Autonomous Aircraft Market Size, Share, Trends and Forecast by Component, Technology, Aircraft Type, End Use, and Region, 2025-2033

Autonomous Aircraft Market Size and Trends:

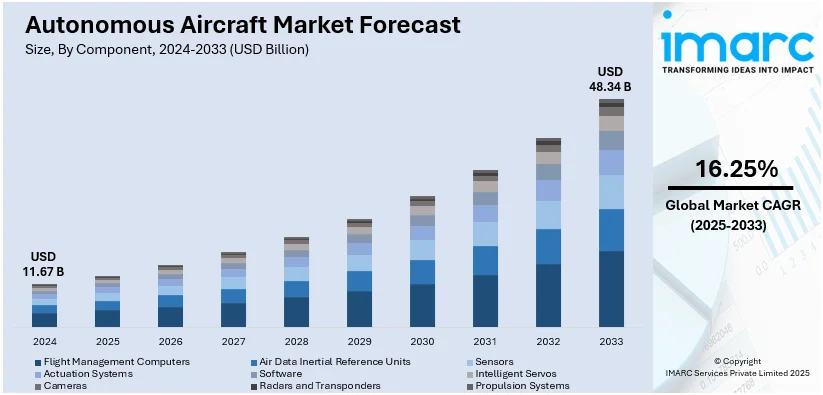

The global autonomous aircraft market size was valued at USD 11.67 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 48.34 Billion by 2033, exhibiting a CAGR of 16.25% from 2025-2033. North America currently dominates the market, holding a market share of over 38.2% in 2024. The growing safety concerns regarding pilots being exposed to hazardous and dangerous environments, the rising need for more efficient and cost-effective operations in the aerospace and defense industry, and the augmenting demand for unmanned aerial vehicles (UAVs) in a wide range of end-use applications represent some of the key factors driving the expansion of autonomous aircraft market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.67 Billion |

|

Market Forecast in 2033

|

USD 48.34 Billion |

| Market Growth Rate (2025-2033) | 16.25% |

The global autonomous aircraft market growth is primarily driven by the rising demand for efficient and cost-effective air transportation solutions, such as air taxis and cargo delivery. In accordance with this, continual advancements in artificial intelligence (AI), machine learning, and sensor technologies are enhancing the performance and safety of autonomous aircraft, thereby impelling the market. For example, on June 5, 2024, Airbus Defence and Space and Helsing signed a cooperation agreement to develop AI technologies for the Wingman system, an unmanned fighter aircraft that will work alongside manned jets like the Eurofighter, performing tasks such as reconnaissance, jamming, and target destruction. Furthermore, the increasing need for autonomous systems in defense applications and the rise of urban air mobility services are also significant drivers for market growth. Besides this, regulatory developments supporting autonomous flight operations, such as advanced airspace management systems, are further providing an impetus to the market. Additionally, rising environmental concerns encouraging the development of autonomous electric aircraft are creating a positive outlook for the market.

The United States is a key regional market and is witnessing growth mainly due to significant investments in defense and military technologies, where autonomous aircraft enhance surveillance, reconnaissance, and combat capabilities. Similarly, ongoing advancements in urban air mobility (UAM) and the push for air taxis are fueling the autonomous aircraft market demand, offering efficient solutions for transportation in congested urban areas. For instance, on January 14, 2025, ANRA Technologies and Future Flight Global partnered to develop digital infrastructure for advanced air mobility (AAM), focusing on a real-time airspace management system to support electric aircraft like eVTOLs and drones, thereby improving safety and scalability. Furthermore, innovations in AI and autonomous flight systems continue to enhance the market appeal. Besides this, substantial government funding for research and development is further accelerating product innovation. Additionally, the growing need for reduced operational costs and improved safety is driving product adoption in sectors such as logistics, agriculture, and infrastructure monitoring.

Autonomous Aircraft Market Trends:

Escalating Demand for Autonomous Cargo Aircraft

The increasing need for autonomous cargo aircraft in the expanding e-commerce industry is significantly driving the expansion of the autonomous aircraft market share. As e-commerce continues to grow, there's a pressing need for efficient and timely delivery solutions. Autonomous cargo aircraft offer the potential for cost-effective, 24/7 operations without the constraints of human crew limitations. Additionally, they can access remote or hard-to-reach areas, enhancing logistics capabilities. Moreover, most of the developments in the autonomous aircraft market are aimed at bringing autonomous cargo aircraft into commercial use to fill in the gap due to the pilot shortage. For instance, in May 2023, Xwing received a contract from the U.S. Air Force to perform pilotless cargo trials. As per the terms of the contract, Xwing is entitled to coordinate the identification of best use cases for autonomous flight operations with the Air Force and military stakeholders. Xwing is also responsible for conducting test flights that include a fusion of flight control systems, auto takeoff/landing, Detect-and-Avoid (DAA) systems, auto braking, auto taxi, and remote operations software to enable autonomous operations on the Cessna 208B platform. Besides this, significant growth in the e-commerce sector and rising levels of globalization are also bolstering the autonomous aircraft industry. For instance, the global e-commerce market size reached USD 21.1 Trillion in 2023. Looking forward, IMARC Group expects the market to reach USD 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032, thereby positively impacting the autonomous aircraft market outlook.

Increasing Investments in Research and Development Activities

As per the autonomous aircraft market trends, the market is witnessing a rise in research and development (R&D) activities driven by technological advancements and market demand. Aerospace companies, startups, and research institutions are investing heavily in areas such as artificial intelligence (AI), sensor technology, and autonomous algorithms to enhance the capabilities and reliability of autonomous aircraft. Moreover, various key market players are also increasingly investing in testing activities to launch autonomous aircraft with improved functionality and technologies. For instance, in December 2022, under the Skyborg Program, the U.S. Department of Defense (DoD) tested the autonomous F-16 jet VISTA X-62A for more than 17 hours of autonomous flight. In the test simulation, the VISTA jet operated by AI engaged in fighter maneuver skills and simulated dog fights, and AI outperformed the human pilot. Similarly, the U.S. military also conducted the inaugural flight of a Black Hawk helicopter in November 2022. Lockheed Martin provided a model following algorithm (MFA) and a system for autonomous control of the simulation (SACS) updates for the VISTA jet before testing. Such efforts aim to overcome technical challenges, improve safety, and expand the range of applications for autonomous flight, including cargo transport, urban air mobility, and aerial surveillance. The growing R&D activities and funding in the sector are anticipated to propel the autonomous aircraft market share in the coming years.

Growing Product Application in Air Medical Services

Autonomous aircraft are revolutionizing air medical services by offering rapid and efficient transportation for critical patients. Equipped with advanced medical equipment and staffed by specialized personnel, these aircraft provide timely access to medical care, especially in remote or inaccessible areas. Furthermore, these aircraft have been proven significantly helpful in times of natural disasters and emergency medical services. Consequently, various key market players are increasingly investing in developing autonomous aircraft integrated with AI to provide help in times of emergencies. For instance, in April 2024, Windracers, a UK-based global cargo vehicle operator, partnered with Purdue as a founding member of the Center on AI for Digital, Autonomous, and Augmented Aviation (AIDA). Purdue University is pioneering initiatives to fly nearly 1 million commercial uncrewed aircraft systems throughout the U.S. by 2027. These aircraft will provide key supplies for emergency services, defense, humanitarian aid, and health care, even assisting in fighting wildfires. With the potential for round-the-clock operations and seamless integration into existing emergency medical systems, autonomous aircraft are reshaping air medical services, enhancing patient outcomes, and saving lives.

Restrictive Factors:

The complex process of designing, testing, and certifying autonomous aircraft slows market growth. These drones require advanced components and software for monitoring and situational awareness, which must comply with strict government regulations to ensure safety in harsh conditions and onboard systems. Moreover, as autonomous drones are a new concept, many countries have introduced specific standards that manufacturers must follow. The software also requires thorough testing and certification for safe use. Additionally, challenges like limited battery life, low load-carrying capacity, and the need for long-distance travel hinder market expansion.

Autonomous Aircraft Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global autonomous aircraft market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, technology, aircraft type, and end use.

Analysis by Component:

- Flight Management Computers

- Air Data Inertial Reference Units

- Sensors

- Actuation Systems

- Software

- Intelligent Servos

- Cameras

- Radars and Transponders

- Propulsion Systems

Based on the autonomous aircraft market outlook, flight management computers (FMCs) leads the market share in 2024. They play a vital role in autonomous aircraft by overseeing navigation, flight planning, and system management. These sophisticated onboard systems utilize advanced algorithms to interpret sensor data, optimize routes, and render real-time adjustments during flight. FMCs integrate with autopilot systems to execute precise maneuvers, maintain safe separation from obstacles, and adhere to air traffic control instructions. Their redundancy features ensure reliability and fault tolerance, critical for autonomous operations. By centralizing control functions and automating decision-making processes, FMCs enhance the efficiency, safety, and autonomy of aircraft, paving the way for the future of unmanned aviation.

Analysis by Technology:

- Increasingly Autonomous

- Fully Autonomous

As per the autonomous aircraft market forecast, fully autonomous leads the market share in 2024. These aircrafts are vehicles capable of operating and navigating through airspace without direct human intervention. They also utilize advanced artificial intelligence, sensor systems, and automation technologies to perform all flight functions, including takeoff, navigation, obstacle avoidance, and landing. They render decisions in real time based on sensor data, pre-programmed instructions, and machine learning algorithms, ensuring safe and efficient flight operations. Fully autonomous aircraft have the potential to revolutionize various industries, including transportation, delivery, and surveillance, offering benefits such as reduced operational costs, increased safety, and greater flexibility in mission execution, ultimately paving the way for a new era of autonomous aviation. As a result, various key market players are extensively investing in the development of fully autonomous aircraft. For instance, in December 2023, a US-based startup, Reliable Robotics, achieved a significant milestone as the company successfully piloted a fully autonomous flight. The company utilized a Cessna 208B Caravan aircraft with no crew on board. The unmanned aircraft was supervised by a remote pilot from Reliable's control center, which was located 50 miles away.

Analysis by Aircraft Type:

- Fixed Wing

- Rotary Wing

Rotary wing leads the market with around 57.8% of market share in 2024. Rotary wing autonomous aircraft, commonly known as drones or unmanned aerial vehicles (UAVs), are aircraft that utilize rotating wings or blades to generate lift and propulsion. These aircraft can operate without onboard pilots, controlled remotely or autonomously through pre-programmed instructions and sensors. They are versatile tools used for various purposes, including reconnaissance, surveillance, cargo delivery, and search and rescue missions. With advancements in technology, rotary wing autonomous aircraft offer increased maneuverability and accessibility, making them ideal for tasks in challenging terrain or urban environments. Various end-user industries are increasingly utilizing these UAVs to carry out operational tasks efficiently. For instance, AIIMS Bhubaneswar used a drone to transport a blood bag from the institute to a community health center in Khordha district, covering a distance of 60 km in 35 minutes.

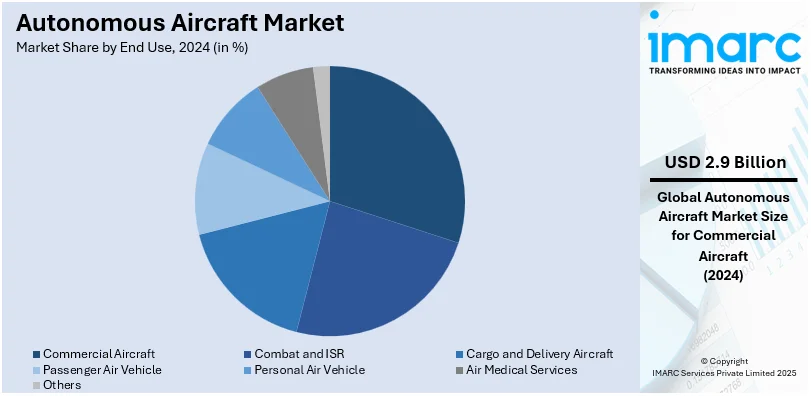

Analysis by End Use:

- Commercial Aircraft

- Combat and ISR

- Cargo and Delivery Aircraft

- Passenger Air Vehicle

- Personal Air Vehicle

- Air Medical Services

- Others

Commercial aircraft leads the market with around 25.0% of market share in 2024. They are pivotal in modern global transportation, facilitating efficient travel for passengers and cargo. Their widespread use connects people and businesses worldwide, fostering economic growth and cultural exchange. Commercial aircraft offer numerous benefits, including rapid travel over long distances, convenience, and accessibility to remote locations. They contribute to job creation, tourism, and international trade, driving economic development. Moreover, advancements in technology enhance safety, comfort, and environmental sustainability, making air travel increasingly attractive and sustainable. Overall, commercial aircraft play a vital role in shaping our interconnected world, providing essential services, and fostering global connectivity and prosperity.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.2%. Some of the factors driving the North America autonomous aircraft market included its continual technological advancements, considerable growth in the aerospace and defense industries, inflating disposable income levels, etc. Moreover, the presence of various prominent market players in the region is also contributing to the region’s growth. Additionally, the escalating utilization of autonomous cargo aircraft is offering lucrative growth opportunities to the overall market. A majority of market players are adding these aircraft to their portfolios to increase their sales and attract more potential customers. For instance, in July 2023, Ribbit, a cargo airline startup developing software for autonomous flight, signed a USD 1.3 Million contract with Transport Canada and Innovative Solutions Canada to begin testing self-flying aircraft in remote regions. Such developments are expected to boost the growth of the market in the North American region. Besides this, extensive investments by the government and autonomous aircraft market companies in testing aircraft before launch are also creating a positive outlook for the market. For instance, the U.S. military tested the first flight of a Black Hawk helicopter in November 2022. Lockheed Martin provided a model following algorithm (MFA) and a system for autonomous control of the simulation (SACS) updates for the VISTA jet before testing.

Key Regional Takeaways:

United States Autonomous Aircraft Market Analysis

In 2024, the United States held 80.00% of the North America autonomous aircraft market. The market is growing at a very rapid pace due to the significant defense investments along with some new innovations in aerospace technologies. As of fiscal year 2023, the U.S. Department of Defense had planned to invest more than USD 2.6 Billion in unmanned systems alone and had at least 29 programs fully focused on the procurement of unmanned aerial systems. Strong investment in military applications for surveillance, logistics, and combat operations drives adoption. Commercial revenues are increasing with civilian adoption, and major players like General Atomics and Boeing are innovating. Federal Aviation Administration regulatory support continues to push the market upward. New emerging technologies such as AI-driven navigation and swarm robotics are transforming autonomous aviation. On its part, continuously improved system performance and safety given government backed research and development (R&D) initiatives is ensuring that the U.S. remains at the top of autonomous aircraft in international markets.

Europe Autonomous Aircraft Market Analysis

The European autonomous aircraft market is growing due to increasing defense spending, as well as advancements in technology. In 2023, the member states of the European Union committed a record EUR 279 Billion (approximately USD 300 Billion) to defense, representing a 10% year-on-year increase. European members of NATO collectively accounted for 28% of the total NATO spending in 2023, which was the highest ever recorded during the period of 2014–2023. Another market driver is investment in military and defense technologies on the part of the European Commission. The EDF commits around USD 7.8 Billion to this purpose from 2021-2027. In 2023, it already pledged more than USD 1.2 Billion to different military-related projects, such as drones, radar systems, and communication technologies. Companies like Airbus, Leonardo, amongst others, develop autonomous aircraft independently. Strict legislations of EU are concerned for safety and are sustainable. Cooperation in defense amongst European nations further ensures the strong position of European nations in world autonomous aircraft industry.

Asia Pacific Autonomous Aircraft Market Analysis

Strong growth in the market has been witnessed in the Asia Pacific region, due to the upsurge of defense budgets and regional security dynamics. In 2022, China devoted about USD 229 Billion towards its defense budget, with most of it for improving unmanned aerial systems (UAS) surveillance and combat. The 2023-2024 defense budget for India was estimated at around USD 75 Billion, as per reports. The "Make in India" program helps to enhance domestic production of cutting-edge autonomous systems. Both nations are aggressively promoting the development and deployment of high-end unmanned systems, increasing their military power. With rising geopolitical tension, the independent systems-the aircraft, drone-surveillance systems of autonomous planes that have started serving defense strategy become increasingly vital. Cooperation at the regional, local level together with foreign investors is significantly fostering innovation as the region appears to gain relevance in the broader global market on autonomous aircraft systems.

Latin America Autonomous Aircraft Market Analysis

Latin America is seeing innovation, especially in Brazil, where Moya Aero has made significant strides with its autonomous cargo eVTOL. In December 2023, Moya Aero successfully launched the first flight test of its heavy-duty eVTOL prototype, marking a major milestone in the region. The eVTOL has a 23-foot wingspan, with a payload capacity of up to 200 kg (441 lbs), carrying loads over 100 km (68 miles) on a single charge. Backed by FINEP, Brazil's government innovation institution, Moya is poised to revolutionize cargo logistics and agricultural operations with promised increased efficiency and zero-emission operations. Commercial service will start by 2026, more than 100 units are ordered, and forecasts are for selling over 1,000 units, which are expected to create revenue above USD 2 Billion, as per reports. This represents one of the most significant regional investments in the development of autonomous aviation technologies.

Middle East and Africa Autonomous Aircraft Market Analysis

The autonomous aircraft market in the Middle East and Africa is changing rapidly. Some of the key developments here include urban air mobility (UAM). In 2023, EHang made history by performing the first autonomous passenger-carrying flight over the Middle East with its EH216-S eVTOL aircraft in Abu Dhabi, UAE. During this flight, it carried a board member of a local partner to demonstrate the possibility and safety of autonomous air travel in the region. This is part of the efforts from EHang on broader levels towards introducing autonomous UAM solutions to the Middle East. It does so through close partnerships at local levels, including partnering with Abu Dhabi's Investment Office to build the eVTOL vertiport and get prepared for commercializing UAM routes. This will be in conjunction with government support in the UAE, indicating the development of eVTOL aircraft is a good sign for progress in adopting autonomous aircraft for urban transportation, driving growth in the region's air mobility sector.

Competitive Landscape:

The competitive landscape of the market is characterized by an amalgamation of established aerospace companies, technology innovators, as well as emerging startups. Leading manufacturers are heavily investing in autonomous aircraft technologies to capture the growing demand for unmanned aerial vehicles (UAVs) and autonomous flight systems. For example, on January 13, 2025, XTI Aerospace entered a strategic partnership with ReadyMonitor, acquiring a 30% stake in the autonomous Drone-as-a-Service company. This collaboration focuses on integrating ReadyMonitor's AI-powered drones with XTI’s Vertical Takeoff and Landing (VTOL) technologies. Technology giants are also advancing drone-based solutions for logistics and delivery. Meanwhile, startups are exploring niche markets such as urban air mobility and cargo drones. This competition fuels innovation in safety, navigation, and battery technology, while collaboration with regulatory bodies is crucial to addressing airspace integration and safety standards.

The report provides a comprehensive analysis of the competitive landscape in the autonomous aircraft market with detailed profiles of all major companies, including:

- Aerovironment Inc.

- Airbus S.A.S.

- BAE Systems plc

- Bell Textron Inc. (Textron Inc.)

- Elbit Systems Ltd.

- Kitty Hawk Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

Latest News and Developments:

- December 2024: Sikorsky, a Lockheed Martin company, will fly the Optionally Piloted Black Hawk helicopter for the U.S. Marine Corps, demonstrating the MATRIX™ autonomy system as part of its Aerial Logistics Connector program that explores autonomous aircraft for resupply in contested environments, precision operations, and tablet-controlled mission updates.

- July 2024: Boeing successfully conducted its second phase of autonomous flight trials in Wales. It involved the demonstration of Air Launched Effect (ALE) missions using Albatross UAVs. The latter was shown with advanced platform-to-platform teaming, multispectral vision, and machine learning to potentially show application for UK Defence. The team involved Phantom Works Global and the University of Manchester.

- June 2024: Joby Aviation Inc. revealed the acquisition of Xwing Inc.'s autonomy division to expedite the completion of current contract obligations with the U.S. Department of Defense (DoD) and to enhance opportunities for future contracts. The acquisition encompasses all of Xwing's ongoing automation and autonomy technology initiatives.

- June 2024: China’s HH-100 unmanned transport aircraft flew its first flight in the country’s northwestern Shaanxi Province.

- April 2024: Windracers, a UK-based global cargo vehicle operator, partnered with Purdue as a founding member of the Center on AI for Digital, Autonomous, and Augmented Aviation (AIDA). Purdue University is pioneering various initiatives to fly nearly 1 million commercial uncrewed aircraft systems throughout the U.S. by 2027. These aircraft will deliver essential supplies for emergency services, defense, humanitarian aid, and healthcare, while also supporting efforts in combating wildfires.

Autonomous Aircraft Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Flight Management Computers, Air Data Inertial Reference Units, Sensors, Actuation Systems, Software, Intelligent Servos, Cameras, Radars and Transponders, Propulsion Systems |

| Technologies Covered | Increasingly Autonomous, Fully Autonomous |

| Aircraft Types Covered | Fixed Wing, Rotary Wing |

| End Uses Covered | Commercial Aircraft, Combat and ISR, Cargo and Delivery Aircraft, Passenger Air Vehicle, Personal Air Vehicle, Air Medical Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerovironment Inc., Airbus S.A.S., BAE Systems plc, Bell Textron Inc. (Textron Inc.), Elbit Systems Ltd., Kitty Hawk Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Saab AB, The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the autonomous aircraft market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global autonomous aircraft market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the autonomous aircraft industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The autonomous aircraft market was valued at USD 11.67 Billion in 2024.

The autonomous aircraft market is projected to exhibit a CAGR of 16.25% during 2025-2033, reaching a value of USD 48.34 Billion by 2033.

The key factors driving the market include growing demand for efficient air transportation solutions, advancements in AI, sensor technologies, increased defense investments, regulatory support, and the rise of urban air mobility and autonomous cargo aircraft. Additionally, environmental concerns are promoting the development of electric aircraft.

North America currently dominates the autonomous aircraft market, accounting for a share exceeding 38.2%. This dominance is fueled by substantial investments in defense technologies, technological advancements, and a growing presence of major aerospace companies driving innovation.

Some of the major players in the autonomous aircraft market include Aerovironment Inc., Airbus S.A.S., BAE Systems plc, Bell Textron Inc. (Textron Inc.), Elbit Systems Ltd., Kitty Hawk Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Saab AB, and The Boeing Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)