Automotive Refinish Coatings Market Size, Share, Trends and Forecast by Resin Type, Product Type, Technology, Vehicle Type, and Region, 2025-2033

Automotive Refinish Coatings Market Size and Share:

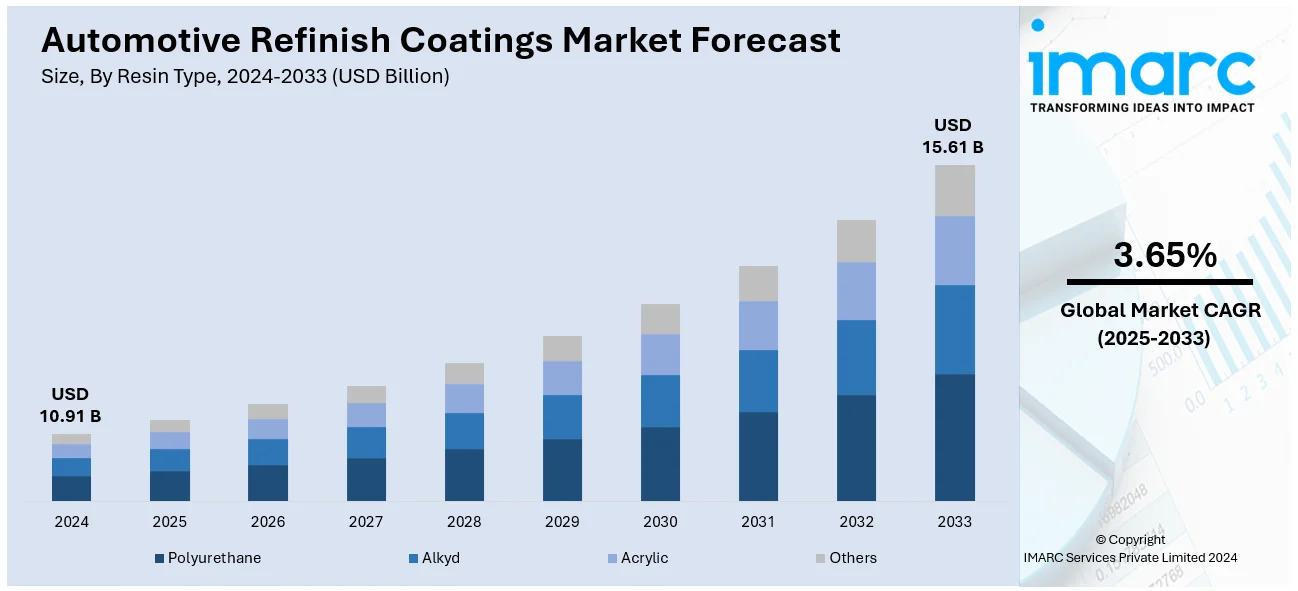

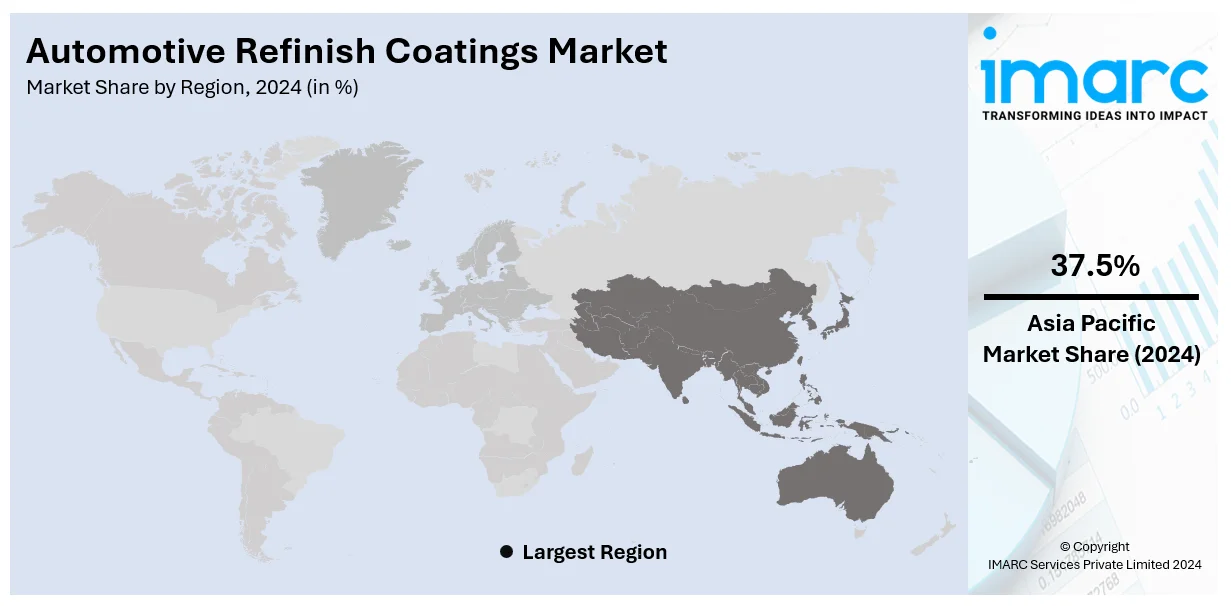

The global automotive refinish coatings market size was valued at USD 10.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.61 Billion by 2033, exhibiting a CAGR of 3.65% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.5% in 2024. The market is primarily driven by the stable growth in global vehicle ownership and usage, implementation of stringent environmental regulations, increasing awareness of sustainability, and the rapid development of eco-friendly and high-performance coatings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.91 Billion |

|

Market Forecast in 2033

|

USD 15.61 Billion |

| Market Growth Rate 2025-2033 | 3.65% |

The increasing demand for aesthetic vehicles and the requirements of regular repair and maintenance are major contributors to the market, as most consumers are concerned regarding the aesthetic look of vehicles. In addition, with the increasing rate of road accidents and increased vehicle decoration, the market has expanded significantly. Also, technologies related to the coating formulations have enhanced the quality as well as the durability of coatings, thereby attracting consumers and manufacturers. For example, on August 9, 2024, Nissan developed cooling paint technology capable of reducing vehicle surface temperatures by up to 21.6°F (12°C) when exposed to direct sunlight. This innovative solution aims to address the issue of overheating in parked cars, enhancing comfort and safety for drivers. Nissan's cooling paint utilizes infrared-reflective technology to minimize heat absorption, marking a significant advancement in automotive coatings. Increased vehicle manufacturing and sales on a global scale are resulting in a higher need for automotive refinish coatings.

The United States is a key regional market, primarily driven by the rise in the vehicle count necessitating repair and refinishing. In addition to this, there is growth in the U.S market due to special demands for high quality finishes in different vehicles. Furthermore, the rising claims through insurance related to damage incurred by vehicles due to accidents and weather conditions drive the market growth significantly. Furthermore, strategic collaborations, along with the development of low VOC and high-performance coatings, made refinishing more cost-effective and environmentally friendly for the customers. For instance, on November 6, 2024, 3M and BASF Coatings are collaborating to create sustainable standard operating procedures (SOPs) and training for the collision repair industry, debuting in early 2025. These SOPs aim to reduce material waste, emissions, and inefficiencies while improving productivity and quality. The initiative highlights both companies' commitment to advancing sustainability in automotive refinishing processes. Moreover, increasing environmental concerns and stringent regulations over chemical usage have led to innovation towards eco-friendly substitutes, such as waterborne and non-toxic coatings.

Automotive Refinish Coatings Market Trends:

The increasing vehicle ownership and usage

As the number of vehicles on the road continues to rise, there is a corresponding increase in wear and tear and automotive refinish coatings market share. For instance, Indian passenger vehicle sales increased by 4.4% in November 2024. The vehicles are often exposed to various environmental factors such as sun, rain, snow, and road debris throughout life cycles, which cause fade out, chipping out of paint, and deterioration on the surface. Regular maintenance and refinishing services aid in restoring the appearance of these vehicles and preventing further degradation. Vehicle owners are focusing on maintaining the aesthetic value of their investments, which is leading to increased demand for these coatings. Vehicle owners also want a personal touch, and several people want to individualize their cars and display their personality, so there is a huge need for customization in coatings. The trend is no longer only among hard-core auto enthusiasts but is now seen increasingly among consumers who wish to use their vehicles to express themselves.

The development of eco-friendly and high-performance coatings

The development of environmentally friendly coatings that are made with fewer or no volatile organic compounds (VOCs) is in line with stricter laws and growing environmental consciousness. Also, due to the lower emissions compounds, these coatings help to enhance air quality and lessen their influence on the environment. For instance, INX International's USD 50 Million Venture Capital program invests in DetraPel, advancing eco-friendly, high-performance coatings, supporting sustainability in the coatings industry. Manufacturers and companies that ensure greener alternatives position themselves to be responsive and sensitive toward the environment. It helps sustain its reputation and attracts customers and other stakeholders involved in the industry. The performance level of eco-friendly coatings has gained popularity with the traditional solvent-based coatings and even surpassed them in performance. These coatings demonstrate excellent adhesion, weather resistance, UV protection, and corrosion prevention. With high performance and reduced environmental impact, refinished surfaces become longer lasting and attract more consumers, thereby expanding the automotive refinish market size.

Favourable Regulatory Environment

The implementation of government regulations is prompting manufacturers to invest in research and development (R&D) activities in coating formulations with lower levels of VOCs and hazardous air pollutants. These regulations have led to cleaner formulation, and as a result, water-based and low-VOC coatings have resulted in reduced emissions and decreased harmful impact on air quality. These high-tech coatings meet the rising consumers' environmental concerns regarding the products being purchased. Stringent environmental norms have increased collaboration and partnerships among coating manufacturers, automotive companies, and regulatory bodies. The collaborations are reshaping the automotive refinish coatings market trends and providing a positive outlook for the market.

Automotive Refinish Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive refinish coatings market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on resin type, product type, technology, and vehicle type.

Analysis by Resin Type:

- Polyurethane

- Alkyd

- Acrylic

- Others

Polyurethane stand as the largest component in 2024, holding around 54.9% of the market. Automotive refinish coatings are required to be resistant to multiple environmental stressors in terms of UV radiation, extreme temperatures, and harsh weather conditions. The resistance of polyurethane coatings is remarkable and ensures that refinished vehicles maintain their looks as well as protection over extended periods. This ability reduces the free need for the refinishing process, thereby saving costs and keeping customer satisfaction high. The other advantage of polyurethane coatings is that they offer high versatility in appearance and finish. It can be formulated to provide gloss, matte, or various textured finishes to match the desired aesthetics of different vehicles. In the automotive industry, such versatility is particularly crucial and is therefore contributing to the overall segment growth, as consumers value individuality and unique designs.

Analysis by Product Type:

- Primer

- Basecoat

- Activator

- Filler

- Topcoat

- Others

Basecoat leads the market with around 35.0% of market share in 2024. Base coat formulations consist of colored pigments that deliver the desired hue to the vehicle's surface. This layer serves as the foundation for the final color and visual appeal of the vehicle. Automotive enthusiasts, as well as customers seeking personalized aesthetics, highly value the color options and finishes that base coat can provide. This demand for diverse and appealing vehicle colors significantly drives the preference for base coat products. Moreover, the popularity of base coat popularity is attributed to its compatibility with advanced painting techniques such as two-stage painting systems, which is resulting in a higher product uptake.

Analysis by Technology:

- Solvent-borne

- Water-borne

- UV-cured

Solvent-borne leads the market with around 47.5% of market share in 2024. Solvent-borne coatings offer excellent durability and a premium finish. Coatings in this category usually possess better adhesion, corrosion resistance, and color retention than many of their alternatives. Such performance is critical for the automotive refinish segment, which demands that coatings resist numerous environmental stresses such as sun exposure, weathering, and chemical pollution. In addition, solvent-borne coatings are characterized by good flow and leveling properties, which contribute to a smooth, even finish. The increasing number of consumers preferring visually appealing, mirror-like finishes are therefore making this technology the most preferred option.

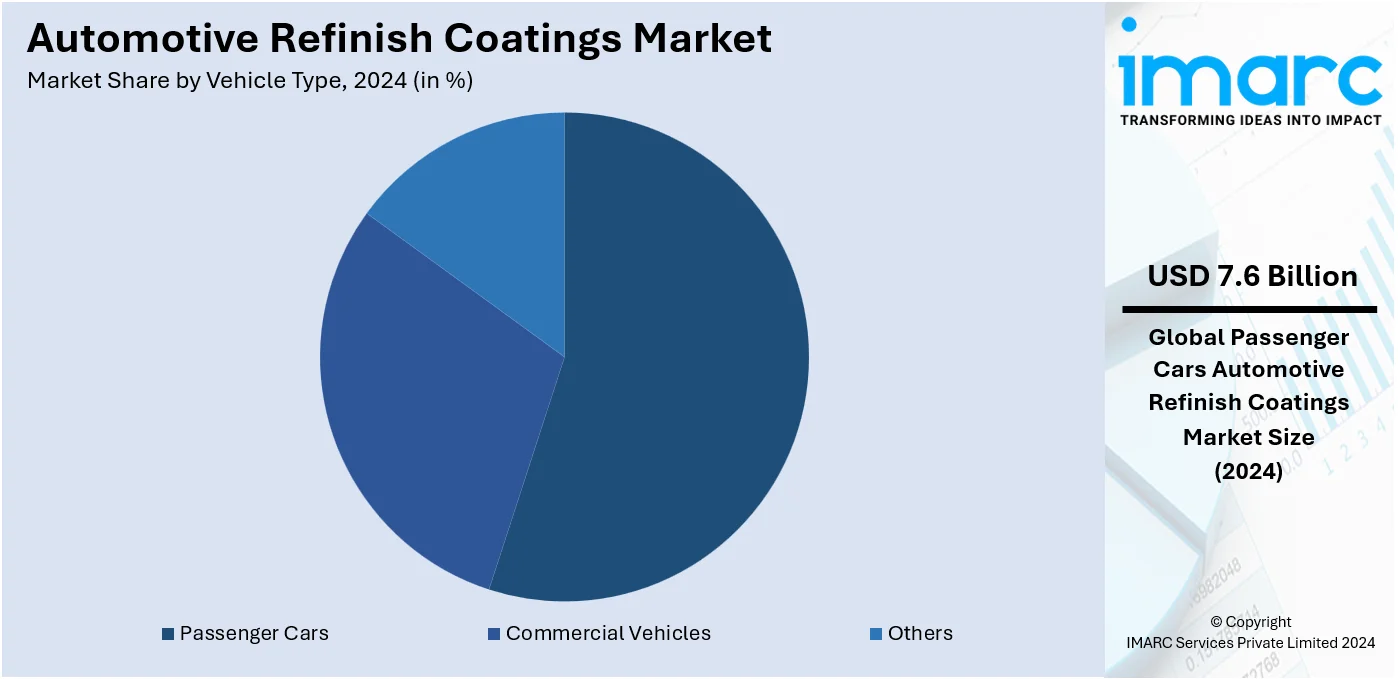

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Others

Passenger cars lead the market with around 69.7% of market share in 2024. The sheer volume of passenger cars on the road contributes to their dominant market share. Passenger cars belong to a large section of the total automotive sector, their fleet, therefore. It undergoes accidental, weather-induced damages as well as sheer user-caused wear and tear. The demand level of necessity to refinish or redecorate passenger cars is relatively higher than other vehicles. Furthermore, in addition to the aesthetic looks, most passenger car owners tend to maintain their automobiles' general condition, which is another significant factor contributing to the popularity of the segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37.5%. Economic development in Asia Pacific has resulted from inflating disposable incomes and rapid urbanization that have occurred over the last few decades. Increased car ownership throughout the region resulted from economic expansion. Rising vehicle ownership, in turn, increases greater demand for automotive refinish coatings. With a growing number of people and businesses with cars, so also will the demand for maintenance, repair, and refinishing activities. Emerging countries, especially China, India, and Southeast Asia, have a developing middle-class population and are witnessing massive growth in the industrial sector.

Key Regional Takeaways:

United States Automotive Refinish Coatings Market Analysis

In 2024, the United States accounted for 88.50% of the North America automotive refinish coatings market. The growing demand for eco-friendly and high-performance coatings has led to a rise in the adoption of automotive refinish coatings in the United States. As environmental concerns continue to grow, both consumers and businesses are seeking sustainable solutions in vehicle maintenance and repair. For instance, in the United States, toxic releases in the coatings sector have decreased by over 80%, with production waste reduced by 48% and 97% of waste solvents being reclaimed for future use. As such, eco-friendly formulations like water-based and low VOC formulations have become very popular as they have a rather negligible environmental impact compared with traditional coatings. Concurrently, there is an increasing demand for coatings that beautify and render vehicles durable. High-performance coatings have been highly preferred by professionals as well as DIY vehicle refinishing due to their ability to withstand corrosion and environmental stresses. This shift is fueled by the preference for better value retention in long-lasting and high-quality finishes that contribute to the value of the vehicle. Additionally, stricter regulations related to emissions and environmental protection in the region have further encouraged the use of advanced coating technologies.

Asia Pacific Automotive Refinish Coatings Market Analysis

In Asia-Pacific, the expansion of the automotive sector has significantly contributed to the rising adoption of automotive refinish coatings. According to India Brand Equity Foundation, the automotive sector has attracted a cumulative equity FDI inflow of approximately USD 35.40 Billion from April 2000 to September 2023, highlighting its rapid growth. This substantial investment highlights the industry's expanding global presence and its potential for further development. Growing production and sales of vehicles both in developed and emerging markets have created a need for repair and maintenance services, thus increasing the requirement for automotive coatings. As the number of vehicle usage continues to increase, the requirement for high-quality refinish solutions to maintain and restore vehicle appearance and performance also increases. The growth of the automotive manufacturing industry, along with rapidly increasing vehicle ownership, has also led to greater attention being paid to refinish services, and so has the growth in the automotive refinish coatings market. The current trend towards increasing aesthetic enhancement as well as customizing maintenance of vehicles propels further demand for such innovative coatings that benefit both aesthetically and functionally. With the changing dynamics of consumer preferences, companies continue to develop coatings that provide better durability, more resistance to UV, and easy application, catering to the diverse needs of this automobile sector in the entire region.

Europe Automotive Refinish Coatings Market Analysis

In Europe, the increasing vehicle ownership has played a significant role in driving the adoption of automotive refinish coatings. According to International Council on Clean Transportation, 2023 marked a notable rise in new car registrations across all European Union Member States, with approximately 10.6 million new vehicles registered, reflecting a 14% increase from 2022. This growth represents the first overall increase in registrations since 2019. As the vehicle fleet expands across the region, the need for vehicle repairs, maintenance, and cosmetic refinishing has grown substantially. Many consumers opt for refinishing services to restore their vehicles’ appearance and extend their lifespan, contributing to the market's growth. Vehicle owners have become more discerning regarding the quality of coatings used, with a preference for finishes that offer enhanced protection against environmental factors, such as UV radiation, weathering, and scratches. This growing demand for high-quality refinish coatings is also influenced by the region's strict environmental regulations, which encourage the use of low-VOC and eco-friendly coating solutions. Furthermore, the increasing rates of automobile accidents and the requirement to resurface them provide increased requirements for refinishing products. The continued expansion in the automotive sector and rising awareness and importance of automobile's attractiveness and protection are propelling the demand for coatings products in the auto refinishing market.

Latin America Automotive Refinish Coatings Market Analysis

In Latin America, inflating disposable income has significantly contributed to the growing adoption of automotive refinish coatings. For instance, the rising disposable income in Latin America, projected to increase by 60% from 2021-2040, is driven by narrowing regional disparities, technological progress, and a shift towards higher value-added industries. As consumers' purchasing power increases, many vehicle owners are more inclined to invest in vehicle maintenance and refinishing services to preserve and enhance the appearance of their cars. This trend is particularly evident among the growing middle class, which now has greater access to automotive services, including high-quality coatings. Rising vehicle ownership has created a huge demand for vehicle repairs that often involve refinishing. As disposable income continues to rise, consumers are more likely to prioritize the long-term value of their vehicles, leading to greater investments in refinishing products. This, in turn, drives the automotive refinish coating market, with a growing number of consumers opting for coatings that offer durability, better aesthetics, and protection against harsh environmental factors, all of which contribute to the market's expansion in the region.

Middle East and Africa Automotive Refinish Coatings Market Analysis

In the Middle East and Africa, the adoption of automotive refinish coatings is accelerating due to growing urbanization and infrastructure development. Rapid urban growth in key metropolitan areas is contributing to a higher number of vehicles on the road, which in turn increases the need for repair and maintenance services, including refinishing. The Ministry of Energy and Infrastructure, UAE has undertaken 129 development projects valued at approximately USD 3.21 Billion as part of its five-year plan (2018-2023). This initiative aims to strengthen the nation's growth in terms of infrastructure. With generally improved infrastructure, including road networks, an increase has been witnessed in the possession of vehicles, while the need for quality coatings has grown. Cities become more modernized and house more cars, so an increased requirement for vehicle maintenance and repair services automatically builds up the automotive refinish coatings market.

Competitive Landscape:

Automotive refinishing coatings have a very competitive landscape due to the high requirements for durability and high performance in coatings used in car repair and customizations. The industry has many participants, including established companies to smaller, specialized companies. The eco-friendly and low-VOC innovation sets a differentiator for players due to stringent global regulations. Market dynamics are expected to change with advancement of technology, increasing consumers' expectations about high-quality finish, and increasing ownership rates of cars in developing nations. The development of creating coatings that have increased durability, faster drying times, accuracy in color, and reduced environmental impact, thus obtaining better revenue in the market of automotive refinish coatings. An effective distribution network as well as after-sales support are significant to maintain market position.

The report provides a comprehensive analysis of the competitive landscape in the automotive refinish coatings market with detailed profiles of all major companies, including:

- 3M Company

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF SE

- Berger Paints India Limited

- Clariant AG

- Dow Inc.

- Kansai Paint Co. Ltd.

- KCC Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- The Sherwin-Williams Company

Latest News and Developments:

- December 2024: McLarens Group launched the 3M Ceramic Coating in Sri Lanka, marking a significant advancement in the automotive aftermarket. This innovative product provides vehicles with exceptional protection and a durable, long-lasting shine. The launch, which includes premium 3M automotive products, is a first for the Sri Lankan market.

- December 2024: Brenntag Specialties expanded its exclusive distribution agreement with 3M to include Glass Bubbles as additives for coatings, plastics, and construction materials in France and Iberia. This builds on the successful collaboration with 3M in the UK and will take effect on January 1, 2025. The agreement enables full access to 3M Glass Bubbles for customers in the CASE, Construction, Polymer, and Rubber industries in these regions.

- December 2024: AkzoNobel’s Marine and Protective Coatings business entered a Memorandum of Cooperation with Sinopec to support the Chinese company's global expansion and promote green energy. This partnership builds on their long-standing relationship since the early 2000s, focusing on supplying International® high-performance coatings for Sinopec's overseas construction projects. The collaboration aims to drive sustainable energy solutions worldwide.

- December 2024: BASF inaugurated a new Application and Technical Center in Jiangmen, China, focusing on the innovation and development of waterborne automotive coatings. This facility enhances BASF's R&D capabilities in the Asia-Pacific region, which is a key global automotive market. The center aims to drive advancements in testing and application for sustainable coatings solutions. The move aligns with BASF's strategy to support the growing demand for eco-friendly automotive products.

- September 2024: BASF Coatings introduced its first ChemCycling® products to the automotive refinish market, leveraging advanced mass balance technology. The new premium clearcoats, made from recycled waste tires, are added to the Glasurit® Eco Balance and R-M® eSense portfolios. The products were unveiled at Automechanika 2024, advancing sustainability in the automotive aftermarket industry.

Automotive Refinish Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Alkyd, Acrylic, Others |

| Product Types Covered | Primer, Basecoat, Activator, Filler, Topcoat, Others |

| Technologies Covered | Solvent-Borne, Water-Borne, UV-Cured |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | 3M Company, Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, Berger Paints India Limited, Clariant AG, Dow Inc., Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Holdings Co., Ltd., PPG Industries Inc., The Sherwin-Williams Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive refinish coatings market from 2019-2033.

- The automotive refinish coatings market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive refinish coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive refinish coatings market was valued at USD 10.91 Billion in 2024.

IMARC estimates the global Automotive Refinish Coatings market to exhibit a CAGR of 3.65% during 2025-2033.

The key factors driving the market include the rising demand for vehicle aesthetics, increasing vehicle repairs and maintenance activities, technological advancements in coating solutions, and growing vehicle production and sales globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market with a market share of 37.5%.

Some of the major players in the global automotive refinish coatings market include 3M Company, Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, Berger Paints India Limited, Clariant AG, Dow Inc., Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Holdings Co., Ltd., PPG Industries Inc., and The Sherwin-Williams Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)