Autonomous Tractors Market Size, Share, Trends and Forecast by Component, Power Output, Crop Type, Application, and Region, 2025-2033

Autonomous Tractors Market Size and Share:

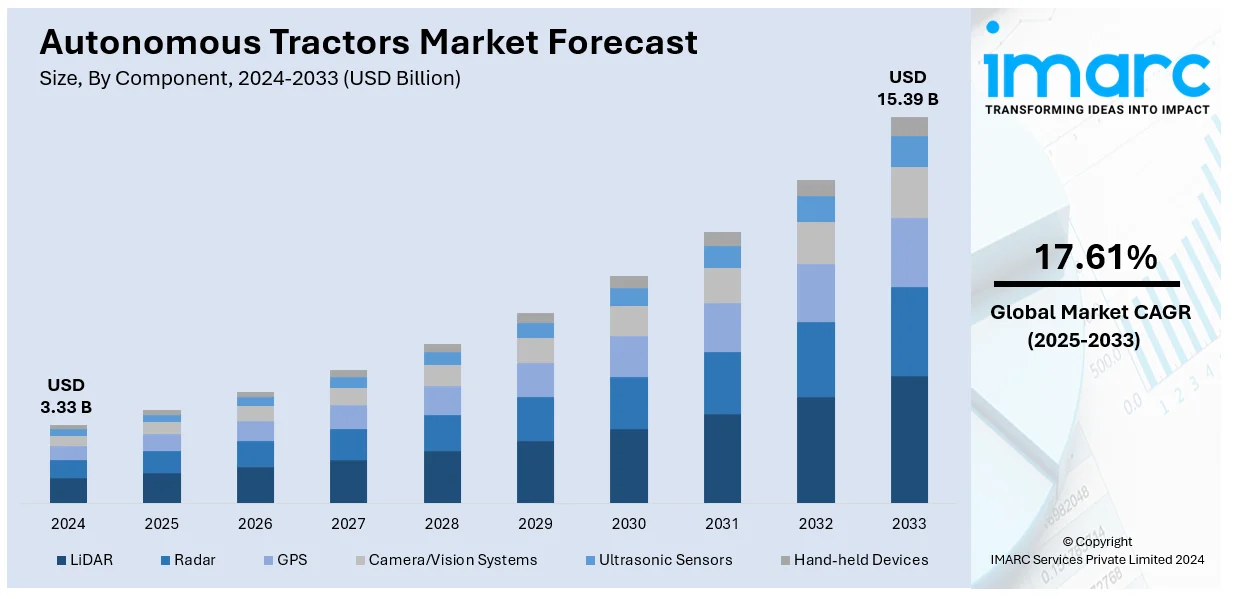

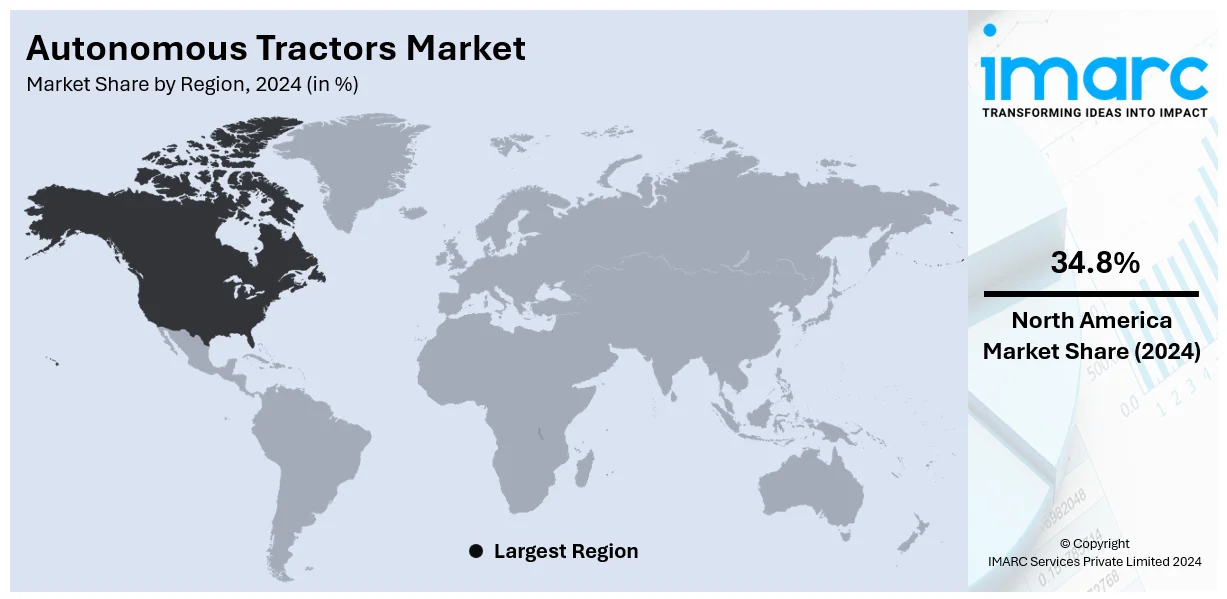

The global autonomous tractors market size was valued at USD 3.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.39 Billion by 2033, exhibiting a CAGR of 17.61% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.8% in 2024. This dominance can be attributed to labor shortages, rising agricultural efficiency needs, and advancements in AI, GPS, and IoT technology. Precision farming demand and supportive government policies further drive adoption, addressing operational challenges and improving crop yields.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.33 Billion |

|

Market Forecast in 2033

|

USD 15.39 Billion |

| Market Growth Rate 2025-2033 | 17.61% |

At present, there is a rise need to increase the efficiency of agricultural procedures as cultivable land is limited and the productivity of the farm depends on environmental conditions. This, along with the growing focus of farmers on improving the yield of the farm, represents one of the key factors driving the autonomous tractors market growth. Moreover, these tractors offer optimum labor productivity by enabling farmers to manage various farming operations simultaneously. This, coupled with the escalating demand for agricultural output due to the increasing population around the world, is propelling the growth of the market. In addition, governments of several countries are extensively investing in the agriculture industry, which is positively influencing the market. Besides this, auto-steering in autonomous tractors assist farmers in farming with more reliability. In line with this, the increasing unavailability of labor, especially in developed economies, is catalyzing the demand for autonomous tractors. Additionally, the rising employment of autonomous tractors to achieve sustainable food security supported by self-sustaining agricultural mechanization strategies across the globe is stimulating the market growth.

The United States plays a pivotal role in the global autonomous tractors market, driven by advanced agricultural practices and significant investments in automation technologies. With a well-established farming sector and rising labor shortages, the adoption of autonomous tractors has accelerated to improve efficiency and productivity. For instance, according to the American Farm Bureau Federation, the U.S. agricultural workforce is witnessing challenges in 2024 due to declining labor force growth and limited workforce participation post-pandemic, despite a 4.1% unemployment rate and labor force growth of 12 million over a decade. In addition, key manufacturers and technology providers in the U.S. are leveraging artificial intelligence, GPS, and IoT for precision farming solutions. Moreover, government support for sustainable farming practices and the growing demand for higher crop yields further contribute to the market's expansion, solidifying the U.S. as a leader in agricultural innovation.

Autonomous Tractors Market Trends:

Advancements in Automation and AI Technology

Advances in artificial intelligence, machine learning, and automation technologies are driving the autonomous tractors market. With these innovations, tractors can be operated independently with higher precision in tasks such as plowing, planting, and harvesting. AI-powered tractors can analyze soil conditions, adjust settings in real-time, and optimize operations, reducing labor costs and increasing efficiency for farmers. By 2050, the world's population, according to the Food and Agriculture Organization (FAO), is projected to exceed 9.1 billion, and the demand for food is believed to increase by 70%. Thus, it really calls for efficient agricultural use to meet the growing demand. Autonomous tractors are also taking a significant place in boosting the productivity and sustainability of farmers to overcome these challenges, with better yields and optimal resource use.

Labor Shortage in Agriculture

The growing shortage of skills in the agricultural industry requires autonomous tractors. Given the increasing difficulty of seeking farmworkers who are willing to operate machinery and rising labor costs, farmers are considering autonomous tractors as sure ways to ensure productivity through constant operation and overcome shortage of labor. The National Agricultural Workers Survey finds that 7 out of every 10 crop farm employees based in the United States were born outside of the United States, meaning much of the agricultural sector is dependent on immigrant labor. The problem of not getting enough workers and the labor cost is increasing; this is where autonomous tractors come in handy. Such tractors can work non-stop for 24 hours a day, thereby boosting farm efficiency and productivity while minimizing manual labor dependency. This means that farmers can easily maintain productivity even when the labor force is in a shortage, thus meeting demand for agricultural produce.

Sustainability and Precision Agriculture

The increasing demand for sustainable farm practices that reduce environmental damage will be met with autonomy tractors. The high-technology precision agriculture seeks to make farming more productive and environmentally friendly by introducing technologies that help achieve it. Autonomous tractors therefore employ sensors, GPS among other technologies to minimize fuel, avoid soil compaction among others, and thus are in the pursuit of being the most sustainable agricultural technologies. Agricultural output increased almost four times, while the world's population increased 2.6 times; therefore, agricultural output has grown 53% over the USDA. This tremendous increase in demand for agriculture emphasizes the importance of more efficient and sustainable farming techniques. Autonomous tractors are central to addressing this demand in terms of efficiency improvement on farms, reduction of the environmental footprint, and in line with feeding a larger global population with fewer resources.

Autonomous Tractors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global autonomous tractors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, power output, crop type, and application.

Analysis by Component:

- LiDAR

- Radar

- GPS

- Camera/Vision Systems

- Ultrasonic Sensors

- Hand-held Devices

GPS leads the market with around 43.7% of market share in 2024, reflecting its essential role in precision farming. These systems provide accurate navigation, enabling tractors to perform tasks with minimal human intervention while optimizing fuel and time efficiency. The technology ensures seamless integration with other advanced systems, such as sensors and software, for real-time decision-making. Farmers increasingly rely on GPS to reduce overlaps, improve crop yields, and lower input costs. In addition, with advancements in satellite technologies and the adoption of high-accuracy positioning systems like RTK (real-time kinematics), GPS remains a critical enabler of autonomous operations, meeting the growing demand for efficiency in modern agriculture. Furthermore, its versatility across various terrains and farming scales solidifies its position as the leading component in the autonomous tractors market.

Analysis by Power Output:

- Less than 30 HP

- 30-50 HP

- 51-100 HP

- More than 100HP

51-100 HP leads the market with around 34.8% of market share in 2024. The 51-100 HP autonomous tractors segment addresses the needs of large-scale farming and commercial operations. These tractors are equipped with robust power outputs, enabling them to handle demanding tasks such as plowing, heavy tillage, and large-scale planting. The integration of advanced GPS and AI-driven systems enhances their efficiency and precision, appealing to farmers focused on maximizing yields. Moreover, this segment is experiencing significant demand from developed regions where large agricultural landholdings are prevalent. Continuous innovation in automation technology and connectivity solutions further drive the adoption of this segment among professional farming enterprises.

Analysis by Crop Type:

- Fruits and Vegetables

- Cereals and Grains

- Oilseeds and Pulses

Fruits and vegetables leads the market by crop type. This is due to their high-value cultivation and labor-intensive farming processes. Autonomous tractors enable precise planting, harvesting, and crop monitoring, addressing labor shortages and increasing productivity. The growing demand for fresh produce and sustainable farming practices has further driven adoption, especially in regions with large-scale horticulture operations. Additionally, technologies integrated into autonomous tractors ensure optimal resource utilization, such as water and fertilizers, enhancing crop quality and reducing waste. As consumer preferences shift toward healthier diets, the focus on efficient fruit and vegetable production strengthens, positioning this segment as a leading driver for the market's growth.

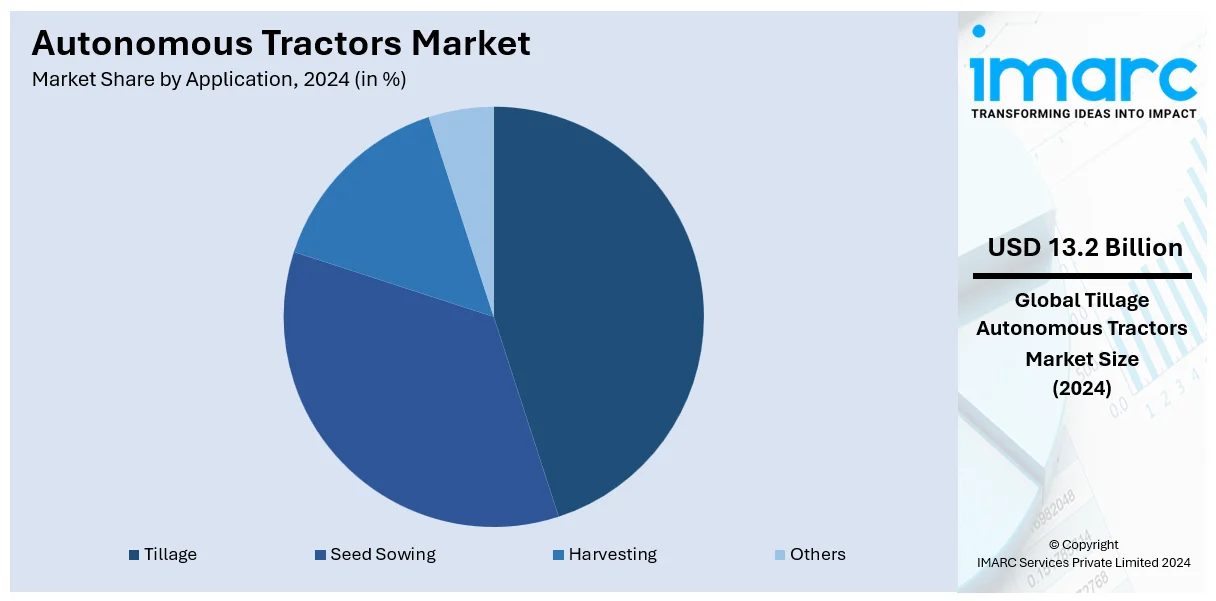

Analysis by Application:

- Tillage

- Seed Sowing

- Harvesting

- Others

Tillage leads the market with around 36.7% of market share in 2024, driven by its critical role in soil preparation. Autonomous tractors equipped with advanced technologies efficiently perform tasks like plowing, harrowing, and leveling, reducing operational time and costs. These systems ensure consistent soil conditioning, promoting better seed germination and higher crop yields. Moreover, with the growing emphasis on sustainable farming, autonomous tillage solutions help minimize soil compaction and conserve resources, aligning with environmental goals. Adoption is particularly strong in large-scale farms where efficiency and precision are paramount. The integration of real-time data analysis in tillage operations further enhances performance, securing its leading position within the application segment of the autonomous tractors market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.8%. This region plays a pivotal role in the global autonomous tractors market, driven by advanced agricultural practices and significant investment in automation technologies. The region heavily profits from magnifying labor shortages, a well-established agricultural industry, and elevated adoption rates of precision farming methodologies, consequently propelling the demand for autonomous solutions. For instance, as per 2024 industry reports, the significant shortage of workforce led to the loss of 141,733 farms in the last five years in the US, with an estimated 2.4 million farm labor positions requiring fulfillment currently. Furthermore, the United States leads the market with significant research and development initiatives, fostered by leading startups and manufacturers. In addition, government ventures endorsing effective and sustainable farming techniques further bolster market expansion. The implementation of advanced technologies, such as IoT, GPS, and AI, in farming equipment is revolutionizing conventional practices, improving both cost-effectiveness and productivity. North America’s robust emphasis on technological advancements establishes it as a dominant driver of expansion in the autonomous tractors market globally.

Key Regional Takeaways:

United States Autonomous Tractors Market Analysis

In 2024, United States accounted for 75.60% of the market share in North America. The growth in U.S. farm output, almost three times higher in 2021 compared to 1948, is one of the driving factors behind the adoption of autonomous tractors. According to the USDA, U.S. farm output expanded at an average annual rate of 1.46% between 1948 and 2021. The input mix changed dramatically during this period, with labor and land inputs falling by 76% and 28%, respectively, while intermediate inputs-including machinery, energy, agricultural chemicals, and services-increased by 109%. This is a step forward towards machinery and technology, emphasizing the increase in the demand for automation in farming to fulfill the productivity targets. Autonomous tractors, which can work with lower intervention from humans, are a solution to labor shortages, increase operational efficiency, and also contribute to sustainability. This makes autonomous tractors a foundational part of the present and future scope of U.S. agriculture, making it a key driver for the autonomous tractor market.

Europe Autonomous Tractors Market Analysis

According to the Economic Accounts for Agriculture (EAA)’s first preliminary data for 2023, the agricultural labor productivity index in the EU witnessed a slump of 6.6% year-on-year, after continuous growth from 2019 and 2022. This trend in productivity underscores the difficulties that European agriculture continues to face, including labor shortages and the need for more efficient farming practices. As a result, the region is witnessing growing demand for autonomous tractors. Such advanced machines, equipped with artificial intelligence and automation technologies, can operate independently, enhancing farm efficiency, reducing dependence on manual labor, and increasing overall productivity. Moreover, the adoption of autonomous tractors is further enhanced by Europe's commitment to sustainability and precision agriculture since these technologies help minimize environmental impact while optimizing resource use. Autonomous tractors become a major growth driver in the European market with a need to counterbalance declining labor productivity and to improve farm efficiency.

Asia Pacific Autonomous Tractors Market Analysis

Under the Production Linked Incentive Scheme for Food Processing Industries, Indian food brands receive a boost in international appreciation through financial incentives. This program covers 50% of expenses incurred in branding and marketing abroad, up to 3% of a company's annual sales of food products or around USD 6 Million per year. This is according to PIB. This is pushing the agenda for new modern agricultural practices; for example, autonomous tractors, towards improving productivity while meeting the export standards required.

While some 52% of India's total workforce works in agriculture to date, the Indian Council of Agricultural Research estimates it will remain around 25% through 2050. Consequently, the growth in labour deficit is where autonomous tractors are experiencing increased utilization. Advanced technology enables large-scale farming to be realized while offering a solution for the shortages of labor inputs. And so, factors like that contribute to increasing the Asian-Pacific autonomous tractor market.

Latin America Autonomous Tractors Market Analysis

The Brazilian government has provided nearly BRL 294 billion (USD 47.5 Billion) for supporting farmers in covering the cost of essential production and commercialization, including inputs for agriculture, labor, maintenance, and transportation. BRL 107.3 billion (USD 17.3 Billion) will be used for productive investments through different credit lines, including modernizing agricultural machinery, building up storage capacity, and adopting low-carbon production practices. These initiatives reflect increases of around 8% and 17%, respectively, from the Crop Plan 2023/24, according to USDA. Focused solely on medium and large farmers, these investments look to improve agricultural efficiency and sustainability. This increased investment is driving the demand for high-tech agricultural technologies such as autonomous tractors that will increase productivity and minimize manual labor. These are advanced capabilities that can make the operations streamlined, which are an essential part of the changing agricultural landscape in Latin America.

Middle East and Africa Autonomous Tractors Market Analysis

The Middle East and North Africa (MENA) region, covering 14 low- and middle-income countries or territories from Iran to Morocco, boasts an excellent agricultural landscape. According to 2023 reports, its population has reached 500.7 million, of which 165.3 million people live in rural areas, making the importance of agriculture for these populations clear. North Africa particularly has shown remarkable agricultural development, with fruit and vegetables production amounting to 34.9 million tons each in 2023, a significant increase over 2020. This increased agricultural production is demanding advanced farming technologies, like autonomous tractors. The tractors enhance precision, efficiency, and productivity in agriculture, countering challenges such as labor shortages and increasing operational costs. In the light of the agricultural sector's pursuit to fulfill the needs of a growing population, autonomous tractors are emerging as a transformative solution, empowering farmers to optimize their operations and sustain the region's agricultural growth.

Competitive Landscape:

The market is highly competitive, represented by key players focusing on innovation and strategic partnerships. Prominent companies are driving advancements in autonomous technology to enhance precision and efficiency. Investments in artificial intelligence, IoT integration, and advanced GPS systems are central to gaining a competitive edge. Furthermore, collaborative efforts with technology firms and research institutions are accelerating product development and market adoption. In addition, regional manufacturers are expanding their portfolios to meet the growing demand for smart farming solutions. Moreover, increasing regulatory support for sustainable agriculture and rising competition among market leaders are shaping the evolving dynamics of the autonomous tractors market. For instance, in July 2024, Monarch Tractor, a leading autonomous tractor manufacturer, announced plans to magnify sales and expand its production post securing the unprecedented fund of USD 133 million.

The report provides a comprehensive analysis of the competitive landscape in the autonomous tractors market with detailed profiles of all major companies, including:

- AutoNext Automation Pvt. Ltd.

- Autonomous Solutions Inc.

- Deere & Company

- Kubota Corporation

- Raven Industries Inc.

- Trimble Inc.

- Yanmar Holdong Co.Ltd.

- Zimeno Inc.

Latest News and Developments:

- February 2024: Deere & Company released its all-new four-track tractor with high horsepower. This comes with a flagship model providing 830 horsepower. This 2025 series boasts new models such as 9RX 710, 9RX 770, and 9RX 830, which have been packed with enhanced engines, advance hydraulic systems, and even upgraded technology packages. In addition, modern improvements adorn the updated cabs as well. The MY25 8 Series and 9 Series tractors will also feature an autonomous-ready option, allowing for smooth introduction of automation based on the readiness of the farm.

- October 2023: Monarch Tractor has announced its entry into the European market, marking a significant milestone in its growth journey around the world. This strategic move highlights Monarch Tractor's commitment to addressing the evolving needs of farmers by providing sustainable and efficient agricultural technologies. It marks Monarch Tractor as a growing player in the European agri-tech sector and opens up further potential for advancements and international outreach.

- February 2023: Kubota Corporation launched its LX20 Series with the LX3520 and LX4020 models. The company further expanded its L02 Series by releasing the L2502 and L4802. This move by Kubota adds more to the development of its LX and L02 series as it strives to provide the best solutions to various needs of farming operations.

Autonomous Tractors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | LiDAR, Radar, GPS, Camera/Vision Systems, Ultrasonic Sensors, Hand-Held Devices |

| Power Outputs Covered | Less than 30 HP, 30-50 HP, 51-100 HP, More than 100HP |

| Crop Types Covered | Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses |

| Applications Covered | Tillage, Seed Sowing, Harvesting, Others |

| Segment Coverage | Component, Power Output, Crop Type, Application, Region |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AutoNext Automation Pvt. Ltd., Autonomous Solutions Inc., Deere & Company, Kubota Corporation, Raven Industries Inc., Trimble Inc., Yanmar Holdong Co.Ltd., Zimeno Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the autonomous tractors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global autonomous tractors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the autonomous tractors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global autonomous tractors market was valued at USD 3.33 Billion in 2024.

The market is estimated to reach USD 15.39 Billion by 2033, exhibiting a CAGR of 17.61% from 2025-2033.

Key factors driving the market include increasing demand for precision agriculture, labor shortages in farming, rising adoption of advanced technologies like AI and IoT, growing focus on productivity and operational efficiency, and the need to minimize environmental impact through optimized resource utilization in agricultural practices.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global autonomous tractors market include AutoNext Automation Pvt. Ltd., Autonomous Solutions Inc., Deere & Company, Kubota Corporation, Raven Industries Inc., Trimble Inc., Yanmar Holdong Co.Ltd., Zimeno Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)