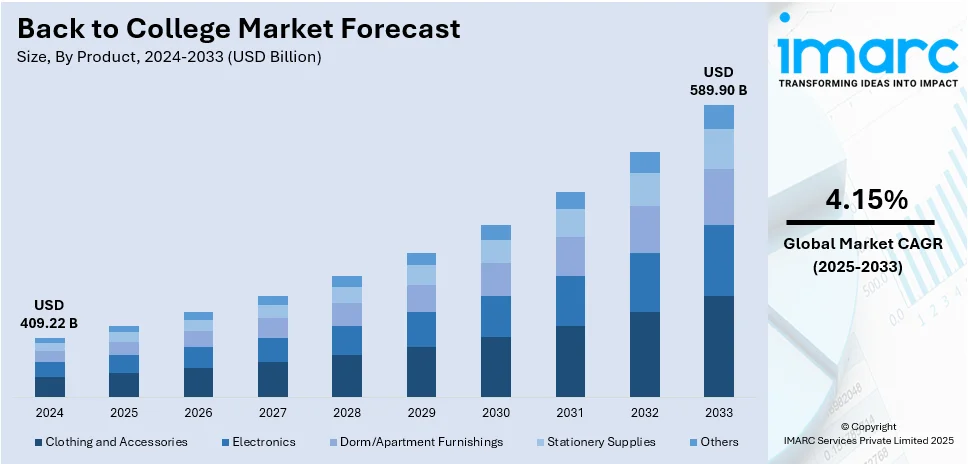

The global back to college market size was valued at USD 409.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 589.90 Billion by 2033, exhibiting a CAGR of 4.15% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 36% in 2024. Increasing student enrollments, rising expenditure on educational supplies, expanding e-commerce penetration, promotional discounts, technological advancements in education, shifting consumer preferences toward branded merchandise, hybrid learning adoption, and government initiatives for education are some of the major factors positively impacting the back to college market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 409.22 Billion |

| Market Forecast in 2033 | USD 589.90 Billion |

| Market Growth Rate (2025-2033) | 4.15% |

The global market is primarily driven by rising digitalization in higher education, fostering demand for laptops, tablets, and smart study tools. Additionally, increased awareness of ergonomic furniture for student well-being is influencing purchases. Moreover, the growing influence of social media and influencer marketing is shaping student preferences for apparel, electronics, and dorm essentials. In addition to this, expanding student mobility, with more international enrollments, is increasing demand for travel essentials, storage solutions, and home goods. According to reports, the United States accommodated a record-breaking number of 1,126,690 foreign students. during the 2023-2024 academic year, marking a 7% rise from 2022-2023. According to the Fall 2024 International Student Enrollment Snapshot, U.S. institutions saw a 3% rise in international student enrollment as of the beginning of the 2024-2025 academic year. Furthermore, sustainability concerns are promoting eco-friendly school supplies, energy-efficient devices, and second-hand furniture, which is shaping purchasing decisions across diverse student demographics.

The market in the United States is witnessing significant growth due to the rising need for individualized and technologically advanced shopping experiences. For instance, on May 1, 2024, Pottery Barn Teen unveiled its most extensive dorm collection to date, introducing enhanced digital tools and an improved shopping experience. Among the new features are the "Ultimate Dorm Wishlist" and the "Build My Bed" 3D visualizer, which are available on the website and mobile app. Customers can also expedite their dorm room preparations by taking advantage of the free dorm design services. Besides this, subscription-based learning platforms and e-textbooks are gaining traction due to digital transformation in education, which is providing a boost to back to college market growth. In line with this, the increasing emphasis on mental health and well-being is accelerating purchases of ergonomic chairs, blue-light-blocking glasses, and wellness products. Apart from this, a strong culture of collegiate branding and school spirit is fueling demand for university merchandise, customized stationery, and campus lifestyle accessories.

Back To College Market Trends:

Rising enrollment in higher education institutions

The global back-to-college market experiences significant back to college market trend due to the continually increasing enrollment in higher education institutions worldwide. According to reports, the number of institutions in the country has increased significantly over the past nine years, from 723 in 2014 to 1,113 in 2023. As more students seek to pursue tertiary education, the demand for college-related products and services, such as textbooks, stationery, dormitory essentials, and technology devices, intensifies. This driver underscores the consistent need for various academic supplies and amenities that facilitate a successful educational journey. Educational institutions' expanding student bodies contribute to the sustained growth of the market, making it a critical factor for businesses to consider when strategizing their offerings and marketing approaches.

Integration of technology in education

The integration of technology within educational curricula emerges as a powerful driver, which enhances the back-to-college market outlook. The modern education landscape heavily relies on digital tools and electronic gadgets for enhanced learning experiences. This trend spurs demand for laptops, tablets, e-readers, and software applications tailored to educational purposes. Furthermore, the prevalence of online learning platforms and digital study resources requires students to possess compatible devices, shaping their preferences in technology-related purchases. For instance, approximately half of lower secondary schools worldwide had access to the Internet for educational reasons in 2022. As technology continues to reshape educational methodologies, its influence on the back-to-college market remains robust and calls for tailored product offerings that cater to students' technological needs.

Evolving fashion trends and self-expression

The evolving fashion landscape significantly impacts the back-to-college market share as students keenly follow trends to express their individuality. Collegegoers are increasingly drawn to clothing, accessories, and personal care products that align with the latest fashion styles. This driver fuels demand for a diverse range of items, from trendy apparel to stylish backpacks and grooming essentials. Students view their appearance as a means of self-expression, and this inclination toward fashion-consciousness propels them to seek out products that resonate with their personal style. As a result, businesses in the back-to-college market must stay attuned to changing fashion preferences and create offerings that empower students to showcase their identities through their choices in attire and personal grooming.

Back To College Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global back to college market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Clothing and Accessories

- Electronics

- Dorm/Apartment Furnishings

- Stationery Supplies

- Others

Clothing and accessories lead the market with around 29.7% of market share in 2024. Clothing and accessories represent both personal expression and functional necessity. Students choose their fashion according to their identities, cliques, and rapidly changing trends, making apparel a key purchase category. Retailers often take advantage of this seasonal demand by offering exclusive collections, promotional deals, and packages of jeans, hoodies, sneakers, backpacks, and tech-ability accessories. Most of the students seek clothes and accessories based on comfort and versatility. Additionally, branded merchandise, college-logo apparel, and weather-appropriate clothing drive purchases, which reflects school spirit and regional climate needs. Social media presence, influencer marketing, and online shopping mechanisms further enhance and change the purchasing choice process along the way. Clothing and accessories are not just back-to-school essentials but also a significant revenue factor for brands, as they influence student lifestyles and place fierce competition in the crosshairs of retailers.

Analysis by Distribution Channel:

- Online

- Offline

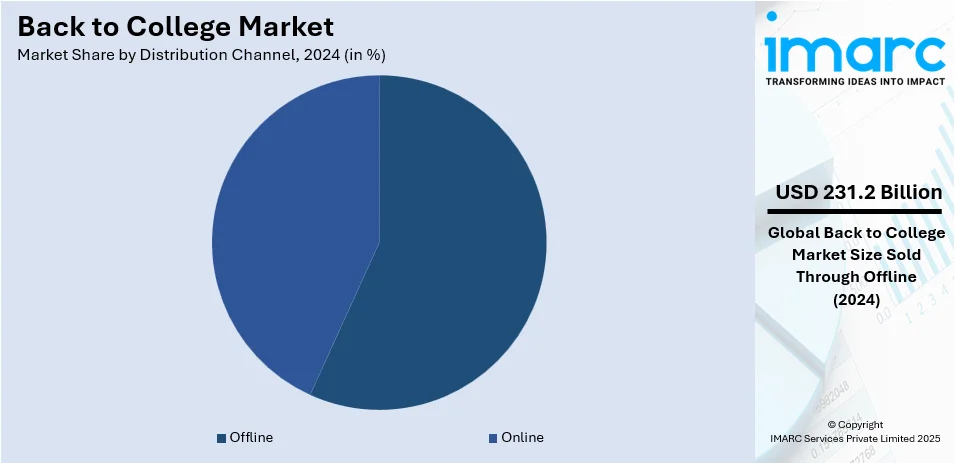

Offline lead the market with around 56.5% of market share in 2024. Offline channels make it possible for students and their parents to experience shopping themselves. From department stores to specialty retailers and campus bookstores, there is availability of a wide range of products. Offline provides personalized assistance in trying on clothes, testing electronics, and evaluating school supplies prior to purchasing. Many retailers give exclusive discounts, loyalty programs and interactive promotions in their stores to attract students to their stores. The environment of offline shopping aids and influences decision-making, especially for apparel and footwear. Additionally, brick-and-mortar stores benefit from last-minute purchases, as students often need items urgently before classes begin. Pop-up shops and temporary campus stores further contribute to seasonal sales, reinforcing the relevance of offline channels. Shopping in a store is preferred by many people despite a more progressive rise in e-commerce and mainly due to convenience and immediate gratification.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 36%, due to a large student population, increasing disposable incomes, and urbanization. Countries such as China, India, Japan, and South Korea experience strong demand for educational supplies, electronics, clothing, and dorm essentials as students prepare for a new academic year. Consumption of premium and branded products is fueled by the growing middle class. While offline retail is a predominant force in many areas, e-commerce platforms are growing exponentially, with discounts and exclusive deals provided in peak shopping seasons. The implementation of favorable government initiatives in support of education, technological advancements in learning equipment, and dynamic fashion trends facilitate market growth in the region. Social media and influencer marketing increasingly determine buying patterns within the younger segment. The region’s diverse cultural and economic landscape drives varied shopping behaviors, making the Asia Pacific a critical market for brands targeting back-to-college consumers.

Key Regional Takeaways:

United States Back to College Market Analysis

The United States holds a substantial share of the North American back to college market at 84.20%. In the United States, the growing back to college adoption is driven by substantial investments in the education landscape. According to The Institute of Education Sciences, in 2020–21, the United States spent USD 927 Billion on public primary and secondary education. Increased funding for educational institutions, scholarships, and initiatives to improve learning also have made a more accessible and appealing environment for students. Also, the focus on innovative educational models acts as an impetus for the adoption of back to college market trends. The trend toward technology-enhanced education, including digital tools and online courses, is further fueling market growth, providing students with more flexibility and access to education. Retailers experience peak sales from mid-July to early September, with strong requirements for laptops, tablets, and accessories due to the increasing reliance on digital learning. College students' increased reliance on digital platforms further expands buy-now-pay-later options, which boosts sales for high-ticket items. With a focus on improving educational infrastructure, these investments are expected to continue driving students to pursue higher education and return to college.

Asia Pacific Back to College Market Analysis

Rapid urbanization, academic pursuits, and technology-induced lifestyles are the main driving forces in the Asia Pacific market. According to the World Bank Group, by 2036, about 70% of the nation's GDP will come from urban areas, and 600 million people, or 40% of the population, will reside in towns and cities, up from 31% in 2011. With urbanization and economies growing, more students can access higher education. The rise of e-learning platforms and hybrid education models is propelling the high demand for laptops, tablets, and online study tools. Sustainability is gradually gaining popularity, with students opting for biodegradable stationery and second-hand books. Products are being made accessible through influencer marketing and digital payment solutions, including buy-now-pay-later options. The increasing importance of academic achievements and professional growth further inspires students to seek higher education. Additionally, the tech-driven lifestyles of the region's young population, with their high reliance on digital tools and gadgets, have further encouraged this trend, making it easier to embrace education through innovative learning methods, both in physical classrooms and online formats.

Europe Back to College Market Analysis

In Europe, there is an increased back to college market demand due to the growing requirements for laptops, tablets, e-readers, and software applications tailored to educational purposes is fueling the growing back to college adoption. For instance, in 2021, Spaniards purchased an estimated 20.7 Million e-books. As students increasingly rely on technology to support their learning, the need for efficient, portable devices has risen, which is further prompting both institutions and students to invest in these tools. Educational software and digital resources have completely revolutionized the learning experience, allowing for more personalized, interactive, and far-reaching content access. European governments' emphasis on digital education is also fueling the demand for software subscriptions and cloud storage solutions. Social media and digital marketing strategies over the past few years have become pivotal in shaping student purchasing decisions. This growth in demand for technology in education thus enhances the back-to-college community, with many students taking these technology-laden learning instruments as part of their academic path.

Latin America Back to College Market Analysis

In Latin America, the growing internet penetration is a significant driving force behind the increasing back to college adoption. According to reports, the inclusion of the middle and lower income levels has caused internet penetration in Latin America to rise from 43% to 78% in the last ten years, even reaching 90% in Chile and exceeding China. Government education subsidies in some countries influence spending patterns, particularly for laptops and digital resources. The popularity of digital learning tools and online courses is creating demand for software subscriptions and cloud-based services. In almost all countries in the region, students have easy access to an assortment of online learning platforms and other educational resources due to the widespread internet. This has expanded the reach of higher education, making it easier for individuals to pursue their academic goals regardless of their geographical location. The improved digital infrastructure has also contributed to more flexible learning options, further fueling the back-to-college trend in the region.

Middle East and Africa Back to College Market Analysis

In the Middle East and Africa, the growing back-to-college trend is largely attributed to the increasing number of international educational institutions. For instance, The QS World University Rankings 2024 included 81 Middle Eastern universities. As more institutions open campuses and partnerships in the region, students are exposed to a broader range of educational opportunities. The UAE and Saudi Arabia lead in spending, driven by strong consumer purchasing power and advanced education infrastructure. Electronics, school supplies, and dorm essentials remain key categories, with students favoring global brands and high-quality products. Social media and influencer marketing are playing a crucial role in shaping student buying decisions. This expansion is not only helping to elevate the quality of education but also fostering global connections. With greater access to internationally recognized programs, students are motivated to pursue higher education within their region, contributing to the growth of the educational landscape.

Competitive Landscape:

The back to college market is highly competitive, driven by seasonal demand and evolving student preferences. Retailers compete in terms of price, variety, and ease of purchase, leveraging online and in-store strategies. Heavy discounts, quick shipping, and offers propel the competition on the e-commerce side of retailing. At the same time, brick-and-mortar stores attract customers with exclusive in-store deals and experiential shopping. Subscriptions and rentals of textbooks, technology, and dorm essentials are on the rise. Artificial intelligence (AI) based, personalized recommendations and loyalty programs are major aids in binding customers to a brand. Sustainability becomes a major point of differentiation, influencing product design and marketing. The market is witnessing developments with innovations in smart gadgets, ergonomically designed furniture, and multifunctional supplies focused on student needs based on affordability and function.

The report provides a comprehensive analysis of the competitive landscape in the back to college market with detailed profiles of all major companies, including:

- ACCO Brands Corporation

- Apple Inc.

- Dell Technologies Inc.

- Faber-Castell AG

- Hewlett-Packard Company

- ITC Limited

- Mitsubishi Pencil Co. Ltd.

- Newell Brands

- Staples Inc.

Latest News and Developments:

- January 2025: BSBI introduces new staff and student digital library resources, enhancing academic success and research support. The library offers EBSCO e-books, Elsevier, Springer, Wiley, and Hogrefe PsyJOURNALS, available on campus with global access coming soon. These resources cover various subjects, providing essential tools for academic and professional growth. Access is flexible, ensuring convenience for all users.

- November 2024: Launches MyLOFT app, Guru Gobind Singh Indraprastha University now offers students, researchers, and faculty remote access to its library resources. The app allows simultaneous access for over 5,000 users, improving convenience and accessibility to educational materials. This digital initiative aims to enhance the learning experience for the university community.

- October 2024: Schlager Group has launched the Schlager Digital Library, offering a DRM-free platform for curated primary sources, ideal for undergraduate and graduate research. Developed with NewGen KnowledgeWorks, the library provides unlimited access and downloads across devices. The platform's debut includes the Essential Primary Sources collection, enhancing classroom instruction and research.

- May 2024: KOKUYO Co., Ltd. opened its first stationery Pop-up Shop in India at R CITY mall, Mumbai. The shop featured Japanese KOKUYO stationery and popular Chinese-origin products. More than 800 parties visited during the seven-day event. The initiative aimed to introduce KOKUYO’s diverse offerings to Indian consumers. The company sees strong potential for expansion in the Indian market.

- April 2024: Government of India to launch e-Granthalaya Software, making 5 lakh books from government-run libraries available online. The initiative aims to provide easy access to books, with the first phase featuring a collection from across the country, including 24,000 books from Varanasi District Library. The software is expected to launch after the Lok-Sabha elections.

Back To College Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Clothing and Accessories, Electronics, Dorm/Apartment Furnishings, Stationery Supplies, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACCO Brands Corporation, Apple Inc., Dell Technologies Inc., Faber-Castell AG, Hewlett-Packard Company, ITC Limited, Mitsubishi Pencil Co. Ltd., Newell Brands, Staples Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the back to college market from 2019-2033.

- The back to college market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the back to college industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The back to college market was valued at USD 409.22 Billion in 2024.

The back to college market is projected to exhibit a CAGR of 4.15% during 2025-2033, reaching a value of USD 589.90 Billion by 2033.

The market is driven by rising enrollment rates, increasing demand for digital learning tools, higher spending on educational supplies, growing preference for branded merchandise, expansion of e-commerce channels, and promotional discounts. Additionally, hybrid learning models and tech-driven education are boosting demand for laptops, tablets, and smart study accessories.

Asia Pacific currently dominates the back to college market, accounting for a share of 36% in 2024. The dominance is fueled by rapid urbanization, inflating disposable incomes, expanding middle-class population, government initiatives for education, and increasing digitalization. Strong retail penetration and growing online shopping trends in the region further contribute to the region’s market leadership.

Some of the major players in the back to college market include ACCO Brands Corporation, Apple Inc., Dell Technologies Inc., Faber-Castell AG, Hewlett-Packard Company, ITC Limited, Mitsubishi Pencil Co. Ltd., Newell Brands, Staples Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)