Automotive Selective Catalytic Reduction Market Size, Share, Trends and Forecast by Component, Vehicle Type, Fuel Type, and Region, 2025-2033

Automotive Selective Catalytic Reduction Market Size and Share:

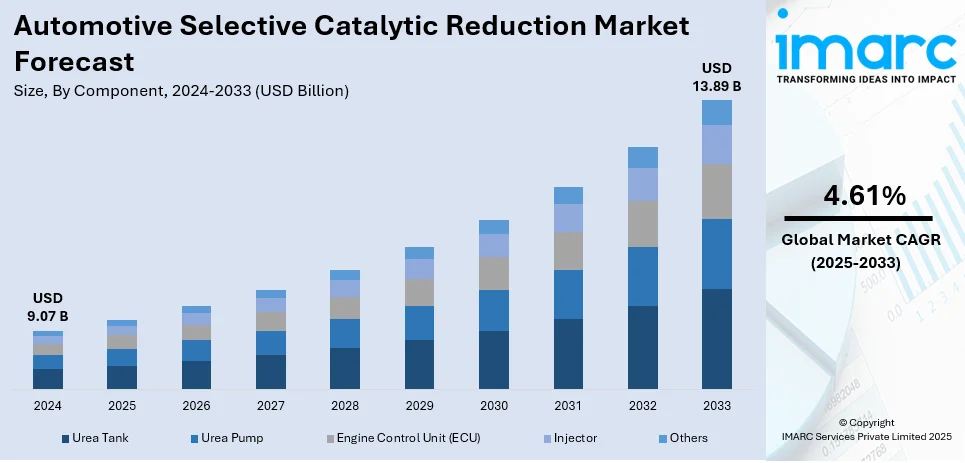

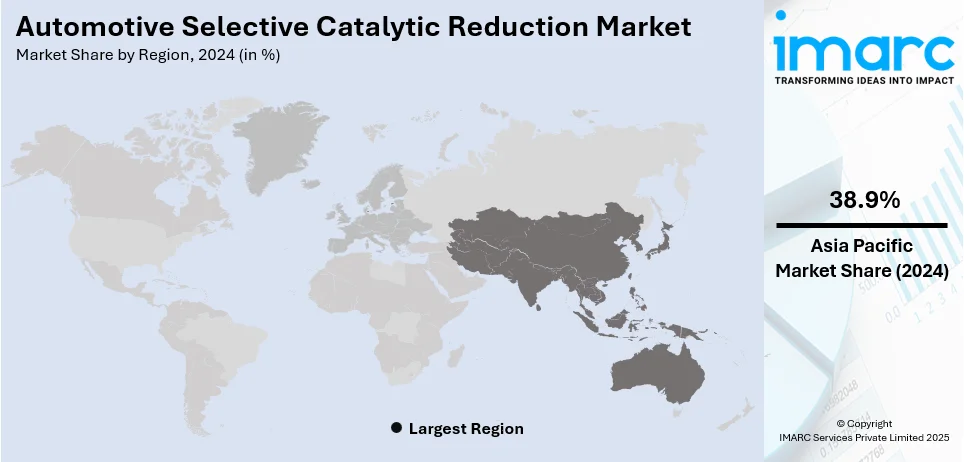

The global automotive selective catalytic reduction market size was valued at USD 9.07 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.89 Billion by 2033, exhibiting a CAGR of 4.61% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 38.9% in 2024, driven by growing industrial activities, strict emission standards, and increasing adoption of diesel vehicles, especially in China, India, and Japan.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.07 Billion |

|

Market Forecast in 2033

|

USD 13.89 Billion |

| Market Growth Rate (2025-2033) | 4.61% |

The automotive selective catalytic reduction (SCR) catalyst market growth is driven mainly by stringent emission regulations established by governments and regulatory bodies around the globe. Organizations, such as the U.S. EPA and the European Commission, have prescribed stringent NOx emission ceilings for diesel automobiles, which compel manufacturers to implement advanced emission control technologies. For instance, in March 2024, The U.S. Department of Transportation announced new fuel economy standards, improving heavy-duty truck and van efficiency by 10% annually through 2032, saving owners $700 in fuel costs over vehicle lifetimes. Furthermore, SCR systems, which utilize diesel exhaust fluid (DEF) to convert NOx emissions into harmless nitrogen and water, have become a critical solution for compliance. As regulatory standards continue to tighten, the demand for SCR technology is increasing, driving its widespread adoption across commercial and passenger vehicle segments.

The United States plays a crucial role in the automotive selective catalytic reduction (SCR) market through stringent environmental regulations and advancements in emission control technologies. Strict nitrogen oxide (NOx) standards under programs such as Tier 3 and the Clean Air Act are enforced by the Environmental Protection Agency (EPA) and have resulted in widespread introduction of SCR systems in diesel vehicles. It is also a must-have for major automotive manufactures and component suppliers who are very active in research and development towards improved SCR efficiency, reduced costs of compliance, and better performance of the vehicles. For instance, in February 2024, ANDRITZ secured an order from TPC Group to install an SCR system in Houston, TX, aiming to reduce NOx emissions and enhance production while meeting stringent environmental standards. Additionally, the growing infrastructure for diesel exhaust fluid (DEF) distribution supports the seamless integration of SCR technology nationwide.

Automotive Selective Catalytic Reduction Market Trends:

Stricter Emission Regulations Driving SCR Adoption

The increasing severity of norms on emission to reduce air pollution from diesel vehicles is a global trend. Euro 6 in Europe, China 6 in China, and Bharat Stage 6 in India call for substantial reductions in nitrogen oxide (NOx) emissions. For instance, according to the International Council on Clean Transportation (ICCT), Euro 6d standards require NOx emissions from diesel passenger cars to be below 80 mg/km, while China 6 standards limit NOx emissions to 35 mg/km for light-duty vehicles. Selective Catalytic Reduction (SCR) technology presently stands as another angle of preference to achieving these standards, as it can efficiently reduce NOx to nitrogen and water by means of diesel exhaust fluid (DEF). More and more automobile manufacturers are now installing SCR systems in their commercial and passenger vehicles to comply with the changing laws. In addition, other incentives being offered by governments and penalties on miscompliance are speeding up the pace of incorporation of SCR technology. The SCR market should witness growth because regulatory authorities keep reducing emission limits, particularly in areas with higher diesel vehicle density.

Rising Demand for Fuel Efficiency and Sustainability

The focus of the automobile industry is improving fuel economy and reducing environmental footprints, and this is largely due to the advancement of SCR technologies. This represents one of the key automotive selective catalytic reduction market trends. SCR systems facilitate more efficient combustion, thus significantly reducing NOx emissions while diesel engines perform optimally, without compromising fuel economy levels. Thus, fleet operators are investing in SCR-enabled trucks and buses where transport solutions must embrace green practices, particularly around commercial vehicles. For instance, Old World Industries mentions that post-2010 heavy-duty trucks fitted with SCR could save on fuel use by close to approximately 5% compared to the models from 2007 with similar engine specifications. Governments also go beyond this by making policies and incentives that encourage cleaner technologies of vehicle usage. Availability of diesel exhaust fluid further enhanced by the development of SCR components such as catalysts and injectors boost system efficiency. However, SCR remains a major technology installation for meeting clean and sustainable vehicles' operation objectives as manufacturers move towards fuel economy improvements while keeping the carbon footprint low.

Growing Penetration of Hybrid and Electric Vehicles Impacting Market Growth

The rising popularity of hybrid- and electric-vehicle (EV) technologies is changing the condition of demand for emission control techniques, such as SCR technologies, in turn, facilitating the global automotive selective catalytic reduction market demand. Global EV sales surpassed 14 million units in 2023, accounting for 18% of new vehicle sales, according to the International Energy Agency (IEA). Be that as it may, while battery-electric vehicles (BEVs) are completely having zero tailpipe emissions, the hybrid and diesel ones still need technologically advanced emission-after-treatment for regulatory compliance. The transition to electric mobility may be slowing down the SCR market growth in respect to passenger cars mostly in the regions that give robust incentives for EV purchases. But still, SCR remains a requirement in commercial transportation, heavy-duty trucks, and off-highway vehicles, in which diesel engines continue to span all technologies. Hydrogen-based internal combustion engines and alternative fuel vehicles may affect the way SCR is adopted in the future. The visit towards electrification would, no doubt, alter the entire cause of events, but SCR technology would remain relevant in some key segments, particularly where electrification has not yet been made viable.

Automotive Selective Catalytic Reduction Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive selective catalytic reduction market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, vehicle type, and fuel type.

Analysis by Component:

- Urea Tank

- Urea Pump

- Engine Control Unit (ECU)

- Injector

- Others

Urea tank leads the market in 2024. Urea tanks are essential components in SCR systems, which are widely used in diesel engines to reduce nitrogen oxide (NOx) emissions. These systems inject a mixture of diesel exhaust fluid (DEF), also known as urea solution, into the exhaust stream, helping to convert harmful NOx emissions into harmless nitrogen and water. The demand for urea tanks is being driven by stricter environmental regulations and the rising adoption of diesel engine technologies in heavy-duty trucks, commercial vehicles, and passenger cars. As regulatory bodies like the U.S. Environmental Protection Agency (EPA) implies more stringent emission standards, the need for urea tanks and SCR systems continues to grow, making them a dominant force in the market.

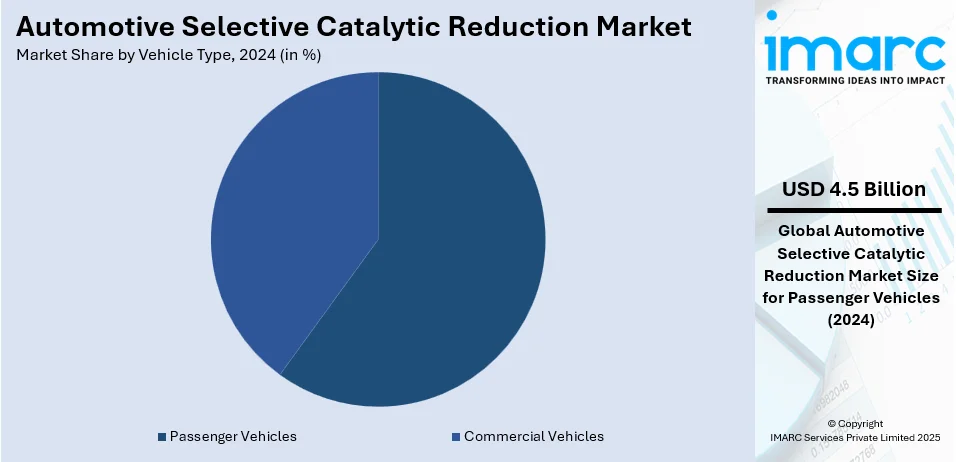

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

Passenger vehicles lead the market with around 49.8% of the automotive selective catalytic reduction market share in 2024. The demand for SCR systems in passenger vehicles is primarily driven by tightening emission regulations globally, especially in regions like North America and Europe. SCR technology is crucial for reducing nitrogen oxide (NOx) emissions in diesel-powered cars, ensuring compliance with stringent environmental standards. As governments continue to enforce low-emission mandates, automakers are increasingly incorporating SCR systems into their passenger vehicles to meet regulatory requirements and enhance vehicle performance. Moreover, growing consumer awareness of environmental impact and the push for cleaner transportation solutions are further fueling the adoption of SCR technology in the passenger vehicle segment. This trend is expected to persist as the global automotive industry continues its shift towards sustainability.

Analysis by Fuel Type:

- Gasoline

- Diesel

Diesel leads the market in 2024 due to their widespread use in commercial and heavy-duty vehicles. Diesel engines are known for their fuel efficiency and performance, particularly in sectors like transportation, logistics, and construction. However, the increasing focus on reducing nitrogen oxide (NOx) emissions has made SCR technology essential for compliance with stringent environmental regulations. Diesel engines, which produce higher levels of NOx, benefit greatly from SCR systems, which use diesel exhaust fluid (DEF) to reduce harmful emissions. The growing adoption of SCR in diesel vehicles is driven by regulatory pressure in key markets such as Europe and North America, where emission standards are tightening. As a result, diesel-powered vehicles continue to dominate the SCR market in 2024.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 38.9%. This region is experiencing significant growth in the automotive sector, driven by rapid industrialization, urbanization, and a rising demand for commercial vehicles. As governments across Asia Pacific implement stricter environmental regulations to combat pollution, the adoption of SCR technology in diesel-powered vehicles has become essential to meet emission standards. Countries like China, India, and Japan are focusing on reducing nitrogen oxide (NOx) emissions, leading to a surge in the demand for SCR systems. Additionally, the presence of major automotive manufacturers and an expanding infrastructure for diesel exhaust fluid (DEF) further supports the region's dominant position in the market.

Key Regional Takeaways:

United States Automotive Selective Catalytic Reduction Market Analysis

The U.S. automotive selective catalytic reduction (SCR) market has been fluctuating with many factors such as emissions regulations and the use of diesel vehicles for commercial transport. The industry report states that there were 11.4 million diesel-powered Class 3-8 trucks as of December 2023; 61% of which are from model year 2010 or newer and equipped with SCR systems to meet their NOx reduction targets. Driving market growth and increasing API consumption of Diesel Exhaust Fluid (DEF) is the need for legislative compliance. Major industry players have been advancing SCR technology, including Cummins and Tenneco; both are focusing on improving system efficiency and durability. While electrification continues to gain momentum, the commercial vehicle industry invests in SCR technologies to ensure compliance with strict environmental standards.

North America Automotive Selective Catalytic Reduction Market Analysis

North America’s automotive selective catalytic reduction (SCR) market is expanding due to stringent emission regulations and rising adoption of advanced diesel engine technologies. The U.S. Environmental Protection Agency (EPA) and the California Air Resources Board (CARB) enforce strict nitrogen oxide (NOx) emission limits, driving demand for SCR systems in commercial vehicles, heavy-duty trucks, and off-highway equipment. For instance, in December 2024, California announced that it has received U.S. EPA approval for two regulations aimed at reducing pollution, unlocking $36 billion in public health benefits, and moving toward zero-emission vehicle sales by 2035. The region hosts leading manufacturers such as Cummins, Tenneco, and BorgWarner, which invest in research and development to enhance SCR system efficiency and compliance. Additionally, the well-established diesel exhaust fluid (DEF) infrastructure supports widespread SCR adoption. As government policies push for lower emissions and sustainable transportation, North America remains a key market for SCR technology, with continued growth opportunities in commercial and passenger vehicle segments.

Europe Automotive Selective Catalytic Reduction Market Analysis

New market trends are emerging in the automotive selective catalytic reduction (SCR) market across Europe as a result of stricter norms on emissions and the fact that diesel continues to be the fuel source of choice for the vast majority of commercial vehicles. According to the European Automobile Manufacturers Association (ACEA), as of 2023, diesel trucks are still the main type of vehicle used in Europe, making up some 95% to 96% of all new truck registrations. Germany still plays a major part in the market, with well over 3.1 million commercial diesel vehicles in use, thus increasing the demand for SCR systems. The Green Deal of the European Commission strives to reduce overall greenhouse emissions by 55% by 2030, hastening investments in advanced emission control technologies. While alternative fuels are gathering speed, the commercial field has remained SCR-compatible to meet Euro VI requirements. The principal manufacturers, such as Bosch and Continental, have therefore focused their research and development activities on innovating SCR solutions for better efficiency and evolution with regulation compliance.

Asia Pacific Automotive Selective Catalytic Reduction Market Analysis

The SCR market is flourishing in the Asia Pacific region due to accelerated industrialization and government regulation over vehicle emissions. The Ministry of Ecology and Environmental Protection in China stated that over 20 million commercial diesel vehicles were operating in China in 2023, making China the largest market for SCR technology. Initiated by the introduction of Bharat Stage VI (BS-VI) norms in India in April 2020, the uptake of SCR technology has seen a further boost with a reported 18% of diesel vehicle sales to the total passenger vehicle sales in 2023 according to the Society of Indian Automobile Manufacturers (SIAM). Ongoing research and development initiatives in SCR technology are being targeted towards meeting regional regulatory standards by companies, including Weichai Power and Denso.

Latin America Automotive Selective Catalytic Reduction Market Analysis

Automotive selective catalytic reduction (SCR) is proliferating within Latin America owing to the impact of regulatory drives and the need to cut down on emissions from diesel vehicles. In 2023, Brazil alone has registered more than 2.18 million new light vehicles, of which more than 83 percent of these are flexible fuel, signaling an increasing regional focus toward cleaner fuel alternatives. However, diesel-powered commercial vehicles continue to be a constant in freight and logistics, which will invariably ensure a steady demand in SCR technology use. Other emissions regulatory countries such as Mexico and, to a less rigid extent, Argentina, will adopt such improvements on par with Euro VI-equivalent emission standards, thus increasing the need for investments towards more advanced exhaust after treatment systems. The subjects of this industry, such as Cummins and BorgWarner, are consequently optimizing SCR efficiencies in light of the developing environmental policies. While electric mobility is increasingly budding out, the reality, which proves to be tough to get away from in Latin America, sustains diesel engines as the preferred means of commercial transport use. Consequently, both aspects keep the market buoyant and busy with products.

Middle East and Africa Automotive Selective Catalytic Reduction Market Analysis

The Middle East and Africa automotive selective catalytic reduction (SCR) market is globalizing under the pressure of emissions regulations and modernization of commercial fleets. According to an industrial report, there were over 100,000 heavy-duty diesel vehicles in Saudi Arabia in 2023, and roughly 113,000 new commercial vehicles were sold that year, notching importance on heavy-duty trucks in the transport sector of the country. SCR-equipped diesel vehicle sales remain buoyed by logistics and construction. Regional governments are aligning emission policies with global standards for the benefit of investment into advanced emission control systems. The growing alternative fuels and electric vehicles are new forays in the transport sector, but SCR growth remains paralleled by a continued reliance on diesel-powered transportation. Major manufacturers such as Bosch and Tenneco are working with local distributors to facilitate the uptake of SCR systems while ensuring conformance to changing environmental regulations.

Competitive Landscape:

The automotive selective catalytic reduction (SCR) market is highly competitive, driven by stringent emission regulations and advancements in emission control technologies. Key players focus on innovation, product efficiency, and cost optimization to strengthen their market positions. The companies are investing copiously in research and development for improving the performance of SCR systems, lowering nitrogen oxide (NOx) emissions, and improving fuel efficiency. Strategic alliances further add mergers and acquisitions to heighten competition, allowing organizations to expand their technological capabilities and geographic presence. For instance, in February 2025, Johnson Matthey and Bosch announced a long-term collaboration to develop catalyst coated membranes (CCM) for hydrogen fuel cells, advancing zero-emission hydrogen technology for commercial vehicles. Additionally, increasing demand for cleaner diesel engines fuels the adoption of SCR technology across global markets.

The report provides a comprehensive analysis of the competitive landscape in the automotive selective catalytic reduction market with detailed profiles of all major companies, including:

- BASF SE

- BOSAL, Continental AG

- CORMETECH Inc.

- Faurecia SE

- Johnson Matthey

- Kautex Textron GmbH & Co.

- KG (Textron Inc.)

- Magneti Marelli S.p.A.

- Plastic Omnium

- Robert Bosch GmbH

- Röchling SE & Co. KG

- Tenneco Inc.

Latest News and Developments:

- June 2023: Johnson Matthey has patented SCARFTM technology that integrates SCR and SCRF into compact hardware design able to heat quickly and sustain performance in reducing NOx and particulates. Located closer to the engine, this technology helps with regulating emissions as global regulations become stringent, especially for improved cold-start performances in diesel cars and vans.

- November 2021: The research department that investigates and develops things, BASF, bagged the title achievement of the 2021 Thomas Alva Edison Patent Award in awarding advanced Diesel Oxidation Catalyst (DOC) research and development. Low temperature allows for enhanced NO₂ generation from this innovation, perfecting Selective Catalytic Reduction performance. This low-cost approach benefits automotive OEMs in compliance with strict output laws and a cleaner environment.

- September 2021: SABIC has also partnered with the Indian Oil Corporation Limited to supply Technical-grade Urea for producing AUS-32, a type of Aqueous Urea Solution. An Aqueous Urea Solution this is used in diesel vehicles' Selective Catalytic Reduction systems to reduce nitrogen dioxide emissions by over 70% which conforms to the Bharat Stage VI emission regulation in India.

- August 2019: Volkswagen has recently launched SCR system with "twin-dosing" technology in its latest SCR application, lowering the NOX emissions by 80%. First available for the Passat 2.0 TDI Evo, which is compliant with Euro 6d standards, it will be fitted into future models, such as the next-generation Golf.

Automotive Selective Catalytic Reduction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Urea Tank, Urea Pump, Engine Control Unit (ECU), Injector, Others |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles |

| Fuel Types Covered | Gasoline, Diesel |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, BOSAL, Continental AG, CORMETECH Inc., Faurecia SE, Johnson Matthey, Kautex Textron GmbH & Co. KG (Textron Inc.), Magneti Marelli S.p.A., Plastic Omnium, Robert Bosch GmbH, Röchling SE & Co. KG, Tenneco Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive selective catalytic reduction market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive selective catalytic reduction market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive selective catalytic reduction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive selective catalytic reduction market was valued at USD 9.07 Billion in 2024.

IMARC estimates the automotive selective catalytic reduction market to reach USD 13.89 Billion by 2033, exhibiting a CAGR of 4.61% during 2025-2033.

Key factors driving the automotive selective catalytic reduction (SCR) market include stringent emission regulations, rising demand for diesel and commercial vehicles, environmental concerns, technological advancements in SCR systems, increasing adoption of diesel exhaust fluid (DEF), and growing focus on reducing nitrogen oxide (NOx) emissions for cleaner air quality.

Asia Pacific currently dominates the market with a 38.9% share, driven by rapid industrial growth, stringent emission regulations, and high demand for diesel vehicles. Countries like China, India, and Japan are adopting SCR systems to meet NOx reduction targets, further boosting the region's dominance in the automotive SCR market while creating a positive automotive selective catalytic reduction market outlook.

Some of the major players in the automotive selective catalytic reduction market include BASF SE, BOSAL, Continental AG, CORMETECH Inc., Faurecia SE, Johnson Matthey, Kautex Textron GmbH & Co. KG (Textron Inc.), Magneti Marelli S.p.A., Plastic Omnium, Robert Bosch GmbH, Röchling SE & Co. KG, Tenneco Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)