Autonomous Vehicle Market Size, Share, Trends and Forecast by Component, Level of Automation, Application, and Region, 2025-2033

Autonomous Vehicle Market Size and Share:

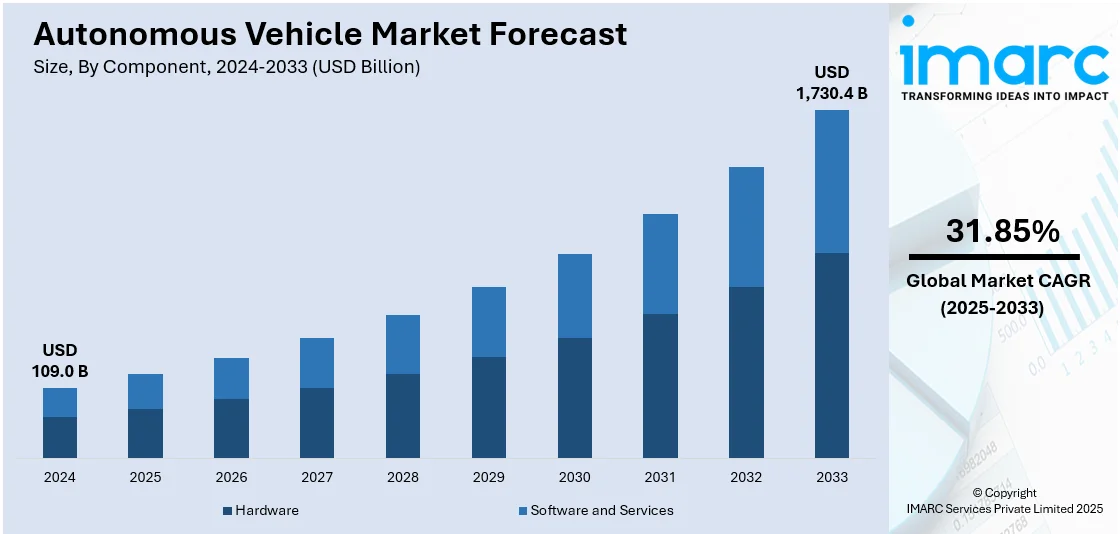

The global autonomous vehicle market size was valued at USD 109.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,730.4 Billion by 2033, exhibiting a CAGR of 31.85% from 2025-2033. North America currently dominates the market, holding a market share of over 40.8% in 2024. The growing implementation of favorable regulations, rising purchases of personal vehicles to travel comfortably without the hassle of public transportation, and increasing integration of artificial intelligence (AI) and machine learning (ML) algorithms are driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 109.0 Billion |

|

Market Forecast in 2033

|

USD 1,730.4 Billion |

| Market Growth Rate 2025-2033 | 31.85% |

The global market for autonomous vehicles is growing due to ongoing improvements in artificial intelligence and machine learning, which facilitate accurate navigation and decision-making in intricate situations. Major investments from automakers and technology companies are speeding up adoption, exemplified by Isuzu Motors' USD 30 Million investment in Gatik AI in May 2024 aimed at enhancing middle-mile autonomous driving in North America. This collaboration centers on creating level 4 autonomous driving technologies, featuring a safety-improved chassis, with large-scale manufacturing targeted for 2027. Increasing demand for safety enhancements to mitigate road accidents and the drive for sustainable transit within smart city projects is additionally expanding the market. Supportive government incentives and strategic partnerships are further fostering a favorable atmosphere for the worldwide adoption of autonomous vehicles.

The United States is emerging as a key regional market, primarily driven by the continual progress in vehicle-to-everything (V2X) communication and 5G connectivity, which facilitate smooth data transfer and enhanced reactivity. In accordance with this, growth in public and private funding for autonomous mobility infrastructure, including smart road systems and dedicated testing facilities, is propelling market advancement. The market is also driven by the considerable growth in shared mobility services and increasing demand for autonomous ride-hailing platforms, as well as efforts to ease traffic congestion and improve fuel efficiency. Additionally, cooperation between auto companies, tech startups, and government institutions stimulates innovation and develops regulatory policies for the mass deployment of autonomous vehicles. For example, Drive Forward Fund LP, sponsored by the White House, with Monroe Capital at the helm, raised USD 1 Billion on September 23, 2024, to help small and medium-sized automotive businesses develop innovation in electric vehicles, clean energy, and advanced automotive technologies.

Autonomous Vehicle Market Trends:

Technological Advancements

Continual technological advancement to improve the functionalities of automotive components is driving the autonomous vehicle market size. Autonomous driving primarily depends on advanced software and hardware technologies. Artificial intelligence (AI) and machine learning (ML) algorithms are crucial as they enable these vehicles to process extensive datasets from sensors and cameras in real time, enhancing the driving experience. These sensors offer the vehicle a complete 360-degree perspective of its environment, allowing it to identify and respond to obstacles, pedestrians, and other cars. A piece released in the Times of India in 2024 states that the emergence of self-driving cars is creating a renaissance for the automotive sector, projected to generate revenue between USD 450 Billion and USD 600 Billion worldwide.

Regulatory Support and Investment

Government bodies across the globe are increasingly putting effort into the development of these through facilitating frameworks and incentives, appreciating the transformative power of self-governing vehicles. Notably, in 2024, the United States Transportation Department established a USD 500 Million grant program known as Strengthening Mobility and Revolutionizing Transportation (SMART). The SMART will support autonomous automobiles, roadside sensors, as well as aerial drones. The program will invest in projects that cause radical transformation in transportation. Such regulations majorly target safety standards, testing protocols, and liability issues that contribute to creating a conducive environment for innovation and testing of their products by AV manufacturers. All major automakers, technology companies, and startups are committed to spending heavily on R&D. Such spending has revolutionized innovation and determined the market outlook for autonomous vehicles.

Rising Focus on Maintaining Safety and Efficiency

The rising focus on maintaining safety and efficiency is driving the development of autonomous vehicles, with their potential to reduce accidents and save lives being a significant factor in their adoption. According to a study conducted by Pennsylvania State University, it was found that autonomous vehicles have fewer crashes as compared to conventional vehicles. Autonomous vehicles have been involved in 195 crashes over 4.62 million miles which is 2.3 times fewer than crashes than conventional vehicles per mile driven. In line with this, 87.7% of autonomous vehicles crashes resulted in only property damage. Autonomous vehicles are equipped with the ability to perceive their environment with unparalleled accuracy, making them capable of reacting to potential hazards faster than human drivers. In an article published by Alliance for Automotive Innovation, autonomous vehicles are less prone to crashes caused by human error such as distracted driving, fatigue, or impaired driving. Data from the government shows that 94% of crashes occurs due to drivers’ behaviour or error. Autonomous vehicles are not prone to the common human errors that cause most crashes. Beyond safety, AVs offer efficiency gains. They can optimize routes, driving patterns, and speed to maximize fuel efficiency and minimize emissions. Additionally, they can reduce traffic congestion through smoother traffic flow, resulting in shorter commute times and lower fuel consumption for all road users. In an article published by Alliance for Automotive Innovation, autonomous vehicles maintain safe distances between vehicles, reducing stop-and-go waves and congestion. University of Texas researchers predict that AV platoons could cut highway delays by 60%.

Autonomous Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global autonomous vehicle market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, level of automation, and application.

Analysis by Component:

- Hardware

- Software and Services

Software and services lead the market with around 70.2% of market share in 2024. The software and services segment includes sophisticated software algorithms, machine learning (ML) models, and artificial intelligence (AI) systems that enable self-driving vehicles to perceive their surroundings, interpret data, and make intelligent decisions. Additionally, services, such as mapping, data analytics, over-the-air updates, and remote monitoring are crucial for the efficient operation and continuous improvement of autonomous vehicles (Avs). The software and services segment are the largest and fastest-growing portion of the market, as it is central to enhancing the capabilities, safety, and functionality of autonomous vehicles. It plays a pivotal role in the ongoing development and optimization of self-driving technology, making it a key focus for industry stakeholders and investors.

Analysis by Level of Automation:

- Level 3

- Level 4

- Level 5

Level 3 leads the market with around 72.8% of market share in 2024. Level 3 automation enables vehicles to perform most driving tasks autonomously, including acceleration, braking, and lane-keeping, under predefined conditions and routes. It combines advanced automation with safety features, offering convenience and compliance with regulatory standards. This level of automation is increasingly favored by automakers and users seeking a reliable and efficient driving experience. By balancing autonomy and control, level 3 systems enhance driving efficiency while addressing industry needs for advanced technology and safety in modern transportation solutions.

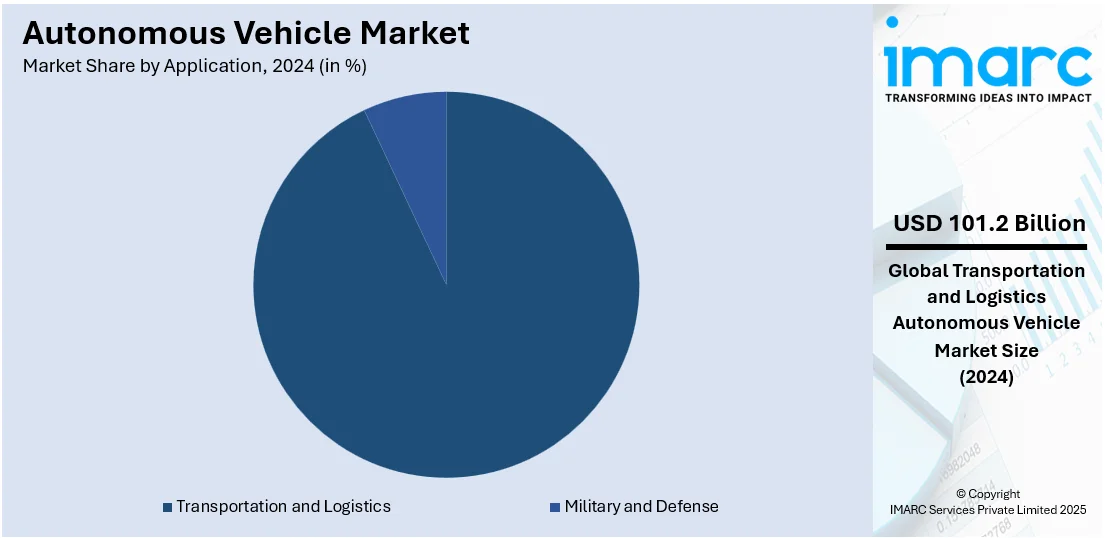

Analysis by Application:

- Transportation and Logistics

- Military and Defense

Transportation and logistics lead the market with around 92.8% of market share in 2024. The transportation and logistics sector encompasses a wide range of applications, including autonomous delivery (AV) trucks, self-driving taxis and ride-sharing services, autonomous public transit, and automated long-haul freight transportation. AVs offer the potential to revolutionize this sector by increasing operational efficiency, reducing labor costs, and improving the overall safety of transportation and logistics operations. The growth in e-commerce and the need for more efficient last-mile delivery solutions are accelerating the adoption of AVs in this segment. Companies are investing heavily in autonomous technology to enhance the speed and reliability of goods and people transportation, making it the largest and most dynamic segment of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.8%. The North America autonomous vehicle (AV) market is the rising purchase of personal cars to travel comfortably. Robust regulatory support at both federal and state levels is encouraging testing and deployment. Government agencies are also issuing guidelines and legislation to facilitate the growth of this industry. The popularity of ridesharing and mobility-as-a-service (MaaS) platforms is driving the demand for AVs.

Key Regional Takeaways:

United States Autonomous Vehicle Market Analysis

In 2024, the United States accounts for 76.80% of the North America autonomous vehicle market. Strong investments in research, advantageous regulatory environments, and a strong technology ecosystem are driving the U.S. market for autonomous vehicles. Leading businesses at the forefront of developing self-driving technologies include Tesla, Waymo, and General Motors' Cruise. The U.S. Department of Transportation established standards to encourage the adoption of autonomous vehicles, and the government actively sponsored research and development (R&D) programs. New aggregated data from the Autonomous Vehicle Industry Association's (AVIA) suggests that autonomous vehicles have driven over 44 Million miles on public highways in the United States.

The industry is also driven by the growing need for safer and more effective modes of transportation. According to a research, autonomous vehicles, which could reduce traffic fatalities by up to 90% by eliminating accidents caused by human error, estimated to be 94% of fatalities, could save more than 29,000 lives per year in the United States alone. The dependability of autonomous systems increased due to the quick development of artificial intelligence (AI), machine learning, and sensor technologies like radar and LiDAR, which is prompting adoption. Commercialisation is also being accelerated by alliances between manufacturers and IT behemoths, like Ford's with Argo AI.

Europe Autonomous Vehicle Market Analysis

Favorable government initiatives, sophisticated automotive production skills, and rising consumer interest in environmentally friendly transportation are driving the European market for autonomous vehicles. With the help of initiatives like the European Commission's Mobility Package, which encourages automation and digitisation in transport, nations like Germany, the United Kingdom, and France are at the forefront of the region. In the region, autonomous driving is the most important item on the agenda. With Tesla just stating its intention to bring fully autonomous technology to European roads by early 2025, the landscape of self-driving cars in the EU and the UK is changing quickly. Development is further encouraged by the amendment to Germany's Road Traffic Act that permits autonomous vehicles on public roads. Furthermore, the Automated Vehicles Act 2024 in the UK seeks to safeguard consumers, define legal liability, and establish a strict safety framework for self-driving technology. The existence of automakers such as BMW, Volkswagen, and Renault encourage advancements in autonomous driving technology. These businesses are making significant research and development (R&D) investments with the goal of equipping their cars with level 3 and level 4 autonomy. Since autonomous electric vehicles are viewed as a means of accomplishing climate goals, Europe's emphasis on lowering carbon emissions also stimulates the industry.

Asia Pacific Autonomous Vehicle Market Analysis

The market for autonomous vehicles is expanding significantly in Asia-Pacific due to large technological expenditures and the quick uptake of smart mobility solutions. With government-backed programs like the Made in China 2025 program, which prioritises self-driving technology, China is leading the way. Leading innovators in AI and autonomous driving platforms include Baidu and Huawei. China's expansion is augmented by initiatives from the Chinese government, such as establishing pilot zones, issuing licenses, and developing regulations and standards. For instance, In June 2024, the government selected 20 cities to participate in a pilot program aimed at creating roadside infrastructure and a cloud-based control platform for the operation of "smart connected vehicles.” The market is also driven by Japan's emphasis on using automated solutions to overcome labour shortages, especially in public transit and logistics. Targeting both home and foreign markets, automakers such as Toyota and Honda are incorporating autonomous technologies into their cars. The development of autonomous driving technology is complemented by India's drive for the creation of smart cities and the use of electric automobiles.

Latin America Autonomous Vehicle Market Analysis

The market for autonomous vehicles is still in its initial state in Latin America, but it is expanding attributed to increasing urbanisation and the demand for effective transit systems. Leading markets are Brazil and Mexico, which gain from robust auto manufacturing industries. Pilot programs for driverless cars in cities have been introduced thanks to partnerships with international tech corporations. The region's emphasis on lowering traffic congestion and accidents is another factor propelling the deployment of autonomous vehicles. Policies to incorporate self-driving cars into public transit are being investigated by governments, especially in megacities.

Middle East and Africa Autonomous Vehicle Market Analysis

Government-led smart city projects and the use of cutting-edge transport technologies are driving the market for autonomous vehicles in the Middle East and Africa. With initiatives like Dubai's Autonomous Transportation Strategy, which seeks to make 25% of transportation autonomous by 2030, nations like the United Arab Emirates and Saudi Arabia are leading the way. Saudi Arabia's Vision 2030 includes considerable expenditures in self-driving technologies, especially for public transit and smart logistics. The region's emphasis on improving urban transportation and lowering traffic deaths encourages the use of autonomous vehicles. Even though there are still issues with infrastructure in Africa, growing technological investments and pilot programs in nations like South Africa are progressively propelling growth.

Competitive Landscape:

Key players in the autonomous vehicle market are actively pursuing several strategic initiatives to advance their technology and market presence. Leading automakers are continually improving their autonomous driving systems, pushing for broader deployment of their full self-driving (FSD) features. Tech giants are focused on deploying autonomous ride-hailing services and forging partnerships with other automakers to expand their reach. Top companies are investing heavily in electric and autonomous vehicle development, aiming to launch autonomous ride-sharing services and enhance autonomous capabilities. Leading companies are engaged in extensive testing and refining of autonomous vehicle technology for eventual commercial deployment. They are also actively collaborating with governments, regulators, and technology partners to navigate the complex landscape of autonomous vehicle development and deployment.

The report provides a comprehensive analysis of the competitive landscape in the autonomous vehicle market with detailed profiles of all major companies, including:

- AB Volvo

- AUDI Aktiengesellschaft (Volkswagen Group)

- Bayerische Motoren Werke AG

- Daimler AG

- Ford Motor Company

- General Motors

- Tesla Inc.

- Toyota Motor Corporation

- Uber Technologies Inc.

- Waymo LLC (Alphabet Inc.)

Latest News and Developments:

- September 2024: The Chinese EV producer BYD recently teamed up with Huawei to include Qiankun, Huawei's cutting-edge autonomous driving technology, into BYD's off-road Fang Cheng Bao EVs. The goal of this strategic partnership is to promote BYD's high-end brands, such as Yangwang, Fangchengbao, and Denza.

- July 2024: The two firms announced that Uber will begin using 100,000 electric BYD vehicles on its ride-hailing network in Europe and Latin America. According to the press release, the businesses will also create "autonomous-capable vehicles" for Uber's ride-hailing service. Even if the EU raised taxes on imports of Chinese-made electric cars this year, following the U.S., the multi-year strategic relationship still stands.

- July 2023: AUDI Aktiengesellschaft (Volkswagen Group) launched its first autonomous vehicle test fleet in Austin, Texas.

- March 2023: Ford Motor Company announced the establishment of Latitude AI, a wholly owned subsidiary focused on developing a hands-free, eyes-off-the-road automated driving system for millions of vehicles.

- May 2023: Toyota Motor Corporation launched a joint project to develop an autonomous light vehicle that will run on Komatsu's Autonomous Haulage System.

Autonomous Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software and Services |

| Level of Automations Covered | Level 3, Level 4, Level 5 |

| Applications Covered | Transportation and Logistics, Military and Defense |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, AUDI Aktiengesellschaft (Volkswagen Group), Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Uber Technologies Inc., Waymo LLC (Alphabet Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the autonomous vehicle market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global autonomous vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the autonomous vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An autonomous vehicle (AV) is a self-driving vehicle equipped with advanced technologies like sensors, cameras, and artificial intelligence to navigate and operate without human intervention. These vehicles can perform driving tasks such as acceleration, braking, and steering while ensuring safety and efficiency through real-time data analysis and decision-making.

The global autonomous vehicle market was valued at USD 109.0 Billion in 2024.

IMARC estimates the global autonomous vehicle market to exhibit a CAGR of 31.85% during 2025-2033.

The market is primarily driven by advancements in AI and ML, rising investments in autonomous technologies, favorable government regulations, increasing safety concerns, the growth of shared mobility services, and the push for sustainable transportation solutions supported by strategic collaborations and infrastructure development.

In 2024, software and services represented the largest segment by component, driven by advanced AI algorithms, ML models, and essential support services such as mapping and data analytics.

Level 3 leads the market by level of automation attributed to its balance of autonomous functionality, safety features, and regulatory compliance.

Transportation and logistics are the leading segment by application, driven by efficiency gains, cost reduction, and the rise of e-commerce requiring reliable last-mile delivery solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global autonomous vehicle market include AB Volvo, AUDI Aktiengesellschaft (Volkswagen Group), Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Uber Technologies Inc., and Waymo LLC (Alphabet Inc.), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)