Baby Food and Infant Formula Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Baby Food and Infant Formula Market Size and Share Analysis:

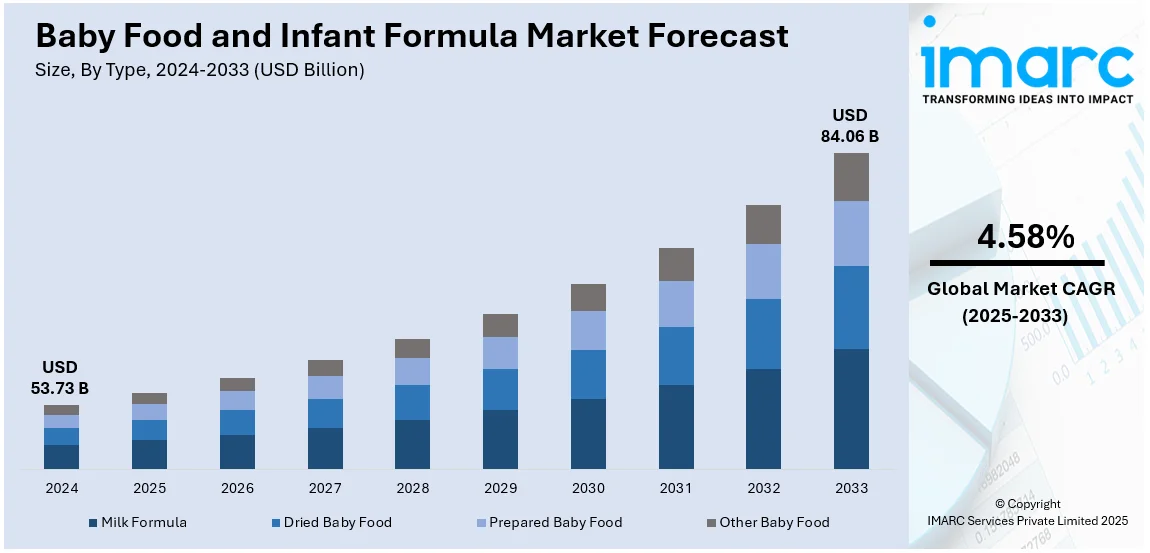

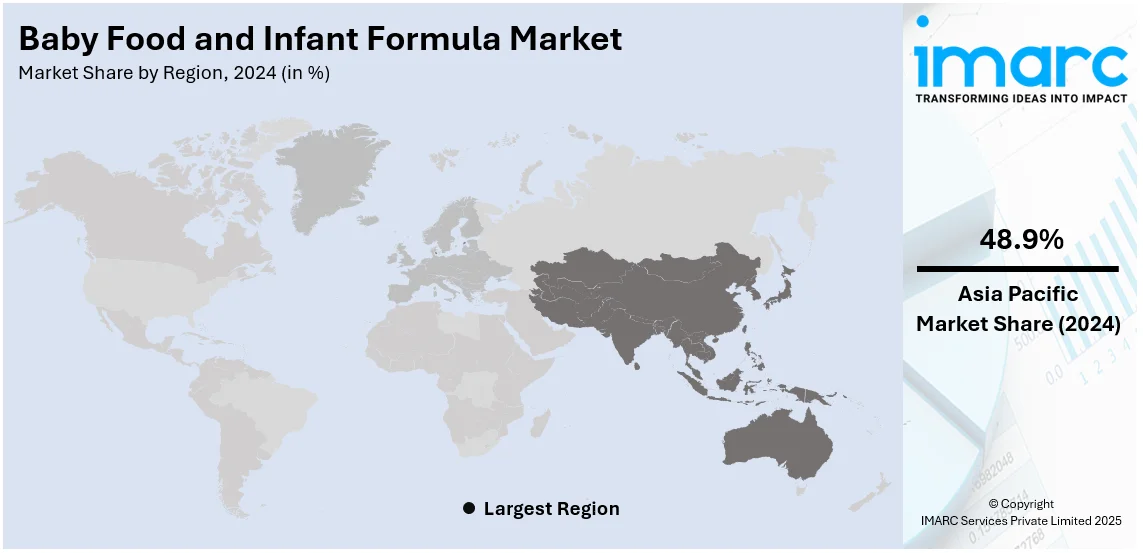

The global baby food and infant formula market size reached USD 53.73 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 84.06 Billion by 2033 exhibiting a growth rate (CAGR) of 4.58% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 48.9% in 2024. The market is expanding, driven by an increased awareness of infant nutrition, the rising number of working mothers, and innovative advancements in product development and technology, catering to the growing demand for nutritious, safe, and convenient feeding options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 53.73 Billion |

|

Market Forecast in 2033

|

USD 84.06 Billion |

| Market Growth Rate (2025-2033) | 4.58% |

The baby food and infant formula market is driven toward growth by several drivers, such as increased parental awareness regarding the nutrition and health of infants. Rapid urbanization and a rise in dual-income households result in higher disposable incomes, which is facilitating the demand for convenient and nutritious feeding solutions. Expanding working population base of mothers along with changing lifestyles are also acting as catalysts for increasing market size. Innovations in organic and specialized infant formulas, catering to allergies and dietary needs, also boosts market growth. Additionally, marketing efforts and endorsements by healthcare professionals enhance consumer trust. Emerging economies with rising birth rates and improving living standards create significant opportunities. Regulatory support and improved retail distribution channels further propel the market growth, making baby food and infant formula widely accessible.

The US market for baby food and infant formula is being driven significantly by an increased consciousness pertaining to infant nutrition among parents and a high demand for on-the-go convenient feeding among the working parents. This is primarily due to rising dual-income household and working women. Consumers nowadays prefer organic and non-GMO, specialty formula to suit individual needs, lactose intolerance, and allergy. Innovations in product formulation and packaging further attract buyers. A declining birth rate has shifted the focus toward premium and high-quality products to capture market share. One of the top suppliers of consumer self-care products worldwide, Perrigo Company plc, revealed new brand partnership: Good Start and Dr. Brown's infant formula solutions. Additionally, strong healthcare recommendations and widespread retail availability through supermarkets and e-commerce platforms support growth. Government regulations ensuring safety and quality also play a crucial role in market expansion.

Baby Food and Infant Formula Market Trends:

Increasing Awareness of Nutritional Needs for Infants

The most important determinant of the outlook for the baby food and infant formula market has been the increasing concern among parents and carers regarding what their infants exactly require. Given the ease and widespread dissemination of information, people are getting informed about how nutritional balance in an infant's diet is important. This is fortified by increasing evidence through scientific study to highlight a range of issues associated with important nutritional components and other nutrients such as DHA, ARA for brain formation and iron and its related family for growth in the body generally, and immunity development specifically. The industry is also witnessing innovation in the form of goods made with natural and organic ingredients, which satisfy parents' desires for safer and healthier solutions for their newborns. The WHO lays out the fundamental guidelines for giving solid foods to babies about six months of age, when their nutritional requirements surpass what breast milk can provide. The organization works to raise knowledge of these guidelines. Infants should start eating complementary foods two to three times a day between the ages of 6 and 8 months, and by the time they are 12 to 24 months old, they should be eating them 3-4 times a day. Additionally, nutritious snacks can be offered.

Rising Number of Working Women

The increasing number of working women across the globe is a significant factor driving the baby food and infant formula market growth. In 2022, women aged 25-54 had a labour force participation rate of 61.4%, while men's was 90.6%, according to data from International Labour Organization (ILO). With more mothers engaged in full-time jobs, the time available for breastfeeding and preparing homemade baby food is considerably reduced. This change has increased the use of infant formula and ready-to-eat baby food as practical substitutes that offer vital nutrients for the growth and development of infants. The market has adapted to this demand by providing a wide variety of goods that are convenient to prepare and eat, in addition to being nutritionally full, to accommodate working parents' hectic schedules.

Technological Advancements and Product Innovation

The market for baby food and infant formula is continuously evolving, due to new product development and technology breakthroughs. This is important as innovation could bring down the number of children who suffer due to lack of nutrition in early stages. As per the data by WHO, if all children aged 0–23 months were adequately breastfed, almost 820,000 children's lives may be spared annually among those under the age of five. These developments are enabling manufacturers to enhance the nutritional value, safety, and convenience of their products. For instance, advancements in food processing technology have led to the creation of products that closely mimic the nutritional profile of breast milk, making infant formula a viable alternative for mothers who are unable to breastfeed. Innovations in packaging, such as single-serve, ready-to-feed bottles, and pouches, are making products more convenient and appealing to on-the-go parents. Furthermore, the use of technology into production processes has enhanced quality control and safety protocols, guaranteeing that goods are free of impurities and meet strict health regulations.

Baby Food and Infant Formula Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with baby food and infant formula market forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Analysis by Type:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Other Baby Food

Milk formula leads the market with around 54.9% of market share in 2024. According to the report, milk formula represented the largest segment. As the largest segment in the baby food and infant formula market, milk formula is a crucial substitute and complement to breastfeeding, particularly for working mothers or those unable to breastfeed. This segment includes various types such as starting milk formula, follow-on milk formula, and special milk formula, each tailored to different stages of a baby’s growth and specific dietary needs. The demand for milk formula is fueled by its convenience, nutritional composition mirroring breast milk, and innovations like added probiotics and prebiotics for digestive health.

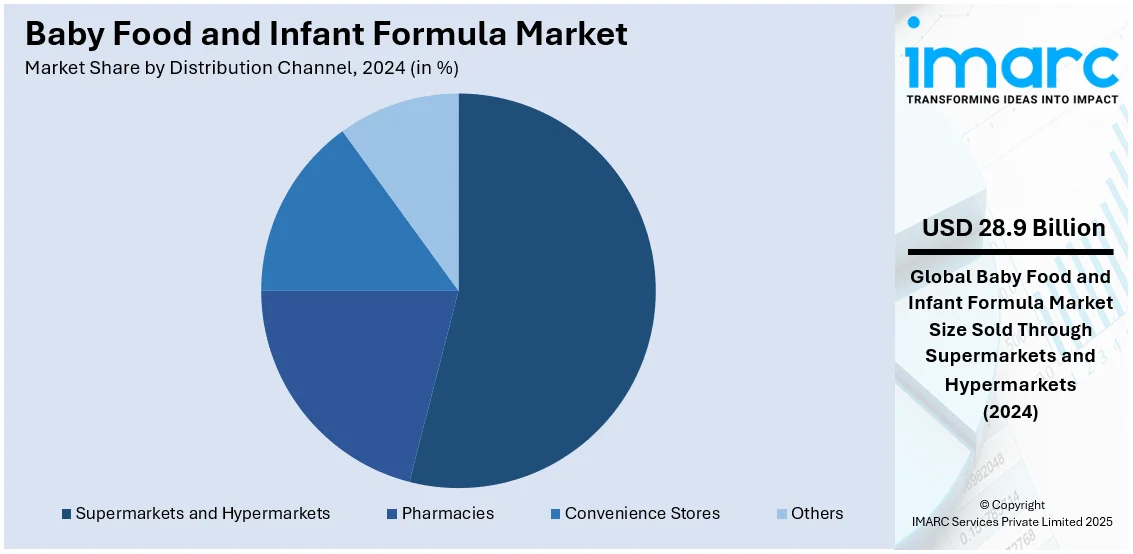

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

Supermarkets and hypermarkets leads the market with around 53.7% of market share in 2024. According to the report, supermarkets and hypermarkets accounted for the largest market share. As the largest distribution channel, supermarkets and hypermarkets offer a wide variety of baby food and infant formula products under one roof, providing convenience and choice to consumers. The extensive shelf space allows for a broad range of brands, types, and price points, catering to diverse consumer needs and preferences. These outlets also benefit from high foot traffic and visibility, making them popular shopping destinations for parents. The competitive pricing, promotional activities, and the opportunity for parents to assess products firsthand contribute to the dominance of this channel.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 48.9%. According to the report, Asia Pacific accounted for the largest market share. Asia-Pacific is the largest and fastest-growing market for infant formula and baby food due to a high birth rate and a growing middle class. In 2023, the birth rate in China was 10.645 births per 1000 people, 16.949 births per 1000 people in India, and 16.8 births per 1000 people in Indonesia, as per an industry report. Due to urbanization and increased disposable incomes, parents are using premium formulas and packaged baby meals. Also, as per industry reports, more than 50% of the urban households in China prefer imported infant formulae due to quality assurance. Market expansion is helped by increasing e-commerce penetration in India, with sales of infant food on sites such as Flipkart and Amazon increasing by 25% year on year, according to industry reports. Campaigns from the government supporting child nutrition, such as India's POSHAN Abhiyaan, are also critical. Increased awareness of nutritional needs has contributed to the increased popularity of organic and fortified baby foods.

Baby Food and Infant Formula Market Regional Takeaways:

North America Baby Food and Infant Formula Market Analysis

The baby food and infant formula market in North America is influenced by several factors, such as increased parental awareness of infant nutrition and the increasing demand for convenient, ready-to-use baby food products. The rising disposable incomes and a greater number of working parents have further driven the demand for time-saving feeding solutions. Innovations in organic and clean-label baby food products have also attracted health-conscious consumers. Declining infant mortality rates and increased support for newborn health in the region further contribute to the growth of the market. The improvement in product formulations by adding essential nutrients required for the development of the infant has also added consumer confidence in the product. E-commerce websites and aggressive marketing by key players have increased accessibility and sales.

United States Baby Food and Infant Formula Market Analysis

In 2024, the United States accounted for the largest market share of over 85.00% in North America. The market for baby food and infant formula in the US is driven by changing lifestyles, increased female labor force participation, and improved awareness of newborn nutrition. According to the U.S. Bureau of Labor Statistics, in 2023, 68.9 percent of women with children under the age of six were working, while 77.8 percent of mothers with children aged 6 to 17 were working. Thus, there is a demand for baby food that is both convenient and nutrient-dense. With an annual birth rate of about 12 per 1,000 people, the United States maintains a stable need for infant food and formula. More than half of parents prefer organic items for their newborns, which indicates the growing popularity of organic and natural baby food options. Businesses are spending more money on R&D to satisfy parents' need for high-quality, simple-to-make products. Government initiatives such as the Women, Infants, and Children (WIC) program, which assists about 6.5 million people monthly, also contribute to demand for infant formula. Market is also changing due to the increasing demand for plant-based and allergy-free baby food. E-commerce sales and digital platforms have grown significantly, with 20% of infant food sales being realized through online transactions. Other factors promoting market growth in the US include new packaging and fortified products.

Europe Baby Food and Infant Formula Market Analysis

High income levels, excellent parental knowledge of child nutrition, and government policies that support food safety drive the baby food and infant formula business in Europe. About half of the parents go for organic baby food. The region is characterized by a low birth rate of 9.8 births per 1,000, which is compensated by the demand for high end, organic items, according to macrotrends. Based on the strong demand of ready-to-eat meal and nutrient-fortified formulations, Germany, France, and the UK account for most of the global market share. The regulation of strict labelling of nutritional content by the EU ensures quality products and further boosts the confidence of customers. Another factor driving the demand for fast and convenient feeding is the increase in working mothers, who in many European countries account for more than half of the female labor force. According to the eight nations that made up the sample for the EU-Labour Force Survey and the Structure of Earnings Survey, the number of workers in Europe increased to over 21 million between 1997 and 2019. Of whom more than 14 million are employed by women amounting to 68 % of the new jobs that are produced. In keeping with the larger trend towards vegan and sustainable diets in Europe, infant food based on plants is increasingly gaining popularity. Innovations in flavour and ingredient clarity are additional factors enhancing the attraction of infant food items in Europe.

Latin America Baby Food and Infant Formula Market Analysis

Latin America, driven by urbanization, enhanced economic conditions, and increasing knowledge regarding child nutrition, is supporting the baby food and infant formula business. Market leaders are Brazil and Mexico where, according to data at Macrotrends, they have annual birth rates about 12 and 16 births per 1,000 people respectively. Increased disposable incomes in metropolitan cities allow parents to choose package infant food products. Government programs to battle malnutrition, such as the PROSPERA program in Mexico, encourage the use of fortified infant foods. Sales at supermarkets and online are increasing, and more than 15% of baby food sales are now made over digital channels. The demand for lactose-free and organic formulas is also growing across the region.

Middle East and Africa Baby Food and Infant Formula Market Analysis

High birth rates and an increasing focus on improving baby nutrition are driving the market in the Middle East and Africa. The high birth rates in countries like Nigeria and Egypt over 36 and 23 births per 1,000 people respectively lead to a high demand for baby formula and meals, according to macrotrends data. Urbanization and rising middle-class incomes increase the use of packaged infant food. Government initiatives targeting malnutrition, such as South Africa's Integrated Nutrition Programme, also promote fortified infant foods. The demand for halal-certified recipes that meet local dietary and cultural requirements drives market expansion in the Middle East.

Leading Baby Food and Infant Formula Companies:

Key players in the baby food and infant formula market actively engage in research and development to innovate and improve their product offerings. They are working to improve the general quality and safety of their goods, address health issues like allergies, and create foods and formulae that closely resemble the nutritional profile of breast milk. These companies are now adding organic and natural ingredients to their product lineup to meet the rising demand for safer and healthier infant food options. To capture a larger market share, they are also investing in marketing and branding strategies, emphasizing the health benefits of their products. Furthermore, these firms are exploring new distribution channels, particularly online platforms, to increase accessibility and convenience for consumers.

The market research report has provided a comprehensive analysis of the baby food and infant formula market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abbott

- Nestlé S.A.

- Danone S.A.

- Mead Johnson & Company, LLC (Reckitt)

- The Kraft Heinz Company

Recent Developments:

- November 2024: Nestlé India announced its plans to cease the sale of refined sugar versions of its cereal-based supplemental food "Cerelac" in India.

- August 2024: Happa Foods, the first Indian baby food company to export baby purees abroad. The company is leading the way in providing organic and healthful baby food options, raising the bar for quality and safety in the worldwide baby food market.

- November 2023: Nestlé announced the development of N3 milk with new nutritional benefits, which was launched first in China. Because it is made from cow's milk, it has all the vital nutrients proteins, vitamins, and minerals that are present in milk. It also has a reduced lactose content, more than 15% fewer calories, and prebiotic fibers.

- July 2023: Danone launched the new Dairy & Plants Blend baby formula to meet parents’ desire for feeding options suitable for vegetarian, flexitarian and plant-based diets, while still meeting their baby’s specific nutritional requirements. This is the first blended baby formula in the industry for healthy babies, with over half (60%) of the protein derived from plants.

Baby Food and Infant Formula Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Other Baby Food |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Pharmacies, Convenience Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Abbott, Nestlé S.A., Danone S.A., Mead Johnson & Company, LLC (Reckitt), The Kraft Heinz Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, baby food and infant formula market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global baby food and infant formula market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the baby food and infant formula industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global baby food and infant formula market was valued at USD 53.73 Billion in 2024.

IMARC estimates the global baby food and infant formula market to exhibit a CAGR of 4.58% during 2025-2033, reaching a value of USD 84.06 Billion by 2033.

The key factors driving the global baby food and infant formula market include rising awareness of infant nutrition, increasing urbanization, and growing numbers of working mothers. The demand for organic and specialized products, innovations in packaging, improved healthcare recommendations, and expanding retail and e-commerce channels further boost market growth, especially in emerging economies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the global baby food and infant formula market include Abbott, Nestlé S.A., Danone S.A., Mead Johnson & Company, LLC (Reckitt), The Kraft Heinz Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)