Automotive Radar Market Size, Share, Trends and Forecast by Range, Vehicle Type, Application, and Region, 2026-2034

Automotive Radar Market Size and Trends:

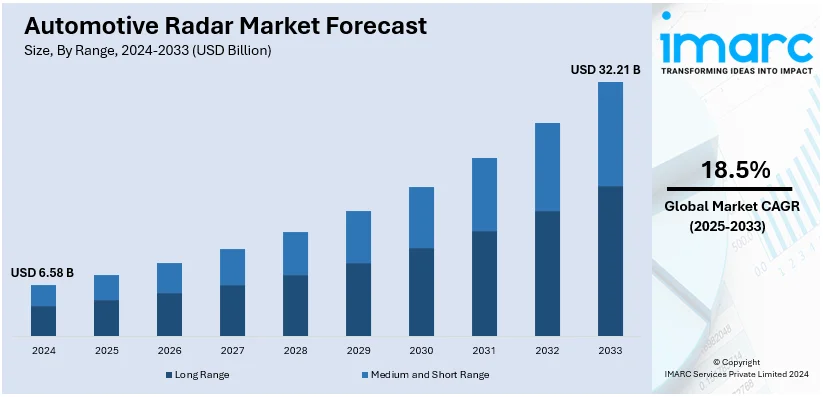

The global automotive radar market size was valued at USD 6.58 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 32.21 Billion by 2034, exhibiting a CAGR of 18.5% from 2026-2034. Asia Pacific currently dominates the automotive radar market share, holding a market share of over 54.9% in 2024. The growth of the Asia-Pacific region is driven by rising vehicle production, increasing adoption of advanced safety systems, regulatory mandates, and advancements in radar sensor technologies.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.58 Billion |

|

Market Forecast in 2034

|

USD 32.21 Billion |

| Market Growth Rate (2026-2034) | 18.5% |

Governing bodies and regulatory agencies globally are enforcing stricter safety standards to reduce road accidents. Mandatory inclusion of features like collision avoidance systems, which depend on radar sensors, is supporting the market growth. Moreover, continuous innovations in radar technology are resulting in improved performance, such as enhanced accuracy, better range, and reduced size and cost. These advancements make radar systems more feasible for integration into vehicles, ranging from budget-friendly models to high-end luxury cars, widening their market scope. Besides this, the development of autonomous and semi-autonomous vehicles is driving the demand for radar systems. Automotive radar provides reliable object detection, speed measurement, and distance calculation, all critical for autonomous navigation.

The United States plays a crucial role in the market, driven by the growing user awareness about safety technologies. The rising preference for vehicles equipped with advanced features like lane-keeping assist and blind-spot detection is encouraging the adoption of radar systems in passenger and commercial vehicles. Additionally, the continuous introduction of advanced radar technologies that enhance detection capabilities, improve decision-making accuracy, and optimize system integration, supporting the growing demand for compact and efficient radar solutions. In 2024, Texas Instruments (TI) introduced the AWR2544, the first 77GHz millimeter-wave radar sensor designed for satellite radar architectures, at CES 2024, in Las Vegas. The sensor improves ADAS decision-making by extending detection ranges beyond 200 meters and reducing sensor size by up to 30%. TI also unveiled other semiconductors for battery management and powertrain systems, emphasizing safety and efficiency.

Automotive Radar Market Trends:

Increasing Demand for Advanced Driver-assistance Systems (ADAS)

Advanced driver-assistance system (ADAS) technologies rely heavily on automotive radar systems for object detection, distance measurement, and collision avoidance. For instance, radar-based adaptive cruise control (ACC) systems use radar sensors to maintain a safe distance from the vehicle ahead, automatically adjusting the speed. The penetration of ADAS has expanded to 14 features across model years 2015 through 2023, reports the PARTS study set. For the 2023 model year, penetration rates for these features range between 22% and 94%, with 10 of the 14 features having penetrated above the 50% threshold. These large gains represent an enthusiastic and diligent action by the automotive industry to ensure advanced driver assistance is introduced into all new vehicles. Similarly, radar-based collision warning systems detect potential collisions and provide timely alerts to the driver. The increasing adoption of these radar-based ADAS features directly drives the demand for automotive radar systems. Moreover, manufacturers are constantly improving radar technology to enhance accuracy, range, resolution, and overall performance. These advancements lead to more sophisticated radar sensors that can support advanced ADAS functionalities, further fueling the growth of the automotive radar market share.

Implementation of Government Regulations and Safety Standards

Governments and regulatory bodies around the world are implementing safety regulations that require certain features to be incorporated into vehicles. As stated in the WHO report, around 1.19 million individuals lose their lives annually due to road traffic accidents. Many of these regulations focus on enhancing vehicle safety and reducing accidents. For instance, requirements for autonomous emergency braking (AEB) systems and forward collision warning (FCW) systems are becoming increasingly common. Automotive radar plays a crucial role in these safety features, as it enables object detection and collision avoidance. The implementation of such regulations directly drives the demand for automotive radar systems. Moreover, to comply with regulations and meet safety standards, manufacturers and suppliers invest in developing advanced radar systems that offer improved performance, accuracy, and reliability, which in turn, is augmenting the market growth.

Various Technological Advancements in Radar Technology

One of the key advancements in radar technology is the improvement in range and resolution capabilities. Higher-frequency radar systems offer better range and resolution, enabling more precise detection and tracking of objects. According to the IEEE, radar systems with 77 GHz frequency are becoming standard due to their enhanced performance. This advancement allows automotive radar systems to detect and identify objects at greater distances and with greater accuracy, enhancing their effectiveness in various applications. Besides this, technological advancements have led to improved object detection and classification capabilities of automotive radar systems. Advanced radar signal processing algorithms and machine learning techniques enable radar systems to distinguish between different types of objects, such as vehicles, pedestrians, and cyclists, which is accelerating their adoption across the globe.

Automotive Radar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive radar market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on range, vehicle type, and application.

Analysis by Range:

- Long Range

- Medium and Short Range

Medium and short range hold the market share, accounting 57.6% in 2024. Medium and short-range radar lead the market due to their critical role in enabling various safety and driver assistance features. These radar systems are extensively used for applications such as blind-spot detection, lane change assist, parking assistance, and rear cross-traffic alert, addressing the immediate surroundings of a vehicle with precision. Their ability to detect objects and obstacles at close ranges makes them essential for navigating urban traffic and tight parking scenarios, where immediate hazard recognition is crucial. Technological advancements have made medium and short-range radar systems more compact, accurate, and cost-efficient, encouraging their integration into vehicles across all price ranges. Additionally, regulatory frameworks advocating for mandatory safety features in new vehicles have further fueled their adoption. With automakers prioritizing the enhancement of safety standards and user demand for reliable in-vehicle technologies growing, medium and short-range radar systems remain a cornerstone of modern automotive safety systems.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars represent the largest segment, accounting 72.4% of the market share in 2024. Passenger cars are widely employed because of the increasing adoption of advanced safety systems and driver assistance technologies. Features such as adaptive cruise control (ACC), blind-spot detection, and automatic emergency braking have become essential components, driven by rising user awareness and demand for safer vehicles. Regulatory mandates emphasizing the integration of collision avoidance systems and other safety technologies in vehicles further bolster this segment's growth. Automotive manufacturers are leveraging radar technology to enhance safety ratings and meet global standards, making these features available across various vehicle categories, from budget-friendly models to luxury cars. Additionally, advancements in radar technology, including improved range, accuracy, and compactness, have made it feasible for widespread implementation in passenger cars. As radar systems offer reliable performance under challenging weather and traffic conditions, their integration has become a priority for automakers aiming to offer enhanced driving experiences while ensuring passenger safety and comfort.

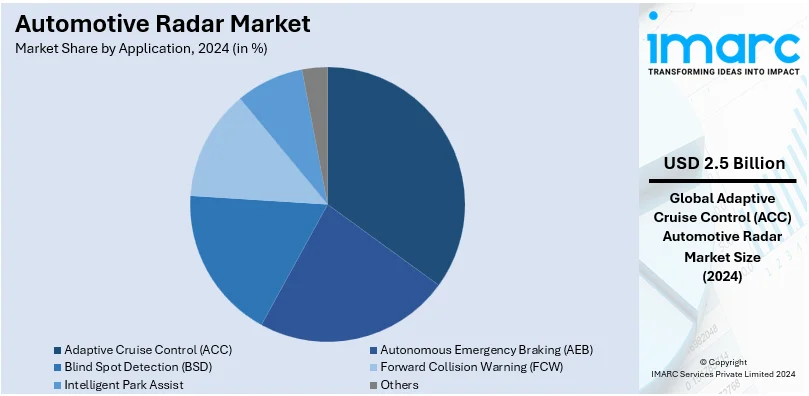

Analysis by Application:

- Adaptive Cruise Control (ACC)

- Autonomous Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning (FCW)

- Intelligent Park Assist

- Others

Adaptive cruise control (ACC) leads the market with 37.7% of market share in 2024. Adaptive cruise control (ACC) represents the largest segment due to its critical role in enhancing vehicle safety and driving comfort. The increasing emphasis on ADAS is elevating the adoption of ACC, as it enables vehicles to automatically adjust their speed to maintain safe distances from other vehicles. Regulatory mandates promoting collision avoidance systems and advanced safety features further support its widespread implementation. ACC's ability to function effectively in various traffic conditions, combined with advancements in radar technology, has made it a preferred choice for manufacturers. Additionally, individuals demand for technologies that reduce driver fatigue during long drives and improve overall driving experience contributes significantly to the segment’s growth. Its integration in a wide range of vehicle types, from mid-range models to luxury cars, ensures its dominance, making ACC a cornerstone of modern automotive safety systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of 54.9%. Asia-Pacific leads the market due to its booming automotive industry, increasing adoption of ADAS, and favorable government policies promoting vehicle safety. Key countries like China, Japan, and South Korea are at the forefront, driven by robust vehicle production, technological advancements, and investments in autonomous driving technologies. Additionally, the region's focus on developing smart transportation systems and autonomous vehicle technologies positions it as a major hub for automotive radar innovation and deployment, ensuring continued market leadership. Companies in the region are investing heavily in advanced radar systems that offer improved range, accuracy, and performance. These developments are supported by partnerships between technology providers and manufacturers, accelerating the adoption of radar solutions in modern vehicles. In 2024, South Korean startup bitsensing partnered with Dutch chipmaker NXP to develop and sell advanced radar systems for vehicles. The collaboration integrates NXP's radar chips with bitsensing's hardware and software, offering superior range and dual-plane operation. Bitsensing highlights radar's advantages over lidar and cameras, particularly in adverse weather conditions.

Key Regional Takeaways:

United States Automotive Radar Market Analysis

In North America, the United States accounted for 89.80% of the total market share. The US automotive radar market growth is evolving with critical regulatory and technological advances. The NHTSA rules require that all new vehicles sold in the United States after 2029 have advanced AEB systems with specific requirements, such as low-light pedestrian detection. This regulation is likely to be a major catalyst for innovation in radar and its complementary technologies, such as LWIR cameras, which will further improve AEB performance under adverse conditions. According to studies from IDTechEx, AEB reduces the risk of pedestrian crashes by 25-27% and injury by 29-30%, thereby underlining its importance in vehicle safety. In 2023, more than 1 million electric vehicles were sold in the US, and this growth is expected to increase the adoption of radar systems in ADAS-equipped vehicles. The leading players, such as Bosch, Continental, and Valeo, are driving the radar sensor technologies ahead to meet the evolving requirements of ADAS and ensure that the US remains a leader in automotive safety innovation.

Europe Automotive Radar Market Analysis

European auto radar market is expanding with regulatory initiatives coupled with the development of advanced ADAS technologies, as cited in industrial reports. Germany is the largest automobile market in the region and illustrates this type of growth because in the year 2023, 50% of the vehicles sold have advanced ADAS with the radar. Similarly, Vision Zero by the EU has goals to eliminate road fatalities by 2050 with the mandatory inclusion of advanced safety features like AEB. European automotive leaders Bosch and Continental back the rising uptake of radar technology, as stringent safety requirements make them innovate to meet those conditions. PROSPECT and HELIAUS, for example, are developing future radar, camera, and LiDAR applications to further the detection of pedestrians and enhance safety on roads. These advancements together for safer cars make Europe one of the important markets in the automotive radar market demand around the world.

Asia Pacific Automotive Radar Market Analysis

The Asia Pacific automotive radar market outlook is growing at a rapid pace as the demand for advanced safety features in vehicles increases and more attention is given towards electric mobility. The demand has been primarily generated by major Chinese, Japanese, and South Korean automakers emphasizing self-driving and electric vehicle technologies. China, which aims to achieve carbon neutrality by 2060, has upped the ante for its automotive companies to make more progress in the development of the radar system. According to the International Energy Agency, as of 2023, more than 8.1 million electric vehicles were sold in China alone, which heavily increased the sales of radar system integration. Locally, firms like Hikvision and Huawei are developing more advanced radar sensors to gain the maximum market share; however, major international players are Bosch and Denso. The investments in infrastructures and research and development incentives are molding the region to become a prime automotive radar market player.

Latin America Automotive Radar Market Analysis

The automotive radar market forecast is growing steadily in Latin America. This growth can be attributed to the increased adoption of advanced safety systems and vehicle sales. In industrial reports, over 3.5 million vehicles were sold in the region in 2023, including a significant growth in mid- to high-range vehicles equipped with ADAS and radar systems. The radar sensor is also gaining attention in Brazil, Mexico, and Argentina, leading the market since automobile manufacturers emphasize achieving global standards in safety. In Brazil and Mexico, pressure on electric vehicle development is seen, and hence the demand for radar systems may rise with initiatives by the governments in support of green transition. Companies like Denso and Valeo are already present in Latin America, and new partnerships between local manufacturers and global leaders are being formed to strengthen local radar production and innovation, thus expanding the footprint of the regional market.

Middle East and Africa Automotive Radar Market Analysis

The automotive radar market is undergoing rapid growth in the Middle East and Africa owing to increased spending on advanced driver assistance systems, as well as a shift in the region to electric vehicles, which is fueled by growing corporate initiatives, especially in the United Arab Emirates. For example, 17 UAE-based companies, such as Aramex, Majid Al Futtaim, and Unilever, signed the 'Road2.0 powered by UACA' declaration in October 2024. This declaration aims to deploy up to 6,000 zero-emission vehicles by 2030, scaling to 20,000 by 2040, thereby fostering a robust EV ecosystem in the region. The adoption of EVs is expected to increase, which will boost the demand for radar-based ADAS. The systems form an important component in improving vehicle safety and autonomy, thus enhancing the integration of advanced radar technologies. Government support through the UAE's Net Zero by 2050 Strategic Initiative on green mobility further fuels the trend, and the Middle East will remain a significant emerging market for automotive radar systems.

Competitive Landscape:

The automotive radar market's competitive environment is vibrant and intensely competitive, featuring numerous major players vying for market share. Currently, different major participants are entering into collaborations, partnerships, and mergers and acquisitions (M&As) to enhance their position in the market. They are likewise concentrating on enhancing their production capabilities and expanding their facilities to secure a competitive advantage in unexplored markets. In addition to this, the top firms are launching enhanced sensors that deliver better performance and precision for detection in advanced driver-assistance systems (ADAS) and autonomous driving uses. They are additionally putting resources into research and development (R&D) efforts to create high-performance compact radars at reduced production costs. In September 2024, Bosch unveiled six new radar-enabled assistance systems, featuring four designed for KTM's soon-to-be-released 2025 model, focused on improving motorcycle safety and comfort. Key characteristics encompass Adaptive Cruise Control Stop & Go, Group Ride Assistance, and Emergency Brake Assistance. These systems will be revealed in November 2024 and begin production in 2025.

The report provides a comprehensive analysis of the competitive landscape in the automotive radar market with detailed profiles of all major companies, including:

- Analog Devices Inc

- Aptiv plc

- Autoliv Inc.

- Continental AG

- Denso Corporation

- HELLA GmbH & Co. KGaA

- Infineon Technologies AG

- NXP Semiconductors

- Robert Bosch GmbH

- Texas Instruments Incorporated

- Valeo

- ZF Friedrichshafen AG

Latest News and Developments:

- January 2025: Bitsensing and NXP Semiconductors announced that they have signed a Memorandum of Understanding (MoU) that is aimed at developing radar solutions for automotive, smart cities, robotics, and healthcare. Collaboration brings together the technology of NXP's chipsets with that of bitsensing, creating new systems, samples of which have already been undergoing evaluation.

- December 2024: Infineon Technologies unveiled its RASIC CTRX8191F, a radar MMIC tailored for advanced 4D and HD imaging radar systems. With enhanced performance including an improved signal-to-noise ratio, this device detects vulnerable road users and vehicles up to 380 meters. It can be integrated into low-cost waveguide antennas, along with flexible waveform generation for use in autonomous driving applications.

- October 2024: Keysight Technologies and Analog Devices announced that the two companies are collaborating to develop testing solutions for automotive Gigabit Multimedia Serial Link (GMSL2) devices, enhancing Advanced Driver Assistance Systems (ADAS). This partnership will present its outcome, including a forward and reverse transmit eye mask, at electronica 2024 in Munich.

- In September 2023, Mercedes-Benz introduced Drive Pilot in the U.S., featuring Level 3 autonomous technology. With a strong emphasis on safety, Drive Pilot integrates advanced features such as a rear camera, LiDAR, a road wetness sensor, and microphones designed to detect emergency vehicles.

- In January 2023, Continental, a technology corporation, partnered with Ambarella, Inc., a semiconductor company focused on edge AI. This collaboration aims to create scalable, end-to-end AI-driven software and hardware solutions for automated driving systems.

Automotive Radar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ranges Covered | Long Range, Medium and Short Range |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered | Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning (FCW), Intelligent Park Assist, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc, Aptiv plc, Autoliv Inc., Continental AG, Denso Corporation, HELLA GmbH & Co. KGaA, Infineon Technologies AG, NXP Semiconductors, Robert Bosch GmbH, Texas Instruments Incorporated, Valeo and ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive radar market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive radar market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive radar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Automotive radar is a sensor technology that uses radio waves to detect objects, measure their speed, and calculate distances. It supports safety features such as adaptive cruise control, collision avoidance, and lane assistance. It is reliable in various weather conditions and essential for advanced driver assistance systems (ADAS) and autonomous driving advancements.

The automotive radar market was valued at USD 6.58 Billion in 2024.

IMARC estimates the global automotive radar market to exhibit a CAGR of 18.5% during 2025-2033.

The global automotive radar market is driven by increasing demand for advanced driver assistance systems (ADAS), rising safety regulations, and the push toward autonomous driving. Factors like technological advancements in radar sensors, growing vehicle electrification, and user preference for enhanced safety features are also significant.

In 2024, medium and short range represented the largest segment by range, driven by the growing demand for features like blind-spot detection, parking assistance, and enhanced traffic monitoring in compact vehicles.

Passenger cars lead the market by vehicle type owing to increasing adoption of advanced safety features, rising user demand for ADAS technologies, and stringent government safety regulations promoting radar integration.

Adaptive cruise control (ACC) is the leading segment by application due to its critical role in enhancing driving convenience, maintaining safe distances, and meeting user demand for advanced safety and comfort features.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global automotive radar market include Analog Devices Inc, Aptiv plc, Autoliv Inc., Continental AG, Denso Corporation, HELLA GmbH & Co. KGaA, Infineon Technologies AG, NXP Semiconductors, Robert Bosch GmbH, Texas Instruments Incorporated, Valeo and ZF Friedrichshafen AG, etc.

The automotive radar market is experiencing significant growth due to the integration of ADAS system, regulatory safety mandates, and advancements in radar technology, enabling enhanced vehicle safety and autonomous driving capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)