Automotive Powertrain Sensors Market Report by Sensor Type (Temperature Sensors, Position Sensors, Exhaust Sensors, Knock Sensors, Speed Sensors, Torque Sensors, Pressure Sensors, and Others), Powertrain Subsystem (Engine Management Sensors, Transmission Management Sensors, Power Steering Sensors), Vehicle Type (Internal Combustion Engines, Electric Vehicles), Sales Channel (Original Equipment Manufacturer (OEMs), Aftermarket), and Region 2025-2033

Global Automotive Powertrain Sensors Market:

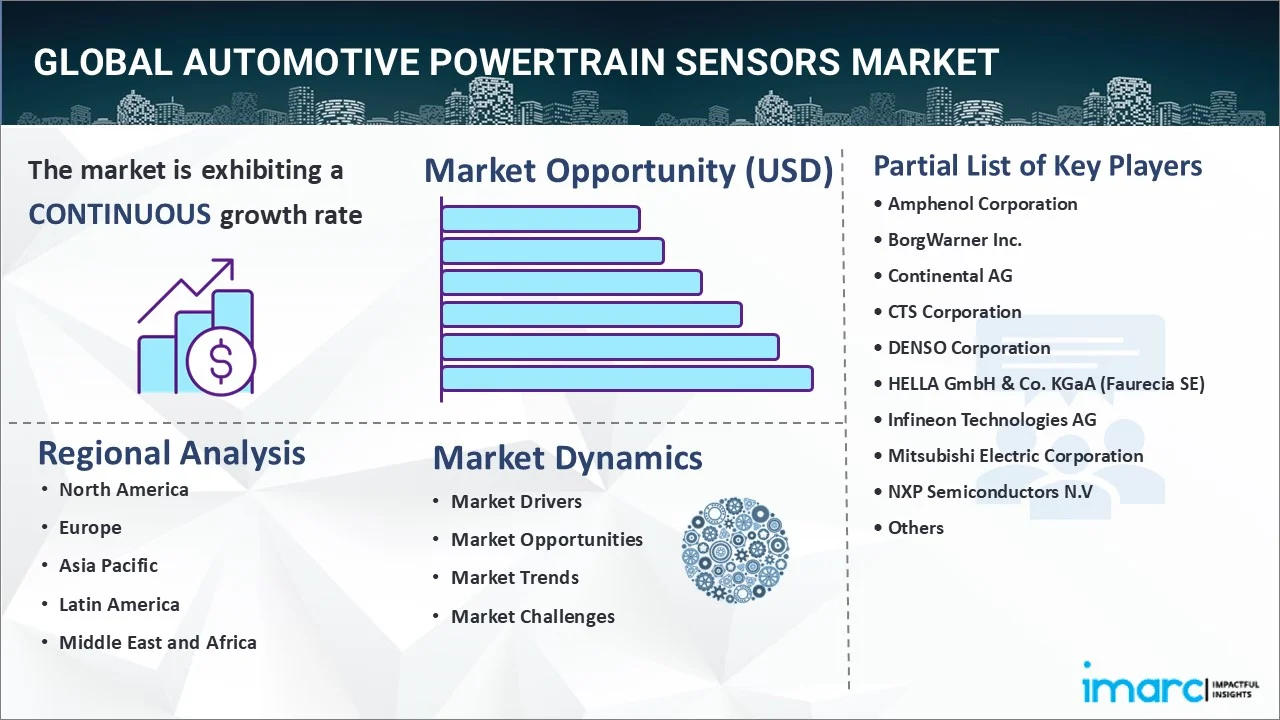

The global automotive powertrain sensors market size reached USD 20.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033. The continuous technological advancements in sensor technologies, the increasing adoption of safety and driver assistance feature, and the integration of artificial intelligence (AI) and machine learning (ML) with powertrain sensors represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.6 Billion |

|

Market Forecast in 2033

|

USD 32.3 Billion |

| Market Growth Rate (2025-2033) | 4.85% |

Automotive Powertrain Sensors Market Analysis:

- Major Market Drivers: Significant growth in the automotive industry is driving the global market. This can be supported by the growing demand for passenger cars, commercial vehicles, and electric vehicles. Moreover, the governments of several countries are imposing stringent emission standards to reduce the environmental impact of cars, which is providing a boost to the market.

- Key Market Trends: The continuous advancements in sensor technologies, such as improved accuracy, reliability, and miniaturization, are also impacting the market. Apart from this, the integration of artificial intelligence (AI) and machine learning (ML) as powertrain sensors plays a crucial role in collecting real-time data for AI and ML applications, enabling advanced functionalities, such as predictive maintenance, adaptive control, and intelligent decision-making, are also impelling the market.

- Competitive Landscape: Some of the prominent automotive powertrain sensors market companies include Amphenol Corporation, BorgWarner Inc., Continental AG, CTS Corporation, DENSO Corporation, HELLA GmbH & Co. KGaA (Faurecia SE), Infineon Technologies AG, Mitsubishi Electric Corporation, NXP Semiconductors N.V, Renesas Electronics Corporation, Robert Bosch GmbH, TE Connectivity, and Texas Instruments Incorporated, among many others.

- Geographical Trends: According to the automotive powertrain sensors market dynamics, Europe exhibits a clear dominance in the market. The shift towards electric and hybrid vehicles is significantly boosting the demand for advanced powertrain sensors. These sensors are essential for managing the powertrain systems in electric and hybrid vehicles.

- Challenges and Opportunities: High development costs associated with automotive powertrain sensors, and data security concerns are hampering the market's growth. However, the rapid expansion of the electric vehicle (EV) market presents a significant opportunity for powertrain sensors, which are critical for the efficient operation of EVs.

Automotive Powertrain Sensors Market Trends:

Rising Demand for Electric Vehicles

The shift towards electric (EV) and hybrid vehicles is significantly boosting the demand for advanced powertrain sensors. For instance, EV sales surpassed 10 million, with 14% of all new vehicles sold being electric, a significant increase from 9% in 2021 and less than 5% in 2020. As a result, more than 26 million electric vehicles were on the road worldwide by 2022, a 60% increase from 2021. Powertrain sensors are essential for managing and optimizing the powertrain systems in these vehicles, ensuring they operate efficiently and reliably. These factors are expected to propel the automotive powertrain sensors market in the coming years.

Stringent Emission Regulations

Governments and regulatory bodies are implementing strict emission standards to combat environmental pollution. For instance, in March 2023, the European Union passed a groundbreaking modification to the EU's light-duty vehicle (LDV) CO2 rules. With this amendment, the EU will become the first major region in the world to set a 100% CO2 emission reduction target for all new vehicles and vans registered after 2035. In addition, the present CO2 reduction target for 2030 has been increased to -55% for automobiles and -50% for vans, compared to a 2021 baseline. This drives the need for sophisticated powertrain sensors that can monitor and control emissions more effectively, ensuring compliance with these regulations. These factors further positively influence the automotive powertrain sensors market forecast.

Technological Advancements

Continuous advancements in sensor technology, such as improvements in accuracy, reliability, and miniaturization, are fueling market growth. Innovations like wireless sensors and the integration of Internet of Things (IoT) technologies are creating new possibilities and applications for powertrain sensors. For instance, in January 2023, TDK Corporation introduced the TDK i3 Micro Module, the world's first module with integrated edge AI and wireless mesh networking. TDK collaborated with Texas Instruments (TI) to incorporate the TI SimpleLink platform, which includes the CC2652R7, an Arm Cortex-M4F multiprotocol 2.4-GHz wireless 32-bit microcontroller (MCU) for real-time monitoring. The new module also combines TDK's IIM-42352 high-performance SmartIndustrialTM MEMS accelerometer and digital output temperature sensor, edge AI, and mesh network features into a single unit, allowing for easier data gathering, integration, and processing, thereby boosting the automotive powertrain sensors systems market revenue.

Global Automotive Powertrain Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive powertrain sensors market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on sensor type, powertrain subsystem, vehicle type, and sales channel.

Breakup by Sensor Type:

- Temperature Sensors

- Thermocouple

- Thermistor

- Silicon

- Position Sensors

- Capacitive

- Inductive

- Magnetic

- Exhaust Sensors

- Lambda/ Oxygen Sensors

- Nitrogen Sensors

- Soot Sensors

- Ammonia Sensors

- Knock Sensors

- Speed Sensors

- Torque Sensors

- Pressure Sensors

- Others

Temperature sensors exhibited a clear dominance in the market

The report types provided a detailed breakup and analysis of the automotive powertrain sensors market based on the sensor type. This includes temperature sensors (thermocouple, thermistor and silicon), position sensors (capacitive, inductive and magnetic), exhaust sensors (lambda/ oxygen sensors, nitrogen sensors, soot sensors and ammonia sensors), knock sensors, speed sensors, torque sensors, pressure sensors, and others. According to the report, temperature sensors exhibited a clear dominance in the market.

According to the automotive powertrain sensors market outlook, temperature sensors are used to monitor the temperature of electric motors and inverters, critical components in electric powertrains, to avoid thermal damage and maintain performance. Moreover, in electric and hybrid vehicles, temperature sensors are essential for monitoring battery temperature to prevent overheating and ensure efficient operation. Proper engine temperature management is essential for reducing emissions and improving fuel efficiency. Temperature sensors help maintain the engine within the optimal temperature range.

Breakup by Powertrain Subsystem:

- Engine Management Sensors

- Transmission Management Sensors

- Power Steering Sensors

Engine management sensors exhibited a clear dominance in the market

A detailed breakup and analysis of the automotive powertrain sensors market based on the powertrain subsystem has also been provided in the report. This includes engine management sensors, transmission management sensors, and power steering sensors. According to the report, engine management sensors exhibited a clear dominance in the market.

According to the automotive powertrain sensors market overview, engine management sensors are essential components in modern vehicles, providing critical data to the engine control unit (ECU) to optimize engine performance, enhance fuel efficiency, reduce emissions, and ensure overall vehicle safety. Moreover, governments worldwide are imposing stricter emission regulations to combat air pollution. Engine management sensors play a vital role in monitoring and controlling emissions, ensuring vehicles meet these stringent standards.

Breakup by Vehicle Type:

- Internal Combustion Engines

- Passenger

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Hybrid Electric Vehicles

Internal combustion engines exhibited a clear dominance in the market

A detailed breakup and analysis of the automotive powertrain sensors market based on the vehicle type has also been provided in the report. This includes internal combustion engines (passenger, light commercial vehicles and heavy commercial vehicles) and electric vehicles (battery electric vehicles, fuel cell electric vehicles, plug-in hybrid electric vehicles and hybrid electric vehicles). According to the report, internal combustion engines exhibited a clear dominance in the market.

ICE technology has been refined over decades, leading to highly reliable and efficient engines. This maturity has established a robust market for the sensors needed to optimize and maintain these engines. These technologies are used in a variety of vehicles, from passenger cars to commercial trucks, construction equipment, and agricultural machinery, expanding the scope of sensor applications. Moreover, a wide range of sensors are used in ICE vehicles to monitor various engine parameters, including temperature, pressure, air flow, and knock. These sensors ensure optimal performance, efficiency, and longevity of the engine.

Breakup by Sales Channel:

- Original Equipment Manufacturer (OEMs)

- Aftermarket

Original equipment manufacturer (OEMs) exhibited a clear dominance in the market

A detailed breakup and analysis of the automotive powertrain sensors market based on the sales channel has also been provided in the report. This includes original equipment manufacturer (OEMs), and aftermarket. According to the report, original equipment manufacturer (OEMs) exhibited a clear dominance in the market.

OEMs have well-established supply chains and long-term relationships with major automakers. This integration ensures a steady demand for their products. Moreover, they often work closely with automakers to develop custom sensor solutions tailored to specific vehicle models and performance requirements. Apart from this, OEMs adhere to rigorous quality control standards, ensuring that their sensors meet the high reliability and performance requirements of automakers.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe accounts for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe exhibited a clear dominance in the market.

According to the automotive powertrain sensors market statistics, some of the factors driving the Europe automotive powertrain sensors market included expanding automotive industry, shifting preference towards connected and autonomous infrastructure, and growing demand for electric power steering. Various European countries offer incentives and subsidies to promote electric and hybrid vehicles, driving the demand for powertrain sensors specific to these vehicles. Moreover, continuous improvements in sensor accuracy, reliability, and integration capabilities drive the adoption of advanced powertrain sensors. Also, advances in miniaturization and the integration of sensors with other vehicle systems enhance performance and functionality, making them more attractive to manufacturers. Apart from this, the escalating demand for electric vehicles in also proliferating the industry’s growth. For instance, according to the Federal Motor Transport Authority a quarter more electric cars were registered in Germany in the first half of 2022 than the previous year during the same period.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Amphenol Corporation

- BorgWarner Inc.

- Continental AG

- CTS Corporation

- DENSO Corporation

- HELLA GmbH & Co. KGaA (Faurecia SE)

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V

- Renesas Electronics Corporation

- Robert Bosch GmbH

- TE Connectivity

- Texas Instruments Incorporated

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Automotive Powertrain Sensors Market Recent Developments:

- June 2024: Infineon Technologies launched the 600 V CoolMOS S7TA Superjunction MOSFET for automotive power management applications. The S7TA has an inbuilt temperature sensor that increases the precision of junction temperature monitoring, building on the gains achieved by its industrial equivalent (CoolMOS S7T).

- May 2024: Sheba Microsystems Inc., a MEMS technology provider, launched the Sharp-7, an autofocus car camera. Sheba's first automotive-specific solution has an automotive-grade huge 8-megapixel (MP) sensor and a fully integrated MEMS driver.

- January 2024: Texas Instruments (TI) launched new semiconductors to improve automotive safety and intelligence. The AWR2544 77GHz mm-wave radar sensor chip enables a high level of autonomy by improving sensor fusion.

Automotive Powertrain Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sensor Types Covered |

|

| Powertrain Subsystems Covered | Engine Management Sensors, Transmission Management Sensors, Power Steering Sensors |

| Vehicle Types Covered |

|

| Sales Channels Covered | Original Equipment Manufacturer (OEMs), Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amphenol Corporation, BorgWarner Inc., Continental AG, CTS Corporation, DENSO Corporation, HELLA GmbH & Co. KGaA (Faurecia SE), Infineon Technologies AG, Mitsubishi Electric Corporation, NXP Semiconductors N.V, Renesas Electronics Corporation, Robert Bosch GmbH, TE Connectivity, Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global automotive powertrain sensors market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global automotive powertrain sensors market?

- What is the impact of each driver, restraint, and opportunity on the global automotive powertrain sensors market?

- What are the key regional markets?

- Which countries represent the most attractive automotive powertrain sensors market?

- What is the breakup of the market based on the sensor type?

- Which is the most attractive sensor type in the automotive powertrain sensors market?

- What is the breakup of the market based on the powertrain subsystem?

- Which is the most attractive powertrain subsystem in the automotive powertrain sensors market?

- What is the breakup of the market based on the vehicle type?

- Which is the most attractive vehicle type in the automotive powertrain sensors market?

- What is the breakup of the market based on the sales channel?

- Which is the most attractive sales channel. in the automotive powertrain sensors market?

- What is the competitive structure of the global automotive powertrain sensors market?

- Who are the key players/companies in the global automotive powertrain sensors market?

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive powertrain sensors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive powertrain sensors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive powertrain sensors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)