Automotive Parts Magnesium Die Casting Market Report by Production Process (Pressure Die Casting, Vacuum Die Casting, Gravity Die Casting, Squeeze Die Casting), Application (Body Parts, Engine Parts, Transmission Parts, and Others), and Region 2025-2033

Automotive Parts Magnesium Die Casting Market Size:

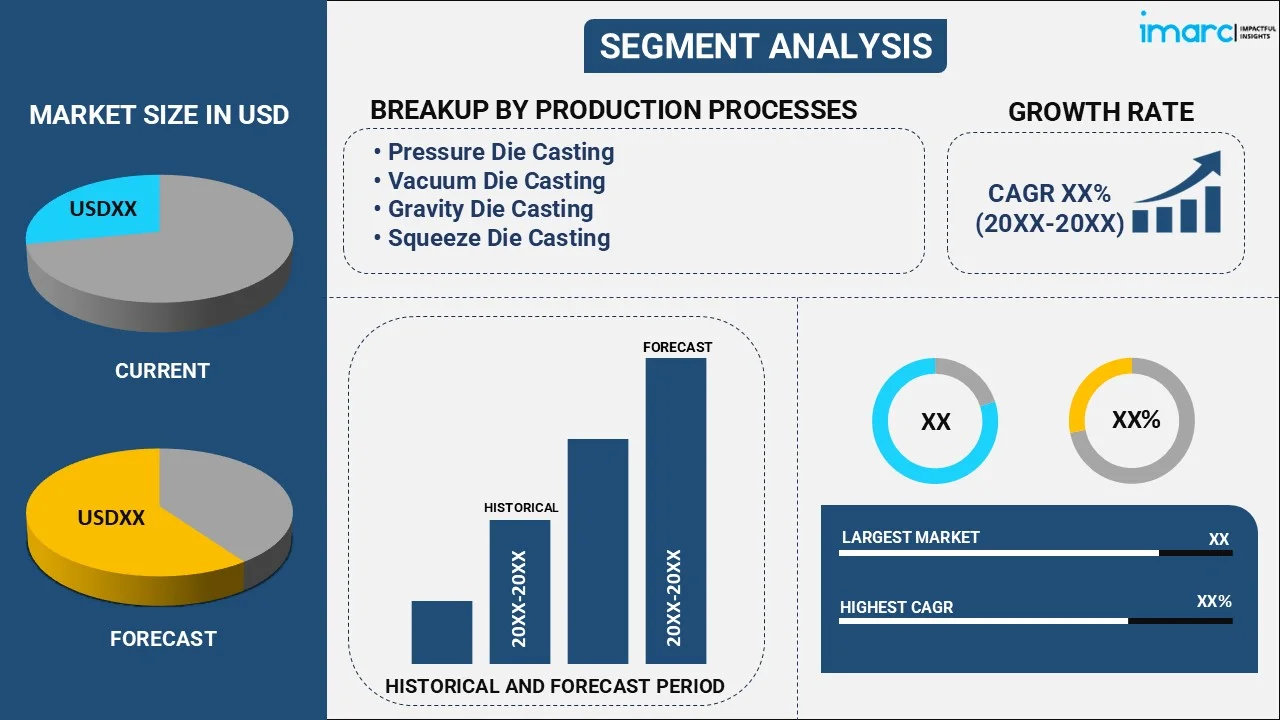

The global automotive parts magnesium die casting market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. Rising demand for lightweight vehicles, increasing electric vehicle (EV) production, advancements in die casting technology, growing vehicle electrification trends, regulatory pressures for fuel efficiency, development of improved material strength, and the industry's focus on performance enhancement and emission reduction are some of the factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.3 Billion |

|

Market Forecast in 2033

|

USD 5.5 Billion |

| Market Growth Rate 2025-2033 | 5.51% |

Automotive Parts Magnesium Die Casting Market Analysis:

- Major Market Drivers: Increasing demand for lightweight materials across the automotive sector due to the high strength-to-weight ratio of magnesium, which helps boost fuel efficiencies and reduce carbon emissions, is one of the primary factors supporting the market growth. Furthermore, the advancement of die casting technology has aided magnesium casting to become more complementary for mass production due to improved efficiency and cost-effectiveness, which is another factor driving the automotive parts magnesium die casting market growth. Moreover, the growing popularity of electric vehicles (EVs) and strict government regulations implemented against carbon emissions are accelerating the market growth.

- Key Market Trends: The increasing use of magnesium in structural components, driven by its lightweight properties and the rising demand for vehicle weight reduction, is a major market trend. The market is also experiencing a shift toward automated die casting processes, which helps increase the precision and reduce labor cost. Another crucial factor is escalating focus on sustainability, which has compelled key manufacturers to decrease waste and energy consumption. Apart from this, the integration of Industry 4.0 with technologies such as Internet of Things (IoT) and artificial intelligence (AI) to boost efficiencies in die casting operations are creating a positive automotive parts magnesium die casting market outlook.

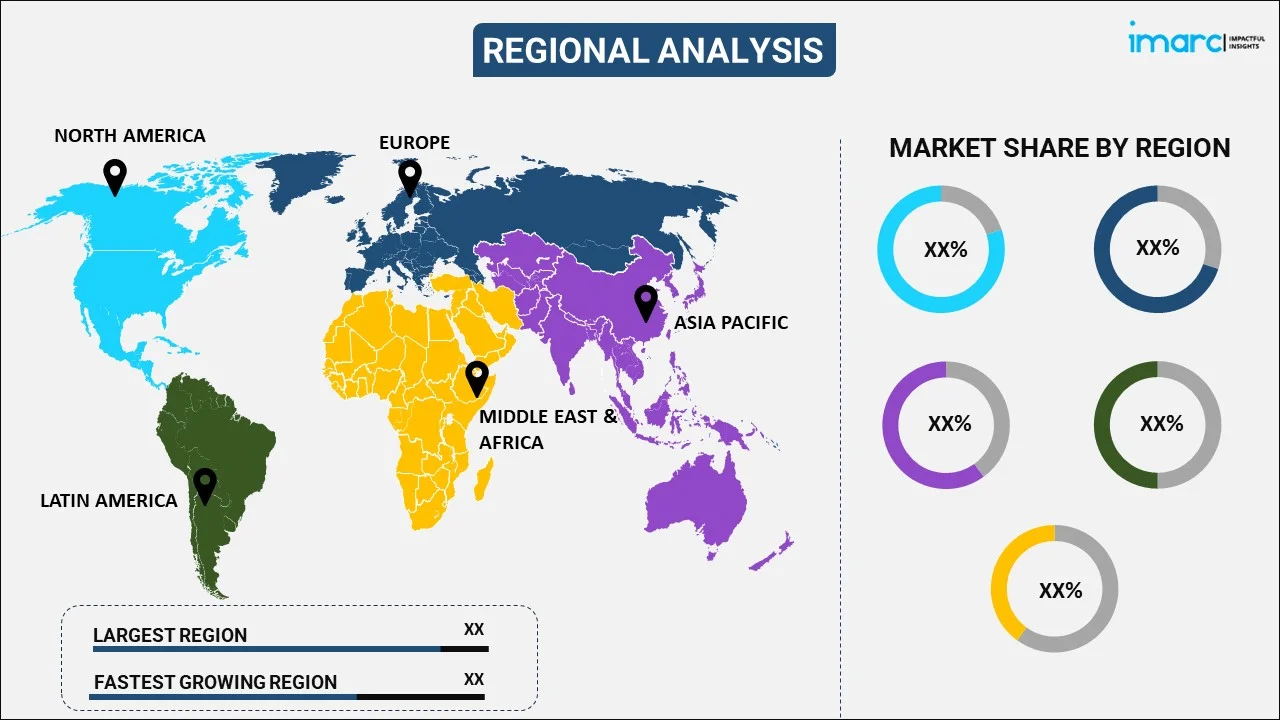

- Geographical Trends: Asia-Pacific leads the market due to the strong growth of automobile industry in countries such as China and India. Additionally, the presence of umpteen automotive giants and an extensive distribution network are other factors stimulating the regional market growth. North America holds a considerable automotive parts magnesium die casting market share as it is backed by the presence of robust manufacturing sector and rapid technological advancements. In Europe, the growing focus on reducing vehicle weight and meeting stringent environmental mandates are driving the market growth.

- Competitive Landscape: Some of the major market players in the automotive parts magnesium die casting industry include Chicago White Metal Casting Inc., Dynacast International Inc. (Form Technologies Company), Georg Fischer Ltd., Gibbs Die Casting Corporation (Koch Enterprises Inc.), Meridian Lightweight Technologies, Morimura Bros. Inc., Ortal Diecasting Ltd., Pace Industries (Leggett & Platt Incorporated), Ryobi Limited, Sandhar Technologies Limited, Shiloh Industries Inc. and Twin City Die Castings Co., among many others.

- Challenges and Opportunities: The higher cost of magnesium parts as compared to its substitutes, such as steel and aluminum, is one primary challenges for the market. Moreover, the lower melting temperature of magnesium further necessitates the use of sophisticated technology, which is further hindering the market growth. However, the development of better alloys and coatings to boost magnesium's durability is one of the key opportunities for the market. Additionally, the rising demand for electric vehicles (EVs) and growing efforts to reduce weight of the vehicle are promoting the market growth.

Automotive Parts Magnesium Die Casting Market Trends:

Lightweight Vehicle Demand

The burgeoning demand for lightweight vehicles is one of the prime factors fueling the market growth. Governments worldwide are implementing strict emission regulations to enhance fuel efficiency, prompting manufacturers to reduce vehicle weight while maintaining strength, which further propels market expansion. This has further boosted the demand for magnesium alloys as they offer a robust strength-to-weight ratio that surpasses traditional materials, such as steel and aluminum. Furthermore, the increasing focus on the automakers on the design of ultra-light vehicles to comply with fuel-efficiency norms is propelling the need for efficient magnesium die-casting solutions, further fostering the market growth.

Rise in Electric Vehicle (EV) Production

The rapid manufacturing of electric vehicles (EVs) is one of the primary factors bolstering the market growth. According to the industry reports, the sales of electric vehicles (EVs) rose to about 1.6 million in the U.S. in 2023, up by around 60% in 2022. This has further soared the need for magnesium die casting to produce light weight parts and improve the overall efficiency of EV batteries, further reducing on-board battery consumption and extending battery range. Additionally, a competitive EV market is driving manufacturers to develop new materials and techniques, which is providing a considerable thrust to the market growth.

Vehicle Electrification and Advancements in Die Casting Technology

The advancements in die casting technology and surging vehicle electrification are some of the factors facilitating the market growth. Globally, the manufacturers are gradually transitioning toward more efficient electrified powertrains, which has surged the demand for high-quality, lightweight composite components to maximize performance and efficiency. Magnesium die casting meets these needs by producing parts with high precision and minimal waste, contributing to the lightweighting efforts essential for electric vehicles (EVs). Moreover, the advancements in die casting technology has led to the development of enhanced magnesium casting, which has further facilitated the manufacturing of complex and detailed components, which is creating a positive outlook for the market.

Automotive Parts Magnesium Die Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on production process and application.

Breakup by Production Process:

- Pressure Die Casting

- Vacuum Die Casting

- Gravity Die Casting

- Squeeze Die Casting

The report has provided a detailed breakup and analysis of the market based on the production process. This includes pressure die casting, vacuum die casting, gravity die casting, and squeeze die casting.

The pressure die casting segment is driven by the demand for high-volume production of complex and thin-walled automotive components. This process allows for rapid manufacturing cycles, making it ideal for mass production in the automotive industry. The growing need for precision and consistency in part dimensions further fuels the adoption of pressure die casting, especially in the production of intricate parts like engine blocks and transmission housings.

The vacuum die casting segment is driven by the increasing need for superior quality components with minimal porosity and enhanced mechanical properties. This process is preferred for critical automotive parts that require high strength and structural integrity, such as chassis components and wheels. The ability to produce parts with fewer defects and improved surface finish makes vacuum die casting essential in manufacturing high-performance magnesium components for luxury and performance vehicles.

The gravity die casting segment is driven by its suitability for producing large, simple automotive parts that require excellent dimensional stability and a good surface finish. This process is particularly favored for making components like cylinder heads, manifolds, and brake components. The demand for cost-effective manufacturing solutions with lower tooling costs and the ability to produce parts with high density and mechanical strength supports the growth of the gravity die casting segment.

The squeeze die casting segment is driven by the need for high-strength and defect-free magnesium parts in automotive applications where structural performance is critical. This process combines the benefits of forging and casting, enabling the production of components with superior mechanical properties, such as suspension parts and structural frames. The increasing focus on enhancing vehicle safety and durability, along with the demand for lightweight, high-strength materials, is driving the adoption of squeeze die casting in the automotive sector.

Breakup by Application:

- Body Parts

- Engine Parts

- Transmission Parts

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes body parts, engine parts, transmission parts, and others.

As per the automotive parts magnesium die casting market forecast, the body parts segment is driven by the need for lightweight materials to improve fuel efficiency and reduce emissions in vehicles. Magnesium die casting is increasingly favored for body components due to its excellent strength-to-weight ratio, which helps manufacturers meet regulatory requirements while enhancing vehicle performance. Additionally, advancements in die casting techniques allow for more complex and durable body parts, further boosting demand in this segment.

The engine parts segment is driven by the automotive industry's push for lighter engines to enhance fuel efficiency and reduce carbon dioxide (CO2) emissions. Magnesium die casting is preferred for engine components due to its ability to withstand high temperatures and stress while reducing overall engine weight. This reduction in weight contributes to better fuel economy and performance, making magnesium an ideal material for modern engine parts.

The transmission parts segment is driven by the demand for efficient and lightweight transmission systems in vehicles. Magnesium die casting provides the necessary durability and strength while significantly reducing the weight of transmission components. This weight reduction leads to improved fuel efficiency and smoother transmission operation, making it a key driver for the adoption of magnesium die casting in this segment.

The others segment is driven by the increasing application of magnesium die casting in various automotive components beyond body, engine, and transmission parts. This includes structural and interior parts, where lightweight and durable materials are essential. The versatility of magnesium die casting allows for the production of complex shapes and components, making it a preferred choice for various automotive applications, thereby driving growth in this segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

North America’s regional market is driven by the growing demand for lightweight vehicles, driven by stringent fuel efficiency and emission regulations. The region's strong automotive manufacturing base, particularly in the US, supports the adoption of magnesium die casting. Additionally, the increasing production of electric vehicles (EVs) and the focus on enhancing vehicle performance and safety are further fueling market growth, as manufacturers seek to reduce vehicle weight while maintaining strength and durability.

The Asia Pacific regional market is driven by the rapid expansion of the automotive industry, particularly in countries like China, Japan, and India. The region's growing focus on electric vehicles (EVs) and the demand for fuel-efficient vehicles is boosting the adoption of lightweight materials like magnesium. Moreover, advancements in die casting technology and the availability of low-cost manufacturing options in the region are encouraging the use of magnesium die casting in automotive parts production, contributing to the market's growth.

The European regional market is driven by stringent environmental regulations and the region's strong commitment to reducing vehicle emissions. The adoption of magnesium die casting is growing as automotive manufacturers in countries like Germany and France seek to produce lightweight, fuel-efficient vehicles. Additionally, the region's leadership in electric vehicle (EV) innovation and the increasing use of magnesium in luxury and high-performance vehicles are key factors propelling the market forward.

The Latin American regional market is driven by the rising demand for fuel-efficient vehicles and the growth of the automotive industry in countries like Brazil and Mexico. The region's focus on improving vehicle performance and reducing emissions is leading to increased adoption of magnesium die casting in automotive parts.

The Middle East and Africa regional market is driven by the increasing demand for lightweight vehicles and the growing automotive industry, particularly in South Africa and the Gulf Cooperation Council (GCC) countries. The region's focus on enhancing vehicle durability and performance in challenging environments is boosting the automotive parts magnesium die casting demand.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the automotive parts magnesium die casting industry include Chicago White Metal Casting Inc., Dynacast International Inc. (Form Technologies Company), Georg Fischer Ltd., Gibbs Die Casting Corporation (Koch Enterprises Inc.), Meridian Lightweight Technologies, Morimura Bros. Inc., Ortal Diecasting Ltd., Pace Industries (Leggett & Platt Incorporated), Ryobi Limited, Sandhar Technologies Limited, Shiloh Industries Inc., Twin City Die Castings Co., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the automotive parts magnesium die casting market are actively focusing on several strategies to strengthen their market position and capitalize on the growing demand for lightweight materials. They are investing heavily in research and development (R&D) to enhance die casting technologies, enabling the production of more complex and high-precision magnesium parts. This includes advancements in vacuum-assisted die casting and improved alloy compositions to boost the strength and durability of the components. Additionally, these companies are expanding their production capacities to meet the increasing demand, particularly from the electric vehicle (EV) segment, where lightweighting is crucial. As per the automotive parts magnesium die casting market research report, key players are also increasingly focusing on sustainability, adopting eco-friendly manufacturing practices, and optimizing their supply chains to reduce the environmental impact.

Automotive Parts Magnesium Die Casting Market News:

- In 2023, a significant milestone was achieved in Chongqing, China, with the successful prototyping of the world’s largest magnesium alloy automotive die-casting component. This development marks a pivotal moment in the automotive industry, particularly in the realm of lightweight vehicle manufacturing. The prototype, produced by a leading manufacturer in Chongqing, demonstrates the advanced capabilities of magnesium alloy in automotive die casting, emphasizing its potential to revolutionize vehicle design by significantly reducing weight while maintaining structural integrity.

- In 2023, Georg Fischer Ltd. (GF) announced the opening of a new, advanced manufacturing facility in Shenyang, China, dedicated to the production of magnesium die-cast components for the automotive industry. This facility is equipped with cutting-edge technologies designed to enhance the efficiency and precision of magnesium die casting, particularly for lightweight automotive parts. This expansion is part of GF's broader strategy to meet the rising demand for lightweight components in electric vehicles (EVs) and fuel-efficient cars, which require innovative materials to optimize performance and reduce emissions.

Automotive Parts Magnesium Die Casting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Processes Covered | Pressure Die Casting, Vacuum Die Casting, Gravity Die Casting, Squeeze Die Casting |

| Applications Covered | Body Parts, Engine Parts, Transmission Parts, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Chicago White Metal Casting Inc., Dynacast International Inc. (Form Technologies Company), Georg Fischer Ltd., Gibbs Die Casting Corporation (Koch Enterprises Inc.), Meridian Lightweight Technologies, Morimura Bros. Inc., Ortal Diecasting Ltd., Pace Industries (Leggett & Platt Incorporated), Ryobi Limited, Sandhar Technologies Limited, Shiloh Industries Inc., Twin City Die Castings Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive parts magnesium die casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive parts magnesium die casting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive parts magnesium die casting industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global automotive parts magnesium die casting market was valued at USD 3.3 Billion in 2024.

We expect the global automotive parts magnesium die casting market to exhibit a CAGR of 5.51% during 2025-2033.

The widespread adoption of automotive parts magnesium die casting in the manufacturing of engine parts, gearbox, motor covers, etc., as it improves reliability, simplifies designs, reduces the effects of thermal fatigue, etc., is primarily driving the global automotive parts magnesium die casting market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for vehicles, thereby negatively impacting the global market for automotive parts magnesium die casting.

Based on the production process, the global automotive parts magnesium die casting market has been segregated into pressure die casting, vacuum die casting, gravity die casting, and squeeze die casting. Among these, pressure die casting currently holds the majority of the total market share.

Based on the application, the global automotive parts magnesium die casting market can be bifurcated into body parts, engine parts, transmission parts, and others. Currently, body parts exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global automotive parts magnesium die casting market include Chicago White Metal Casting Inc., Dynacast International Inc. (Form Technologies Company), Georg Fischer Ltd., Gibbs Die Casting Corporation (Koch Enterprises Inc.), Meridian Lightweight Technologies, Morimura Bros. Inc., Ortal Diecasting Ltd., Pace Industries (Leggett & Platt Incorporated), Ryobi Limited, Sandhar Technologies Limited, Shiloh Industries Inc., and Twin City Die Castings Co.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)