Automotive Rain Sensor Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, and Region, 2025-2033

Automotive Rain Sensor Market Size and Trends:

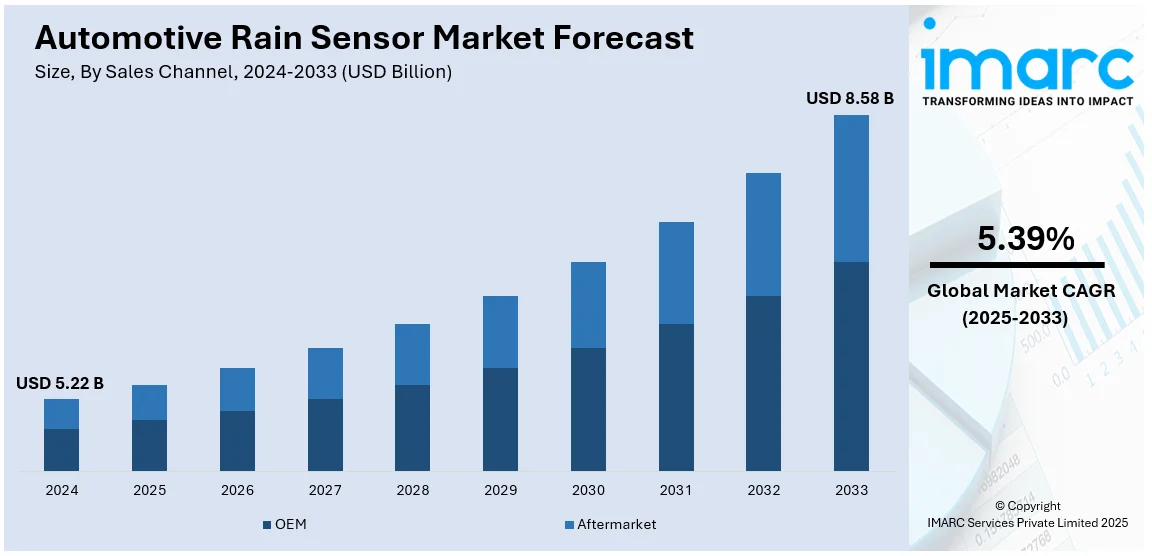

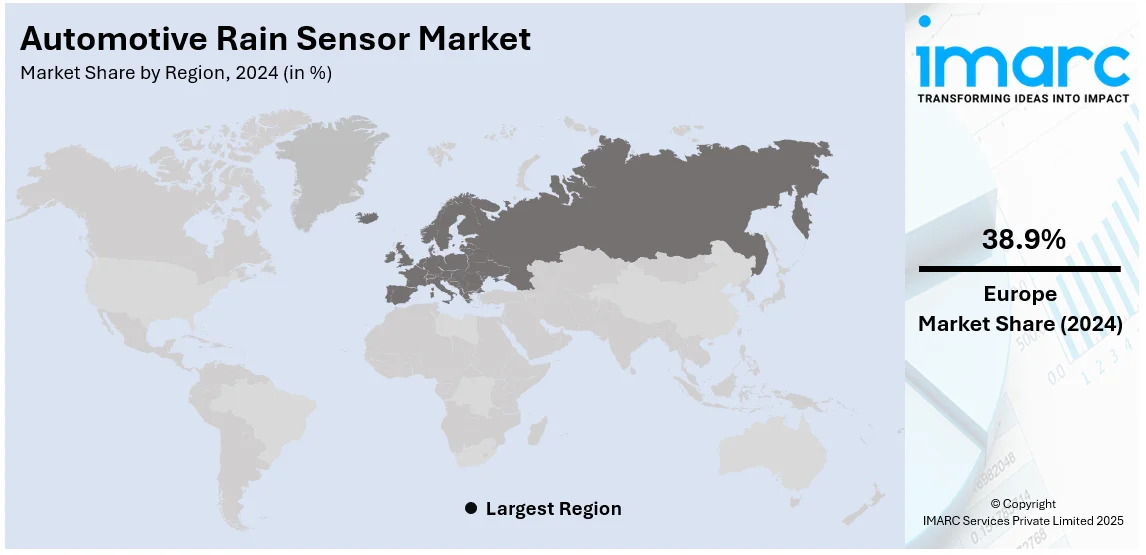

The global automotive rain sensor market size was valued at USD 5.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.58 Billion by 2033, exhibiting a CAGR of 5.39% during 2025-2033. Europe currently dominates the market, holding a market share of over 38.9% in 2024. Rapid technological advancements, growing demand for driver assistance systems, increased vehicle safety regulations, rising preference for electric vehicles, focus on autonomous driving, smart transportation infrastructure, cost-effective sensor solutions, connected vehicle integration, environmental sustainability efforts, advanced manufacturing techniques, and ongoing R&D investments are some of the major factors propelling the automotive rain sensor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.22 Billion |

| Market Forecast in 2033 | USD 8.58 Billion |

| Market Growth Rate (2025-2033) | 5.39% |

The global automotive rain sensor market demand is primarily driven by the rapid technological advancements in sensor technologies, enhancing vehicle performance and safety. Along these lines, the increasing demand for advanced driver assistance systems (ADAS) is also fueling the market. Moreover, the rising importance of vehicle safety regulations in various regions is boosting the automotive rain sensor market growth. Additionally, increasing interest in autonomous driving technology is creating novel opportunities for sensing technologies, therefore accelerating the expansion of the market. The industry is also catalyzed by the introduction of cost-effective yet reliable sensor solutions tailored for mass-market vehicles. On 19th November 2024, onsemi announced that its Hyperlux sensors have been selected by Subaru for integration into the automaker’s next-generation AI-based EyeSight system. This collaboration is expected to enhance the vehicle’s ADAS by improving the accuracy of driver monitoring and object detection. The adoption of Hyperlux sensors aligns with the growing demand for advanced automotive sensors, including rain sensors, which play a crucial role in optimizing driver safety and vehicle performance.

The United States stands out as a key regional market, which is mainly due to the growth in autonomous and semi-autonomous vehicles. In addition, the rising need for electric and hybrid vehicles in the U.S. is helping the demand for sensors that measure vehicle performance and energy consumption. Besides this, the fast-paced developments in AI and machine learning technologies that are being implemented in vehicle systems open up new opportunities for automotive sensor applications. Apart from this, the improving infrastructure for smart cities and connected vehicle ecosystems is further accelerating the market growth. The market is further supported through the key presence of automotive manufacturers as well as technology innovators within the U.S. to drive the development of next-generation sensor solutions. Other contributing factors include an increased focus on reducing vehicular accidents and rising need for smart, connected vehicle systems.

Automotive Rain Sensor Market Trends:

Increasing emphasis on vehicle safety and ADAS integration

As concerns for road safety continues to rise, automotive manufacturers are now working to integrate the latest safety features into their vehicles. Rain sensors play a very important role in enhancing driving safety in adverse weather conditions such as rain, snow, or fog. The sensor can detect rainfall on the windshield and automatically activate the wipers at an appropriate speed to ensure clear visibility for the driver. With the help of rain sensors, reducing distraction as well as the need to readjust wiper blades manually has been helpful in preventing accidents, as it significantly reduces visibility. With the spread of ADAS, rain sensors are becoming a part of the safety suite and will further increase adoption in modern vehicles. CRISIL projects that by fiscal 2028, around 55-60% of total passenger vehicle sales with ADAS features will be dominated by utility vehicles, with compact utility vehicles accounting for 20-25%, midsize vehicles for 10-15%, and hatchbacks/small cars making up the remaining 3-7%.

Growing consumer demand for convenience and comfort features

The modern customer is more conscious of convenience and comfort in a vehicle. As such, increased demand for rain sensors and other intelligent and automated features has provided a boost to the adoption rates. Rather than operating wipers manually, the drivers can depend on rain sensors to take care of the task. This is particularly helpful during sudden changes in weather, since the rain sensors can immediately react to rainfall intensity, making appropriate adjustments in the speed of the wiper. The United States Environmental Protection Agency states that since 1901, global precipitation has risen at an average rate of 0.03 inches per decade, whereas precipitation in the contiguous 48 states has increased at a rate of 0.18 inches per decade. Consequently, automakers are incorporating rain sensors in mid-range and high-end car models to cater to customer preferences, propelling the market growth.

Government regulations and safety standards

Government regulations and various safety standards adopted by countries worldwide have significantly encouraged the use of automotive rain sensors. In several areas, governments have now made it mandatory for automobiles to satisfy specific safety norms and install rain sensors. Such regulation aims to lower accidents resulting from low visibility while raining. According to WHO, road traffic crashes result in the deaths of approximately 1.19 million people around the world each year. As a result, automakers are compelled to include rain sensors in their vehicles to meet the mandated safety standards, creating a positive outlook for market expansion. Apart from this, favorable government incentives and initiatives promoting road safety and the use of advanced safety technologies have further impelled the integration of rain sensors in automobiles.

Automotive Rain Sensor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive rain sensor market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type and sales channel.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicle

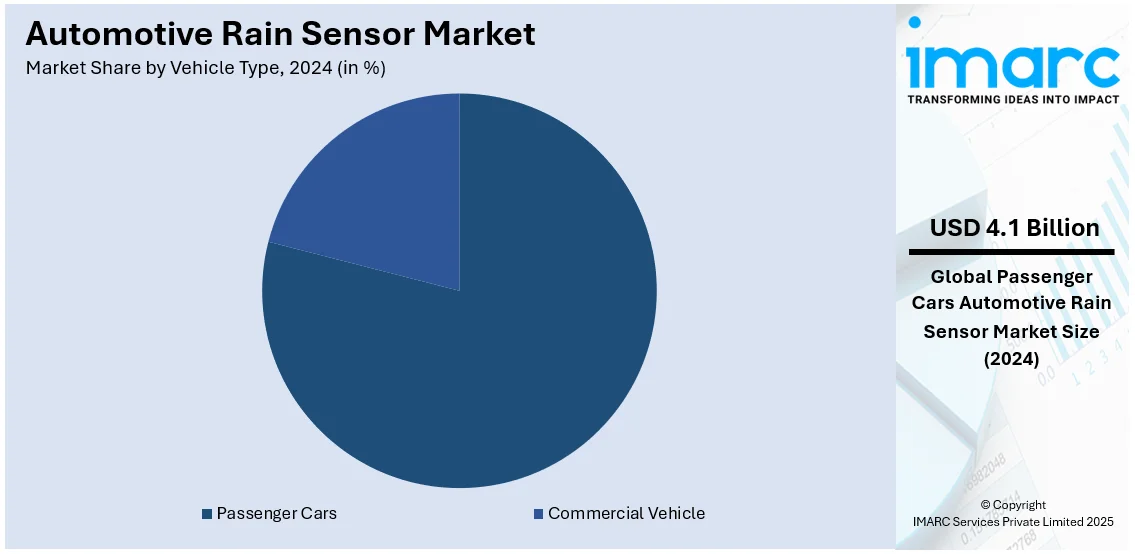

As per the automotive rain sensor market outlook, passenger cars stand as the largest component in 2024, holding around 78.7% of the market. The growing tendency of individuals buying and using premium and luxury passenger car models with ADAS is contributing to the growth of rain sensors' market. Moreover, as manufacturers of these vehicles attempt to improve the overall experience of driving such automobiles, especially in safety terms, rain sensors have been included as a convenient feature to enhance driving in poor weather. Additionally, the trends of urbanization, and the enhancement in income have resulted in an increase in the number of consumers buying and using passenger cars, especially in the urban area where visibility while driving in heavy rain is of considerable importance. Therefore, the demand for rain sensors as a safety and comfort feature has increased among the urban commuters who want a more advanced driving experience.

Analysis by Sales Channel:

- OEM

- Aftermarket

Based on the recent automotive rain sensor market forecast, OEM leads the market with around 62.5% of market share in 2024. The growing emphasis on vehicle safety and regulatory norms across the globe has motivated car manufacturers to fit their vehicles with advanced safety technologies. Rain sensors are one of the most important technologies that improve driving visibility in adverse weather conditions, thereby reducing the chances of accidents resulting from poor visibility caused by rain or snow. This leads to OEMs integrating rain sensors into their cars to satisfy safety criteria and remain at the top in the market. Simultaneously, growing awareness of consumers to safety features, and a strong preference for the vehicle fitted with driver assistance system, are pushing up the demand of OEM rain sensors. Moreover, an increasing number of consumers expect their vehicles to be integrated with cutting-edge safety technologies, such as rain sensors, which are propelling the market forward.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 38.9%. Europe experiences diverse weather conditions throughout the year, including frequent rain, snow, and fog in various regions. As a result, there is a heightened need for reliable and efficient rain sensors to ensure optimal visibility during inclement weather, enhancing road safety for drivers and pedestrians. Moreover, stringent European regulations and safety standards prioritize vehicle safety, encouraging automakers to integrate advanced safety technologies into their vehicles, including rain sensors. Additionally, consumers' inclination towards premium and high-end vehicle models with ADAS has further boosted the demand for rain sensors, as these sensors are often included as standard or optional features in such vehicles, providing added convenience and safety for drivers in challenging weather conditions.

Key Regional Takeaways:

United States Automotive Rain Sensor Market Analysis

The growing adoption of automotive rain sensors in the United States is driven by increased investments in vehicle safety technologies. According to reports, by 2026 over 60% of new vehicles sold in the U.S. have some form of ADAS. As awareness regarding the importance of road safety continues to rise, manufacturers are incorporating more advanced features into their vehicles, including rain sensors. These sensors automatically detect rain and activate windshield wipers, ensuring optimal visibility for drivers during inclement weather. With a focus on reducing accidents and enhancing driving conditions, particularly in adverse weather situations, there is a growing emphasis on advanced sensor technologies. The continued push for regulatory standards requiring safety features in vehicles further accelerates the integration of rain sensors. As a result, vehicles equipped with these sensors are becoming more common, making them a standard feature in many car models and contributing to their increased adoption across the country.

Asia Pacific Automotive Rain Sensor Market Analysis

In the Asia-Pacific region, the adoption of automotive rain sensors is being driven by the rising investments in the automobile sector. According to the India Brand Equity Foundation data, the automobile industry secured a cumulative equity FDI capital of over USD 35.65 Billion from April 2000 to December 2023. Countries within this region are focusing on innovation and the development of advanced vehicle technologies to meet consumer demand for enhanced safety and comfort features. As more automobile manufacturers shift towards producing vehicles with greater safety and convenience features, the integration of rain sensors is becoming more widespread. These sensors, which adjust windshield wipers automatically based on rain intensity, contribute to improved visibility and road safety. The expanding middle class, increasing disposable incomes, and growing demand for more advanced vehicles are all helping to accelerate the use of rain sensors in cars across the region. With more vehicles being sold in the region, the automotive rain sensor market is expanding rapidly.

Europe Automotive Rain Sensor Market Analysis

In Europe, the growing adoption of automotive rain sensors can be attributed to the rising vehicle ownership across the continent. According to International Council on Clean Transportation, about 10.6 million new cars were registered in the 27 Member States in 2023, 14% more than in 2022. As more people own vehicles, the need for advanced safety features has increased. European drivers are placing greater importance on innovations that improve visibility, particularly during rainy or foggy conditions. Rain sensors provide an automatic and efficient solution by adjusting the wiper speed according to the intensity of the rain, ensuring that drivers have clear views of the road. With the push for increased vehicle safety features, governments have also implemented regulations that encourage the use of such technologies in new vehicles. As a result, automotive manufacturers in Europe are increasingly incorporating rain sensors into their vehicles, meeting both consumer demand and regulatory requirements. This trend is helping to further drive the adoption of these sensors in European automobiles.

Latin America Automotive Rain Sensor Market Analysis

The increasing adoption of passenger cars in Latin America is largely driven by the growing disposable income of the population. For instance, total disposable income in Latin America is set to rise by nearly 60% in real terms over 2021-2040. As more individuals can afford to purchase vehicles, there is a growing demand for cars with advanced safety features, including rain sensors. These sensors offer the convenience of automatically activating windshield wipers when rain is detected, providing optimal visibility, and reducing driver distraction. This feature is becoming increasingly attractive to consumers who prioritize comfort and safety, especially as road conditions in the region can be unpredictable and often include heavy rainfall. As disposable income continues to rise in Latin America, there is a greater opportunity for manufacturers to introduce vehicles equipped with these advanced features, driving the market for rain sensors in the region.

Middle East and Africa Automotive Rain Sensor Market Analysis

In the Middle East and Africa, the growing adoption of automotive rain sensors is being driven by the increasing need for improved visibility and road safety during inclement weather. According to reports, with 352 road deaths in 2023, a three percent increase from 2022. As the number of vehicles on the road rises, accidents caused by poor visibility during rainstorms have also become a growing concern. Rain sensors provide a valuable solution by ensuring that windshield wipers adjust automatically to changing weather conditions, enhancing driver visibility and safety. With accidents due to inclement weather on the rise, vehicle manufacturers are more focused on integrating technologies that can reduce such risks. The increased focus on safety features has led to a surge in the adoption of rain sensors across the region, helping to prevent accidents and improve driving conditions in unpredictable weather.

Automotive Rain Sensors Key Market Players & Competitive Insights:

To support the growth of the automotive rain sensor market, leading companies are making substantial investments in research and development to diversify and enhance their product portfolios. Some of the strategic developments comprise new product launches, agreements and contracts, mergers and acquisitions, expanded investments, and collaborations, all to build a greater presence in the global market. Cost-effective solutions are the primary focus of the industry with respect to changing market dynamics. A major strategy adopted by manufacturers to control operational costs is the establishment of local production facilities, which are pretty helpful to customers and boost sector growth. Major players are working hard to stimulate demand through R&D initiatives. They also create specialized vehicle offerings such as headlamps, rear combination lamps, and car body lighting, reaching out to wholesales, garages, and OEMs with innovative solutions.

Competitive Landscape:

Major players in the automotive rain sensors market are focusing on developing advanced, high-precision sensor technologies, such as optical and capacitive sensors, to improve rain detection accuracy. They are also integrating these sensors into broader driver assistance systems (ADAS) and autonomous vehicle platforms, meeting increasing demand for safety and convenience features. Additionally, companies are investing in strategic partnerships, product innovation, and expanding their global reach through collaborations with automakers and technology providers, ensuring compatibility with next-generation vehicles. Furthermore, they are enhancing product offerings to support eco-friendly initiatives, aiming for cost-effective solutions without compromising on performance.

The report provides a comprehensive analysis of the competitive landscape in the automotive rain sensor market with detailed profiles of all major companies, including:

- ams-OSRAM AG

- Casco Logistics GmbH

- Denso Corporation

- Ford Motor Company

- HELLA GmbH & Co. KGaA (Faurecia SE)

- Leopold Kostal GmbH & Co. KG

- Semiconductor Components Industries LLC

Latest News and Developments:

- January 2025: Tata Motors is enhancing vehicle safety by integrating artificial intelligence (AI) and advanced technologies, focusing on pre-accident prevention, crash management, and post-accident support. The company uses a combination of radars and cameras to ensure optimal performance in various conditions, including fog and rain, further emphasizing the adoption of automotive rain sensors. This comprehensive approach aims to protect both occupants and vulnerable road users.

- December 2024: Ansys has partnered with Sony Semiconductor Solutions to advance scenario-based perception testing for autonomous vehicles (AVs) and ADAS. This collaboration enhances the validation of automotive rain sensors and other sensor systems under various weather and lighting conditions. By leveraging Ansys' AVxcelerate Sensors and Sony’s HDR image sensor model, OEMs can now simulate and test vehicle performance in rain, snow, and fog scenarios. This significantly accelerates road testing and improves safety validation for AVs.

- October 2024: Volkswagen India has launched the Virtus GT Plus Sport and GT Line, featuring sporty aesthetics and advanced technologies, including rain-sensing wipers. The new lineup includes enhancements like a digital cockpit, electric sunroof, and auto-dimming IRVM. Positioned as a segment leader, the Virtus GT Plus Sport offers 23 aesthetic and feature updates. The Highline Plus variant also debuts with a rain sensor and additional premium features.

- September 2024: Hyundai unveiled the facelifted Alcazar, with enhanced safety features. The updated SUV includes Level 2 ADAS and key upgrades such as rain-sensing wipers, adaptive cruise control, and lane-keeping assist. These additions aim to elevate driver convenience and passenger safety. The Creta-based three-row model also enhances second-row comfort, emphasizing a premium experience.

- May 2024: Valeo Rakovník, a leading automotive technology manufacturer in the Czech Republic, is driving advancements in safer mobility with the production of key components like ultrasonic and automotive rain sensors. With cutting-edge automated manufacturing processes and a commitment to high industrial standards, the facility produces high-tech components for autonomous driving, including cameras and sensors. As Valeo continues to innovate, the plant plays a vital role in the development of ADAS and autonomous systems, reinforcing its position as a leader in the automotive sector.

- January 2024, Tata Motors unveiled the Punch EV, a mid-sized electric SUV featuring advanced safety technology, including rain-sensing wipers, automatic headlights, and a 360° parking camera. The Punch EV caters to growing consumer demand for smart, eco-friendly vehicles. Its innovative features position it competitively in the evolving EV market.

Automotive Rain Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicle |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ams-OSRAM AG, Casco Logistics GmbH, Denso Corporation, Ford Motor Company, HELLA GmbH & Co. KGaA (Faurecia SE), Leopold Kostal GmbH & Co. KG, Semiconductor Components Industries LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive rain sensor market from 2019-2033.

- The automotive rain sensor market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive rain sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive rain sensor market was valued at USD 5.22 Billion in 2024.

IMARC estimates the automotive rain sensor market to exhibit a CAGR of 5.39% during 2025-2033, reaching a value of USD 8.58 Billion by 2033.

The automotive rain sensor market is driven by the growing demand for advanced driver assistance systems (ADAS), increased vehicle safety standards, rising consumer preference for convenience features, the adoption of automated and autonomous vehicles, and continuous advancements in sensor technologies for more accurate environmental detection and wiper performance optimization.

Europe currently dominates the global automotive rain sensor market, accounting for a share exceeding 38.9%, fueled by the region's stringent safety regulations, high adoption of advanced driver assistance systems (ADAS), presence of major automotive manufacturers, strong technological advancements, and growing consumer demand for comfort and convenience features in vehicles.

Some of the major players in the automotive rain sensor market include ams-OSRAM AG, Casco Logistics GmbH, Denso Corporation, Ford Motor Company, HELLA GmbH & Co. KGaA (Faurecia SE), Leopold Kostal GmbH & Co. KG, and Semiconductor Components Industries LLC, among others.

Passenger cars lead the vehicle type segment of the automotive rain sensor marker.

OEM led the sales channel segment of the automotive rain sensors market with a 62.5% market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)