Aviation Test Equipment Market Size, Share, Trends and Forecast by Type, End-Use Sector, and Region, 2026-2034

Aviation Test Equipment Market Size & Share:

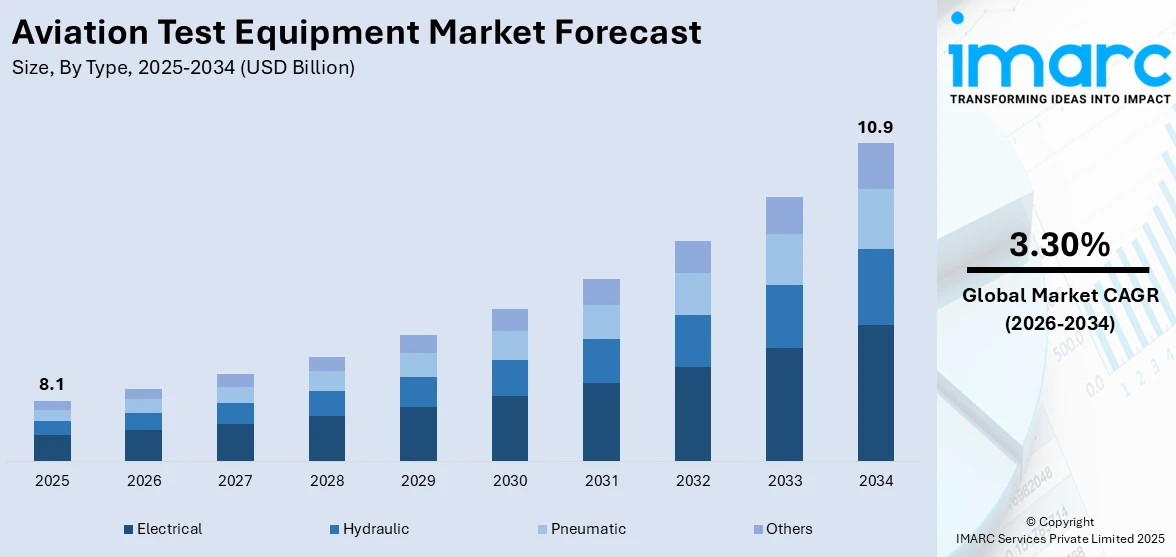

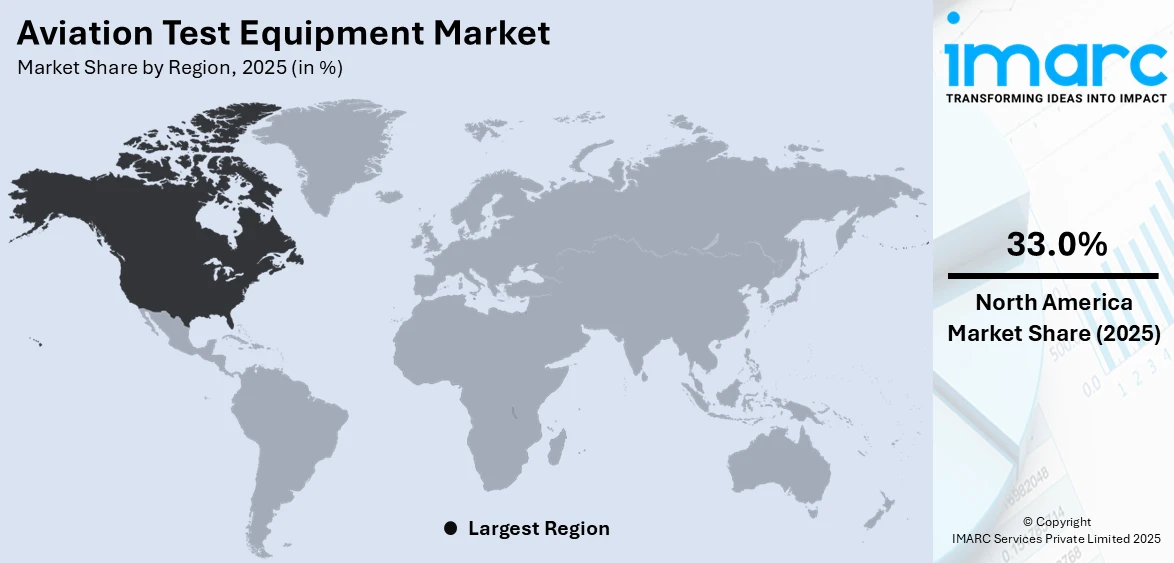

The global aviation test equipment market size was valued at USD 8.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 10.9 Billion by 2034, exhibiting a CAGR of 3.30% during 2026-2034. North America currently dominates the market, holding a significant aviation test equipment market share of over 33.0% in 2025. Advancements in avionics, fleet modernization, stringent safety regulations, increased MRO activities, and the rising demand for efficient and automated testing solutions are major factors driving the aviation test equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.1 Billion |

|

Market Forecast in 2034

|

USD 10.9 Billion |

| Market Growth Rate (2026-2034) | 3.30% |

The expanding aerospace and defense industries represent some of the key factors driving the market growth. Aviation test equipment is used to control tests and supervise and report results. They also aid in constructing, improving, and integrating several weapon systems, contributing to their extensive demand in the defense sector. The market expansion is also being supported by the growing trend of software-adaptable solutions and their capacity to test various weaponry. Enhanced focus on research and development (R&D) to develop more advanced product variants is further driving the industry growth. Moreover, the changing trends in the aviation sector, which often fuse the innovations with traditional systems is expected to create a positive outlook for the market. Some of the other key factors facilitating the market growth include rising defense budget and the increase in expenditure on the aviation industry by governments of several nations across the globe thus impelling the aviation test equipment market demand.

To get more information on this market Request Sample

In the United States, the aviation test equipment market is driven by the country’s robust aerospace and defense industry, significant military spending, and the presence of major aircraft manufacturers and MRO facilities. The increasing demand for advanced avionics, coupled with fleet modernization programs, fuels the need for sophisticated testing solutions. Stringent FAA regulations and safety standards mandate frequent testing and certification of aircraft systems. Additionally, rising air travel and cargo operations amplify the need for reliable maintenance equipment. Investments in next-generation technologies, such as automated and software-driven testing systems, and a focus on green aviation practices further support market growth. For instance, in December 2024, The Federal Aviation Administration ("FAA") granted Joby Aviation, Inc., a business that develops electric air taxis for commercial passenger service, certification credit after it successfully completed a historic set of significant aerostructure tests. For the first time, the company tested a significant aerostructure of its aircraft for credit with FAA representatives present, and Joby successfully finished static load testing of the tail structure. The tests, which were conducted at Santa Cruz, California, as part of a thorough testing campaign that covered every system, structure, and component on the aircraft, produced the data needed for the aircraft to receive FAA type certification.

Aviation Test Equipment Market Trends:

Increased Aircraft Production and Fleet Expansion

The growing demand for commercial and military aircraft is fueled by rising passenger traffic and defense modernization programs, which drive the need for aviation test equipment. Airlines are expanding their fleets and older aircraft are being replaced; manufacturers and maintenance organizations invest in advanced test equipment to ensure operational reliability and compliance with stringent safety standards. For example, according to an industrial report, Airbus delivered 735 commercial aircraft in 2023, an increase of 11% over 2022. This robust growth points to the continued demand for new aircraft, even in a complex operating environment, further positively impacting aviation test equipment market outlook owing to the need for advanced equipments to support production, maintenance, and regulatory compliance.

Technological Advancements in Avionics and Aircraft Systems

Avionics advanced technology, automated flight systems, and integrated communication systems have been adopted in the aviation industry at an incredible rate. This demand requires accurate testing solutions. Test equipment in aviation ensures accurate calibration and validation, whereas innovations like wireless testing and modular instrumentation make it efficient and accurate. In-flight connectivity has become a necessity as new-generation LEO satellites have enabled global coverage, over 400 Mbps speeds, and 40 ms latency. For instance, companies such as Satcom Direct and Honeywell offer solutions for light jets in providing full connectivity. Renewable resources like SAF reduce the carbon footprint of aviation fuel by as much as 80%. These factors prove that aviation test equipment is a vital tool to help guarantee the safety and sustainability of flying.

Stringent Regulatory and Safety Requirements

Another major aviation test equipment market trends is the global aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), have strict safety and performance regulations in place to ensure aircraft reliability. These standards, such as FAA Part 25 (Airworthiness Standards for Transport Category Airplanes) and EASA CS-25 (Certification Specifications for Large Aeroplanes), require thorough testing and certification of avionics, navigation, and communication systems. Regulations such as FAA AC 43-210 on MROs and EASA Part 145 for MROs also make strict testing standards for validation and calibration of systems. This creates significant demand among aerospace manufacturers and MRO providers to implement advanced test equipment to fulfill compliance. This regulatory landscape greatly boosts the demand for advanced aviation test solutions that meet safety and operational efficiency in addition to global standards.

Aviation Test Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global aviation test equipment market report, along with forecasts at the global and regional level from 2026-2034. Our report has categorized the market based on type and end-use sector.

Analysis by Type:

- Electrical

- Hydraulic

- Pneumatic

- Others

Electrical test equipment holds the largest aviation test equipment market growth share due to the increasing complexity and reliance on advanced electrical systems in modern aircraft. These systems, including avionics, navigation, communication, and power management, require precise testing to ensure reliability and compliance with safety standards. The rise of electric and hybrid-electric aircraft amplifies the demand for electrical testing solutions. Additionally, electrical systems play a critical role in both commercial and military aviation, necessitating frequent maintenance and testing. Innovations in automated and portable electrical testing equipment further enhance their adoption, contributing to their dominant position in the market.

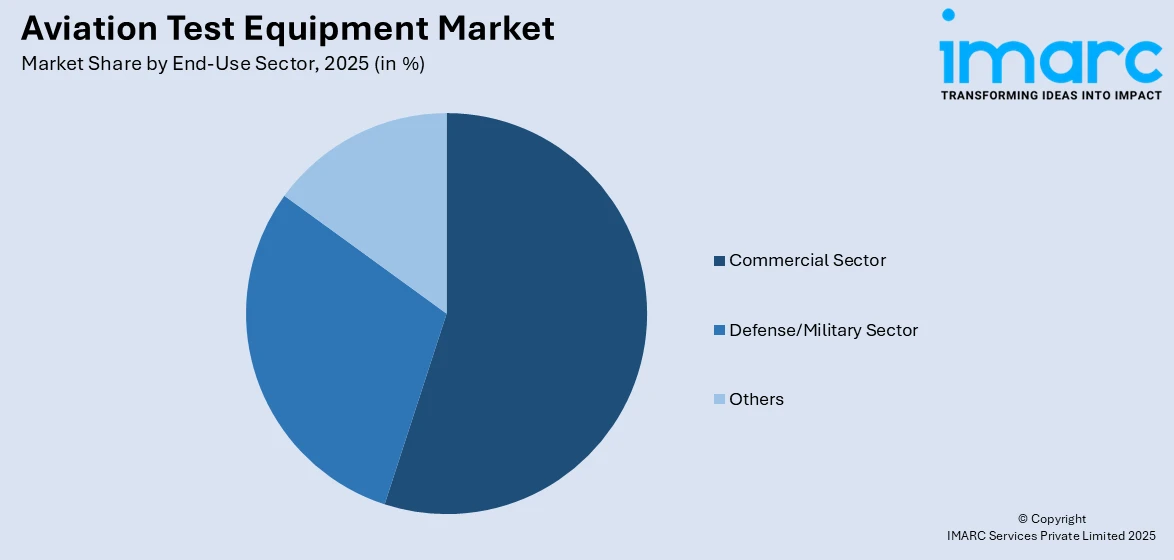

Analysis by End-Use Sector:

Access the comprehensive market breakdown Request Sample

- Commercial Sector

- Defense/Military Sector

- Others

Commercial sector leads the market with around 55.3% of market share in 2025. The commercial sector holds the largest share of the aviation test equipment market due to the rapid expansion of air travel, fleet modernization, and increasing demand for fuel-efficient aircraft. Rising passenger and cargo traffic drives the need for rigorous maintenance, repair, and overhaul (MRO) activities to ensure operational safety and efficiency. Additionally, advanced avionics systems in modern commercial aircraft require precise testing solutions. Airlines' emphasis on adhering to stringent regulatory standards further boosts demand. The growth of low-cost carriers and emerging markets also contributes to fleet expansion, fueling the need for reliable test equipment to support maintenance and compliance.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2025, based on the aviation test equipment market forecast North America accounted for the largest market share of over 33.0%. Driven by a well-established aerospace and defense industry, significant military spending, and the presence of major aircraft manufacturers and MRO service providers, the aviation test equipment market in North America is experiencing growth. Increasing air travel demand, fleet modernization, and advancements in avionics systems contribute to market growth. Stringent FAA safety regulations and standards necessitate regular testing of aircraft systems, boosting the need for advanced testing equipment. The growing adoption of next-generation technologies, such as automated and software-driven testing solutions, further fuels market expansion. Additionally, initiatives to develop sustainable and electric aircraft, coupled with investments in research and development for innovative testing tools, support aviation test equipment market growth in North America, making it a leading region globally.

Key Regional Takeaways:

United States Aviation Test Equipment Market Analysis

In 2025, the United accounted for the market share of over 85%. Commercial aviation is highly significant to the U.S. economy since it connects millions of passengers, while a vast amount of cargo moves both domestically and internationally. There is steady demand for air travel, primarily because the population is rising, and so are disposable incomes. Another factor that has caused the air cargo market to experience substantial growth is e-commerce and globalization.

The United States boasts one of the most advanced and well-funded military aviation programs in the world. To sustain its military dominance, significant investments are made in cutting-edge technologies like stealth and autonomous systems. A substantial portion of funding is dedicated to the development and testing of advanced fighter aircraft. In 2022, the U.S. accounted for 39% of global defense spending, with military expenditures totaling USD 877 billion, reflecting a 0.7% increase, according to an industry report. These factors underscore the ever-rising demand for complex aircraft test equipment to ascertain their reliability, safety, and performance in commercial as well as military sectors.

Europe Aviation Test Equipment Market Analysis

Europe's aviation industry is increasing significantly due to an upward trend in air travel, where a need is placed on upgrading the fuel economy in their fleets by equipping new aircraft. With regard to this, UK-based air firms focused primarily on the acquisition of aeroplanes as follows; recently, at the tail end of December 2023, EasyJet firmly ordered 56 models of Airbus A320neo aside from 101 A321neo; then in September this year, British Airways acquired six Boeing 787-10, coupled with ten A320Neo, as per an industry report. Such new fleet will create huge requirements for high-tech aviation testing equipment that will be complied accordingly, with the safety, performance, and regulatory requirements of the same.

According to another industry report, GA too occupies a very significant space within the European aviation landscape. It employs around 12,000 people in the UK alone. There exist about 21,000 civilian aircraft registered in the UK, out of which almost 96% of such aircraft are used for GA purposes. They log in with around 1.25 and 1.35 million flight hours per annum. Such huge volumes of activity in this stream itself raises the demand for proper testing and maintenance solutions.

Further fuelling the growth of the market is the advancements in aviation testing technology. For example, in April 2022, France-based ATEQ Aviation launched the ATEQ BCA, a battery charger-analyzer designed for the maintenance, certification, and homologation of various aviation battery types, reflecting the advancement in specialized testing solutions across Europe.

Asia Pacific Aviation Test Equipment Market Analysis

The Asia-Pacific market for military aviation test equipment is currently recording strong growth due to the growth in its military aviation sector. Such countries as China and India are increasing their defense spendings to improve their power of air force against nationwide security concerns and tensions spreading regionally. Among other things, these enlarged budgets acquire state-of-the-art fighter planes and surveillance aircraft, a situation that stimulates the increased need for testing equipment aviators use in ensuring such equipment's reliability, efficiency, and safety. An industry report reveals that in 2023, China's defense budget has grown to USD 230 billion, marking a 7.1% year-on-year increase. Meanwhile, India allocated around USD 70 billion for defense, with a substantial portion focused on strengthening its air force capabilities. This upsurge in military investments has made it critical to require advanced testing solutions to support the region's growing fleet of sophisticated aircraft, making it a key driver for the Asia-Pacific aviation test equipment market.

Latin America Aviation Test Equipment Market Analysis

The aviation market in Latin America is expanding steadily because of heightened demand for cargo services, domestic travel, and the increasing popularity of low-cost carriers. Chile, Colombia, and Argentina are improving their air services, especially within the region of Latin America. The region experienced 47.6 million air passengers in 2023, a little lesser than the 48.2 million in 2022, as per an industry report. This continued growth in air travel highlights the increasing need for high-quality aviation testing equipment to ensure that the growing number of aircraft meets stringent safety, performance, and compliance standards. As the aviation industry in the region continues to expand and modernize, reliable testing solutions will be essential to maintain operational efficiency and safety, positioning the Latin American aviation test equipment market for ongoing growth.

Middle East and Africa Aviation Test Equipment Market Analysis

According to an industry report, the commercial aircraft segment in the Middle East and Africa showed the most remarkable growth with nearly 96% of the deliveries made in 2022 as compared to 2021. This growth came off the back of recovery of air travel after disruptions, which had caused a shutdown of production, delayed supplies, and transportation. According to industry reports, over 1,080 commercial aircraft are supposed to be delivered to this region during the forecast period, which will further propel demand for aviation test equipment.

As per industry insights, despite a slight decline in the Middle East defense expenditure of around USD 184 Billion in 2022, and in Africa, which had defense spending of USD 39.4 Billion, military aviation in both these regions is still a very significant contributor to the market. This means the Middle East and Africa aviation test equipment market would see sustained growth in commercial and military aviation as militaries around the world upgrade their fleets, including advancing their technology through constant innovation.

Competitive Landscape:

The aviation test equipment market is highly competitive, with key players focusing on technological advancements and innovation to strengthen their market position. Major companies like Boeing, Honeywell International, Lockheed Martin, and Rockwell Collins dominate due to their extensive expertise and global presence. Emerging players are entering the market with automated and software-driven solutions, intensifying competition. Partnerships, mergers, and acquisitions are common strategies to expand product portfolios and enhance capabilities. Companies also emphasize sustainability by developing eco-friendly testing equipment. The competitive landscape is further shaped by increasing investments in R&D, as market participants aim to meet the growing demand for efficient, precise, and reliable test systems.

The report has also provided a comprehensive analysis of the competitive landscape in the global aviation test equipment market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Honeywell International Inc.

- Boeing

- General Electric Co.

- 3M

- Airbus

- Rockwell Collins

- Moog Inc.

- Teradyne Inc.

- SPHEREA Test & Services

- Rolls Royce Holdings Plc

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Recent Developments:

- In December 2024, The FAA approved SpaceX’s modified Part 450 launch license for additional Starship test missions, allowing the company to proceed with its seventh flight. The approval covers Starship and the Super Heavy booster’s configuration and mission profile. Scheduled for launch from Boca Chica, Texas, Starship will complete a half-globe flight, while Super Heavy will attempt a return and catch landing. The FAA emphasized its commitment to safe space transportation.

- In October 2024, Prime Ministers Narendra Modi and Pedro Sanchez inaugurated a plant in Vadodara for producing Airbus C295 military transport aircraft, marking a significant milestone in India’s defence and aviation sectors. Set up by Tata Advanced Systems in collaboration with Airbus Spain, the plant will manufacture 40 C295s for the Indian Air Force under a $2.5-billion deal. The first aircraft is expected by 2026, with six of the 16 "fly-away" aircraft already delivered.

- In September 2024, GE Aerospace opened its Services Technology Acceleration Center (STAC) near its Cincinnati headquarters, set to advance engine inspection, repair, and overhaul technologies. The facility aims to simplify MRO processes and deploy cutting-edge inspection and repair solutions across GE’s global network. Nicole Jenkins, GE's chief MRO engineer, highlighted that STAC will be pivotal in accelerating and scaling these innovative technologies for broader market implementation.

- In May 2024, Extech unveiled a new range of measurement instruments, which included the multipurpose BR450 W borescopes, the sophisticated EX series of clamp meters and multimeters, and the IAQ320 air quality sensor. These goods are very reasonably priced and meet all safety regulations.

- In May 2024, IDEAL Electrical announced two new circuit tracer models: the SureTrace™ Circuit Tracer (61-946) and SureTrace™ Plus Circuit Tracer (61-948). The 61-946 is rated up to CAT III 480V, while the 61-948 supports CAT III 600V and includes a patent-pending integrated continuity tester. Both models feature the TightSight™ rotating display for improved readability.

- In March 2023, Viavi Solutions Inc. announced the approval of its AVX-10K Flight Line Test Set for use on all Boeing commercial aircraft, previously approved for the IFR4000 and IFR6000. The AVX-10K meets Boeing's equivalency requirements and streamlines performance verification and troubleshooting of airborne systems, offering capabilities from quick auto-tests to detailed diagnostics.

Aviation Test Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electrical, Hydraulic, Pneumatic, Others |

| End-Use Sectors Covered | Commercial Sector, Defense/Military Sector, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Honeywell International Inc., Boeing, General Electric Co., 3M, Airbus, Rockwell Collins, Moog Inc., Teradyne Inc., SPHEREA Test & Services and Rolls Royce Holdings Plc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aviation test equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aviation test equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the aviation test equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Aviation Test Equipment refers to specialized tools and systems used to evaluate, diagnose, and ensure the functionality, performance, and safety of aircraft components and systems, including avionics, electrical, hydraulic, and pneumatic systems. These tools are vital for maintenance, repair, manufacturing, and compliance with aviation safety standards.

The aviation test equipment market was valued at USD 8.1 Billion in 2025.

IMARC Group estimates the market to reach USD 10.9 Billion by 2034, exhibiting a CAGR of 3.30% during 2026-2034.

The aviation test equipment market is driven by advancements in aircraft technology, growing air traffic, fleet modernization, stringent safety regulations, and increased demand for efficient maintenance. Additionally, the rise of electric and hybrid aircraft and the adoption of automated and software-driven testing solutions further fuel market growth.

According to the report, electrical represented the largest segment by type, due to increased reliance on advanced electrical systems, electric aircraft growth, stringent safety standards, and innovations in automated, precise, and portable testing solutions.

The commercial sector leads the market by end use sector due to expanding air travel, fleet modernization, stringent safety regulations, increased MRO activities, and growing demand for advanced avionics testing solutions.

North America accounted for the largest market share of over 33.0%, driven by a well-established aerospace and defense industry, significant military spending, and the presence of major aircraft manufacturers and MRO service providers.

Some of the major players in the global aviation test equipment market include Honeywell International Inc., Boeing, General Electric Co., 3M, Airbus, Rockwell Collins, Moog Inc., Teradyne Inc., SPHEREA Test & Services and Rolls Royce Holdings Plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)