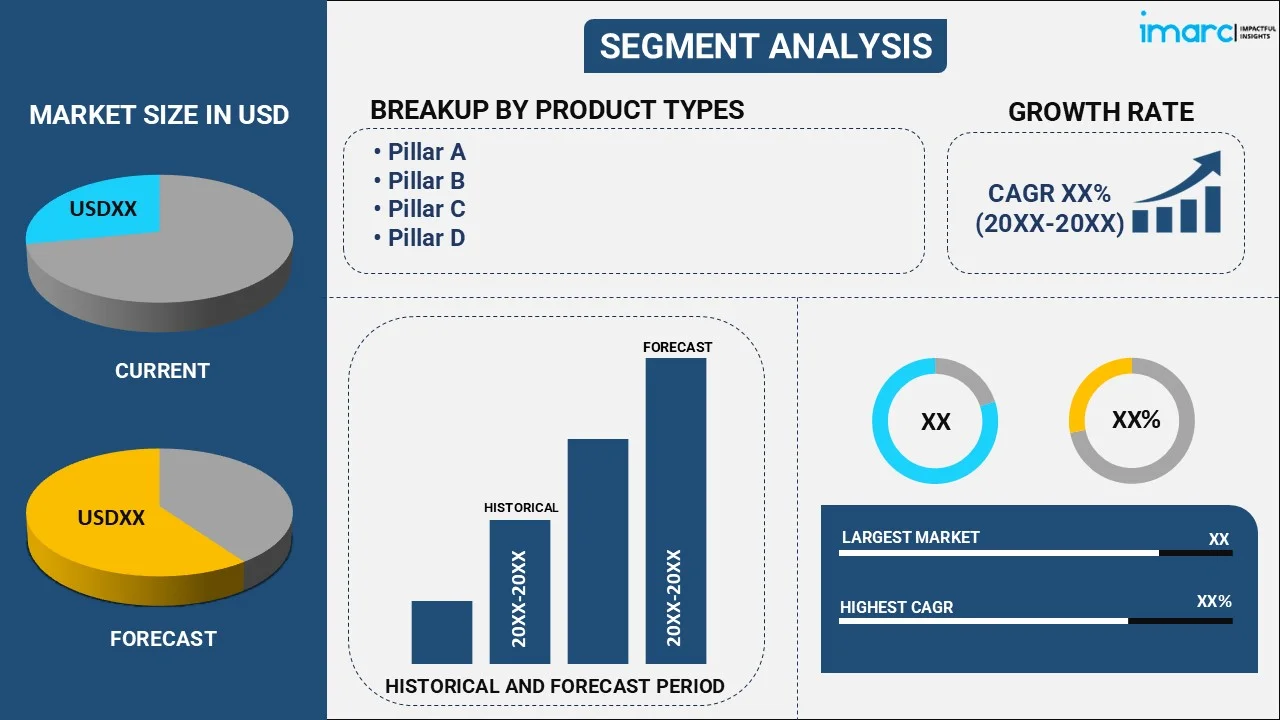

Automotive Pillar Market Report by Product Type (Pillar A, Pillar B, Pillar C, Pillar D), Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), Material (Aluminum, Steel, Plastic, Composites), Sales Channel (OEM, Aftermarket), and Region 2025-2033

Automotive Pillar Market Size:

The global automotive pillar market size reached USD 6,740.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,233.4 Million by 2033, exhibiting a growth rate (CAGR) of 3.54% during 2025-2033. The market is growing as a result of recent advancements in manufacturing techniques and materials, increased automobile demand, particularly in developing countries, and the implementation of severe safety standards by regulatory agencies and governments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,740.3 Million |

| Market Forecast in 2033 | USD 9,233.4 Million |

| Market Growth Rate (2025-2033) | 3.54% |

Automotive Pillar Market Analysis:

- Major Market Drivers: Advances in materials and manufacturing procedures that improve the strength, durability, and lightweight properties of vehicle pillars are propelling the automotive pillar market growth. Aside from that, higher car manufacturing and stringent safety criteria are fueling industry growth.

- Key Market Trends: One of the most prominent automotive pillar market trends is the increasing popularity of electric cars (EVs), which necessitate the use of specialized pillar designs to handle battery packs and other EV-specific components. Beyond this, the growing preference for lightweight vehicles and technological integrations is expanding the market share.

- Geographical Trends: Asia Pacific holds the majority of the share in the automotive pillar industry due to significant automotive production and sales volumes driven by countries like China, Japan, South Korea, and India. Other regions are experiencing growth in this industry, owing to a strong emphasis on technology advancements and increased car manufacturing and ownership.

- Competitive Landscape: Some of the major market players in the automotive pillar industry include GEDIA Automotive Group, KIRCHHOFF Group, Toyoda Iron Works Co. Ltd., Unipres Corporation, among many others.

- Challenges and Opportunities: The latest automotive pillar market outlook highlights few challenges, including the high cost of advanced materials like composites and aluminum, which can be a barrier for some manufacturers. Alongside this, balancing the need for lightweight yet strong materials to meet safety standards and performance expectations remains a critical challenge. However, the recent automotive pillar market forecast suggests that the increasing focus on sustainability presents opportunities for the development of recyclable and environmentally friendly products.

Automotive Pillar Market Trends:

Technological Advancements

Technological advancements are playing a crucial role in increasing the automotive pillar market revenue. These innovations encompass improvements in production techniques, design approaches, and materials. Moreover, the sector is progressing due to the development of high-strength steel and aluminum alloys, which have greater strength-to-weight ratios than conventional materials. These materials not only improve the structural integrity of automotive pillars, but they also help to reduce overall vehicle weight, increase fuel efficiency, and lower emissions. Furthermore, improvements in composite materials, such as carbon fiber-reinforced polymers, are becoming more popular due to their outstanding strength and lightweight qualities. In addition, advances in manufacturing technology have made it possible to produce increasingly intricate and accurate pillar designs, enhancing crashworthiness and occupant safety. Examples of these techniques include hydroforming and hot stamping.

Increasing Vehicle Production

The rising global demand for automobiles, particularly in emerging markets, is a significant factor boosting the automotive pillar market size. As developing economies rise, so do disposable incomes and urbanization. This economic expansion leads to higher car ownership rates and, as a result, increased vehicle production. In 2022, 85.4 million motor vehicles were produced globally, up 5.7% from 2021. To meet the rising demand, major automakers are also establishing new manufacturing facilities and increasing their production capabilities in these areas. This surge in vehicle production necessitates a proportional increase in the production of automotive components, including pillars, which are essential structural elements. Furthermore, the trend towards vehicle electrification is driving up manufacturing volumes, as electric cars (EVs) frequently require unique pillar designs to accommodate battery packs and other EV-specific components.

Stringent Safety Regulations

Stringent safety rules established by governments and regulatory agencies around the world are a major factor strengthening the automotive pillar market share. These regulations require rigorous safety standards for automobiles in order to provide optimum protection for occupants in the case of an accident. Automotive pillars, as vital structural components, play a critical function in safeguarding the vehicle's interior during collisions. Regulatory frameworks such as the European New Car Assessment Program (Euro NCAP), the National Highway Traffic Safety Administration (NHTSA) in the United States, and other regional safety requirements require manufacturers to incorporate current safety features and strong structural designs. Compliance with these rules frequently requires the employment of high-strength materials and novel engineering solutions in pillar construction. Additionally, these regulations drive continuous research and development (R&D) efforts to enhance the safety performance of automotive pillars.

Automotive Pillar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, vehicle type, material, and sales channel.

Breakup by Product Type:

- Pillar A

- Pillar B

- Pillar C

- Pillar D

Pillar A accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pillar A, pillar B, pillar C, and pillar D. According to the report, pillar A represented the largest segment.

Based on the recent findings of the automotive pillar market research report, Pillar A holds the majority of the share due to its critical role in vehicle safety and structural integrity. As the foremost pillar in the vehicle's body structure, Pillar A supports the windshield, contributes to the overall rigidity of the vehicle, and houses vital components such as airbags and electrical systems. It plays a pivotal role in protecting occupants during frontal impacts and rollover accidents, making its design and construction paramount to meeting stringent safety standards. Furthermore, manufacturers are investing substantially in the development of Pillar A to ensure that it meets legal criteria and improves driver safety. Furthermore, the incorporation of advanced driver assistance systems (ADAS) and other technical features into Pillar A increases demand while cementing its dominant market position.

Breakup by Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Passenger car holds the largest share of the industry

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger car, light commercial vehicle, and heavy commercial vehicle. According to the report, passenger car accounted for the largest market share.

Passenger cars hold the majority of the share according to the automotive pillar market overview. This is due to their widespread use and high production volumes. The global demand for passenger cars is driven by increasing urbanization, rising disposable incomes, and the growing preference for personal mobility solutions. Additionally, passenger cars require sophisticated and robust structural components, including pillars, to ensure safety and comfort for occupants. The emphasis on safety features and the adoption of advanced technologies in passenger cars necessitate the use of high-quality pillars. Moreover, the trend towards electric vehicles (EVs), which are predominantly passenger cars, further boosts the demand for specialized pillar designs.

Breakup by Material:

- Aluminum

- Steel

- Plastic

- Composites

The report has provided a detailed breakup and analysis of the market based on the material. This includes aluminum, steel, plastic, and composites.

Aluminum is a highly favored material in the automotive pillar market due to its exceptional strength-to-weight ratio and corrosion resistance. Its lightweight nature significantly contributes to vehicle weight reduction, which enhances fuel efficiency and lowers emissions. The use of aluminum in automotive pillars also improves vehicle handling and performance. As manufacturers strive to meet stringent environmental regulations and consumer demand for efficient vehicles, the adoption of aluminum in pillar construction is growing.

The latest automotive pillar market analysis highlights the importance of steel in this market because of its superior strength, durability, and cost-effectiveness. High-strength steel and advanced high-strength steel (AHSS) are particularly popular for their ability to absorb impact energy during collisions, thereby enhancing occupant safety. Steel's extensive use is supported by well-established manufacturing processes and its availability, making it a reliable choice for automotive manufacturers. Furthermore, advancements in steel processing technologies, such as hot stamping, have enabled the production of complex and highly durable pillar designs.

Plastic is increasingly being utilized in automotive pillar manufacturing primarily due to its lightweight properties and versatility. Modern engineering plastics can be molded into complex shapes, allowing for innovative and ergonomic designs that enhance vehicle aesthetics and functionality. Plastics are also resistant to corrosion and can be engineered to provide sufficient strength for certain applications, making them suitable for non-structural components or in combination with other materials.

Composites, including carbon fiber-reinforced plastics (CFRP) and glass fiber-reinforced plastics (GFRP), are gaining traction due to their exceptional strength, stiffness, and lightweight characteristics. These materials offer significant weight savings over traditional metals, contributing to better fuel efficiency and performance. Composites also provide excellent impact resistance and can be tailored to meet specific design and safety requirements. Their use is particularly prevalent in high-performance and luxury vehicles, where the benefits of weight reduction and enhanced performance justify the higher costs.

Breakup by Sales Channel:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

According to the automotive pillar market report, OEM segment refers to the direct sales of pillars to vehicle manufacturers for integration into new vehicles during the production process. This segment is driven by the constant demand for innovative and high-quality components that meet stringent safety and performance standards. OEMs prioritize pillars that offer superior strength, lightweight properties, and compatibility with advanced safety systems. Additionally, the push for electric vehicles and the incorporation of advanced driver-assistance systems (ADAS) necessitate specialized pillar designs, further driving demand in the OEM market.

The aftermarket segment encompasses the sales of pillars for vehicle repairs, replacements, and upgrades after the original sale of the vehicle. This segment is fueled by the need to maintain and enhance vehicle safety and performance over its lifespan. Accidents, wear and tear, and the desire for aesthetic or functional upgrades drive the demand for aftermarket pillars. This segment benefits from the growing number of vehicles on the road and the increasing average age of vehicles, leading to a higher incidence of repairs and replacements. Additionally, the aftermarket segment offers opportunities for customization, allowing consumers to choose from a variety of materials and designs to suit their preferences and needs.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest automotive pillar market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for automotive pillar.

Asia Pacific holds the majority of the market share due to the region's significant automotive production and sales volume, which is boosting automotive pillar demand. Countries like China, Japan, South Korea, and India are major automotive manufacturing hubs, with extensive production capacities and a strong presence of both domestic and international automotive manufacturers. Additionally, the rapid economic growth, increasing urbanization, and rising disposable incomes in these countries drive the demand for vehicles, particularly passenger cars. Besides this, government initiatives promoting automotive industry growth and the increasing adoption of electric vehicles are further boosting automotive pillar market value.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the automotive pillar industry include GEDIA Automotive Group, KIRCHHOFF Group, Toyoda Iron Works Co. Ltd., and Unipres Corporation.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Leading automotive pillar companies are focusing on several strategic initiatives to maintain and enhance their market position. They are heavily investing in research and development (R&D) to innovate and improve the strength, durability, and lightweight properties of automotive pillars. Collaborations and partnerships with automotive manufacturers are common among these market leaders to ensure their products meet the latest safety standards and technological advancements, such as integrating advanced driver assistance systems (ADAS). Furthermore, these companies are also expanding their global footprint through acquisitions and establishing new production facilities in emerging markets.

Automotive Pillar Market News:

- In January 2024: Chevrolet launched the new Chevy Traverse, a series of full-size crossover SUVs. The new car model boasts an all-new exterior design featuring shark fin style C-pillar, which rises sharply just behind the rear door before leveling off and falling back sown to the vehicle’s shoulder line.

- In March 2022: General Motors filed a patent for a transparent A-pillar design that expands the driver’s field of view out of the windshield.

Automotive Pillar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pillar A, Pillar B, Pillar C, Pillar D |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle |

| Materials Covered | Aluminum, Steel, Plastic, Composites |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | GEDIA Automotive Group, KIRCHHOFF Group, Toyoda Iron Works Co. Ltd., Unipres Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global automotive pillar market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global automotive pillar market?

- What is the impact of each driver, restraint, and opportunity on the global automotive pillar market?

- What are the key regional markets?

- Which countries represent the most attractive automotive pillar market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the automotive pillar market?

- What is the breakup of the market based on the vehicle type?

- Which is the most attractive vehicle type in the automotive pillar market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the automotive pillar market?

- What is the breakup of the market based on the sales channel?

- Which is the most attractive sales channel in the automotive pillar market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global automotive pillar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive pillar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive pillar market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive pillar industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)