Automotive Wrap Films Market Size, Share, Trends and Forecast by Film Type, Vehicle Type, and Region, 2025-2033

Automotive Wrap Films Market Size and Trends:

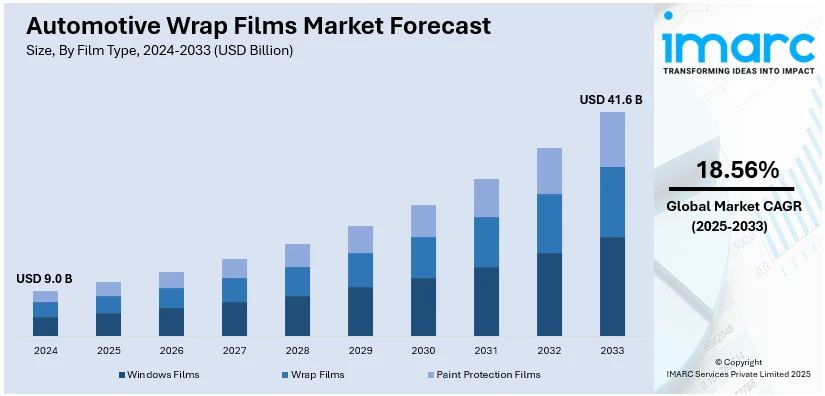

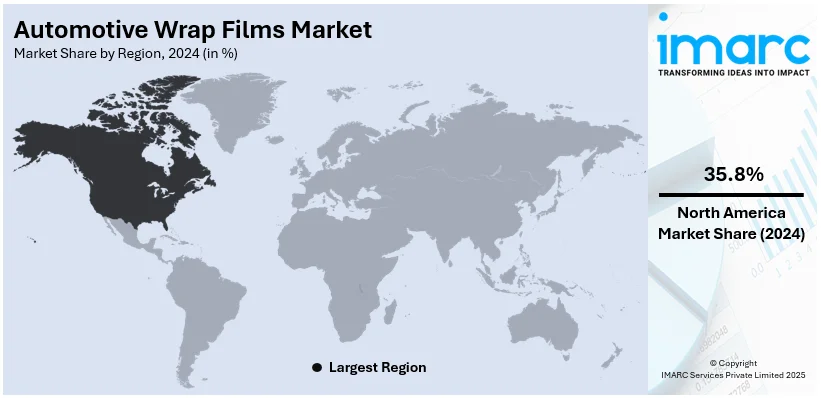

The global automotive wrap films market size was valued at USD 9.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.6 Billion by 2033, exhibiting a CAGR of 18.56% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.8% in 2024. The increasing sales of luxury vehicles, rising integration of advanced technologies, and the growing focus on collaboration and mergers and acquisitions (M&A) represent some of the key factors driving the market toward growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.0 Billion |

|

Market Forecast in 2033

|

USD 41.6 Billion |

| Market Growth Rate (2025-2033) | 18.56% |

Key factors that drive the automotive wrap films market trends are the growing demand for vehicle customization, improvements in wrap film materials that offer durability and ease of application and the increased use of wraps for advertising and branding purposes. The increasing popularity of matte, satin, and chrome finishes among consumers also drives the market. The cost-effectiveness of wraps as compared to paint jobs and their protective properties against scratches and UV damage contribute to the expansion of the market. For instance, in January 2024, Eastman Performance Films announced the launch of LLumar Protective Wrap Film combining the aesthetics of car wraps with the durability of paint protection film. Initially available in satin black, the self-healing film offers enhanced scratch resistance and a 5-year limited warranty.

The key drivers in the United States automotive wrap films market share are rising consumer demand for vehicle customization and personalization, advancements in high-quality, durable wrap film technologies and the growing trend of using wraps for commercial branding and advertising. Aesthetic finishes such as matte, satin and carbon fiber are also gaining popularity. The cost-effectiveness of wraps in comparison to traditional paint jobs as well as the protective benefits that wraps provide against environmental damage continues to spur market growth throughout the United States automotive sector. The market is also witnessing strategic mergers and acquisitions to strengthen capabilities and expand market presence. For instance, in January 2025, Vision Graphics acquired Queen of Wraps a leading commercial vehicle wrap provider expanding its capabilities in the graphics market. Both the companies plan future growth and new location openings while remaining key stakeholders.

Automotive Wrap Films Market Trends:

Rising Demand for Vehicle Customization

The increasing popularity of vehicle customizations is driving the automotive wrap films market growth. Customers are shifting to wrap films as a cheap substitute for regular paint jobs. Wrap films can be provided in a variety of finishes, which range from matte to metallic and gloss, satin, and even textured finishes that help in coming up with some unique and individualized designs. They can easily be applied and removed, hence very suitable for short-term customization or seasonal fads. Commercial fleets are also taking advantage of wrap films for branding and advertising purposes, which can be more easily visible and cheaper in the long run than repainting. The 3M vehicle wraps study points out that fleet graphics average about 6 million impressions per truck every year. In addition, the study further indicates that fleet graphics offer an impressively low cost of USD 0.48 per thousand impressions, which means this is one of the most effective media for advertisement. These are a few reasons for the strong growth trend in the vehicle wraps market: it's no longer just a cosmetic wrap for decoration but for branding and advertisement purposes. The installation ease and flexibility of the modern wrap film attract both car enthusiasts and business organizations. The market is seeing consistent growth in the light of this aesthetic upgrade without permanent modification. The increased awareness and availability of high-quality wrap films should continue to maintain strong demand for personal and professional applications.

Growth in Electric Vehicle (EV) Adoption

There are growing opportunities for the automotive wrap films market from surging electric vehicle adoption. The owners of electric vehicles find a great affinity to customization that is aligned with their vehicles' innovative and futuristic appeal. The U.S. EV market also saw a significant rise, with EV sales reaching over 1.4 million units in 2023, up from 800,000 in 2022, as per the U.S. Department of Energy. There is an emerging use of wrap films in EV differentiation on roads as an aesthetic upgrade and branding towards eco-friendly features. ACEA reports that the share of EVs in new car registrations in the EU has increased significantly, indicating a move toward sustainability. Commercial fleets of EVs also use wrap films as an efficient means of promoting green initiatives and services. Moreover, manufacturers are designing eco-friendly wrap films to meet the needs of environmentally conscious consumers, which is in line with the values of the EV market. With governments worldwide propelling the uptake of EVs, the automobile wrap films market is ready for growth, creating customized solutions to this evolving category.

Technological Advancements in Wrap Films

Technological advancement in film durability and aesthetics contributes to the global automotive wrap films market demand. According to an industrial report, the self-healing wrap film is gaining popularity among personal and fleet vehicle applications; by 2023, about 15% of all the vehicle wraps used in the U.S. would be using the self-healing technology. Another feature that prevents color fades and material degradations under UV rays makes them suitable for a wide climate range. They are resistant to extreme weather conditions for long-lasting endurance. These innovations are highly attractive to commercial fleet operators who demand durable and low-maintenance products. Additionally, manufacturers are now offering thinner yet tougher films, making them easier to apply and reducing the cost of production. Innovations in printing technology are also allowing for greater complexity in design and texture, giving way to limitless possibilities for customization. The creation of biodegradable and recyclable films is addressing environmental concerns, making the market even more attractive. As consumers and businesses demand high-performance, sustainable, and visually appealing options, technological progress in wrap films will remain a pivotal growth driver.

Automotive Wrap Films Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive wrap films market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on film type and vehicle type.

Analysis by Film Type:

- Windows Films

- Wrap Films

- Paint Protection Films

Based on the automotive wrap films market forecast, windows films holds the largest automotive wrap films market share. Window films dominate the automotive wrap films market mainly because of their dual role in aesthetics and practical benefits. They provide protection against UV, heat reduction and increased privacy for users hence being in huge demand among the consumers. With advanced technology high-performance window films have also been developed that include scratch resistance and improved durability which boosts their adoption further. The demand for window films is also driven by regulatory support in regions with strict sun control laws. Window films are cost-effective compared to other modifications which contribute significantly to their market share as they appeal to both individual car owners and fleet operators.

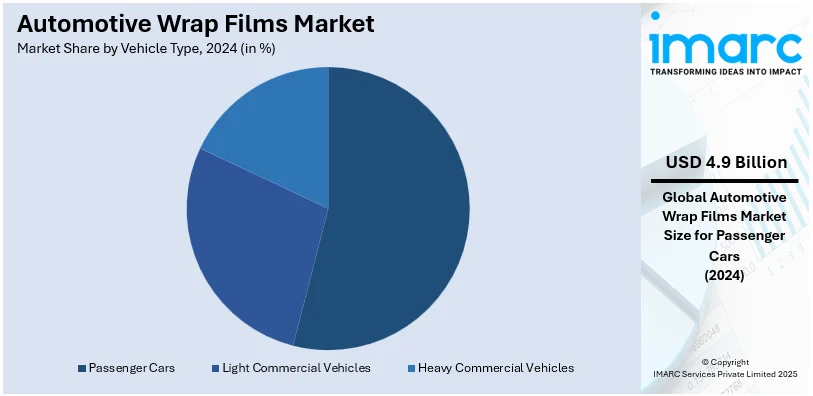

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

As per the automotive wrap films market outlook, passenger cars lead the market with around 54.0% of market share in 2024. Passenger cars lead the market in automotive wrap films due to the increasing demand for vehicle personalization and aesthetic changes. Owners increasingly opt for wrap films for their flexibility: they are a temporary change that makes a significant impact on color, texture or design without altering the original paint. Wraps also protect vehicle exteriors from scratches, UV damage and weathering thereby increasing resale value. The automotive wrap films market demand is also driven by the growing trend of using cars for advertising as wraps provide low-cost branding opportunities. Improvement in wrap film technology for example enhanced durability and easier application further enhance adoption by owners of passenger cars around the world.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.8%. North America holds the largest market share in the automotive wrap films market which is driven by high consumer demand for vehicle customization and advanced protective solutions. The robust automotive industry of the region along with the popularity of advertising through vehicle wraps has significantly boosted automotive wrap films market growth. Consumers in the United States and Canada increasingly adopt wrap films for their versatility, durability and aesthetic appeal. This region also benefits from the presence of major wrap film manufacturers and constant innovations in material technology. North America's leadership in the market is further supported by increased awareness of protection against environmental damage and the popularity of personalized designs.

Key Regional Takeaways:

United States Automotive Wrap Films Market Analysis

In 2024, the United States captured 85.00% of revenue in the North American market. The U.S. automotive wrap films market is driven by high demand for vehicle customization and the increasing popularity of fleet branding. According to CEIC data, U.S. vehicle production was around 10.6 million units in 2023, which presents a huge opportunity for wrap film applications. U.S. vehicle sales were around 15.5 million light vehicles in 2023, further driving the demand for wrap films in personal and commercial vehicle sectors. The green film market is in demand, following federal legislation which encourages more environmentally friendly solutions. In this context, market leaders, like 3M and Avery Dennison, control a significant market share with their innovations and product longevity. Increased interest in vinyl wrapping is a trend in customized application and affordable promotional advertising; also, developments in material technology mean products will have longer lifespan as well as higher aesthetic value. Besides, the U.S. market is supported by robust domestic manufacturing and R&D investments in supporting technological advancements in automotive wrap films.

Europe Automotive Wrap Films Market Analysis

Growing demand for vehicle personalization and green practices are positively contributing to the growth of the European automotive wrap films market. According to ACEA, electric vehicles account for 22.7% of new car registrations in the EU for the year 2023. In addition, due to stringent EU environmental regulations, eco-friendly materials for wrap are gaining prominence and further accelerating the market for innovation. The three countries leading in market share in the region are Germany, the UK, and France, owing to strong automotive industries and the desire for customized cars. Leading players, such as Hexis and Orafol, are looking at advanced materials that are more sustainable and quality oriented. Commercial vehicle fleet branding is also another growth driver in the European market. There are increasing investments in UV-resistant and self-healing wrap films to ensure long-term performance and aesthetic appeal. All these traits lead toward the Europe as an innovation hub for automotive wrap film technology.

Asia Pacific Automotive Wrap Films Market Analysis

The Asia Pacific automotive wrap films market is growing rapidly with the booming automotive sector and increased interest in vehicle customization among consumers. According to CEIC data, China was the largest producer of vehicles in the region, producing over 30 million vehicles in 2023, which has directly impacted the adoption of wrap films. The Indian automotive sector is also on the rise, with the "Make in India" initiative promoting local production and technology advancement. The popularity of ride-hailing services and branding of commercial vehicles increases demand for durable and flexible wrap films that can be customizable. Local firms such as Nanolam as well as region-specific subsidiaries from global companies focus on innovative material wrap that the rising consumer base demands. Low-cost wrap is introduced along with premium wrap making the market easily accessible. Increased disposable incomes and awareness of wrap films as a cost-effective alternative to paint further accelerate the market's growth across the region.

Latin America Automotive Wrap Films Market Analysis

Brazil is one of the strongest automotive markets in Latin America. According to industrial reports, Brazil ranks as the world's eighth largest automotive market and sixth largest in the production of passenger vehicles. According to an industrial report, in 2022, Brazil had approximately 1.58 million new units sold for passenger cars. Of those sales, Chevrolet and Fiat held 16.8% and 15.5% of the sales, respectively. The automotive market is expected to grow at 1.2% annually for the next five years, opening doors for wrap film applications. The São Paulo International Motor Show events increase market visibility, and increased vehicle customization trends boost demand. Local distributors and manufacturers capitalize on the expanding market by introducing more advanced vinyl wrap solutions tailored to regional preferences. In addition, higher consumer concerns on aesthetic appeal and branding create further growth hotspots for Latin America in the automobile wrap films market.

Middle East and Africa Automotive Wrap Films Market Analysis

The Middle East and Africa automotive wrap films market is driven by increasing vehicle sales and demand for customization. A report indicates that the UAE sold about 259,140 new vehicles in 2023, thereby opening up massive opportunities for wrap films as protective and aesthetic solutions. The luxury vehicle market in the region fuels demand for premium wraps, especially in countries such as the UAE and Saudi Arabia. South Africa's automotive industry is also contributing to market growth, as local manufacturers develop durable and UV-resistant films suitable for harsh climates. Fleet branding for commercial vehicles and ride-sharing services further propels adoption. Partnerships between global players and local distributors enhance product availability. Government incentives and the development of infrastructures in this region aid the growing demand for the automotive wrap films, positioning the Middle East and Africa as an emerging market for innovative solutions for automotive wraps.

Competitive Landscape:

The competitive landscape of the automotive wrap films market is characterized by the presence of several players offering a diverse range of products catering to various consumer preferences and industry needs. Companies are focusing on innovation by introducing advanced films with enhanced durability, UV resistance and customizability to meet aesthetic and functional requirements. The market witnesses significant investments in research and development (R&D) to develop ecofriendly and high-performance wrap films. Strategic activities such as partnerships, collaborations and product launches are driving competition while the growing adoption of digital printing technology is expanding design possibilities. The increasing demand for vehicle customization and protection is fostering a dynamic environment encouraging players to enhance their market presence through improved product offerings.

The report provides a comprehensive analysis of the competitive landscape in the automotive wrap films market with detailed profiles of all major companies, including:

- 3M Company

- Arlon Graphics LLC (Flexcon Company Inc.)

- Avery Dennison Corporation

- Hexis S.A.S

- Kay Premium Marking Films Ltd.

- Madico Inc. (LINTEC Corporation)

- ORAFOL Europe GmbH

Recent Developments:

- October 2024: ORAFOL announced the acquisition of a stake in Group M.A.M., a Belgian manufacturer specializing in films, with the intention of pursuing full ownership in the future. The acquisition will expand ORAFOL's climate protection solutions, including solar protection films for the building and automotive sectors. Production will start in 2025 at ORAFOL’s Oranienburg facility.

- September 2024: Avery Dennison introduced its fall 2024 Supreme Wrapping Film collection, Bright Escapes, featuring three vibrant colors: Gloss Metallic Popstar Concert Purple, Gloss Pool Party Pink, and Gloss Tropical Vacation Green. The collection evokes 90s nostalgia and offers durability, performance, and easy application with Easy Apply RS adhesive technology. Available in 60" rolls, these films provide seamless coverage for vehicle wraps.

- September 2024: Spandex partnered with KPMF to expand its vehicle wrap range with the introduction of the KPMF VWS IV series. The new range offers over 100 colour options, four finishes, and 13 over-laminate choices. These cast PVC films are designed for full vehicle wrapping, ensuring bubble-free installation and up to seven years of durability.

- June 2024: 3M is a key partner in the automotive industry, providing end-to-end solutions. This includes offering innovative technologies for automotive design and addressing challenges, which may encompass developments in automobile wrap films as part of their broader offerings.

- June 2024: According to Avery Dennison, the company will unveil the eco-friendly SP 1504 Easy Apply RS™ digital print film on June 18, 2024, in Australia and New Zealand. This sustainable vehicle wrap solution reduces greenhouse gas emissions by 53% compared to PVC-based alternatives. It features easy installation and exceptional printability, enhancing corporate branding while minimizing environmental impact.

- March 2024: Arlon Graphics introduced its VITAL range of non-PVC automobile wrap films. This innovative product emphasizes quality, durability, and sustainability, setting a new industry standard while aligning with Arlon's commitment to performance and environmental responsibility.

Automotive Wrap Films Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Film Types Covered | Windows Films, Wrap Films, Paint Protection Films |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Arlon Graphics LLC (Flexcon Company Inc.), Avery Dennison Corporation, Hexis S.A.S, Kay Premium Marking Films Ltd., Madico Inc. (LINTEC Corporation), ORAFOL Europe GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive wrap films market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive wrap films market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the automotive wrap films industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive wrap films market was valued at USD 9.0 Billion in 2024.

IMARC estimates the automotive wrap films market to reach USD 41.6 Billion by 2033 exhibiting a CAGR of 18.56% during 2025-2033.

The automotive wrap films market is driven by rising consumer demand for vehicle customization, protection from scratches and UV damage, and cost-effective alternatives to repainting. Advancements in digital printing technology, growing adoption of eco-friendly films, and increased use in advertising and branding also contribute to market growth.

In 2024, North America held the largest share of the automotive wrap films market over 35.8%. This dominance is attributed to the growing demand for vehicle customization, increased adoption of wrap films in advertising, and advancements in wrap technologies. The region's robust automotive industry and consumer preference for cost-effective, protective solutions further drive market growth.

Some of the major players in the automotive wrap films market include 3M Company, Arlon Graphics LLC (Flexcon Company Inc.), Avery Dennison Corporation, Hexis S.A.S, Kay Premium Marking Films Ltd., Madico Inc. (LINTEC Corporation), ORAFOL Europe GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)