Aviation Lubricants Market Report by Type (Hydraulic Fluid, Engine Oil, Grease, Special Lubricants and Additives), Technology (Mineral-based, Synthetic), Platform (Commercial Aviation, Military Aviation, Business and General Aviation), End User (OEM, Aftermarket), and Region 2025-2033

Aviation Lubricants Market Size:

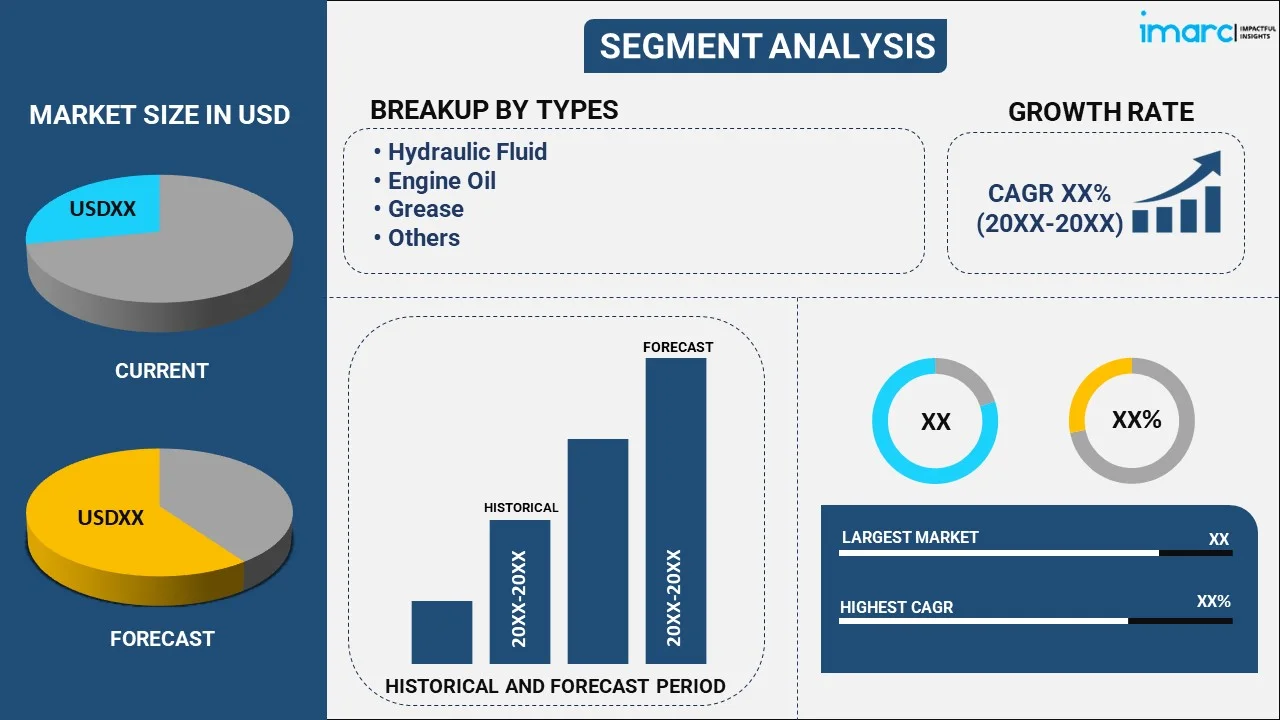

The global aviation lubricants market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.35% during 2025-2033. The market is driven by the growth in air travel, ongoing advancements in aircraft technology, implementation of stringent regulations on engine performance and efficiency, increasing focus on reducing environmental impact and heightening demand for fuel efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Market Growth Rate (2025-2033) | 5.35% |

Aviation Lubricants Market Analysis:

- Major Market Drivers: The aviation lubricants market is significantly driven by the expansion of the global air travel industry and advancements in aircraft technology. Increased aviation lubricants demand for fuel-efficient and high-performance engines necessitates advanced lubricants that enhance engine life and efficiency. Stringent regulations imposed by aviation authorities to ensure engine reliability and safety further boost the need for specialized lubricants. Additionally, the rise in commercial and military aviation activities globally and the increasing focus on reducing carbon emissions and enhancing operational efficiency are key factors propelling market growth. The continuous development of new aircraft models and the modernization of existing fleets also contribute to the rising demand for high-quality aviation lubricants.

- Key Market Trends: The shift toward synthetic and high-performance lubricants due to their superior properties in extreme conditions is among the key aviation lubricants market trends. These advanced lubricants offer better thermal stability, oxidation resistance, and reduced friction, which are crucial for modern aircraft engines. Another trend is the growing emphasis on sustainability, with increased research into eco-friendly lubricants that minimize environmental impact. Additionally, technological advancements are leading to the development of smart lubricants that can provide real-time performance data. The integration of digital technologies, such as predictive maintenance systems, is becoming more prevalent, influencing the formulation and application of aviation lubricants to ensure optimal engine performance and longevity.

- Geographical Trends: Asia Pacific is the largest market for aviation lubricants. Countries, such as China and India, are experiencing significant increase in air travel due to their expanding economies and rising middle-class population. The aviation lubricants market recent developments include region’s investment in new airport infrastructure and fleet expansion. Additionally, the presence of major aircraft manufacturing hubs and a growing focus on improving aviation safety and efficiency further support the market's expansion in Asia Pacific. The region's strategic importance in global aviation, coupled with increasing international and domestic flights, continues to drive its dominance in the market.

- Competitive Landscape: Some of the major market players in the aviation lubricants industry include Aerospace Lubricants Inc., Eastman Chemical Company, Exxon Mobil Corporation, Whitmore Manufacturing LLC, Lanxess AG, Lukoil, Nyco, Nye Lubricants Inc. (Fuchs Petrolub SE), Rocol (Illinois Tool Works Inc.), Royal Dutch Shell plc, Tecsia Lubricants Pte Ltd and The Chemours Company, among many others.

- Challenges and Opportunities: The aviation lubricants market faces challenges including stringent regulatory standards and the high cost of advanced lubricants. Compliance with evolving environmental regulations and the need for continuous innovation to meet performance requirements can be demanding. However, these challenges present. Companies have the chance to develop cutting-edge, eco-friendly lubricants and invest in research and development to address regulatory and performance issues. The growing focus on sustainable aviation practices and fuel efficiency offers significant potential for new product development and market expansion. Additionally, emerging markets and the modernization of aging aircraft fleets are some of the aviation lubricants market recent opportunities that expand market reach and enhance product offerings.

Aviation Lubricants Market Trends:

Increasing demand for aircraft fleet expansion

With the growing passenger and cargo demand in the global air traffic sector, the airline fleets are expanding. While airlines are expanding their fleets in response to this demand, the rate of expansion is much more rampant in regions like Asia-Pacific and the Middle East. Increasing aircraft necessitates raising the maintenance levels-including lubrication of engines, gears, and hydraulic systems. Lubricants play a critical role in reducing friction and preventing wear and tear, thus ensuring the optimal maintenance of the engine. In order to offer the long operational lifespans of their airplanes, for the sake of fuel efficiency, airlines prefer high-performance lubricants leading to increased growth in the market. The demand for specialized lubricants will also gain a boost through the introduction of new aircraft models with advanced technology, hence improving the trajectory of growth in the market.

Technological advancements

Technological advancements in aviation lubricant formulations are a major factor driving the aviation lubricants market growth. The aviation industry demands lubricants that can withstand extreme temperatures, high pressures, and diverse environmental conditions. Newer formulations are being developed to enhance the performance of lubricants, ensuring better viscosity, improved thermal stability, and longer service intervals. These innovations help reduce operational costs for airlines by minimizing the frequency of lubricant changes and prolonging engine life. Synthetic lubricants, in particular, are gaining traction due to their superior properties over traditional mineral-based oils. These lubricants offer extended durability, greater protection against corrosion, and enhanced resistance to oxidation. As airlines and military aviation sectors seek to improve operational efficiency, the demand for advanced, high-performance lubricants is expected to rise, driving market expansion.

Increasing regulatory standards

Emission of carbon by aircraft leads to big regulatory bodies such as ICAO imposing tough regulations on cutting the same in the fight against global warming. These prompt airlines to come up with more efficient and eco-friendly means. In this respect, aviation lubricants play a great role as their quality can increase efficiency of the engine and reduce fuel combustion leading to lower emissions. This involves more concentration on environmental-friendly lubricants with lesser volatility and production of lower environmentally hazardous products. Such lubricants comply with regulatory requirements and cater to the sustainability interests of airlines. Since there is growing regulatory pressure, the applications for lubricants that improve fuel efficiency and emission norms will increase and drive the aviation lubricants market.

Aviation Lubricants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, technology, platform, and end user.

Breakup by Type:

- Hydraulic Fluid

- Engine Oil

- Grease

- Special Lubricants and Additives

Engine oil accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydraulic fluid, engine oil, grease, and special lubricants and additives. According to the report, engine oil represented the largest segment.

Engine oil is the largest segment by type in the aviation lubricants market due to its critical role in ensuring optimal engine performance and longevity. Engine oils are essential for lubricating internal engine components, reducing friction, and dissipating heat, which is crucial for maintaining engine efficiency and reliability. The high demand for engine oils is driven by the increasing number of aircraft in service and advancements in engine technology that require specialized lubricants. Using good engine oils is an important factor. This underscores the importance of engine oils in the aviation industry, thereby generating a favorable aviation lubricants market revenue.

Breakup by Technology:

- Mineral-based

- Synthetic

Synthetic holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes mineral-based and synthetic. According to the report, synthetic accounted for the largest market share.

Synthetic lubricants are the largest segment by technology in the aviation lubricants market due to their superior performance characteristics and adaptability to extreme conditions. Unlike traditional mineral-based lubricants, synthetic lubricants offer enhanced thermal stability, oxidation resistance, and reduced friction, which are crucial for modern high-performance engines. This results in longer intervals between oil changes and better engine protection. According to Tribology and Lubrication engineering society, synthetic and part-synthetic lubricants are now used in more than 70 different applications. The advanced properties of synthetic lubricants also align with stringent industry regulations and the growing demand for more reliable and efficient aviation technologies, driving their dominance in the market.

Breakup by Platform:

- Commercial Aviation

- Military Aviation

- Business and General Aviation

Commercial aviation represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the platform. This includes commercial aviation, military aviation, and business and general aviation. According to the report, commercial aviation represented the largest segment.

Commercial aviation is the largest segment by platform in the aviation lubricants market due to its substantial contribution to global air travel and the high operational demands placed on commercial aircraft. The rapid growth in passenger air traffic and the rapid expansion of airline fleets drive significant demand for aviation lubricants to ensure engine performance, safety, and reliability. According to the International Air Transport Association (IATA), global passenger traffic is expected to increase by 3.4% annually over the year 2040, fueling the need for continuous maintenance and lubrication of commercial aircraft. The sheer volume of commercial flights and the necessity for regular maintenance and engine care make commercial aviation the dominant segment in the aviation lubricants market.

Breakup by End User:

- OEM

- Aftermarket

Aftermarket exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes OEM and aftermarket. According to the report, aftermarket accounted for the largest market share.

As per the aviation lubricants market overview, the aftermarket represents the largest segment in the aviation lubricants market due to the extensive need for maintenance, repair, and overhaul (MRO) services across existing aircraft fleets. As aircraft age, they require more frequent servicing and replacement of lubricants to ensure continued performance and compliance with safety regulations. This ongoing maintenance is critical for extending the operational life of aircraft and preventing costly downtimes. The growing fleet of aging aircraft and the need for reliable, high-performance lubricants in MRO activities drive the dominance of the aftermarket segment in the aviation lubricants market.

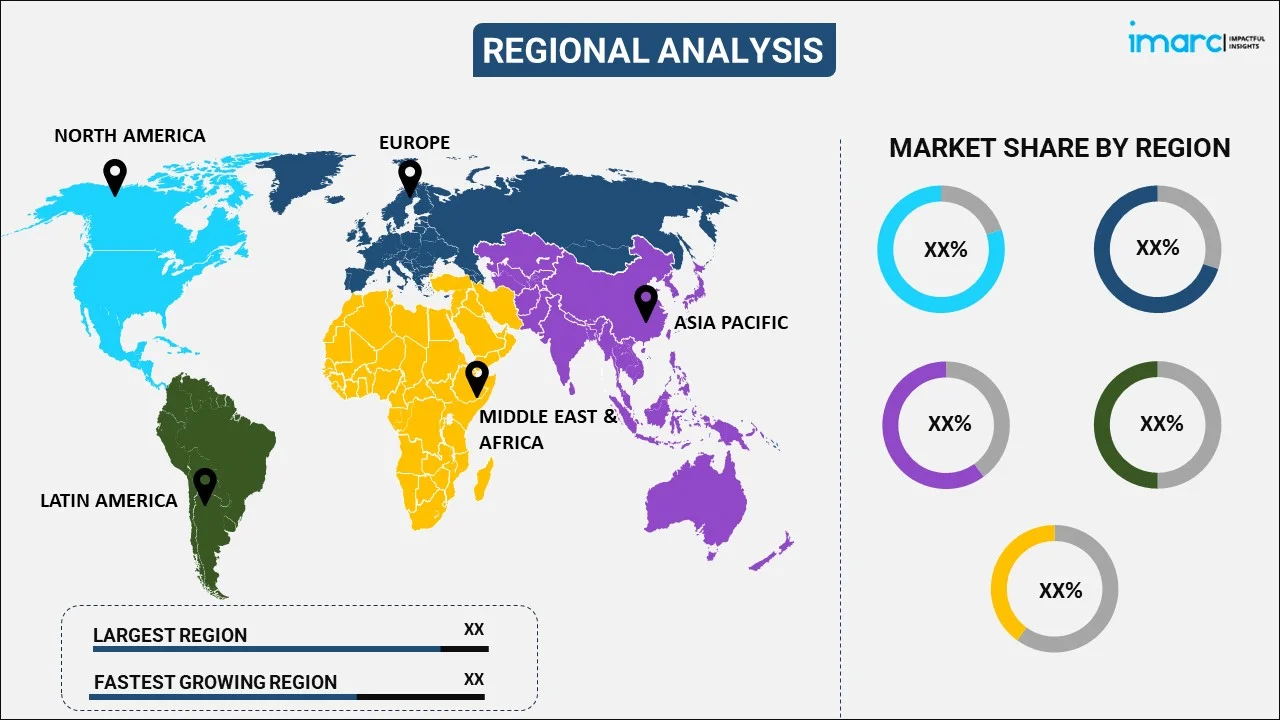

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest aviation lubricants market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest regional market for aviation lubricants.

Asia Pacific is the largest segment by region in the aviation lubricants market due to rapid growth in air travel and significant investments in aviation infrastructure across the region. Countries such as China and India are expanding their airport capacities and increasing their aircraft fleets to meet the rising demand for both domestic and international flights. The region's strong economic growth and increasing middle-class population further drive air travel expansion. According to International Air Transport Association (IATA), routes to, from and within Asia-Pacific will see an extra 2.35 billion annual passengers by 2037, for a total market size of 3.9 billion passengers. Its CAGR of 4.8% is the highest, followed by Africa and the Middle East, Asia Pacific is projected to account for over 40% of the world's passenger traffic by 2030. This substantial growth in air traffic fuels the demand for aviation lubricants, making Asia Pacific the dominant regional market in the industry.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the aviation lubricants industry include:

- Aerospace Lubricants Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Whitmore Manufacturing LLC

- Lanxess AG

- Lukoil

- Nyco

- Nye Lubricants Inc. (Fuchs Petrolub SE)

- Rocol (Illinois Tool Works Inc.)

- Royal Dutch Shell plc

- Tecsia Lubricants Pte Ltd

- The Chemours Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The competitive landscape of the aviation lubricants market is characterized by a mix of established multinational corporations and innovative specialty companies. Major aviation lubricants companies, including ExxonMobil, Chevron, and BP, dominate the market with their extensive product portfolios and global reach. These companies leverage their vast resources to invest in research and development, ensuring they offer cutting-edge, high-performance lubricants. Meanwhile, niche players focus on developing specialized products tailored to emerging technological advancements and sustainability trends. For instance, in 2024, Shell Aviation introduced its new “Shell Flight” synthetic lubricant, designed to enhance engine efficiency, and reduce environmental impact, reflecting the industry's shift toward eco-friendly solutions. This strategic move underscores the growing emphasis on innovation and sustainability within the competitive landscape.

Aviation Lubricants Market News:

- In January 2024, Shell has signed long-term agreement with Air Europa for AeroShell aviation lubricants . The arrangement calls for AeroShell to supply engine oils, greases, and fluids for the airline's Boeing 737 and 787 fleets.

Aviation Lubricants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydraulic Fluid, Engine Oil, Grease, Special Lubricants and Additives |

| Technologies Covered | Mineral-based, Synthetic |

| Platforms Covered | Commercial Aviation, Military Aviation, Business and General Aviation |

| End Users Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerospace Lubricants Inc., Eastman Chemical Company, Exxon Mobil Corporation, Whitmore Manufacturing LLC, Lanxess AG, Lukoil, Nyco, Nye Lubricants Inc. (Fuchs Petrolub SE), Rocol (Illinois Tool Works Inc.), Royal Dutch Shell plc, Tecsia Lubricants Pte Ltd, The Chemours Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aviation lubricants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aviation lubricants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aviation lubricants industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global aviation lubricants market was valued at USD 2.3 Billion in 2024.

We expect the global aviation lubricants market to exhibit a CAGR of 5.35% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary halt in numerous production activities for aviation lubricants.

The rising demand for aviation lubricants in eliminating the friction between the metal parts, improving the energy efficiency of an aircraft, and preventing deposit formation as well as protecting engine parts, is primarily driving the global aviation lubricants market.

Based on the type, the global aviation lubricants market has been divided into hydraulic fluid, engine oil, grease, and special lubricants and additives. Currently, engine oil exhibits a clear dominance in the market.

Based on the technology, the global aviation lubricants market can be categorized into mineral-based and synthetic, where synthetic technology currently accounts for the majority of the global market share.

Based on the platform, the global aviation lubricants market has been segregated into commercial aviation, military aviation, and business and general aviation. Among these, commercial aviation holds the largest market share.

Based on the end user, the global aviation lubricants market can be bifurcated into OEM and aftermarket. Currently, aftermarket exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global aviation lubricants market include Aerospace Lubricants Inc., Eastman Chemical Company, Exxon Mobil Corporation, Whitmore Manufacturing LLC, Lanxess AG, Lukoil, Nyco, Nye Lubricants Inc. (Fuchs Petrolub SE), Rocol (Illinois Tool Works Inc.), Royal Dutch Shell plc, Tecsia Lubricants Pte Ltd, and The Chemours Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)