Automotive NVH Materials Market Size, Share, Trends and Forecast by Product, Vehicle Type, Application, and Region, 2026-2034

Automotive NVH Materials Market Size and Share:

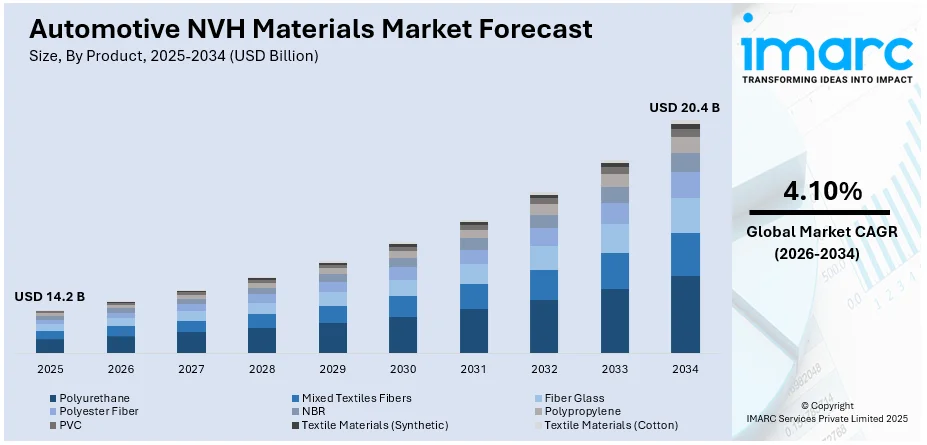

The global automotive NVH materials market size was valued at USD 14.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 20.4 Billion by 2034, exhibiting a CAGR of 4.10% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 40.2% in 2025. The market is growing significantly due to the amplifying demand for improved noise reduction and vehicle comfort. Manufacturers are currently emphasizing on advanced, lightweight materials for noise, vibration, and harshness (NVH) control, principally driven by customer requirements and regulatory policies for more efficient and quieter vehicles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 14.2 Billion |

|

Market Forecast in 2034

|

USD 20.4 Billion |

| Market Growth Rate (2026-2034) | 4.10% |

The automotive NVH (Noise, Vibration, and Harshness) materials industry is witnessing steady growth with increasing vehicle manufacturing, more stringent noise regulations, and growing customer demand for smoother, quieter rides. Automakers are focusing on advanced NVH materials like acoustic foams, elastomers, and damping sheets to improve cabin insulation, cut vibrations, and suppress road noise. The transition to electric vehicles (EVs) is also fueling the automotive NVH materials market demand, as EVs, without the noise of conventional engines, need improved soundproofing solutions to enhance in-cabin experience. Lightweight NVH materials are also gaining popularity due to fuel efficiency standards, which are leading manufacturers to use composite and bio-based materials that fulfill sustainability objectives without compromising on performance.

To get more information on this market Request Sample

The United States remains a key market for automotive NVH materials, supported by high vehicle production, strict noise pollution standards, and increasing luxury car sales. Urbanization and infrastructure development contribute to higher traffic density, representing one of the key automotive NVH materials market trends, and increasing the need for effective NVH solutions in both passenger and commercial vehicles. For instance, as per industry reports, currently 83% of the U.S. population currently resides in urban areas. Automakers in the U.S. are also investing in advanced insulation technologies, integrating multi-layered acoustic materials to enhance vehicle comfort. Additionally, the rise of hybrid and electric vehicles is pushing manufacturers to develop innovative NVH solutions tailored to low-noise powertrains.

Automotive NVH Materials Market Trends:

Magnified Adoption of Electric Vehicles (EVs)

The amplifying popularity of EVs is significantly boosting the demand for upgraded NVH materials in the automotive sector. According to the International Energy Agency, in 2023, around 14 million new electric cars were registered worldwide, bringing the total on-road number to 40 million. Furthermore, electric car sales in the same year witnessed a 35% year-on-year increase, with 3.5 million more units sold in comparison to 2022, accounting for 18% of total vehicle sales. EVs, particularly due to their quieter functioning, demand improved vibration and noise control systems to cater to the heightened awareness of road vibrations and noise. In addition, this trend is compelling manufacturers to develop advanced NVH materials customized for electric drivetrains. As EVs adoption is constantly bolstering worldwide, the market for such materials is anticipated to grow substantially, with an escalated emphasis on environmentally sustainable and lightweight solutions that improve overall vehicle performance as well as comfort.

Rising Emphasis on Lightweight NVH Materials

Automotive producers are intensely emphasizing on lightweight NVH materials to improve the fuel efficiency of their vehicles and adhere to the strict emission policies. By leveraging advanced polymers or composites, such materials provide efficient vibration and noise management without adding substantial weight to the overall vehicle body. According to the Department of Energy, replacing conventional steel materials with lightweighted ones like polymer composites or carbon fiber can significantly minimize a vehicle’s weight by approximately 50%, resulting in reduced fuel consumption. Furthermore, integrating such advanced materials in one-quarter of the U.S. vehicle fleet can potentially save around 5 billion gallons of fuel yearly by the year 2030. In addition, this trend is especially crucial as automakers aim to balance environmental, comfort, and performance factors. Moreover, the inclination toward lightweight materials is further boosted by the need for enhanced vehicle efficacy, establishing it a critical factor in the formulation of NVH materials across the global automotive industry, thereby contributing to the automotive NVH materials market growth.

Incorporation of Sustainable Materials in NVH Systems

Sustainability is emerging as a prime objective in the global automotive NVH materials market, as automakers are currently seeking solutions to lower their environmental impact. As per industry reports, the automotive sector is a key contributor to carbon dioxide emissions. Consequently, in 2023, approximately 480 automotive companies globally committed to reducing their emissions. The increasing demand for eco-friendly materials, such as recyclable polymers or natural fibers, highlights this emerging trend. Moreover, such sustainable alternatives offer efficient noise and vibration management while catering to both customer and regulatory demands for greener automotive systems. In addition, with increasing customer awareness and implementation of stringent environmental standards, the incorporation of sustainable materials is projected to escalate, driving growth as well as innovation in the global market.

Automotive NVH Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive NVH materials market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, vehicle type, and application.

Analysis by Product:

- Polyurethane

- Mixed Textiles Fibers

- Fiber Glass

- Polyester Fiber

- NBR

- Polypropylene

- PVC

- Textile Materials (Synthetic)

- Textile Materials (Cotton)

Polyurethane leads the market with around 34.9% of the automotive NVH materials market share in 2025. Polyurethane holds the largest market share mainly due to its exceptional NVH control attributes. This material is extensively leveraged for its durability, lightweight profile, and capability to offer superior sound insulation. In addition, polyurethane’s adaptability in production complicated shapes positions is as an ideal material for manufacturing numerous automotive components, such as headliners, seats, and panels. Moreover, the efficacy and cost-efficiency of polyurethane in lowering both vibration and noise across various type of vehicles further fortify its domination in the global NVH materials market.

Analysis by Vehicle Type:

- Passenger Vehicles

- LCV

- HCV

Passenger vehicle leads the market with around 68.5% of market share in 2025, due to its extensively leveraging NVH materials. The growing demand for improved driving experience, quieter cabins, and increased comfort in passenger vehicle is highly driving the usage of such materials. Additionally, increasing production of electric as well as luxury vehicle, which are mostly focused on vibration control and sound insulation, is further propelling this segment's growth in the international market. As per industry reports, electrified vehicles represented 42.4% of luxury vehicle retail registrations in September 2023, reflecting a stable growth of electrified luxury vehicles segment. In addition, strict government rules regarding vehicle noise limit fuels the demand for efficient NVH solutions in passenger vehicles, strengthening their dominant position in the market.

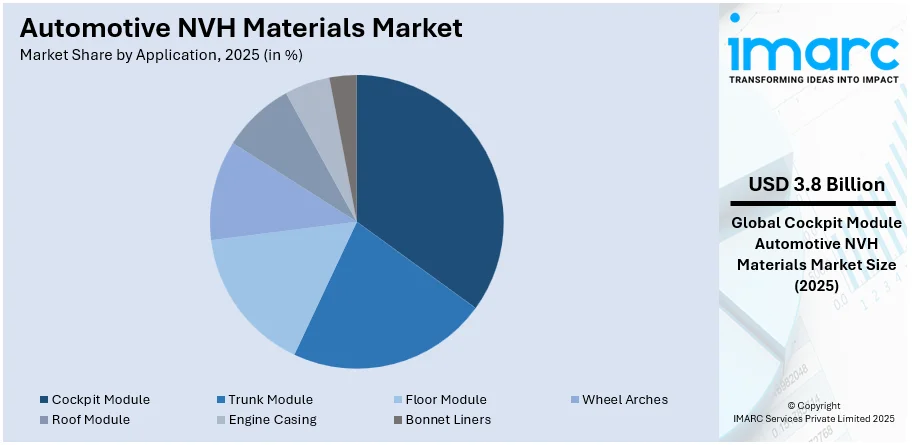

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Trunk Module

- Floor Module

- Wheel Arches

- Cockpit Module

- Roof Module

- Engine Casing

- Bonnet Liners

Cockpit module leads the market with around 27.9% of market share in 2025, predominantly due to the necessity for vibration as well as noise control within the vehicle cabin. NVH materials are prominently leveraged in the cockpit module to lower noise particularly from the road, air, and engine, improving overall passenger and driver comfort. As vehicle interiors are rapidly becoming functionally robust and complex, need for excellent-performance NVH materials in cockpit modules continues to fuel. In addition, this segment’s significance is further emphasized in electric vehicles, where reduced engine noise increases the need for cabin noise management, as other noises become more noticeable.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 40.2%. Asia Pacific has emerged as the leading regional market, principally driven by an expanding customer base seeking improved vehicle performance and comfort and robust vehicle manufacturing. As per industry reports, in 2023, Asia Pacific’s light vehicle manufacturing reached a record 51.8 million units, highlighting approximately 10% year-on-year growth. This expansion was propelled by robust production in Japan and China, combined with contributions from India as well as South Korea. Furthermore, China established itself as the leading vehicle exporter globally in the same year. Key automotive companies in countries such as India, China, and Japan are rapidly integrating NVH systems to address both international and regional vibration and noise protocols. In addition, Asia Pacific’s intense competitive manufacturing ecosystem, coupled with government policies prompting electric vehicle purchases, further strengthens its leadership. Moreover, this heightened NVH materials demand is anticipated to magnify as the automotive sector shift toward advanced technology and sustainability.

Key Regional Takeaways:

United States Automotive NVH Materials Market Analysis

In 2025, United States accounted for 84.90% of the market share in North America. The U.S. automotive NVH (Noise, Vibration, and Harshness) materials market continues to grow further because of rigid noise pollution policies and the upsurge of electric vehicle uptake. As such, CEIC has reported a vehicle production amounting to over 10.6 million in the United States for the year 2023. In parallel, new registrations of over 1.2 million EV units have been accounted for U.S. in 2023. The Department of Energy has augmented the need for specialty NVH materials in a bid to control battery noise. The innovations surrounding lightweight and eco-friendly materials benefit the market-the bio-based polyurethane foam, for example. It has been noted that 3M, BASF, and DuPont dominate because they apply these advanced composites to cabin acoustic improvements and better ride comfort. Federal fuel efficiency and emission regulation further supports this adoption. Rising consumer expectations for quieter vehicles and ongoing investments in acoustic insulation technologies position the U.S. as a leading NVH materials market globally.

North America Automotive NVH Materials Market Analysis

The North America automotive NVH (Noise, Vibration, and Harshness) materials market is expanding due to rising vehicle production, stringent noise regulations, and increasing consumer demand for comfort. For instance, according to industry reports, in December 2023, the United States produced motor vehicles amounting to 10,611,555 units, reflecting the steady expansion of the industry and demand. Additionally, automakers are incorporating high-performance NVH materials, including polyurethane foams, rubber, and acoustic laminates, to dampen noise and vibrations in passenger cars and commercial vehicles. Adoption of electric vehicles (EVs) is also compelling demand, as EVs necessitate soundproofing solutions of higher quality because engine noise is eliminated. Moreover, regulations on interior noise levels and technologies related to lightweight high-performance NVH materials are dictating market trends. Furthermore, companies prioritize sustainability, using recyclable and bio-based components to comply with the standards of the environment and fuel efficiency requirements.

Europe Automotive NVH Materials Market Analysis

Europe's automotive NVH materials market is driven by stringent EU noise and emission standards, alongside the growing EV market. According to ACEA, electric vehicles accounted for 22.7% of new car registrations in the European Union in 2023, up from about 4% in 2022, increasing the need for enhanced NVH solutions. Germany, as the automotive sector's largest producer in Europe, still leads the way, in this case with high energy efficiency through investments in lightweight NVH materials. The need for sustainability within the European Commission has also accelerated innovations in NVH recyclable materials. Examples of high-performance acoustic insulation are the expertise of the companies Autoneum, Henkel, and Sika AG. It is also turning out that advanced damping materials contribute to being able to deliver consumer-preferred premium in-cabin experiences. With increasing vehicle electrification and regulatory pressures, Europe remains a key market for NVH material advancements.

Asia Pacific Automotive NVH Materials Market Analysis

Increasing vehicle production and growing electric vehicle (EV) demand propel the growth of the Asia Pacific automotive NVH materials market. China's China Association of Automobile Manufacturers claimed the country built over 30 million vehicles in 2023 alone, claiming to be the largest automotive market worldwide. More specifically, there has been India's push towards electric mobility by setting up a USD 3.1 billion PLI for battery manufacturing; such demand in India is bound to increase NVH solutions targeted specifically for electric vehicles. The region is also seeing advancements in lightweight NVH materials to enhance fuel efficiency. Countries like Japan and South Korea, home to automakers such as Toyota and Hyundai, are investing in high-performance NVH solutions to enhance vehicle comfort. Global and local players are focusing on R&D for innovative materials, including graphene-based soundproofing solutions. With rapid urbanization and growing automotive exports, Asia Pacific is poised to be a dominant force in NVH material adoption.

Latin America Automotive NVH Materials Market Analysis

The automotive NVH materials market in Latin America is growing as the vehicle manufacturing sector increases and the regulatory environment pays more attention to the control of noise in vehicles. An industry report shows that Brazil, the largest automotive producer in the region, produced over 2.2 million vehicles in 2023, creating a significant demand for NVH solutions. Mexico, one of the biggest automotive export hubs, is incorporating advanced NVH materials to meet global emission and noise standards. The demand for cost-effective, lightweight NVH solutions is growing, especially in commercial vehicles, as fleet operators focus on fuel efficiency. Local manufacturers are also investing in bio-based and recycled NVH materials to meet sustainability goals. Companies such as Grupo Antolin and regional suppliers are increasing production capacities to meet growing OEM and aftermarket demand. Warming up to improving automotive infrastructure and growing awareness of vehicle comfort, Latin America NVH materials market is expected to grow steadily.

Middle East and Africa Automotive NVH Materials Market Analysis

The Middle East and Africa's automobile NVH material market is driven by the upsurge of vehicle production coupled with infrastructure expansion. According to the UAE official portal, 2022 funding for the nation's federal health sector was an allocation of AED 4.25 billion (USD 1.16 billion), bolstering medical facilities, which helps the growth in logistics indirectly. Meanwhile, Turkey is the region's leader in automotive manufacturing, producing close to 1.47 million vehicles in 2023, a growth of 8.6% over the previous year, as per reports. The rising automotive sector drives the demand for advanced NVH solutions. The increase in urbanization, government support for automotive, and increased consumer demand for quieter and more comfortable vehicles also fuel the adoption of NVH materials. The region is moving steadily towards advanced acoustic and vibration control technologies with multinational players investing in local production and research to enhance both the vehicle's performance and the passenger's experience.

Competitive Landscape:

The market is represented by the presence of key manufacturers emphasizing on product development as well as technological innovations. Numerous enterprises are heavily investing in upgraded materials like sustainable or lightweight composites, to address the transforming customer demand as well as industry standards. In addition, tactical acquisition, mergers, and partnerships are highly prevalent as companies seek to proliferate their market foothold and product portfolios. For instance, in May 2024, BASF SE announced a strategic partnership with 3B Fibreglass to improve sustainable production of its Ultramid polyamide, used in the automotive sector for NVH and other critical application, by leveraging 3B’s sustainably produced fiber glass. Moreover, global players are currently witnessing rising competition from regional firms in emerging economies, where cost-effective manufacturing and increasing automotive needs bolster the competitive dynamics of this evolving market.

The report provides a comprehensive analysis of the competitive landscape in the automotive NVH materials market with detailed profiles of all major companies, including:

- BASF SE

- The DOW Chemical Company

- ExxonMobil

- 3M Company

- Mitsui Chemicals, Inc.

- Sumitomo Riko Company Limited

- Covestro AG

- Celanese Corporation

- Huntsman Corporation

- Lanxess AG

- Borgers AG

Latest News and Developments:

- June 2024: Uniproducts Ltd., a major NVH components manufacturer in India, announced a partnership with Integral Coach Factory, an India-based rail coaches’ manufacturer, to supply sound insulation parts for the country’s fastest train project. By integrating Uniproducts’ advanced insulation materials, these trains are positioned to offer a quieter travel environment to the passengers.

- May 2024: BASF SE unveiled its new Polyurethane Technical Development Center in India. This center will support the market development of polyurethane applications in various sectors, including transportation, where it is extensively leveraged as an NVH material.

- April 2024: Dow opened its first European MobilityScience™ Studio in Correggio, Italy, enhancing collaborations with OEMs and Tiers. The facility will support R&D for sustainable mobility solutions, including NVH materials. Existing U.S. studios offer acoustic and powertrain testing for tailored NVH and sealing system innovations.

- April 2024: Celanese has introduced Zytel NVH, a structural material designed to reduce specific frequencies, for use in electric vehicle motor mounts. This innovation aims to minimize noise, vibration, and harshness (NVH) in EVs, enhancing passenger comfort by isolating and damping high-frequency motor noise.

Automotive NVH Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Polyurethane, Mixed Textiles Fibers, Fiber Glass, Polyester Fiber, NBR, Polypropylene, PVC, Textile Materials (Synthetic), Textile Materials (Cotton) |

| Vehicle Types Covered | Passenger Vehicles, LCV, HCV |

| Applications Covered | Trunk Module, Floor Module, Wheel Arches, Cockpit Module, Roof Module, Engine Casing, Bonnet Liners |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, The DOW Chemical Company, ExxonMobil, 3M Company, Mitsui Chemicals, Inc., Sumitomo Riko Company Limited, Covestro AG, Celanese Corporation, Huntsman Corporation, Lanxess AG, Borgers AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive NVH materials market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive NVH materials market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive NVH materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive NVH materials market was valued at USD 14.2 Billion in 2025.

IMARC estimates the global automotive NVH materials market to reach USD 20.4 Billion in 2034, exhibiting a CAGR of 4.10% during 2026-2034.

The automotive NVH materials market is driven by rising vehicle production, stricter noise regulations, and increasing consumer demand for quieter, more comfortable rides. Growth in electric vehicles (EVs) further fuels demand, as EVs require enhanced soundproofing. Additionally, lightweight materials supporting fuel efficiency and sustainability goals are gaining industry adoption.

Asia Pacific currently dominates the market, holding a market share of over 40.2% in 2024. This competitive edge is due to high vehicle production, rapid urbanization, and stringent noise regulations. Growing EV adoption and increasing demand for comfort and safety further drive the use of advanced NVH materials across key markets like China, Japan, and India, thereby creating a positive automotive NVH materials market outlook.

Some of the major players in the automotive NVH materials market include BASF SE, The DOW Chemical Company, ExxonMobil, 3M Company, Mitsui Chemicals, Inc., Sumitomo Riko Company Limited, Covestro AG, Celanese Corporation, Huntsman Corporation, Lanxess AG, Borgers AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)