Baby Powder Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

Baby Powder Market Size and Share:

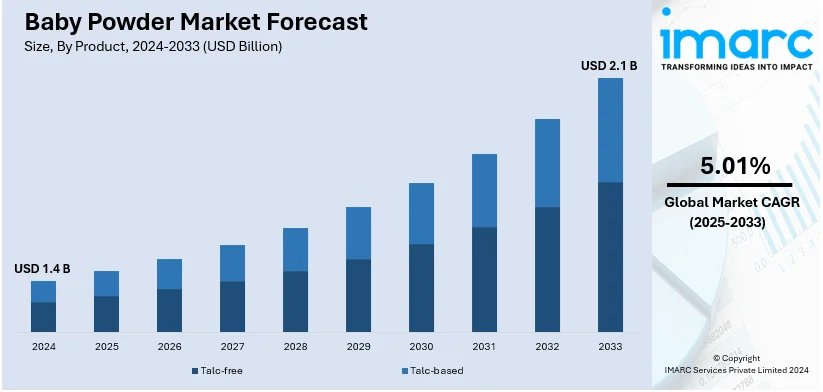

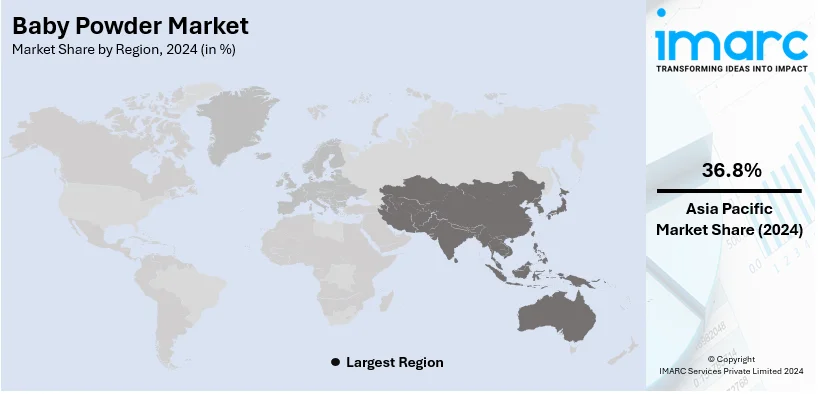

The global baby powder market size was valued at USD 1.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.1 Billion by 2033, exhibiting a CAGR of 5.01% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 36.8% in 2024. Some of the key factors driving the market are the increasing importance of baby healthcare products, the rapidly growing e-commerce industry, and the rising expenditure capacities of consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.4 Billion |

|

Market Forecast in 2033

|

USD 2.1 Billion |

| Market Growth Rate (2025-2033) | 5.01% |

The baby powder market is primarily driven by rising consumer awareness regarding baby hygiene and the increasing focus on infant skincare. To prevent diaper rash, irritation, and chafing, parents find products that are gentle and safe for baby skin, which increases the demand for baby powders made with gentleness and skin-friendliness. Improved access to products via e-commerce has also increased demand in various regions. Organic and natural baby powders are gaining immense popularity, as parents prefer products free from chemicals, as most parents are health-conscious and desire products that are free from harmful chemicals. Innovations in packaging, such as travel-friendly designs, are further increasing the appeal of a product. Birth rates in emerging markets are expanding, and disposable incomes are improving, by which parents can afford premium baby care products. Regulatory compliance, combined with strict quality requirements by regulatory authorities, has increased consumer confidence in branded products and made them sustainable in the market.

The United States emerged as a key regional market for baby powder. The market is influenced by elevated awareness about infant skincare and hygiene, as parents seek products that facilitate comfort and avoid irritation. The demand for organic and hypoallergenic formulations is rising in response to consumers' need to opt for chemical-free and dermatologist-approved products. Rising disposable incomes and a focus on premium baby care products further boost market growth. The widespread availability of baby powder through retail and e-commerce platforms supports convenience and accessibility, fostering market expansion. Moreover, strong regulatory standards in the U.S. enhance consumer trust in branded and quality-certified products. Innovations in packaging, as well as targeted marketing campaigns, also contribute to increasing consumer engagement and product adoption in the region.

Baby Powder Market Trends:

Rising desire for safe and efficient infant healthcare products

The growing concern for infants' health and hygiene made baby powders a component of baby care. There is reliance on these powders for the prevention of diaper rash, chafing, and other skin irritation, giving comfort and care to sensitive infant skin. As parents become more careful about the products they buy, there is a growing demand for clinically tested, hypoallergenic, and additive-free formulas. Besides their protective properties, baby powders have other benefits, such as moisturizing, soothing irritated skin, and eliminating odors. Their versatility makes them an essential product in homes with young children, further reinforcing their widespread adoption. The assurance of safety and efficacy offered by established brands has solidified baby powder's position in the global market, driving consistent demand. The baby powder market forecast indicates growth driven by increasing user preference for safer, hypoallergenic formulations and the rising awareness about infant health and hygiene concerns globally.

Increasing demand for natural and organic baby powder

The growing preference for natural and organic baby powders is revolutionizing the market landscape as consumers become more aware about the risks involved with synthetic and chemical-based products. An independent survey conducted recently reveals that 85.9% of parents prefer chemical-free products, and the need for safe and natural formulations is, therefore, a crucial factor in demand. Manufacturers are responding to the demand by infusing their products with soothing and nourishing ingredients such as aloe vera, chamomile, and lavender. It also gives extra moisturization content but is in support of the new trend, which focuses on the sustainability concept while considering environmental concerns. Active parents seek non-harming products for their babies in the environment with minimal damaging effects. Increasing awareness about the synthetic use of additives makes people inclined toward safe, toxin-free types to consume. This natural and organic powder is what they want-to-sell baby health-conscious customers prefer.

Market expansion through innovation and accessibility

The convenience and availability of baby powder have emerged with improvements in packaging and distribution. For instance, innovations in packaging, such as mess-free dispensers, have benefited busy parents in their lifestyle by making things convenient. Moreover, easy travel packaging helps to utilize space. Furthermore, e-commerce platforms have evolved so that more products can be used for customers who do their shopping while in their houses. High disposable incomes in developing economies are fueling the adoption of premium baby care products. Manufacturers also concentrate on enriching baby powders with natural oils and non-toxic ingredients that are highly useful for baby's skin care while maintaining the safety standards required, thus making the products irreplaceable for the upkeep of infant skin. The increasing awareness regarding the right skincare for babies, combined with the ease of access and innovative offerings, is set to propel the baby powder market toward strong growth in the years ahead.

Baby Powder Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global baby powder market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and end user.

Analysis by Product:

- Talc-free

- Talc-based

In 2024, the talc-free segment leads the baby powder market with a share of 74.3%, as consumer concerns over the safety of talc-based products are increasing. Growing awareness about health risks associated with talc has led parents to opt for alternatives, thereby increasing demand for talc-free formulations. These products, often made more natural and organic through cornstarch and plant extract, appeal to the conscience of parents who prefer their children to be safe from all hypo allergens. Regulatory scrutiny and lawsuits surrounding talc-based products have further hastened the shift to talc-free powders. The rising preference for eco-friendly and sustainable products supports the growth of this segment as well. With manufacturers continuously innovating to include added benefits such as improved moisturizing and soothing properties, the talc-free segment is likely to maintain its market leadership.

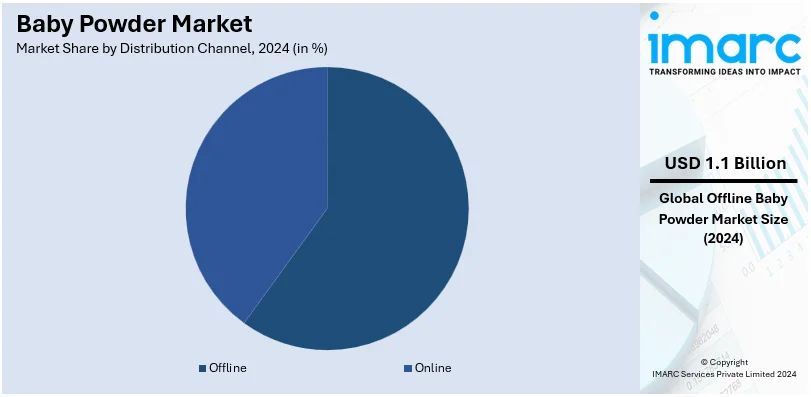

Analysis by Distribution Channel:

- Offline

- Online

Offline channels have the largest baby powder market share of 77.3% in 2024, driven by the trust and convenience associated with physical retail stores. Baby care products are mainly bought from retail stores due to authenticity and quality assurance, especially in supermarkets, hypermarkets, and pharmacies. It provides an opportunity for customers to personally view the products, compare different brands, and obtain advice from experts on these products. The promotional campaigns, discounts, and in-store offers only help sell through offline channels. The penetration of offline stores in urban and rural areas is also strong. This will help ensure availability, especially in regions where the online channel is still at a nascent stage. The offline segment remains a significant growth contributor to the market, given its capacity to create customer confidence and loyalty.

Analysis by End User:

- Infant

- Toddler

The infant segment holds a significant position in the baby powder market, as babies, especially newborns, essentially require skin protection and hygiene. Baby powders are among the essentials to prevent diaper rash irritation and chafing, which can be very painful for infants with sensitive skin. Parents would want the best and gentlest products for their infants, and thus, increased demand for hypoallergenic, dermatologically tested formulations. The market has expanded further by offering talc-free and organic options, thereby catering to the health-conscious preferences of parents. As birth rates are increasing in many geographies and infant care continues to be a significant focus area, this segment is likely to remain strong.

The toddler segment also contributes to growth in the market, as powders are widely used for skincare beyond infancy. Hydration, soothing, and deodorizing products are especially valued by parents as toddlers begin to get more active. Innovations in formulations made specifically for toddlers, like powders with calming and moisturizing properties from ingredients like chamomile and aloe vera, contribute to this growth. As the focus on multifunctional baby care products increases and parents remain open to spending money on premium offerings, the market for these products continues to grow.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific region holds the leading share of 36.8% in the baby powder market and has seen high growth rates, with increased birth rates and rising consumer awareness about infant hygiene. Urbanization, coupled with increasing disposable income in countries such as India, China, and Indonesia, has also helped families invest in high-end baby care products. Parents are opting for gentle, effective solutions that do not trigger irritation in babies' skin and hence prefer talc-free and hypoallergenic baby powders, thus increasing the demand in the region. The availability of baby powders through growing retail networks and e-commerce platforms is further promoting the market. The increasing number of organic and natural products are in sync with consumer preferences for safer, chemical-free options, mainly in markets where traditional remedies for skin care are being modernized for present-day use. Manufacturers are introducing affordable yet quality products, catering to the requirements of price-sensitive consumers, and this is further expanding the market. In addition, the health campaign and growing acceptance of Western parenting are encouraging the use of baby powders for daily infant care. Innovative packaging and marketing strategies targeted at diverse consumer segments are also supporting baby powder market growth. These factors collectively position Asia-Pacific as a rapidly growing market for baby powder, with strong opportunities for expansion and innovation.

The baby powder market in North America is led by high consumer awareness about infant skincare and hygiene. The rising preference for hypoallergenic and dermatologist-tested products is driving demand for talc-free formulations. The market is also helped by stringent regulatory controls, which guarantee the safety of the products, thereby enhancing consumer confidence in established brands. Organic and chemical-free baby powders are gaining popularity as consumers are increasingly adopting health-conscious purchasing decisions with a rise in disposable incomes. The stronger e-commerce networks help boost the availability of products. In contrast, innovations in packaging and marketing from the manufacturing sector help attract a broad spectrum of consumers to ensure steady growth in this saturated market.

A healthy desire for natural and environmentally friendly products drives the market in Europe. Organic and talc-free variants have increasingly become the choice for parents due to increased awareness about nontoxic chemical exposure through health and environmental factors. Strict regulatory standards about baby care products encourage the adoption of safer alternatives. Increasing disposable incomes, along with a growing inclination for premium baby care products, further support market demand in the region. Moreover, the growth of online retailing channels and the availability of innovative products enriched with natural ingredients enhance consumer convenience and engagement, which is set to support steady growth in the region.

Growing awareness about infant skincare and rising disposable incomes fuel the baby powder market in Latin America. Parents are increasingly investing in baby care products that offer comfort and protection from diaper rash and irritation. There is an increasing preference for affordable, natural, and hypoallergenic baby powders, which further boosts market growth. The improvement in retail networks and e-commerce platforms enhances product access across urban and rural regions. Manufacturers are fine-tuning their products according to regional preferences, thereby establishing localized marketing strategies that appeal to the consumer. These and the impact of health awareness campaigns make Latin America a steadily growing market.

Rising birth rates and heightened awareness about infant hygiene drive baby powder in the Middle East and Africa. Improving economic conditions and rising disposable incomes allow parents to spend on quality baby care products. The demand for talc-free and organic formulations is increasing as consumers are focusing on safety and natural ingredients. Expanding retail and e-commerce networks are improving product accessibility even in remote areas. In addition, the influence of health initiatives and campaigns promoting infant care drives awareness and adoption. Manufacturers are leveraging regional preferences by launching skin-friendly, affordable formulations to meet the demands of various markets.

Key Regional Takeaways:

United States Baby Powder Market Analysis

In 2024, the United Sates accounts for 88.90% of the baby powder market in North America. The factor driving the market is growing awareness about product safety, particularly with concerns about chemicals and ingredients. Parents are increasingly looking for natural, hypoallergenic, and organic alternatives to conventional baby powder, which has led to the growth of plant-based options. Health-conscious parents for their babies' skin care also increases the demand for safer, dermatologically tested products. The growth in the number of working parents coupled with a hectic lifestyle creates more demand for convenient, easy-to-use products like baby powder. These safety concerns highlighted by marketing through labels of allergen-free and talc-free products are also fueling the expansion of the market. This rising disposable income and urbanization further nudges families to invest in premium baby care products. The disposable income of the US consumer reportedly increased by 8.1% in 2023, thus offering much-needed flexibility in their budgets and shifting their eating-out behaviors. This added income adds money to the pocket for all types of non-essential spending, which might encompass baby care products such as baby powder. Consumer trust in established brands, combined with their continued research into safer formulations, further promotes the steady demand for baby powder in the region. Additionally, the influence of e-commerce platforms makes it easier for parents to access a variety of baby powder products, enhancing market growth.

Europe Baby Powder Market Analysis

Baby powder market demand in Europe is shaped due to a growing level of awareness about good health among parents while deciding which products to use with regard to their infants. Nowadays, parents are more particular about using baby care products containing natural ingredients free from harmful chemicals, parabens, and artificial fragrances. Organic baby powder demand is high in markets including the UK, Germany, and France, given the interest of citizens in sustainable and environmental-friendly products. Reports indicate that consumer demand for sustainable materials is on the rise, with 46.5% of Europeans opting for sustainable fashion in 2022, thus indicating a rising trend for eco-friendly products. This is beneficial to baby powder as consumers make more conscious decisions about sustainability before making a purchase. Another factor is working mothers, who are on the rise and require easier baby care solutions that could be applied at home and on the go. In addition, European parents are very concerned with the safety and dermatological aspects of baby powder. They tend to choose products that are dermatologically tested and hypoallergenic. The strict regulations and standards of safety in the European Union also increase the confidence of buying baby powder since the products are considered to be of the highest safety standards. This is due to more people having accessed online shopping platforms through which they reach various brands of baby powder. Increasing premium and eco-friendly brands that target health-conscious parents are opening greater market opportunities.

Asia Pacific Baby Powder Market Analysis

An increased focus on infant care within the Asia-Pacific region, with the rising number of parents demanding safe and efficient products for their babies, is driving the baby powder market. Growing awareness about sensitive skin in infants has caused an increase in demand for baby powders that are gentle and hypoallergenic. Furthermore, the expanding middle class in countries like India and China has resulted in greater affordability and access to premium baby care products. Urbanization plays a significant role, as more parents in cities prioritize convenient and high-quality baby care solutions. According to WHO, India's rapid urbanization, with 600 Million people expected in urban areas by 2036, will drive a 70% contribution to GDP. This urban growth and infrastructure development would create opportunities, and sectors such as baby powder would experience an increase in consumer demand with the expansion of urban markets. Yet another factor is the power of social media and internet platforms, where product recommendations and reviews play a critical role in influencing consumer preferences. The emergence of modern retail outlets, supermarkets, and specialty stores increases the accessibility and visibility of baby care products. It is also shaped by natural and organic ingredients in baby powders due to more and more health-conscious parents who ensure a specific kind of product that could be trusted and from reputed international brands.

Latin America Baby Powder Market Analysis

The rising middle class in Latin America demands high-quality, safe, and affordable products for their infants, thereby driving the baby powder market. Changing lifestyles, such as urbanization and nuclear families, make parents more concerned about baby care. Growing awareness about skin health, especially concerning sensitive skin, pushes demand for gentle and hypoallergenic powders. Social media and online platforms also influence purchasing decisions, with parents looking for trusted product recommendations. For instance, In January 2024, Brazil had 144.0 Million active social media users, representing 66.3% of the population, with a 1.4% annual increase. This extensive social media presence offers significant opportunities for baby powder brands to engage with a large, dynamic audience. Moreover, the demand for products comprising natural ingredients is growing as a consumer is becoming health conscious.

Middle East and Africa Baby Powder Market Analysis

The Middle East and Africa baby powder market benefits from growing urbanization and increasing adoption of modern lifestyles. With a high percentage of young parents looking for good quality products for their babies, demand for gentle and hypoallergenic powders is gaining momentum. Increasing awareness among parents concerning the sensitivities of an infant's skin and ensuring that the right baby product is used effectively and safely also drives the purchase decisions. There is an increase in the sales of baby care products available both in offline retail platforms and online. For example, in August 2023, the Middle East saw a rapid digital transformation. About 91% of consumers bought online, and 70% preferred to make digital payments. That can boost the potential of selling baby powder on e-commerce websites to nearly 100%. Furthermore, as growing health consciousness grows, more and more parents are opting for natural, organic baby powders to save their babies from these chemicals.

Competitive Landscape:

Baby powder manufacturers are focusing on innovation, diversification of product portfolio, and geographical reach expansion in order to survive and compete in the market. Most major players in the industry have also recently launched talc-free natural and organic baby powders in response to rising customer demands for safer, chemical-free products. Several manufacturers have further enriched their products with gentle, soothing, and moisturizing agents such as aloe vera, chamomile, and lavender. Players are trying to strengthen their market position through e-commerce and tie-ups with retail majors, ensuring product availability in the market throughout geographies. The thrust for strategic marketing campaigns focused on safety, dermatological testing, and environmental-friendliness has become key in gaining a share of the health-conscious consumer. The use of biodegradable packaging to cater to environmentally conscious customers is also part of this new trend. In addition, joint ventures and acquisitions are being sought for market share expansion and gaining access to new markets. For instance, multinational companies are targeting regions such as Asia-Pacific and Latin America, where growing birth rates and disposable incomes push growth. These activities manifest the dynamic and competitive character of the baby powder market.

The report provides a comprehensive analysis of the competitive landscape in the baby powder market with detailed profiles of all major companies, including:

- Artsana S.p.A.

- Burt's Bees Inc. (The Clorox Company)

- California Baby

- Himalaya Wellness Company

- Mothercare plc (Boots UK Limited)

- Prestige Consumer Healthcare Inc.

- PZ Cussons plc

- The Moms Co. (Amishi Consumer Technologies Private Limited)

Latest News and Developments:

- November 2024: Fresh & Dry Baby Powder, a talc-free alternative, was launched in the UK to address concerns about talc's potential asbestos contamination and cancer risks. Made from natural corn powder, it is non-allergenic, more absorbent, and free from harmful ingredients. The product is certified as cruelty-free, vegan, and ethically produced, offering a safer option for families.

- October 2024: Mothercare formed a joint venture with Reliance Brands Holding UK to manage the Mothercare brand in India, Nepal, Sri Lanka, Bhutan, and Bangladesh. Reliance Brands holds a 51% stake, while Mothercare retains 49%. This partnership strengthens Mothercare’s presence in South Asia and supports financial growth and reduced leverage.

- July 2024: Himalaya Wellness expanded its portfolio in baby care by launching a new product range where cow ghee is an important component. This approach underscores how the company is pushing forward for natural and safe baby care products amid the growing consumer need for organic and holistic offerings. Being positioned with a traditional product gives Himalaya the mark of a wellness and sustainability-driven baby care brand.

- July 2024: DKSH Business Unit Consumer Goods entered a distribution agreement with Kimberly-Clark to distribute Huggies baby diapers and skin health products in Cambodia. This partnership is aimed at enhancing the Huggies brand’s visibility and market presence in the region. It also ensures greater availability of premium baby care products for Cambodian consumers, supporting the demand for high-quality baby essentials.

- August 2024: Indian baby products retailer FirstCry attracted USD 3.4 Billion in bids for its USD 501 Million IPO in 2024. The overwhelming response highlights investor confidence in India’s booming childcare market. The IPO underscores FirstCry's market leadership and growth potential. It reflects increasing investor interest in the sector's prospects.

Baby Powder Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Talc-free, Talc-based |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Infant, Toddler |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Artsana S.p.A., Burt's Bees Inc. (The Clorox Company), California Baby, Himalaya Wellness Company, Mothercare plc (Boots UK Limited), Prestige Consumer Healthcare Inc., PZ Cussons plc, The Moms Co. (Amishi Consumer Technologies Private Limited), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the baby powder market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global baby powder market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the baby powder industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Baby powder is an effective, gentle product of milling that is designed to keep moisture out and also eliminate friction to help prevent chafing and diaper rash from occurring in infants and toddlers. It is often manufactured in talc or natural substitutes for talc, which ensures soothing and protective care on delicate baby skin.

The baby powder market was valued at USD 1.4 Billion in 2024.

IMARC estimates the global baby powder market to exhibit a CAGR of 5.01% during 2025-2033.

Some of the key factors driving the market are the increasing importance of baby healthcare products, rapidly growing e-commerce industry, and rising expenditure capacities of consumers.

In 2024, talc free represented the largest segment by product due to rising consumer concerns over talc safety and the preference for talc-free formulations.

Offline leads the market by distribution channel driven by the trust and convenience associated with physical retail stores.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global baby powder market include Artsana S.p.A., Burt's Bees Inc. (The Clorox Company), California Baby, Himalaya Wellness Company, Mothercare plc (Boots UK Limited), Prestige Consumer Healthcare Inc., PZ Cussons plc, The Moms Co. (Amishi Consumer Technologies Private Limited), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)