Automotive Transceivers Market by Protocol (CAN, LIN, Flexray, and Others), Vehicle Type (Passenger Cars, Commercial Vehicles), Application (Body Electronics, Infotainment, Powertrain, Chassis and Safety), and Region 2025-2033

Market Overview:

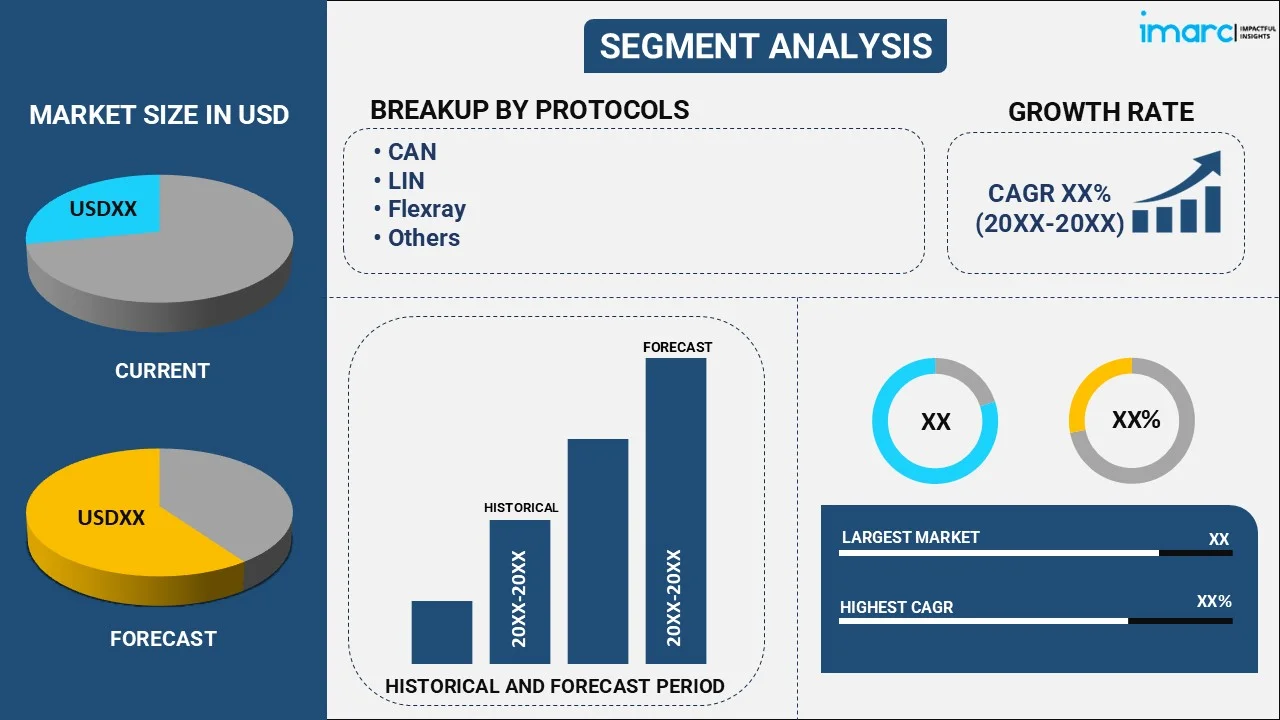

The global automotive transceivers market size reached USD 6.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.69% during 2025-2033. The significant growth in the automotive industry, rising expenditure capacities of consumers, and extensive research and development (R&D) activities represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.3 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Market Growth Rate (2025-2033) | 4.69% |

Automotive transceivers are electronic devices that are used in vehicles to enable communication between different components of the vehicle's electrical system. They consist of microcontrollers, transceiver chips, power management units (PCU), and oscillators. They are widely used engine control units, transmission control units, dashboards, multimedia, navigation, telematics, and electric power steering systems. Automotive transceivers are designed to operate in harsh automotive environments, including extreme temperatures, vibration, and electromagnetic interference. They help to ensure reliable and efficient communication between the various electronic components in the vehicle, helping to provide a safe and comfortable driving experience. As a result, automotive transceivers are widely used in passenger cars and commercial vehicles and offer a range of advantages, such as improved efficiency, safety, comfort, convenience, and performance.

Automotive Transceivers Market Trends:

The significant growth in the automotive industry across the globe is one of the key factors creating a positive outlook for the market. Automotive transceivers are widely used in modern vehicles to enable reliable and efficient communication between electronic components. In line with this, the widespread utilization of automotive transceivers owing to the increasing demand for connected cars is favoring the market growth. Automotive transceivers enable communication with other devices and networks by providing a reliable and efficient means of transmitting data between electronic components in a vehicle. Moreover, the increasing need for cost-effective and reliable electronic components that can improve the efficiency, safety, and comfort of vehicles is acting as another growth including factor. Apart from this, manufacturers are focusing on the development of more advanced and efficient transceivers that can meet the needs of the modern automotive industry, which in turn is propelling the market growth. Additionally, the widespread product adoption in luxury vehicles that include advanced safety features, such as collision avoidance systems and adaptive cruise control features, is providing an impetus to the market growth. Furthermore, the increasing inclination towards the introduction of miniaturized automotive transceivers that are smaller and more compact, which makes them easier to integrate into modern vehicles, is positively influencing the market growth. Other factors, including rising expenditure capacities of consumers, growing demand for infotainment and multimedia technologies, extensive research and development (R&D) activities, and increasing demand for electric and hybrid vehicles, are anticipated to drive the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive transceivers market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on protocol, vehicle type, and application.

Protocol Insights:

- CAN

- LIN

- Flexray

- Others

The report has provided a detailed breakup and analysis of the automotive transceivers market based on the protocol. This includes CAN, LIN, flexray and others. According to the report, LIN represented the largest segment.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the automotive transceivers market based on the vehicle type has also been provided in the report. This includes passenger cars and commercial vehicles. According to the report, passenger cars accounted for the largest market share.

Application Insights:

- Body Electronics

- Body Control Module

- HVAC

- Dashboard

- Others

- Infotainment

- Multimedia

- Navigation

- Telematics

- Others

- Powertrain

- Engine Management System

- Auto Transmission

- Chassis and Safety

- Electric Power Steering

- ADAS/Autonomous Driving

The report has provided a detailed breakup and analysis of the automotive transceivers market based on the application. This includes body electronics (body control module, HVAC, dashboard, and others), infotainment (multimedia, navigation, telematics, and others), powertrain (engine management system and auto transmission), chassis and safety (electric power steering and ADAS/autonomous driving). According to the report, body electronics represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for automotive transceivers. Some of the factors driving the Asia Pacific automotive transceivers market included extensive research and development (R&D) activities, rising expenditure capacities of consumers, and rapid technological advancements.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global automotive transceivers market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Analog Devices Inc, Elmos Semiconductor, Infineon Technologies AG, Melexis (Xtrion N.V.), Microchip Technology Inc, National Instruments Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, Robert Bosch Gesellschaft mit beschränkter Haftung, Rohm Semiconductor, STMicroelectronics N.V., Texas Instruments Incorporated, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Protocols Covered | CAN, LIN, Flexray, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc, Elmos Semiconductor, Infineon Technologies AG, Melexis (Xtrion N.V.), Microchip Technology Inc, National Instruments Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, Robert Bosch Gesellschaft mit beschränkter Haftung, Rohm Semiconductor, STMicroelectronics N.V., Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global automotive transceivers market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global automotive transceivers market?

- What is the impact of each driver, restraint, and opportunity on the global automotive transceivers market?

- What are the key regional markets?

- Which countries represent the most attractive automotive transceivers market?

- What is the breakup of the market based on the protocol?

- Which is the most attractive protocol in the automotive transceivers market?

- What is the breakup of the market based on the vehicle type?

- Which is the most attractive vehicle type in the automotive transceivers market?

- What is the competitive structure of the global automotive transceivers market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the automotive transceivers market?

- Who are the key players/companies in the global automotive transceivers market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive transceivers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive transceivers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive transceivers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)