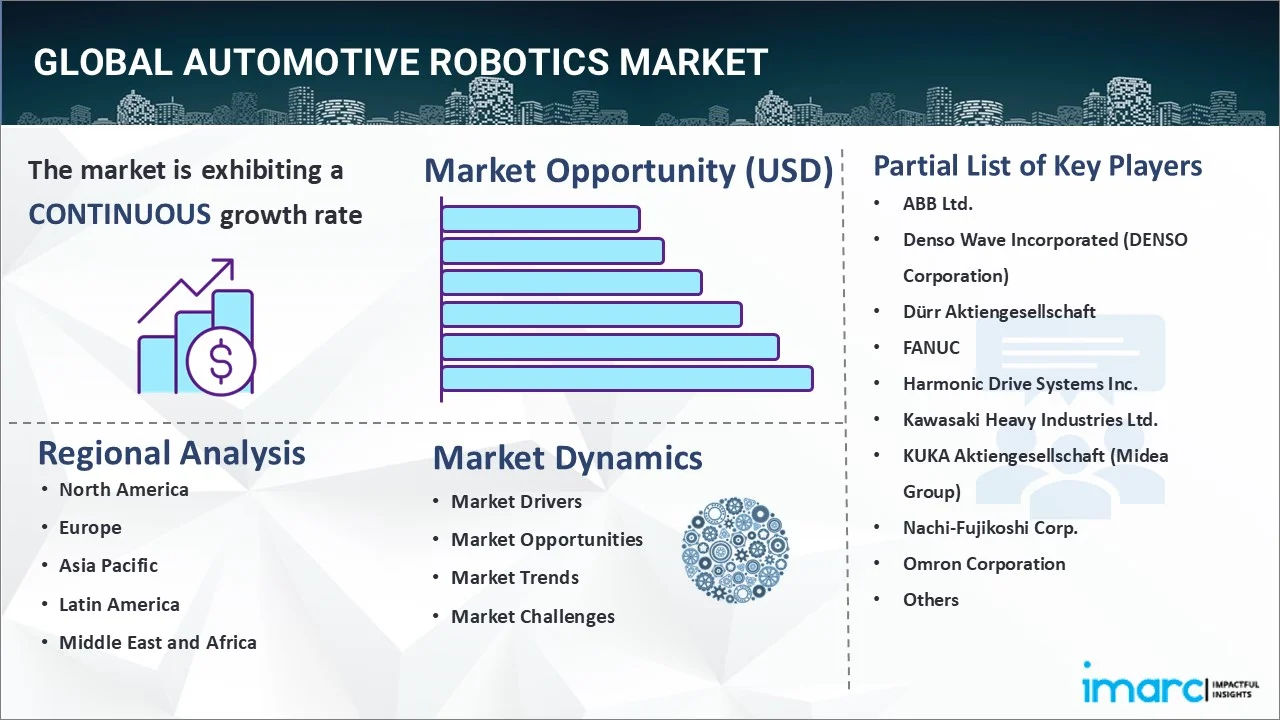

Automotive Robotics Market Report by Product Type (Cartesian Robots, SCARA Robots, Articulated Robot, and Others), Component Type (Controller, Robotic Arm, End Effector, Drive and Sensors), Application (Assembly, Dispensing, Material Handling, Welding, and Others), End User (Vehicle Manufacturers, Automotive Component Manufacturers), and Region 2025-2033

Automotive Robotics Market Size:

The global automotive robotics market size reached USD 12.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 28.6 Billion by 2033, exhibiting a growth rate (CAGR) of 9.55% during 2025-2033. The market is expanding due to increasing demand for automation in the automotive industry, rising disposable income of consumers, growing demand for electric vehicles (EVs), rapid technological advancements, the heightened integration of robotics with industry 4.0, and the widespread consumer demand for customization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.1 Billion |

|

Market Forecast in 2033

|

USD 28.6 Billion |

| Market Growth Rate (2025-2033) | 9.55% |

Automotive Robotics Market Analysis:

- Major Market Drivers: The primary drivers of the global automotive robotics market include the increasing need for automation to enhance manufacturing efficiency and reduce costs, ongoing shift towards electric vehicles and the necessity for specialized manufacturing processes for EVs, and the rising disposable income of consumers.

- Key Market Trends: The ongoing shift towards integrating artificial intelligence (AI) with robotic systems to enhance their ability to perform complex tasks autonomously and adapt to changing production conditions, is bolstering the automotive robotics market recent opportunities.

- Geographical Trends: Asia Pacific dominates the automotive robotics market due to the rapid expansion of automotive manufacturing, supported by strong government initiatives and the presence of major robotics manufacturers. Other regions are also growing, due to modernization of existing automotive facilities and the increasing adoption of electric vehicles that require new manufacturing techniques and automation solutions.

- Competitive Landscape: As per the automotive robotics market statistics, some of the major market players in the automotive robotics industry include ABB Ltd., Denso Wave Incorporated (DENSO Corporation), Dürr Aktiengesellschaft, FANUC, Harmonic Drive Systems Inc., Kawasaki Heavy Industries Ltd., KUKA Aktiengesellschaft (Midea Group), Nachi-Fujikoshi Corp., Omron Corporation, Seiko Epson Corporation, Yamaha Motor Co. Ltd., and Yaskawa Electric Corporation, among many others.

- Challenges and Opportunities: The market faces several problems, such as high initial investment and the complexity of integrating robotic systems into existing manufacturing lines. However, this also presents opportunities for robotics vendors to develop more cost-effective and flexible solutions that can be easily integrated and scaled according to business needs.

Automotive Robotics Market Trends:

Increasing demand for automation in manufacturing processes

The automotive industry is increasingly adopting robotics to enhance manufacturing efficiency, reduce costs, and improve product quality. According to the International Federation of Robotics (IFR), the installation of robotics in manufacturing rose by 12% and reached 41,624 units in 2022 in North America. Among those, the automotive industry was the largest adopter as they installed 20,391 industrial robots, which is an increase of 30% compared to 2021. Automation through robotics offers precision and repeatability, which are important for maintaining high-quality standards in automotive production. In the United States, demand from car makers and manufacturers of components rose by 48% in 2022, boosting the use of robotics in welding, painting, assembling, and heavy lifting, which increased adoption rates to 14,594 units. Moreover, in Canada, the utilization of robotics for motor vehicles, engines, and bodies grew by 99%, with 263 units sold.

Rising disposable income of consumers

With rising household incomes and increased demand for automobiles, particularly in emerging nations, there has been a significant increase in passenger car sales worldwide. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), around 92724668 vehicles and 65272367 passenger cars were sold globally in 2022. As a result, some automakers are seeking to improve vehicle production by implementing novel technology such as robots. For example, in April 2021, BMW i Ventures, Inc. made an investment in Plus One Robotics, a well-known developer of vision software for logistical industrial robots. The company's goal with this cooperation is to speed up automation across the supply chain and logistics sector while also providing warehouse operators with a transformational experience.

Growing demand for electric vehicles (EVs)

The expanding usage of electric cars (EVs), as environmental concerns mount and government laws favor sustainable transportation options, is driving demand for automotive robots. For example, in November 2021, the governments of the United States, Canada, Mexico, and the United Kingdom agreed to convert their entire fleet of 120,000 cars to electric vehicles. This effort intends to attain zero emissions by 2040, with the goal of lowering greenhouse gas emissions. It demands the modification of manufacturing processes to meet the specific needs of electric vehicle production, such as battery assembly, the integration of complicated electrical systems, and lightweight material handling. For example, in January 2022, FANUC introduced the M-1000iA, a 1,000 kg payload industrial robotic arm. This robot is built to manage hefty products, including automotive components, construction materials, and battery packs for EVs.

Automotive Robotics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, component type, application, and end user.

Breakup by Product Type:

- Cartesian Robots

- SCARA Robots

- Articulated Robot

- Others

Articulated robot accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cartesian robots, SCARA robots, articulated robot, and others. According to the report, articulated robot represented the largest segment.

As per the automotive robotics market trends, articulated robots represent the largest segment. They are characterized by their rotational joints that allow for exceptional flexibility and range of motion in performing complex tasks, such as assembly, welding, and material handling. Moreover, the versatility of articulated robots that makes them ideally suited for various applications within the automotive manufacturing process, such as intricate component installations and heavy lifting and precise positioning tasks, is fueling the automotive robotics market demand. Besides this, their adaptability to work in constrained spaces and handle different tasks without reconfiguration, thereby enhancing production efficiency and reducing operational costs, is fostering automotive robotics market recent developments.

Breakup by Component Type:

- Controller

- Robotic Arm

- End Effector

- Drive and Sensors

Robotic arm holds the largest share of the industry

A detailed breakup and analysis of the market based on the component type have also been provided in the report. This includes controller, robotic arm, end effector, and drive and sensors. According to the report, robotic arm accounted for the largest market share.

Based on the automotive robotics market analysis, the robotic arm emerged as the largest segment. Robotic arms are crucial for their precision and efficiency in automating critical manufacturing tasks, such as welding, painting, and assembly, in automotive production lines. Moreover, their design allows for replicating complex human arm movements, making them indispensable for operations requiring high accuracy and consistency. Besides this, the robustness and versatility of robotic arms that enable manufacturers to boost productivity, maintain quality standards, and reduce human error and labor costs are enhancing the automotive robotics market growth.

Breakup by Application:

- Assembly

- Dispensing

- Material Handling

- Welding

- Others

Welding represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes assembly, dispensing, material handling, welding, and others. According to the report, welding represented the largest segment.

According to the automotive robotics forecast, welding is identified as the largest segment. Robotic welding has become indispensable in automotive manufacturing due to its precision, speed, and consistency, which are critical for achieving strong, durable welds in vehicle assembly. Moreover, they enhance production efficiency by executing high-quality welds faster than manual processes and with fewer errors, significantly reducing material waste and rework costs. Besides this, the integration of advanced sensors and control systems, allowing the robots to adapt to varying materials and complex geometries while ensuring optimal weld quality across diverse production requirements, is catalyzing the automotive robotics market share.

Breakup by End User:

- Vehicle Manufacturers

- Automotive Component Manufacturers

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes vehicle manufacturers and automotive component manufacturers.

Based on the automotive robotics market outlook, vehicle manufacturers represent a major end-user segment as they utilize robotics extensively across various stages of the vehicle manufacturing process, such as stamping, body assembly, painting, and final inspection. Moreover, the increasing adoption of robotics by vehicle manufacturers, driven by the need to enhance production efficiency, increase precision, and ensure consistency in quality while managing large-scale production volumes, is bolstering the automotive robotics market revenue.

According to the automotive robotics market report, automotive component manufacturers form another crucial segment in the automotive robotics market. It employs robotics primarily for tasks, such as component assembly, machining, and material handling. Moreover, robotics in component manufacturing ensures high precision and efficiency, especially in producing complex and small parts that require meticulous attention to detail, thereby positively impacting the automotive robotics market recent price.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest automotive robotics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for automotive robotics.

According to the automotive robotics market overview, Asia Pacific stands out as the largest regional segment, driven by rapid industrialization and the expansion of automotive manufacturing in countries such as China, Japan, South Korea, and India. Moreover, the heightened adoption of robotics due to its strong emphasis on enhancing manufacturing processes, increasing production capacities, and reducing operational costs is bolstering the automotive robotics market's recent opportunities. Along with this, the presence of major automotive and electronics manufacturers, who are early adopters of advanced robotic technologies, is fueling the market growth. Additionally, the imposition of various government initiatives to promote the use of industrial automation to maintain manufacturing competitiveness in the global arena is strengthening the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the automotive robotics industry include ABB Ltd., Denso Wave Incorporated (DENSO Corporation), Dürr Aktiengesellschaft, FANUC, Harmonic Drive Systems Inc., Kawasaki Heavy Industries Ltd., KUKA Aktiengesellschaft (Midea Group), Nachi-Fujikoshi Corp., Omron Corporation, Seiko Epson Corporation, Yamaha Motor Co. Ltd., Yaskawa Electric Corporation, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Major automotive robotics market companies are actively engaged in expanding their product portfolios, enhancing technological capabilities, and entering strategic partnerships and acquisitions to strengthen their market positions. Companies like ABB, KUKA AG, Fanuc Corporation, and Yaskawa Electric are leading with innovations in robotic systems that offer greater precision, flexibility, and integration with advanced technologies, such as artificial intelligence (AI) and machine learning (ML). They are aimed at optimizing production processes and enabling customization in automotive manufacturing. Additionally, major players are expanding their geographical reach by establishing new facilities and collaborating with automotive manufacturers in emerging markets. They are forming collaborations and joint ventures with local firms to tailor their offerings to regional needs and comply with local regulations.

Automotive Robotics Market News:

- In April 2020, KUKA AG and BMW AG signed a framework agreement to supply around 5,000 robots for new production lines and factories. The KUKA industrial robots will be used around the world at the international production sites of the BMW Group for the manufacture of the current and future generations of vehicle models. The several robot models will be used predominantly in body-in-white production and other technologies.

- In February 2022, FANUC unveiled the CRX family of collaborative robots, which includes the CRX-5iA with a 5kg payload, CRX-20iA/L with a 20kg payload and the CRX-25iA with a 25-30kg payload. They all follow the CRX-10iA and CRX-10iA/L, cobot models with a 10kg payload.

Automotive Robotics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cartesian Robots, SCARA Robots, Articulated Robot, Others |

| Component Types Covered | Controller, Robotic Arm, End Effector, Drive and Sensors |

| Applications Covered | Assembly, Dispensing, Material Handling, Welding, Others |

| End Users Covered | Vehicle Manufacturers, Automotive Component Manufacturers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Denso Wave Incorporated (DENSO Corporation), Dürr Aktiengesellschaft, FANUC, Harmonic Drive Systems Inc., Kawasaki Heavy Industries Ltd., KUKA Aktiengesellschaft (Midea Group), Nachi-Fujikoshi Corp., Omron Corporation, Seiko Epson Corporation, Yamaha Motor Co. Ltd., Yaskawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive robotics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive robotics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive robotics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global automotive robotics market was valued at USD 12.1 Billion in 2024.

We expect the global automotive robotics market to exhibit a CAGR of 9.55% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous manufacturing units for vehicles, thereby negatively impacting the global market for automotive robotics.

The increasing concerns toward employee safety across the automotive industry, along with the rising demand for automotive robots to simplify complex production processes and enhance operational efficiency, are primarily driving the global automotive robotics market.

Based on the product type, the global automotive robotics market can be segmented into cartesian robots, SCARA robots, articulated robot, and others. Currently, articulated robot holds the majority of the total market share.

Based on the component type, the global automotive robotics market has been divided into controller, robotic arm, end effector, and drive and sensors. Among these, robotic arm currently exhibits a clear dominance in the market.

Based on the application, the global automotive robotics market can be categorized into assembly, dispensing, material handling, welding, and others. Currently, welding accounts for the majority of the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global automotive robotics market include ABB Ltd., Denso Wave Incorporated (DENSO Corporation), Dürr Aktiengesellschaft, FANUC, Harmonic Drive Systems Inc., Kawasaki Heavy Industries Ltd., KUKA Aktiengesellschaft (Midea Group), Nachi-Fujikoshi Corp., Omron Corporation, Seiko Epson Corporation, Yamaha Motor Co. Ltd., and Yaskawa Electric Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)