Avalanche Photodiode Market Size, Share, Trends, and Forecast by Material, Sales Channel, End User, and Region, 2025-2033

Avalanche Photodiode Market Size and Share:

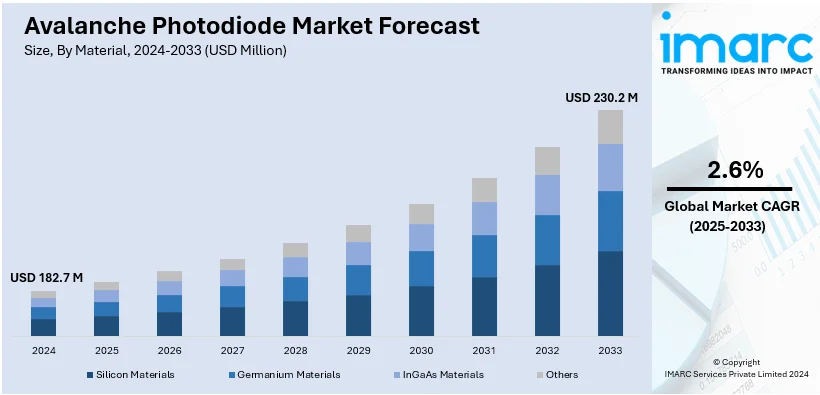

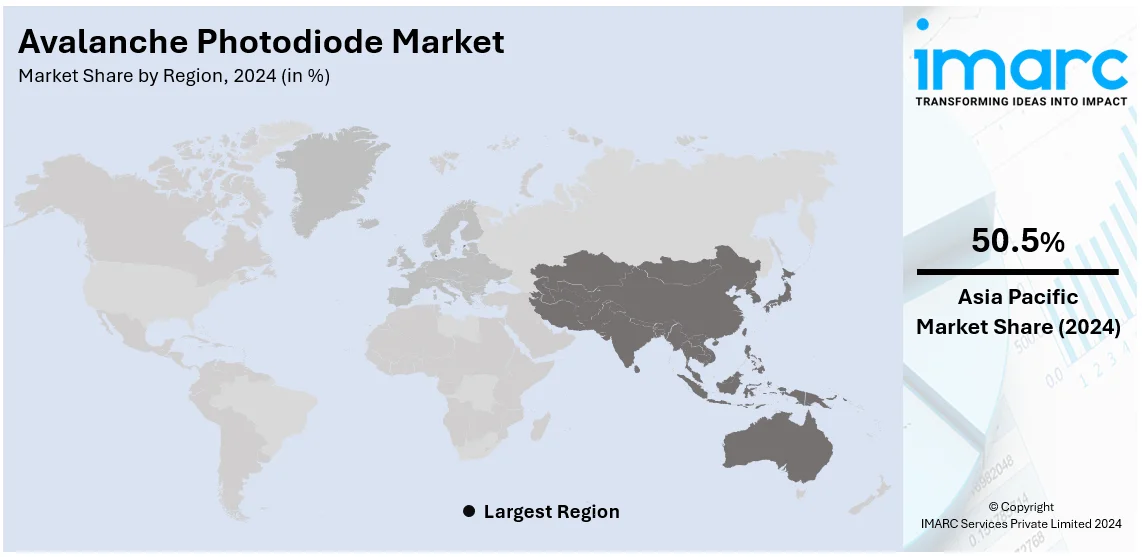

The global avalanche photodiode market size was valued at USD 182.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 230.2 Million by 2033, exhibiting a CAGR of 2.6% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 50.5% in 2024. Technological advancements in medical imaging, heightening demand for high-speed communication and increasing applications in sectors like defense and aerospace, are some of the factors driving the market across Asia Pacific.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 182.7 Million |

|

Market Forecast in 2033

|

USD 230.2 Million |

| Market Growth Rate (2025-2033) | 2.6% |

The rapid growth of the global avalanche photodiode market is fueled by rising need for high-speed optical communication systems in sectors such as telecommunications and data centers. The increasing use of 5G technology is greatly increasing the demand for effective photodetectors to guarantee smooth data transfer at elevated frequencies. The increase in need for medical imaging and diagnostics, such as CT scans and fluorescence imaging, is driving market growth as avalanche photodiodes can provide improved sensitivity and precision. Moreover, the aerospace and defense industries are crucially involved, as they are extensively utilized in laser range finders, lidar systems, and missile guidance systems. The market growth is being further boosted by the growing attention toward autonomous vehicles and improvements in lidar technology, since avalanche photodiodes play a crucial role in lidar sensors for accurately detecting objects. According to the IMARC Group, the global autonomous vehicles market has reached USD 109.0 Billion in 2024. Moreover, advancements in material sciences and production methods are enhancing the efficiency and cost-effectiveness of devices, promoting their use in developing markets. The increasing use of these photodiodes in quantum computing and research improves their market opportunities.

The United States has emerged as a key regional market for avalanche photodiode. The United States avalanche photodiode market is driven by the advances in optical communications technologies which are in high demand by a wide array of industries, such as telecommunications, data centers, and broadband networks. Another major factor driving the market in this region is the tremendous growth of the U.S. defense and aerospace industries, as avalanche photodiode play a major role in laser range finders, lidar systems, advanced missile guidance, and more. Furthermore, in the healthcare sector, the market has been driven by the growing acceptance of medical imaging technologies including molecular imaging and CT scans, with proven ability to deliver high sensitivity in accurate imaging. As per the IMARC Group, the United States medical imaging market reached USD 10.4 Billion in 2024.

Avalanche Photodiode Market Trends:

Heightening Product Demand in High-Speed Telecommunications

The global avalanche photodiode market is witnessing substantial growth mainly due to the increasing demand for high-speed telecommunications. With the significant expansion of 5G technology and fiber optics network, avalanche photodiodes are rapidly becoming a requisite for signal amplification and detection purposes. As per industry reports, by the end of the year 2029, 85% of the global population is projected to have 5G technology coverage access, while 5G mobile subscriptions are expected to reach around 5.6 Billion in the same year. Such diodes enable more effective, faster data transfer over long distances. In addition, as telecom enterprises are currently focusing on making significant investments in optimizing infrastructure, the demand for avalanche photodiodes is anticipated to bolster, further driving the market demand, particularly in regions emphasizing on upgraded network solutions.

Technological Advancements in Medical Imaging

The deployment of avalanche photodiodes in medical imaging, especially in positron emission tomography (PET) equipment, is a surging trend in the global market. Such diodes provide improved sensitivity, positioning them as an ideal option for detecting low-light levels critical in accurate medical diagnostics. Moreover, the heightening adoption of upgraded imaging technologies across various healthcare facilities is supporting the demand for avalanche photodiodes. For instance, technological advancements in medical imaging, including the rising use of avalanche photodiodes and AI-driven solutions, are transforming diagnostics and treatment planning, with the AI medical imaging market projected to grow from USD 762 Million in 2022 to USD 14.2 Billion by 2032. These innovations enhance precision, efficiency, and patient outcomes in detecting and managing complex conditions. In addition, as advancements in medical equipment continue, the incorporation of such diodes into newer, advanced imaging systems in projected to further spur the market expansion. For instance, in March 2024, Hamamatsu Photonics, an avalanche photodiodes provider, unveiled the S16835, its new thermoelectric-cooled single photon avalanche photodiodes series, featuring reduced dark count, high sensitivity, and excellent detection efficiency, suited for low-light levels. This can be used in PET scanning, single-photon experimentation, time of flight (ToF) 3D imaging, etc.

Increasing Product Adoption in Aerospace and Quantum Applications

Avalanche photodiodes are rapidly being leveraged in aerospace application and quantum communication solutions, significantly propelling market expansion. Their quick response times and exceptional sensitivity make them a preferable option for optical sensing in aerospace networks and detecting photons in quantum systems. In addition, as private sectors and governmental bodies are currently investing aerospace technologies and quantum research, the need for upgraded optical sensors, including avalanche photodiodes, is anticipated to bolster. For instance, in May 2024, Phlux Technology, a prominent photodiodes and electronics company, collaborated with The University of Sheffield and Airbus Defense and Space, an aeronautics company, on a €500,000 (USD 0.52 Million) project funded by the European Space Agency to develop effective free-space optical communication satellite terminals using Phlux’s avalanche photodiode products, providing improved sensitivity. These photodiodes aim to enable low-latency, faster communications with LEO satellites at 2.5 Gbps or higher speeds. Moreover, this trend is especially prominent in regions with resilient research and development abilities.

Avalanche Photodiode Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global avalanche photodiode market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, sales channel, end user, and region.

Analysis by Material:

- Silicon Materials

- Germanium Materials

- InGaAs Materials

- Others

Silicon materials dominate the market, holding around 46% of the market. Silicon possesses exceptional efficiency and sensitivity in detecting light across a broad range of spectrum. Its excellent compatibility with integrated circuits as well as cost-efficiency make it an ideal choice for numerous key sectors, especially in medical imaging and telecommunications. In addition, silicon-based avalanche photodiodes provide superior performance in both high-speed communication and low-light detection application, significantly propelling their adoption and contributing to an optimistic avalanche photodiode market outlook. Furthermore, ongoing innovations in silicon technology continue to improve product abilities, maintaining its leading position in the global market.

Analysis by Sales Channel:

- OEMs

- Aftermarket

OEMs leads the market with around 60.2% of market share in 2024. Original equipment manufacturers (OEMs) hold the largest share in the sales channel segment as they are key players in incorporating avalanche photodiodes into end use products across various sectors, such as healthcare, telecommunications, and aerospace. Their critical role in ensuring both performance and quality standards propels their need in the global market. In addition, with escalating requirement for customized photodiode systems, OEMs are currently emphasizing on advancements and product development to address the specific industry demands, further solidifying their position as a key sales channel in this dynamic market.

Analysis by End User:

- Aerospace and Defense

- Telecommunication

- Healthcare

- Others

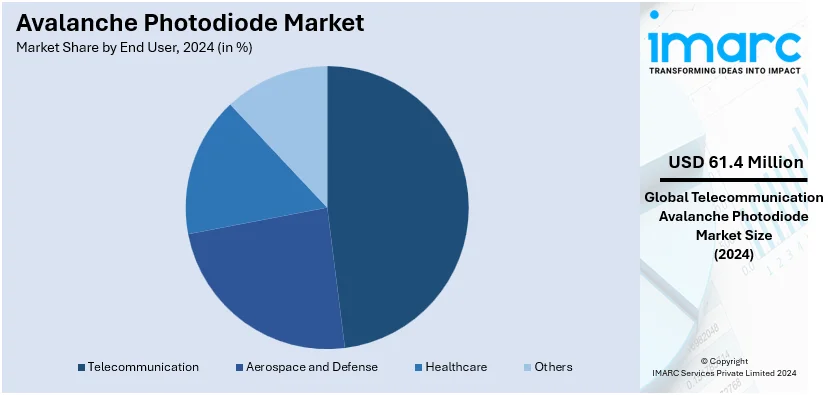

Telecommunication leads the market with around 33.6% of market share in 2024. The telecommunication sector accounts for the largest end user segment in the global avalanche photodiode market as the high-speed optical communication systems heavily depend on such diodes for signal amplification as well as detection. With heightening need for faster data transfer and proliferated fiber optic infrastructure, the demand for avalanche diodes has significantly surged in this industry. In addition, their ability to improve communication performance, especially in low-light and long-distance conditions, positions them as requisite components for telecom purposes, fortifying the sector’s position as the dominant consumer of this product.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 50.5%. Asia Pacific leads the global avalanche photodiode market, predominantly driven by the increasing investments in electronics and telecommunication industries and rapid technological innovations. Countries like Japan, China, and South Korea are the major contributors, along with accelerating requirement for advanced and high-speed data transfer systems and expansion of fiber optic networks. For instance, in October 2023, China Unicom Group, a major telecommunications company, announced plans to develop a 3,000 km-long submarine optical fiber network to enhance internal communication with Cambodia. The project is anticipated to be completed by the third quarter of 2025. In addition, Asia Pacific’s expanding semiconductor sector and the amplifying utilization of photodiodes in consumer electronics and automotive industries further boost its market dominance. Furthermore, robust research and development projects in optical technology also foster the region’s significant growth in avalanche photodiode market.

Key Regional Takeaways:

United States Avalanche Photodiode Market Analysis

The United States accounts for the 83.2% of the avalanche photodiode in North America. The country is leveraging advancements in photodiode technology to enhance its position in key industries such as telecommunications, healthcare, and defense. The adoption of cutting-edge photodiodes is enabling faster data transmission, improved medical imaging, and advanced military applications, solidifying the nation's global competitiveness. Innovations in photodiode materials and manufacturing processes have increased their efficiency and sensitivity, making them ideal for fiber-optic communications and high-precision lidar systems. According to U.S. Technology Competitiveness data, the U.S. semiconductor industry invested USD 59.3 Billion in R&D in 2023, driving innovations like the adoption of Avalanche Photodiodes (APDs) to maintain global market leadership. This 0.9% increase over 2022 highlights the critical role of sustained R&D in advancing cutting-edge technologies. States like California and Massachusetts are at the forefront of this growth, driven by tech hubs in Silicon Valley and Boston. Additionally, research institutions in New York and Texas are developing new photonic devices to improve performance in low-light conditions. For example, photodiodes are being utilized in autonomous vehicles to enhance safety and reliability. By embracing these technological advancements, the United States is strengthening its infrastructure and fostering growth across sectors, reinforcing its leadership in the rapidly evolving photonics market.

Asia Pacific Avalanche Photodiode Market Analysis

The Asia-Pacific region is emerging as a key hub for technological advancements in photonics, leveraging innovative detection technologies to support applications in telecommunications, healthcare, and environmental monitoring. Countries like Japan, South Korea, and China are at the forefront, utilizing cutting-edge photodiode systems in high-speed fiber-optic communication and LiDAR systems for autonomous vehicles. For instance, in January 2023, Asia-Pacific continues to dominate the global semiconductor market, holding 100% of advanced chip manufacturing capacity and leading silicon production, with China contributing six million metric tons in 2021. This regional supremacy underscores the importance of Avalanche Photodiodes, as semiconductor advancements drive their adoption for precision detection applications. With state-level investments in digital infrastructure across India and smart cities in Southeast Asia, the region is strengthening its position as a global leader in optoelectronics. Examples include South Korea’s deployment of next-generation sensors for 5G networks and China's advancements in precision medical imaging. The strategic location of the region, with access to a diverse range of markets, further enhances its competitive edge, fostering innovation and driving adoption across multiple industries.

Europe Avalanche Photodiode Market Analysis

The adoption of advanced photodetection technologies across Europe is significantly enhancing the region's capabilities in sectors like telecommunications, medical imaging, and aerospace. European countries, including Germany, France, and the Netherlands, are leveraging innovative photodetector solutions to boost the efficiency of fiber-optic communication networks and improve medical diagnostics. According to projections for the European Semiconductors market, revenue is set to reach USD 60.8 Billion in 2024, with Integrated Circuits leading at USD 46.0 Billion. The adoption of avalanche photodiodes is accelerating, leveraging the market's 8.9% CAGR (2024-2029) to meet growing demand for high-speed, low-light sensing applications. The development of high-performance optical systems, driven by advancements in semiconductor technologies, is positioning Europe as a leader in precision imaging and light detection applications. For instance, the United Kingdom and Switzerland are witnessing breakthroughs in quantum research and lidar systems, supporting autonomous vehicle innovation and environmental monitoring. Additionally, Europe's strategic locations for research and manufacturing hubs in regions such as Bavaria and Île-de-France are fostering innovation while enabling seamless integration of photodetection advancements into industries. By investing in cutting-edge facilities and aligning with global standards, Europe is strengthening its competitive edge and fostering sustainable growth in next-generation optical technologies.

Latin America Avalanche Photodiode Market Analysis

Latin America is leveraging cutting-edge photonic technology to enhance telecommunications, medical imaging, and environmental monitoring. Advancements in optical detection systems are driving improved performance in low-light conditions, enabling precise applications like remote sensing and high-speed internet delivery in countries such as Brazil and Chile. According to the United Nations COMTRADE database, Brazil's exports of diodes, transistors, and similar semiconductor devices to Argentina reached USD 255,400 in 2023. This growth highlights the increasing adoption of avalanche photodiodes in Latin America's expanding semiconductor market. These innovations strengthen the region’s position as a growing hub for photonics, benefiting rural and urban areas across Mexico, Argentina, and Colombia. Examples include the deployment of advanced sensors for seismic activity monitoring in earthquake-prone zones and enhanced optical systems supporting diagnostic tools in healthcare facilities across states in Brazil and Mexico.

Middle East and Africa Avalanche Photodiode Market Analysis

The Middle East and Africa region is witnessing significant growth in optical technology, with advancements in photodiode applications driving innovation across various industries. Nations like the UAE and South Africa are utilizing cutting-edge photodetection technologies to enhance telecommunications and medical imaging. According to data on the United Arab Emirates semiconductors market, revenue is projected to reach USD 295.5 Million in 2024, with optoelectronics, including avalanche photodiodes, dominating at USD 140.60 Million. The market's 6.4% CAGR (2024-2029) highlights growing adoption driven by advancements in optoelectronic applications. This adoption is transforming sectors like defense and aerospace, particularly in countries such as Saudi Arabia, where precision and reliability are paramount. Additionally, states in Africa are leveraging these advancements for renewable energy monitoring, showcasing their potential in enhancing infrastructure and sustainability. Strategic geographic positioning aids regional industries in accessing global markets effectively.

Competitive Landscape:

Major key players in the avalanche photodiode industry are employing various tactics to strengthen their market presence and address changing industry needs. These tactics involve broadening product portfolios to provide more advanced and diversified photodiode solutions, participating in mergers and acquisitions to boost technological capabilities and market presence, and establishing strategic partnerships and collaborations to encourage innovation and enter new markets. Moreover, businesses are directing their efforts towards expanding into new regions to capitalize on developing economies and enhance their worldwide footprint.

The report provides a comprehensive analysis of the competitive landscape in the avalanche photodiode market with detailed profiles of all major companies, including:

- Excelitas Technologies Corp.

- First Sensor AG (TE Connectivity)

- Global Communication Semiconductors LLC

- Hamamatsu Photonics K.K.

- Kyoto Semiconductor Co. Ltd.

- Laser Components (Photona GmbH)

- Lumentum Operations LLC

- Luna Innovations

- OSI Systems Inc.

- Renesas Electronics Corporation

- SiFotonics Technologies Co. Ltd.

Latest News and Developments:

- In October 2024, A recent study in Nature Communications reports the development of an avalanche photodiode (APD) with a record-high gain-bandwidth product of 1.5 THz. This advancement significantly enhances APD performance, offering improved sensitivity and speed for applications in optical communication and sensing technologies.

- In July 2024, Phlux Technology's innovative InGaAs Avalanche Photodiodes (APDs) operate at 1,550 nm, offering 12× greater sensitivity than traditional APDs, addressing LiDAR cost and efficiency challenges. These advancements enhance autonomous vehicle ADAS systems by improving object detection accuracy up to 200 meters. With MEMS-based FOV control reducing costs, LiDAR technology adoption is accelerating in automotive applications. APDs play a pivotal role by amplifying reflected light signals, boosting subsystem performance.

- In January 2024, Phlux Technology, a University of Sheffield spinout, has unveiled the Noiseless InGaAs Avalanche Photodiode (APD) series, boasting 12x greater sensitivity than conventional APDs. These low-noise, high-sensitivity sensors address limitations in long-range applications like LiDAR. The innovation enhances optical sensing performance, marking a breakthrough in photodiode technology.

- In January 2024, Phlux technology, a leading avalanche photodiode infrared sensors manufacturer, launched its exceptionally sensitive avalanche photodiode IR sensors, based on Noiseless InGaAs technology. It is twelve times more sensitive than conventional avalanche photodiode with compact size and 40% reduced system costs.

- In April 2023, Excelitas Technologies Corp., a leading industrial technology provider of innovative photonic solutions, launched the C30733BQC-01 InGaAs avalanche photodiode. This device offers a high gain, fast recovery time, and low noise performance, making it ideal for advanced telecommunication test equipment, optical communication, distributed fiber sensing, and LiDAR applications in smart cities and smart factories.

Avalanche Photodiode Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Silicon Materials, Germanium Materials, InGaAs Materials, Others |

| Sales Channels Covered | OEMs, Aftermarket |

| Applications Covered | Aerospace and Defense, Telecommunication, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Excelitas Technologies Corp., First Sensor AG (TE Connectivity), Global Communication Semiconductors LLC, Hamamatsu Photonics K.K., Kyoto Semiconductor Co. Ltd., Laser Components (Photona GmbH), Lumentum Operations LLC, Luna Innovations, OSI Systems Inc., Renesas Electronics Corporation, SiFotonics Technologies Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the avalanche photodiode market from 2019-2033.

- The avalanche photodiode market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the avalanche photodiode industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Avalanche photodiode is a highly sensitive semiconductor device used to detect and convert light into an electrical signal. It operates on the principle of the photoelectric effect, where incoming photons generate electron-hole pairs within the device.

The avalanche photodiode market was valued at USD 182.7 Million in 2024.

IMARC estimates the global avalanche photodiode market to exhibit a CAGR of 2.6% during 2025-2033.

The increasing product demand in nuclear instrumentation for precise radiation detection, growing utilization in environmental monitoring systems for accurate light detection, increasing interest in space exploration and astronomy needing high-sensitivity photodetectors are some of the key factors driving the market.

According to the report, silicon materials represented the largest segment by material, driven by its superior sensitivity, cost-effectiveness, and widespread availability for manufacturing avalanche photodiodes used in diverse applications.

OEMs lead the market by sales channel as they directly integrate avalanche photodiodes into end-use products, ensuring consistent demand from industries like telecommunications, aerospace, and healthcare.

Telecommunication holds the maximum number of shares due to the extensive deployment of avalanche photodiodes in high-speed optical fiber networks and 5G infrastructure, which require precise and reliable light detection for data transmission.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global avalanche photodiode market include Excelitas Technologies Corp., First Sensor AG (TE Connectivity), Global Communication Semiconductors LLC, Hamamatsu Photonics K.K., Kyoto Semiconductor Co. Ltd., Laser Components (Photona GmbH), Lumentum Operations LLC, Luna Innovations, OSI Systems Inc., Renesas Electronics Corporation, SiFotonics Technologies Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)